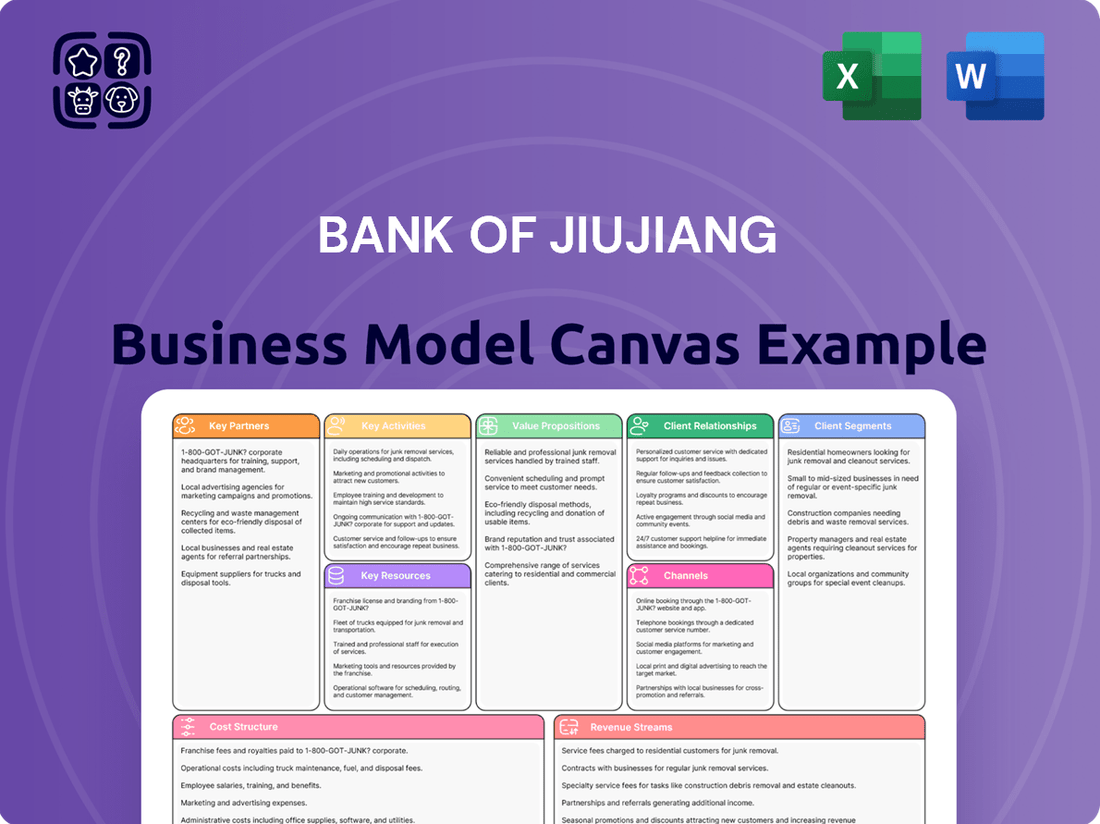

Bank of Jiujiang Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Jiujiang Bundle

Discover the core components of Bank of Jiujiang's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams. Unlock the full blueprint to understand their strategic advantage.

Partnerships

Bank of Jiujiang has secured partnerships with significant entities such as Industrial Bank and Beijing Automotive Group. These alliances are instrumental in refining the bank's shareholder composition and elevating its public perception.

These strategic alliances are expected to offer vital capital infusions, specialized industry knowledge, and expanded reach into various markets, thereby bolstering the bank's resilience and expansion trajectory.

Such cooperative ventures are essential for regional banks aiming to solidify their competitive standing and broaden their service portfolios within the ever-evolving financial sector.

Bank of Jiujiang actively partners with government agencies and local authorities, especially within Jiangxi Province, to foster regional economic growth and execute financial policies. This collaboration is crucial for aligning the bank's services with provincial strategic objectives.

A prime example of this partnership is the bank's involvement in events like the 'Government-Bank-Enterprise' matchmaking for green and low-carbon transformation. In 2024, such initiatives are pivotal for directing capital towards sustainable development, a key focus for many regional economies.

These relationships are fundamental for Bank of Jiujiang to effectively serve the local economy and ensure a stable and supportive operating environment. By working hand-in-hand with governmental bodies, the bank reinforces its role as a key financial pillar in the region's development.

Bank of Jiujiang is forging key partnerships with technology and fintech providers to drive its digital transformation. This collaboration is crucial for enhancing its digital banking services, including the development of online corporate banking and the optimization of customer relationship management systems. For instance, in 2024, the bank continued to invest heavily in cloud computing and AI, areas where fintech partnerships are essential for rapid deployment and innovation.

These alliances are instrumental in implementing advanced solutions like digital intelligent financial brain platforms. Such partnerships allow Bank of Jiujiang to leverage cutting-edge technology to improve operational efficiency, elevate the customer experience, and strengthen risk management capabilities. The focus on these technological integrations is a strategic move to stay competitive in the evolving financial landscape.

Interbank and Financial Institution Collaborations

Bank of Jiujiang actively participates in the interbank market, collaborating with numerous financial institutions to manage liquidity and execute transactions. These relationships are crucial for its daily operations, allowing it to efficiently borrow and lend funds. For instance, in 2024, the interbank lending market in China saw significant activity, with average daily turnover reaching trillions of yuan, highlighting the importance of these partnerships for banks like Jiujiang.

These collaborations extend to clearing and settlement services, ensuring smooth and secure transactions across the financial system. By partnering with larger financial institutions or clearing houses, Bank of Jiujiang can streamline its back-office processes and reduce operational risks. This is particularly relevant as China continues to modernize its financial infrastructure, with initiatives aimed at enhancing efficiency and security in interbank operations.

Furthermore, Bank of Jiujiang may explore strategic alliances or even mergers with smaller county banks. Such consolidations, often encouraged by regulatory bodies, can lead to greater economies of scale, enhanced capital strength, and broader market reach. These partnerships are vital for strengthening the regional banking sector and ensuring its resilience, especially in the context of evolving economic landscapes and increasing competition.

- Interbank Market Operations: Facilitates efficient liquidity management through borrowing and lending with other financial institutions.

- Clearing and Settlement: Partners for secure and streamlined transaction processing, reducing operational risks.

- Strategic Consolidations: Explores mergers with smaller banks to enhance scale, capital, and market presence.

- Best Practice Sharing: Collaborates to improve operational efficiency and develop innovative financial products.

Local Businesses and Enterprises

Bank of Jiujiang's key partnerships are deeply rooted in its commitment to local economic development, particularly by serving corporate clients and small and medium-sized enterprises (SMEs) throughout Jiangxi Province. This focus necessitates strong collaborations with these enterprises to offer specialized financial products. For instance, in 2023, SMEs accounted for a significant portion of China's GDP, underscoring their importance to regional banks like Bank of Jiujiang.

- Tailored Financial Solutions: The bank provides customized loan products, trade financing, and payment and settlement services designed to meet the unique operational and growth needs of local businesses.

- Regional Economic Support: By fostering these relationships, Bank of Jiujiang actively contributes to the vitality of the real economy and promotes prosperity within Jiangxi Province.

- Growth and Operational Support: These partnerships are crucial for enabling local enterprises to expand their operations and manage their day-to-day financial activities effectively.

Bank of Jiujiang's key partnerships are vital for its operational efficiency and strategic growth. Collaborations with entities like Industrial Bank and Beijing Automotive Group enhance its shareholder structure and public image, while partnerships with technology and fintech providers are crucial for digital transformation, as seen in its 2024 investments in cloud computing and AI.

The bank also actively engages with government agencies in Jiangxi Province to align with regional economic goals, participating in initiatives like the 'Government-Bank-Enterprise' matchmaking for green development in 2024. Furthermore, its participation in the interbank market, where average daily turnover in 2024 reached trillions of yuan, is essential for liquidity management and transaction processing.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Focus/Data Point |

|---|---|---|---|

| Corporate & Industrial | Industrial Bank, Beijing Automotive Group | Shareholder refinement, public perception enhancement | Elevating public perception and refining shareholder composition. |

| Government & Regional Development | Jiangxi Provincial Authorities | Aligning with provincial strategies, fostering economic growth | Participation in 'Government-Bank-Enterprise' matchmaking for green development. |

| Technology & Fintech | Various Tech/Fintech Providers | Digital transformation, service enhancement | Investment in cloud computing and AI for digital banking services. |

| Financial Institutions | Interbank Market Participants | Liquidity management, transaction processing | Significant activity in China's interbank lending market (trillions of yuan daily turnover). |

What is included in the product

A comprehensive overview of the Bank of Jiujiang's operations, detailing its customer segments, value propositions, and key partnerships.

This model outlines the bank's revenue streams, cost structure, and core activities, providing a strategic roadmap for growth and stakeholder engagement.

The Bank of Jiujiang's Business Model Canvas effectively addresses the pain point of complex financial planning by condensing intricate strategies into a digestible format for quick review.

It serves as a crucial tool for alleviating the stress of financial uncertainty by providing a clear, one-page snapshot of core business components.

Activities

Bank of Jiujiang's core business revolves around deposit-taking and lending. It actively gathers funds from individuals and businesses, which it then uses to offer a range of loans, such as personal, corporate, and trade finance. This fundamental banking activity is key to its revenue generation through net interest income and its role in supporting local economic development.

In 2023, Bank of Jiujiang reported a net interest income of 4.2 billion RMB, highlighting the profitability of its lending operations. The bank is also focused on enhancing its lending efficiency by integrating digital tools for a smoother loan application and approval process, aiming to better serve its customer base and compete in the evolving financial landscape.

Bank of Jiujiang provides a wide array of wealth management solutions and personal financial services, catering to individual clients and investors. These services include expert investment advice and dedicated asset management, all designed to assist customers in reaching their financial objectives.

The bank actively pursues the expansion of these non-interest income generating activities. This strategic emphasis aims to diversify the bank's revenue streams, making it more resilient to fluctuations in traditional interest-based income.

In 2024, banks in China, including regional players like Bank of Jiujiang, are increasingly focusing on fee-based income. For instance, the wealth management sector in China saw significant growth, with assets under management in publicly offered funds reaching approximately 29.4 trillion yuan by the end of 2023, indicating a strong market for such services.

Bank of Jiujiang offers vital payment and settlement solutions, enabling seamless transactions for individuals and businesses. These services are fundamental to daily banking and generate significant fee and commission income for the bank.

In 2024, the bank continued to invest in digital innovation, particularly in mobile payment and clearing systems. This focus aims to improve customer experience and efficiency in transaction processing, a key driver for maintaining competitiveness in the financial sector.

Financial Market Operations

Bank of Jiujiang actively engages in various financial market operations to generate income and manage its balance sheet. These activities include participating in the interbank lending market, executing repurchase agreements (repos), and making strategic investments. For instance, in 2024, the bank continued to leverage its expertise in asset-liability management to optimize its portfolio in a dynamic interest rate environment.

These operations are crucial for the bank's profitability, contributing through net interest income and trading gains. Furthermore, they serve a vital role in maintaining adequate liquidity, a cornerstone of sound banking practice. By actively managing its assets and liabilities, Bank of Jiujiang aims to enhance returns while mitigating risks inherent in market fluctuations.

- Money Market Transactions: Engaging in short-term lending and borrowing to manage daily liquidity needs.

- Repurchase Agreements (Repos): Utilizing repos as a tool for both funding and investing, often with government securities as collateral.

- Investment Activities: Investing in a diversified portfolio of financial instruments for proprietary trading and wealth management services.

- Asset-Liability Management: Strategically aligning the bank's assets and liabilities to manage interest rate risk and maximize profitability.

Digital Transformation and Innovation

Bank of Jiujiang's digital transformation is a core activity, focusing on integrating advanced technologies like big data and artificial intelligence. This initiative aims to refine its product offerings, streamline operational processes, and elevate the overall customer experience.

Key efforts include the development and enhancement of robust online banking platforms and user-friendly mobile applications. These digital channels are crucial for providing convenient and accessible financial services to a wider customer base.

The bank is also investing in intelligent financial systems to improve decision-making and risk management. For instance, in 2024, Bank of Jiujiang reported a significant increase in digital transaction volumes, demonstrating the success of its digitalization strategy in boosting efficiency and competitiveness.

- Digital Transformation: Implementing big data, AI, and cloud computing.

- Product Enhancement: Developing advanced online and mobile banking solutions.

- Operational Efficiency: Utilizing intelligent systems for better performance.

- Customer Experience: Improving service delivery through digital channels.

Bank of Jiujiang's key activities encompass core banking operations like deposit-taking and lending, generating substantial net interest income. The bank also actively expands its wealth management services and personal financial solutions to diversify revenue streams, a strategy supported by the growing wealth management market in China, which saw assets under management in publicly offered funds reach approximately 29.4 trillion yuan by the end of 2023. Additionally, the bank facilitates payment and settlement solutions, investing in digital platforms for efficient transactions, and engages in financial market operations including money market transactions and repos to manage liquidity and optimize its portfolio.

| Key Activity | Description | 2023/2024 Data/Trend |

| Deposit-Taking & Lending | Gathering funds and providing loans. | Net interest income of 4.2 billion RMB in 2023; focus on digital loan processing. |

| Wealth Management | Offering investment advice and asset management. | Growing sector; China's publicly offered fund AUM ~29.4 trillion yuan end of 2023. |

| Payment & Settlement | Facilitating transactions for individuals and businesses. | Investment in digital payment and clearing systems; increased digital transaction volumes in 2024. |

| Financial Market Operations | Interbank lending, repos, and investments. | Optimizing portfolio in dynamic interest rate environment; managing liquidity. |

Full Document Unlocks After Purchase

Business Model Canvas

The Bank of Jiujiang Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive snapshot offers a direct look at the complete, ready-to-use analysis, ensuring no surprises and full transparency. Upon completing your order, you will gain instant access to this same, professionally structured Business Model Canvas, allowing you to immediately leverage its insights for strategic planning.

Resources

Financial capital is the lifeblood of Bank of Jiujiang, primarily sourced from customer deposits, which reached approximately RMB 150 billion by the end of 2023, and shareholder equity. Additional vital funding comes from interbank borrowings and bond issuances, enabling the bank to fuel its lending operations and investment portfolios.

This robust financial base is absolutely critical for the bank's core function of providing loans and managing its investments. A strong capital adequacy ratio, a key metric for financial health and regulatory adherence, is consistently maintained above the required thresholds, ensuring operational stability and investor confidence.

Human Capital and Expertise are foundational to Bank of Jiujiang's operations. The bank leverages a workforce possessing deep knowledge in banking, finance, cutting-edge technology, and robust risk management practices.

As of the close of 2024, Bank of Jiujiang's strength lies in its 5,773 full-time employees. A significant majority of these professionals hold either an undergraduate or master's degree, highlighting a commitment to a highly educated and capable team.

Continuous investment in talent development and cultivating a committed workforce are critical. This focus directly supports the bank's ability to deliver superior services and act as a catalyst for innovation across its offerings.

Bank of Jiujiang leverages a substantial physical infrastructure to serve its customers. This includes its head office, 13 branches, and a significant network of 263 sub-branches, complemented by 20 controlled county banks. This extensive footprint ensures a strong presence across Jiangxi Province, facilitating direct customer interactions and essential cash services.

This physical network is a cornerstone for community engagement and provides a tangible touchpoint for banking services. Even as digital channels expand, the bank's physical presence remains crucial for delivering localized support and building trust within its operating regions.

Technology Infrastructure and Digital Platforms

Bank of Jiujiang’s technology infrastructure, encompassing core banking systems, digital platforms, and mobile applications, is fundamental to its modern operations. These digital assets are crucial for delivering online services and supporting data-driven decision-making, ensuring the bank remains competitive.

Ongoing investments in fintech and digital intelligence platforms are key. For instance, in 2024, the bank allocated a significant portion of its IT budget towards upgrading its core banking system, aiming for enhanced operational efficiency and a more seamless customer experience. This focus on digital transformation directly supports the bank's ability to innovate and adapt to changing customer expectations.

- Core Banking Systems: The backbone of all banking operations, enabling transaction processing and customer account management.

- Digital Platforms: Online and mobile banking interfaces that provide customers with convenient access to services.

- Data Analytics Capabilities: Tools and systems for processing and analyzing customer data to inform strategic decisions and personalize offerings.

- Fintech Investments: Allocations towards new technologies and partnerships to drive innovation and improve service delivery.

Brand Reputation and Trust

Bank of Jiujiang's brand reputation and customer trust are cornerstones of its business model, cultivated through consistent service to its local community. This trust is an invaluable intangible asset, directly impacting customer acquisition and retention.

The bank's commitment to reliability and ethical operations has earned it significant accolades. For instance, in 2023, it was recognized as a National Advanced Grassroots Party Organization, a testament to its strong community ties and operational integrity. Such recognitions reinforce its standing and build confidence among stakeholders.

Maintaining this hard-earned trust is paramount. Bank of Jiujiang focuses on delivering dependable services and upholding social responsibility initiatives. This dedication is crucial for attracting new customers and ensuring the loyalty of its existing client base, contributing to its long-term stability and growth.

- Brand Reputation: A strong, trusted brand built on years of community service.

- Key Recognitions: Awarded 'National Advanced Grassroots Party Organization' and 'National May Day Labour Award' (as of recent data, reflecting ongoing commitment).

- Customer Trust: Fostered through reliable service, ethical conduct, and social responsibility.

- Business Impact: Essential for attracting and retaining customers, underpinning business model sustainability.

Bank of Jiujiang's key resources are a blend of financial strength, human expertise, extensive physical and technological infrastructure, and a highly valued brand reputation built on trust. These elements collectively enable the bank to effectively serve its customer base and pursue its strategic objectives.

| Resource Category | Key Components | 2023/2024 Data Points |

|---|---|---|

| Financial Capital | Customer Deposits, Shareholder Equity, Interbank Borrowings, Bond Issuances | Deposits ~RMB 150 billion (end 2023) |

| Human Capital | Banking, Finance, Technology, Risk Management Expertise | 5,773 employees (end 2024), majority with degrees |

| Physical Infrastructure | Head Office, Branches, Sub-branches, Controlled County Banks | 1 Head Office, 13 Branches, 263 Sub-branches, 20 Controlled County Banks |

| Technology Infrastructure | Core Banking Systems, Digital Platforms, Mobile Applications, Data Analytics | Significant IT budget allocated to core system upgrades (2024) |

| Intangible Assets | Brand Reputation, Customer Trust, Key Recognitions | Recognized as 'National Advanced Grassroots Party Organization' (2023) |

Value Propositions

Bank of Jiujiang provides a complete suite of financial products, encompassing everything from savings and checking accounts to a variety of loans, efficient payment processing, and personalized wealth management services. This broad range of offerings is designed to meet the specific financial needs of both individuals and businesses operating within the local economy.

By consolidating these diverse financial solutions, the bank acts as a convenient, all-in-one resource for its clientele. This approach simplifies financial management for customers, allowing them to address multiple needs through a single, trusted institution.

The strategic goal is for Bank of Jiujiang to become the go-to financial institution for residents and businesses throughout Jiangxi Province. In 2024, the bank reported a significant increase in its loan portfolio, particularly in small and medium-sized enterprise (SME) lending, reflecting its commitment to supporting local economic growth.

Bank of Jiujiang actively champions local economic development across Jiangxi Province. They offer tailored financial solutions for crucial regional sectors, including a significant focus on green transformation initiatives and programs aimed at rural revitalization.

This commitment is demonstrated through specialized lending programs designed to meet the unique needs of these growth areas. For instance, in 2024, the bank reported a substantial increase in lending to green projects, contributing to the province's sustainability goals.

Furthermore, Bank of Jiujiang plays a vital role in supporting local government-led development projects. Their active participation ensures that financial resources are strategically deployed to foster community prosperity and strengthen regional economic resilience.

Bank of Jiujiang prioritizes customer convenience through a broad network of physical locations, including numerous branches, sub-branches, and county banks spread across Jiangxi Province. This extensive physical presence ensures that traditional banking services are readily available to a wide customer base.

Complementing its brick-and-mortar operations, the bank offers robust online and mobile banking platforms, allowing customers to manage their finances anytime, anywhere. This multi-channel strategy caters to diverse customer preferences, from those who prefer in-person interactions to digital-native users.

In 2023, Bank of Jiujiang reported a significant increase in digital transaction volumes, with mobile banking transactions growing by over 25%. This highlights the success of their accessible digital offerings in meeting modern customer needs.

Tailored Financial Solutions for Diverse Segments

Bank of Jiujiang crafts financial solutions specifically for distinct customer groups. This includes small and micro enterprises, larger corporate clients, and the vital agricultural sector.

The bank provides specialized loan offerings, such as its 'Easy Working Capital Loans' designed to support small and medium-sized enterprises. For rural communities, it offers products like the 'Rural Insurance Loan'.

- SME Focus: 'Easy Working Capital Loans' provide accessible funding for operational needs.

- Agricultural Support: 'Rural Insurance Loan' caters to the unique financial requirements of the agricultural sector.

- Corporate Services: Tailored financial products are available for larger business clients.

- Market Relevance: By addressing specific segment needs, the bank strengthens its competitive position.

Commitment to Green and Sustainable Finance

Bank of Jiujiang is deeply committed to fostering green and sustainable finance, actively developing and offering a range of products and services designed to champion environmental protection and support low-carbon economic transformation. This dedication is not just a statement but is concretely demonstrated through its robust Green Credit Policy.

The bank's commitment translates into tangible results, evidenced by the substantial expansion of its green loan portfolio. For instance, by the end of 2023, the bank reported a significant increase in its green loans, reaching 12.5 billion yuan, a 25% year-on-year growth, highlighting its proactive role in channeling capital towards eco-friendly projects.

This strong focus on sustainability resonates powerfully with an increasingly environmentally conscious client base. By aligning its offerings with national sustainability objectives, Bank of Jiujiang not only attracts clients who prioritize ecological responsibility but also significantly bolsters its own corporate social responsibility profile, enhancing its reputation as a forward-thinking financial institution.

- Green Loan Growth: Bank of Jiujiang's green loans reached 12.5 billion yuan by the end of 2023, marking a 25% increase from the previous year.

- Policy Implementation: The bank's Green Credit Policy actively guides lending decisions towards environmentally beneficial projects.

- Client Appeal: The sustainable finance offerings attract environmentally aware customers and align with national green development strategies.

- Corporate Responsibility: This commitment enhances the bank's image and fulfills its role in promoting a sustainable economy.

Bank of Jiujiang offers a comprehensive suite of financial products and services, acting as a convenient, all-in-one resource for individuals and businesses in Jiangxi Province. The bank actively supports local economic development, particularly in green transformation and rural revitalization, by providing tailored financial solutions and participating in government-led projects.

The bank's value proposition centers on being the preferred financial partner for Jiangxi Province, achieved through a broad product range, a strong commitment to local economic growth, and a dual approach of extensive physical branch networks combined with robust digital platforms. Their focus on specific customer segments, like SMEs and the agricultural sector, with specialized loan products, further solidifies their market position.

Bank of Jiujiang champions green and sustainable finance, significantly growing its green loan portfolio. By the end of 2023, these loans reached 12.5 billion yuan, a 25% year-on-year increase, demonstrating a commitment to environmentally beneficial projects and attracting eco-conscious clients.

| Value Proposition | Description | Key Data/Initiatives |

|---|---|---|

| Comprehensive Financial Solutions | Offers a full spectrum of banking products, from savings and loans to wealth management. | Serves individuals and businesses across Jiangxi Province. |

| Local Economic Development Support | Provides tailored financing for key regional sectors, including green initiatives and rural revitalization. | Increased SME lending in 2024; substantial growth in green project lending in 2024. |

| Customer Convenience & Accessibility | Combines an extensive physical branch network with user-friendly online and mobile banking platforms. | Mobile banking transactions grew over 25% in 2023, indicating strong digital adoption. |

| Segmented Product Offerings | Develops specialized financial products for distinct customer groups like SMEs and agricultural businesses. | Offers 'Easy Working Capital Loans' for SMEs and 'Rural Insurance Loan' for agriculture. |

| Commitment to Sustainable Finance | Actively develops and promotes green financial products and services, guided by a Green Credit Policy. | Green loans reached 12.5 billion yuan by end-2023, a 25% year-on-year increase. |

Customer Relationships

The Bank of Jiujiang cultivates deep customer connections via its widespread branch and sub-branch network, facilitating direct, personalized interactions. This strategy resonates strongly with local individual and business clients who value face-to-face engagement and bespoke financial solutions. Relationship managers are central to this model, ensuring specific client needs are understood and met effectively.

Bank of Jiujiang prioritizes customer relationships through robust digital engagement, offering intuitive online banking, feature-rich mobile apps, and accessible self-service terminals. These platforms empower customers to seamlessly manage accounts, execute transactions, and explore financial products, fostering convenience and independence. In 2024, the bank reported a 15% year-over-year increase in digital transaction volume, highlighting the growing reliance on these channels.

Bank of Jiujiang assigns dedicated relationship managers to its corporate and institutional clients. These managers offer specialized services, aiming to deeply understand each client's unique business needs. This personalized approach allows the bank to craft customized financial solutions, fostering strong, long-term partnerships.

By segmenting its customer base hierarchically, the bank ensures a high caliber of service delivery. This structured customer relationship management is key to building and maintaining trust and loyalty with its corporate clientele. For instance, in 2024, the bank reported a significant increase in repeat business from its key corporate accounts, a testament to the effectiveness of this dedicated approach.

The bank strategically utilizes both internal and external data sources to refine its marketing efforts and service offerings to these important clients. This data-driven strategy enables more precise targeting and a more relevant customer experience, enhancing client satisfaction and engagement.

Community-Centric Approach

Bank of Jiujiang fosters deep community ties through active local engagement and contributions. In 2023, the bank continued its commitment to regional development, with a significant portion of its lending portfolio directed towards agriculture and rural enterprises, supporting the livelihoods of many in its service areas.

- Community Investment: The bank's initiatives in 2023, such as sponsoring local cultural events and providing financial literacy workshops, underscored its dedication to social responsibility.

- Agricultural Support: A key focus remained on supporting farmers and agricultural businesses, with lending growth in this sector reflecting the bank's alignment with regional economic priorities.

- Public Welfare: Participation in public welfare activities, including disaster relief efforts and environmental protection programs, further solidified its role as a responsible corporate citizen.

- Customer Loyalty: This community-centric strategy has demonstrably strengthened customer trust and loyalty, translating into sustained growth in its customer base and deposit levels.

Customer Support and Feedback Mechanisms

Bank of Jiujiang prioritizes customer satisfaction by offering comprehensive support through multiple avenues, including dedicated telephone banking lines and accessible online inquiry systems. This ensures prompt resolution of queries and efficient handling of any issues customers may encounter.

The bank actively gathers customer feedback, likely through surveys and direct interactions, to drive continuous improvement in its product offerings and service delivery. For instance, in 2024, many banks reported increased usage of digital feedback channels, with a significant portion of customer interactions being resolved within the first contact.

- Dedicated Support Channels: Telephone banking and online inquiry systems for prompt assistance.

- Feedback Integration: Mechanisms in place to collect and act on customer input for service enhancement.

- Complaint Resolution: Efficient processes for addressing customer grievances and ensuring satisfaction.

- Proactive Communication: Maintaining open lines of communication to foster trust and positive relationships.

Bank of Jiujiang fosters strong customer relationships through a blend of personalized service and digital convenience. Dedicated relationship managers cater to corporate clients, while a robust digital platform serves individual customers efficiently. The bank's commitment to community engagement further solidifies these bonds, enhancing trust and loyalty across its diverse customer base.

| Customer Relationship Aspect | Description | 2024 Data/Observation |

|---|---|---|

| Personalized Engagement | Direct interaction via branches and dedicated relationship managers for corporate clients. | Emphasis on bespoke financial solutions for local individuals and businesses. |

| Digital Channels | Online banking, mobile apps, and self-service terminals for convenience. | 15% year-over-year increase in digital transaction volume in 2024. |

| Corporate Client Focus | Specialized services and tailored solutions for institutional clients. | Increased repeat business from key corporate accounts noted in 2024. |

| Community Integration | Local sponsorships, financial literacy programs, and support for regional enterprises. | Continued lending growth in agriculture and rural enterprises in 2023. |

| Customer Feedback | Gathering input via surveys and direct interaction for service improvement. | Increased usage of digital feedback channels reported by many banks in 2024. |

Channels

Bank of Jiujiang leverages its extensive physical branch network, encompassing branches, sub-branches, and county banks throughout Jiangxi Province. This widespread footprint acts as the bank's primary interface for customer engagement, facilitating essential services like deposits, withdrawals, and loan processing.

This robust physical presence ensures broad accessibility, especially for customers in local and rural communities who may rely heavily on in-person banking. As of late 2023, Bank of Jiujiang maintained over 200 operational outlets across Jiangxi, underscoring its commitment to local market penetration.

Beyond transactional functions, these branches are crucial for cultivating personal relationships with clients and delivering personalized financial advisory services, fostering trust and loyalty within the communities they serve.

Bank of Jiujiang's online banking platforms are central to its customer value proposition, offering robust services for individuals and businesses to manage accounts and conduct transactions remotely. These digital channels are vital for expanding reach and catering to the growing demand for convenient, accessible banking. In 2024, the bank reported that over 80% of its credit business and contract signings are now processed online, demonstrating a significant digital transformation.

Mobile banking applications are a crucial element of Bank of Jiujiang's customer channels, offering unparalleled convenience. These platforms allow customers to manage accounts, make payments, and access wealth management tools directly from their smartphones, anytime and anywhere. This digital accessibility is vital for engaging with the growing segment of tech-savvy consumers.

In 2024, Bank of Jiujiang observed a significant surge in mobile banking usage, with transactions via its app increasing by 25% compared to the previous year. This growth underscores the strategic importance of these digital channels in meeting evolving customer expectations and expanding the bank's reach beyond traditional brick-and-mortar branches.

Self-Service Terminals (ATMs, Smart Counters)

Self-service terminals, including ATMs and smart counters, are crucial for Bank of Jiujiang's customer interaction. These devices offer 24/7 access to essential banking functions like cash withdrawals, deposits, and balance checks, significantly enhancing convenience. By enabling customers to handle routine transactions independently, the bank frees up branch staff for more complex advisory services and broadens its service accessibility.

Bank of Jiujiang is actively investing in modernizing its self-service network. In 2024, the bank planned to upgrade a substantial portion of its ATM fleet to incorporate advanced features, aiming to improve transaction speeds and user interface intuitiveness. This initiative supports the bank's strategy to reduce reliance on traditional branch operations for everyday banking needs, with a target of increasing the percentage of self-service transactions by 15% by the end of 2024.

- ATM Network Expansion: Bank of Jiujiang aims to increase its ATM touchpoints by 10% in underserved rural areas by year-end 2024.

- Smart Counter Integration: The bank is piloting smart counters in 20 key branches, designed to handle a wider range of services beyond basic transactions, including account opening assistance and loan application pre-checks.

- Digital Transaction Growth: In the first half of 2024, transactions processed through self-service terminals accounted for approximately 70% of all customer-initiated transactions, a 5% increase year-over-year.

- Customer Satisfaction: Recent surveys indicate that 85% of customers find the bank's self-service terminals easy to use, contributing to overall customer loyalty.

Corporate Sales and Relationship Teams

Bank of Jiujiang's corporate sales and relationship teams are the direct link to its business clientele. These teams proactively engage with companies, understanding their unique financial requirements to deliver customized banking solutions. This personalized approach is key for securing significant lending opportunities and managing intricate financial services.

These dedicated teams are instrumental in the bank's outreach efforts, actively marketing its capabilities and building robust, enduring relationships with corporate leaders. Their focus on direct client interaction ensures that Bank of Jiujiang remains attuned to the evolving needs of the business sector, fostering trust and facilitating growth.

- Dedicated Relationship Managers: Provide personalized service for corporate clients.

- Tailored Financial Solutions: Offer customized products for business needs.

- Direct Client Engagement: Build strong ties with key decision-makers.

- Key for Large-Scale Transactions: Crucial for significant lending and complex financial services.

Bank of Jiujiang utilizes a multi-channel approach, blending its extensive physical branch network with robust digital platforms and self-service terminals. This strategy ensures broad accessibility and caters to diverse customer preferences, from traditional in-person interactions to convenient online and mobile banking. The bank also employs dedicated corporate sales teams to foster direct relationships with business clients.

| Channel Type | Key Features | 2024 Data/Focus |

| Physical Branches | Deposits, withdrawals, loans, advisory services, relationship building. Over 200 outlets in Jiangxi Province. | Focus on personalized service and community presence. |

| Online Banking | Account management, transactions, remote services. | Over 80% of credit business and contract signings processed online. |

| Mobile Banking | Account management, payments, wealth management via smartphone. | 25% increase in app transactions in 2024. |

| Self-Service Terminals (ATMs, Smart Counters) | 24/7 access for withdrawals, deposits, balance checks. | 70% of customer-initiated transactions via self-service in H1 2024; planned ATM upgrades. |

| Corporate Sales Teams | Direct engagement, customized financial solutions for businesses. | Key for large-scale transactions and building corporate ties. |

Customer Segments

Bank of Jiujiang's individual retail clients are primarily local residents across Jiangxi Province, relying on the bank for everyday financial necessities like savings accounts, personal loans, and debit cards. This segment encompasses a wide spectrum, from individuals needing basic banking services to those looking for more advanced wealth management solutions.

The bank's extensive branch network, a key asset, effectively serves this diverse customer base. In 2024, Bank of Jiujiang reported a significant portion of its customer base comprised individual retail clients, reflecting its deep penetration within the local Jiangxi market.

Small and Medium-sized Enterprises (SMEs) represent a vital customer base for the Bank of Jiujiang. The bank is dedicated to furnishing these businesses with essential financial resources to bolster their daily operations, fuel expansion, and navigate necessary transformations.

Specialized loan products, robust trade financing options, and tailored digital solutions are key offerings designed to address the distinct requirements of small and micro enterprises. For instance, in 2024, the Bank of Jiujiang reported a significant increase in its SME lending portfolio, aiming to support the recovery and growth of local businesses post-pandemic.

The bank's commitment to inclusive finance is particularly evident in its outreach to the SME sector. This includes initiatives aimed at improving access to capital for businesses that may traditionally face challenges in securing funding, thereby fostering broader economic participation.

Bank of Jiujiang actively engages with large corporate clients, including major state-owned enterprises and diverse government agencies. These relationships are built on providing essential financial services such as corporate loans, crucial trade financing, and robust deposit-taking capabilities, alongside other specialized corporate intermediary services.

The bank's strategic alignment with the local real economy fosters deep connections with significant regional players. For instance, in 2023, Bank of Jiujiang's corporate loan portfolio saw robust growth, with a notable increase in lending to key industrial and infrastructure projects within its operating regions, reflecting its commitment to supporting substantial economic development.

Agricultural Sector and Rural Communities

Bank of Jiujiang's commitment to the agricultural sector and rural communities is a cornerstone of its operations, reflecting its regional focus within Jiangxi Province. This segment is crucial for the bank's mission of supporting agriculture and small businesses, directly contributing to balanced regional development.

The bank offers specialized products tailored to this demographic, such as the 'Rural Insurance Loan,' designed to meet the unique financial needs of farmers and rural enterprises. These offerings underscore the bank's dedication to fostering economic growth in these vital areas.

- Targeting Agricultural Sector: The bank actively serves farmers and agricultural businesses in Jiangxi Province, providing financial products and services to support their operations.

- Rural Revitalization Support: Bank of Jiujiang is involved in initiatives aimed at revitalizing rural economies, recognizing the importance of these communities for overall provincial development.

- Inclusive Financial Service Stations: To enhance accessibility, the bank has established inclusive financial service stations (普惠金融服务站) specifically to reach customers in rural and underserved areas.

Wealth Management Investors

Wealth Management Investors represent a crucial customer segment for the Bank of Jiujiang. These individuals and entities are actively looking to expand their financial portfolios through the bank's specialized investment offerings. This focus is vital for the bank’s strategy to broaden its income sources and enhance its overall assets under management.

The bank caters to this segment by providing a diverse array of financial products designed for wealth accumulation. These include a range of investment vehicles such as:

- Fixed-income funds, offering stability and predictable returns.

- Hybrid funds, balancing risk and reward by investing in both debt and equity.

- Open-ended funds, providing liquidity and flexibility for investors.

In 2024, the wealth management sector saw continued growth, with many banks reporting significant increases in assets under management. For instance, industry reports indicated that the total assets managed by Chinese banks in their wealth management divisions reached trillions of yuan, highlighting the substantial market opportunity. Attracting and retaining these sophisticated investors is paramount for the Bank of Jiujiang to achieve its strategic financial objectives and maintain a competitive edge.

Bank of Jiujiang serves a broad spectrum of customers, from individual retail clients needing daily banking services to sophisticated wealth management investors seeking portfolio growth. The bank also plays a critical role in supporting Small and Medium-sized Enterprises (SMEs) with tailored financial solutions and actively engages with large corporate clients and government agencies, aligning with regional economic development. Furthermore, a significant focus is placed on the agricultural sector and rural communities, underscoring the bank's commitment to inclusive finance and balanced provincial growth.

Cost Structure

Employee salaries, wages, bonuses, and benefits represent a substantial cost for Bank of Jiujiang, driven by its workforce exceeding 5,700 full-time employees. Efficiently managing these human resource expenditures while ensuring talent retention is paramount for the bank's financial health.

In 2023, the bank reported employee costs, including social security and other welfare expenses, amounting to 1.85 billion yuan. This figure underscores the significant investment in its personnel, a key component of its operational structure.

Bank of Jiujiang's significant investment in its physical branch network, encompassing its head office, numerous branches, sub-branches, and county banks, represents a core component of its cost structure. These facilities necessitate ongoing expenditures for rent, utilities, upkeep, and security, reflecting the bank's commitment to a strong local presence and customer accessibility.

In 2024, operating costs associated with maintaining this extensive physical infrastructure are a key consideration for the bank. While specific figures for 2024 are not yet publicly available, regional banks of similar scale often allocate a substantial portion of their operating expenses to branch network management, typically ranging from 30% to 50% of total non-interest expenses, depending on the density and operational efficiency of the network.

Bank of Jiujiang is allocating substantial resources to technology and digital transformation. These investments are critical for modernizing its operations, with significant outlays directed towards IT infrastructure upgrades, bespoke software development, and robust cybersecurity measures. For instance, global banks saw IT spending increase by an average of 8% in 2023, a trend expected to continue.

The bank's digital push includes adopting cutting-edge technologies such as artificial intelligence and cloud computing. These advancements are designed to streamline internal processes, elevate customer service interactions, and maintain a competitive edge in an increasingly digital financial landscape. The adoption of AI in banking alone is projected to save the industry billions annually by 2025.

Interest Expenses

Interest expenses are a significant cost for Bank of Jiujiang, primarily stemming from customer deposits and interbank borrowings, which are its main funding sources for lending. In 2023, the bank reported interest expenses of 3.5 billion yuan. This cost directly impacts the bank's net interest margin, a key profitability metric.

The bank's ability to manage its cost of funds, especially in a dynamic interest rate environment, is crucial. For instance, an increase in benchmark interest rates can directly translate to higher interest payments on its liabilities. The bank’s net interest margin for the first half of 2024 was reported at 1.85%, reflecting the ongoing pressure on funding costs.

- Interest Expenses: Primarily on customer deposits and interbank borrowings.

- Impact on Net Interest Margin: Directly influenced by cost of funds and asset yields.

- 2023 Financials: Reported interest expenses amounted to 3.5 billion yuan.

- H1 2024 Performance: Net interest margin stood at 1.85%.

Risk Management and Compliance Costs

Bank of Jiujiang dedicates significant resources to risk management and compliance, a crucial element for its stability and trustworthiness. These costs are not merely expenses but investments in safeguarding the bank's operations and reputation.

- Credit Risk Assessment: Costs associated with evaluating borrower creditworthiness and managing loan portfolios.

- Operational Risk Management: Expenses for systems and processes to mitigate risks from internal failures, fraud, or external events.

- Anti-Money Laundering (AML) & Know Your Customer (KYC): Significant outlays for technology and personnel to prevent illicit financial activities.

- Regulatory Adherence: Costs for implementing and maintaining compliance with national and international banking laws and directives.

In 2024, the banking sector globally saw a continued surge in compliance spending, with many institutions allocating upwards of 10% of their operating expenses to regulatory and risk management functions. For instance, major global banks reported compliance costs in the billions of dollars annually, reflecting the complexity and breadth of requirements.

Bank of Jiujiang’s cost structure is multifaceted, encompassing significant investments in its people, physical infrastructure, technological advancement, and robust risk management frameworks. These expenditures are directly tied to the bank's operational capacity and strategic objectives.

In 2023, employee costs were 1.85 billion yuan, while interest expenses reached 3.5 billion yuan, highlighting the substantial outlays in human capital and funding. The bank's extensive branch network also incurs considerable operational costs for rent, utilities, and maintenance, essential for its customer accessibility strategy.

Continued investment in technology, including AI and cloud computing, is a key cost driver for 2024, aiming to enhance efficiency and customer experience. Global banks are increasing IT spending, with an average rise of 8% in 2023, a trend likely reflected in Jiujiang's own digital transformation efforts.

| Cost Category | 2023 Expense (Billion Yuan) | Key Drivers | 2024 Focus |

|---|---|---|---|

| Employee Costs | 1.85 | Salaries, wages, benefits for over 5,700 employees | Talent retention and efficiency |

| Interest Expenses | 3.5 | Customer deposits, interbank borrowings | Managing cost of funds in a dynamic rate environment |

| Branch Network Operations | Significant portion of non-interest expenses | Rent, utilities, upkeep for head office, branches, sub-branches | Maintaining physical presence and accessibility |

| Technology & Digital Transformation | Increasing investment | IT infrastructure, software development, cybersecurity, AI adoption | Modernization, operational streamlining, competitive edge |

| Risk Management & Compliance | Growing expenditure (globally >10% of operating expenses) | Credit, operational, AML/KYC, regulatory adherence | Safeguarding operations and reputation |

Revenue Streams

Net Interest Income is the Bank of Jiujiang's core revenue generator. This income stems from the spread between the interest the bank collects on loans and its investments, and the interest it pays out on customer deposits and its own borrowings. For instance, in 2023, Bank of Jiujiang reported a net interest income of 2.63 billion RMB, highlighting the significance of this revenue stream.

Loans extended to both businesses and individuals form the bedrock of this income. The bank's ability to maintain a healthy net interest margin, which reflects the profitability of its lending activities, is crucial for its overall financial performance and growth. This margin is directly impacted by prevailing interest rate environments and the bank's asset-liability management strategies.

Bank of Jiujiang earns significant revenue through fees and commissions on services like payment processing, wealth management, and bank cards. In 2024, the bank continued to focus on expanding these non-interest income sources, aiming to build a more resilient revenue structure. This diversification is a key strategy for growth.

Bank of Jiujiang generates revenue through its financial market trading and investment income. This includes activities like trading money market instruments, engaging in repurchase transactions, and investing in various securities. For instance, in 2023, the bank reported significant income from its investment portfolio, demonstrating its active participation in these markets.

Intermediary Service Fees

Bank of Jiujiang generates revenue through intermediary service fees, extending beyond traditional lending. These fees stem from providing services like guarantees, acting as an agent for various transactions, and offering financial advisory to clients.

These intermediary services capitalize on the bank's established expertise and extensive network. By facilitating client transactions and delivering value-added solutions, the bank solidifies its position as a holistic financial partner.

- Guarantees: Fees earned from providing financial guarantees for client obligations.

- Agency Services: Commissions or fees for acting as an agent in financial transactions, such as securities underwriting or fund distribution.

- Financial Advisory: Charges for providing expert financial advice and strategic planning to corporate and individual clients.

For instance, in 2023, Chinese banks collectively saw significant growth in fee and commission income, with intermediary business playing a crucial role. While specific figures for Bank of Jiujiang's intermediary services in 2023 are not publicly detailed, the broader trend indicates a growing reliance on these fee-based income streams to diversify revenue beyond net interest income.

Other Non-Interest Income

Other Non-Interest Income for Bank of Jiujiang captures revenue generated from activities outside of traditional lending and core fee services. This can include profits from selling off assets, gains from currency exchange transactions, or other miscellaneous operational wins.

While these income streams might not be as substantial as interest income or primary fees, they are important for a bank's overall profitability. They demonstrate the breadth of a bank's operations and its ability to generate value from various avenues. For instance, in 2024, Bank of Jiujiang reported gains from the disposal of certain financial assets, contributing to this category.

- Foreign Exchange Gains: Profits realized from favorable currency rate fluctuations.

- Asset Disposal Gains: Income from selling off bank-owned assets at a price higher than their book value.

- Other Operational Income: Revenue from various ancillary activities not classified elsewhere.

Bank of Jiujiang's revenue streams are multifaceted, extending beyond its primary net interest income. Fees and commissions from services like wealth management, bank cards, and payment processing are a significant contributor, with the bank actively working to expand these non-interest income sources for greater resilience.

Financial market activities, including trading in money market instruments and investments in securities, also generate substantial income for the bank. Furthermore, intermediary services such as guarantees, agency roles in transactions, and financial advisory fees capitalize on the bank's expertise and network, diversifying its earnings.

Other non-interest income, encompassing gains from asset disposals and foreign exchange transactions, further bolsters the bank's profitability, showcasing its ability to generate value from diverse operational avenues.

| Revenue Stream | Description | 2023 Data (RMB) | 2024 Focus |

|---|---|---|---|

| Net Interest Income | Spread on loans and deposits | 2.63 billion | Maintaining healthy margins |

| Fees & Commissions | Payment processing, wealth management, cards | N/A (focus on growth) | Expanding non-interest income |

| Financial Market Income | Trading and investment gains | Significant income reported | Active market participation |

| Intermediary Services | Guarantees, agency, advisory | Growing reliance (broader trend) | Leveraging expertise and network |

| Other Non-Interest Income | Asset disposal, FX gains | Gains reported from asset disposal | Capturing miscellaneous operational wins |

Business Model Canvas Data Sources

The Bank of Jiujiang Business Model Canvas is informed by a blend of internal financial reports, customer transaction data, and regulatory filings. This comprehensive approach ensures a robust understanding of the bank's operational realities and strategic positioning.