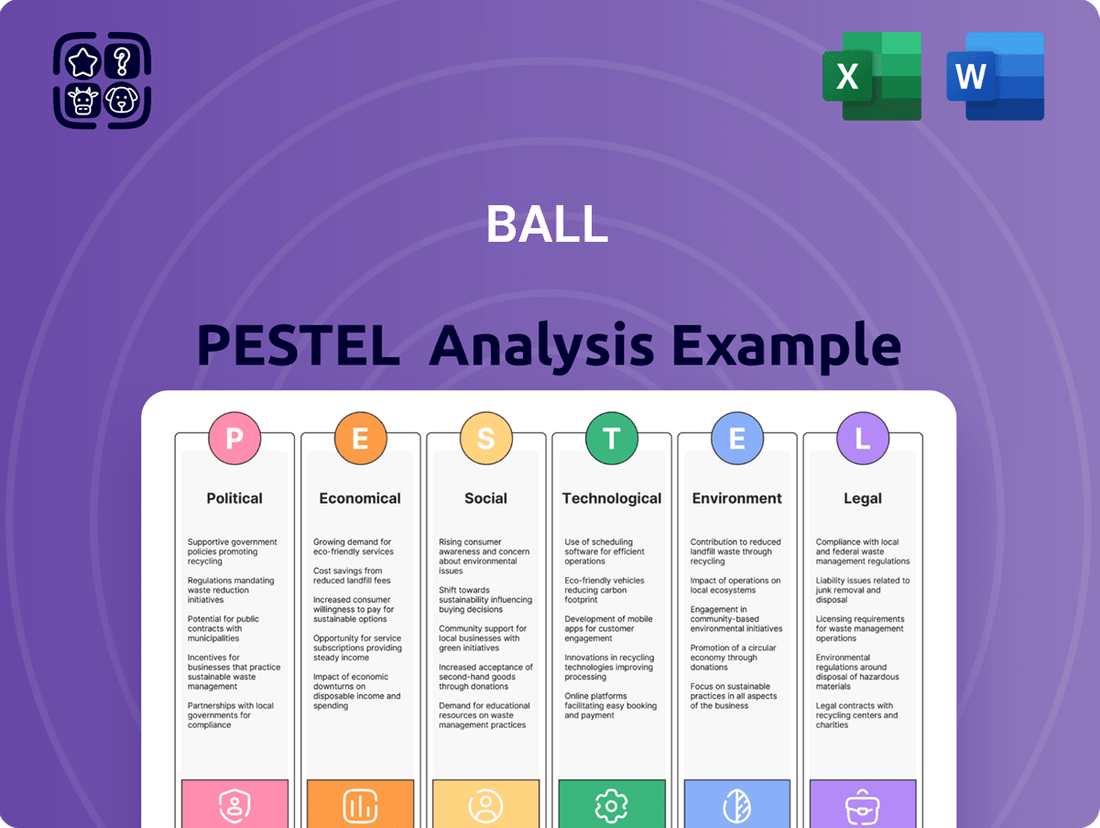

Ball PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ball Bundle

Unlock the forces shaping Ball's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing its operations and strategic direction. Gain a competitive edge by leveraging these expert insights to anticipate challenges and identify opportunities. Download the full report now for actionable intelligence that drives informed decision-making.

Political factors

Ball Corporation's extensive global manufacturing and supply chain are highly sensitive to evolving trade policies, especially those concerning aluminum and metal packaging. These policies directly influence the cost of raw materials essential for Ball's operations.

For example, in 2024, U.S. tariffs on aluminum added approximately $42.3 million to Ball's expenses. The impending 50% U.S. tariff on imported aluminum, slated to take effect in June 2025, presents a significant challenge, potentially reducing profit margins unless these increased costs can be successfully passed on to customers.

Government infrastructure and defense spending, particularly in the United States, has historically been a significant driver for companies like Ball Corporation, especially within its former aerospace segment. While Ball divested its aerospace division to BAE Systems in February 2024, understanding this factor remains crucial for analyzing the company's historical trajectory and the broader industry landscape. For instance, in fiscal year 2023, Ball's aerospace segment contributed approximately $1.5 billion in revenue, underscoring the substantial impact of government contracts on its operations prior to the sale.

Geopolitical complexities present significant hurdles for Ball Corporation's global operations, necessitating potential revenue adjustments and strategic shifts across diverse markets. These international dynamics directly impact the company's ability to navigate trade policies and supply chain stability.

Heightened geopolitical uncertainty in key regions, particularly impacting European and Asian markets, was a contributing factor to a noticeable decline in Ball's net earnings during the first quarter of 2025. This uncertainty led to an estimated 3% contraction in sales from these affected areas compared to the previous year.

Packaging Regulations and Extended Producer Responsibility (EPR) Laws

New packaging regulations are significantly impacting businesses, especially those operating in North America and Europe. These rules focus on reducing waste, mandating the use of recyclable materials, and promoting circular economy principles. For instance, several U.S. states have enacted Extended Producer Responsibility (EPR) laws, placing the onus on manufacturers for the entire product lifecycle, including end-of-life management. This shift means companies need to invest in more sustainable packaging solutions and robust recycling infrastructure.

The European Union's Packaging and Packaging Waste Regulation (PPWR), set to be fully effective by February 2025, is a prime example of these evolving mandates. The PPWR targets a substantial reduction in packaging waste and aims to boost recycling rates across member states. This regulation will likely lead to increased compliance costs for businesses, but it also presents opportunities for innovation in packaging design and material science. Companies that proactively adapt to these regulations can gain a competitive edge by demonstrating their commitment to environmental sustainability.

- North American EPR Laws: Multiple U.S. states have implemented EPR legislation, making producers responsible for packaging waste management.

- EU PPWR Impact: The EU's Packaging and Packaging Waste Regulation, effective February 2025, aims to cut packaging waste and enhance recycling.

- Circularity Focus: Regulations increasingly emphasize circular economy principles, pushing for reusable and infinitely recyclable packaging materials.

- Compliance Costs: Businesses face potential increases in operational expenses due to the need for new packaging materials and waste management systems.

Political Stability and Regulatory Environment

Ball Corporation's global operations are significantly impacted by the political stability and evolving regulatory landscapes in its key markets. For instance, in 2024, ongoing geopolitical tensions in Eastern Europe continue to pose risks to supply chains and energy costs, areas where Ball has significant exposure through its manufacturing facilities and raw material sourcing.

The company navigates a complex web of environmental regulations, particularly concerning packaging and recycling. As of early 2025, the push for enhanced Extended Producer Responsibility (EPR) schemes in North America and Europe could lead to increased compliance costs or necessitate investments in new collection and recycling infrastructure. Conversely, favorable government incentives for sustainable packaging can present growth opportunities.

- Regulatory Impact: Changes in trade policies or tariffs, such as those potentially affecting aluminum imports into the United States, can directly influence Ball's cost of goods sold and pricing strategies.

- Sustainability Focus: Government mandates promoting higher recycled content in beverage cans, a core product for Ball, are expected to intensify through 2025, driving innovation and capital expenditure in advanced recycling technologies.

- Geopolitical Risk: Political instability in regions where Ball has manufacturing plants, like South America, can disrupt operations and impact local demand for its products.

- Trade Agreements: The renegotiation or establishment of international trade agreements can alter market access and competitive dynamics for Ball's diverse product lines.

Political factors, including trade policies and geopolitical stability, significantly shape Ball Corporation's operational costs and market access. For instance, anticipated U.S. tariffs on aluminum in 2025 could increase Ball's expenses by an estimated $42.3 million, impacting profitability unless passed on to consumers.

Evolving environmental regulations, such as the EU's Packaging and Packaging Waste Regulation effective February 2025 and North American Extended Producer Responsibility laws, are compelling Ball to invest in sustainable packaging and recycling infrastructure, potentially increasing compliance costs but also fostering innovation.

Geopolitical uncertainties, particularly in Europe and Asia, have already led to a projected 3% sales contraction in early 2025 for Ball in those regions, underscoring the direct impact of global instability on financial performance.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the Ball, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable framework that simplifies complex external factors, allowing teams to focus on strategic responses rather than getting bogged down in data overload.

Economic factors

Ball Corporation is actively managing through a period of significant economic uncertainty, including ongoing recessionary pressures. The company's financial strategy emphasizes maintaining resilience in this volatile environment.

In 2023, Ball Corporation demonstrated its financial footing by reporting $14.2 billion in revenue and achieving $786 million in net income. The company's debt-to-equity ratio stood at 1.42, suggesting a moderate level of financial leverage and a capacity to weather economic downturns.

Fluctuations in aluminum prices significantly influence Ball Corporation's manufacturing expenses, given that aluminum constitutes approximately 40% of its total production costs. For instance, in early 2024, aluminum prices saw considerable swings, trading in the $2,200 to $2,400 per metric ton range, impacting Ball's cost structure.

Ball actively works to cushion the blow from this price volatility through strategies like securing long-term supply contracts and investing in new production facilities, such as its U.S. smelter which commenced operations in late 2023. Despite these efforts, the inherent unpredictability of aluminum market prices continues to represent a notable risk factor for the company's financial performance.

Inflationary pressures continue to be a significant factor for Ball Corporation. For instance, as of May 2024, the US Consumer Price Index (CPI) saw a 3.3% increase year-over-year, indicating persistent cost increases for raw materials and operational expenses.

The Federal Reserve's interest rate policies directly impact Ball's borrowing costs. With the federal funds rate target range remaining elevated in mid-2024, potentially around 5.25%-5.50%, the cost of capital for Ball's capital-intensive projects, such as expanding manufacturing capacity, becomes more expensive.

Higher interest rates can also signal a potential economic slowdown, which could dampen consumer demand for packaged goods, a core market for Ball. If consumers face increased borrowing costs or reduced disposable income, demand for beverages and other products packaged by Ball may soften.

Consumer Disposable Income and Purchasing Power

Consumer disposable income is a critical driver for Ball Corporation, as it directly influences spending on the packaged goods they produce. When consumers have more discretionary income, they tend to increase their purchases of beverages, personal care items, and household products, all of which rely on Ball's packaging solutions. For instance, in 2024, global disposable income is projected to see continued growth, especially in emerging markets, which could translate into higher demand for Ball's products.

Rising purchasing power, particularly in developing economies, presents a significant opportunity for market expansion for Ball. As more consumers in these regions gain access to higher incomes, their consumption patterns shift towards branded goods that often require sophisticated packaging. This trend is supported by data showing a steady increase in per capita disposable income in key Asian markets throughout 2023 and into 2024.

- Global disposable income growth in 2024 is expected to boost consumer spending on packaged goods.

- Emerging markets with rising disposable incomes are key growth areas for Ball Corporation's packaging solutions.

- Increased consumer purchasing power directly correlates with higher demand for beverages and personal care products.

- Ball's financial performance is sensitive to fluctuations in consumer spending habits driven by income levels.

Market Growth in Aluminum Packaging

The global aluminum foil packaging market is poised for significant expansion, fueled by a growing preference for materials that are both lightweight and highly recyclable, offering excellent protective qualities. This trend is a direct economic tailwind for companies like Ball Corporation.

Projections indicate a compound annual growth rate (CAGR) of 4.9% for this market between 2025 and 2035. This robust growth trajectory translates into substantial economic opportunities, particularly for packaging manufacturers leveraging aluminum's inherent advantages.

- Market Expansion: The aluminum foil packaging sector is expected to grow substantially.

- Key Drivers: Demand is driven by lightweight, recyclable, and barrier properties.

- Projected Growth: A CAGR of 4.9% is anticipated from 2025 to 2035.

- Economic Opportunity: This presents a significant economic upside for Ball Corporation.

Economic factors present a mixed outlook for Ball Corporation. While global disposable income growth in 2024, particularly in emerging markets, is expected to boost consumer spending on packaged goods, the company remains sensitive to economic volatility and inflationary pressures.

Aluminum price fluctuations, a key cost component for Ball, continue to pose a risk, despite mitigation efforts like long-term contracts and new facility investments. Higher interest rates, a result of Federal Reserve policy in mid-2024, increase capital costs for expansion and could dampen consumer demand.

The aluminum foil packaging market, however, offers a positive economic tailwind, projected to grow at a 4.9% CAGR between 2025 and 2035, driven by recyclability and protective qualities.

| Economic Factor | Impact on Ball Corporation | Data Point/Projection |

|---|---|---|

| Global Disposable Income Growth | Increased consumer spending on packaged goods | Projected growth in 2024, especially in emerging markets |

| Aluminum Prices | Influence on manufacturing expenses (approx. 40% of production costs) | Trading range of $2,200-$2,400/metric ton in early 2024 |

| Inflation (US CPI) | Increased operational expenses | 3.3% year-over-year increase as of May 2024 |

| Interest Rates (Federal Funds Rate) | Higher borrowing costs for capital-intensive projects | Target range around 5.25%-5.50% in mid-2024 |

| Aluminum Foil Packaging Market Growth | Opportunity for market expansion | Projected 4.9% CAGR from 2025-2035 |

Preview the Actual Deliverable

Ball PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ball PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing a robust strategic overview.

Sociological factors

Consumers are increasingly leaning towards packaging that is kind to the planet, and this is a significant tailwind for Ball Corporation. Their commitment to aluminum, which is infinitely recyclable, perfectly aligns with this growing preference. This shift isn't just a nice-to-have; it directly boosts demand for Ball's core offerings.

This trend is quantifiable. For instance, a 2024 NielsenIQ report indicated that 73% of global consumers are willing to change their consumption habits to reduce their impact on the environment. This directly translates into a stronger market position for Ball, as their sustainable aluminum cans and bottles resonate with a large and growing segment of the population actively seeking greener choices.

Consumers increasingly prioritize convenience, driving demand for ready-to-eat and on-the-go food options. This trend directly benefits Ball Corporation, as its aluminum packaging solutions, like aluminum foil, are ideal for preserving freshness and extending the shelf life of these convenient food products. The global market for convenience foods was valued at approximately $1.1 trillion in 2023 and is projected to grow significantly, underscoring the relevance of Ball's offerings.

Consumers are increasingly prioritizing health and wellness, leading to a greater demand for beverages and foods perceived as healthier. This shift directly impacts packaging needs, with a growing preference for materials that align with these wellness values. Ball's aluminum cans and containers are well-positioned to meet this demand, offering a recyclable and premium packaging solution for a wide array of health-conscious products, from sparkling water to functional beverages.

Social Awareness and Brand Reputation

Ball Corporation's dedication to sustainability and circular economy principles significantly bolsters its brand image, appealing to consumers and investors increasingly focused on environmental, social, and governance (ESG) criteria. This commitment is crucial in a market where corporate social responsibility directly influences purchasing decisions and investment flows.

In 2023, Ball Corporation reported that its customers had used over 100 billion of its aluminum beverage cans, a testament to the growing consumer preference for recyclable packaging. This strong performance in circularity metrics directly translates into a more positive brand perception and a stronger market position.

The emphasis on sustainability not only attracts environmentally conscious consumers but also opens doors to a wider pool of investors. For instance, the global sustainable investing market saw continued growth, with assets under management in ESG funds reaching trillions by late 2024, demonstrating the financial sector's increasing alignment with sustainable business practices.

- Enhanced Brand Loyalty: Consumers increasingly favor brands demonstrating genuine commitment to environmental stewardship, leading to stronger customer loyalty for companies like Ball.

- Investor Attraction: A robust ESG profile, exemplified by Ball's circular economy initiatives, attracts a growing segment of investors prioritizing sustainable and responsible companies.

- Market Differentiation: In a competitive landscape, Ball's leadership in sustainability provides a distinct advantage, setting it apart from competitors and reinforcing its market leadership.

- Regulatory Alignment: Proactive engagement with sustainability goals positions Ball favorably for evolving environmental regulations and policies globally.

Workforce Diversity and Inclusion

Ball Corporation actively promotes a diverse, equitable, and inclusive work environment, strictly prohibiting any form of discrimination. This dedication to social responsibility directly influences employee morale, significantly aids in attracting top talent, and positively shapes the company's overall corporate image. In 2023, Ball reported that 41% of its global workforce identified as female, and 36% identified as belonging to an underrepresented racial or ethnic group, demonstrating a tangible commitment to diversity.

The company's focus on inclusion is not merely a policy but a strategic imperative that enhances innovation and problem-solving. By embracing a wide range of perspectives, Ball fosters a more dynamic and creative workforce. This inclusive approach is increasingly valued by stakeholders, including investors and consumers, who expect companies to demonstrate strong social governance. For instance, a 2024 survey by Deloitte found that 70% of employees believe diversity and inclusion initiatives positively impact their perception of a company's brand.

- Employee Engagement: A diverse and inclusive workplace often leads to higher employee engagement and retention rates.

- Talent Acquisition: Companies known for their DEI efforts are more attractive to a broader pool of skilled candidates.

- Innovation: Varied backgrounds and experiences can spark creativity and lead to more innovative solutions.

- Corporate Reputation: Strong DEI practices enhance a company's public image and brand loyalty.

Sociological factors highlight a significant shift in consumer preferences towards sustainability and health, directly benefiting Ball Corporation's aluminum packaging solutions. The increasing demand for eco-friendly products, coupled with a growing emphasis on convenience and wellness, aligns perfectly with Ball's offerings. This trend is further amplified by a strong societal push for corporate responsibility, influencing both consumer choices and investment decisions.

Technological factors

Ball Corporation is a major player in aluminum packaging, and its commitment to technological innovation is a key driver. In 2023, the company continued to focus on lightweighting initiatives, aiming to reduce the amount of aluminum used per can. This not only lowers material costs but also decreases the carbon footprint associated with transportation.

Furthermore, Ball is actively investing in advanced recycling technologies. These innovations are crucial for increasing the circularity of aluminum packaging, a material that is infinitely recyclable. By enhancing recycling processes, Ball is helping to ensure a more sustainable supply chain for its products, aligning with growing consumer and regulatory demand for environmentally friendly options.

Ball is actively pursuing digital transformation, leveraging big data, AI, and robotic process automation to streamline operations and achieve its sustainability goals. This focus aims to enhance productivity and reduce waste across its manufacturing processes.

In 2024, Ball's investment in information and communication technology (ICT) was substantial, reaching an estimated $801.1 million. This significant expenditure underscores the company's commitment to integrating advanced technologies for improved efficiency and competitive advantage.

Ball Corporation's commitment to advanced materials development is a cornerstone of its strategy for creating next-generation, environmentally friendly packaging solutions. This focus directly supports their ambitious sustainability goals.

A key initiative is enhancing material stewardship, which includes a significant push to increase the recycled content in aluminum cans. By 2030, Ball aims for its aluminum cans to contain an impressive 85% recycled material, a target that underscores their dedication to a circular economy and reducing reliance on virgin resources.

Automation and Manufacturing Processes

Ball Corporation's commitment to automation and advanced manufacturing is a key technological driver. Significant investments in these areas are designed to boost productivity and optimize costs across their worldwide facilities. This strategic focus directly translates into unlocking greater manufacturing efficiencies and maintaining rigorous control over their cost structures, which is crucial for competitiveness in the global packaging market.

For instance, Ball has been actively implementing Industry 4.0 technologies. In 2023, the company reported ongoing progress in its automation initiatives, contributing to improved operational performance. These advancements are not just about speed; they are about precision, waste reduction, and creating a more agile production environment. The company's capital expenditure plans consistently allocate funds towards upgrading and automating its manufacturing lines, reflecting a long-term strategy to leverage technology for sustained efficiency gains.

Ball's technological investments in manufacturing processes are geared towards several key outcomes:

- Enhanced Productivity: Automation streamlines production, leading to higher output per unit of time and labor.

- Cost Optimization: Advanced manufacturing techniques reduce material waste, energy consumption, and labor costs.

- Improved Quality Control: Automated systems offer greater precision, ensuring consistent product quality and fewer defects.

- Supply Chain Agility: Flexible and automated production lines allow for quicker adaptation to market demand shifts and product variations.

Aerospace Technology Advancements

Ball Corporation's historical engagement in aerospace, though concluded with its early 2024 divestiture, showcased its deep involvement with advanced technologies. The company was a key supplier of sophisticated aerospace systems to both commercial entities and government agencies, demonstrating a strong foundation in cutting-edge aerospace engineering and manufacturing.

This exposure meant Ball was at the forefront of developments in areas like satellite technology, spacecraft components, and advanced sensor systems. For instance, in the fiscal year ending December 31, 2023, Ball's aerospace segment contributed significantly to its overall revenue, highlighting the technological prowess embedded within that division before its sale.

- Satellite Systems: Ball developed and manufactured critical components for a wide range of satellites, including those used for Earth observation, communication, and scientific research.

- Spacecraft Manufacturing: The company provided advanced structures, thermal management systems, and optical payloads for numerous space missions.

- Defense Applications: Ball's technology was integral to various defense and intelligence programs, requiring high reliability and performance in demanding environments.

- Innovation in Materials: Their work often involved pioneering the use of advanced materials and manufacturing techniques to meet the stringent requirements of spaceflight.

Ball Corporation's technological strategy heavily emphasizes sustainability and efficiency through advanced manufacturing and digital integration. The company's substantial investment of $801.1 million in information and communication technology (ICT) in 2024 highlights its commitment to leveraging data, AI, and automation to optimize operations and reduce waste.

Ball is also pushing for higher recycled content in its aluminum cans, aiming for 85% by 2030, which necessitates advancements in recycling technologies and material science. These technological pursuits are designed to enhance productivity, control costs, and improve product quality across its global operations.

The company's past involvement in aerospace, which concluded in early 2024, showcased its deep expertise in cutting-edge technologies like satellite systems and advanced sensor development, demonstrating a strong foundation in innovation.

| Technology Focus | Key Initiatives | Impact/Goal |

|---|---|---|

| Advanced Manufacturing & Automation | Industry 4.0 implementation, robotic process automation | Enhanced productivity, cost optimization, improved quality control |

| Digital Transformation | Big data analytics, AI integration | Streamlined operations, sustainability goal achievement |

| Materials Science & Recycling | Lightweighting, advanced recycling technologies | Reduced material usage, increased circularity, higher recycled content (85% by 2030) |

| Information & Communication Technology (ICT) | Significant investment | Estimated $801.1 million in 2024 for efficiency and competitive advantage |

Legal factors

Extended Producer Responsibility (EPR) legislation is increasingly shaping the landscape for companies like Ball Corporation. As of 2024, over 15 U.S. states have implemented or are considering EPR laws specifically for packaging, placing a direct financial and operational burden on manufacturers for post-consumer waste management.

These regulations, such as those in Maine and Oregon, are designed to incentivize producers to design more recyclable packaging and invest in collection and recycling infrastructure. Ball Corporation, as a major beverage packaging producer, faces growing compliance costs and the need to adapt its product lifecycle strategies to meet these evolving legal requirements.

The EU Packaging and Packaging Waste Regulation (PPWR), effective February 2025, mandates significant changes for companies like Ball. It sets ambitious targets for packaging reduction and promotes reuse systems, directly influencing how Ball designs and utilizes its packaging solutions across Europe.

Key provisions include mandates for minimum recycled content in plastic packaging, aiming for 30% recycled content in all plastic packaging by 2030. This will necessitate adjustments in Ball's material sourcing and production processes to meet these new environmental standards.

Recycled content mandates are increasingly shaping the packaging landscape. California, for instance, raised its minimum post-consumer recycled (PCR) content requirement for beverage bottles to 25% as of January 1, 2025. Similarly, New Jersey has enacted legislation to boost the use of recycled materials in packaging.

Trade Tariffs and Import Regulations

Trade tariffs and import regulations significantly impact Ball Corporation's operational costs and strategic decisions. For instance, tariffs on essential imported raw materials such as aluminum directly influence the company's cost of goods sold and necessitate adjustments to its supply chain management.

A notable example is the U.S. tariff on imported aluminum. As of June 2025, this tariff is set at 50%. This legal and economic factor presents a substantial challenge, potentially increasing Ball's raw material expenses and requiring a review of sourcing strategies to mitigate adverse financial effects.

- Tariff Impact: A 50% U.S. tariff on imported aluminum, effective June 2025, directly increases Ball's raw material costs.

- Supply Chain Adjustments: This regulation compels Ball to re-evaluate its global sourcing and logistics to manage expenses.

- Competitive Landscape: Competitors also facing these tariffs may have different abilities to absorb or pass on these increased costs.

Competition Laws and Anti-Trust Regulations

Ball Corporation emphasizes that its supply chain partners must strictly adhere to all relevant competition laws. These regulations are in place to ensure a level playing field and prevent monopolistic behavior.

Key prohibited activities under these laws include agreements among competitors to fix prices, divide markets, or boycott certain suppliers or customers. Such actions undermine fair competition and can lead to significant legal penalties.

- Price Fixing: Agreements between competitors to set prices at a certain level.

- Market Allocation: Competitors dividing territories or customer segments among themselves.

- Bid Rigging: Collusion to manipulate the outcome of competitive bidding processes.

- Abuse of Dominant Position: Exploiting market power to stifle competition.

In 2024, antitrust enforcement globally continued to be robust, with various jurisdictions investigating and penalizing companies for anti-competitive practices, highlighting the ongoing importance of compliance for all businesses, including Ball's partners.

Extended Producer Responsibility (EPR) laws in over 15 U.S. states as of 2024 place financial responsibility on packaging producers like Ball for waste management, driving innovation in recyclable design and collection systems.

The EU's Packaging and Packaging Waste Regulation (PPWR), effective February 2025, mandates packaging reduction and reuse, impacting Ball's product lifecycle strategies with targets like 30% recycled content in plastic packaging by 2030.

Increasingly stringent recycled content mandates, such as California's 25% post-consumer recycled content requirement for beverage bottles by January 1, 2025, necessitate adjustments in Ball's material sourcing and production.

Trade policies, including a 50% U.S. tariff on imported aluminum as of June 2025, directly increase Ball's raw material costs, prompting supply chain re-evaluation and impacting competitive pricing.

Environmental factors

Ball Corporation is significantly advancing its circular economy initiatives, focusing on unlocking aluminum's infinite recyclability. The company aims to boost recycling rates and enhance collection and sorting infrastructure, contributing to a waste-free future.

In 2023, Ball reported that over 75% of its beverage can customers' packaging was made from recycled aluminum, a testament to their commitment. They are actively investing in technologies to further improve the efficiency of aluminum recycling processes globally.

Ball Corporation is actively pursuing significant reductions in its carbon footprint. The company has established science-based targets, committing to an absolute reduction of 55% in its operational greenhouse gas emissions by 2030, using 2019 as its baseline year.

To achieve these goals, Ball is making substantial investments in renewable energy. Currently, over half of its worldwide electricity usage is sourced from renewable resources. Notably, all of Ball's beverage packaging plants in the United States are powered by 100% renewable energy.

Ball Corporation, as a significant manufacturing entity, faces considerable scrutiny regarding its water usage. The company actively manages its water footprint, recognizing its responsibility to minimize environmental impact. For instance, in 2023, Ball reported a 1.7% decrease in its total water withdrawal compared to the previous year, demonstrating a commitment to conservation efforts across its global operations.

Waste Reduction and Recycling Rates

Ball Corporation is making significant strides in waste reduction and recycling. Their commitment to increasing aluminum recycling rates is a core part of their environmental strategy, aiming for a substantial 90% global recycling rate for aluminum beverage cans, bottles, and cups by 2030. This focus is critical because aluminum's infinite recyclability makes it the most valuable material commonly found in recycling streams.

The company's efforts are supported by the inherent value of aluminum. In 2023, the U.S. Environmental Protection Agency (EPA) reported that aluminum cans had a recycling value of approximately $1,315 per ton, significantly higher than other packaging materials like steel or plastic. This economic incentive, coupled with Ball's initiatives, drives higher participation in recycling programs.

Ball's proactive approach includes investments in recycling infrastructure and consumer education campaigns. These efforts are crucial for achieving their ambitious goals. For instance, in 2024, several states have seen increased recycling rates due to expanded deposit return schemes, demonstrating the effectiveness of policy and infrastructure improvements that Ball often advocates for.

- Goal: Achieve a 90% global recycling rate for aluminum packaging by 2030.

- Value Proposition: Aluminum is infinitely recyclable and the most valuable item in the recycling bin.

- Industry Data: In 2023, the EPA noted aluminum cans had a recycling value of roughly $1,315 per ton.

Sustainable Sourcing of Materials

Ball Corporation is actively working to ensure its raw materials are sourced responsibly, a key component of its commitment to environmental stewardship. This focus is integral to their overarching sustainability strategy and their ambitious climate transition plan. For instance, in 2023, Ball reported that 70% of its aluminum was sourced from recycled content, a significant step towards reducing reliance on virgin materials and minimizing the environmental footprint of its production processes.

Their efforts extend to engaging with suppliers to promote sustainable practices throughout the value chain. This includes evaluating suppliers based on environmental performance and ethical standards, aiming to foster a more responsible approach to resource extraction and utilization. Ball's 2023 ESG report highlighted a 10% increase in supplier sustainability assessments compared to the previous year, demonstrating a proactive approach to driving positive change.

The company's commitment to sustainable sourcing is directly linked to its climate goals, aiming to reduce Scope 3 emissions, which are largely influenced by the materials they procure. By prioritizing recycled content and working with suppliers who share their environmental values, Ball is not only mitigating risks but also building a more resilient and sustainable business model for the future.

Ball Corporation is deeply invested in environmental stewardship, focusing on reducing its operational footprint and promoting circularity. The company's commitment to sustainability is evident in its aggressive targets for greenhouse gas emission reductions and its significant investments in renewable energy sources. Furthermore, Ball actively manages its water usage and champions aluminum recycling, recognizing its infinite recyclability and economic value.

Ball's dedication to a circular economy is underscored by its goal of achieving a 90% global recycling rate for aluminum packaging by 2030. This initiative is bolstered by the fact that aluminum cans held a recycling value of approximately $1,315 per ton in 2023, according to the EPA, making them highly attractive for collection and reprocessing. By 2023, over 75% of their beverage can customers' packaging was already made from recycled aluminum, showcasing tangible progress.

The company is also making strides in responsible sourcing, with 70% of its aluminum sourced from recycled content in 2023. This focus on recycled materials directly supports their climate transition plan by aiming to reduce Scope 3 emissions. Ball's proactive engagement with suppliers to enhance environmental performance further solidifies its commitment to a sustainable value chain.

| Environmental Focus | 2023 Data/Target | Impact |

|---|---|---|

| Recycled Aluminum Usage | Over 75% of beverage can packaging | Reduces reliance on virgin materials, lowers carbon footprint |

| Greenhouse Gas Emissions Reduction | Absolute reduction of 55% by 2030 (vs. 2019 baseline) | Mitigates climate change impact |

| Renewable Energy Usage | Over 50% of global electricity sourced from renewables | Decreases carbon intensity of operations |

| Water Withdrawal | 1.7% decrease in total withdrawal (vs. prior year) | Conserves water resources |

| Aluminum Recycling Rate Goal | 90% global rate by 2030 | Maximizes material value, minimizes waste |

PESTLE Analysis Data Sources

Our Ball PESTLE Analysis is built on a robust foundation of data from official government reports, reputable market research firms, and international economic organizations. We meticulously gather information on political stability, economic indicators, technological advancements, and social trends to provide comprehensive insights.