Bâloise Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bâloise Group Bundle

Understanding the Bâloise Group's competitive landscape requires a deep dive into Porter's Five Forces. This analysis reveals critical insights into buyer power, supplier leverage, the threat of new entrants, and the intensity of rivalry within the insurance sector.

The complete report reveals the real forces shaping Bâloise Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bâloise's reliance on reinsurers to manage risk exposes it to the bargaining power of these specialized providers. The reinsurance market, while essential for risk diversification, is relatively concentrated, allowing major reinsurers to potentially influence pricing and contract terms. However, the sector's stability is expected to continue through 2024 and 2025, bolstered by healthy profits and strong capital reserves, which should temper excessive demands from reinsurers.

The insurance sector's rapid digital evolution, embracing insurtech, AI, and sophisticated data analytics, significantly elevates the bargaining power of technology and software vendors. Companies like Bâloise Group are increasingly dependent on these specialized providers for critical functions.

Providers offering advanced AI solutions for claims automation, risk assessment, and personalized customer engagement can leverage this dependency to command premium pricing. For instance, the global AI in insurance market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially, indicating strong demand for these specialized capabilities.

Data and analytics providers wield considerable bargaining power in the insurance industry, as access to vast, accurate, and real-time data is fundamental for effective risk assessment, dynamic pricing, and crafting personalized insurance products. In 2024, the demand for specialized datasets, like telematics data for usage-based auto insurance or sophisticated climate risk analytics, continues to surge. Insurers like Bâloise Group rely heavily on these providers, making unique or difficult-to-replicate data sources a significant leverage point for suppliers.

Investment Management Services

For Bâloise Group's investment management services, the bargaining power of suppliers is generally moderate. While Bâloise Asset Management manages a significant CHF 59.5 billion in assets as of December 31, 2024, external asset managers or financial institutions offering specialized investment products or platforms can exert some influence, especially for niche or high-performing vehicles.

This power stems from the potential for Bâloise to integrate these specialized offerings into its own product suite, thereby enhancing its market appeal. However, Bâloise's scale and internal capabilities in asset management also provide a degree of counter-bargaining power.

- Supplier Influence: External asset managers providing specialized investment products or platforms can exert moderate bargaining power over Bâloise's investment management services.

- Bâloise's Scale: Bâloise Asset Management's substantial CHF 59.5 billion in assets under management as of December 31, 2024, provides a degree of leverage against suppliers.

- Strategic Integration: The ability for Bâloise to integrate external specialized products can enhance its own market position, influencing supplier negotiations.

Human Capital/Specialized Talent

The bargaining power of suppliers, particularly concerning human capital, is significant for Bâloise Group. The demand for specialized talent in areas such as actuarial science, risk management, data science, and AI within the insurance industry remains robust. This high demand creates a competitive landscape for acquiring and retaining skilled professionals.

In key markets for Bâloise, including Switzerland, Germany, Belgium, and Luxembourg, the scarcity of these specialized skills allows talent to negotiate for higher salaries and more comprehensive benefits. For instance, in 2024, the average salary for a data scientist in Switzerland could range between CHF 100,000 and CHF 130,000 annually, depending on experience and specific skills. This directly impacts Bâloise's operational costs, as competitive compensation packages are necessary to attract and keep essential personnel.

- High demand for actuarial, risk, data science, and AI professionals in insurance.

- Specialized talent can command higher salaries and benefits in competitive European markets.

- Increased operational costs for insurers like Bâloise Group due to talent acquisition and retention needs.

Bâloise's reliance on reinsurers, while crucial for risk management, means these specialized providers hold some sway. The reinsurance market, though stable through 2024 and 2025 with healthy capital, is somewhat concentrated, allowing major players to influence terms.

The increasing integration of insurtech and AI amplifies the bargaining power of technology and software vendors. Providers of advanced AI for claims automation or risk assessment can command higher prices, as evidenced by the global AI in insurance market, valued at roughly $1.5 billion in 2023 and poised for significant growth.

Data and analytics providers are also powerful, given the insurance industry's need for accurate data for risk assessment and personalized products. The demand for specialized datasets, like telematics data, surged in 2024, giving unique data source providers leverage.

| Supplier Type | Bargaining Power Factors | Bâloise's Counter-Leverage | Data Point/Example |

|---|---|---|---|

| Reinsurers | Market concentration, essential risk management services | Sector stability, Bâloise's own risk diversification strategies | Reinsurance market expected to remain stable through 2024-2025. |

| Technology & AI Vendors | Dependency on specialized solutions (AI, data analytics) | Bâloise's adoption of in-house capabilities, vendor diversification | Global AI in insurance market ~$1.5 billion (2023), growing. |

| Data & Analytics Providers | Uniqueness and accessibility of specialized data (e.g., telematics) | Bâloise's data management infrastructure, internal analytics teams | Surging demand for telematics and climate risk data in 2024. |

| Human Capital (Specialized Talent) | Scarcity of actuarial, data science, AI professionals | Competitive compensation, strong employer branding, training programs | Data scientist salaries in Switzerland CHF 100k-130k (2024). |

What is included in the product

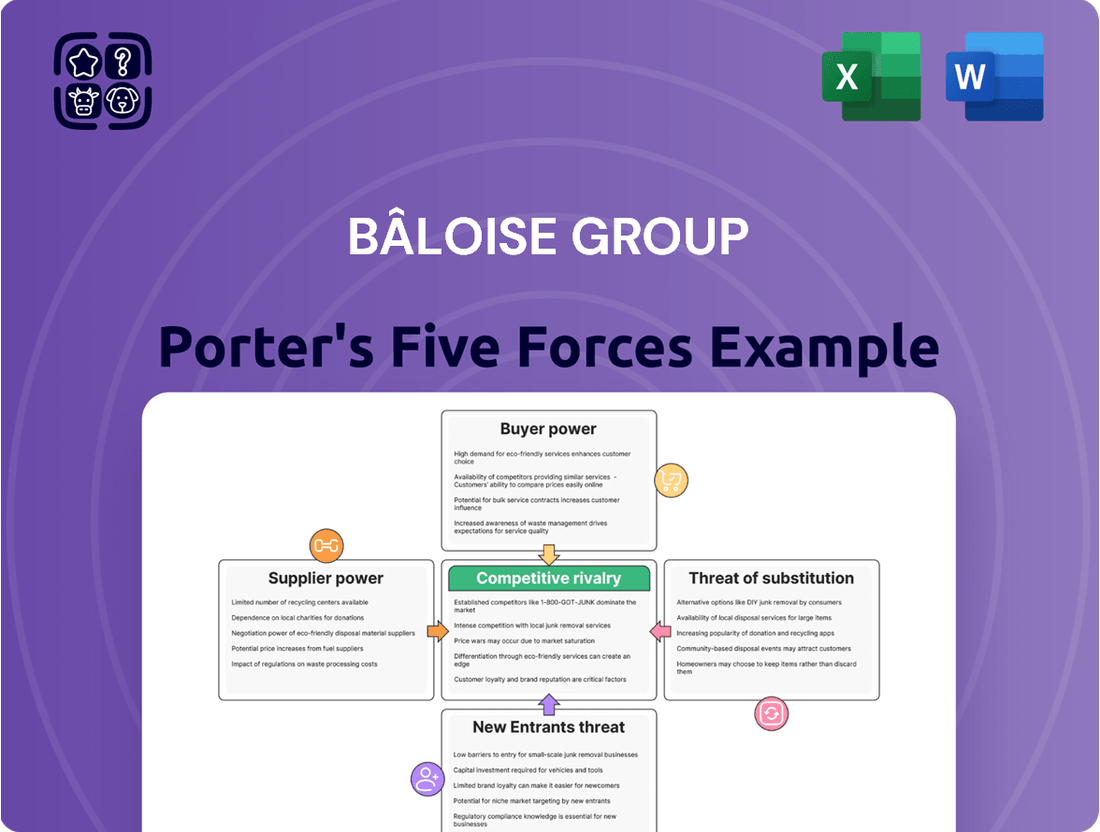

This analysis evaluates the competitive landscape for Bâloise Group by examining the intensity of rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitutes.

Instantly identify competitive pressures and strategic vulnerabilities with a clear, actionable overview of Bâloise Group's Porter's Five Forces.

Easily adapt the analysis to changing market dynamics, allowing for proactive adjustments to Bâloise Group's competitive strategy.

Customers Bargaining Power

Customers, both individuals and businesses, are increasingly using online comparison tools to easily evaluate insurance offerings and pricing from different companies. This growing transparency often heightens price sensitivity, giving customers more leverage, especially when dealing with straightforward insurance policies.

Modern customers, accustomed to seamless digital experiences, increasingly demand personalized products and efficient service. This shift, fueled by insurtech innovations, empowers consumers to seek tailored insurance solutions with readily available digital access.

For instance, by the end of 2024, a significant portion of Bâloise Group’s customer interactions are anticipated to occur through digital channels, reflecting this growing expectation for online engagement and self-service options.

This heightened customer power necessitates substantial investment in digital transformation for traditional insurers like Bâloise, pushing them to adapt to a landscape where personalized, on-demand services are becoming the norm.

For Bâloise Group, customer bargaining power is influenced by switching costs. In 2024, basic insurance products like property and motor insurance often present low switching costs. This means customers can readily compare and move to providers offering more attractive premiums or enhanced services, a trend observed across the European insurance market.

Conversely, more intricate financial solutions, such as Bâloise’s life insurance or pension products, can involve higher switching costs. These are often tied to long-term contractual commitments, surrender charges, or the financial implications of moving accumulated funds, thereby somewhat mitigating customer power in these segments.

Segment-Specific Power

The bargaining power of customers within Bâloise Group's operations is not uniform; it shifts considerably depending on the specific market segment. For instance, large institutional clients procuring substantial group pension plans wield significant leverage due to the sheer volume of their business, enabling them to negotiate more favorable terms.

Conversely, individual retail customers, while possessing less individual clout, can collectively exert considerable influence. Their aggregated purchasing power and shared preferences can shape market trends and product development. For example, by 2024, the increasing demand for flexible and digitalized insurance solutions from retail customers has pushed insurers like Bâloise to adapt their offerings.

- Segmented Leverage: Institutional clients often have greater bargaining power than individual retail customers due to the scale of their transactions.

- Collective Influence: Retail customers, acting in concert, can significantly impact market demands and product innovation.

- 2024 Trend: A notable trend in 2024 has been the growing customer expectation for digital-first, adaptable insurance and financial products, compelling companies like Bâloise to respond.

Regulatory Protection

Regulatory protection significantly influences the bargaining power of customers within Bâloise Group's core markets. In Switzerland, for instance, the Financial Market Supervisory Authority (FINMA) enforces stringent rules on insurance providers, ensuring fair treatment and transparent product information. This oversight directly empowers policyholders, giving them confidence and leverage when engaging with insurers.

Similarly, Germany's Federal Financial Supervisory Authority (BaFin) maintains a robust consumer protection regime for the insurance sector. These regulations often mandate clear policy terms, prohibit unfair contract clauses, and provide accessible complaint mechanisms. Such protections can reduce information asymmetry and enhance customers' ability to negotiate favorable terms or switch providers if dissatisfied.

In Belgium and Luxembourg, national regulatory bodies also play a crucial role in safeguarding insurance consumers. These frameworks typically include requirements for solvency, product disclosure, and conduct of business, all of which contribute to a more balanced relationship between insurers and their clients. The collective effect of these regulations across Bâloise's operating regions strengthens the bargaining power of its customer base.

- Consumer Protection Laws: Regulations in Switzerland, Germany, Belgium, and Luxembourg mandate fair practices and transparency in insurance sales and claims handling.

- Dispute Resolution Mechanisms: Established channels for customer complaints and arbitration provide avenues for recourse, increasing customer leverage.

- Product Standardization and Disclosure: Regulatory requirements for clear policy information reduce information asymmetry, enabling customers to compare offerings more effectively.

- Market Conduct Oversight: Supervisory authorities monitor insurer behavior, ensuring adherence to consumer rights and preventing unfair treatment.

The bargaining power of customers for Bâloise Group is amplified by the increasing availability and sophistication of digital comparison tools, especially for simpler insurance products. By 2024, this trend, coupled with a demand for personalized digital experiences, has significantly empowered consumers, making price sensitivity a key factor.

Switching costs play a crucial role; while basic insurance products in 2024 offer low barriers to switching, complex financial products like life insurance or pensions present higher costs, somewhat moderating customer leverage in those segments.

Institutional clients and aggregated retail customer demand both contribute to customer bargaining power, influencing Bâloise's strategy towards more adaptable and digital-first offerings, a trend strongly evident in 2024.

Regulatory frameworks across Bâloise's operating regions, such as those enforced by FINMA in Switzerland and BaFin in Germany, enhance customer bargaining power through mandates for fair treatment, transparency, and accessible dispute resolution mechanisms.

| Factor | Impact on Bâloise | 2024 Relevance |

|---|---|---|

| Digital Comparison Tools | Increased price sensitivity, higher leverage for customers | Widespread adoption, driving demand for transparent pricing |

| Personalization Demand | Need for tailored products and digital service delivery | Key driver for insurtech integration and customer retention efforts |

| Switching Costs (Basic Products) | Low, facilitating easy customer movement | Intensified competition in motor and property insurance segments |

| Switching Costs (Complex Products) | High, mitigating customer power | Bâloise’s advantage in long-term financial solutions |

| Regulatory Protection | Enhanced customer rights and fair treatment | Ensures a more balanced negotiation environment for policyholders |

What You See Is What You Get

Bâloise Group Porter's Five Forces Analysis

This preview showcases the Bâloise Group's Porter's Five Forces Analysis, detailing the competitive landscape within the insurance sector. You're viewing the exact, professionally formatted document you'll receive instantly upon purchase, offering a comprehensive breakdown of industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes. This is the complete, ready-to-use analysis file, ensuring you get precisely what you need without any surprises.

Rivalry Among Competitors

The European insurance landscape is characterized by significant fragmentation, meaning many companies compete for customers. This intense rivalry, especially in key markets like Germany where Bâloise operates, can drive down prices and squeeze profit margins.

In 2023, the European insurance market saw continued competition, with premium growth varying across segments. For instance, non-life insurance premiums in the EU grew by an estimated 3.5% in 2023, according to preliminary data, reflecting a dynamic but competitive environment where players like Bâloise must constantly innovate to stand out.

Bâloise Group faces intense competition from major international insurers such as Allianz and AXA. These giants command substantial market share, boast strong brand loyalty, and operate extensive distribution channels throughout Europe, making it challenging for Bâloise to gain significant market penetration.

The financial muscle of these established players is a key factor. For instance, in 2024, Allianz reported a net profit of €7.7 billion, demonstrating its capacity for aggressive investment in innovation, marketing campaigns, and strategic acquisitions, which directly impacts the competitive landscape for Bâloise.

Competitive rivalry within Bâloise Group's operating regions is shaped by distinct local market dynamics. In 2024, the Swiss market demonstrated robust performance, with non-life premiums showing pleasing growth, suggesting a relatively stable competitive environment there.

Conversely, the German motor insurance sector presents a different picture. Following several years of significant losses, this market is anticipated to return to profitability by 2025. This projected turnaround implies that competitive pressures may have been intense, forcing insurers to adapt strategies to regain financial health.

Digitalization and Insurtech Adoption

The insurance sector is experiencing heightened competitive rivalry due to the rapid embrace of digitalization and insurtech. Insurers are in a race to deploy innovative digital services, offer tailored customer experiences, and streamline operations. This digital transformation means that companies not keeping pace risk ceding ground to nimble, technology-focused rivals.

For instance, in 2024, the global insurtech market was projected to reach approximately $10.4 billion, signaling a significant investment and focus on digital innovation within the industry. This surge in insurtech adoption directly fuels competitive pressures.

- Digitalization Drives Innovation: Insurtech startups and established players alike are launching new digital platforms and services, from AI-powered claims processing to personalized policy offerings.

- Customer Experience is Key: Companies that provide seamless, user-friendly digital interactions are gaining a competitive edge, forcing others to invest heavily in their digital customer journeys.

- Efficiency Gains: Automation and digital tools allow for more efficient underwriting, claims handling, and customer service, creating cost advantages for early adopters.

- Market Share Shifts: A failure to adapt to these digital trends can lead to a tangible loss of market share as customers gravitate towards more digitally advanced providers.

Product Diversification and Specialization

The insurance landscape is intensely competitive, with companies vying not just on price but also on the breadth and depth of their offerings. Bâloise Group leverages its extensive portfolio, encompassing insurance, pension, investment, and banking services, to engage customers across various financial needs. This broad approach allows Bâloise to capture a larger share of the customer wallet.

However, this diversification strategy also means facing rivals who excel in specific, often highly profitable, market segments. These specialized players can offer tailored products and expertise that challenge Bâloise in those particular niches. For instance, a fintech startup focusing solely on parametric insurance for a specific industry might offer more innovative solutions than a diversified giant.

- Bâloise's diversified offerings span insurance, pensions, investments, and banking, enabling cross-selling opportunities.

- Specialized competitors can gain an edge by focusing on niche markets and offering highly tailored products.

- In 2023, the European insurance market saw continued innovation in specialized product development, particularly in cyber insurance and sustainable investments.

- The intensity of rivalry is amplified in segments where specialized insurers have developed deep expertise and proprietary technologies.

Competitive rivalry is a defining characteristic of the European insurance market where Bâloise Group operates. This intensity is fueled by a fragmented market, the presence of large global players with substantial financial resources, and the rapid adoption of digital technologies by insurtechs and established firms alike. Bâloise must navigate this dynamic landscape by differentiating its offerings and adapting to evolving customer expectations.

In 2024, major competitors like Allianz reported significant profits, enabling them to invest heavily in innovation and marketing, directly intensifying the competitive pressure on Bâloise. Furthermore, the global insurtech market, projected to reach approximately $10.4 billion in 2024, highlights the ongoing digital race, where companies failing to innovate risk losing market share to more agile, tech-savvy rivals.

| Competitor | 2024 Net Profit (approx.) | Key Competitive Factor |

|---|---|---|

| Allianz | €7.7 billion | Financial strength, brand loyalty, extensive distribution |

| AXA | Not directly comparable for 2024, but significant market presence | Global reach, diversified product portfolio |

| Insurtech Startups | Varies significantly | Digital innovation, customer experience, niche specialization |

SSubstitutes Threaten

Large corporations increasingly explore self-insurance and risk retention, especially for predictable, high-frequency risks. This directly challenges traditional insurers by offering a cost-effective alternative. For instance, many large companies now manage their own deductibles or create captive insurance subsidiaries to underwrite their risks, bypassing external providers for certain exposures.

Government social security programs, especially in mature European markets where Bâloise operates, can significantly impact demand for private insurance. For instance, in Germany, the statutory pension insurance (Deutsche Rentenversicherung) provides a baseline retirement income, potentially reducing the need for supplementary private pension plans. Similarly, comprehensive public healthcare systems in Switzerland and Belgium can substitute for basic private health insurance coverage, especially for essential medical services.

Alternative risk transfer (ART) mechanisms, such as catastrophe bonds and captive insurance, present a significant threat by offering ways to manage risks outside of traditional insurance policies. For instance, the global market for insurance-linked securities (ILS), which includes catastrophe bonds, saw a robust issuance volume in 2023, reaching approximately $15 billion, demonstrating a growing appetite for these capital markets-based solutions to transfer risk.

These financial instruments, particularly for large or complex exposures, can bypass conventional insurers and reinsurers. Companies can directly access capital markets to fund potential losses, thereby creating a substitute for the risk pooling and transfer services offered by Bâloise Group. This disintermediation is particularly relevant for managing catastrophic events where traditional capacity might be strained or prohibitively expensive.

Preventative Technologies and Risk Mitigation

The increasing adoption of preventative technologies poses a significant threat of substitutes for traditional insurance products. For instance, smart home sensors that detect water leaks or fire hazards can directly mitigate the likelihood of claims, potentially reducing the demand for home insurance. In 2024, the smart home market saw continued growth, with an estimated 40% of households in developed countries expected to have at least one smart home device.

Telematics, integrated into vehicles, encourages safer driving habits by monitoring speed, braking, and mileage. This shift towards risk-reducing behavior, incentivized by potential premium discounts, can erode the need for comprehensive auto insurance coverage. Usage-based insurance (UBI) models, powered by telematics, are gaining traction, with projections indicating that UBI policies could account for over 25% of new auto insurance policies by 2028.

- Smart Home Adoption: Growing penetration of devices like leak detectors and smoke alarms reduces insurable events.

- Telematics in Vehicles: Driving behavior monitoring and potential discounts incentivize safer driving, lessening reliance on traditional auto coverage.

- Shift to Usage-Based Insurance: Preventative technologies enable new insurance models that align premiums with actual risk, challenging fixed-premium policies.

Financial Products as Alternatives to Life Insurance

The threat of substitutes for Bâloise Group's life insurance and pension solutions is significant. Direct investment products, savings accounts, and other financial instruments from banks or asset managers can serve as viable alternatives. These substitutes often appeal to customers seeking competitive returns or greater flexibility, potentially bypassing the perceived complexity of traditional insurance products.

In 2024, the appeal of flexible investment products is likely to grow. For instance, the global wealth management market, which includes many of these alternative financial products, was projected to reach over $124 trillion by the end of 2024. This substantial market size indicates a strong availability and customer preference for non-insurance-based financial planning tools.

- Direct Investment Products: Funds, stocks, and bonds offer potential for higher returns without the insurance component.

- Savings Accounts and Fixed Deposits: These provide safety and liquidity, appealing to risk-averse customers.

- Other Financial Instruments: Annuities offered by competitors or wealth management services can also act as substitutes.

- Customer Preference for Simplicity and Returns: A growing segment of the market prioritizes straightforward financial growth over bundled insurance benefits.

The threat of substitutes for Bâloise Group's offerings is multifaceted, encompassing both risk management alternatives and financial planning tools. Preventative technologies in homes and vehicles, alongside government social programs, directly reduce the need for traditional insurance. Furthermore, capital markets and alternative investment products provide customers with options that bypass conventional insurance channels.

The increasing prevalence of smart home devices and telematics in vehicles directly mitigates insurable risks, thereby acting as substitutes for property and casualty insurance. For example, by 2024, it's estimated that 40% of households in developed nations will have at least one smart home device, capable of preventing claims. Similarly, usage-based insurance models, leveraging telematics, are projected to represent over 25% of new auto policies by 2028, incentivizing safer driving and reducing reliance on comprehensive coverage.

In the life and pension segments, direct investment products and savings vehicles pose a significant threat. The global wealth management market, encompassing these alternatives, was projected to exceed $124 trillion by the end of 2024, highlighting a strong customer preference for flexible, return-focused financial planning outside of traditional insurance wrappers.

| Substitute Category | Examples | Impact on Bâloise | Market Trend/Data (2024) |

|---|---|---|---|

| Risk Mitigation Technologies | Smart home sensors, vehicle telematics | Reduces demand for property & casualty insurance | 40% of developed households expected to have smart home devices. UBI policies to reach >25% of new auto policies by 2028. |

| Government Programs | Social security, public healthcare | Decreases need for private pensions & basic health insurance | Significant baseline coverage in mature European markets. |

| Alternative Risk Transfer | Catastrophe bonds, captive insurance | Bypasses traditional insurance for large risks | ILS issuance reached ~$15 billion in 2023. |

| Direct Financial Products | Stocks, bonds, savings accounts, wealth management | Challenges life insurance & pension sales | Global wealth management market >$124 trillion by end of 2024. |

Entrants Threaten

The insurance sector, including Bâloise Group's operating markets like Switzerland, Germany, Belgium, and Luxembourg, faces substantial regulatory hurdles. These include stringent capital reserve requirements, often in the hundreds of millions of Swiss Francs or equivalent, and the need to secure specific licenses, making entry highly capital-intensive and time-consuming.

Compliance with evolving legal frameworks and solvency regulations, such as Solvency II in Europe, adds another layer of complexity and cost for potential new entrants. For instance, in 2024, the Swiss Financial Market Supervisory Authority (FINMA) continued to enforce robust capital adequacy ratios, demanding significant financial muscle from all insurers, thereby deterring smaller or less capitalized players.

The insurance sector, inherently built on trust, presents a formidable barrier for new entrants aiming to challenge established players like Bâloise Group. Bâloise's decades of operation have cultivated strong brand recognition and deep customer loyalty, making it difficult for newcomers to gain traction.

Building a comparable level of trust and reputation requires substantial time and financial investment, a challenge exacerbated by the intangible nature of insurance services. For instance, in 2023, Bâloise reported a gross premium volume of CHF 10.3 billion, underscoring the scale of established market presence that new entrants must contend with.

Building extensive and efficient distribution networks, whether through agents, brokers, or direct channels, is absolutely key to reaching a wide customer base in the insurance sector. For a new player to even begin to compete, they’d need to invest heavily and dedicate significant time to replicate the established scale and reach that incumbents like Bâloise Group already possess across multiple European markets.

Insurtech Startups and Niche Players

Insurtech startups are a significant threat to established players like Bâloise Group. These agile companies utilize advanced technology to create more efficient and user-friendly insurance products. For instance, in 2023, the insurtech sector saw substantial investment, with global funding reaching over $10 billion, indicating a strong drive for innovation and market penetration.

These new entrants often focus on specific segments of the insurance market, offering specialized solutions that can be more appealing to certain customer groups. Their ability to quickly adapt and deploy new technologies allows them to challenge traditional business models. By 2024, many insurtechs are expected to further refine their offerings, potentially capturing market share from incumbents through superior digital experiences and competitive pricing.

- Insurtech investment in 2023: Over $10 billion globally.

- Key differentiators: Technology-driven innovation, streamlined processes, customer-centricity.

- Market impact: Potential to disrupt traditional insurance models through niche targeting and agility.

Data Access and Analytics Capabilities

New entrants face a significant hurdle in replicating the extensive historical data and sophisticated analytical capabilities that incumbents like Bâloise Group have cultivated. This data is crucial for accurate risk assessment and competitive pricing in the insurance market. For instance, in 2024, the insurance industry's reliance on big data analytics for underwriting and fraud detection continues to grow, making it difficult for newcomers to match the precision of established players.

While publicly available data exists, the proprietary customer information and advanced modeling techniques employed by established insurers offer a distinct advantage. This allows them to develop more tailored products and manage risk more effectively. The barrier to entry is amplified by the substantial investment required to build comparable data infrastructure and analytical expertise.

- Data Advantage: Established insurers possess vast proprietary datasets, offering superior insights into customer behavior and risk profiles.

- Analytical Sophistication: Incumbents leverage advanced analytics and AI models, developed over years, which are difficult and costly for new entrants to replicate.

- Investment Barrier: Building a comparable data infrastructure and analytical team requires significant capital, deterring many potential new entrants.

- Market Trust: Existing customer relationships and a proven track record, built on data-driven decisions, foster trust that new entrants must work hard to earn.

The threat of new entrants for Bâloise Group is moderate, primarily due to high capital requirements and extensive regulatory compliance, such as stringent solvency ratios enforced by bodies like FINMA in 2024. Building brand trust and customer loyalty, which Bâloise has cultivated over decades, presents a significant challenge for newcomers, as evidenced by Bâloise's 2023 gross premium volume of CHF 10.3 billion.

Insurtech startups, however, pose a growing threat, fueled by over $10 billion in global investment in 2023 and their ability to leverage technology for innovative, customer-centric products. These agile firms can disrupt traditional models by targeting specific market segments with tailored solutions, a trend expected to accelerate through 2024.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Regulatory Hurdles | Stringent capital reserves and licensing, e.g., FINMA's 2024 solvency enforcement. | High capital intensity and time-consuming entry. |

| Brand Reputation & Trust | Decades of operation building customer loyalty. | Difficult for newcomers to gain traction and trust. |

| Distribution Networks | Established, efficient channels require significant investment to replicate. | Challenges in reaching a broad customer base. |

| Insurtech Innovation | Technological advancements and agility of new players. | Potential to capture market share through niche offerings and digital experiences. |

| Data & Analytics | Proprietary data and sophisticated modeling capabilities. | Disadvantage for new entrants in risk assessment and pricing. |

Porter's Five Forces Analysis Data Sources

Our Bâloise Group Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Bâloise's annual reports, investor presentations, and regulatory filings. We supplement this with industry-specific market research reports and analyses from reputable financial news outlets.