Ball Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ball Bundle

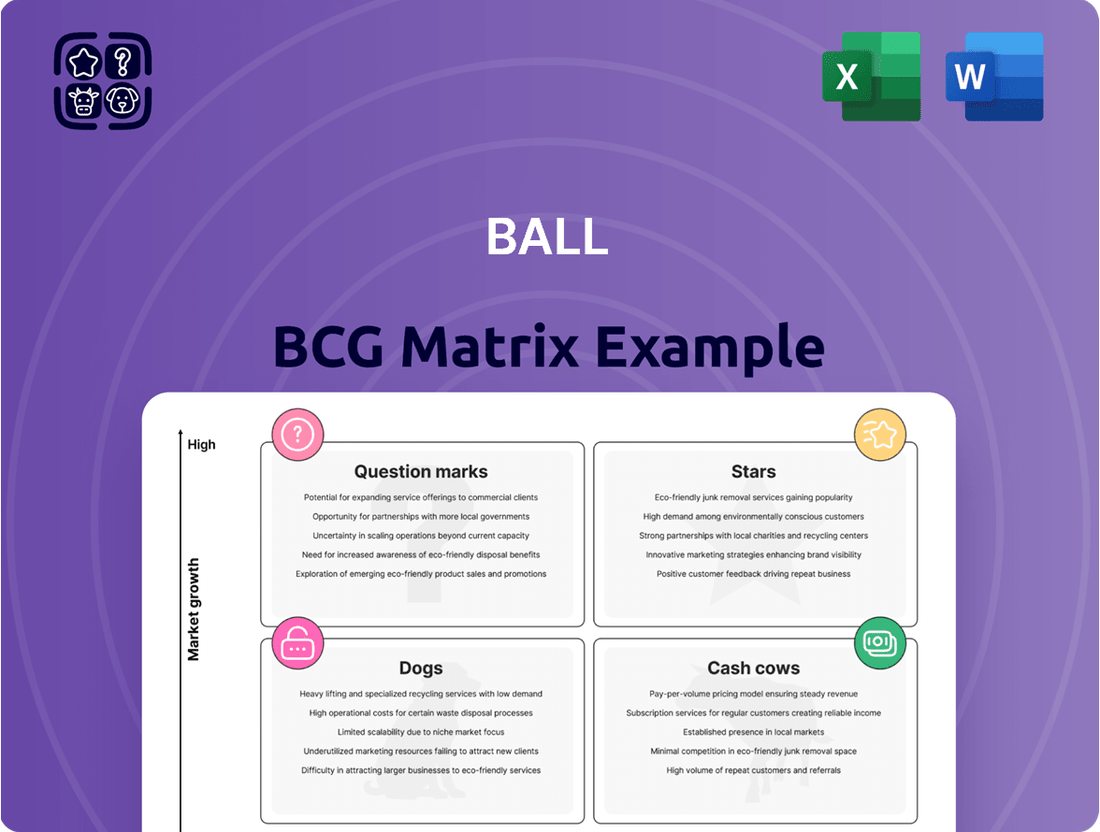

Curious about how this company's products stack up? The BCG Matrix categorizes them into Stars, Cash Cows, Dogs, and Question Marks, offering a vital snapshot of market performance. Unlock the full potential of this analysis by purchasing the complete BCG Matrix for a comprehensive breakdown and actionable strategic insights.

Stars

Ball Corporation, a titan in the beverage packaging sector, commands the largest share of the global aluminum beverage can market. In 2024, the demand for aluminum cans surged as consumers increasingly favored sustainable options, pushing the market towards an estimated value of over $50 billion. This preference for recyclability over plastic and glass is a key growth driver.

The North and Central America Beverage Packaging segment is a cornerstone of Ball Corporation's business, representing a substantial portion of its revenue. In 2024, this segment continued its upward trajectory, demonstrating robust sales growth driven by both organic volume increases and strategic expansion, such as the integration of Florida Can.

This market is characterized by a strong demand for aluminum beverage cans, a trend bolstered by increasing consumer awareness of sustainability and a preference for the portability and convenience of cans. Ball's consistent performance in this region highlights its ability to capitalize on these evolving market dynamics, further solidifying its position as a market leader.

Ball's EMEA beverage packaging operations are performing exceptionally well, with sales experiencing significant increases and volume growth in the mid-single digits, even when accounting for currency fluctuations. This robust performance highlights the strength of their offerings in a dynamic market.

The European region is a key driver of this success, witnessing a substantial transition from tinplate to aluminum cans. This shift is fueled by growing consumer preferences for soft drinks, water, beer, and seltzers, all packaged in aluminum. Ball is well-positioned to capitalize on this trend.

South America Beverage Packaging

The South American beverage packaging segment is a notable performer for Ball, demonstrating robust growth. In 2024, this region contributed significantly to the company's overall financial health, with comparable operating earnings and revenue experiencing substantial increases. This upward trend is fueled by consistent, low-single-digit volume gains and beneficial price/mix improvements, reflecting strong market demand.

Ball's strategic focus on emerging markets, including South America, positions it well for future expansion. These regions, alongside Asia Pacific, are anticipated to be key drivers of increased aluminum can demand. Factors such as ongoing urbanization and rising disposable incomes are directly contributing to this projected growth, making South America a vital market for Ball's beverage packaging business.

- South American beverage packaging shows strong growth.

- Key drivers include low-single-digit volume gains and improved price/mix.

- Emerging markets like South America are expected to lead aluminum can demand growth.

- Urbanization and increasing disposable incomes are supporting this trend.

Sustainable Packaging Innovation

Ball Corporation's commitment to sustainable packaging innovation, particularly in aluminum, is a significant driver of its market position. The company's ongoing investments in lightweighting technologies and advanced recycling programs directly address the increasing consumer and regulatory demand for environmentally responsible products. This focus on circular economy principles, aiming for higher recycling rates for aluminum beverage cans, is crucial in a market increasingly prioritizing sustainability.

Ball's efforts are reflected in tangible progress. For instance, in 2023, the company reported that its customers' aluminum cans had an average recycled content of 46%, a figure it aims to increase. Their advanced recycling initiatives, such as partnerships for chemical recycling, are designed to further boost the circularity of aluminum, a material infinitely recyclable. This strategic direction positions Ball favorably within the beverage packaging sector, where environmental impact is a key consideration for brands and consumers alike.

- Ball's Investment in Lightweighting: Reduces material usage and transportation emissions, contributing to a lower carbon footprint for beverage packaging.

- Advanced Recycling Initiatives: Ball is actively involved in developing and supporting technologies that enable higher and more efficient recycling of aluminum.

- Circular Economy Focus: The company's objective is to maximize the recycling rates of aluminum beverage containers globally, aligning with environmental goals and consumer preferences.

- Market Responsiveness: Ball's sustainable packaging solutions cater to growing consumer demand for eco-friendly products and increasing regulatory pressures for reduced environmental impact.

Stars in the BCG Matrix represent business units with high market share in high-growth industries. For Ball Corporation, this segment would encompass their core beverage packaging operations, particularly aluminum cans, which are experiencing robust demand. The company's dominant position in this growing market, driven by sustainability trends and consumer preference, aligns perfectly with the characteristics of a Star.

Ball's North and Central America segment, a significant revenue contributor, exemplifies Star characteristics. The surge in demand for aluminum cans, valued at over $50 billion globally in 2024, coupled with Ball's market leadership, firmly places this business unit in the Star category. Their ability to capitalize on consumer preference for recyclable packaging further solidifies this position.

Similarly, Ball's EMEA beverage packaging operations, showing mid-single-digit sales growth even with currency impacts, also exhibit Star-like qualities. The significant shift towards aluminum cans in Europe, driven by demand for various beverages, highlights a high-growth market where Ball holds a strong position.

The South American beverage packaging segment, with its substantial growth in operating earnings and revenue in 2024, further reinforces Ball's Star portfolio. Low-single-digit volume gains and beneficial price/mix improvements in this region, supported by urbanization and rising incomes, indicate a high-growth market where Ball is a key player.

| Business Segment | Market Growth | Ball's Market Share | BCG Classification |

|---|---|---|---|

| North & Central America Beverage Packaging | High | High | Star |

| EMEA Beverage Packaging | High | High | Star |

| South America Beverage Packaging | High | High | Star |

What is included in the product

Strategic framework for analyzing a company's product portfolio based on market share and growth rate.

Quickly identify underperforming "Dogs" to divest, freeing up resources.

Cash Cows

Ball Corporation's established aluminum beverage can production is a classic Cash Cow. This core business benefits from a dominant global market share in a mature industry, consistently churning out significant cash flow. The company's extensive scale and well-developed infrastructure mean less need for aggressive marketing, and the high barriers to entry for new competitors solidify Ball's strong market position and profitability.

Ball Corporation's long-standing customer relationships are a significant driver of its Cash Cow status. The company boasts deep, enduring contracts with major global beverage titans, many of which represent billion-dollar brands. This established customer base, built on trust and consistent performance, translates into remarkably stable and predictable revenue streams for Ball's aluminum packaging solutions.

These strong partnerships significantly reduce the need for costly and intensive new business acquisition. For instance, Ball's multi-year agreements with leading soft drink and beer manufacturers provide a reliable foundation for its financial performance, allowing it to generate consistent cash flow with minimal incremental investment. This predictability is a hallmark of a true Cash Cow.

Ball Corporation's dedication to operational excellence is a cornerstone of its success, particularly within its core packaging segment. By focusing on manufacturing efficiencies and rigorous cost management, the company consistently achieves robust profit margins. For instance, in 2023, Ball reported a net income of $1.6 billion, underscoring the effectiveness of its disciplined approach to costs.

Investments in supporting infrastructure play a crucial role in enhancing operational efficiency and bolstering cash flow, even in mature or low-growth markets. These strategic capital expenditures are designed to streamline processes and reduce waste, thereby directly contributing to sustained profitability and a strong cash generation capability.

Shareholder Return Programs

Ball's shareholder return programs highlight its status as a cash cow, consistently rewarding investors. The company's robust free cash flow fuels aggressive share buybacks and dividend payouts, a testament to its stable, high-performing established businesses.

In the first quarter of 2025, Ball returned over $600 million to shareholders, with projections to surpass $1.5 billion annually. This strong capital return strategy underscores the reliable cash generation from its mature operations.

- Shareholder Capital Returned (Q1 2025): Over $600 million

- Projected Annual Shareholder Returns: Exceeding $1.5 billion

- Program Focus: Aggressive share buybacks and dividends

- Underlying Strength: Robust free cash flow from established businesses

Divested Aerospace Business Proceeds

The divested aerospace business, while no longer an operating segment, generated substantial cash proceeds exceeding $4.6 billion in February 2024. This significant capital infusion has been strategically deployed for deleveraging and share repurchases, effectively acting as a cash cow for Ball Corporation.

- Cash Influx: Over $4.6 billion received from the aerospace business sale in February 2024.

- Strategic Use: Proceeds utilized for debt reduction and share buybacks.

- Financial Flexibility: Enhanced the company's overall financial strength and maneuverability.

- Cash Cow Status: The divested asset's proceeds continue to provide significant financial benefits.

Cash Cows, in the context of the BCG Matrix, represent established, low-growth market leaders that generate more cash than they consume. Ball Corporation's core aluminum beverage can business exemplifies this, benefiting from a mature market and significant market share. The company's consistent profitability, evidenced by its $1.6 billion net income in 2023, stems from operational efficiencies and strong customer relationships. These factors allow Ball to generate substantial free cash flow, which is then strategically returned to shareholders through buybacks and dividends, with over $600 million returned in Q1 2025 alone.

| Metric | Value (2023/Q1 2025) | Significance |

|---|---|---|

| Net Income | $1.6 billion (2023) | Demonstrates strong profitability from core operations. |

| Shareholder Capital Returned | Over $600 million (Q1 2025) | Highlights robust free cash flow being channeled back to investors. |

| Aerospace Sale Proceeds | Over $4.6 billion (Feb 2024) | Provided significant capital for debt reduction and share repurchases, enhancing financial flexibility. |

Full Transparency, Always

Ball BCG Matrix

The preview you see is the definitive BCG Matrix report you will receive upon purchase, offering a complete and unwatermarked strategic tool. This document has been meticulously prepared with professional formatting and actionable insights, ensuring you get precisely what you need for your business planning. Once acquired, this BCG Matrix will be immediately available for your use, ready to inform critical decisions and drive market strategy. You can confidently expect the same high-quality, analysis-ready file that is presented here, designed for immediate application and impact.

Dogs

Ball Corporation's legacy steel food and aerosol assets, divested in stages, including a 51% stake in Ball Metalpack in 2018 and its subsequent sale to Sonoco in 2022, align with the 'Dog' quadrant of the BCG Matrix. These product lines, characterized by their non-aluminum nature, were likely viewed as having low market share and limited growth potential for Ball, prompting their strategic exit.

Ball Corporation has observed slower volume growth in specific regional markets for aluminum packaging, as highlighted in their Q4 2024 earnings report. These regions, often characterized by maturity and high competition, may represent areas where Ball's market share is less dominant.

These segments could be categorized as 'Dogs' within the BCG matrix framework. Such markets might offer minimal returns, potentially breaking even or even consuming cash without generating significant profits, especially if Ball faces strong competitive pressures.

While aluminum cans dominate beverage packaging, Ball Corporation's products in this segment face growing competition from innovative biodegradable plastics and advanced paperboard solutions. These alternatives are particularly gaining traction in niche markets and for specific product types, potentially impacting Ball's market share and growth prospects in those areas. For instance, the rise of plant-based packaging in the food service industry presents a direct challenge.

Underperforming Older Manufacturing Facilities

Underperforming older manufacturing facilities, particularly those struggling with efficiency and requiring significant capital for modernization, often find themselves in the Dogs category of the BCG Matrix. These assets may not offer a clear route to increasing market share in their current regional markets. For instance, a 2024 report indicated that manufacturing plants over 50 years old often face higher maintenance costs and lower energy efficiency compared to newer facilities.

These older plants can become significant drains on resources. They might tie up valuable capital that could be better allocated to more promising growth areas or research and development. The minimal returns they generate, coupled with ongoing operational expenses, make them prime candidates for a thorough strategic review. This review often leads to decisions about divestment, restructuring, or even closure.

- Low Market Share: These facilities typically hold a small or declining share of their regional market.

- Low Growth Potential: The markets served by these older plants often exhibit slow or no growth.

- Capital Intensive: Modernizing or maintaining these facilities can require substantial, often unrecoverable, investment.

- Divestment Candidates: They are frequently considered for sale or closure to free up capital and management focus.

Products with Limited Innovation Potential

Products in the 'Dogs' quadrant of the BCG matrix are those that have largely exhausted their innovation potential. This means there's little room left for exciting new features, design improvements, or ways to expand into new markets, especially when competitors are also very active. For instance, consider the market for basic, non-smart feature phones. While still functional, the core technology and user experience have plateaued.

These types of products often struggle to attract new customers or justify higher prices. Their growth is typically stagnant or declining, and they hold a small share of their respective markets. By 2024, the global feature phone market, while still existing, represents a small fraction of the overall mobile phone industry, with sales figures indicating a mature and largely unexpanding segment.

- Limited Feature Advancement: Products like basic calculators or standard USB-A flash drives have seen minimal innovation in recent years.

- Mature Market Saturation: Many established consumer electronics, such as CD players, have reached a point where further market penetration is difficult.

- Low Growth Potential: For example, sales of traditional landline telephones have been in steady decline for over a decade, reflecting limited future growth.

- Price Sensitivity: Products with little differentiation often compete primarily on price, further limiting profitability and investment in innovation.

Ball Corporation's divestment of its legacy steel food and aerosol assets, including the sale of a majority stake in Ball Metalpack, illustrates a strategic move away from 'Dog' segments. These non-aluminum packaging lines likely exhibited low market share and minimal growth prospects for the company, prompting their divestiture to focus on more lucrative ventures.

Ball has acknowledged slower volume growth in certain regional aluminum packaging markets, as reported in their Q4 2024 earnings. These mature, competitive regions may represent areas where Ball's market position is less dominant, fitting the profile of 'Dog' business units with limited revenue potential and potentially requiring cash to maintain operations.

These underperforming segments can be viewed as 'Dogs' in the BCG matrix. They may offer negligible returns, potentially breaking even or consuming cash without substantial profit generation, especially when facing intense competition. For example, older manufacturing facilities, often less efficient and requiring significant capital for upgrades, can fall into this category. A 2024 industry analysis noted that plants exceeding 50 years in age typically incur higher maintenance and energy costs compared to newer counterparts.

Products in the 'Dog' quadrant often experience stagnant or declining growth and hold a small market share. By 2024, the global market for basic feature phones, for instance, represents a small fraction of the overall mobile industry, indicating a mature and largely unexpanding segment. Similarly, products with limited innovation, such as standard USB-A flash drives, face market saturation and compete primarily on price, hindering profitability.

| BCG Quadrant | Characteristics | Ball Corporation Example/Consideration | Market Dynamics | Strategic Implication |

| Dogs | Low market share, low growth potential | Divested steel packaging assets, mature regional aluminum markets | High competition, limited innovation, price sensitivity | Divestment, restructuring, or closure to reallocate resources |

| Minimal returns, potential cash drain | Older, less efficient manufacturing facilities | High operational costs, low energy efficiency | Focus on core competencies, investment in growth areas |

Question Marks

Ball Corporation's Oasis Venture Holdings, focused on aluminum cups, currently fits the Question Mark category in the BCG Matrix. This segment is a new product with strong alignment to the growing demand for sustainable packaging solutions, a trend that saw the global aluminum can market reach approximately $110 billion in 2023, with a projected CAGR of over 4% through 2030.

The aluminum cup business, while promising high growth potential due to its eco-friendly attributes and novelty, is still in its nascent stages. It commands a relatively low market share, necessitating substantial investment to scale production, build brand awareness, and capture a larger portion of the beverage packaging market, which is increasingly favoring aluminum over plastic.

Ball Corporation is strategically venturing into new product categories for aluminum cans, moving beyond beverages to include household items. This expansion taps into a growing consumer demand for sustainable packaging solutions across a wider range of goods.

These emerging markets represent significant growth potential, but Ball's current market penetration in these non-beverage sectors is minimal. Consequently, substantial investment in marketing and consumer education will be necessary to drive adoption and establish market share.

For instance, the market for aluminum packaging in personal care products, a category Ball is targeting, saw a notable increase in interest throughout 2024. Companies are increasingly opting for aluminum's recyclability and premium feel over plastics for items like deodorants and hairsprays.

Ball Corporation's introduction of advanced printing technologies like Dynamark Advanced Pro positions them to significantly enhance brand personalization and customer creative expression. This strategic move aims to differentiate their product offerings and potentially tap into new, specialized market segments. For instance, in 2024, the demand for customized packaging solutions saw a notable increase across various consumer goods sectors.

However, the market penetration and ultimate success of these sophisticated printing capabilities are still being assessed. While the technology itself is innovative, its widespread adoption and the resultant market share gains are in their nascent stages. This places Dynamark Advanced Pro squarely in the Question Mark category of the BCG Matrix, awaiting validation of its market impact and profitability.

Developing Market Expansion for Aluminum Cans

Developing market expansion for aluminum cans, particularly in emerging economies, positions Ball Corporation's can segment squarely within the question mark category of the BCG matrix. These regions present substantial growth potential, driven by rising consumer spending and a shift towards packaged beverages. For instance, the global aluminum can market was projected to reach approximately $120 billion by 2024, with emerging markets accounting for a significant portion of this growth.

Ball's strategy to increase its footprint in these dynamic areas necessitates considerable investment. While the long-term outlook is promising, initial market penetration may be challenging, leading to lower market share in the short to medium term. This investment is crucial to build brand recognition, establish robust distribution networks, and potentially acquire local players to accelerate growth.

- High Growth Potential: Emerging markets are experiencing a surge in demand for aluminum cans due to increasing disposable incomes and a growing preference for convenient beverage packaging.

- Investment Required: Capturing market share in these regions demands significant capital outlay for production capacity, marketing, and distribution infrastructure.

- Uncertain Future: While growth is anticipated, the ultimate success and market leadership in these developing territories remain uncertain, characteristic of question mark products.

- Strategic Focus: Ball's emphasis on these markets indicates a strategic bet on future growth, aiming to transform these question marks into stars over time.

Strategic Alliances for New Packaging Technologies (e.g., Meadow Kapsul)

Ball Corporation's strategic alliance with Meadow, focusing on Meadow Kapsul's innovative pre-filled aluminum cartridges for personal care items, positions these ventures as potential Stars within the BCG matrix. This move signifies Ball's investment in nascent packaging technologies with significant future growth prospects.

These early-stage initiatives, while holding high growth potential, currently exhibit low market penetration, demanding considerable capital expenditure to scale and capture market share. For instance, the sustainable packaging market, which Meadow Kapsul targets, is projected to grow significantly, with some estimates suggesting a compound annual growth rate exceeding 6% through 2028.

- High Growth Potential: Meadow Kapsul addresses a growing consumer demand for sustainable and convenient packaging solutions.

- Low Market Share: The technology is still in its early adoption phase, meaning widespread market penetration is yet to be achieved.

- Significant Investment Required: Ball's commitment to these alliances indicates substantial R&D and market development funding.

- Future Market Leadership: Successful scaling could establish Ball as a leader in innovative aluminum packaging for new product categories.

Question Marks in Ball Corporation's portfolio represent new ventures with high growth potential but low market share. These segments require significant investment to gain traction and establish dominance. The success of these ventures is uncertain, as they are in the early stages of market development and adoption.

Ball's Oasis Venture Holdings for aluminum cups and its expansion into non-beverage aluminum packaging, alongside the Dynamark Advanced Pro printing technology, are prime examples of Question Marks. These areas show promise due to market trends like sustainability and customization, but their market penetration is currently minimal, necessitating substantial capital for growth.

Emerging market expansion for aluminum cans also falls into this category, offering substantial growth but demanding considerable investment for market penetration and brand building. The ultimate success of these strategic bets hinges on effective execution and market acceptance, aiming to convert these Question Marks into future Stars.

| BCG Category | Ball Corporation Segment | Market Characteristics | Strategic Consideration |

|---|---|---|---|

| Question Mark | Oasis Venture Holdings (Aluminum Cups) | High market growth, Low market share | Requires significant investment to increase market share. |

| Question Mark | Non-Beverage Aluminum Packaging | Growing demand for sustainable solutions, Nascent market penetration | Investment in marketing and consumer education needed. |

| Question Mark | Dynamark Advanced Pro Printing | High potential for differentiation, Early adoption phase | Market impact and profitability still being assessed. |

| Question Mark | Emerging Market Can Expansion | Substantial growth potential, Low initial market share | Investment in capacity, marketing, and distribution is crucial. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.