BASF Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BASF Bundle

BASF operates in a dynamic chemical industry, facing intense competition from established players and emerging threats. Understanding the bargaining power of buyers, the threat of new entrants, and the influence of suppliers is crucial for navigating this landscape. The availability of substitutes and the intensity of rivalry further shape BASF's strategic positioning.

Ready to move beyond the basics? Get a full strategic breakdown of BASF’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

BASF, the world's largest chemical producer, has a significant dependence on raw materials and energy. For instance, in 2023, energy costs represented a substantial portion of their operating expenses, with natural gas prices in Europe experiencing considerable volatility due to geopolitical events. This reliance means that suppliers of these essential inputs hold considerable sway over BASF's cost structure.

BASF actively manages supplier power by maintaining a broad and globally diverse supplier network. This diversification is crucial for mitigating risks associated with any single supplier's leverage. For instance, in 2023, BASF's procurement volume for key raw materials was spread across numerous suppliers worldwide, preventing over-reliance on any one entity.

Strategic partnerships with key suppliers are another cornerstone of BASF's approach. These collaborations foster mutual trust and allow for better negotiation leverage and supply chain stability. BASF's commitment to long-term relationships ensures preferential access to critical inputs, even during periods of market volatility, a strategy that proved vital in navigating 2024's fluctuating energy markets.

Increasing regulatory frameworks, like the German Supply Chain Due Diligence Act and the EU Corporate Sustainability Due Diligence Directive, are significantly expanding sustainability requirements for BASF’s suppliers. This means suppliers must invest more in environmental, social, and governance (ESG) compliance.

Non-compliance with these evolving sustainability standards can restrict a supplier's access to BASF's business, potentially shrinking the overall supplier pool. As a result, those suppliers who can effectively meet and demonstrate these stringent ESG criteria gain a stronger negotiating position, enhancing their bargaining power.

Proprietary Technology and Specialized Inputs

Suppliers of proprietary technology and specialized inputs can wield significant bargaining power. In certain niche chemical markets, providers of unique catalysts or highly specialized intermediates, backed by their own advanced intellectual property or deep technical know-how, can command better terms. This is particularly relevant for companies like BASF that are heavily invested in innovation and the development of sustainable, next-generation materials.

BASF's strategic emphasis on green chemistry and bio-based feedstocks means it may depend on suppliers offering cutting-edge environmental technologies or novel renewable raw materials. The ability of these suppliers to differentiate through unique product offerings or patented processes directly influences their leverage in negotiations. For instance, a supplier of a novel bio-catalyst that significantly improves yield or reduces energy consumption in a BASF production process would likely possess strong bargaining power.

- Proprietary Catalysts: Suppliers of patented catalysts crucial for specific chemical reactions, offering higher efficiency or unique product characteristics, can dictate terms.

- Advanced Intermediates: Providers of highly specialized chemical building blocks, where few or no alternatives exist, possess considerable leverage.

- Sustainable Feedstocks: Companies developing and supplying advanced bio-based or recycled feedstocks, aligned with BASF's sustainability goals, may enjoy enhanced bargaining power.

- R&D Collaboration: Suppliers involved in co-development or possessing unique research capabilities that are vital for BASF's product pipeline can exert greater influence.

Logistics and Supply Chain Resilience

Disruptions in raw material delivery, stemming from supplier insolvencies, quality issues, severe weather, or geopolitical instability, present significant operational risks for BASF. For instance, the ongoing global semiconductor shortage, impacting various industries, highlights the vulnerability of complex supply chains. In 2023, many companies reported increased lead times and higher input costs due to these persistent disruptions.

BASF's strategic focus on bolstering supply chain resilience through enhanced visibility, agility, and flexibility is paramount. This includes diversifying supplier bases and investing in advanced tracking technologies to mitigate the impact of unforeseen events. By proactively managing these vulnerabilities, BASF can effectively reduce its reliance on individual suppliers and lessen their bargaining power.

- Supply Chain Visibility: Implementing real-time tracking and data analytics to monitor inventory and shipments across the entire supply network.

- Supplier Diversification: Reducing dependence on single-source suppliers by establishing relationships with multiple providers globally.

- Inventory Management: Optimizing stock levels to buffer against short-term supply interruptions without incurring excessive holding costs.

- Geopolitical Risk Assessment: Continuously evaluating and adapting to political and economic changes that could affect supply routes and material availability.

Suppliers of specialized chemicals, proprietary catalysts, and advanced intermediates hold significant bargaining power over BASF, especially when few alternatives exist. This leverage is amplified for suppliers who invest in R&D and possess unique intellectual property, crucial for BASF's innovation goals. For example, in 2024, suppliers of advanced bio-based feedstocks, critical for BASF's sustainability initiatives, saw their negotiating positions strengthen due to high demand and limited availability of certified materials.

The increasing regulatory landscape, including sustainability due diligence laws, also shifts power towards suppliers who can meet stringent ESG criteria. This means suppliers demonstrating strong environmental, social, and governance compliance gain an advantage. For instance, in 2023, suppliers with robust carbon footprint reporting and ethical sourcing practices were better positioned to secure favorable terms with BASF.

BASF mitigates supplier power through broad diversification and strategic partnerships. By maintaining a global network of suppliers, as seen in their 2023 procurement strategies, they reduce reliance on any single entity. Long-term collaborations also ensure preferential access to critical inputs, a strategy that proved vital in navigating 2024's volatile energy markets.

The bargaining power of suppliers for BASF is influenced by factors such as the uniqueness of their offerings, compliance with evolving regulations, and their ability to ensure supply chain resilience. Suppliers of proprietary catalysts and advanced intermediates can command higher prices, while those meeting stringent ESG standards are increasingly valued. BASF actively counters this by diversifying its supplier base and fostering strategic partnerships.

| Supplier Characteristic | Impact on Bargaining Power | Example (2023-2024) |

|---|---|---|

| Proprietary Technology/IP | High | Suppliers of patented catalysts for specialty chemicals |

| Limited Alternatives | High | Providers of unique chemical intermediates |

| ESG Compliance | Increasingly High | Suppliers of certified bio-based feedstocks |

| Diversified Supplier Base (BASF Strategy) | Lowers Supplier Power | BASF's global sourcing network for raw materials |

| Strategic Partnerships (BASF Strategy) | Lowers Supplier Power | Long-term agreements for critical inputs |

What is included in the product

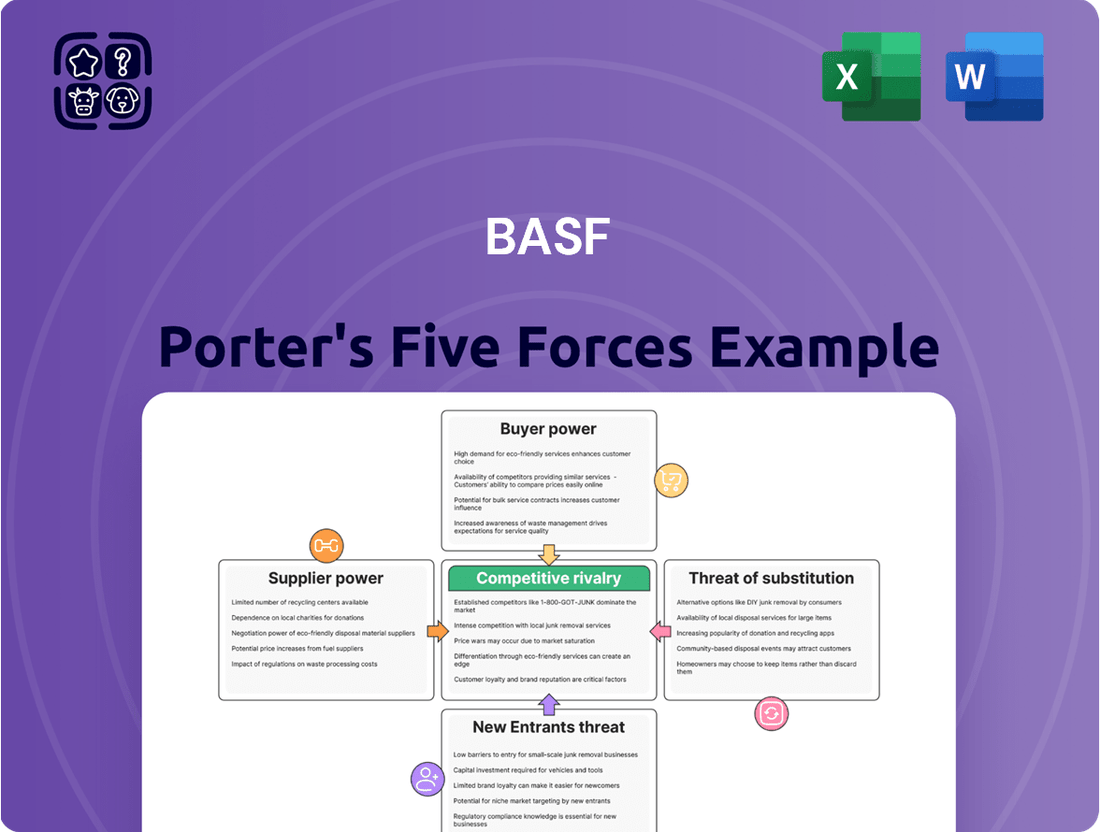

BASF's Porter's Five Forces Analysis dissects the competitive intensity within the chemical industry, examining supplier and buyer power, the threat of new entrants and substitutes, and the rivalry among existing players to understand profitability drivers.

Instantly identify competitive vulnerabilities and opportunities with a dynamic, interactive Porter's Five Forces model, providing actionable insights for BASF's strategic planning.

Customers Bargaining Power

BASF's extensive reach across diverse sectors like agriculture, automotive, construction, electronics, and consumer goods significantly dilutes the bargaining power of any single customer. This broad customer portfolio, serving numerous industries, naturally limits the impact of individual clients on BASF's pricing and terms.

BASF is doubling down on customer centricity, which means truly understanding and catering to client needs. This focus on tailored solutions helps build strong customer loyalty in the chemical sector. For instance, in 2024, BASF continued to highlight its role in helping customers achieve sustainability goals, such as reducing CO2 emissions.

By offering products and processes that give customers a competitive edge, like those that improve resource efficiency, BASF aims to solidify these relationships. This strategic approach can effectively mitigate the bargaining power of customers. For example, providing specialized chemical formulations that enhance a client's product performance can make them less likely to switch to a competitor, even if prices are slightly higher.

Customers are increasingly integrating sustainability into their business strategies, driven by a global push towards lower CO2 emissions and a circular economy. This means a growing appetite for chemical products that possess strong sustainability credentials.

In the medium term, demand for these eco-friendly chemical solutions is projected to outstrip available supply. For instance, by 2024, the global market for sustainable chemicals is expected to reach over $100 billion, indicating a significant shift in purchasing priorities.

This heightened demand can empower customers, making them more willing to pay a premium for low-emission alternatives. Consequently, their price sensitivity may decrease, potentially softening their bargaining power against suppliers.

Impact of Downstream Industry Performance

The economic health of BASF's customer industries significantly shapes the bargaining power of its buyers. When sectors like automotive or construction experience a downturn, demand for BASF's chemical products naturally weakens. This reduced demand grants customers in these struggling industries greater leverage to negotiate prices or demand more favorable terms. For instance, if the global automotive production, which is a key market for BASF's plastics and coatings, slows down considerably, car manufacturers can push for lower prices on these essential components.

Consider the impact of economic cycles. In 2023, for example, many industrial sectors faced headwinds. The automotive industry in Europe saw production challenges, impacting demand for chemicals used in vehicle manufacturing. This environment inherently strengthens the position of automotive companies as buyers, allowing them to exert more pressure on their chemical suppliers like BASF.

- Customer Industry Health: The performance of downstream industries directly affects the demand for BASF's offerings.

- Economic Slowdowns: Recessions or slowdowns in key customer sectors like construction or automotive increase buyer leverage.

- Negotiating Power: Weaker demand allows customers to negotiate better pricing and terms from chemical suppliers.

- 2023 Impact: European automotive production issues in 2023 exemplify how industry-specific challenges can empower buyers.

Long-Term Contracts and Strategic Partnerships

BASF often enters into long-term contracts and strategic partnerships, particularly for its specialized chemicals and high-value solutions. These agreements can lock in demand and foster deeper collaboration, thereby mitigating the bargaining power of customers in specific market segments.

A prime example is BASF's strategic partnership with CATL, a leading global battery manufacturer. This collaboration, focused on battery materials, not only secures a significant demand channel for BASF but also provides invaluable insights into evolving battery design trends and technological advancements. This shared knowledge strengthens BASF's product development and market positioning, effectively reducing the individual bargaining leverage of customers within this critical sector.

- Long-Term Agreements: BASF secures predictable revenue streams and customer loyalty through multi-year contracts for specialized chemical products.

- Strategic Alliances: Partnerships, like the one with CATL for battery materials, create symbiotic relationships that benefit both parties and can reduce customer price sensitivity.

- Customer Dependence: By integrating deeply into customer value chains, BASF can foster a degree of dependence, thereby limiting customers' ability to switch suppliers without significant disruption.

BASF's broad customer base across many industries naturally limits the power of any single buyer. However, the increasing customer focus on sustainability, as seen in the projected over $100 billion global sustainable chemicals market by 2024, can empower customers willing to pay a premium for eco-friendly solutions, potentially softening their price sensitivity.

Economic downturns in key sectors like automotive or construction, which experienced challenges in 2023, can significantly increase customer leverage. For instance, reduced automotive production in Europe in 2023 meant car manufacturers could push for lower prices on essential chemical components from suppliers like BASF.

BASF mitigates customer bargaining power through long-term contracts and strategic partnerships. The collaboration with CATL for battery materials, for example, secures demand and provides crucial market insights, strengthening BASF's position and reducing individual customer leverage in this vital sector.

| Factor | Impact on BASF | Customer Bargaining Power |

|---|---|---|

| Customer Diversification | Widespread market presence | Low for individual customers |

| Sustainability Demand | Growing market for eco-friendly chemicals (>$100B by 2024) | Potentially Higher for eco-conscious buyers |

| Economic Downturns (e.g., 2023 auto sector) | Reduced demand in key industries | Higher for customers in struggling sectors |

| Long-Term Contracts & Partnerships (e.g., CATL) | Secured demand, market insights | Lower for partners in strategic alliances |

What You See Is What You Get

BASF Porter's Five Forces Analysis

This preview showcases the complete BASF Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the chemical giant. You're viewing the exact, professionally formatted document that will be instantly available to you upon purchase, offering a comprehensive understanding of industry rivalry, buyer and supplier power, the threat of new entrants, and the impact of substitutes on BASF's operations.

Rivalry Among Competitors

The global chemical industry is a battleground of intense rivalry, with ongoing consolidation shaping the competitive landscape. BASF, a titan in this sector, faces formidable competition from established giants and emerging players, particularly those benefiting from favorable raw material and energy costs in Asia, North America, and the Middle East.

In 2023, the chemical industry saw significant shifts, with companies like Dow and DuPont continuing to navigate market dynamics. BASF itself reported sales of approximately €68.9 billion for 2023, underscoring its scale amidst this competitive pressure. The rise of Asian chemical manufacturers, in particular, presents a growing challenge, leveraging cost advantages to capture market share.

Overcapacity in key chemical production segments, particularly in Europe and Asia, is a significant driver of intense rivalry. This oversupply, combined with sluggish demand in certain regions during 2024, has forced many players, including BASF, to operate at lower utilization rates. For example, the European cracker operating rates dipped significantly in early 2024 due to these factors.

This imbalance between supply and demand directly translates into considerable pricing pressures across the industry. When there's more product than buyers need, companies often resort to price cuts to move inventory. This can erode profit margins for all participants, as seen in the reduced pricing for basic chemicals like ethylene and propylene throughout much of 2024, directly impacting BASF's top-line performance.

BASF actively differentiates itself through a robust focus on innovation and sustainable solutions, a strategy that directly addresses competitive rivalry. The company’s extensive patent portfolio, with a notable emphasis on sustainability-linked advancements, underpins its enduring competitive strength. For instance, in 2023, BASF continued to invest heavily in research and development, with a significant portion allocated to green chemistry and circular economy initiatives, aiming to secure a distinct market advantage.

Regional Cost Advantages and Geopolitical Factors

European chemical producers, including giants like BASF, grapple with significant cost disadvantages stemming from higher energy prices compared to competitors in the United States and Asia. For instance, in early 2024, natural gas prices in Europe remained notably elevated, impacting production costs for energy-intensive chemical manufacturing.

Geopolitical factors exacerbate these challenges. Trade restrictions and tariffs, such as those that have emerged in recent years, can disrupt established supply chains and limit market access for European chemical exports, directly affecting cost competitiveness and profitability.

- Elevated Energy Costs: European chemical companies consistently face higher natural gas and electricity prices, impacting their cost base.

- Geopolitical Trade Disruptions: Tariffs and trade tensions can increase the cost of raw materials and hinder access to key international markets.

- Supply Chain Vulnerabilities: Geopolitical instability can lead to supply chain disruptions, increasing lead times and costs for essential inputs.

Portfolio Restructuring and Strategic Focus

BASF's competitive rivalry is intensifying as the company actively restructures its portfolio. By divesting non-core assets, such as its construction chemicals business sold in 2023 for €3.17 billion, BASF aims to sharpen its focus on core chemical operations and high-growth specialty areas. This strategic move is designed to unlock value and reallocate capital towards innovation and resilience, directly impacting how it competes within the chemical industry.

This portfolio restructuring is a direct response to the dynamic competitive landscape. For instance, in 2024, BASF is prioritizing investments in areas like battery materials, a sector experiencing rapid growth driven by the electric vehicle market. This strategic focus means BASF will be competing more directly with specialized players in these niche, high-margin segments, intensifying rivalry in those specific chemical sub-sectors.

- Divestment Strategy: BASF sold its construction chemicals business for €3.17 billion in 2023, signaling a shift away from standalone units.

- Focus on Core: The company is concentrating on its integrated Verbund sites and specialty chemical businesses.

- Capital Reallocation: Proceeds from divestments are earmarked for investments in growth areas like battery materials and sustainable solutions.

- Enhanced Resilience: Restructuring aims to improve BASF's ability to navigate macroeconomic volatility and strengthen its competitive position.

BASF faces intense competition from global players, particularly those with cost advantages in Asia and North America, driving price pressures and impacting profitability. The company's 2023 sales of €68.9 billion reflect its scale amidst this rivalry, exacerbated by overcapacity in key chemical segments, leading to lower operating rates in early 2024.

BASF counters this by investing in innovation and sustainability, evidenced by its R&D focus in 2023 on green chemistry. However, elevated energy costs in Europe, a significant factor in early 2024, place it at a disadvantage compared to competitors in regions with lower energy prices.

The company's strategic divestment of its construction chemicals business for €3.17 billion in 2023, and its subsequent focus on high-growth areas like battery materials in 2024, signifies an effort to sharpen its competitive edge in specialized markets.

| Key Competitor Actions/Factors | Impact on BASF | 2023/2024 Relevance |

|---|---|---|

| Asian Manufacturers' Cost Advantages | Increased price competition, market share erosion | Ongoing challenge, particularly in basic chemicals |

| European Overcapacity & Low Utilization Rates | Pricing pressure, reduced margins | Significant in early 2024 for crackers |

| BASF's R&D Investment in Sustainability | Differentiation, potential for premium pricing | Continued focus in 2023, driving future competitiveness |

| Elevated European Energy Costs | Higher production costs, reduced cost competitiveness | Persistent issue in early 2024 impacting European players |

| Portfolio Restructuring (Divestments/Focus Areas) | Sharpened focus, capital reallocation to growth | Divestment of construction chemicals for €3.17bn (2023), focus on battery materials (2024) |

SSubstitutes Threaten

The chemical industry is seeing a major move toward greener options. This means more bio-based materials and renewable feedstocks are being used, directly challenging traditional fossil-fuel-derived chemicals. For instance, by 2024, the global bio-based chemicals market is projected to reach over $100 billion, highlighting the growing appeal and viability of these alternatives.

Technological advancements in green chemistry, including biorefining and CO2 utilization, are creating new pathways for chemical production. These innovations, often driven by significant R&D investment, offer alternatives to traditional petrochemical-based products. For instance, companies are exploring enzymatic processes that can yield chemicals with lower environmental impact, directly challenging established product lines.

BASF itself is a major investor in these evolving fields, recognizing their potential to reshape the chemical industry. However, the rapid pace of discovery means that competitors could quickly develop and commercialize substitute chemicals derived from these sustainable sources. This could erode market share for BASF's existing offerings if they are not equally competitive in performance or cost.

The development of advanced catalysis is also a key driver, enabling more efficient and cost-effective production of bio-based chemicals. For example, breakthroughs in catalyst design have made it feasible to convert biomass into valuable chemical intermediates at scale. This trend presents a direct threat, as these novel bio-based chemicals can serve as direct substitutes for products currently manufactured by BASF.

Mounting environmental concerns and a significant regulatory push are accelerating the shift towards sustainable alternatives in the chemical industry. For example, the European Union's Green Deal aims to make the EU climate-neutral by 2050, which includes stringent regulations on chemical usage and production. This societal trend directly impacts BASF by increasing the threat of substitutes, as consumers and businesses increasingly favor eco-friendly products over conventional ones.

Performance and Cost of Substitutes

The performance and cost of substitute products significantly influence the threat of substitution for BASF's offerings. While sustainable alternatives are emerging, their market penetration hinges on matching or exceeding the efficacy and affordability of conventional chemicals. For instance, bio-based plastics are gaining traction, but their production costs can still be higher than petroleum-based counterparts, limiting widespread adoption in price-sensitive sectors.

As these alternative technologies mature and benefit from economies of scale, their competitive edge will sharpen. For example, advancements in green chemistry are making bio-solvents more cost-effective, potentially challenging traditional petrochemical-based solvents in industrial cleaning and coatings. This ongoing technological evolution means the threat of substitution is dynamic and likely to increase.

Key factors influencing the threat of substitutes for BASF include:

- Cost Competitiveness: The price difference between BASF's products and viable substitutes is a primary driver of customer choice. For example, while electric vehicles (EVs) are a substitute for internal combustion engine vehicles, the initial purchase price and charging infrastructure costs remain barriers for some consumers.

- Performance Parity: Substitutes must offer comparable or superior performance characteristics. In the agricultural sector, for instance, new bio-pesticides must demonstrate efficacy against pests comparable to synthetic pesticides to gain market share.

- Technological Advancement: Ongoing innovation in areas like renewable energy sources and advanced materials can create new substitutes or improve existing ones. The increasing efficiency and decreasing cost of solar panels, for example, represent a growing substitute for traditional energy sources.

- Regulatory Support: Government policies and incentives favoring sustainable or alternative products can accelerate their adoption and increase the threat of substitution. For example, carbon taxes or subsidies for renewable materials can make them more attractive relative to traditional options.

Circular Economy Initiatives

The growing emphasis on circular economy principles, focusing on waste reduction and material recovery, presents a significant threat of substitutes for traditional chemical production. Advanced recycling technologies, including chemical recycling, are gaining traction. For instance, by 2024, the global chemical recycling market is projected to reach tens of billions of dollars, offering alternative pathways for material sourcing.

These innovative recycling methods can reprocess plastic waste into valuable feedstocks, directly competing with virgin materials. Companies are investing heavily in these areas; for example, several major chemical firms announced significant investments in chemical recycling capacity in 2023 and 2024. This shift challenges the established supply chains for virgin petrochemicals.

The threat is amplified as these circular solutions mature and become more cost-competitive. The potential for reduced reliance on fossil fuels for chemical production is a key driver. By 2025, it's anticipated that a notable percentage of certain polymers could be sourced from recycled content, impacting demand for primary production.

- Chemical Recycling Advancements: Technologies like pyrolysis and gasification break down plastics into their molecular building blocks, creating substitutes for virgin feedstocks.

- Material Recovery Rates: Improved collection and sorting infrastructure are increasing the availability of post-consumer waste suitable for recycling.

- Product Longevity and Design: Initiatives promoting product durability and design for disassembly reduce the overall demand for new materials.

- Policy and Consumer Demand: Government regulations and increasing consumer preference for sustainable products are accelerating the adoption of circular economy models.

The chemical industry faces a growing threat from substitutes, particularly those derived from sustainable and bio-based sources. As environmental concerns and regulatory pressures mount, the demand for greener alternatives is accelerating. For instance, the global bio-based chemicals market was projected to exceed $100 billion by 2024, indicating a significant shift in market preferences.

Technological advancements in areas like biorefining and chemical recycling are creating cost-effective and high-performance substitutes for traditional petrochemical-based products. By 2025, a notable percentage of certain polymers are expected to be sourced from recycled content, directly impacting the demand for virgin materials. This trend challenges BASF's existing product lines if they cannot match the performance or cost-competitiveness of these emerging alternatives.

The viability of these substitutes is heavily influenced by their cost-competitiveness and performance parity with conventional chemicals. For example, while bio-solvents are becoming more cost-effective due to advancements in catalysis, their widespread adoption still depends on matching the efficacy of petrochemical-based solvents. Government policies, such as carbon taxes or subsidies for renewable materials, further enhance the attractiveness of substitutes, increasing the overall threat to established chemical producers.

Entrants Threaten

The chemical industry, especially for bulk chemicals, demands massive upfront investments in sophisticated manufacturing facilities and extensive infrastructure. For instance, constructing a new cracker for ethylene production can cost billions of dollars, a prohibitive sum for most aspiring entrants.

BASF's renowned Verbund concept, which links production plants to efficiently utilize by-products and energy, creates significant economies of scale. This integration lowers per-unit production costs, making it incredibly difficult for new, smaller-scale competitors to match BASF's cost efficiency and competitive pricing, thereby acting as a substantial barrier.

The chemical industry, including giants like BASF, operates under a microscope of strict environmental regulations and safety standards worldwide. For any new company looking to enter this space, navigating the labyrinth of permits and ensuring adherence to these complex, ever-changing rules presents a formidable challenge. This compliance process is not only costly but also incredibly time-consuming, acting as a significant barrier to entry.

BASF's significant investment in technological expertise and research and development (R&D) presents a formidable barrier to new entrants. The company's commitment to innovation is underscored by its substantial R&D expenditure, which reached approximately €2.0 billion in 2023. This continuous investment fuels the development of proprietary processes and cutting-edge technologies, making it exceedingly difficult for new players to match BASF's innovative capabilities and product differentiation.

Established Supply Chains and Customer Relationships

Established supply chains and customer relationships present a significant barrier for new entrants. Companies like BASF have spent years building robust networks for sourcing raw materials and energy, crucial for consistent production. For instance, in 2024, BASF continued to leverage its integrated Verbund sites, optimizing logistics and cost efficiencies across its operations, a feat difficult for newcomers to replicate quickly.

Furthermore, deep-rooted relationships with a diverse customer base, built on trust and consistent product quality, are hard for new players to penetrate. These established connections ensure demand for existing players' products, making it challenging for unproven entities to secure market share. In 2024, BASF reported strong demand from key sectors like automotive and construction, highlighting the loyalty and reliance of its existing customer base.

- Established Supply Chains: Companies like BASF have optimized global sourcing and logistics, reducing costs and ensuring reliability.

- Customer Loyalty: Long-standing relationships foster repeat business and make it difficult for new entrants to gain traction.

- Integrated Operations: BASF's Verbund system offers significant cost advantages and operational efficiencies that are challenging to match.

- Market Penetration Costs: New entrants face substantial investment requirements to build comparable supply chains and establish customer trust.

Specialization and Niche Markets

While BASF generally faces high barriers to entry due to its scale and integrated production, new players might find opportunities by focusing on specialized niche markets or rapidly developing areas like sustainable chemicals and bio-based products. These segments, though smaller, can offer avenues for innovation where established players might be slower to adapt. However, even in these specialized fields, the substantial investment required for research and development, coupled with the necessity to scale production efficiently, continues to pose significant hurdles.

For instance, the global market for bio-based chemicals, a key area for specialization, was estimated to be around $100 billion in 2023 and is projected to grow significantly, presenting potential entry points. Yet, companies entering this space must contend with the complex supply chains for raw materials and the capital-intensive nature of biochemical production facilities.

- Niche Market Focus: New entrants can target specialized segments within the chemical industry, such as high-performance polymers or specific additives, where deep technical expertise can create a competitive advantage.

- Emerging Technologies: Specialization in areas like green chemistry, advanced battery materials, or biodegradable plastics offers potential entry points, capitalizing on growing demand and regulatory tailwinds.

- R&D and Scaling Challenges: Despite niche opportunities, significant upfront investment in research and development and the subsequent capital expenditure for scaling production remain substantial barriers for new entrants.

- Sustainable Chemicals Growth: The sustainable chemicals market, projected to reach over $150 billion by 2027, highlights a segment where specialized knowledge and innovative processes can attract investment, though achieving cost competitiveness with traditional chemicals is a key challenge.

The threat of new entrants for BASF is generally low, primarily due to the immense capital required for establishing chemical production facilities. For example, building a new world-scale cracker for ethylene production can easily cost billions of dollars. This high initial investment acts as a significant deterrent for potential new companies looking to enter the bulk chemical market.

BASF's deeply integrated Verbund system, a network of interconnected production plants, offers substantial economies of scale and cost efficiencies that are exceptionally difficult for newcomers to replicate. This operational advantage, combined with established supply chains and strong customer loyalty built over decades, creates formidable barriers to entry.

Navigating the stringent and complex global regulatory landscape for environmental protection and safety standards presents another major hurdle. New entrants must invest heavily in compliance, permits, and specialized knowledge, which is both time-consuming and costly, further limiting the ease of market entry.

BASF's continuous, significant investment in research and development, amounting to approximately €2.0 billion in 2023, fuels proprietary technologies and product differentiation. This commitment to innovation makes it challenging for new players to compete on technological advancement and product quality.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023/2024) |

| Capital Requirements | Massive upfront investment in manufacturing facilities and infrastructure. | Prohibitive for most potential entrants. | Ethylene cracker construction costs in billions of USD. |

| Economies of Scale & Verbund | BASF's integrated production network optimizes resource utilization and lowers per-unit costs. | Makes it difficult for smaller-scale competitors to match cost efficiency. | Verbund sites optimize logistics and cost efficiencies across operations in 2024. |

| Regulatory Compliance | Strict environmental and safety standards require extensive permits and adherence. | Costly and time-consuming process, acting as a significant hurdle. | Ongoing investments in sustainability and compliance measures. |

| R&D and Technology | Continuous investment in innovation and proprietary processes. | Difficult for new players to match BASF's technological capabilities. | R&D expenditure of approx. €2.0 billion in 2023. |

| Supply Chains & Customer Relationships | Established networks for sourcing and strong, loyal customer bases. | Challenging for new entrants to penetrate and secure market share. | Strong demand from automotive and construction sectors in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for BASF is built upon a robust foundation of data, including BASF's official annual reports, investor presentations, and SEC filings. This is supplemented by industry-specific market research reports from firms like IHS Markit and ICIS, as well as macroeconomic data from sources such as the World Bank and Eurostat.