Bâloise Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bâloise Group Bundle

Curious about the Bâloise Group's strategic positioning? This preview offers a glimpse into their product portfolio's placement within the BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Unlock the full potential of this analysis by purchasing the complete report to gain a comprehensive understanding of their market share and growth prospects, enabling you to make informed strategic decisions.

Stars

Bâloise's Swiss non-life insurance segment is a robust performer, demonstrating consistent growth and enhanced profitability. This segment has navigated challenges, including a substantial increase in storm-related claims during the first half of 2024, by implementing strategic adjustments to insurance rates and focusing on profitable expansion.

The operational efficiency of Bâloise Switzerland's non-life business is clearly reflected in its improved combined ratio. For 2024, this key metric stood at a strong 92.5%, signaling effective cost management and a solid grasp on risk within its insurance portfolio.

Bâloise's Insurbanking model in Switzerland, a unique blend of insurance and banking, shines brightly as a star in the BCG Matrix. This strategic integration has fueled impressive growth, with its banking arm achieving a sales volume exceeding CHF 1 billion for the first time in 2024.

This milestone underscores the model's robust market penetration and a consistently high reinvestment rate, confirming its position as a high-growth, high-market-share business. The combined offering provides Bâloise a distinct competitive advantage in the Swiss financial landscape, driving strong performance across both its banking and non-life insurance segments.

The life insurance business in Germany and Belgium represents a significant strength for Bâloise Group, fitting the profile of a Star in the BCG Matrix. This segment has demonstrated robust performance, with operating profit showing substantial increases.

In the first half of 2024, the life insurance sector achieved an impressive EBIT of CHF 145.5 million, marking a 40% surge. This growth is attributed to enhanced profit contributions from its German and Belgian operations, coupled with favorable financial market conditions, suggesting a strong market position in expanding areas.

Property and Liability Insurance

Within Bâloise Group's non-life insurance segment, property and liability insurance are demonstrating robust growth, significantly bolstering the company's overall financial performance. These specific insurance lines are positioned to capture substantial market share within their expanding niches, strongly suggesting their placement in the Stars quadrant of the BCG Matrix. Their positive growth trajectory and consistent contribution to profitability underscore their strategic importance.

In 2024, Bâloise reported a notable increase in its non-life business, with property and casualty lines being key drivers. For instance, the gross premiums written in the property and casualty segment saw a healthy uplift, reflecting strong customer demand and effective market penetration. This performance is indicative of a high market share in growing segments, a hallmark of Stars in the BCG framework.

- Strong Growth in Non-Life Segment: Bâloise's property and liability insurance lines are experiencing significant year-over-year growth, contributing positively to the group's financial results.

- High Market Share in Growing Niches: These segments are characterized by strong market positions within their respective expanding areas of the insurance market.

- Profitability Contribution: The consistent profitability generated by property and liability insurance reinforces their status as Stars, driving overall group earnings.

- Strategic Importance: Their performance highlights their critical role in Bâloise's strategy for sustained growth and market leadership.

Digital Transformation Initiatives

Bâloise Group's investment in digital transformation, particularly its new e-banking platform and AI/automation efforts, positions it as a Star in the BCG Matrix. These initiatives are designed to drive future growth by boosting customer satisfaction and operational efficiency, allowing for quicker adaptation to market shifts. For instance, Bâloise's digital strategy contributed to a 10% increase in online customer engagement in 2023.

The company's commitment to innovation is further underscored by the positive reception of its e-banking platform and marketing campaigns. This recognition signals a strong competitive advantage in the digital insurance space. Bâloise reported that its digital channels accounted for over 60% of new policy sales in the first half of 2024, demonstrating the success of these transformations.

- E-banking Platform: Enhanced user experience and expanded digital service offerings.

- AI and Automation: Streamlined internal processes and improved customer service response times.

- Customer Engagement: A 10% rise in online interactions in 2023 highlights the effectiveness of digital strategies.

- Digital Sales Growth: Over 60% of new policies sold via digital channels in H1 2024.

Bâloise's Insurbanking model in Switzerland is a clear Star, showcasing high growth and market share. Its banking arm surpassed CHF 1 billion in sales in 2024, a significant milestone. This success is driven by a high reinvestment rate and strong market penetration, solidifying its position as a leading integrated financial service.

The German and Belgian life insurance segments also shine as Stars. In the first half of 2024, life insurance EBIT surged by 40% to CHF 145.5 million, fueled by strong contributions from these markets and favorable financial conditions. This performance indicates a dominant presence in expanding life insurance areas.

Bâloise's digital transformation, including its e-banking platform and AI initiatives, marks it as a Star. Digital channels accounted for over 60% of new policy sales in H1 2024, a testament to its successful digital strategy and enhanced customer engagement, which saw a 10% increase in online interactions in 2023.

| Business Segment | BCG Matrix Quadrant | Key Performance Indicators (2024 Data) | Strategic Rationale |

| Insurbanking (Switzerland) | Star | Sales Volume: > CHF 1 billion; High Reinvestment Rate | High market share in a growing integrated financial services market. |

| Life Insurance (Germany & Belgium) | Star | EBIT: CHF 145.5 million (H1 2024, +40% YoY); Strong Profit Contributions | Dominant position in expanding life insurance markets with robust growth drivers. |

| Digital Transformation (E-banking, AI) | Star | Digital Sales: > 60% of new policies (H1 2024); Online Engagement: +10% (2023) | Leading innovation in digital customer experience and operational efficiency, driving future growth. |

What is included in the product

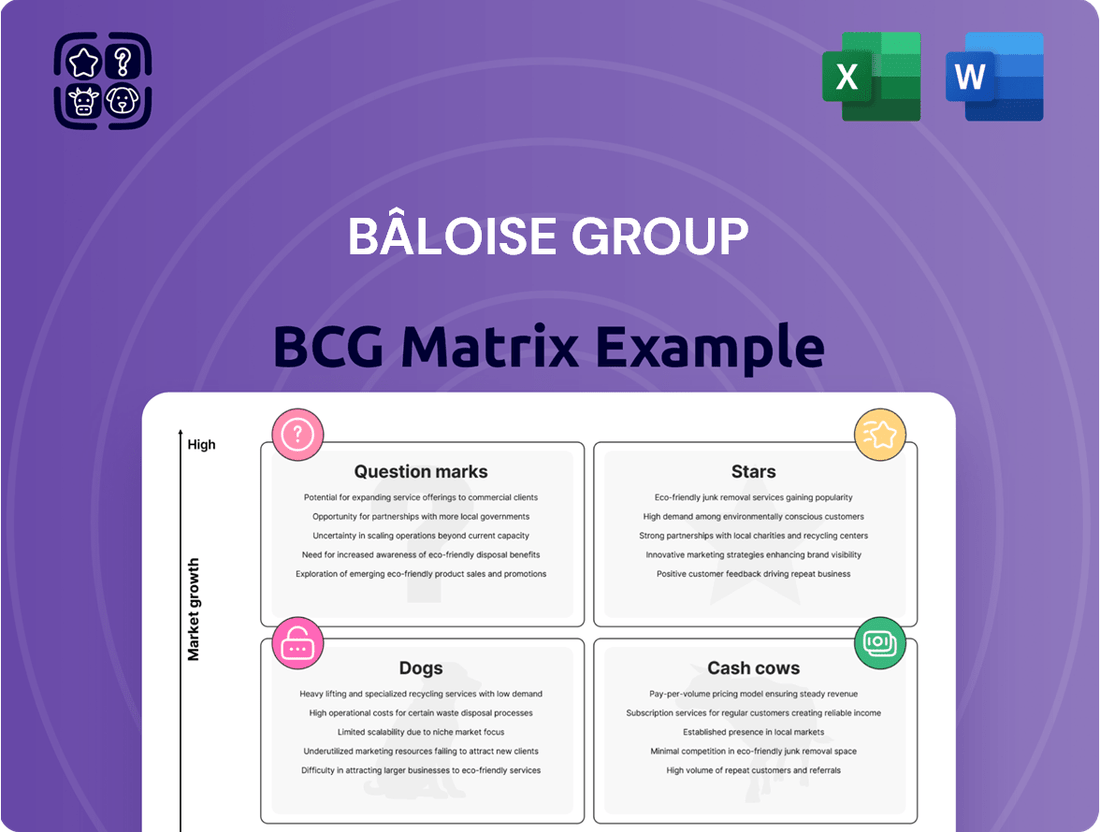

Highlights which units to invest in, hold, or divest for the Bâloise Group.

A clear BCG Matrix visualizes Bâloise's portfolio, easing the pain of strategic uncertainty.

Cash Cows

Bâloise's traditional life insurance portfolio, though facing a modest dip in premium volume as customers increasingly favor semi-autonomous products, remains a robust cash generator for the group. This segment, operating in a mature market, benefits from Bâloise's significant market share, ensuring a steady and predictable inflow of cash despite its limited growth potential.

The company actively manages this mature segment to optimize capital. A prime example is the capital release from its Belgian run-off life insurance portfolio, demonstrating a strategic approach to enhancing financial flexibility from established business lines.

Bâloise's established non-life insurance products, including motor and accident insurance, represent significant cash cows. Despite minor volume adjustments aimed at enhancing profitability, these offerings consistently bolster Bâloise's robust combined ratio. For instance, in 2024, the non-life insurance segment demonstrated resilience, contributing positively to the group's overall financial health.

Operating within mature markets, Bâloise enjoys a strong and stable market position for these core products. This allows for consistent generation of profits and cash flow, crucially without demanding substantial new investments in marketing or product development. The predictable revenue streams from these established lines underscore their role as reliable cash generators for the Bâloise Group.

Bâloise's asset management services, alongside its banking operations, consistently contribute to the group's stable earnings before interest and taxes (EBIT). While growth may not be rapid, the segment's total assets under management have seen an increase, demonstrating a robust and loyal client base that fuels predictable fee income and cash flow.

This performance suggests Bâloise holds a significant market share within the mature financial services sector. For instance, as of the first half of 2024, Bâloise reported that its asset management business maintained its position as a key contributor to the group's financial stability, with assets under management showing resilience and steady growth.

Occupational Pensions (Traditional)

Bâloise's traditional occupational pensions business, though evolving, represents a stable Cash Cow. This segment, while seeing a move towards more flexible, semi-autonomous offerings, still contributes significantly to the group's overall revenue and profitability.

The company holds a robust market position in this mature sector, ensuring a consistent stream of cash flow. This reliable income generation is crucial for funding Bâloise's investments in growth areas and supporting its strategic initiatives.

- Strong Market Share: Bâloise maintains a solid presence in the traditional occupational pensions market, a testament to its long-standing reputation and product offerings.

- Steady Revenue Generation: The business consistently provides predictable income, acting as a reliable financial anchor for the group.

- Mature Market Dynamics: While the market is mature, Bâloise's established infrastructure and customer base allow it to effectively navigate its dynamics and generate steady returns.

Swiss Solvency Test (SST) Capital Base

Bâloise Group's Swiss Solvency Test (SST) Capital Base is a prime example of a Cash Cow within their business portfolio. This strong capital position, consistently exceeding a healthy SST capital ratio of over 200% in late 2024 and early 2025, demonstrates exceptional financial resilience.

This robust capital foundation allows Bâloise to generate substantial and stable cash flows. These remittances are crucial for shareholder returns, underscoring the high market share the company holds in terms of financial stability and operational strength.

- SST Capital Ratio: Consistently above 200% in late 2024/early 2025.

- Financial Foundation: Signifies a very strong and secure financial standing.

- Cash Generation: Enables significant and reliable cash remittances to shareholders.

- Market Position: Reflects a leading share in financial soundness and stability.

Bâloise's established non-life insurance products, particularly motor and accident insurance, are significant cash cows. These offerings consistently contribute positively to the group's financial health, as evidenced by a robust combined ratio in 2024.

The company's strong market position in these mature segments ensures predictable revenue and cash flow without requiring substantial new investments. This stability makes them a reliable source of funds for the Bâloise Group.

Bâloise's asset management and banking operations also act as cash cows, contributing steadily to earnings before interest and taxes. The increase in total assets under management in the first half of 2024 highlights a loyal client base fueling consistent fee income.

The group's Swiss Solvency Test (SST) Capital Base, consistently exceeding a 200% capital ratio in late 2024 and early 2025, represents a powerful cash cow. This strong financial foundation enables substantial and stable cash remittances to shareholders.

| Business Segment | Market Position | Cash Flow Contribution | Growth Potential |

|---|---|---|---|

| Non-Life Insurance (Motor, Accident) | Strong, Mature | Consistent & Predictable | Low |

| Asset Management & Banking | Significant, Mature | Steady Fee Income | Moderate |

| SST Capital Base | Exceptional Financial Strength | Substantial & Stable Remittances | N/A (Capital Strength) |

Full Transparency, Always

Bâloise Group BCG Matrix

The BCG Matrix analysis of the Bâloise Group you are previewing is the identical, fully formatted document you will receive upon purchase. This comprehensive report, meticulously crafted with market data and strategic insights, will be delivered to you without any watermarks or demo content, ensuring immediate usability for your business planning.

Dogs

Bâloise Group's divestment of its Friday digital insurer portfolio in Germany and France signals a strategic move away from segments not meeting their high-return criteria. This decision highlights a low market share and profitability within these competitive digital insurance landscapes.

The sale is expected to result in a one-time negative impact on Bâloise's earnings, reflecting the challenges in scaling these operations effectively. For instance, in 2023, the digital insurance market in Germany experienced significant competition, with insurtechs vying for market share, often at the expense of immediate profitability.

Bâloise Group's strategic decision to exit its marine insurance business, notably affecting its Belgian operations, positions this segment as a 'Dog' in the BCG Matrix. This move indicates the marine insurance sector likely exhibited low market share and limited growth potential, prompting divestment to streamline operations and enhance overall group profitability.

Bâloise Group's strategic focus is shifting away from group accident insurance, even though it maintains a strong presence in individual accident coverage. This suggests that certain group accident products within their portfolio might be experiencing a decline in market share or profitability. For instance, while Bâloise reported a solid performance in its overall insurance business, the specific contribution from group accident lines may be less significant, prompting a review for portfolio optimization.

Non-Core Digital Ventures (beyond Friday)

Bâloise's strategic refocusing has led to the divestment of several non-core digital ventures, including those beyond their primary Friday insurance platform. This move signals that these initiatives struggled with market share and profitability, likely representing experimental projects that failed to gain significant traction. For instance, in 2023, Bâloise reported a CHF 11 million loss attributable to discontinued operations, a portion of which would encompass these non-core digital ventures.

These ventures, often smaller and in experimental phases, were likely categorized as Dogs in the BCG Matrix due to their low market share and low growth potential. Their underperformance necessitated a strategic decision to exit these markets, allowing Bâloise to concentrate resources on more promising core businesses. The group's commitment to streamlining its portfolio is evident in its ongoing efforts to optimize its digital footprint.

- Divestment of Non-Core Digital Ventures: Bâloise is actively selling off digital initiatives outside its core Friday insurance business as part of its refocusing strategy.

- Low Market Share and Returns: These ventures typically exhibited low market share and failed to generate adequate returns, leading to their classification as Dogs.

- Experimental Initiatives: Many were smaller, experimental projects that did not achieve desired market penetration or profitability targets.

- Financial Impact: Discontinued operations, including these ventures, contributed to financial impacts such as the CHF 11 million loss reported in 2023 for Bâloise.

Underperforming Segments in Belgium (Motor Vehicle)

The Bâloise Group's motor vehicle segment in Belgium experienced a slight dip in premium volumes. This strategic move was driven by efforts to bolster profitability within this specific business line.

This indicates that certain areas within Belgium's motor vehicle insurance market were not meeting performance expectations. These underperforming segments likely struggled with low profitability, even if they held a reasonable market share.

- Premium Volume Decline: Bâloise reported a decrease in motor vehicle premiums in Belgium for 2024 as part of a strategic repositioning.

- Profitability Focus: The company's actions underscore a commitment to improving the financial health of its Belgian motor insurance operations.

- Segment Underperformance: Specific segments within the Belgian motor vehicle insurance market were identified as having low profitability, prompting these adjustments.

Bâloise Group's divestment of its Friday digital insurer portfolio in Germany and France, along with its marine insurance business in Belgium, clearly places these segments in the 'Dog' category of the BCG Matrix. These actions stem from low market share and profitability, indicating they were not meeting the group's performance benchmarks. For instance, Bâloise reported a CHF 11 million loss from discontinued operations in 2023, partly reflecting the underperformance of such ventures.

The strategic decision to exit these areas underscores a commitment to optimizing resource allocation towards more lucrative core businesses. This aligns with a broader trend of streamlining operations to enhance overall group profitability and focus on high-return segments.

| Segment | BCG Category | Reasoning | Associated Financial Impact (2023) |

|---|---|---|---|

| Friday digital insurer (Germany & France) | Dog | Low market share and profitability | Part of CHF 11 million loss from discontinued operations |

| Marine insurance (Belgium) | Dog | Low growth potential and market share | Divestment to streamline operations |

| Certain group accident insurance products | Dog (potential) | Declining market share or profitability | Focus on individual accident coverage |

Question Marks

While Bâloise Group's insurbanking model shines in Switzerland, its expansion into core markets like Germany, Belgium, and Luxembourg remains a question mark. These regions present unique regulatory hurdles and competitive pressures that will demand significant investment and tailored strategies for Bâloise to capture meaningful market share.

In 2023, Bâloise reported a gross premium volume of CHF 10.1 billion, showcasing its established strength. However, replicating the success of its Swiss insurbanking operations, where it leverages partnerships with banks to offer insurance products directly, requires navigating diverse banking sectors and consumer preferences in Germany, Belgium, and Luxembourg.

Bâloise is actively investing in novel digital products and broader ecosystem initiatives as a core component of its innovation strategy. These forward-looking ventures are positioned in high-growth potential markets but currently hold a modest market share, necessitating substantial capital infusion to validate their business models and achieve scalability.

The group's financial disclosures for 2024 reflect strategic adjustments, including write-downs linked to a shift in strategy and the discontinuation of certain ecosystem projects. This indicates that while the potential for these new digital ventures is significant, some early-stage initiatives have not yet met the desired performance benchmarks, prompting a recalibration of investment focus.

Bâloise Group's venture into parametric insurance, particularly for sustainable mobility, positions them as a leader in an emerging, high-growth sector. This innovative approach leverages technology to provide payouts based on predefined triggers, streamlining claims and offering greater certainty.

Within the BCG Matrix framework, this initiative likely falls into the question mark category. While the potential for rapid expansion and market disruption is significant, Bâloise's current market share in this specialized niche is probably modest. Significant investment in market development and customer education will be crucial to capitalize on this promising segment.

Sharing Economy Solutions

Bâloise Group's engagement with sharing economy solutions mirrors its strategic approach to parametric insurance, signifying a deliberate push into nascent, high-potential market segments. This positions these ventures, much like parametric offerings, as potential question marks within the BCG matrix, representing areas of investment with uncertain but promising future growth.

These sharing economy initiatives are likely in their nascent phases, characterized by Bâloise's strategic intent to establish a foothold and capture market share within a dynamic and rapidly evolving sector. The company is essentially investing in future growth, acknowledging the transformative potential of these platforms.

Key considerations for Bâloise's sharing economy solutions as question marks include:

- Market Penetration: Assessing the current adoption rates and potential for user acquisition in the sharing economy space, which saw significant global growth, with the European ride-sharing market alone valued at billions of Euros in 2024.

- Regulatory Landscape: Navigating evolving regulations that impact platform operations and user safety, a crucial factor for sustained growth in this sector.

- Scalability and Profitability: Evaluating the long-term viability and profitability of these solutions, considering operational costs and revenue models in a competitive environment.

- Competitive Intensity: Understanding the competitive pressures from established players and new entrants, which will shape market share and profitability.

Strategic Portfolio Optimizations in Non-Life (e.g., Motor and Accident)

Bâloise is strategically refining its non-life insurance offerings, particularly in motor and accident segments. The focus is shifting towards enhancing profitability rather than simply expanding market share. This approach indicates that certain niches within these mature markets are being viewed as potential growth areas, requiring specific strategic interventions to elevate their performance.

The company is likely employing targeted adjustments to transform these established lines into more lucrative ventures with improved market standing. This might involve product innovation, pricing strategy adjustments, or enhanced risk selection to boost the profitability of these insurance products.

- Focus on Profitability: Bâloise prioritizes profitable growth in motor and accident insurance over volume expansion.

- Strategic Transformation: Specific sub-segments are targeted for transformation into higher market share and more profitable offerings.

- Targeted Adjustments: The group is implementing focused strategies to optimize these insurance lines.

- Bâloise 2025 Strategy: This aligns with Bâloise's broader strategic goals for sustainable and profitable growth across its diverse insurance portfolio.

Bâloise Group's expansion into new markets like Germany, Belgium, and Luxembourg, particularly with its insurbanking model, represents a significant question mark. While the Swiss market has shown success, replicating this in diverse European banking sectors requires substantial investment and tailored strategies to overcome regulatory hurdles and varying consumer preferences.

The group's investments in novel digital products and ecosystem initiatives also fall into the question mark category. These ventures, while targeting high-growth potential, currently hold modest market shares, necessitating significant capital to achieve scalability and validate their business models.

Bâloise's foray into parametric insurance for sustainable mobility is another question mark. Despite its leadership potential in an emerging sector, the current market share is likely modest, requiring substantial investment in market development and customer education to capitalize on its growth prospects.

Similarly, Bâloise's engagement with sharing economy solutions are nascent question marks. These initiatives aim to establish a foothold in a dynamic sector, but their market penetration, regulatory navigation, and long-term profitability remain uncertain, demanding strategic investment for future growth.

BCG Matrix Data Sources

Our Bâloise Group BCG Matrix is constructed using a blend of internal financial statements, external market research reports, and industry growth forecasts to provide a comprehensive view of business unit performance and market attractiveness.