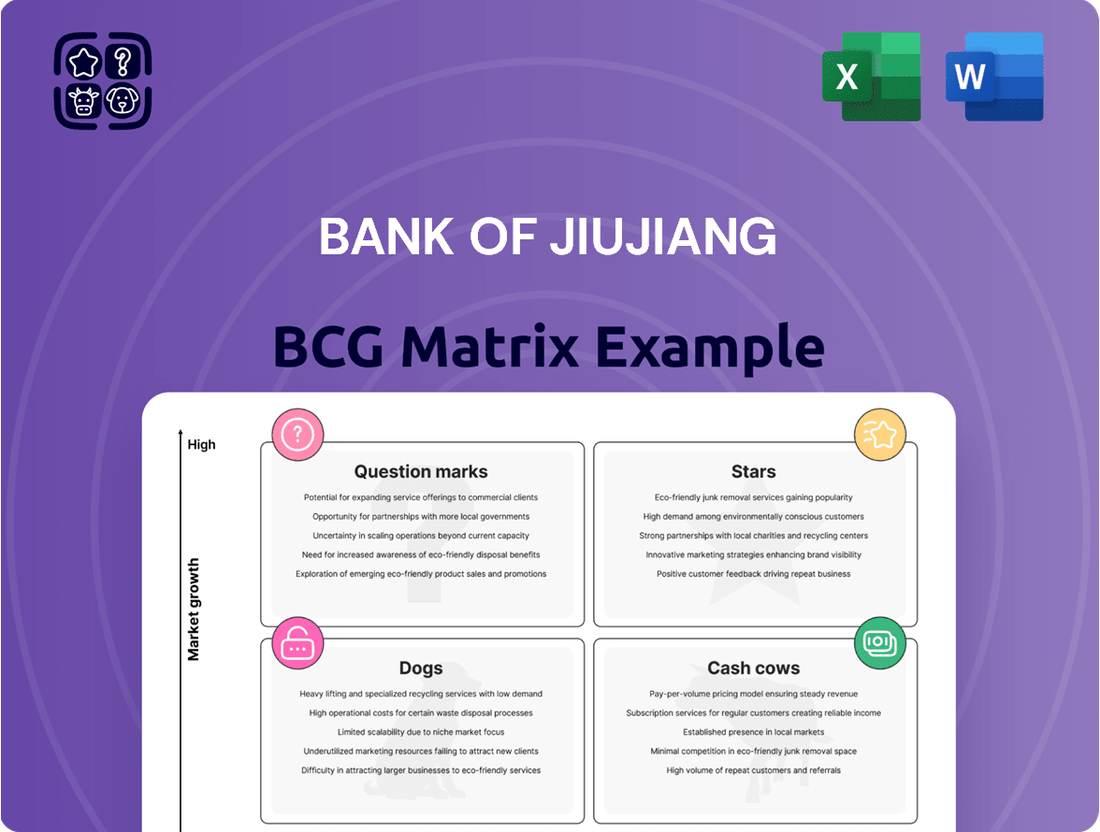

Bank of Jiujiang Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Jiujiang Bundle

Discover the strategic positioning of Bank of Jiujiang's product portfolio with our comprehensive BCG Matrix analysis. Understand which offerings are market leaders (Stars), which generate stable income (Cash Cows), which require careful consideration (Question Marks), and which may be underperforming (Dogs). This preview offers a glimpse into the critical insights that can shape your investment and product development strategies.

Ready to unlock the full potential of Bank of Jiujiang's strategic landscape? Purchase the complete BCG Matrix report to gain detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your capital allocation and product decisions. Don't miss out on the actionable intelligence you need to thrive.

Stars

Green Finance Products within the Bank of Jiujiang's portfolio are experiencing robust expansion. The bank's green loan balance has seen an impressive average growth of over 30% annually for the past five years, culminating in RMB 40,624 million by the close of 2024. This surge reflects China's national emphasis on sustainable development and the growing demand for environmentally conscious lending solutions.

The bank's dedication to green finance is further underscored by the implementation of its inaugural Green Credit Policy in 2024. This strategic move, coupled with the recognition as the '2024 Jiujiang Role Model for Green Finance' in February 2025, positions these products as key drivers of future growth and market leadership.

Bank of Jiujiang's digital banking services are a shining example of a growing industry segment, reflecting a broader trend in finance. The bank has been actively enhancing its digital capabilities, a move that aligns with the increasing adoption of AI and the drive to streamline financial platforms. This strategic focus is crucial as consumer demand for seamless digital experiences continues to surge.

Innovations in areas like mobile payments and credit card services are key indicators of Bank of Jiujiang's commitment to digital advancement. In 2023, digital channels accounted for a significant portion of the bank's transaction volume, demonstrating their growing importance. This positions the bank favorably as digital engagement becomes a primary differentiator in the competitive banking landscape.

Bank of Jiujiang's retail banking has seen significant improvements, a direct result of its ongoing transformation strategy. The bank now serves a substantial customer base, boasting over 1.9 million individual customers, 158,000 personal loan clients, and 660,000 credit card users.

This strong individual customer focus, coupled with an emphasis on digital services, firmly places retail banking as a high-potential growth segment for the bank. The commitment to enhancing customer experience and deepening service quality further solidifies this position.

Inclusive Finance (SME and Rural Loans)

Bank of Jiujiang has demonstrated strong growth in inclusive finance, especially in lending to small and medium-sized enterprises (SMEs) and supporting rural development. This strategic focus is crucial for economic growth and aligns with national priorities.

The bank successfully met regulatory requirements for inclusive loans to SMEs. Furthermore, they are actively involved in rural financial initiatives, such as the 'One County, One Produce' project, which aims to boost local economies.

- SME Loan Growth: Bank of Jiujiang has seen a notable increase in its SME loan portfolio, contributing to job creation and economic activity.

- Rural Revitalization Efforts: The bank's support for rural areas includes targeted financial products designed to foster agricultural productivity and local enterprise development.

- Regulatory Compliance: Meeting and exceeding regulatory targets for inclusive finance underscores the bank's commitment to social responsibility and financial inclusion.

- Strategic Alignment: These initiatives directly support national policies aimed at strengthening rural economies and empowering small businesses.

Wealth Management Products

Bank of Jiujiang's wealth management products are a significant component of its business, evidenced by its accolades in 2024, including 'Excellent Asset Management Urban Commercial Bank' and 'Excellent Wealth Management Urban Commercial Bank'. This recognition highlights the bank's commitment to delivering high-quality financial solutions to its clients.

The Chinese wealth management market itself saw substantial growth in 2024. This expansion was characterized by a rising number of investors actively participating and a notable increase in the overall balance of wealth management products. This trend indicates a strong demand for sophisticated financial planning and investment vehicles.

Bank of Jiujiang is strategically positioning itself for continued success within this dynamic market. By focusing on improving customer service and refining its existing product offerings through rigorous data analysis, the bank aims to meet the evolving needs of its clientele and capitalize on market opportunities.

- Award Recognition: Bank of Jiujiang received 'Excellent Asset Management Urban Commercial Bank' and 'Excellent Wealth Management Urban Commercial Bank' awards in 2024.

- Market Growth: The Chinese bank wealth management market expanded in 2024, with more investors and increased product balances.

- Strategic Focus: The bank is enhancing customer service and revising products based on data analysis to drive growth.

Bank of Jiujiang's Stars, representing high market share and high growth, are primarily its Green Finance Products and Digital Banking Services. These segments demonstrate strong momentum, indicating they are leaders in their respective fields and are poised for continued expansion. Their current performance and strategic focus suggest they will likely remain key contributors to the bank's future success.

| Business Segment | Market Share | Growth Rate | Strategic Importance |

|---|---|---|---|

| Green Finance Products | High | Over 30% annual growth (past 5 years) | Key driver of future growth, aligns with national sustainability goals |

| Digital Banking Services | High | Significant portion of transaction volume in 2023 | Crucial for competitive differentiation and meeting evolving customer demand |

What is included in the product

Strategic insights into Bank of Jiujiang's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, and Dogs.

The Bank of Jiujiang BCG Matrix offers a clear, one-page overview of each business unit's position, relieving the pain of strategic uncertainty.

Cash Cows

Bank of Jiujiang's traditional corporate banking segment acts as a solid cash cow. This division caters to businesses, government bodies, and other financial entities, providing essential services such as corporate loans, trade finance, and deposit accounts.

This segment boasts a significant market share and serves as a stable foundation for the bank's earnings, consistently delivering net interest income. While its growth prospects are modest, its deep-rooted client relationships and established market position ensure a dependable stream of cash flow for the bank.

Deposit-taking activities represent a core and well-established service for the Bank of Jiujiang. This function is crucial for building a stable and reliable funding foundation for the bank's operations.

In 2024, the bank observed a healthy increase in general deposits, with figures rising by 9.46%. This growth signifies a robust and expanding deposit base, a key indicator of customer trust and financial stability.

Characterized by low growth but high market share, deposit-taking is a classic cash cow. It generates substantial and consistent cash flow with minimal need for aggressive promotional spending, a hallmark of mature, dominant business units.

Bank of Jiujiang's Payment and Settlement Solutions are firmly positioned as Cash Cows. These services, crucial for both individuals and businesses, operate in a mature, low-growth market where the bank holds a significant market share.

The bank's recognition with awards for its mobile payment and credit card operations underscores its strong performance and operational efficiency in this established segment. This consistent success fuels a steady and reliable cash flow for the institution.

Established Branch Network and County Banks

Bank of Jiujiang's established branch network and county banks represent a significant cash cow. With 279 outlets, including 13 branches and 265 sub-branches, the bank has achieved full coverage of cities with districts in Jiangxi Province. This extensive physical presence, bolstered by 20 established county banks, ensures deep market penetration and a loyal customer base.

This mature network generates consistent revenue streams with minimal need for further substantial investment, a hallmark of a cash cow. For instance, in 2024, the bank's extensive network facilitated continued stable deposit growth and loan origination, reinforcing its position as a reliable revenue generator.

- Extensive Network: 279 outlets (13 branches, 265 sub-branches) and 20 county banks.

- Market Penetration: Full coverage of cities with districts in Jiangxi Province.

- Revenue Generation: Consistent income from a stable, broad customer base.

- Low Investment Needs: Mature infrastructure requires minimal additional capital for growth.

Inter-bank and Money Market Transactions

Inter-bank and Money Market Transactions, as a component of Bank of Jiujiang's business, operate within a high-market-share financial sector. This segment is crucial for the bank's liquidity and profitability, generating stable returns through activities like money market transactions and repurchase agreements.

These operations, though not directly customer-facing, underscore the bank's significant role in the broader financial ecosystem. For instance, in 2024, the total value of interbank lending in China reached trillions of yuan, highlighting the scale of such markets. Bank of Jiujiang's participation in these transactions contributes to its robust financial health.

- High Market Share: Operates in a segment with significant volume within the financial sector.

- Stable Returns: Generates consistent profitability through money market and repurchase transactions.

- Liquidity Management: Plays a vital role in managing the bank's overall liquidity.

- Non-Customer Facing: Primarily an internal or wholesale banking activity.

Bank of Jiujiang's traditional corporate banking segment, including corporate loans and trade finance, is a prime example of a cash cow. This division has a significant market share and provides a stable, dependable stream of earnings for the bank.

The bank's deposit-taking activities, which saw a 9.46% increase in general deposits in 2024, are a classic cash cow. This mature business unit generates substantial cash flow with minimal need for aggressive investment, reinforcing its role as a stable funding base.

Payment and Settlement Solutions, recognized for operational efficiency, also function as cash cows. Operating in a low-growth market with high market share, these services consistently fuel reliable cash flow for the institution.

The established branch network, comprising 279 outlets and 20 county banks covering Jiangxi Province, acts as a significant cash cow. This mature infrastructure generates consistent revenue with low investment needs, as evidenced by stable deposit growth and loan origination in 2024.

| Business Segment | BCG Category | 2024 Performance Indicator | Market Position | Cash Flow Impact |

|---|---|---|---|---|

| Corporate Banking | Cash Cow | Stable Net Interest Income | Significant Market Share | Dependable Cash Flow |

| Deposit Taking | Cash Cow | 9.46% Deposit Growth | High Market Share | Substantial Cash Generation |

| Payment & Settlement | Cash Cow | Award-Winning Operations | High Market Share | Steady Cash Flow |

| Branch Network & County Banks | Cash Cow | Stable Deposit & Loan Growth | Extensive Coverage | Consistent Revenue Streams |

Full Transparency, Always

Bank of Jiujiang BCG Matrix

The Bank of Jiujiang BCG Matrix preview you are currently viewing is the exact, final document you will receive upon purchase. This comprehensive report is fully formatted and ready for immediate strategic application, containing no watermarks or placeholder content. You can confidently expect to download this polished analysis, designed to provide clear insights into the bank's product portfolio, without any hidden surprises or subsequent revisions needed.

Dogs

Underperforming legacy loan portfolios, particularly those heavily concentrated in sectors like traditional manufacturing or outdated commercial real estate, often fall into the dog category within the Bank of Jiujiang's BCG matrix. These segments are characterized by persistently high non-performing loan (NPL) ratios, consuming significant management attention and capital without generating commensurate returns.

While the bank strives to maintain a low overall NPL ratio, these legacy books can act as cash traps. For instance, if a substantial portion of the bank's NPLs in 2024 originated from loans made to businesses in industries significantly disrupted by technological advancements or shifts in consumer demand, these would represent classic dog segments. Managing these assets might involve extensive restructuring efforts or provisions, draining resources that could be better allocated to growth areas.

Bank of Jiujiang's digital offerings may include features with low customer adoption, such as certain legacy mobile app functionalities or less utilized online banking tools. These could be considered dogs in the BCG matrix if they require ongoing maintenance costs but generate minimal revenue or customer engagement. For instance, if a specific bill payment feature within their digital platform is only used by less than 5% of active digital users, it might fall into this category.

Niche services with limited geographic reach at Bank of Jiujiang, such as highly specialized wealth management for a very specific local agricultural sector within Jiangxi Province, could be classified as dogs. These offerings often struggle with low market share and minimal growth prospects, making them inefficient resource drains. For instance, a product designed for a particular type of local cooperative might have only a few dozen clients, generating negligible revenue.

Physical Branches in Declining Areas

While Bank of Jiujiang's extensive branch network is a significant asset, certain individual physical branches situated in areas facing notable population decline or economic contraction could be classified as dogs. These specific locations may present a challenge, as their operational expenses, including rent and staffing, could outweigh the diminishing revenue generated from a shrinking customer base. This scenario often leads to a re-evaluation of their viability, potentially prompting closure or a strategic shift in their function.

For instance, in 2024, reports indicated that several rural areas in China experienced a net population outflow, with some regions seeing a decline of over 5% in their working-age population. Branches in such locales might struggle to maintain profitability.

- Declining Customer Base: Branches in economically depressed or depopulating areas face a shrinking pool of potential customers, impacting transaction volumes and new account openings.

- High Fixed Costs: Maintaining physical infrastructure, including rent, utilities, and personnel, in areas with low business activity can lead to negative operating margins.

- Strategic Re-evaluation: These branches may be candidates for consolidation, conversion to digital-only service points, or complete closure to optimize the bank's overall resource allocation.

Certain Low-Margin, High-Maintenance Corporate Clients

Certain low-margin, high-maintenance corporate clients can be categorized as 'dogs' within the Bank of Jiujiang's BCG Matrix. These are relationships that demand significant operational effort, including extensive servicing and stringent regulatory oversight, yet they contribute minimally to the bank's overall profitability. This low return on investment, both in terms of net interest income and fee-based revenue, means these clients consume valuable resources without generating commensurate value.

For instance, a corporate client requiring constant compliance checks and customized reporting, while maintaining a very small loan balance or minimal transaction volume, would fit this profile. In 2024, banks globally have been increasingly scrutinizing such relationships. Data from the Federal Reserve in late 2023 indicated that the cost of compliance for financial institutions continued to rise, impacting the profitability of smaller, less active commercial accounts.

- Resource Drain: High servicing costs and regulatory burdens tie up bank personnel and infrastructure.

- Low Profitability: Minimal net interest income and fee generation fail to offset the operational expenses.

- Strategic Re-evaluation: These 'dog' segments necessitate a review of their long-term viability and potential for restructuring or divestment.

- Opportunity Cost: Resources allocated to these clients could be redirected to more profitable 'star' or 'cash cow' segments.

In the Bank of Jiujiang's BCG Matrix, 'dogs' represent business areas or products with low market share and low growth potential. These segments typically consume resources without generating significant returns, often due to declining customer bases or high operational costs relative to revenue. For example, certain niche digital features with minimal user engagement or legacy loan portfolios in struggling industries can fall into this category.

These 'dog' segments require careful management to avoid becoming a drain on the bank's overall performance. Strategies often involve cost reduction, restructuring, or eventual divestment. For instance, a physical branch in a depopulating rural area might see its operational costs exceed its revenue, prompting a review for closure or conversion. Similarly, low-margin corporate clients demanding extensive servicing but contributing little profit are prime candidates for re-evaluation.

The challenge with 'dogs' is their tendency to tie up valuable capital and human resources that could be better deployed in high-growth or stable segments. In 2024, as financial institutions navigate evolving market dynamics, identifying and addressing these underperforming areas is crucial for optimizing resource allocation and enhancing overall profitability. The bank must actively manage these segments to prevent them from hindering growth in more promising areas.

The Bank of Jiujiang's approach to 'dogs' involves a strategic assessment of their potential for revitalization versus the cost of continued investment. For example, a digital service with low adoption might be retired if the cost of enhancement outweighs the potential user growth. Conversely, a legacy loan portfolio might undergo restructuring if there's a viable path to improved performance.

Question Marks

Bank of Jiujiang is actively exploring new partnerships with emerging fintech companies, particularly those focused on cutting-edge, yet unproven, financial technologies. These collaborations are classified as question marks within the BCG matrix because they possess significant potential for high future growth but currently command a very small market share.

These ventures necessitate substantial investment in research, development, and strategic marketing to foster customer adoption and achieve market penetration. For instance, a partnership with a blockchain-based cross-border payment provider, while promising for reduced transaction fees and increased speed, is still in its nascent stages of adoption within the broader banking landscape.

While green loans are a strong performer for Bank of Jiujiang, other specialized green finance products represent question marks. These include areas like green bonds, where China's issuance saw a notable slowdown in early 2024, impacting potential market share.

Nascent green insurance products also fall into this category. Although the overall green finance market is expanding, the specific market penetration and profitability of these newer offerings for Bank of Jiujiang are still in their early stages. Significant investment will be needed for these products to scale effectively and become major revenue drivers.

Bank of Jiujiang's foray into cross-border financial services, particularly its engagement in the RMB business and international cooperation for financial transformation, positions it as a question mark within the BCG matrix. This strategic move acknowledges the significant growth potential in global markets, yet it also highlights the considerable investment and effort needed to cultivate a strong international presence.

The bank's current market share outside its primary domestic operations is likely nascent, necessitating substantial capital infusion and strategic planning to build brand recognition and customer trust in new territories. Navigating diverse regulatory landscapes and establishing robust operational frameworks are key challenges that will determine the success of this expansion. For instance, by the end of 2023, China's cross-border RMB payments reached 3.75 trillion yuan, indicating a growing but competitive market.

Advanced AI-driven Personalized Financial Solutions

Bank of Jiujiang's investments in advanced AI for hyper-personalized financial experiences represent a significant question mark on its BCG Matrix. While the banking sector is witnessing rapid AI adoption, the bank's effective implementation and market penetration in this high-growth area are still developing.

Achieving market leadership requires substantial data analysis and technological development. For instance, a 2024 report indicated that banks investing heavily in AI saw a 15% increase in customer engagement, yet Bank of Jiujiang's specific AI-driven personalization metrics are still in their early stages of measurement and refinement.

- Nascent Market Penetration: While AI in banking is growing, Bank of Jiujiang's personalized offerings are not yet widespread.

- High-Growth Potential: The demand for tailored financial advice and services powered by AI is accelerating across the industry.

- Data Dependency: Effective AI personalization relies on robust data infrastructure and sophisticated analytical capabilities, which are under development at the bank.

- Investment Justification: Significant R&D is needed to translate AI potential into tangible, market-leading customer solutions.

New Rural Revitalization Financial Products

New rural revitalization financial products, moving beyond basic inclusive finance, represent potential question marks for Bank of Jiujiang. These are highly specialized offerings designed for nascent rural industries or burgeoning digital village initiatives. The market for these products is experiencing significant growth, fueled by strong national policy support, but their current penetration is notably low, demanding considerable investment in marketing and user adoption to ascend to star status.

These products, while targeting a high-growth sector, require substantial upfront investment in product development, risk assessment for new industries, and extensive outreach to build awareness and trust among rural communities and businesses. For instance, the Chinese government's emphasis on rural revitalization, as seen in the 2024 Central Rural Work Conference, highlights the policy tailwinds, yet the practical implementation of tailored financial solutions remains in its early stages.

- Emerging Rural Industries: Financial products supporting sectors like rural e-commerce, agritourism, and specialty agricultural processing, which are gaining traction but lack established financial track records.

- Digital Village Ecosystems: Innovative financing for smart agriculture, rural broadband expansion, and digital infrastructure development, areas with high potential but currently limited market penetration.

- Policy-Driven Growth: The market benefits from national directives like the Rural Revitalization Strategy, creating a favorable environment for new financial instruments.

- Low Initial Adoption: Significant efforts are needed to educate potential customers and build confidence in these novel financial products, a common challenge for question mark categories.

Question marks for Bank of Jiujiang represent strategic initiatives with high growth potential but low current market share, requiring significant investment to develop. These ventures, such as new fintech partnerships and emerging green finance products, are crucial for future expansion but carry inherent risks. Success hinges on effective market penetration and scaling, transforming them into future stars or cash cows.

| Initiative | Growth Potential | Current Market Share | Investment Needs | Key Challenge |

|---|---|---|---|---|

| Fintech Partnerships | High | Low | Substantial R&D, Marketing | Customer Adoption |

| Green Bonds/Insurance | High | Low | Product Development, Outreach | Market Penetration |

| Cross-Border RMB Business | High | Nascent | Capital Infusion, Brand Building | Regulatory Navigation |

| AI Personalization | High | Developing | Data Infrastructure, Tech Dev | Metrics Refinement |

| Rural Revitalization Products | High | Low | Product Dev, Risk Assessment | User Trust & Awareness |

BCG Matrix Data Sources

The Bank of Jiujiang BCG Matrix is informed by official financial disclosures, market growth data, and competitor analysis.