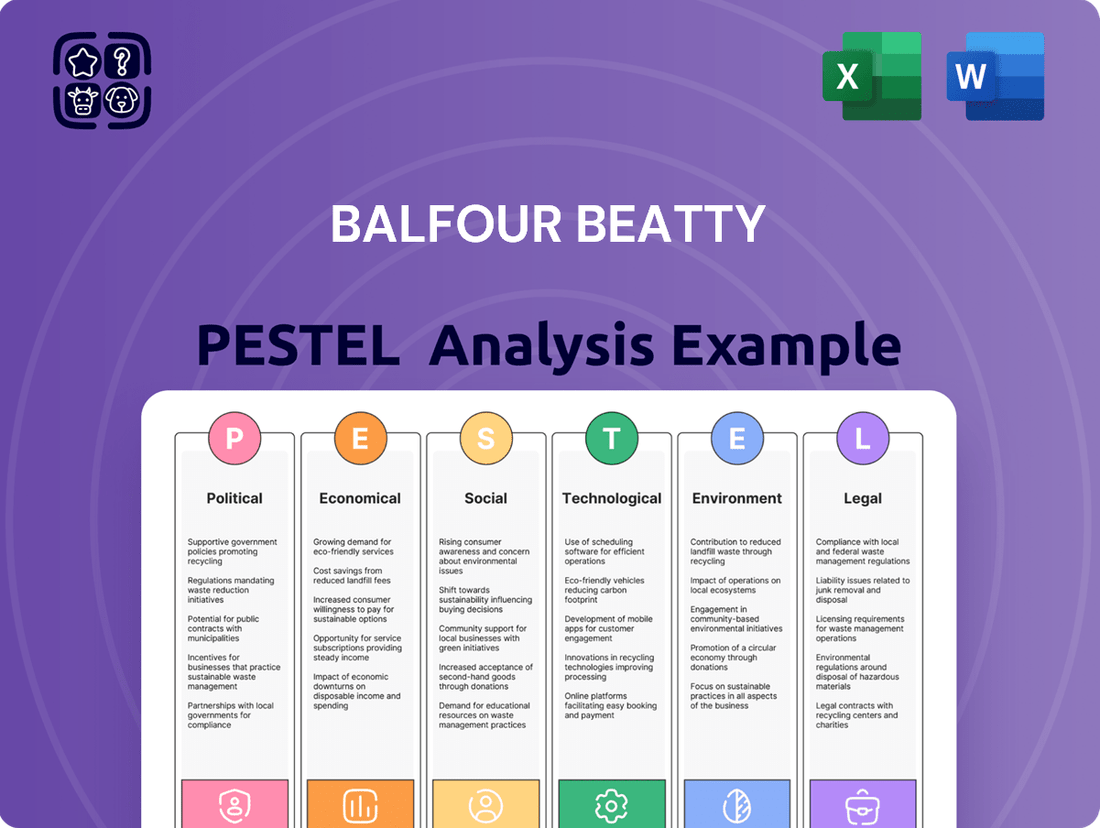

Balfour Beatty PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balfour Beatty Bundle

Navigate the complex external forces shaping Balfour Beatty's trajectory with our expert PESTLE analysis. Understand the intricate interplay of political stability, economic fluctuations, social shifts, technological advancements, environmental regulations, and legal frameworks impacting this construction giant. Gain a strategic advantage by uncovering critical opportunities and potential threats. Download the full PESTLE analysis now to unlock actionable intelligence and refine your own market approach.

Political factors

The UK government's commitment to significant infrastructure investment presents a substantial opportunity for Balfour Beatty. A projected £700-775 billion over the next decade, with £164 billion earmarked for planned investments between 2023 and 2025, signals a robust pipeline of projects across crucial sectors.

This substantial government outlay directly benefits Balfour Beatty, particularly in areas like transport and energy infrastructure. For instance, the £4.8 billion allocated to National Highways for 2025/26 and £2.2 billion for defence infrastructure demonstrate tangible financial commitments that translate into potential contracts and sustained business activity.

The bipartisan Infrastructure Investment and Jobs Act (IIJA) is a significant driver for Balfour Beatty's US operations. The act is set to allocate substantial federal funds to infrastructure development, with projections of $134 billion in 2025 and $136 billion in 2026. This ongoing investment is directly fueling a surge in construction projects nationwide.

This federal commitment has already translated into tangible benefits for the construction industry, supporting over 40,000 infrastructure projects. For Balfour Beatty, this policy has demonstrably boosted its business, evidenced by a notable 26% increase in its US order book during 2024, highlighting the direct impact of the IIJA on company growth.

The Hong Kong SAR government's 2024-25 Budget signals a robust commitment to infrastructure, allocating HK$131.4 billion for public works, a notable 17% increase. This focus prioritizes technological advancement, enhanced safety, and environmental sustainability across key projects.

Significant investments are earmarked for transformative developments like the Northern Metropolis, alongside crucial railway expansion, including the Northern Link Main Line slated for construction commencement in 2025. These projects are designed to bolster connectivity and economic growth.

Furthermore, the administration plans to issue green, sustainable, and infrastructure bonds, totaling HK$50 billion over the next fiscal year. This initiative presents substantial financing avenues and underscores Hong Kong's dedication to green finance principles.

Political Stability and Policy Consistency

Political stability in Balfour Beatty’s core markets, including the UK, US, and Hong Kong, directly shapes the long-term feasibility of major projects and investor sentiment. For example, the UK government's commitment to infrastructure spending, such as the HS2 project, while facing ongoing scrutiny, remains a significant factor. Fluctuations in political leadership or policy direction can create uncertainty for large-scale, multi-year construction ventures.

Consistent government policies are vital for Balfour Beatty’s strategic foresight and its ability to secure future contracts. This includes predictable frameworks for infrastructure investment, evolving environmental standards, and the structure of public-private partnerships. In the US, the Infrastructure Investment and Jobs Act of 2021, with its multi-year funding commitments, provides a more stable outlook for infrastructure projects, a key sector for Balfour Beatty.

- UK Infrastructure Investment: The UK government has allocated significant funds towards infrastructure, with projections showing continued investment in transport and energy networks through the mid-2020s, impacting Balfour Beatty's project pipeline.

- US Infrastructure Spending: The US Bipartisan Infrastructure Law aims to invest hundreds of billions of dollars in roads, bridges, and public transit, directly benefiting companies like Balfour Beatty involved in these sectors.

- Hong Kong Development Plans: Hong Kong’s ongoing urban renewal and transport infrastructure projects, such as the Northern Metropolis development, present opportunities contingent on government planning and execution.

Any significant shifts in political priorities, such as changes in infrastructure spending levels or the introduction of new regulatory burdens, could materially affect Balfour Beatty's project pipeline and overall profitability. For instance, a change in government could lead to a re-evaluation of existing large-scale projects, impacting future revenue streams.

Regulatory Environment and Public Procurement

The regulatory landscape for public procurement significantly shapes Balfour Beatty's opportunities, particularly in securing government contracts. These frameworks dictate tender processes, emphasizing transparency and fairness, which directly influence the company's success rate in winning public sector projects. Adherence to local content mandates and ethical standards are also paramount, impacting project execution and profitability.

In the UK, for instance, the government has been actively reviewing procurement regulations. Initiatives like the Procurement Act 2023, which came into force in October 2024, aim to simplify and modernize public purchasing, potentially creating new avenues for companies like Balfour Beatty. This legislation seeks to reduce administrative burdens and encourage greater competition, while also embedding social value considerations into procurement decisions.

Balfour Beatty's performance in public procurement is also influenced by evolving environmental and social governance (ESG) requirements. Many governments are increasingly incorporating sustainability criteria into tender evaluations. For example, in 2023, the UK government's Procurement Policy Note 01/23 reinforced the importance of net zero carbon emissions targets in public contracts, a factor Balfour Beatty must actively address.

- UK Procurement Act 2023: Introduced in October 2024, aims to streamline public procurement processes.

- Net Zero Targets: UK government policy (Procurement Policy Note 01/23) mandates consideration of carbon emissions in public contracts.

- Social Value: Increasing emphasis on social value outcomes in procurement decisions across various jurisdictions.

Government infrastructure spending remains a critical driver for Balfour Beatty. The UK's commitment to significant infrastructure investment, with £164 billion planned between 2023 and 2025, and the US Infrastructure Investment and Jobs Act (IIJA) injecting substantial federal funds, directly fuels Balfour Beatty's project pipeline. For instance, the IIJA has already supported over 40,000 infrastructure projects, boosting Balfour Beatty's US order book by 26% in 2024.

Political stability and consistent policy frameworks are vital. The UK's HS2 project, despite scrutiny, highlights the impact of government commitment. Similarly, the multi-year funding from the US IIJA provides a more stable outlook for infrastructure projects, a core sector for Balfour Beatty.

Changes in government priorities or regulatory burdens could significantly impact Balfour Beatty's future revenue. The UK's Procurement Act 2023, effective October 2024, aims to simplify public purchasing, while ESG requirements, like the UK's net zero targets in procurement, necessitate strategic adaptation.

| Market | Government Infrastructure Commitment (Approximate) | Key Policy/Legislation | Impact on Balfour Beatty (Recent) |

|---|---|---|---|

| UK | £164 billion (2023-2025 planned investment) | Procurement Act 2023 (Oct 2024), Net Zero targets (PPN 01/23) | Streamlined procurement, focus on sustainability |

| US | $134 billion (2025), $136 billion (2026) federal allocation | Infrastructure Investment and Jobs Act (IIJA) | 26% US order book increase (2024) |

| Hong Kong | HK$131.4 billion (2024-25 Public Works) | Northern Metropolis, Northern Link Main Line (2025 start) | Opportunities in major urban and transport development |

What is included in the product

This Balfour Beatty PESTLE analysis examines the influence of external macro-environmental factors on the company's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into market dynamics, regulatory landscapes, and emerging trends to inform strategic decision-making and identify opportunities for growth.

A concise Balfour Beatty PESTLE analysis summary that highlights key external factors, enabling quick identification of opportunities and threats to inform strategic decision-making and reduce uncertainty.

Economic factors

Balfour Beatty faces ongoing inflationary pressures, especially concerning raw materials like concrete and steel, alongside increasing labor expenses. These factors directly challenge project profitability. To counter this, the company must implement strong cost management and utilize contractual clauses for mitigation.

Despite these headwinds, Balfour Beatty demonstrated resilience, achieving a 4% revenue increase to £10 billion in 2024. The company also anticipates earnings growth for 2024, maintaining an optimistic financial outlook extending into 2025 and 2026.

Interest rate fluctuations directly influence the cost of capital for Balfour Beatty's extensive infrastructure projects. Higher rates increase borrowing expenses, potentially making large-scale developments less financially viable and impacting the company's overall investment strategy.

Maintaining access to competitive financing and the ability to issue bonds are crucial for Balfour Beatty to fund its pipeline of new projects. The company's robust financial health, evidenced by an average net cash position of £766 million in 2024, underpins its capacity to secure favorable financing terms and pursue growth opportunities.

The overall economic health and anticipated growth rates in key markets like the UK, US, and Hong Kong are crucial drivers for the construction sector. Strong economic performance typically translates to increased demand for new infrastructure projects, benefiting companies like Balfour Beatty.

In the UK, infrastructure output is forecast to expand by 2.6% in 2025, with a substantial 18% increase anticipated over the next five years, signaling robust opportunities. The US construction industry is also experiencing a boost, largely due to significant federal investments in infrastructure development, creating a favorable environment for growth.

Hong Kong's construction market is projected to grow by 0.7% in 2025. This growth is primarily fueled by ongoing investments in vital transport and housing projects, indicating a steady but targeted expansion in its construction activities.

Exchange Rate Volatility

Balfour Beatty, as a global entity with significant operations in the UK, US, and Hong Kong, faces considerable exposure to exchange rate volatility. Fluctuations between the Pound Sterling (GBP), US Dollar (USD), and Hong Kong Dollar (HKD) directly affect the company's reported financial performance. For instance, if the USD strengthens against the GBP, US-based earnings translate into more Pounds, boosting reported revenue. Conversely, a weakening USD would have the opposite effect.

The financial impact of these currency movements can be substantial. In its 2023 annual report, Balfour Beatty noted the potential for significant translation differences. While specific figures for exchange rate impact are often embedded within broader financial disclosures, the company's reliance on international markets means that even moderate currency shifts can influence its consolidated profit and loss statements. For example, a 5% adverse movement in key exchange rates could potentially impact pre-tax profit by millions of pounds.

To mitigate these risks, Balfour Beatty employs various financial instruments and strategies. These hedging activities aim to lock in exchange rates for future transactions, thereby providing greater certainty over the value of foreign earnings when repatriated. Effective currency risk management is crucial for maintaining financial stability and ensuring that operational successes in different regions are not eroded by adverse currency market movements.

- Exposure: Balfour Beatty operates in the UK, US, and Hong Kong, making it susceptible to GBP, USD, and HKD exchange rate fluctuations.

- Impact: Currency movements can significantly alter reported revenues and profits when foreign earnings are converted to the reporting currency (GBP).

- 2023 Data Context: While specific exchange rate impacts are complex, the company's international footprint means currency translation differences are a constant consideration in financial reporting.

- Mitigation: The company actively manages currency risk through hedging strategies to protect its financial stability.

Public and Private Investment Balance

The interplay between public and private investment in infrastructure significantly shapes the economic landscape. Government investment offers a predictable foundation, but private capital injects dynamism and novel approaches. Balfour Beatty's strategic positioning, which encompasses both traditional public projects and private finance initiatives (PFIs) and public-private partnerships (PPPs), enables it to capitalize on these distinct funding streams.

For instance, in the UK, infrastructure investment has seen a notable shift. While government budgets remain crucial, the 2024-2025 period saw continued emphasis on attracting private finance to meet ambitious infrastructure goals. The National Infrastructure Strategy, updated in 2024, highlighted the government's intention to de-risk projects to encourage private sector participation, aiming to unlock billions in private capital for key sectors like transport and energy.

- UK Government Infrastructure Investment: The UK government committed £650 billion in infrastructure investment over the next decade as part of its 2024 Autumn Statement, with a significant portion intended to be delivered through private sector partnerships.

- Private Sector Infrastructure Funding: By 2025, it's projected that private finance will account for over 50% of total infrastructure investment in key developed economies, driven by the need to bridge funding gaps and foster innovation.

- Balfour Beatty's PFI/PPP Portfolio: Balfour Beatty's involvement in numerous PFI and PPP projects across the UK and internationally provides it with a steady revenue stream and access to private capital, diversifying its reliance on direct government funding.

Inflationary pressures, particularly on materials and labor, are a significant economic challenge, impacting profitability. However, Balfour Beatty's 2024 revenue reached £10 billion, a 4% increase, with anticipated earnings growth into 2025, demonstrating financial resilience. Interest rate hikes increase capital costs, potentially affecting large project viability, underscoring the importance of Balfour Beatty's £766 million average net cash position in 2024 for securing favorable financing.

The economic outlook in key markets like the UK and US presents growth opportunities. The UK infrastructure output is projected to grow by 2.6% in 2025 and 18% over five years, boosted by government investment and private partnerships. The US construction sector also benefits from federal infrastructure spending, creating a positive environment for Balfour Beatty's expansion.

Same Document Delivered

Balfour Beatty PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Balfour Beatty PESTLE analysis provides a comprehensive overview of the external factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape relevant to Balfour Beatty.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed analysis is crucial for understanding potential opportunities and threats facing Balfour Beatty in the global market.

Sociological factors

The construction sector, including Balfour Beatty's operations in the UK and US, faces a significant challenge with an aging workforce and a continuing skills gap. This demographic trend means fewer experienced workers are available, exacerbating the need for new talent.

Demand for specialized skills, especially in areas like renewable energy infrastructure and digital construction technologies, is outstripping supply. For instance, in the UK, the Office for National Statistics reported in late 2023 that the construction sector continues to experience high vacancy rates, particularly for skilled trades.

Balfour Beatty must therefore implement robust strategies for attracting, training, and retaining skilled personnel. This includes investing in apprenticeship programs and upskilling existing employees to meet the evolving demands of modern construction projects, which is vital for maintaining project timelines and operational efficiency.

Public and regulatory expectations for health and safety in construction are exceptionally high, especially for major infrastructure projects. Balfour Beatty prioritizes a world-class safety record, aiming to protect its employees and reduce accidents. In 2023, Balfour Beatty reported a Lost Time Injury Frequency Rate (LTIFR) of 0.17, demonstrating a strong commitment to worker well-being.

A robust safety culture directly impacts employee morale and minimizes operational disruptions. This focus not only safeguards personnel but also enhances the company's reputation and operational efficiency, contributing to a more stable business environment.

Balfour Beatty actively engages with communities, aiming to create lasting social value. This commitment extends beyond just building projects; it's about leaving a positive mark.

The company has already exceeded its initial goal, generating over £3 billion in social value in the UK by 2025. Looking ahead, they've set an ambitious target of £6 billion by 2030, demonstrating a strong focus on community impact.

This social value creation is achieved through various initiatives, including boosting employment opportunities, supporting local businesses, engaging with educational institutions, and encouraging employee volunteering. These efforts directly benefit the areas where Balfour Beatty operates.

Diversity, Equity, and Inclusion (DE&I)

Balfour Beatty recognizes that building a diverse, equitable, and inclusive (DE&I) workforce is paramount for attracting and retaining top talent, especially in a sector that has historically seen limited representation from various groups. Their commitment is to create an environment where everyone feels valued and can thrive.

This focus on DE&I is directly linked to their sustainability goals. For instance, Balfour Beatty has set ambitious targets for the UK by 2030:

- Increase the percentage of female colleagues by 50%.

- Boost the representation of minority ethnic and Black colleagues by 60%.

Achieving these targets is not just about social responsibility; it's a strategic imperative that enhances innovation and problem-solving by bringing a wider range of perspectives to projects. In 2023, Balfour Beatty reported that 27.9% of their UK workforce were women, and they are actively working to close the remaining gap.

Public Perception and Reputation

Balfour Beatty's reputation is a critical asset, shaped by its track record in project execution, commitment to ethical conduct, and active engagement in social initiatives. A strong public image is foundational for winning new business, fostering confidence among investors and partners, and attracting skilled professionals. For instance, in 2023, Balfour Beatty reported a strong safety performance with a Group Lost Time Injury Frequency Rate (LTIFR) of 0.14, demonstrating a commitment to responsible operations that positively influences public perception.

Negative publicity stemming from past legal challenges or safety lapses can significantly erode public trust. The company's proactive approach to corporate responsibility, including its focus on sustainability and community engagement, is therefore paramount. Balfour Beatty's 2023 Sustainability Report highlighted a £1.2 billion positive impact on UK society through its operations and supply chain, underscoring efforts to build and maintain a favorable reputation.

- Project Delivery: Consistent on-time and on-budget project completion is key to building a positive reputation.

- Ethical Practices: Adherence to high ethical standards and transparency in business dealings are crucial for stakeholder trust.

- Social Contributions: Community investment and social value creation, such as Balfour Beatty's 2023 commitment to creating 5,000 apprenticeships and jobs, enhance public perception.

- Risk Mitigation: Addressing past legal issues and maintaining rigorous safety standards, evidenced by their low LTIFR, are vital for preserving public confidence.

Balfour Beatty faces a critical need to address the aging workforce and skills gap within the construction sector. To combat this, the company is investing heavily in training and development, aiming to attract and retain a skilled workforce. For example, in 2023, they reported a Group Lost Time Injury Frequency Rate (LTIFR) of 0.14, highlighting their commitment to safety and a positive working environment.

The company's dedication to social value is substantial, having already surpassed its initial £3 billion UK target by 2025 and aiming for £6 billion by 2030. This commitment is demonstrated through job creation and community support initiatives.

Furthermore, Balfour Beatty is prioritizing diversity, equity, and inclusion (DE&I) to enhance innovation and talent acquisition. Their 2030 targets include a 50% increase in female colleagues and a 60% boost in representation for minority ethnic and Black colleagues in the UK, with 27.9% of their UK workforce being women in 2023.

| Sociological Factor | Balfour Beatty's Approach/Data (2023/2024/2025 Focus) |

|---|---|

| Workforce Demographics & Skills Gap | Addressing aging workforce and skills shortage through robust training programs. |

| Health & Safety Expectations | Prioritizing world-class safety, reporting a Group LTIFR of 0.14 in 2023. |

| Social Value Creation | Exceeded £3bn UK social value by 2025, targeting £6bn by 2030. |

| Diversity, Equity & Inclusion (DE&I) | Targets for UK by 2030: +50% female colleagues, +60% minority ethnic/Black colleagues. 27.9% UK workforce female in 2023. |

Technological factors

The construction industry is rapidly embracing digital tools, with Building Information Modelling (BIM) becoming a cornerstone for enhancing project lifecycles. This shift is driven by the need for greater efficiency and accuracy in design, planning, and execution.

Balfour Beatty is actively integrating a digital-first strategy, utilizing advanced technologies like AI and data lakes to improve safety and productivity. For instance, their investment in digital solutions aims to reduce project errors and boost overall project delivery assurance.

In 2023, Balfour Beatty reported significant progress in its digital transformation, with over 90% of its projects utilizing BIM. This digital adoption is key to their strategy of delivering better project outcomes and maintaining a competitive edge in the evolving construction landscape.

Balfour Beatty is actively embracing industrialized construction and offsite manufacturing, with a target to reduce onsite construction by 25% by 2025. This strategic shift leverages modular building techniques and offsite fabrication to boost safety, productivity, and overall quality.

This commitment aligns with broader government objectives focused on delivering projects with lower costs, reduced environmental impact through fewer emissions, and accelerated timelines. For instance, the UK government's Construction Playbook strongly advocates for these modern methods of construction.

Balfour Beatty is increasingly leveraging Artificial Intelligence (AI) and data analytics to enhance its operations. This technology is crucial for optimizing project delivery, anticipating maintenance needs, and better managing potential risks. For instance, by the end of 2024, Balfour Beatty aims to have over 200 data scientists and engineers actively working on its digital transformation initiatives, with a focus on integrating AI into core business processes.

The company's digital strategy heavily relies on data lakes and AI-driven insights to boost efficiency and support smarter decision-making across its diverse projects. This strategic adoption is expected to yield significant improvements in areas like resource allocation and site safety. In 2023, Balfour Beatty reported a 15% reduction in project delays attributed to improved data-driven planning and predictive analytics.

Advanced Materials and Sustainable Technologies

Innovation in advanced materials and sustainable construction is paramount for achieving environmental goals and enhancing project durability. This involves investigating low-carbon options, energy-efficient systems, and intelligent infrastructure. Balfour Beatty's commitment to energy efficiency in U.S. military housing projects, for instance, highlights this focus.

The drive towards sustainability is reshaping the construction industry. Companies are increasingly adopting materials with lower embodied carbon and implementing technologies that reduce operational energy consumption. This trend is supported by growing regulatory pressure and client demand for greener building practices.

- Balfour Beatty’s investment in energy efficiency upgrades for U.S. military housing aims to reduce carbon footprints and operational costs.

- The company is exploring low-carbon concrete and recycled materials to decrease the environmental impact of its projects.

- Smart infrastructure solutions, such as sensor-integrated roads and bridges, are being developed to improve maintenance and extend asset life.

- The global green building materials market is projected to reach significant growth, driven by sustainability initiatives and technological advancements.

Cybersecurity and Data Protection

As construction projects increasingly rely on digital technologies, Balfour Beatty faces growing cybersecurity risks. The potential for cyber threats and data breaches is a significant concern, impacting project continuity and sensitive information. In 2024, the global cybersecurity market is projected to reach over $232 billion, highlighting the scale of investment and the pervasive nature of these threats.

Robust cybersecurity and data protection are therefore paramount for Balfour Beatty. These measures are crucial for safeguarding intellectual property, client data, and the operational integrity of its infrastructure projects. Failing to protect against these threats could lead to substantial financial losses and reputational damage, a growing worry for major infrastructure firms.

- Increased Digitalization: Construction projects are becoming more reliant on digital tools, from BIM to IoT devices, expanding the attack surface for cyber threats.

- Data Breach Costs: The average cost of a data breach in the infrastructure sector can be substantial, impacting profitability and investor confidence.

- Regulatory Compliance: Stricter data protection regulations, such as GDPR and similar frameworks globally, necessitate significant investment in cybersecurity infrastructure.

- Operational Resilience: Protecting against cyberattacks is vital for maintaining operational continuity, especially for critical infrastructure projects managed by Balfour Beatty.

Technological advancements are fundamentally reshaping construction, with Balfour Beatty prioritizing digital integration. The company's commitment to a digital-first approach, including extensive use of BIM, saw over 90% of its projects utilizing it in 2023, driving efficiency and accuracy.

Balfour Beatty is leveraging AI and data analytics to optimize operations, aiming for over 200 data scientists and engineers by the end of 2024 to enhance decision-making and risk management.

The company is also exploring advanced materials and smart infrastructure solutions to improve sustainability and asset longevity, aligning with global green building trends.

However, increased digitalization introduces significant cybersecurity risks, necessitating robust protection measures for data and operational integrity, a growing concern in the sector with the global cybersecurity market projected to exceed $232 billion in 2024.

Legal factors

Following the Grenfell Tower tragedy, the UK has seen a substantial tightening of building safety regulations, placing increased obligations on construction firms like Balfour Beatty. This regulatory shift directly impacts how projects are managed and executed, demanding rigorous adherence to new standards.

Balfour Beatty has acknowledged these changes, making specific provisions in its financial statements to address the requirements of the UK Building Safety Act. For instance, in its 2023 annual report, the company detailed its ongoing commitment to ensuring compliance with these updated safety frameworks.

Strict adherence to these evolving building safety regulations is paramount for Balfour Beatty. Failure to comply can result in significant financial penalties, legal challenges, and severe damage to the company's reputation, impacting its ability to secure future contracts.

Balfour Beatty must navigate a complex web of environmental laws, covering everything from carbon emissions and waste disposal to protecting biodiversity. Meeting these regulations is crucial for avoiding hefty fines and potential legal battles. The company has committed to ambitious net-zero targets, aiming for Scope 1 and 2 emissions to be net-zero by 2045, and Scope 3 by 2050.

Furthermore, Balfour Beatty is actively working towards the UK's goal of halting nature loss by 2030, demonstrating a commitment to broader environmental stewardship. Failure to comply with these evolving legal frameworks could result in significant financial penalties and reputational damage, impacting project viability and investor confidence.

Balfour Beatty must strictly adhere to labor laws governing fair wages, safe working conditions, and fundamental employment rights across all its operational geographies. This commitment extends to evolving regulations concerning diversity, equity, and inclusion (DE&I), a key pillar of the company's sustainability framework. For instance, in the UK, the National Living Wage increased to £11.44 per hour in April 2024, a benchmark Balfour Beatty would need to meet or exceed.

Compliance with these multifaceted labor regulations is not merely a legal obligation but a strategic imperative. It effectively mitigates potential legal challenges and reputational damage, while simultaneously fostering a positive and productive work environment that attracts and retains talent. Failure to comply can result in significant fines and operational disruptions, impacting project timelines and profitability.

Contract Law and Dispute Resolution

The legal landscape surrounding construction contracts and how disputes are handled is absolutely critical for Balfour Beatty. Having solid contracts in place, clear processes for resolving disagreements, and following established legal rulings are key to managing the risks involved in their projects and making sure things are fair.

For instance, Balfour Beatty reported in their 2024 financial results that delays on a few of their civil engineering projects in the United States had a negative effect on their profits. This situation underscores just how vital it is to have strong contractual agreements that anticipate and address potential issues.

- Contractual Clarity: Ensuring all project contracts, from client agreements to subcontractor terms, are meticulously drafted to cover scope, timelines, payment, and risk allocation is paramount.

- Dispute Resolution Clauses: The inclusion of well-defined arbitration, mediation, or litigation clauses within contracts provides clear pathways for resolving inevitable project disputes, aiming for timely and cost-effective solutions.

- Adherence to Precedents: Staying current with and applying legal precedents in construction law, particularly concerning contract interpretation and liability, helps Balfour Beatty navigate complex legal challenges and mitigate potential litigation costs.

Anti-Bribery and Corruption Laws

Operating globally, Balfour Beatty faces significant legal hurdles, particularly concerning anti-bribery and corruption. The UK Bribery Act and the US Foreign Corrupt Practices Act (FCPA) are critical pieces of legislation that demand strict adherence. These laws impose severe penalties for engaging in corrupt practices, impacting companies operating in over 100 countries.

To navigate this complex legal landscape, Balfour Beatty must maintain exceptionally strong internal controls and clear ethical guidelines. This proactive approach is essential to prevent any involvement in corrupt practices and ensure full compliance with the ever-evolving global anti-corruption legislation. Failure to comply can lead to substantial fines and reputational damage, as seen in various high-profile cases involving infrastructure firms in recent years.

- UK Bribery Act: Prohibits bribery of public and private individuals.

- US Foreign Corrupt Practices Act (FCPA): Targets bribery of foreign officials and requires accurate accounting.

- Global Enforcement: Increased scrutiny and enforcement actions worldwide, with significant penalties for violations.

- Compliance Programs: Essential for demonstrating due diligence and mitigating legal risks.

Balfour Beatty's operations are heavily influenced by evolving building safety regulations, particularly in the UK following events like the Grenfell Tower tragedy. The company's 2023 annual report highlights its commitment to complying with the UK Building Safety Act, demonstrating proactive measures to meet new standards and avoid penalties.

Furthermore, stringent labor laws, including minimum wage requirements like the UK's National Living Wage increase to £11.44 per hour in April 2024, necessitate careful management of employee compensation and rights. Adherence to these legal frameworks is crucial for mitigating risks and fostering a positive work environment.

Navigating complex construction contract law and dispute resolution mechanisms is vital, as evidenced by Balfour Beatty's 2024 financial report noting project delays impacting profitability. Robust contractual clarity and effective dispute resolution clauses are essential for managing project risks and ensuring fair outcomes.

The company also faces significant legal scrutiny regarding anti-bribery and corruption laws, such as the UK Bribery Act and the US FCPA, which impact operations in over 100 countries. Maintaining strong internal controls and ethical guidelines is paramount to ensure compliance and avoid severe penalties.

| Legal Area | Key Legislation/Regulation | Impact on Balfour Beatty | Compliance Measures |

|---|---|---|---|

| Building Safety | UK Building Safety Act | Increased project management and execution standards; potential penalties for non-compliance. | Financial provisions for compliance; adherence to new safety frameworks. |

| Labor Laws | UK National Living Wage (£11.44/hr from April 2024) | Ensuring fair wages and safe working conditions; attracting and retaining talent. | Meeting or exceeding minimum wage benchmarks; commitment to DE&I. |

| Contract Law | Construction contract precedents | Managing project risks and disputes; impact of delays on profitability. | Meticulous contract drafting; inclusion of dispute resolution clauses. |

| Anti-Bribery & Corruption | UK Bribery Act, US FCPA | Severe penalties for corrupt practices; global compliance requirements. | Strong internal controls; clear ethical guidelines; proactive prevention. |

Environmental factors

Balfour Beatty is actively addressing climate change by setting ambitious, science-backed targets. They aim to cut Scope 1 and 2 greenhouse gas emissions by 42% by 2030 and reach net-zero by 2045, with a Scope 3 net-zero goal for 2050, as validated by the Science Based Targets initiative (SBTi).

These commitments translate into tangible actions, focusing on reducing carbon emissions throughout their direct operations and extending to their extensive supply chain. This dual approach ensures a comprehensive strategy for environmental stewardship.

Balfour Beatty is actively expanding its sustainability efforts to become nature positive, aiming to halt nature loss in the UK by 2025 and fully integrate nature positive principles by 2050. This commitment means their projects will focus on safeguarding and improving natural environments, habitats, and wildlife.

Balfour Beatty is actively pursuing resource efficiency, setting ambitious goals to significantly reduce waste. Their UK operations aim to eliminate non-hazardous excavation waste sent to landfill by 2030, a crucial step towards environmental responsibility. Furthermore, the company targets zero avoidable waste in the UK by 2040 and in the US by 2050, demonstrating a long-term commitment to sustainability.

Sustainable Supply Chain Management

Balfour Beatty recognizes that a sustainable supply chain is crucial for environmental responsibility. This involves ensuring the integrity of their supply chain and actively promoting sustainable procurement practices.

A key objective for Balfour Beatty is to achieve a 25% reduction in Scope 3 carbon emissions originating from purchased goods and services by the year 2030. This ambitious target underscores their commitment to minimizing their environmental footprint across the entire value chain.

The company prioritizes local spending, which not only supports regional economies but also often leads to reduced transportation emissions. Furthermore, Balfour Beatty collaborates closely with its supply chain partners to ensure the responsible sourcing of materials and to drive down emissions throughout the entire lifecycle of their projects.

- Target: 25% reduction in Scope 3 carbon emissions from purchased goods and services by 2030.

- Strategy: Prioritizing local spend to reduce transportation-related emissions.

- Collaboration: Working with supply chain partners on responsible sourcing and emission reduction initiatives.

Water Management and Pollution Prevention

Balfour Beatty places significant emphasis on water management and pollution prevention, particularly on its extensive construction projects. This commitment involves carefully controlling water usage, ensuring no contamination of nearby water bodies, and actively managing runoff and sediment to protect local ecosystems. For instance, in 2023, the company reported a continued focus on reducing its environmental impact, with water management being a key area of operational oversight.

The company's internal 'What3Things for Environment' framework is instrumental in this regard. It serves to heighten employee awareness regarding environmental responsibilities and provides a clear structure for mitigating potential risks associated with water usage and pollution. This proactive approach aims to ensure compliance with stringent environmental regulations and to foster sustainable practices across all its operations.

Key actions and considerations include:

- Minimizing water consumption through efficient practices and technology on-site.

- Preventing contamination of groundwater and surface water by implementing robust containment measures for chemicals and waste.

- Controlling sediment runoff using techniques like silt fences and settlement ponds to protect aquatic environments.

- Adhering to and exceeding regulatory standards for wastewater discharge and site drainage.

Balfour Beatty is deeply committed to environmental stewardship, setting ambitious targets for emission reductions and nature positivity. The company aims for a 42% cut in Scope 1 and 2 greenhouse gas emissions by 2030 and net-zero by 2045, with a Scope 3 goal for 2050, all validated by the Science Based Targets initiative (SBTi).

Resource efficiency is a core focus, with plans to eliminate non-hazardous excavation waste from UK landfills by 2030 and achieve zero avoidable waste in the UK by 2040 and the US by 2050.

Water management and pollution prevention are critical, with initiatives to minimize consumption and prevent contamination of water bodies, supported by their internal 'What3Things for Environment' framework.

| Environmental Target | Year | Status/Metric |

|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 2030 | 42% reduction |

| Net-Zero GHG Emissions | 2045 | Target |

| Scope 3 GHG Emissions Reduction (Purchased Goods & Services) | 2030 | 25% reduction |

| Eliminate Non-Hazardous Excavation Waste to Landfill (UK) | 2030 | Target |

| Achieve Nature Positive (UK) | 2025 | Halt nature loss |

PESTLE Analysis Data Sources

Our PESTLE analysis for Balfour Beatty is informed by a comprehensive review of official government publications, industry-specific reports, and reputable economic data providers. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the company.