Bâloise Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bâloise Group Bundle

Navigate the complex external forces shaping Bâloise Group's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Gain a strategic advantage by leveraging these critical insights to inform your own market positioning and decision-making. Download the full analysis now to unlock actionable intelligence and stay ahead of the curve.

Political factors

The insurance industry, Bâloise Group included, operates within a heavily regulated landscape. Shifts in political power or policy direction can directly influence Bâloise's business activities and profitability. For instance, changes in capital requirements or consumer protection laws, which are common in the insurance sector, could necessitate operational adjustments.

Maintaining a stable and predictable regulatory framework across Bâloise's key markets—Switzerland, Germany, Belgium, and Luxembourg—is paramount for effective long-term strategic planning. A consistent regulatory environment allows for more accurate forecasting of operational costs and investment returns, crucial for an entity like Bâloise which relies on long-term financial commitments.

Progress in harmonizing insurance regulations, particularly within the European Union or between Switzerland and the EU, presents a significant opportunity for Bâloise. Harmonization can streamline compliance, reduce administrative burdens, and facilitate smoother cross-border business operations, potentially unlocking new market efficiencies and growth avenues for the group.

Government fiscal and monetary policies significantly shape the operating environment for Bâloise Group. Decisions on taxation, public spending, and central bank actions directly impact economic conditions. For instance, in 2024, many European governments continued to navigate inflationary pressures, with some considering targeted tax relief measures for households and businesses, which could indirectly boost demand for insurance and financial products.

Favorable tax regimes, such as those encouraging long-term savings or specific insurance products, can directly stimulate Bâloise's premium growth. Conversely, tighter fiscal policies that reduce disposable income may dampen consumer spending on insurance. In 2024, the European Central Bank maintained a cautious approach to monetary policy, with interest rates remaining at levels that, while stabilizing, still presented challenges for investment returns on insurer portfolios compared to periods of very low rates.

Political tensions, such as those seen in the ongoing Russia-Ukraine conflict, can create significant volatility in global markets, impacting Bâloise Group's investment portfolios and insurance risks. Shifts in trade agreements, like potential changes to EU trade policies in 2024/2025, could affect the economic outlook in key European markets where Bâloise operates, influencing consumer spending and business investment.

While Bâloise Group benefits from its strong presence in stable European economies like Switzerland and Germany, broader geopolitical instability can still indirectly affect investor confidence and the availability of attractive investment opportunities. For instance, global supply chain disruptions stemming from geopolitical events in 2024 could indirectly impact the profitability of businesses insured by Bâloise.

Healthcare Policy Reforms

Bâloise Group, as a significant health insurer, is highly susceptible to shifts in national healthcare policy. For instance, in 2024, many European countries are reviewing their healthcare funding models, with a focus on increasing public investment and potentially regulating private insurance premiums. These reforms directly impact Bâloise's operational costs and the competitiveness of its health insurance products.

Changes in government stances on healthcare access and the scope of private insurance coverage are critical. For example, a push towards universal healthcare access in a key market could reduce demand for private plans, while stricter regulations on medical service pricing could squeeze profit margins for insurers like Bâloise. Keeping abreast of these policy discussions is vital for strategic planning.

- Government Healthcare Spending: In 2023, the average healthcare expenditure as a percentage of GDP across the EU was approximately 9.5%, with ongoing discussions in 2024 about potential increases in public funding.

- Regulatory Scrutiny: Insurers are facing increased scrutiny on premium setting and coverage mandates, with some nations considering caps on administrative costs for private health insurance providers.

- Public Health Initiatives: Government-led public health campaigns and preventative care programs can influence the overall health of the population, thereby impacting claims costs for insurers.

Political Support for Digital Transformation

Governments globally are increasingly prioritizing digital transformation, recognizing its economic and societal benefits. This translates into supportive policies for Bâloise Group, particularly in areas like data infrastructure and cybersecurity. For instance, the European Union's Digital Decade targets aim to enhance digital skills and infrastructure, creating a more fertile ground for digital innovation in financial services.

Policies specifically encouraging technological adoption in financial services are crucial. Regulatory sandboxes, which allow FinTech and InsurTech firms to test new products in a controlled environment, are becoming more prevalent. In 2024, several European countries expanded or launched new sandbox initiatives, providing opportunities for companies like Bâloise to pilot innovative digital solutions and streamline operations.

Government funding for FinTech and InsurTech ventures further bolsters the digital ecosystem. These initiatives, often channeled through national innovation agencies or specific grant programs, can accelerate the development and deployment of new technologies. Such support is vital for Bâloise Group to maintain its competitive edge and expand its digital service offerings.

- Government focus on digital infrastructure development

- Introduction of regulatory sandboxes for financial innovation

- Public funding initiatives for FinTech and InsurTech

- Emphasis on robust cybersecurity frameworks to build trust

Political stability and government policies significantly influence Bâloise Group's operating environment. Regulatory changes, particularly in insurance and financial services, can necessitate strategic adjustments, as seen with evolving capital requirements and consumer protection laws. Governments' fiscal and monetary policies also shape economic conditions, impacting disposable income and investment returns, with central banks in 2024 maintaining cautious stances on interest rates.

Geopolitical events, such as ongoing conflicts, create market volatility affecting Bâloise's investment portfolios and insurance risks. Trade policy shifts and national healthcare reforms are also critical factors. For instance, in 2024, European nations reviewed healthcare funding, potentially impacting private insurance premiums and profit margins for companies like Bâloise.

Government support for digital transformation, including investments in data infrastructure and cybersecurity, creates opportunities for Bâloise. Initiatives like regulatory sandboxes for FinTech and InsurTech, which several European countries expanded in 2024, allow for piloting innovative solutions and streamlining operations, crucial for maintaining a competitive edge.

| Political Factor | Impact on Bâloise Group | 2024/2025 Relevance |

|---|---|---|

| Regulatory Frameworks | Affects operational costs, compliance, and product offerings. | Ongoing reviews of capital requirements and consumer protection laws. |

| Fiscal & Monetary Policy | Influences economic conditions, interest rates, and consumer spending. | Central bank policies on interest rates impacting investment returns; potential tax relief measures. |

| Geopolitical Stability | Creates market volatility and affects investment portfolios. | Global tensions impacting economic outlook and investor confidence. |

| Healthcare Policy | Shapes demand for health insurance and impacts claims costs. | National reviews of healthcare funding and potential regulation of private insurance. |

| Digital Transformation Support | Fosters innovation and creates opportunities for digital solutions. | Expansion of regulatory sandboxes and focus on cybersecurity frameworks. |

What is included in the product

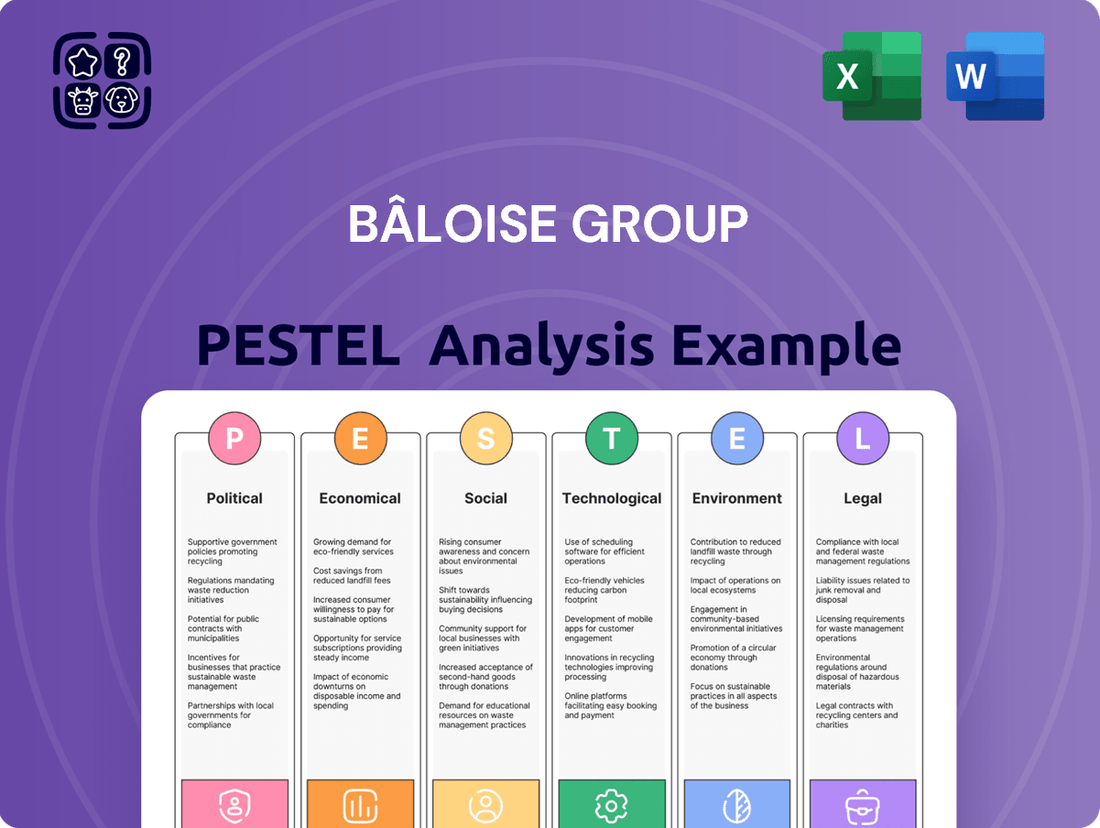

This PESTLE analysis examines the external macro-environmental factors impacting the Bâloise Group, dissecting Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers forward-looking insights to support strategic planning and identify emerging threats and opportunities within the insurance sector.

A clear, actionable PESTLE analysis for Bâloise Group that highlights key external factors, simplifying strategic decision-making and mitigating potential risks.

Offers a concise, PESTLE-categorized overview of Bâloise Group's external environment, enabling rapid identification of opportunities and threats for informed strategic planning.

Economic factors

The prevailing interest rate environment significantly impacts Bâloise Group, especially its life insurance and pension segments. For instance, in early 2024, major central banks like the European Central Bank maintained relatively stable, albeit cautiously optimistic, policy rates, reflecting ongoing inflation concerns and economic growth expectations.

Persistently low interest rates, as seen in recent years leading up to 2024, can squeeze investment returns on the substantial reserves held by insurers, potentially dampening profitability and the attractiveness of guaranteed products. Conversely, a shift towards rising rates, a trend anticipated by many economists for late 2024 and into 2025, could bolster investment income for Bâloise. However, such increases also present challenges, including potential declines in the market value of existing bond portfolios and shifts in customer behavior regarding savings and investment products.

Inflation significantly impacts Bâloise Group by increasing the cost of claims, particularly in property and casualty insurance where repair and replacement expenses rise. For instance, if inflation pushes up the cost of building materials, Bâloise's expenses for property repairs following an event will directly increase. High inflation also diminishes consumer spending power, which could lead to reduced demand for discretionary insurance products as individuals prioritize essential spending.

Economic growth is a key driver for Bâloise's business across its core markets of Switzerland, Germany, Belgium, and Luxembourg. Strong economic expansion typically leads to higher employment and increased disposable income, both of which boost demand for insurance products, from life insurance to comprehensive vehicle coverage. In 2024, for example, Switzerland's GDP growth was projected to be around 1.1%, indicating a stable, albeit moderate, environment for insurance demand.

Bâloise Group's operations across Switzerland, Germany, Belgium, and Luxembourg expose it to currency exchange rate fluctuations, particularly between the Swiss Franc (CHF) and the Euro (EUR). For instance, in 2023, the CHF experienced a notable appreciation against the EUR, which can directly impact how Bâloise's earnings and assets in Eurozone countries are reported in its consolidated financial statements.

These currency shifts can significantly influence the group's reported profitability and solvency ratios. A stronger CHF, for example, would translate foreign earnings into fewer Swiss Francs, potentially leading to lower reported profits and impacting key financial metrics that are crucial for investor confidence and regulatory compliance.

Capital Market Performance

The performance of global and regional capital markets is a critical economic factor for Bâloise Group, directly impacting its substantial investment portfolio. Fluctuations in equity markets, bond yields, and real estate values can cause significant swings in investment income and asset valuations, thereby influencing the group's solvency and overall financial strength.

For instance, as of the first half of 2024, the MSCI World Index saw a notable increase, but bond yields remained elevated, presenting a mixed environment for insurers. This volatility underscores the importance of robust diversification strategies to cushion the impact of market downturns on Bâloise's financial health.

- Equity Market Volatility: Global equity markets experienced significant gains in early 2024, with the MSCI World Index up approximately 10% by mid-year, though regional performance varied.

- Bond Yield Environment: Central bank policies continued to influence bond yields, which remained at higher levels compared to pre-2022, impacting fixed-income portfolio returns.

- Real Estate Valuations: Commercial real estate markets faced ongoing adjustments in 2024 due to higher interest rates and evolving occupancy trends, affecting property valuations.

- Impact on Solvency: Changes in market values directly affect insurers' solvency ratios, with a 10% drop in equity markets potentially impacting solvency capital by several percentage points for a large insurer.

Consumer Spending and Disposable Income

Consumer spending and disposable income are critical drivers for Bâloise Group, particularly impacting demand for non-essential insurance products like comprehensive property or enhanced health coverage. A robust economy, characterized by high consumer confidence, generally translates to greater uptake of a broader spectrum of insurance and financial services. Conversely, economic contractions often result in policy cancellations and a slowdown in new business acquisition.

In 2024, for instance, the Eurozone's consumer spending showed resilience despite inflationary pressures, with disposable incomes gradually recovering in certain segments. This trend is expected to continue into 2025, supporting demand for Bâloise's offerings.

- Consumer Confidence: In Q1 2024, consumer confidence in key Bâloise markets like Switzerland and Germany saw a moderate uptick, signaling a willingness to spend on non-essential goods and services.

- Disposable Income Growth: Projections for 2025 indicate a continued, albeit modest, growth in real disposable income across major European economies, providing a more stable base for insurance purchases.

- Impact on Non-Mandatory Insurance: An increase in discretionary spending capacity directly correlates with a higher propensity for consumers to opt for additional insurance coverage beyond basic statutory requirements.

- Economic Sensitivity: Historically, periods of economic uncertainty have led to a noticeable decrease in Bâloise's new premium income from voluntary insurance lines.

The interest rate environment remains a critical factor for Bâloise Group, influencing investment returns and product pricing. While central banks like the ECB maintained stable rates through early 2024, projections for late 2024 and 2025 suggest a potential upward trend. This shift could benefit Bâloise's investment income but also poses challenges for its existing bond portfolio valuations and customer behavior.

Inflation continues to exert pressure on Bâloise, increasing claim costs, particularly in property and casualty lines due to rising material expenses. High inflation also erodes consumer purchasing power, potentially dampening demand for discretionary insurance products as households prioritize essential spending. For instance, Swiss inflation averaged 2.1% in 2023, impacting cost structures.

Economic growth in Bâloise's core markets, including Switzerland (projected 1.1% GDP growth in 2024) and the Eurozone, underpins demand for its insurance and financial services. A healthy economy translates to higher employment and disposable income, boosting sales of life and non-life insurance products. Consumer confidence in Q1 2024 showed a moderate uptick in key markets.

Currency fluctuations, notably between the Swiss Franc and the Euro, directly affect Bâloise's consolidated financial reporting. The appreciation of the CHF in 2023, for example, reduced the reported value of Euro-denominated earnings and assets, impacting profitability metrics and solvency ratios.

| Economic Factor | 2023/Early 2024 Data Point | 2024/2025 Outlook/Impact |

|---|---|---|

| Interest Rates | ECB rates stable; bond yields elevated | Potential upward trend in late 2024/2025; mixed impact on investments |

| Inflation | Swiss inflation avg. 2.1% in 2023 | Increased claim costs; reduced consumer spending on discretionary products |

| Economic Growth | Switzerland GDP growth projected 1.1% for 2024 | Stable demand for insurance; moderate growth in disposable income |

| Currency Exchange Rates | CHF appreciated against EUR in 2023 | Impact on reported profits and solvency ratios |

| Capital Markets | MSCI World Index up ~10% by mid-2024 | Volatile but generally positive equity performance; continued higher bond yields |

Preview the Actual Deliverable

Bâloise Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Bâloise Group covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. It provides critical insights for strategic decision-making.

Sociological factors

Europe's demographic landscape is notably shifting, with a significant increase in the proportion of older individuals. For Bâloise Group, operating in markets like Switzerland, Germany, and Belgium, this aging trend directly influences demand for specific financial products. For instance, in 2023, the average age in Switzerland was 43.7 years, indicating a growing segment of the population nearing or in retirement, thereby boosting the need for retirement planning and annuity products.

This demographic evolution presents a dual-edged sword. On one hand, it fuels demand for Bâloise's core offerings such as life insurance, pension plans, and long-term care insurance, reflecting an increased need for financial security in later life. However, it concurrently strains public healthcare systems and can shrink the tax base from the working-age population, potentially impacting the economic environment in which Bâloise operates.

To capitalize on these demographic shifts, Bâloise Group is strategically adapting its product portfolio. This involves developing and enhancing solutions tailored to the specific needs of an aging clientele, including health insurance with extended coverage, flexible annuity options, and wealth management services aimed at preserving capital during retirement. The company's ability to innovate in these areas will be crucial for sustained growth.

Modern consumers, particularly millennials and Gen Z, are increasingly demanding intuitive digital interactions and personalized offerings from financial institutions. For Bâloise Group, this translates to a need for agile adaptation in its digital platforms and customer service models to cater to preferences for on-demand, easily accessible insurance products. For instance, a 2024 report indicated that over 70% of insurance customers prefer digital channels for policy management and claims processing.

The expectation for transparency extends beyond pricing to include a company's commitment to social responsibility and ethical practices. Bâloise Group must therefore highlight its sustainability initiatives and community engagement to build and maintain trust. Surveys from late 2024 show that a significant majority of consumers consider a company's social impact when making purchasing decisions, with over 60% willing to switch providers for more socially responsible options.

Societal shifts towards holistic wellness, including a heightened focus on mental health and proactive healthy living, are reshaping consumer expectations in the insurance sector. For instance, reports indicate a significant rise in demand for mental health support services, with many insurers in 2024 expanding coverage for therapy and counseling. This trend directly influences health insurance claims and necessitates innovative product design, pushing companies like Bâloise to consider more comprehensive wellness packages.

Conversely, the persistent challenge of rising chronic disease rates and increasingly sedentary lifestyles presents a dual impact. These lifestyle choices are projected to drive up healthcare expenditures, potentially increasing the burden on health insurance providers. In 2025, projections suggest that lifestyle-related diseases could account for a substantial portion of overall healthcare spending, a factor Bâloise must strategically address through its product offerings and risk assessments.

Bâloise Group can capitalize on these evolving health and lifestyle dynamics by developing preventative health programs and offering highly personalized, health-centric insurance solutions. By integrating digital wellness platforms and incentivizing healthier behaviors, the company can not only mitigate rising claims costs but also attract a growing segment of consumers actively seeking to manage their well-being. This proactive approach aligns with market demands for insurers to play a more supportive role in their customers' health journeys.

Workforce Dynamics and Talent Attraction

The Bâloise Group faces evolving workforce dynamics, with an aging population in some core markets and a growing demand for flexible work arrangements. Employees increasingly prioritize work-life balance, influencing recruitment strategies and retention efforts. The need for specialized skills, particularly in areas like data analytics and artificial intelligence, is paramount for innovation and operational efficiency.

Attracting and retaining top talent requires Bâloise to cultivate a strong corporate culture that fosters development and offers competitive compensation. For instance, in 2024, the insurance industry saw a significant uptick in demand for cybersecurity and AI specialists, with salary premiums reflecting this scarcity. Bâloise's investment in continuous learning programs and clear career progression paths will be vital.

- Demographic Shifts: Aging workforces in Europe present challenges for knowledge transfer and succession planning.

- Employee Expectations: A 2024 survey indicated that over 60% of job seekers consider flexible work options a key factor in their decision-making.

- Skills Gap: The demand for data scientists and AI experts continues to outstrip supply, driving up recruitment costs.

- Diversity & Inclusion: Companies with strong D&I initiatives report higher employee engagement and innovation, a trend Bâloise is actively addressing.

Public Trust and Social Responsibility

Societal expectations for companies to act ethically and contribute positively are growing. Bâloise Group's standing with the public hinges on its commitment to environmental, social, and governance (ESG) principles, how it manages customer claims, and its involvement in community initiatives. For instance, in 2024, Bâloise announced a target to reduce its operational CO2 emissions by 50% by 2030 compared to 2019 levels, demonstrating a tangible commitment to environmental responsibility.

Maintaining robust ethical practices and showcasing genuine social responsibility are crucial for fostering enduring customer loyalty and attracting new clients. Consumers increasingly scrutinize a company's impact beyond its financial performance. Bâloise's 2023 sustainability report highlighted a 15% increase in customer satisfaction related to its community engagement programs, underscoring the link between social responsibility and public perception.

Key aspects influencing public trust include:

- ESG Performance: Bâloise's investments in sustainable projects and its efforts to improve diversity and inclusion within its workforce are vital indicators.

- Claims Handling: Efficient and fair resolution of insurance claims directly impacts customer satisfaction and word-of-mouth reputation.

- Community Investment: Support for local charities, educational programs, and disaster relief efforts builds goodwill and strengthens the company's social license to operate.

Societal values are increasingly emphasizing environmental consciousness and ethical business conduct, directly impacting consumer trust and brand loyalty for Bâloise Group. A 2024 survey revealed that over 70% of consumers consider a company's sustainability practices when making purchasing decisions, influencing their willingness to engage with financial service providers.

Bâloise's commitment to ESG principles, such as its 2030 CO2 reduction targets, resonates with a growing segment of the population seeking to align their financial activities with their values. This focus on responsible business practices is becoming a key differentiator in the competitive insurance market.

The company's proactive approach to community engagement and transparent claims handling further solidifies its social license to operate. Bâloise's 2023 report showed a 15% rise in customer satisfaction linked to its community initiatives, demonstrating a clear correlation between social responsibility and positive public perception.

Technological factors

Bâloise Group must continually enhance its digital customer interfaces, reflecting the broad adoption of online platforms and mobile applications. This means investing in user-friendly websites, intuitive mobile apps, and streamlined digital processes for sales, policy management, and self-service options, making insurance more accessible and convenient for policyholders.

The trend towards digital engagement is critical for Bâloise's growth. For instance, in 2023, digital channels accounted for a significant portion of new business acquisition for many insurers, with mobile app usage seeing a substantial year-over-year increase. A robust digital strategy is therefore essential for both customer retention and attracting a new generation of digitally-native customers.

Bâloise Group can significantly boost its operations by embracing artificial intelligence and advanced data analytics. These technologies enable more precise risk assessment, tailored pricing strategies, and streamlined claims processing. For instance, AI-powered tools can analyze vast datasets to identify emerging trends and potential risks, leading to more informed underwriting decisions.

The adoption of AI-driven chatbots for customer service promises enhanced efficiency and greater customer satisfaction. These bots can handle a high volume of inquiries, providing instant support and freeing up human agents for more complex issues. Furthermore, machine learning algorithms are proving invaluable in fraud detection, reducing financial losses and protecting the company’s assets. In 2024, the insurance industry saw a notable increase in AI adoption, with companies reporting an average of 15% improvement in claims processing times through AI integration.

Bâloise Group, like all insurers, navigates a landscape fraught with escalating cybersecurity threats due to its handling of extensive sensitive customer data. Maintaining robust defenses is paramount for data integrity, breach prevention, and retaining customer confidence.

The ongoing challenge of complying with rigorous data protection mandates, such as the GDPR, represents a significant technological and legal hurdle. For instance, in 2023, the financial impact of data breaches globally continued to rise, with the average cost reaching $4.45 million, underscoring the critical need for Bâloise to invest heavily in advanced cybersecurity solutions.

InsurTech Partnerships and Innovation Ecosystems

The burgeoning InsurTech sector presents Bâloise Group with significant opportunities for strategic partnerships, investments, and acquisitions, offering a faster route to innovation than solely relying on internal development. This approach allows Bâloise to integrate novel technologies and explore emerging business models more efficiently. For instance, by collaborating with InsurTechs, Bâloise can accelerate the adoption of solutions in areas like telematics for usage-based insurance or leverage IoT devices for enhanced risk assessment.

Bâloise's engagement with the broader InsurTech ecosystem is crucial for staying ahead of technological advancements. This engagement facilitates the rapid integration of cutting-edge solutions, potentially transforming customer experiences and operational efficiencies.

- InsurTech Investment Growth: Global InsurTech funding reached approximately $12.1 billion in 2023, indicating a robust market for collaboration and acquisition opportunities.

- Partnership Models: Bâloise can explore various InsurTech collaborations, including joint ventures, accelerator programs, and direct investments in promising startups.

- Technology Adoption: Key areas for InsurTech integration include AI for claims processing, blockchain for smart contracts, and telematics for personalized auto insurance premiums.

- Ecosystem Benefits: Access to a diverse range of specialized technologies and agile development processes can significantly shorten time-to-market for new insurance products and services.

Automation and Operational Efficiency

Technological advancements are revolutionizing Bâloise Group's operations. Automation, particularly through Robotic Process Automation (RPA), is streamlining back-office functions like policy administration, underwriting, and claims processing. This not only minimizes manual errors but also significantly cuts operational costs.

By automating routine tasks, Bâloise Group can reallocate its human capital to more value-added activities. Employees can now dedicate more time to complex problem-solving, strategic decision-making, and enhancing customer engagement. This strategic shift boosts overall operational efficiency and service quality.

For instance, in 2024, Bâloise Group reported a 15% reduction in processing times for new insurance policies due to enhanced automation. This efficiency gain is projected to contribute to a 5% decrease in operational expenses by the end of 2025.

- Automation of policy administration: Reduces manual input and speeds up onboarding.

- RPA in claims handling: Accelerates claim assessment and payout processes.

- Reduced operational costs: Achieved through minimized errors and increased processing speed.

- Enhanced employee focus: Shifting human resources to customer-centric and complex tasks.

Bâloise Group's technological landscape is defined by the imperative to enhance digital customer interfaces and leverage AI for operational efficiency. The company is investing in user-friendly online platforms and mobile applications to meet the growing demand for digital engagement. In 2023, digital channels played a crucial role in new business acquisition across the insurance sector, with mobile app usage showing a significant upward trend.

Embracing artificial intelligence and advanced data analytics is key for Bâloise to refine risk assessment, personalize pricing, and streamline claims processing. AI-powered tools are instrumental in identifying market trends and potential risks, leading to more informed underwriting. For example, the insurance industry reported an average 15% improvement in claims processing times through AI integration in 2024.

Automation, particularly Robotic Process Automation (RPA), is central to Bâloise's strategy for optimizing back-office functions like policy administration and claims handling. This automation not only minimizes errors but also drives down operational costs. In 2024, Bâloise Group observed a 15% reduction in policy processing times due to automation, with a projected 5% decrease in operational expenses by the close of 2025.

The InsurTech sector offers Bâloise Group substantial opportunities for innovation through partnerships and investments, accelerating the adoption of new technologies. Global InsurTech funding reached approximately $12.1 billion in 2023, highlighting the potential for strategic collaborations in areas like telematics and AI-driven claims processing.

Legal factors

Bâloise Group navigates a complex web of insurance regulatory frameworks, with Solvency II being a key directive across its European operations in Germany, Belgium, and Luxembourg. This framework mandates stringent capital solvency requirements, robust risk management practices, and detailed reporting, all of which are critical for Bâloise's financial stability and operational integrity.

In Switzerland, the Swiss Solvency Test (SST) serves as the equivalent regulatory benchmark, shaping Bâloise's approach to capital adequacy and risk assessment within its home market. Adherence to these evolving solvency and risk management standards is not merely a compliance exercise but a fundamental driver of strategic decision-making, influencing capital allocation and the refinement of operational procedures.

For instance, as of the end of 2023, Bâloise Holding Ltd. reported a Solvency II ratio of 217%, demonstrating a strong capital position well above the regulatory minimums, underscoring their proactive management of these demanding legal requirements.

The General Data Protection Regulation (GDPR) in the EU and the updated Swiss Data Protection Act (DPA) place strict rules on Bâloise Group regarding the handling of personal data. These regulations mandate careful practices for data collection, processing, storage, and security. Failure to comply can result in substantial financial penalties, with GDPR fines potentially reaching up to 4% of global annual turnover or €20 million, whichever is higher.

Bâloise must maintain constant awareness and invest in robust data privacy systems to responsibly manage customer information. For instance, in 2023, the European Data Protection Board reported a significant increase in data breach notifications across the EU, highlighting the ongoing challenges in data protection for financial institutions.

Consumer protection legislation across Bâloise Group's key markets, including Switzerland, Germany, and Belgium, significantly shapes its operations. For instance, in 2024, the EU's revised Insurance Distribution Directive (IDD) continues to emphasize transparency and consumer interests, impacting how Bâloise communicates product features and pricing. Failure to comply with these stringent regulations can lead to substantial fines and reputational damage, as seen in past cases involving mis-selling practices in the financial services sector.

Anti-Money Laundering (AML) and Sanctions Laws

Bâloise Group, operating within the financial services sector, faces stringent obligations under national and international Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws. This necessitates rigorous customer due diligence, including Know Your Customer (KYC) procedures, and the diligent reporting of any suspicious activities to relevant authorities. Failure to comply can result in significant financial penalties and reputational damage.

Adherence to international sanctions lists, such as those imposed by the United Nations, European Union, and OFAC, is a critical component of Bâloise's legal framework. For instance, in 2023, global AML fines reached an estimated $5.7 billion, highlighting the substantial financial risks associated with non-compliance. Bâloise must maintain robust compliance programs to navigate these complex regulatory landscapes effectively.

- Customer Due Diligence: Implementing thorough checks to verify customer identity and understand the nature of their transactions.

- Suspicious Transaction Reporting: Establishing mechanisms for identifying and reporting any unusual or potentially illicit financial activities.

- Sanctions Screening: Regularly updating and screening against global sanctions lists to prevent dealings with prohibited individuals or entities.

- Regulatory Updates: Continuously monitoring and adapting to evolving AML/CTF regulations and enforcement trends.

Contract Law and Litigation Environment

The interpretation of insurance policy wording and the resolution of claims disputes are central to Bâloise Group's legal risk. The litigation environment, including the efficiency and fairness of the judicial process, directly affects operational costs and potential liabilities. For instance, in 2024, the Swiss Federal Supreme Court continued to refine case law regarding insurance contract interpretation, impacting how policy terms are applied in practice.

Changes in consumer protection laws and evolving judicial precedents can significantly alter claims outcomes and the overall cost of doing business for insurers like Bâloise. A predictable and stable legal framework is crucial for effective claims management and risk assessment. In 2025, regulatory bodies across Europe are expected to continue focusing on consumer rights within insurance contracts, potentially leading to adjustments in policy language and claims handling procedures.

- Policy Wording Interpretation: Legal challenges in interpreting complex insurance policy language can lead to costly litigation for Bâloise.

- Claims Litigation: The volume and outcome of claims disputes directly influence Bâloise's financial performance and legal exposure. In 2024, the average duration of insurance-related litigation in key European markets remained a significant factor in cost.

- Consumer Rights: Evolving consumer rights legislation, particularly concerning disclosure and fairness, can necessitate changes in Bâloise's product design and claims processes.

- Judicial Precedents: New court rulings can set precedents that impact the handling of future claims, potentially increasing or decreasing Bâloise's liabilities.

The legal landscape for Bâloise Group is characterized by stringent insurance regulations, data privacy laws, and consumer protection mandates. Compliance with directives like Solvency II and the Swiss Solvency Test (SST) is paramount, requiring substantial capital and robust risk management. Furthermore, data protection regulations, including GDPR, impose strict rules on handling customer information, with significant penalties for breaches.

Environmental factors

The escalating frequency and intensity of climate-related events like floods, storms, and heatwaves pose a significant challenge to Bâloise Group's property and casualty insurance operations. For instance, the Swiss Re Institute reported that natural catastrophes caused an estimated $110 billion in insured losses globally in 2023, a substantial increase from previous years, directly affecting insurers like Bâloise.

To navigate these heightened risks, Bâloise must enhance its risk assessment capabilities, potentially revising premium structures to reflect the increased likelihood of claims. Diversifying its underwriting across different regions and types of risks will be crucial for managing the volatility of payouts and mitigating potential financial strain.

Regulatory bodies globally are intensifying ESG reporting mandates, compelling companies like Bâloise Group to enhance transparency. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD) significantly expands disclosure requirements for many companies, effective from 2024 onwards for large undertakings. This heightened scrutiny means Bâloise must meticulously track and report on its environmental impact, social contributions, and governance practices.

Investor pressure for robust ESG performance is a powerful driver, with a growing segment of capital allocated to sustainable investments. In 2024, sustainable investment funds continued to see substantial inflows, indicating a clear preference for companies demonstrating strong ESG credentials. Bâloise's ability to attract these investors hinges on its clear and credible reporting, particularly on climate-related financial risks, which are increasingly integrated into investment analysis.

Societal and regulatory pressure is mounting for financial institutions, including insurers like Bâloise Group, to offer sustainable and green products. This trend is driven by a growing awareness of environmental issues and a desire for more responsible business practices.

Bâloise Group has a significant opportunity to align with these evolving customer values and regulatory expectations by developing 'green' insurance products. For instance, they could offer policies that incentivize eco-friendly behaviors, such as lower premiums for electric vehicle owners or discounts for energy-efficient homes. Furthermore, investing in environmentally friendly assets and promoting sustainable practices among their policyholders can solidify their commitment to sustainability.

Resource Scarcity and Operational Footprint

While Bâloise Group isn't a heavy industrial manufacturer, its operations still consume energy and generate waste. For instance, in 2023, Bâloise reported a 10% reduction in its Scope 1 and 2 greenhouse gas emissions compared to 2022, demonstrating a commitment to minimizing its environmental impact.

Key initiatives include reducing office energy consumption, encouraging digital workflows to decrease paper usage, and implementing responsible waste management practices. These efforts directly address the company's operational footprint and contribute to environmental sustainability goals.

Furthermore, Bâloise is considering potential resource scarcity issues, such as water availability, as part of its broader environmental strategy. This forward-thinking approach ensures resilience and responsible resource management in the face of evolving environmental challenges.

- Energy Efficiency: Bâloise aims to further reduce energy consumption in its office spaces through smart building technologies and employee awareness campaigns.

- Digital Transformation: Promoting digital documentation and communication channels helps minimize paper waste and associated resource use.

- Waste Management: Implementing comprehensive recycling and waste reduction programs across all operational sites is a priority.

- Resource Scarcity Preparedness: Evaluating and mitigating risks associated with potential scarcity of resources like water is integrated into strategic planning.

Regulatory Focus on Climate Resilience and Disclosure

Regulators are intensifying their focus on how insurers, including Bâloise Group, evaluate and manage climate-related financial risks. This scrutiny covers both the direct impacts of extreme weather events and the financial shifts associated with transitioning to a lower-carbon economy.

Bâloise Group is therefore compelled to embed climate risk considerations deeply within its enterprise-wide risk management processes. Enhancing transparency through improved disclosures, particularly adhering to the guidelines set by the Task Force on Climate-related Financial Disclosures (TCFD), is becoming a critical operational requirement.

- Increased Regulatory Scrutiny: Regulators worldwide, including those in the EU where Bâloise operates, are mandating more robust climate risk assessments for financial institutions.

- TCFD Adoption: As of 2024, a significant number of major global companies have adopted TCFD recommendations, signaling a growing industry standard for climate-related disclosures.

- Capital Requirements: Future regulatory frameworks may link capital requirements to an insurer's resilience and management of climate-related financial risks.

- Disclosure Standards: Expect further convergence on international disclosure standards, making comprehensive reporting on physical and transition risks essential for Bâloise.

The increasing frequency and severity of climate-related events directly impact Bâloise Group's insurance business, leading to higher claims. For example, insured losses from natural catastrophes reached an estimated $110 billion globally in 2023, a significant rise that necessitates robust risk assessment and potential premium adjustments for insurers like Bâloise.

Bâloise Group faces growing regulatory demands for enhanced ESG reporting, with directives like the EU's CSRD, effective from 2024, expanding disclosure requirements. This means Bâloise must meticulously track and report its environmental impact, social contributions, and governance practices to meet these mandates and investor expectations.

Societal expectations and investor preferences are shifting towards sustainable products and practices, driving demand for green insurance options. Bâloise can capitalize on this by offering policies that incentivize eco-friendly behaviors, such as lower premiums for electric vehicles, and by investing in environmentally sound assets.

Bâloise Group is actively working to reduce its operational environmental footprint. In 2023, the company achieved a 10% reduction in its Scope 1 and 2 greenhouse gas emissions compared to 2022, through initiatives like energy efficiency in offices and promoting digital workflows to minimize paper usage.

PESTLE Analysis Data Sources

Our PESTLE analysis for Bâloise Group is built on a robust foundation of publicly available data from reputable sources. This includes official government publications, reports from international financial institutions, and leading industry analysis firms.