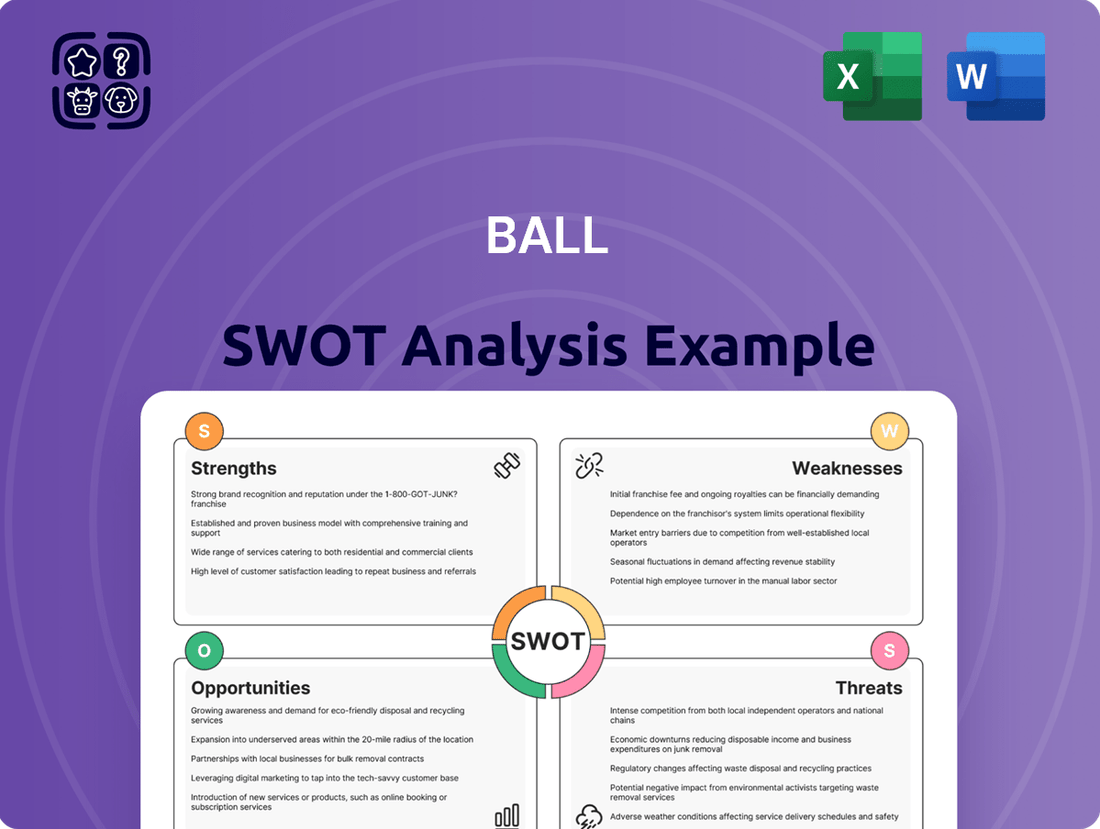

Ball SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ball Bundle

This glimpse into the Ball SWOT analysis reveals key competitive advantages and potential market challenges. Understanding these elements is crucial for navigating the industry landscape effectively.

Want the full story behind Ball's strategic positioning and future opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your business planning and investment decisions.

Strengths

Ball Corporation stands as a global frontrunner in aluminum packaging, a sector increasingly favored for its sustainability. Their extensive product offerings cater to beverages, personal care, and household goods, solidifying their market dominance.

This leadership is significantly bolstered by aluminum's inherent recyclability, a key driver as consumer and regulatory pressure for eco-friendly options intensifies. Ball's commitment to environmental stewardship directly addresses this growing market demand.

In 2023, Ball Corporation reported that approximately 70% of its sales were from aluminum packaging, highlighting the segment's importance. The company actively promotes the circular economy, with aluminum cans boasting a recycling rate of around 70% globally, far exceeding other packaging materials.

Ball Corporation has shown impressive financial strength, with comparable diluted earnings per share seeing consistent growth. This performance translates directly into significant value returned to shareholders via share repurchases and dividends, demonstrating a commitment to rewarding investors.

The strategic divestiture of its aerospace business in early 2024 was a pivotal move, generating substantial proceeds that were used to significantly reduce debt. This deleveraging not only strengthens the balance sheet but also sharpens the company's focus on its core aluminum packaging operations, thereby enhancing overall financial flexibility and operational efficiency.

Ball Corporation's dedication to sustainability is a significant strength, underscored by ambitious targets like achieving 100% renewable electricity globally by 2030. This commitment extends to promoting a 90% global recycling rate for aluminum beverage containers, aligning with growing consumer and regulatory demand for eco-friendly practices.

Their strong emphasis on circularity, evidenced by high recycled content in their aluminum packaging, positions Ball favorably in a market increasingly prioritizing environmental responsibility. This focus not only reduces their environmental footprint but also enhances their brand reputation and market appeal.

Innovation in Packaging Solutions

Ball Corporation demonstrates a strong commitment to innovation in packaging, consistently investing in research and development. This dedication has led to advancements like lighter aluminum cans and novel aerosol containers incorporating significant recycled content. For instance, in 2023, Ball highlighted its ongoing efforts in developing advanced aluminum beverage cans that offer improved sustainability profiles and consumer appeal, a key driver for market share in the competitive beverage packaging sector.

This focus on pioneering new packaging technologies allows Ball to effectively address evolving consumer demands and regulatory pressures, particularly concerning environmental impact. Their ability to introduce solutions with higher recycled content and reduced material usage positions them favorably against competitors. In early 2024, the company emphasized its progress in developing infinitely recyclable aluminum packaging, a testament to its forward-thinking approach.

Ball's innovation pipeline is crucial for maintaining its competitive advantage. The development of new aerosol technologies, for example, caters to a growing market segment seeking more sustainable and user-friendly product delivery systems. This strategic investment in R&D ensures Ball remains at the forefront of the packaging industry, adapting to market trends and customer preferences.

- Lightweighting initiatives: Reduced material usage in aluminum cans, contributing to lower transportation emissions and costs.

- Aerosol technology advancements: Development of containers with higher percentages of post-consumer recycled (PCR) aluminum.

- Sustainability focus: Meeting growing consumer and regulatory demand for environmentally friendly packaging solutions.

- Market differentiation: Offering unique and improved packaging features that set Ball apart from competitors.

Strategic Acquisitions and Global Footprint

Ball Corporation's strategic acquisitions, such as the late 2024 purchase of Alucan, significantly bolster its European presence and aerosol and bottle manufacturing capabilities. This move directly addresses the growing demand for sustainable packaging solutions across the continent.

This expansion, coupled with Ball's established global manufacturing network, enables the company to effectively cater to a wide array of international markets. It positions Ball to capitalize on growth prospects by ensuring efficient production and distribution worldwide.

- European Expansion: Alucan acquisition in late 2024 enhanced Ball's European capacity, particularly in sustainable packaging for aerosols and bottles.

- Global Reach: Ball's existing worldwide manufacturing footprint allows for efficient service to diverse markets.

- Growth Opportunities: The combined strength of acquisitions and global presence enables Ball to pursue new growth avenues effectively.

Ball Corporation's core strength lies in its dominant position in the aluminum packaging market, a segment benefiting from increasing consumer and regulatory preference for sustainable materials. This leadership is further solidified by their commitment to circular economy principles, evidenced by the high recyclability rates of aluminum packaging, which globally averages around 70% for cans. Ball's proactive approach to environmental responsibility, including ambitious targets for renewable energy adoption and increased recycled content, directly aligns with evolving market demands.

What is included in the product

Analyzes Ball’s competitive position through key internal and external factors, highlighting its strengths in sustainable packaging and market leadership, while also identifying potential weaknesses in supply chain reliance and opportunities in emerging markets, alongside threats from regulatory changes and competition.

Offers a clear, actionable framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

Ball Corporation's significant reliance on aluminum as a primary raw material makes it inherently vulnerable to price swings in the global aluminum market. For instance, in 2023, aluminum prices experienced considerable volatility, impacting input costs for Ball's beverage packaging segment.

While Ball utilizes hedging instruments to manage these price fluctuations, substantial and sustained increases in aluminum costs, such as those seen in early 2024, can still put pressure on profit margins, potentially affecting earnings per share.

Geopolitical instability in key markets, coupled with shifting trade policies and the impact of U.S. tariffs on aluminum, presents a significant challenge for Ball Corporation. These factors can directly reduce the company's profitability and create disruptions in its global supply chains.

For instance, the ongoing trade disputes and tariffs, especially those affecting aluminum which is a primary input for beverage cans, can increase raw material costs. In 2023, aluminum prices saw volatility due to these geopolitical concerns, directly impacting the cost structure for can manufacturers like Ball.

Ball is actively addressing these risks by implementing strategies such as increasing local sourcing of raw materials. This approach aims to reduce reliance on imports subject to tariffs and mitigate the impact of supply chain disruptions, thereby safeguarding its financial performance and operational continuity.

Ball Corporation has encountered headwinds with customer demand, notably within the North American beer market. This softness in key alcoholic beverage categories has presented a challenge, partially tempering the company's otherwise robust growth in other segments and impacting overall sales volumes.

High Capital Expenditure Requirements

The packaging industry, including Ball Corporation's operations, inherently demands substantial capital for expansion, upkeep, and technological advancements. For instance, investing in new, efficient manufacturing lines or upgrading existing ones to meet evolving sustainability standards represents a significant outlay.

While Ball has been actively reducing its debt following the divestiture of its aerospace business, ongoing capital expenditures remain crucial. These investments are essential not only to maintain Ball's competitive edge in a dynamic market but also to fund strategic growth initiatives, such as developing innovative, lighter-weight packaging solutions or expanding into new geographic regions.

- Significant Investment Needs: The packaging sector requires continuous capital infusion for machinery, technology, and facility upgrades to stay competitive.

- Post-Divestiture Focus: Ball's recent deleveraging efforts don't eliminate the need for ongoing capital investment to support core business operations and future growth.

- Maintaining Competitiveness: Expenditures are necessary to adopt new manufacturing processes, enhance product innovation, and meet increasing customer demands for sustainable packaging.

Competition from Alternative Packaging Materials

Ball Corporation, a leader in aluminum beverage packaging, faces significant competition from alternative materials such as plastic and glass. This competitive landscape requires ongoing investment in innovation and product development to maintain its market position. For instance, while aluminum offers recyclability benefits, the cost-effectiveness and perceived convenience of plastic continue to pose a challenge. The market share battle is intense, with each material vying for consumer preference and brand adoption.

Ball must continually differentiate its aluminum offerings to counter the appeal of competing materials. This includes highlighting the superior sustainability profile of aluminum, which boasts a significantly higher recycling rate compared to plastic. In 2023, the U.S. recycling rate for aluminum cans reached approximately 45%, a figure Ball actively promotes. However, advancements in bioplastics and lightweight glass designs present evolving threats that demand strategic responses.

The company's ability to innovate is crucial for staying ahead of these alternative packaging trends. This involves not only improving the environmental footprint of its products but also enhancing their functionality and aesthetic appeal. For example, Ball's development of advanced coatings and lighter-weight can designs aims to reduce material usage and transportation costs, thereby improving its competitive edge against materials like PET plastic, which has seen significant market penetration due to its low cost and versatility.

- Competition from plastic: PET plastic remains a strong competitor, particularly in emerging markets, due to its lower production costs and established infrastructure.

- Glass packaging resurgence: Glass is experiencing a niche resurgence, driven by premium branding and consumer preference for perceived purity, presenting a challenge in certain beverage categories.

- Innovation imperative: Ball's continuous investment in R&D is essential to counter these material threats and maintain its market share in the global beverage packaging industry.

- Sustainability as a differentiator: Highlighting aluminum's superior recyclability and lower carbon footprint compared to alternatives is a key strategy to win over environmentally conscious consumers and brands.

Ball Corporation's significant reliance on aluminum makes it susceptible to market price fluctuations. For instance, in early 2024, aluminum prices saw considerable volatility, directly impacting Ball's input costs and potentially squeezing profit margins, as seen in the first quarter earnings reports.

Geopolitical tensions and trade policies, including U.S. tariffs on aluminum, can disrupt supply chains and increase raw material expenses. These external factors directly affect Ball's operational costs and overall profitability, as evidenced by the cost pressures experienced throughout 2023.

The company faces intense competition from alternative packaging materials like plastic and glass, necessitating continuous innovation and investment to maintain market share. For example, the growing popularity of PET plastic, due to its cost-effectiveness, requires Ball to emphasize aluminum's superior recyclability, which stood at approximately 45% in the U.S. in 2023.

Full Version Awaits

Ball SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, ensuring you receive the full, detailed report you need.

Opportunities

The shift towards sustainability is a major tailwind for Ball Corporation. Consumers and businesses are actively seeking packaging that minimizes environmental impact, and aluminum is a standout material in this regard. Its infinite recyclability makes it a compelling alternative to less sustainable options like plastic and glass.

This growing preference directly translates into increased demand for Ball's aluminum beverage cans and aerosol containers. In 2024, the global sustainable packaging market was valued at over $300 billion and is projected to grow significantly, with aluminum packaging expected to capture a larger share as regulations and consumer awareness intensify.

Ball Corporation is well-positioned to capitalize on the significant growth opportunities within emerging markets. These regions often exhibit rapidly increasing disposable incomes, driving higher consumption of packaged goods, including beverages. For instance, the Asia-Pacific region, a key emerging market, is projected to see continued strong demand for beverage cans.

Furthermore, the non-alcoholic beverage sector, particularly energy drinks and ready-to-drink teas, presents a robust avenue for expansion. Ball's expertise in aluminum can manufacturing aligns perfectly with the growing preference for sustainable and recyclable packaging in these categories. This strategic focus can help Ball mitigate any potential slowdowns or challenges encountered in other beverage segments.

Ball Corporation's commitment to technological advancement in production offers significant opportunities. Continued investment in cutting-edge manufacturing processes and lightweighting technologies can lead to increased operational efficiency and cost reductions. For instance, in 2023, the company highlighted its ongoing efforts in developing advanced forming and filling technologies, aiming to boost throughput and reduce material usage.

Innovation in product development is another key avenue for growth. The exploration of new packaging formats, such as refillable aluminum cartridges, signals a strategic move towards meeting evolving consumer demands for sustainability and convenience. This focus on innovation is crucial for Ball to capture emerging market segments and solidify its competitive edge in the evolving beverage and aerosol packaging industries.

Strategic Partnerships and Collaborations

Ball Corporation's strategic partnerships are a significant opportunity to enhance its market standing and drive sustainability. By collaborating with customers and suppliers, Ball can foster the development of innovative packaging solutions, aligning with the growing demand for environmentally responsible products. These alliances are crucial for advancing circular economy principles within the packaging sector.

Ball's existing relationships with major global brands represent a powerful competitive advantage. These collaborations allow for co-creation of packaging that meets specific consumer and brand sustainability goals, thereby strengthening Ball's value proposition. For instance, partnerships can lead to the adoption of new materials or designs that reduce environmental impact.

- Customer Collaborations: Working with beverage and food companies to implement advanced recycling technologies and reduce packaging waste.

- Supplier Integration: Partnering with raw material suppliers to source sustainable inputs, such as recycled aluminum and bio-based plastics.

- Industry Alliances: Engaging with industry groups and NGOs to advocate for and implement policies that support packaging circularity and recycling infrastructure.

- Innovation Hubs: Establishing joint ventures or research partnerships to accelerate the development of next-generation sustainable packaging solutions.

Leveraging Aerospace Divestiture for Core Business Investment

The divestiture of Ball Corporation's aerospace division, completed in 2023 for $2.05 billion, provides significant capital to reinvest in its primary aluminum packaging segment. This strategic move allows for targeted investments in expanding production capacity and implementing advanced operational efficiencies, directly addressing growing market demand.

This focused capital allocation is expected to drive accelerated growth within the beverage packaging sector. Ball's commitment to enhancing its core business through these investments aims to solidify its market leadership and deliver increased shareholder value.

- Capacity Expansion: Ball is actively investing in new facilities and expanding existing ones to meet the surging demand for aluminum cans, particularly for beverages.

- Operational Efficiencies: The company is implementing advanced manufacturing technologies and process improvements to reduce costs and boost productivity.

- Shareholder Value: By concentrating resources on its most profitable segment, Ball aims to enhance its financial performance and return capital to shareholders.

Ball Corporation's strategic divestiture of its aerospace business in 2023, valued at $2.05 billion, has unlocked substantial capital. This financial flexibility allows for significant reinvestment into its core aluminum packaging operations, directly addressing the escalating demand for sustainable beverage containers.

The company is channeling these funds into expanding production capacity and implementing advanced manufacturing technologies. This focus on operational efficiencies and capacity growth is designed to capitalize on the robust market demand for aluminum packaging, particularly within the beverage sector.

Ball's commitment to innovation in packaging formats, such as refillable aluminum cartridges, also presents a significant growth avenue. This forward-thinking approach addresses evolving consumer preferences for convenience and sustainability, positioning Ball to capture new market segments and enhance its competitive standing.

| Opportunity Area | 2024/2025 Focus | Key Data Point |

| Sustainability Demand | Increased aluminum can adoption | Global sustainable packaging market projected to exceed $300 billion in 2024. |

| Emerging Markets | Growth in beverage consumption | Asia-Pacific region showing strong, continued demand for beverage cans. |

| Product Innovation | New packaging formats | Development of refillable aluminum cartridges to meet consumer needs. |

| Capital Reinvestment | Capacity expansion and efficiency | $2.05 billion capital from aerospace divestiture to fuel core business growth. |

Threats

Ball Corporation faces significant challenges from major players like Crown Holdings and Amcor, who also vie for market share in the global packaging sector. This intense rivalry often forces price adjustments and necessitates ongoing investment in advanced manufacturing technologies and sustainable packaging solutions to stay competitive.

Global economic slowdowns directly threaten Ball Corporation's revenue streams. A significant downturn can curb consumer discretionary spending, impacting demand for beverages packaged in Ball's aluminum cans, especially in price-sensitive segments like mass-market beer. For instance, if inflation continues to pressure household budgets through 2024 and into 2025, consumers may trade down to cheaper alternatives or reduce overall consumption, directly affecting sales volumes for Ball's key customers.

Ball Corporation, like many manufacturers, faces significant threats from supply chain disruptions. Issues with the availability of key raw materials, such as aluminum, directly impact production schedules and can lead to increased operational expenses. For instance, fluctuations in aluminum prices, a primary input for Ball's beverage cans, can squeeze profit margins if not effectively managed through hedging or pricing strategies.

Geopolitical events further amplify these risks, creating volatility in global trade routes and raw material sourcing. The ongoing global economic uncertainties and trade tensions, particularly those affecting energy and transportation costs, can exacerbate supply chain vulnerabilities. These external factors necessitate robust contingency planning and diversified sourcing strategies to mitigate potential production halts and cost overruns.

Regulatory Changes and Environmental Compliance Costs

Ball Corporation, a leader in sustainable packaging, faces potential headwinds from shifting environmental regulations. While the company actively invests in eco-friendly practices, new or stricter rules could increase operational expenses or demand substantial capital for technological upgrades. For instance, evolving mandates around recycled content or emissions could necessitate further investment beyond current projections.

- Increased Compliance Costs: New regulations on materials or manufacturing processes could raise Ball's operational expenses.

- Investment in New Technologies: Adapting to stricter environmental standards may require significant capital expenditure for advanced equipment.

- Potential for Fines or Penalties: Non-compliance with evolving regulations could result in financial penalties, impacting profitability.

Currency Fluctuations and Foreign Exchange Risk

Ball Corporation's global presence means it's susceptible to currency fluctuations. Changes in exchange rates can directly affect the value of its international sales and profits when translated back into U.S. dollars. For instance, a stronger U.S. dollar can make Ball's products more expensive for foreign buyers, potentially reducing sales volume, and it also reduces the reported value of earnings generated in weaker foreign currencies.

These currency movements introduce foreign exchange risk, which can create volatility in Ball's reported financial results. In 2023, for example, many multinational corporations reported impacts from currency headwinds, and Ball, with its extensive international operations across Europe, South America, and Asia, is no exception. While specific figures for Ball's currency impact in late 2024 or early 2025 are still emerging, historical trends suggest this remains a significant factor.

The company manages this risk through various hedging strategies, but these are not always perfectly effective. Therefore, unexpected shifts in major currency pairs like the Euro/USD or USD/CNY can still lead to unforeseen impacts on Ball's profitability and the competitiveness of its offerings in key overseas markets.

- Impact on Earnings: Currency swings can reduce the reported value of foreign profits.

- Sales Competitiveness: A stronger dollar can make Ball's products pricier abroad.

- Hedging Limitations: Financial instruments may not fully offset currency volatility.

- Geographic Exposure: Operations in diverse regions amplify the potential for currency impacts.

Ball Corporation faces intense competition from established players like Crown Holdings and Amcor, necessitating continuous investment in technology and sustainable solutions to maintain market position. Economic slowdowns pose a significant threat, as reduced consumer spending, particularly on beverages, can directly impact Ball's sales volumes, a risk amplified by persistent inflation through 2024 and into 2025.

Supply chain volatility, especially concerning aluminum prices, directly impacts Ball's production costs and profit margins. Geopolitical instability further exacerbates these risks by disrupting trade routes and increasing transportation expenses, requiring robust contingency planning. Evolving environmental regulations also present a threat, potentially increasing compliance costs and demanding significant capital for technological upgrades to meet new standards.

Currency fluctuations represent another substantial threat, impacting the value of international sales and profitability when converted to U.S. dollars. A stronger U.S. dollar can make Ball's products more expensive for international customers, potentially reducing demand, while also diminishing the reported value of earnings from operations in weaker currency regions. Despite hedging strategies, these currency movements can still introduce volatility into financial results, a factor observed across multinational corporations in 2023 and likely to persist into 2024-2025.

| Threat Category | Specific Risk | Potential Impact | Example/Data Point (2024-2025 Focus) |

|---|---|---|---|

| Competition | Market Share Erosion | Price pressure, reduced margins | Intense rivalry with Crown Holdings and Amcor |

| Economic Conditions | Reduced Consumer Spending | Lower sales volumes, decreased demand for beverages | Inflationary pressures impacting discretionary income through 2024-2025 |

| Supply Chain | Raw Material Price Volatility (Aluminum) | Increased production costs, squeezed profit margins | Fluctuations in global aluminum prices impacting input costs |

| Geopolitical Factors | Trade Disruptions, Increased Transport Costs | Production delays, higher operational expenses | Global trade tensions affecting energy and logistics |

| Regulatory Environment | Stricter Environmental Standards | Higher compliance costs, capital expenditure for upgrades | Potential new mandates on recycled content or emissions |

| Currency Exchange Rates | Adverse Currency Movements | Reduced value of foreign earnings, decreased international sales competitiveness | Impact of USD strength on sales in Europe, South America, and Asia |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including the company's audited financial statements, comprehensive market research reports, and insights from industry experts and analysts.