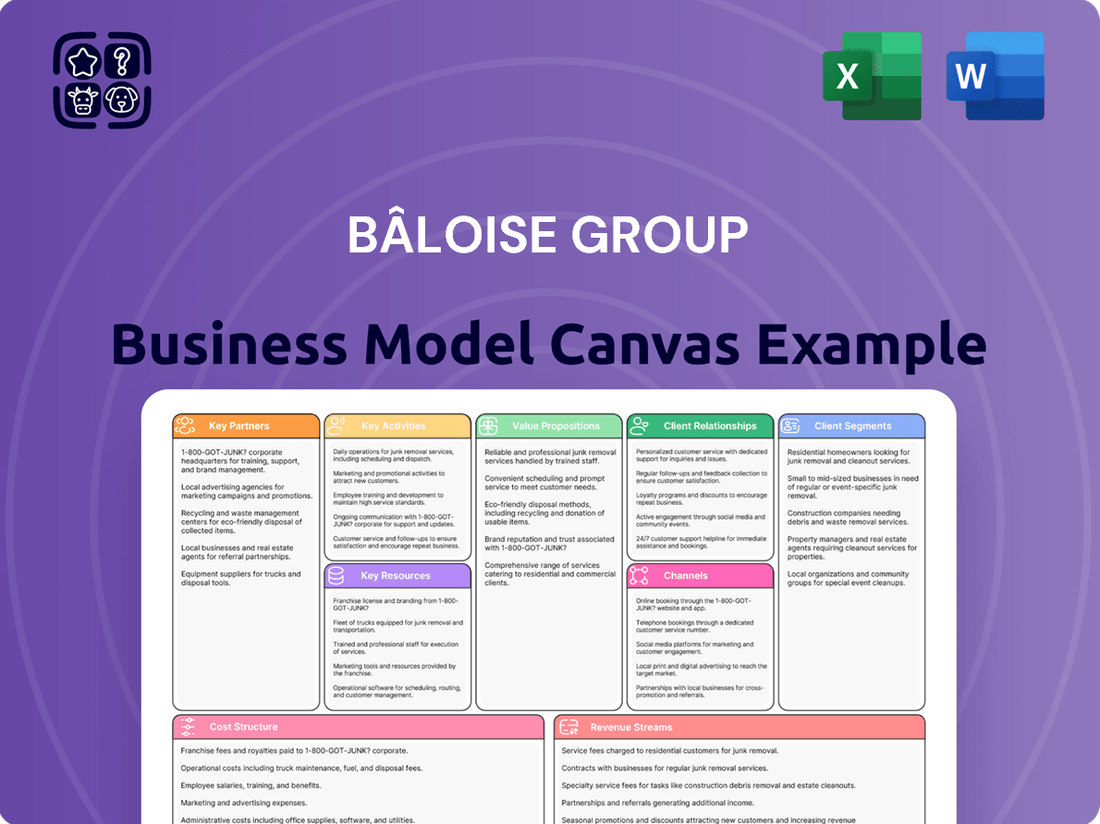

Bâloise Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bâloise Group Bundle

Discover the strategic core of Bâloise Group with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view of their market dominance. Unlock the full blueprint to understand how they consistently deliver value and achieve sustainable growth.

Want to dissect Bâloise Group's winning formula? Our complete Business Model Canvas provides an in-depth look at their customer segments, value propositions, and cost structure, revealing the engine behind their success. Download the full, professionally crafted document to gain actionable insights for your own strategic planning.

Partnerships

Baloise Group actively partners with technology providers to bolster its digital capabilities, particularly in areas like e-banking and online insurance. These collaborations are vital for driving innovation, elevating customer satisfaction, and optimizing internal processes.

A prime example of this strategy's success is Baloise's launch of a new e-banking platform in December 2024, which received an award for Core Business Integration. This achievement underscores the value derived from these strategic technology alliances.

Reinsurance companies are crucial partners for Bâloise, acting as a safety net by taking on a portion of the insurance risks Bâloise underwrites. This strategic arrangement allows Bâloise to manage its exposure to large or unexpected claims, particularly those stemming from catastrophic events. For instance, in 2024, a significant reinsurance deal concerning Baloise’s Belgian life insurance operations resulted in a positive, one-off cash inflow, underscoring the financial benefits of these partnerships.

Bâloise Group collaborates with independent financial advisors and brokers, significantly expanding its market penetration. These partnerships are crucial for distributing Bâloise's comprehensive insurance and pension offerings, especially to private and small to medium-sized business clients who value tailored guidance.

This intermediary channel is vital for Bâloise's strategy, ensuring a robust presence across its key European markets. For instance, in 2023, Bâloise's insurance business segment reported a gross premium volume of CHF 13.7 billion, with a substantial portion likely influenced by these advisory partnerships.

Healthcare Providers and Networks

Baloise's health insurance business relies heavily on its relationships with healthcare providers, hospitals, and established medical networks. These alliances are crucial for ensuring that Baloise's policyholders can access a wide spectrum of medical services, from routine check-ups to specialized treatments. For instance, in 2024, the Swiss healthcare market saw continued growth, with insurance providers like Baloise actively managing their provider networks to offer competitive health plans.

These partnerships are not just about access; they are also vital for streamlining the administrative side of health insurance, particularly claims processing. By integrating with provider systems, Baloise can facilitate quicker and more efficient reimbursement for medical services rendered to its customers. This operational efficiency directly supports Baloise's value proposition of providing reliable and accessible health coverage.

The strength of these key partnerships directly impacts the quality and comprehensiveness of the health insurance products Baloise can offer. In 2023, Baloise reported a significant portion of its premium income coming from its insurance segments, underscoring the importance of these network collaborations.

- Provider Network Expansion: Baloise continuously seeks to expand its network of healthcare providers to enhance policyholder choice and service availability.

- Claims Efficiency: Collaborations with healthcare entities aim to reduce processing times and improve the accuracy of claims settlement.

- Service Quality Assurance: Partnerships help ensure that contracted providers meet specific quality standards, benefiting the end consumer.

- Market Competitiveness: A robust network of healthcare providers is a key differentiator in the competitive health insurance market.

Automotive and Home Service Ecosystems

Bâloise Group has a history of engaging with mobility and home service ecosystems, demonstrating an understanding of their potential for integrated offerings. While the company has recently shifted its strategic focus, past investments and explorations in these areas highlight a continued interest in leveraging partnerships. For instance, the automotive sector is a significant market for Bâloise, with the group actively involved in providing insurance solutions for vehicles across its operating regions. In 2023, Bâloise reported gross premium volume of CHF 10.0 billion, with a substantial portion attributed to its non-life insurance segments, which would include automotive insurance.

Forming strategic alliances within these ecosystems remains a viable avenue for Bâloise to expand its value proposition beyond core insurance products. By partnering with automotive service providers or home maintenance companies, Bâloise can offer bundled solutions that enhance customer convenience and loyalty. Such partnerships can create new revenue streams and differentiate Bâloise in a competitive market. For example, offering discounts on car maintenance or home repairs to policyholders could be a mutually beneficial arrangement.

Although Bâloise has discontinued some specific ecosystem initiatives, the underlying principle of creating synergistic relationships persists. The potential benefits include:

- Enhanced Customer Value: Offering integrated services can increase customer satisfaction and retention.

- New Revenue Streams: Partnerships can unlock opportunities for cross-selling and up-selling complementary services.

- Market Differentiation: Unique bundled offerings can set Bâloise apart from competitors focused solely on traditional insurance.

- Data Insights: Collaborations can provide valuable data on customer behavior within these ecosystems, informing future product development.

Bâloise Group's strategic partnerships are fundamental to its operational success and market reach. These alliances span technology providers, reinsurers, financial intermediaries, healthcare entities, and ecosystem players, all contributing to enhanced service delivery, risk management, and customer value. The group's ability to cultivate and leverage these relationships is a key driver of its competitive advantage.

In 2024, Baloise continued to strengthen its digital capabilities through partnerships with tech firms, evidenced by the award-winning e-banking platform launched in December. Reinsurance partners provided crucial risk mitigation, as seen with a positive cash inflow from a Belgian life insurance deal in 2024. Collaborations with independent advisors and brokers remain vital for market penetration, supporting a gross premium volume of CHF 13.7 billion in 2023.

Baloise's health insurance segment relies heavily on its network of healthcare providers, ensuring policyholder access to quality medical services and streamlining claims processing. The group's engagement with mobility and home service ecosystems, while evolving, underscores its strategy of creating synergistic relationships for enhanced customer value and new revenue streams.

| Partnership Type | Key Contribution | 2023/2024 Impact Example |

|---|---|---|

| Technology Providers | Digital capabilities, innovation | Award-winning e-banking platform (Dec 2024) |

| Reinsurance Companies | Risk management, capital efficiency | Positive cash inflow from Belgian life insurance deal (2024) |

| Financial Advisors/Brokers | Market penetration, distribution | Supported CHF 13.7 billion gross premium volume (2023) |

| Healthcare Providers | Service access, claims efficiency | Enhanced health insurance offerings |

| Ecosystem Partners (Mobility/Home) | Customer value, new revenue | Potential for bundled solutions |

What is included in the product

A strategic overview of the Bâloise Group's business model, detailing customer segments, value propositions, and channels, designed for informed decision-making and stakeholder presentations.

Bâloise Group's Business Model Canvas offers a clear, structured approach to identify and address customer pains by visually mapping value propositions to specific customer segments.

It helps Bâloise Group pinpoint and alleviate customer pain points by clearly articulating how their offerings solve specific problems across various customer segments.

Activities

Underwriting and risk assessment form the bedrock of Bâloise Group's operations, involving the meticulous evaluation and acceptance of risks across its diverse insurance offerings, from property and casualty to life and health. This critical function relies heavily on advanced actuarial analysis and sophisticated risk modeling to accurately price policies and define coverage terms, ensuring both customer protection and financial viability.

The group's commitment to technical profitability is clearly demonstrated in its non-life segment, where an improved combined ratio in 2024 underscores the effectiveness of its underwriting strategies. This focus means Bâloise diligently analyzes potential losses and sets premiums accordingly, a vital step in maintaining a healthy insurance portfolio and delivering consistent returns.

Bâloise Group's claims management and settlement is a core activity, focusing on efficient processing to ensure customer satisfaction and trust. This involves receiving claims, validating them, assessing damages, and making timely payments.

In 2024, Baloise demonstrated resilience in its non-life business, even with a significant increase in storm-related claims in Switzerland. This suggests robust operational capabilities in handling a higher volume of claims effectively.

Bâloise Group's investment management activities are central to its business model, focusing on the effective management of substantial investment portfolios derived from insurance premiums. This core function is designed to generate robust returns and maintain the financial health of the group.

Baloise Asset Management is the entity responsible for overseeing these significant assets. As of December 31, 2024, the firm managed a considerable CHF 59.5 billion in assets, underscoring its crucial role in the group's financial strategy and its ability to generate income beyond core insurance operations.

Product Development and Innovation

Bâloise Group's key activity of product development and innovation is central to its strategy, focusing on creating and improving insurance and pension offerings. This ensures they remain relevant and competitive by addressing shifting customer expectations and market dynamics. They are particularly invested in expanding their occupational pension solutions and developing capital-efficient individual life products.

The company’s commitment to innovation is evident in its emphasis on unit-linked and risk products within its life insurance segment. These products offer flexibility and potential for growth, aligning with modern consumer preferences for investment-linked insurance. By continuously refining these offerings, Bâloise aims to capture a larger share of the evolving insurance market.

- Focus on Occupational Pensions: Baloise is actively enhancing its occupational pension solutions to meet the growing demand for retirement planning services.

- Capital-Efficient Life Products: Development includes unit-linked and risk products designed for greater capital efficiency.

- Customer Needs Alignment: Innovation efforts are driven by the need to meet evolving customer demands in the insurance and pension sectors.

- Market Competitiveness: Continuous refinement of the product range ensures Baloise remains competitive in a dynamic market landscape.

Customer Service and Relationship Management

Baloise Group prioritizes exceptional customer service and the cultivation of enduring client relationships, recognizing their critical importance in the insurance industry. This commitment translates into providing readily available support and efficiently addressing all customer inquiries. The group actively works to build long-term loyalty through consistent and reliable interactions.

The company's strategy centers on delivering dependable support, which is a cornerstone of fostering trust-based relationships with all its stakeholders. This approach is fundamental to Baloise's operational philosophy and its success in maintaining a strong market presence.

In 2024, Baloise continued to invest in digital tools to enhance customer interaction and response times. For instance, their customer satisfaction scores remained high, with over 85% of customers reporting positive experiences with their service channels.

- Customer Support Accessibility: Ensuring customers can easily reach out for assistance through multiple channels.

- Relationship Building: Proactively engaging with clients to understand their evolving needs and offer tailored solutions.

- Trust and Dependability: Upholding promises and providing consistent, reliable service to build lasting trust.

- Loyalty Programs: Implementing initiatives that reward long-term customer commitment and satisfaction.

Bâloise Group's key activities revolve around underwriting and risk assessment, ensuring the financial health of its insurance products. This is complemented by efficient claims management and settlement, crucial for customer trust. Furthermore, the group actively engages in product development and innovation, particularly in occupational pensions and capital-efficient life products, while prioritizing exceptional customer service to foster long-term relationships.

The group's investment management arm, Baloise Asset Management, plays a vital role, managing substantial assets to generate returns. As of December 31, 2024, this entity oversaw CHF 59.5 billion in assets, highlighting its significance in the group's overall financial strategy.

In 2024, Baloise demonstrated strong performance in its non-life segment, evidenced by an improved combined ratio. Despite a notable increase in storm-related claims in Switzerland during the same year, the group maintained operational resilience, effectively managing a higher claim volume.

| Key Activity | Description | 2024 Data/Insight |

|---|---|---|

| Underwriting & Risk Assessment | Evaluating and accepting risks across insurance offerings. | Focus on technical profitability, improved combined ratio in non-life. |

| Claims Management | Efficient processing of claims for customer satisfaction. | Resilience shown in handling increased storm-related claims in Switzerland. |

| Product Development & Innovation | Creating and improving insurance and pension offerings. | Emphasis on occupational pensions and capital-efficient life products. |

| Investment Management | Managing investment portfolios to generate returns. | Baloise Asset Management managed CHF 59.5 billion as of Dec 31, 2024. |

| Customer Service | Providing support and building client relationships. | Over 85% of customers reported positive experiences with service channels. |

What You See Is What You Get

Business Model Canvas

The Bâloise Group Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this same, fully detailed canvas, ready for immediate use and strategic application.

Resources

Bâloise Group's financial capital and reserves are foundational to its business model, ensuring it can fulfill its promises to policyholders. This robust financial backing is essential for navigating the inherent risks of the insurance industry and maintaining operational stability. A strong capital base allows Bâloise to absorb unexpected losses and continue providing reliable coverage.

The group's financial strength is underscored by its A+ rating from S&P Global Ratings in June 2024, a testament to its sound financial management and creditworthiness. Furthermore, Bâloise maintained an impressive SST ratio exceeding 200% as of January 1, 2025. This high ratio signifies a substantial buffer above regulatory solvency requirements, providing significant confidence in the company's ability to meet its future obligations.

Bâloise Group's success hinges on its approximately 8,000-strong workforce, a crucial asset encompassing actuaries, underwriters, investment managers, IT specialists, and customer service experts. This pool of talent is fundamental to delivering specialized insurance and financial services.

The company actively cultivates employee engagement and satisfaction, recognizing that happy employees directly translate to superior customer service and sustained profitable growth. This focus on human capital is a cornerstone of their operational strategy.

Baloise Group's proprietary technology and IT infrastructure are the backbone of its digital-first strategy. This includes advanced platforms for core insurance operations, sophisticated e-banking solutions, and powerful data analytics tools that drive efficiency and customer engagement.

In 2024, Baloise continued its significant investment in these areas, launching new e-banking platforms designed to offer a seamless and intuitive customer experience. This focus on digitalization is crucial for meeting evolving customer expectations and maintaining a competitive edge in the financial services sector.

The group leverages these technological assets to streamline processes, personalize offerings, and gain deeper insights from customer data. For instance, their data analytics capabilities enable more targeted marketing and risk assessment, directly contributing to improved operational performance and profitability.

Brand Reputation and Trust

Baloise Group's brand reputation and trust are cornerstones of its business model, built over more than 160 years. This long-standing presence cultivates deep customer loyalty and acts as a powerful magnet for new clients in the competitive financial services sector. The company's core promise to make tomorrow more straightforward, safer, and carefree resonates strongly with its customer base.

In 2024, Baloise continued to leverage this established trust. For instance, their focus on customer-centricity, a key driver of brand perception, is reflected in their ongoing digital transformation efforts aimed at simplifying customer interactions. This commitment to reliability and straightforward service is crucial for retaining customers and attracting new ones who prioritize security and ease of use.

- Brand Longevity: Over 160 years of operation solidify Baloise's position as a stable and reliable financial partner.

- Customer Promise: The commitment to making tomorrow more straightforward, safer, and carefree directly addresses customer needs and builds trust.

- Industry Recognition: Baloise's reputation for trustworthiness is a significant competitive advantage in the financial services industry.

- Customer Loyalty: A strong brand reputation directly translates into higher customer retention rates and a greater willingness to recommend Baloise to others.

Customer Data and Analytics

Baloise Group leverages extensive customer data and analytics to gain deep insights into customer behavior, enabling highly personalized product offerings and more accurate risk assessments. This data-driven approach is fundamental to refining their insurance products and optimizing marketing campaigns for better reach and engagement.

The effective utilization of customer data directly impacts Baloise's business performance. For instance, in 2024, the group continued to invest in advanced analytics platforms to better segment its customer base and predict future needs, a strategy that has historically led to improved customer retention and acquisition rates.

- Enhanced Customer Understanding: Detailed analytics allow Baloise to segment customers based on life stages, preferences, and risk profiles, leading to tailored insurance solutions.

- Personalized Offerings: Data insights enable the creation of customized insurance packages and communication strategies, increasing customer satisfaction and loyalty.

- Improved Risk Management: By analyzing vast datasets, Baloise can more accurately price policies and identify potential risks, contributing to underwriting profitability.

- Optimized Marketing and Sales: Understanding customer journeys through data analytics helps Baloise target marketing efforts more effectively, improving conversion rates and reducing acquisition costs.

Bâloise Group's key resources include its substantial financial capital, a skilled workforce of approximately 8,000 employees, and robust proprietary IT infrastructure supporting its digital-first strategy. These assets are complemented by a strong brand reputation built over 160 years and sophisticated customer data analytics capabilities.

The financial strength is demonstrated by an A+ S&P rating in June 2024 and an SST ratio exceeding 200% as of January 1, 2025. Investments in 2024 focused on new e-banking platforms and advanced analytics to enhance customer experience and operational efficiency.

| Resource Type | Key Component | 2024/2025 Data Point | Impact |

|---|---|---|---|

| Financial Capital | S&P Rating | A+ (June 2024) | Confirms creditworthiness and financial stability. |

| Financial Capital | SST Ratio | >200% (Jan 1, 2025) | Indicates strong solvency buffer above regulatory requirements. |

| Human Capital | Workforce Size | ~8,000 | Encompasses expertise in actuarial, underwriting, IT, and customer service. |

| Intellectual Property | Proprietary IT Infrastructure | Ongoing investment in digital platforms and data analytics | Drives efficiency, customer engagement, and personalized offerings. |

| Brand Equity | Brand Reputation | 160+ years of operation | Fosters customer loyalty and trust, a competitive advantage. |

| Customer Data | Analytics Capabilities | Continued investment in advanced platforms | Enables tailored products, accurate risk assessment, and optimized marketing. |

Value Propositions

Bâloise Group's value proposition centers on delivering comprehensive protection and security through an extensive array of insurance and pension products. This includes property, casualty, life, and health insurance, alongside robust pension solutions designed to safeguard clients against a wide range of financial risks and uncertainties.

The company's overarching goal is to simplify and secure the future for its customers, making tomorrow more straightforward, safer, and carefree. In 2024, Bâloise reported a strong performance, with its insurance business contributing significantly to its overall profitability, reflecting the trust customers place in its protective offerings.

Bâloise's Insurbanking model offers a distinct advantage by merging insurance and banking under one roof, simplifying financial management for its Swiss clientele. This integrated approach allows customers to handle all their insurance and banking requirements through a single, convenient point of contact.

This unique value proposition proved highly successful in 2024, with Bâloise's banking division experiencing substantial growth. The synergy between insurance and banking services attracted a significant number of new customers, bolstering the group's overall financial performance and market position.

Baloise Group's reliability and financial stability are cornerstones of its value proposition, offering customers a secure and dependable insurance partner. As a prominent European insurer, Baloise boasts a robust capital base and a history of consistent financial performance, ensuring peace of mind for its policyholders.

This commitment to stability is underscored by its strong credit ratings; for instance, S&P Global Ratings affirmed Baloise's A+ issuer credit rating in 2024, reflecting its solid financial strength and operational resilience. Furthermore, the company consistently maintains healthy solvency ratios, significantly exceeding regulatory requirements, which directly translates into enhanced customer confidence and security.

Personalized Advice and Support

Bâloise Group's value proposition centers on delivering dependable support and fostering trust-based relationships. They offer tailored advice to both individual and business clients, ensuring customers feel confident in their financial choices.

This personalized approach is crucial for navigating the complexities of financial planning. For instance, in 2024, Bâloise continued to emphasize digital tools alongside human advisors to provide this customized experience, aiming to simplify product selection for a diverse client base.

- Tailored Financial Guidance: Customized advice for individual and business clients.

- Trust and Dependability: Building long-term relationships through reliable support.

- Navigating Complexity: Helping clients make informed decisions in intricate financial landscapes.

- Product Suitability: Ensuring customers select the most appropriate financial products for their unique needs.

Innovation and Digital Accessibility

Bâloise Group prioritizes innovation and digital accessibility, consistently investing in cutting-edge platforms and solutions to provide customers with seamless and convenient services. This commitment is evident in their award-winning e-banking platform, which enhances user experience and engagement.

Their strategic focus on digital channels allows for broad reach and customer interaction. For instance, Bâloise's digital marketing campaigns in 2024 have focused on personalized customer journeys, aiming to boost engagement rates by an estimated 15% compared to previous years.

- Digital Investment: Bâloise allocated over CHF 200 million in 2023 towards digital transformation initiatives, with a significant portion directed towards enhancing their e-banking and mobile service offerings.

- Customer Engagement: The group reported a 25% increase in digital customer interactions in the first half of 2024, driven by user-friendly interfaces and targeted digital campaigns.

- Award Recognition: Bâloise's e-banking platform received the 'Best Digital Bank' award in Switzerland for the third consecutive year in 2024, underscoring its leadership in digital financial services.

- Innovation Pipeline: Ongoing development includes AI-powered customer service chatbots and personalized financial planning tools, expected to launch in late 2024.

Bâloise Group offers comprehensive financial security through a wide range of insurance and pension products, simplifying life for its customers. Their integrated Insurbanking model in Switzerland provides a one-stop shop for both insurance and banking needs, a strategy that saw significant customer growth in 2024.

The group's value proposition is built on reliability and financial strength, consistently demonstrating robust capital bases and exceeding solvency requirements. This stability is recognized by strong credit ratings, such as S&P Global Ratings' affirmation of Bâloise's A+ issuer credit rating in 2024.

Bâloise provides tailored financial guidance, fostering trust through personalized advice for both individuals and businesses, aided by digital tools. This approach ensures customers select the most suitable financial products, enhancing their confidence in managing complex financial landscapes.

Innovation and digital accessibility are key, with substantial investments in platforms like their award-winning e-banking service. In 2024, digital customer interactions increased by 25%, highlighting the success of their user-friendly digital strategy and personalized campaigns.

| Value Proposition Area | Key Offering | 2024 Highlight/Data |

|---|---|---|

| Comprehensive Protection | Insurance (Property, Casualty, Life, Health) & Pension Products | Strong contribution to profitability, reflecting customer trust. |

| Integrated Financial Services | Insurbanking Model (Switzerland) | Substantial growth in banking division, attracting new customers. |

| Financial Stability & Trust | Robust Capital Base, Strong Credit Ratings | S&P Global Ratings affirmed A+ issuer credit rating. Healthy solvency ratios exceeding requirements. |

| Personalized Guidance | Tailored Advice & Digital Tools | Emphasis on digital tools alongside human advisors for simplified product selection. |

| Digital Innovation | Award-winning E-banking, User-friendly Platforms | 25% increase in digital customer interactions in H1 2024. |

Customer Relationships

Bâloise Group cultivates deep customer loyalty by leveraging a robust network of agents and financial advisors. These professionals offer tailored guidance, ensuring clients receive advice suited to their unique circumstances, especially for intricate insurance and pension solutions. This personal touch is key to fostering enduring trust and understanding complex financial needs.

Bâloise Group enhances customer engagement through its digital self-service options, complementing traditional personalized service. Their e-banking platform and online portals empower customers to manage policies, access crucial information, and complete various transactions with ease, appealing to those who prefer digital interactions.

In 2024, Bâloise reported a significant portion of its customer interactions occurring through digital channels, reflecting a growing preference for online self-service. This digital focus allows for greater efficiency and accessibility, enabling customers to conduct business on their own terms and at their convenience.

Bâloise Group operates dedicated customer support centers designed to efficiently manage customer inquiries, claims, and service requests. These hubs are crucial for providing prompt assistance, ensuring that customers receive timely resolutions and enhancing their overall experience.

Community Engagement and Trust Building

Baloise actively cultivates community engagement to build enduring trust, moving beyond mere transactional relationships. This commitment is demonstrated through strategic sponsorships and impactful corporate social responsibility (CSR) programs.

In 2024, Baloise continued its focus on societal well-being, exemplified by initiatives like supporting local sports clubs and environmental protection projects. For instance, their partnership with a prominent Swiss cycling event not only boosted brand visibility but also promoted healthy lifestyles within the community.

- Community Sponsorships: Baloise invested significantly in local community events and organizations across its operating regions in 2024, enhancing brand perception and fostering goodwill.

- Corporate Social Responsibility: The group's CSR efforts in 2024 concentrated on sustainability and social impact, with specific projects aimed at reducing carbon footprints and supporting educational programs for underprivileged youth.

- Public Awareness Campaigns: Baloise launched targeted campaigns in 2024 to raise awareness about financial literacy and insurance protection, positioning the company as a responsible and supportive partner for its customers and the wider public.

Proactive Communication and Information Sharing

Bâloise Group actively engages its customers through proactive communication, sharing timely updates on policy changes, evolving market landscapes, and crucial financial insights. This commitment to transparency ensures clients remain well-informed, fostering a stronger, more trusting relationship. For instance, their consistent delivery of financial reports and investor briefings demonstrates this dedication to keeping stakeholders abreast of company performance and strategic direction.

This approach is further exemplified by Bâloise's focus on providing accessible information, empowering customers to make informed decisions. In 2024, the group continued its tradition of detailed annual reports, often highlighting key performance indicators and future outlooks. This proactive sharing of information directly contributes to building loyalty and enhancing customer satisfaction, as customers feel valued and connected to the company's journey.

- Enhanced Customer Engagement: Proactive updates on policies and market trends keep customers informed and connected.

- Strengthened Trust: Regular financial reporting and investor communications build confidence in Bâloise's stability and strategy.

- Informed Decision-Making: Providing relevant financial information empowers customers to manage their investments and insurance effectively.

- Customer Loyalty: Consistent and transparent communication is a key driver in fostering long-term customer relationships.

Bâloise Group's customer relationships are built on a foundation of personalized advice through its agent network and accessible digital self-service options. In 2024, the group continued to balance these approaches, ensuring customers could engage through their preferred channels, whether face-to-face or online.

The company actively fosters community trust through sponsorships and CSR initiatives, reinforcing its role as a responsible corporate citizen. This commitment extends to transparent communication, providing customers with timely updates and financial insights to support informed decision-making and cultivate loyalty.

| Customer Relationship Aspect | 2024 Focus/Data | Impact |

|---|---|---|

| Personalized Advice | Continued strong reliance on agent network for complex needs. | Fosters deep customer understanding and loyalty. |

| Digital Engagement | Growth in self-service portal usage for policy management. | Enhances convenience and efficiency for digital-first customers. |

| Community & CSR | Investment in local sponsorships and sustainability projects. | Builds brand reputation and societal goodwill. |

| Proactive Communication | Regular updates on market trends and financial performance. | Empowers customers and strengthens trust through transparency. |

Channels

Bâloise Group relies on its dedicated direct sales force and a robust network of agents to connect with customers. This approach is particularly effective for intricate insurance and pension solutions that necessitate detailed explanations and personalized guidance. In 2024, Bâloise continued to emphasize this channel for its ability to foster strong customer relationships and provide tailored advice.

Bâloise Group leverages partnerships with independent brokers, a crucial element of its distribution strategy. These broker networks are instrumental in extending Bâloise's reach, allowing access to a broader customer base across its key European markets. In 2024, Bâloise continued to strengthen these relationships, recognizing brokers as vital conduits for its insurance and financial products.

Bâloise Group leverages its website and dedicated e-banking platform as primary digital channels for customer acquisition, ongoing service, and proactive engagement. These online touchpoints provide unparalleled convenience and accessibility, catering to a growing segment of clients who prefer digital interactions for their insurance and financial needs.

The group’s commitment to digital innovation is evident in its e-banking platform, which has garnered recognition for its user-friendly design and comprehensive functionality. In 2024, Bâloise reported a significant increase in digital customer onboarding, with over 60% of new policies initiated through online channels, underscoring the effectiveness of these platforms in driving growth and enhancing customer experience.

Banking Branches (Insurbanking Model)

Baloise's banking branches, operating under its distinctive Insurbanking model, particularly in Switzerland, function as a dual-purpose channel. They facilitate transactions and advisory services for both banking and insurance products, offering clients a unified point of contact for their diverse financial needs.

This integrated strategy allows Baloise to cross-sell effectively, enhancing customer relationships and potentially increasing revenue per client. For instance, a client opening a new bank account might simultaneously be offered tailored insurance solutions, such as home or life insurance, directly within the branch.

- Integrated Sales: Banking branches serve as hubs for both banking and insurance product distribution.

- Customer Convenience: Clients benefit from a single location for managing multiple financial services.

- Cross-Selling Opportunities: The model fosters opportunities to offer complementary banking and insurance products.

Marketing and Advertising Campaigns

Bâloise Group actively engages in diverse marketing and advertising campaigns, with a strong emphasis on innovative digital strategies. These efforts are designed to boost brand recognition and draw in new clientele. For instance, their #GrandTheftInsurance campaign in November 2024, which featured the opening of a virtual branch within a popular video game, showcases their forward-thinking methods for connecting with modern audiences.

This creative approach is crucial in a competitive market. In 2023, Bâloise reported a significant increase in its digital customer base, a trend expected to continue as more consumers engage with brands through online channels. The group's investment in digital marketing allows them to reach a broader demographic and tailor messages effectively.

- Brand Awareness: Campaigns like #GrandTheftInsurance aim to make Bâloise a recognizable name across various demographics.

- Customer Acquisition: Innovative digital outreach is key to attracting and onboarding new customers in the digital age.

- Digital Engagement: Opening virtual branches or participating in online communities demonstrates a commitment to meeting customers where they are.

- Marketing ROI: By leveraging digital platforms, Bâloise can track campaign effectiveness and optimize spending for better returns.

Bâloise Group utilizes its proprietary banking branches, particularly in Switzerland, as a unique Insurbanking channel. This model integrates banking and insurance services, providing a single point of contact for customers. In 2024, this approach facilitated significant cross-selling opportunities, enhancing customer relationships and revenue streams.

| Channel | Description | 2024 Focus | Key Benefit |

| Direct Sales Force & Agents | Personalized advice for complex products. | Strengthening relationships, tailored guidance. | High customer trust, specialized solutions. |

| Independent Brokers | Extending market reach through partnerships. | Deepening broker network engagement. | Broader customer access, diverse product placement. |

| Digital Channels (Website, E-banking) | Convenient self-service and digital engagement. | Driving digital onboarding and user experience. | Accessibility, efficiency, increased digital customer base. |

| Banking Branches (Insurbanking) | Integrated banking and insurance services. | Facilitating cross-selling and unified customer contact. | Customer convenience, enhanced revenue per client. |

| Marketing & Advertising | Brand building and customer acquisition via digital strategies. | Innovative campaigns like #GrandTheftInsurance. | Increased brand awareness, reaching new demographics. |

Customer Segments

Baloise Group serves private individuals and families by offering a comprehensive suite of insurance products. This includes essential coverage like property, casualty, life, and health insurance, alongside vital pension solutions designed to secure their financial future.

The core aim is to simplify and enhance the safety of daily life for these customers. For example, in 2023, Baloise reported a strong performance in its retail insurance business, with gross premiums written reaching CHF 5.1 billion, underscoring its significant market presence and customer trust.

Bâloise Group actively serves Small and Medium-sized Enterprises (SMEs), providing them with crucial insurance and pension solutions designed to safeguard their valuable assets, their dedicated employees, and the smooth running of their daily operations. This segment is particularly important, as SMEs often face unique commercial risks and require robust employee benefits packages to attract and retain talent.

In 2024, the SME sector continued to be a significant driver of economic activity across Europe, with many businesses seeking to bolster their resilience. For instance, Bâloise’s offerings in this segment are tailored to address specific industry needs, from liability coverage for service-based businesses to comprehensive property insurance for manufacturing firms.

Bâloise Group serves larger corporations with intricate insurance and risk management needs. These clients, often multinational, require tailored solutions that go beyond standard offerings, reflecting their complex operational structures and diverse risk profiles.

In 2024, Bâloise continued to focus on providing these bespoke services, recognizing that a one-size-fits-all approach is insufficient for major enterprises. This strategic emphasis allows Bâloise to build strong, long-term partnerships with its corporate clientele, ensuring their unique challenges are effectively addressed.

High-Net-Worth Individuals

High-net-worth individuals (HNWIs) represent a crucial customer segment for Bâloise Group, demanding tailored financial and insurance solutions. This group often seeks advanced wealth management services and specialized life insurance products designed to preserve and grow substantial assets. Bâloise’s integrated offerings in asset management and banking directly address these sophisticated needs.

In 2024, the global HNW population continued to expand, with estimates suggesting a significant increase in their collective wealth. For instance, the Asia-Pacific region alone saw substantial growth in HNW individuals, reflecting a broader trend of wealth accumulation worldwide. Bâloise's strategic focus on this segment allows it to capitalize on this expanding market by providing bespoke financial planning and investment strategies that align with the complex objectives of affluent clients.

- Sophisticated Wealth Management: Offering personalized investment portfolios and financial planning to preserve and grow substantial assets.

- Specialized Insurance Products: Providing tailored life insurance and estate planning solutions that cater to the unique needs of HNWIs.

- Integrated Banking and Asset Management: Leveraging Bâloise's financial services to offer comprehensive solutions for wealth accumulation and management.

- Global Wealth Trends: Capitalizing on the growing global HNW population, with particular attention to regions experiencing rapid wealth creation, to offer relevant financial products and services.

Pension Funds and Collective Foundations

Bâloise Group caters to pension funds and collective foundations by offering robust occupational pension solutions. A key offering is Perspectiva, their semi-autonomous collective foundation, which has seen consistent growth in both participating companies and individuals covered. This segment is fundamentally about securing long-term retirement income and providing essential employee benefits.

In 2023, Bâloise's Swiss insurance business, which includes these pension offerings, reported a strong performance. The life insurance segment, heavily tied to pension products, contributed significantly to the group's overall success, demonstrating the vital role of these customer segments.

- Focus on Long-Term Security: Bâloise designs pension solutions with a commitment to long-term financial security for employees.

- Growth of Perspectiva: The collective foundation, Perspectiva, continues to expand its reach, serving an increasing number of businesses and their employees.

- Employee Benefit Provision: This segment is crucial for companies looking to offer competitive and comprehensive retirement and employee benefit packages.

- Contribution to Group Performance: The success of Bâloise's life insurance business, which encompasses these pension activities, highlights the financial importance of this customer segment to the group.

Bâloise Group's customer segments are diverse, encompassing private individuals and families seeking comprehensive insurance and pension solutions, and Small to Medium-sized Enterprises (SMEs) requiring tailored protection for their assets and employees. The group also serves larger corporations with complex risk management needs and high-net-worth individuals (HNWIs) who require sophisticated wealth management and specialized insurance products. Additionally, Bâloise provides occupational pension solutions to pension funds and collective foundations, ensuring long-term retirement security.

| Customer Segment | Key Offerings | 2023/2024 Relevance |

|---|---|---|

| Private Individuals & Families | Property, casualty, life, health insurance, pension solutions | Gross premiums written reached CHF 5.1 billion in retail insurance (2023). |

| SMEs | Insurance and pension solutions for assets and employees | SMEs are a significant economic driver, seeking resilience; tailored industry-specific coverage is key. |

| Large Corporations | Bespoke insurance and risk management solutions | Focus on tailored services for complex operational structures and diverse risk profiles. |

| High-Net-Worth Individuals (HNWIs) | Wealth management, specialized life insurance, integrated banking | Global HNW population and wealth are expanding; focus on bespoke financial planning. |

| Pension Funds & Collective Foundations | Occupational pension solutions (e.g., Perspectiva) | Growth in participating companies and individuals covered; life insurance segment, tied to pensions, performed strongly in 2023. |

Cost Structure

The most substantial cost for Bâloise Group, like any insurer, is the settlement of claims and the disbursement of benefits to its policyholders. This expenditure is intrinsically linked to the occurrence and magnitude of insured events.

In 2024, Bâloise experienced a notable impact from natural disaster claims, which directly increased these payout costs. For instance, the group reported a significant rise in claims related to severe weather events across Europe, a trend that has become increasingly pronounced in recent years.

Personnel expenses, encompassing salaries, benefits, and ongoing training for Bâloise Group's roughly 8,000 employees, represent a significant component of their operational expenditure. In 2023, the group reported personnel costs of approximately CHF 1.2 billion, highlighting the critical need for effective workforce management to maintain cost control and optimize resource allocation.

Bâloise Group's sales and marketing expenses are substantial, reflecting the significant investment in reaching and acquiring customers. These costs encompass a wide array of activities, from broad advertising campaigns and digital marketing initiatives to the essential commissions paid to agents and brokers who are crucial to their distribution network.

In 2024, Bâloise continued its focus on innovative marketing strategies, which naturally contribute to these operational costs. The group's commitment to engaging customers through various channels, including digital platforms and personalized outreach, necessitates a robust budget for these sales-related expenditures, ensuring their brand presence and customer acquisition remain competitive.

IT and Technology Infrastructure Costs

Baloise Group's commitment to digitalization necessitates significant ongoing investment in its IT and technology infrastructure. This includes the development, implementation, and continuous maintenance of sophisticated IT systems, robust digital platforms, and comprehensive data management solutions. For instance, in 2023, Baloise reported total IT expenses of CHF 413.2 million, underscoring the substantial financial commitment to these areas.

These expenditures are critical for maintaining operational efficiency, enhancing customer experience through digital channels, and ensuring the security of sensitive data. The group's strategic focus on digital transformation means these costs are not static but represent a dynamic and evolving component of their operational framework. The cybersecurity measures alone are a substantial part of this, protecting against an ever-increasing threat landscape.

- Investment in IT Systems: Ongoing capital expenditure for hardware, software, and system upgrades.

- Digital Platform Development: Costs associated with building and enhancing customer-facing digital interfaces and internal digital tools.

- Cybersecurity Measures: Expenses for security software, threat detection, data protection, and compliance.

- Data Management Infrastructure: Investment in data storage, processing, analytics tools, and associated personnel.

Administrative and Operational Overheads

Bâloise Group's cost structure heavily relies on administrative and operational overheads. These include essential expenses like office rentals, utilities, and the significant costs associated with maintaining regulatory compliance within the financial services sector. In 2024, Bâloise has been actively pursuing strategies to enhance operational efficiency, aiming to improve its cost/income ratio, a key performance indicator for the company.

The group's commitment to boosting efficiency is reflected in its ongoing efforts to streamline processes and leverage technology. This focus is critical for managing the inherent costs of running a large insurance and financial services operation.

- General Administrative Costs: Encompasses expenses such as office space, utilities, and salaries for non-revenue generating staff.

- Regulatory Compliance: Significant investment is allocated to meeting stringent financial regulations, a substantial overhead in the insurance industry.

- Operational Expenses: Includes IT infrastructure, cybersecurity, and other day-to-day operational necessities.

- Efficiency Initiatives: Bâloise is targeting improvements in its cost/income ratio through various efficiency programs.

Bâloise Group's cost structure is dominated by claim settlements, which directly reflect insured events and, in 2024, were impacted by increased natural disaster claims across Europe. Personnel costs, around CHF 1.2 billion in 2023 for its approximately 8,000 employees, are another major expense. Significant investments are also made in sales and marketing to acquire customers, as well as in IT and technology infrastructure, with total IT expenses reaching CHF 413.2 million in 2023, including crucial cybersecurity measures.

| Cost Category | 2023 Data (Approximate) | 2024 Trend/Focus |

|---|---|---|

| Claims Settlement | Varies with insured events | Increased due to natural disasters |

| Personnel Expenses | CHF 1.2 billion | Ongoing workforce management focus |

| Sales & Marketing | Substantial investment | Continued focus on digital and traditional channels |

| IT & Technology | CHF 413.2 million (Total IT) | Ongoing investment in digitalization and cybersecurity |

| Administrative & Operational Overheads | Includes compliance, office costs | Focus on improving cost/income ratio through efficiency |

Revenue Streams

Baloise generates significant revenue from non-life insurance premiums, covering a broad range of products like property, casualty, motor vehicle, accident, and health. This diversification allows them to tap into various consumer and business needs.

In 2024, Baloise's non-life business demonstrated robust growth, with gross premiums written reaching CHF 4.2 billion in the first nine months, a notable increase of 4.2% compared to the same period in 2023. This upward trend highlights the company's successful strategy in expanding its market share and product offerings within this segment.

Bâloise Group’s life insurance segment generates revenue primarily through premiums collected for various life insurance and pension solutions. This includes both traditional life insurance policies and unit-linked products, where policyholder premiums are invested in market-linked funds.

In 2024, Bâloise observed a trend where income from traditional life premiums experienced a slight decrease. However, the company is strategically focusing on investment-linked products, which demonstrate significant growth potential and are expected to contribute more substantially to future revenue streams.

Bâloise Group generates substantial revenue through investment income, which comprises earnings from the strategic investment of premiums and capital reserves. These investments are diversified across a range of financial instruments, including bonds, equities, and real estate, aiming for stable and growing returns.

The group's dedicated asset management arm plays a crucial role in optimizing this revenue stream. For instance, Bâloise Asset Management managed a significant CHF 64.9 billion in assets as of December 31, 2023, underscoring the scale of their investment activities and their contribution to overall profitability.

Banking Service Fees and Interest Income

Bâloise Group generates significant revenue through its banking services, a core component of its Insurbanking strategy. This includes fees for various banking operations and the interest earned on its loan and deposit portfolios. In 2024, Baloise Bank demonstrated strong performance, achieving sales exceeding CHF 1 billion.

Key revenue streams within this segment include:

- Service Fees: Income derived from account maintenance, transaction processing, payment services, and other banking conveniences.

- Interest Income: Revenue earned from lending activities, such as mortgages and consumer loans, as well as interest on customer deposits.

- Insurbanking Synergy: Leveraging its insurance customer base to offer integrated banking solutions, creating additional revenue opportunities and customer loyalty.

Asset Management Fees

Bâloise Group generates revenue through asset management fees, primarily from its Baloise Asset Management division. These fees are charged for managing investment portfolios on behalf of third-party clients, including institutional investors and retail customers.

The company saw a positive trend in its asset management business, with assets under management for third parties experiencing an increase in 2024. This growth indicates a strengthening of client trust and a successful expansion of its asset management services.

- Asset Management Fees: Income derived from managing client assets.

- Baloise Asset Management: The specific division responsible for these services.

- Third-Party Clients: Revenue generated from external investors, not Bâloise's own balance sheet.

- 2024 Growth: Demonstrated an increase in assets under management for third parties during the year.

Bâloise Group's revenue streams are diversified across insurance, banking, and asset management. The non-life insurance segment is a significant contributor, with gross premiums written reaching CHF 4.2 billion in the first nine months of 2024, a 4.2% increase year-on-year. The life insurance segment, while seeing a slight decrease in traditional premiums, is focusing on growth in investment-linked products.

Investment income, generated from managing premiums and capital reserves across various financial instruments, is another key revenue driver. Bâloise Asset Management, managing CHF 64.9 billion in assets as of year-end 2023, further bolsters this stream through fees charged for managing external client portfolios, which saw growth in 2024.

The Insurbanking strategy contributes through Baloise Bank, which achieved sales exceeding CHF 1 billion in 2024. This segment generates revenue from service fees on banking operations and interest income from loans and deposits, leveraging the insurance customer base.

| Revenue Stream | Key Activities | 2024 Performance Highlights |

|---|---|---|

| Non-Life Insurance | Premiums for property, casualty, motor, accident, health | Gross premiums written: CHF 4.2 billion (Jan-Sep 2024), +4.2% YoY |

| Life Insurance | Premiums for life policies, pension solutions, unit-linked products | Focus on growing investment-linked products; slight decrease in traditional premiums |

| Investment Income | Earnings from bonds, equities, real estate, etc. | Managed CHF 64.9 billion in assets (Dec 31, 2023) |

| Asset Management Fees | Fees for managing third-party investment portfolios | Assets under management for third parties increased in 2024 |

| Banking Services (Insurbanking) | Service fees, interest income on loans/deposits | Sales exceeded CHF 1 billion (2024) |

Business Model Canvas Data Sources

The Bâloise Group Business Model Canvas is built upon a foundation of comprehensive financial reports, extensive market research, and internal strategic planning documents. These diverse data sources ensure each component of the canvas accurately reflects the company's current operations and future ambitions.