BASF Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BASF Bundle

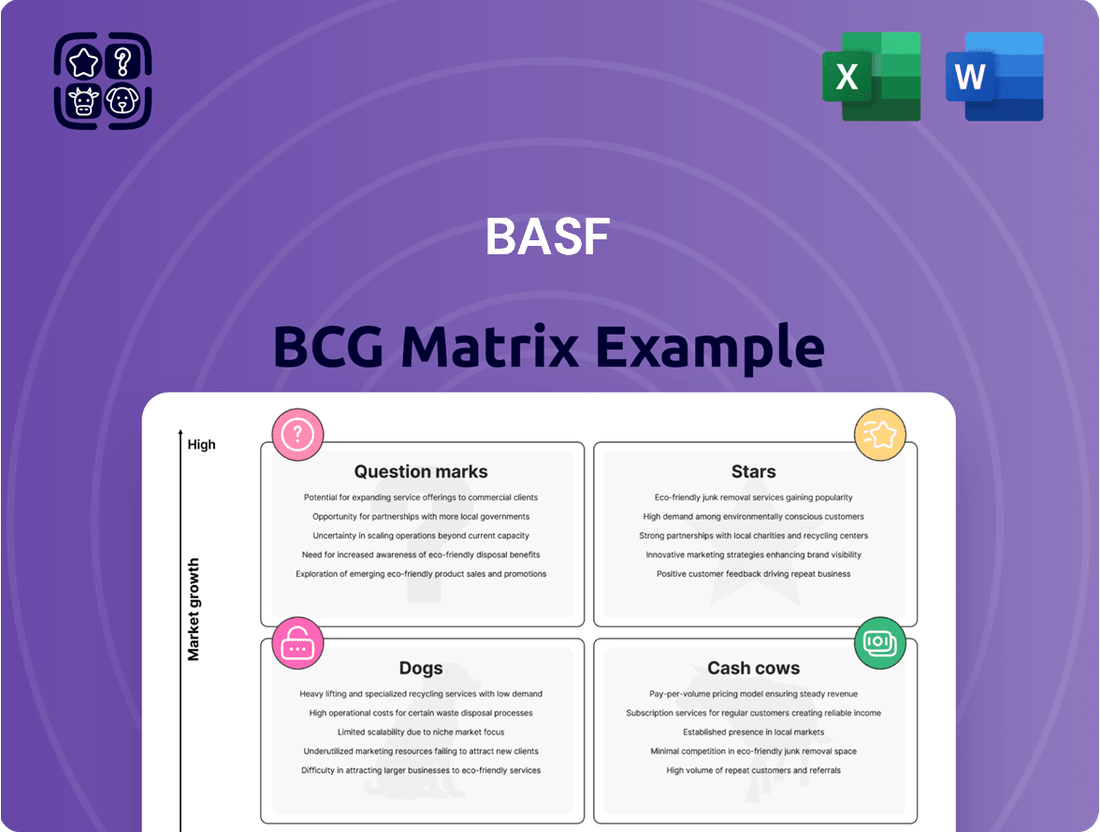

Curious about how BASF navigates the market with its diverse portfolio? Our preview offers a glimpse into its strategic positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete BCG Matrix for a comprehensive breakdown and actionable insights to drive your own business strategy.

Stars

BASF's Battery Materials segment is a prime example of a Star in the BCG matrix. This classification stems from its operation within the booming electric vehicle (EV) and energy storage sectors, both characterized by exceptionally high growth rates. The increasing global adoption of EVs is a primary catalyst for this expansion.

The market for battery materials is experiencing robust expansion, with projections indicating continued strong growth throughout the coming years. This upward trend is directly fueled by the escalating demand for electric vehicles worldwide. BASF is making substantial investments in the research and development of cutting-edge cathode active materials, such as high-nickel NMC and silicon-enhanced formulations, to meet this demand.

Further solidifying its Star position, BASF has entered into a significant strategic framework agreement with CATL, a leading global player in battery technology. This collaboration focuses on the joint development and supply of advanced battery materials, underscoring BASF's commitment to innovation and its strong market positioning.

BASF's Agricultural Solutions segment, with its focus on groundbreaking innovations, aligns well with the characteristics of a Star in the BCG Matrix. The company is heavily investing in research and development for sustainable agricultural advancements.

By 2030, BASF plans to have a robust pipeline of over 30 significant R&D projects, all geared towards making substantial contributions to sustainability in agriculture. This forward-thinking approach is designed to capture future market growth.

Key innovations like the new herbicide tolerance technologies, Axant™ Flex and Provisia, along with fungicides such as Revysol®, are poised to significantly boost future sales. These products are developed to meet the growing global demand for sustainably produced food, positioning BASF for continued success.

BASF's new Verbund site in Zhanjiang, China, is a prime example of a Star in the BCG matrix. This massive, integrated chemical production facility is poised to become a major contributor to BASF's EBITDA, with significant contributions expected from 2025 onward.

The company's substantial investment in Zhanjiang reflects its strategic focus on serving the rapidly expanding Asian markets, especially China. This site is engineered for exceptional cost-competitiveness, a crucial factor in navigating global trade dynamics and securing a strong market position.

Circular Economy Solutions

BASF's commitment to circular economy solutions, encompassing advanced recycling and biodegradable materials, places these initiatives firmly in the emerging category within its strategic framework. The company is actively investing in research and development, focusing on the biodegradability of materials and pioneering solutions like depolymerization for foam mattresses and rigid foam. This strategic focus is driven by a growing global imperative for sustainable products and practices.

This strategic direction is supported by tangible actions and market trends. For instance, the global market for biodegradable plastics was valued at approximately USD 4.7 billion in 2023 and is projected to grow significantly, reaching an estimated USD 11.4 billion by 2030, with a compound annual growth rate (CAGR) of around 13.6% during this period. BASF's development of biodegradable polymers for diverse applications directly addresses this expanding market opportunity.

- Innovation in Recycling: BASF is exploring depolymerization processes to break down materials like foam mattresses into their original components for reuse.

- Biodegradable Materials: The company is developing a range of biodegradable polymers for applications spanning packaging, agriculture, and consumer goods.

- Market Alignment: These efforts align with the increasing consumer and regulatory demand for sustainable and environmentally friendly products.

- Future Growth Potential: The burgeoning market for biodegradable plastics, projected to more than double by 2030, highlights the significant growth potential for BASF's circular economy solutions.

Digital Tools and AI in R&D

BASF's accelerated digital transformation, particularly its increased use of digital tools and artificial intelligence (AI) in research and development, positions this area as a Star in its BCG Matrix. This strategic focus is designed to significantly boost productivity and speed up the innovation cycle, allowing BASF to introduce new technologies to the market more rapidly.

These digital advancements are crucial for developing the next generation of high-growth products across BASF's diverse business segments. For instance, in 2024, BASF reported a substantial increase in R&D spending, with a significant portion allocated to digitalizing research processes and leveraging AI for material discovery and process optimization. This investment is expected to yield a faster pipeline of innovative solutions.

- Digital R&D Investment: BASF's commitment to digitalizing R&D in 2024 saw a notable percentage increase in its overall R&D budget dedicated to AI and advanced analytics.

- AI-Driven Innovation: The company is actively deploying AI to accelerate the discovery of new chemical compounds and optimize manufacturing processes, aiming for quicker time-to-market.

- Productivity Gains: Digital tools are enhancing experimental design and data analysis, leading to more efficient research workflows and reduced development times for new products.

- Future Growth Engine: This focus on digital R&D is foundational for securing BASF's future market leadership by fostering a continuous stream of cutting-edge, high-demand products.

BASF's Battery Materials segment is a prime example of a Star in the BCG matrix. This classification stems from its operation within the booming electric vehicle (EV) and energy storage sectors, both characterized by exceptionally high growth rates. The increasing global adoption of EVs is a primary catalyst for this expansion.

The market for battery materials is experiencing robust expansion, with projections indicating continued strong growth throughout the coming years. This upward trend is directly fueled by the escalating demand for electric vehicles worldwide. BASF is making substantial investments in the research and development of cutting-edge cathode active materials, such as high-nickel NMC and silicon-enhanced formulations, to meet this demand.

Further solidifying its Star position, BASF has entered into a significant strategic framework agreement with CATL, a leading global player in battery technology. This collaboration focuses on the joint development and supply of advanced battery materials, underscoring BASF's commitment to innovation and its strong market positioning.

BASF's Agricultural Solutions segment, with its focus on groundbreaking innovations, aligns well with the characteristics of a Star in the BCG Matrix. The company is heavily investing in research and development for sustainable agricultural advancements.

By 2030, BASF plans to have a robust pipeline of over 30 significant R&D projects, all geared towards making substantial contributions to sustainability in agriculture. This forward-thinking approach is designed to capture future market growth.

Key innovations like the new herbicide tolerance technologies, Axant™ Flex and Provisia, along with fungicides such as Revysol®, are poised to significantly boost future sales. These products are developed to meet the growing global demand for sustainably produced food, positioning BASF for continued success.

BASF's new Verbund site in Zhanjiang, China, is a prime example of a Star in the BCG matrix. This massive, integrated chemical production facility is poised to become a major contributor to BASF's EBITDA, with significant contributions expected from 2025 onward.

The company's substantial investment in Zhanjiang reflects its strategic focus on serving the rapidly expanding Asian markets, especially China. This site is engineered for exceptional cost-competitiveness, a crucial factor in navigating global trade dynamics and securing a strong market position.

BASF's commitment to circular economy solutions, encompassing advanced recycling and biodegradable materials, places these initiatives firmly in the emerging category within its strategic framework. The company is actively investing in research and development, focusing on the biodegradability of materials and pioneering solutions like depolymerization for foam mattresses and rigid foam. This strategic focus is driven by a growing global imperative for sustainable products and practices.

This strategic direction is supported by tangible actions and market trends. For instance, the global market for biodegradable plastics was valued at approximately USD 4.7 billion in 2023 and is projected to grow significantly, reaching an estimated USD 11.4 billion by 2030, with a compound annual growth rate (CAGR) of around 13.6% during this period. BASF's development of biodegradable polymers for diverse applications directly addresses this expanding market opportunity.

- Innovation in Recycling: BASF is exploring depolymerization processes to break down materials like foam mattresses into their original components for reuse.

- Biodegradable Materials: The company is developing a range of biodegradable polymers for applications spanning packaging, agriculture, and consumer goods.

- Market Alignment: These efforts align with the increasing consumer and regulatory demand for sustainable and environmentally friendly products.

- Future Growth Potential: The burgeoning market for biodegradable plastics, projected to more than double by 2030, highlights the significant growth potential for BASF's circular economy solutions.

BASF's accelerated digital transformation, particularly its increased use of digital tools and artificial intelligence (AI) in research and development, positions this area as a Star in its BCG Matrix. This strategic focus is designed to significantly boost productivity and speed up the innovation cycle, allowing BASF to introduce new technologies to the market more rapidly.

These digital advancements are crucial for developing the next generation of high-growth products across BASF's diverse business segments. For instance, in 2024, BASF reported a substantial increase in R&D spending, with a significant portion allocated to digitalizing research processes and leveraging AI for material discovery and process optimization. This investment is expected to yield a faster pipeline of innovative solutions.

- Digital R&D Investment: BASF's commitment to digitalizing R&D in 2024 saw a notable percentage increase in its overall R&D budget dedicated to AI and advanced analytics.

- AI-Driven Innovation: The company is actively deploying AI to accelerate the discovery of new chemical compounds and optimize manufacturing processes, aiming for quicker time-to-market.

- Productivity Gains: Digital tools are enhancing experimental design and data analysis, leading to more efficient research workflows and reduced development times for new products.

- Future Growth Engine: This focus on digital R&D is foundational for securing BASF's future market leadership by fostering a continuous stream of cutting-edge, high-demand products.

What is included in the product

The BASF BCG Matrix analyzes its portfolio by product or business unit, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework provides strategic guidance on investment, holding, or divestment decisions for each category.

A clear visual of BASF's business units, instantly highlighting Stars, Cash Cows, Question Marks, and Dogs, alleviates the pain of strategic uncertainty.

Cash Cows

BASF's Petrochemicals and Intermediates segments are its traditional cash cows. Despite facing margin pressures from high product availability and increased fixed costs from new site startups, these foundational businesses continue to generate significant cash flow for the company.

These segments are crucial to BASF's Verbund strategy, which allows for optimized production costs and the efficient recycling of byproducts. For example, in 2023, BASF's Chemicals segment, which includes these core businesses, reported sales of €20.7 billion, demonstrating their substantial revenue generation capabilities.

BASF's Materials segment, a powerhouse of advanced materials and precursors, firmly sits in the Cash Cow quadrant of the BCG Matrix. This segment, encompassing vital products like polyurethanes and engineering plastics, has demonstrated remarkable resilience. Its healthy EBITDA margins are a testament to consistent demand from crucial sectors.

The demand for these advanced materials is particularly strong in growth areas such as electric vehicles and renewable energy infrastructure. This sustained demand underpins the segment's ability to generate consistent profits. In 2024, the Materials segment is expected to be a significant contributor to BASF's overall earnings, with projections indicating continued positive contributions to earnings growth through 2025.

BASF's Nutrition & Care segment, a key player in supplying ingredients for food, feed, pharmaceuticals, cosmetics, and detergents, functions as a robust Cash Cow within the company's portfolio. This segment consistently generates positive earnings, a testament to its stable market presence and effective pricing strategies.

The segment has demonstrated notable price improvements, reflecting its strong market positioning and the steady demand for its specialized ingredients. This pricing power directly translates into reliable cash generation for BASF.

Looking ahead, the Nutrition & Care segment is projected to be a significant contributor to BASF's overall earnings growth in 2025. This expectation is supported by ongoing innovation and a sustained demand for high-quality ingredients across its diverse end markets.

Industrial Solutions Segment

The Industrial Solutions segment, a cornerstone of BASF's operations, functions as a Cash Cow. This division, focusing on performance chemicals vital for numerous industries, consistently demonstrates a robust market position, even with occasional shifts in earnings.

BASF anticipates this segment to be a significant contributor to its projected EBITDA before special items for 2025. For instance, in 2024, the segment's sales were reported to be €10.4 billion, underscoring its substantial revenue generation capabilities.

- Segment Performance: Industrial Solutions provides essential performance chemicals, driving consistent revenue.

- Market Position: It maintains a strong foothold across various industrial sectors.

- Profitability Driver: The segment is a key contributor to BASF's overall financial health.

- Future Outlook: Expected to boost BASF's EBITDA before special items in 2025, building on its 2024 sales of €10.4 billion.

Established Agricultural Solutions Products

Within BASF's Agricultural Solutions division, established products like crop protection agents and seeds are considered Cash Cows. These offerings are mature but continue to deliver substantial profits and steady volume, particularly in the herbicide market, ensuring a consistent inflow of cash for the company.

The reliable earnings from this segment are crucial for funding other areas of BASF's business, including research and development for new innovations. For instance, in 2023, BASF's Agricultural Solutions segment reported sales of €22.6 billion, demonstrating the significant revenue generated by its established portfolio.

- Revenue Generation: The established agricultural solutions portfolio consistently contributes significant revenue, with the Agricultural Solutions segment achieving €22.6 billion in sales in 2023.

- Profitability: This segment is a major profit driver for BASF, thanks to its mature yet high-volume products.

- Cash Flow: The strong, consistent earnings provide a reliable source of cash flow, supporting investment in growth areas.

- Market Position: Established products, especially in herbicides, maintain a strong market presence, ensuring continued demand and profitability.

BASF's Petrochemicals and Intermediates segments, while facing margin pressures, remain foundational cash cows. Their contribution to the Verbund strategy, optimizing costs and recycling byproducts, is significant. In 2023, the Chemicals segment, encompassing these businesses, generated €20.7 billion in sales.

The Materials segment, featuring advanced products like polyurethanes, is a strong cash cow. Its resilience is evident in healthy EBITDA margins, driven by consistent demand from sectors like electric vehicles and renewable energy. This segment is projected to contribute positively to BASF's earnings growth through 2025.

BASF's Nutrition & Care segment, supplying essential ingredients for various consumer goods, also operates as a robust cash cow. Its stable market presence and effective pricing strategies translate into reliable cash generation. The segment is expected to be a key contributor to overall earnings growth in 2025.

The Industrial Solutions segment, providing vital performance chemicals, functions as a cash cow with a strong market position. Despite occasional earnings shifts, it's anticipated to significantly boost BASF's EBITDA before special items in 2025, building on its €10.4 billion in sales in 2024.

Established crop protection agents and seeds within Agricultural Solutions are considered cash cows. These mature, high-volume products, particularly herbicides, deliver substantial profits and steady cash flow, supporting R&D for new innovations. The segment achieved €22.6 billion in sales in 2023.

| Segment | BCG Classification | Key Products/Focus | 2023 Sales (EUR bn) | Outlook |

| Petrochemicals & Intermediates | Cash Cow | Basic chemicals, intermediates | Included in Chemicals (€20.7 bn) | Continued cash generation despite margin pressures |

| Materials | Cash Cow | Polyurethanes, engineering plastics | Included in Chemicals (€20.7 bn) | Positive earnings growth contribution through 2025 |

| Nutrition & Care | Cash Cow | Food, feed, pharma, cosmetic ingredients | Included in Chemicals (€20.7 bn) | Key contributor to 2025 earnings growth |

| Industrial Solutions | Cash Cow | Performance chemicals | 10.4 | Expected to boost 2025 EBITDA before special items |

| Agricultural Solutions | Cash Cow | Crop protection, seeds | 22.6 | Reliable cash flow for R&D and growth areas |

Delivered as Shown

BASF BCG Matrix

The preview you are currently viewing is the exact BASF BCG Matrix report you will receive upon purchase, offering a comprehensive strategic overview. This document is fully formatted and ready for immediate application, providing actionable insights into BASF's product portfolio. You can trust that what you see is precisely what you'll download, enabling you to conduct thorough strategic planning and competitive analysis without any hidden surprises or additional work.

Dogs

BASF's divestment of its butanediol and PolyTHF operations in Xinjiang, specifically its stakes in BASF Markor Chemical Manufacturing (Xinjiang) Co., Ltd. and Markor Meiou Chemical (Xinjiang) Co., Ltd., places these businesses in the Dogs category of the BCG Matrix. This strategic move suggests these units were not meeting performance expectations or fitting into BASF's long-term vision.

The financial impact of this divestiture is evident in the impairment loss recorded by BASF. For instance, in 2023, BASF reported an impairment loss of €1.1 billion, partly attributable to reclassifying assets held for sale, which would encompass these Xinjiang operations. This signals a recognition that the future economic benefits from these businesses were unlikely to justify their carrying amount.

BASF's decorative paints business in Brazil, divested in February 2025 to Sherwin-Williams, is classified as a Dog in the BCG Matrix. This strategic move highlights the business's likely underperformance, characterized by low market share and limited growth potential within the Brazilian market. For instance, the Brazilian decorative paints market, while substantial, faces intense competition and evolving consumer preferences, making it challenging for established players to maintain high growth rates without significant innovation or market consolidation.

Underperforming assets within BASF's portfolio, those that are not generating sufficient returns or are consuming excessive capital without promising future growth, are typically categorized as Dogs in the BCG matrix. The company's strategic pruning of these units is designed to free up resources for more promising ventures. For instance, in 2023, BASF divested its construction chemicals business, which was a significant move to streamline operations and exit a segment that, while substantial, was not aligning with the company's future growth ambitions.

Older, Less Differentiated Chemical Products

Certain older or less differentiated chemical products within BASF's extensive portfolio might be categorized as Dogs. These are typically products facing significant competition and experiencing shrinking profit margins in established, mature markets.

While BASF doesn't explicitly label specific products as Dogs, the general market conditions in the upstream chemicals sector, characterized by high product availability and price pressures, indicate the likely presence of such offerings. For instance, in 2024, the European chemical industry faced challenges with energy costs and overcapacity in certain basic chemicals, impacting margins for less specialized products.

- Mature Markets: Products in segments like basic petrochemicals or commodity plastics often fall into this category due to intense competition and limited innovation.

- Declining Margins: High raw material costs coupled with price sensitivity from customers squeeze profitability for less differentiated chemicals.

- Competitive Landscape: The presence of numerous global suppliers offering similar products makes it difficult for older chemical lines to command premium pricing.

Businesses with Negative Contributions from Shareholdings

Shareholdings consistently dragging down BASF's net income, like Wintershall Dea and Harbour Energy in Q1 and Q2 2025, are considered Dogs in the BCG Matrix. These investments are likely underperforming due to difficult market conditions or internal operational challenges, negatively impacting overall financial performance.

For instance, Wintershall Dea's contribution to BASF's net income was notably lower in the first half of 2025. This underperformance suggests that the energy sector, where Wintershall Dea operates, faced significant headwinds during this period, or that specific issues within the company are hindering its profitability.

- Wintershall Dea's diminished Q1 2025 net income contribution.

- Harbour Energy's similar Q2 2025 underperformance.

- These holdings operate in challenging market segments.

- They represent a drag on BASF's overall profitability.

BASF's divestment of its butanediol and PolyTHF operations in Xinjiang, along with its decorative paints business in Brazil, clearly places these ventures in the Dogs category of the BCG Matrix. These moves indicate underperformance and a strategic decision to exit segments not aligned with future growth. For example, the Xinjiang divestiture involved impairment losses, with BASF reporting a €1.1 billion impairment in 2023 partly due to reclassifying assets held for sale, reflecting the diminished economic prospects of these operations.

BASF's strategic pruning of underperforming assets, those failing to generate adequate returns or consuming capital without future growth potential, categorizes them as Dogs. The company's 2023 divestment of its construction chemicals business exemplifies this, streamlining operations by exiting a segment not fitting its growth ambitions. This aligns with the general market conditions in upstream chemicals during 2024, where European chemical companies faced margin pressures due to energy costs and overcapacity in basic chemicals.

Shareholdings like Wintershall Dea and Harbour Energy, which negatively impacted BASF's net income in early to mid-2025, are also considered Dogs. Their underperformance, evident in diminished profit contributions during Q1 and Q2 2025, highlights challenges within their respective energy market segments and a drag on overall profitability.

| Business Unit/Holding | BCG Category | Reasoning/Impact | Financial Data Point |

| Xinjiang Operations (Butanediol, PolyTHF) | Dog | Divested due to underperformance and strategic misalignment. | €1.1 billion impairment loss reported in 2023. |

| Decorative Paints (Brazil) | Dog | Divested due to low market share and limited growth potential in a competitive market. | Sold to Sherwin-Williams in February 2025. |

| Wintershall Dea | Dog | Underperformance impacting net income in early 2025. | Diminished net income contribution in Q1 2025. |

| Harbour Energy | Dog | Underperformance impacting net income in mid-2025. | Underperformance noted in Q2 2025. |

Question Marks

Within BASF's Battery Materials segment, specific early-stage ventures focusing on novel chemistries or nascent production capacities might be classified as Question Marks. These areas, while holding future promise, currently demand considerable investment without guaranteed market traction, mirroring the characteristics of a Question Mark in the BCG matrix.

BASF's substantial capital expenditure in new cathode material facilities, such as their planned facility in Schwarzheide, Germany, exemplifies this. These investments, while crucial for long-term growth and technological advancement in areas like solid-state batteries, represent significant cash outflows in their initial phases.

For instance, the development and scaling of advanced cathode materials for next-generation batteries, while strategically important, often involve high research and development costs and a lengthy path to profitability. This makes them prime candidates for a Question Mark classification until their market share and revenue generation become more substantial and predictable.

BASF is channeling considerable resources into new technologies for its green transformation, focusing on areas like sustainable value chains and advanced processes for plastic circularity. These initiatives, while holding significant future growth potential, currently demand substantial research and development investment and face the challenge of market adoption to achieve profitability.

Emerging digital solutions in agriculture, such as precision farming platforms and AI-driven crop monitoring, represent potential Stars or Question Marks within BASF's Agricultural Solutions segment. These innovations are designed to boost efficiency and sustainability, but their market penetration and profitability are still in formative stages. For instance, a 2024 report indicated that while adoption of digital farming tools is growing, only about 30% of farmers globally are actively using them for critical decision-making, highlighting the early-stage nature of this market.

Specific Geographic Expansions (e.g., early phases in Latin America/Southeast Asia)

BASF's strategic expansions into regions like Latin America and Southeast Asia can be viewed through the lens of the BCG Matrix, potentially categorizing these early-stage ventures as Stars or Question Marks, depending on market growth and competitive position.

These emerging markets, while holding significant long-term promise, often require substantial upfront investment to build infrastructure, distribution networks, and brand recognition. For instance, BASF has been actively investing in Southeast Asia, a region projected to see continued economic growth. In 2023, the company announced plans to expand its production facilities in Malaysia to meet growing demand for coatings and automotive solutions.

- Latin America: BASF has a long-standing presence in Latin America, with operations in countries like Brazil and Argentina. These markets present opportunities for growth in agriculture and construction sectors, but also face economic volatility.

- Southeast Asia: The company is focusing on growth in Southeast Asia, particularly in Vietnam and Indonesia, leveraging the region's expanding middle class and industrial development. BASF's investment in a new production site in Cilegon, Indonesia, for example, highlights this commitment.

- Investment Intensity: Establishing a strong foothold in these diverse markets is capital-intensive, requiring significant cash outlays for new facilities, research and development tailored to local needs, and marketing efforts.

- Market Uncertainty: Despite the growth potential, these regions can present challenges such as regulatory complexities, currency fluctuations, and intense local competition, which can make profitability uncertain in the initial phases of expansion.

Novel Sustainable Automotive Coatings

Novel sustainable automotive coatings, incorporating renewable, recycled, and bio-based materials, along with those designed for advanced sensor integration, represent a significant area of innovation for BASF. These coatings aim to meet increasing consumer demand for eco-friendly vehicles and the functional requirements of autonomous driving systems. For instance, the automotive coatings market is projected to reach USD 37.5 billion by 2028, with sustainability being a key driver.

While these advanced coatings offer compelling benefits, their position within the BCG matrix is still developing. Their market adoption rate and profitability are influenced by the competitive landscape and the pace of technological integration within the automotive industry. In 2023, the global automotive coatings market saw growth, but the premium for sustainable or highly functional coatings is still being established.

- Innovation Focus: Development of coatings using bio-resins and recycled plastics.

- Market Potential: Growing demand for eco-friendly and sensor-compatible automotive finishes.

- Challenges: Balancing innovation costs with market acceptance and competitive pricing.

- Strategic Consideration: Investment in R&D to secure early market share in this evolving segment.

Question Marks within BASF represent business units or product lines with low market share in high-growth industries. These ventures demand significant investment to capture market potential but currently generate low returns, making their future uncertain. BASF's exploration of novel materials for advanced electronics, for example, fits this profile, requiring substantial R&D and market development.

The company's ongoing investments in battery materials, particularly for next-generation electric vehicles, exemplify this. While the EV market is expanding rapidly, specific battery chemistries or production technologies may still be unproven, necessitating large capital outlays with uncertain market success. For instance, in 2024, BASF announced further investments in its battery materials production in Europe, aiming to secure a leading position in this high-potential but competitive sector.

Emerging sustainable chemical solutions, such as bio-based plastics or advanced catalysts for carbon capture, also fall into this category. These innovations address critical environmental challenges and have significant long-term growth prospects, but their current market penetration and profitability are limited. A 2023 industry analysis noted that while demand for sustainable chemicals is rising, the cost of production and consumer willingness to pay a premium remain key hurdles for many new entrants.

BASF's strategic focus on digitalization in its agricultural solutions, including AI-driven pest detection and precision farming tools, represents another area with Question Mark characteristics. These technologies promise increased efficiency and yield, but widespread adoption by farmers is still developing. As of early 2024, while interest in ag-tech is high, actual implementation varies significantly by region and farm size, indicating an evolving market landscape.

| Business Area | Example Venture | Market Growth | Market Share | Investment Need | Potential Return |

|---|---|---|---|---|---|

| Battery Materials | New Cathode Chemistries | High | Low | High | Uncertain |

| Agricultural Solutions | AI-driven Precision Farming | High | Low | High | Uncertain |

| Advanced Materials | Bio-based Polymers | High | Low | High | Uncertain |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.