Balfour Beatty Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balfour Beatty Bundle

Balfour Beatty navigates a competitive landscape shaped by powerful buyer bargaining, the constant threat of new entrants, and the intense rivalry among existing players. Understanding these forces is crucial for strategic planning in the infrastructure sector.

The full Porter's Five Forces Analysis reveals the real forces shaping Balfour Beatty’s industry—from supplier influence to the threat of substitute products. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Balfour Beatty, a global infrastructure leader, relies heavily on its supply chain, with two-thirds of its revenue directed towards procurement. For standard construction materials such as concrete, steel, and aggregates, the supplier market is often fragmented. This fragmentation allows Balfour Beatty to leverage its significant purchasing volume and easily switch between numerous suppliers, thereby exerting considerable bargaining power.

Suppliers of specialized equipment and advanced technologies hold significant sway. For instance, providers of cutting-edge AI, Building Information Modeling (BIM) software, and unique engineering components often have fewer competitors, granting them greater bargaining power. Balfour Beatty's strategic shift towards digital-first and sustainable practices amplifies its dependence on these innovative suppliers.

The construction sector, including companies like Balfour Beatty, has grappled with escalating material expenses, particularly for steel and timber. These increases, sometimes ranging from 15% to 25% for specific materials, are partly attributed to global supply chain disruptions and trade policies.

This persistent cost pressure grants suppliers considerable leverage. They are in a stronger position to dictate higher prices, which directly squeezes profit margins on Balfour Beatty's ongoing and future projects. Effective risk management through advanced procurement methods is therefore crucial.

Skilled Labour Shortages

The construction sector, including major players like Balfour Beatty, is grappling with a persistent shortage of skilled labor. This scarcity, affecting roles from engineers to specialized trades, significantly bolsters the bargaining power of the available workforce. For instance, in the UK, the Office for National Statistics reported a 13% decrease in the number of construction apprenticeships started in the year ending March 2024 compared to the previous year, highlighting the ongoing talent pipeline challenge.

This situation directly translates into higher labor costs for companies and the potential for project delays. Balfour Beatty, like its peers, must therefore prioritize substantial investment in talent development and retention strategies to secure the essential expertise needed to deliver projects. Failing to do so risks impacting project timelines and profitability.

- Skilled Labor Scarcity: Persistent shortages in engineers, project managers, and specialized trades grant significant leverage to the workforce.

- Cost Implications: This scarcity drives up labor costs, directly impacting project budgets and company profitability.

- Project Delays: The lack of available skilled personnel can lead to significant delays in project completion schedules.

- Strategic Investment: Companies like Balfour Beatty must invest heavily in talent acquisition, training, and retention to mitigate these risks.

Balfour Beatty's Proactive Supply Chain Management

Balfour Beatty actively manages its supply chain, striving to be a preferred customer through a robust procurement strategy that emphasizes ethical and sustainable practices. This approach aims to mitigate the bargaining power of suppliers by fostering strong, collaborative relationships and ensuring timely payments, encouraging loyalty and potentially securing more favorable terms.

Their strategy involves early integration with key partners, allowing for better planning and alignment, which can reduce the suppliers' ability to dictate terms. By being a reliable and attractive client, Balfour Beatty can secure competitive pricing and consistent supply, thereby lessening the impact of individual supplier leverage.

- Proactive Procurement Strategy: Balfour Beatty's focus on being a 'customer of choice' through ethical and sustainable sourcing directly counters supplier power.

- Collaborative Relationships: Early integration and prompt payments are key tactics to build loyalty and reduce supplier leverage, as seen in their supply chain partnerships.

- Mitigation Tactics: By fostering strong supplier relationships, Balfour Beatty aims to secure favorable terms and ensure supply chain stability, thereby lowering the bargaining power of individual suppliers.

Suppliers of specialized equipment and advanced technologies, such as BIM software providers, hold significant sway due to limited competition, amplifying their bargaining power. Balfour Beatty's increasing reliance on digital solutions means these suppliers are critical, allowing them to command higher prices or influence terms. The company's strategic focus on innovation necessitates careful management of these relationships to avoid being overly dependent.

| Supplier Type | Balfour Beatty's Leverage | Supplier Bargaining Power | Impact on Balfour Beatty |

|---|---|---|---|

| Standard Materials (Concrete, Steel) | High (Fragmented Market, Large Volume) | Low to Moderate | Price sensitivity, ability to switch suppliers |

| Specialized Equipment/Tech (BIM Software) | Moderate (Strategic Importance) | High (Limited Competition) | Higher costs, potential for dictated terms |

| Skilled Labor | Low (Labor Shortages) | High (Scarcity) | Increased labor costs, project delays |

What is included in the product

Analyzes the competitive intensity within the construction and infrastructure sectors, assessing threats from new entrants, substitute services, buyer and supplier power, and rival firms relevant to Balfour Beatty's operations.

Effortlessly identify and mitigate competitive threats with a visual, actionable breakdown of industry pressures.

Customers Bargaining Power

Balfour Beatty's strategic emphasis on large-scale infrastructure, especially within the public sector encompassing transportation, power, water, defense, and social infrastructure, naturally positions them with highly influential clients. These customers are typically government entities or major private developers, possessing substantial financial resources and demanding meticulous specifications.

The sheer scale of these projects, often involving billions of pounds in investment, grants these customers considerable leverage. For instance, major transportation projects, like HS2 in the UK where Balfour Beatty is a key contractor, involve government funding and oversight, allowing for significant negotiation power on pricing and contractual terms.

These powerful clients can dictate stringent requirements and timelines, directly impacting Balfour Beatty's operational flexibility and profit margins. Their ability to bundle services or award future contracts also serves as a significant bargaining chip, influencing Balfour Beatty's willingness to concede on terms.

For Balfour Beatty, customers in infrastructure development typically engage in infrequent but extremely high-value purchases. This means each project is a substantial financial commitment, giving these customers significant leverage. For instance, a major infrastructure project, like a new high-speed rail line or a large-scale renewable energy facility, can run into billions of pounds, making the customer's decision critical.

This inherent nature of the market allows customers to exert considerable bargaining power. They often solicit competitive bids from multiple contractors, including Balfour Beatty, and engage in rigorous negotiations. These discussions frequently incorporate stringent performance guarantees and detailed risk-sharing agreements, ensuring the contractor bears a significant portion of any project-related uncertainties.

The bargaining power of customers in the infrastructure sector is significantly influenced by the unique nature of each project. Because infrastructure development demands highly specific, customized solutions, clients can leverage this by dictating terms related to technology adoption, environmental standards, and innovative methodologies. Balfour Beatty, like its peers, must adapt to these bespoke client requirements to win and retain business, demonstrating the substantial leverage customers hold in this specialized market.

Governmental Influence and Regulatory Frameworks

Governmental influence significantly shapes the bargaining power of customers in the infrastructure sector, a key area for Balfour Beatty. Many projects are tied to public funding, making government policies and budget allocations direct drivers of demand and project scope. For instance, in 2024, governments worldwide continued to prioritize infrastructure investment to stimulate economic growth, but also imposed stricter requirements for social value and sustainability, enhancing customer leverage.

Regulatory frameworks further empower customers by dictating project standards, procurement processes, and performance metrics. This increased scrutiny can lead to greater emphasis on cost-effectiveness and demonstrable social impact, giving clients more room to negotiate terms and conditions. Balfour Beatty, like its peers, must navigate these evolving regulations, which can influence project pipelines and profitability.

- Government Spending on Infrastructure: In 2024, global infrastructure spending was projected to reach trillions, with a substantial portion directed by public entities.

- Regulatory Compliance Costs: Increased environmental and social governance regulations can add to project costs, providing customers with grounds for cost-related negotiations.

- Public Procurement Reforms: Many governments are reforming procurement to favor value over lowest cost, allowing public bodies to exert greater influence on project outcomes and supplier selection.

- Focus on Social Value: The growing emphasis on social value in public projects means that customers can leverage these requirements to negotiate better terms, demanding more than just traditional construction services.

Selective Bidding Strategy of Balfour Beatty

Balfour Beatty's selective bidding strategy directly impacts the bargaining power of their customers. By choosing projects carefully, they aim to mitigate the pressure from customers seeking lower prices or more favorable terms, particularly on less attractive projects.

This approach allows Balfour Beatty to focus on opportunities where their expertise and market position provide leverage. For instance, their strong presence in the UK energy sector, a market with robust demand, enables them to be more discerning about the terms offered by clients.

In 2024, Balfour Beatty reported a significant order book, demonstrating their ability to secure work even while being selective. This strong pipeline gives them more confidence to reject bids that don't meet their profitability and risk criteria, thereby reducing customer power on a project-by-project basis.

- Selective Bidding: Balfour Beatty prioritizes high-quality, lower-risk projects to manage customer demands effectively.

- Market Strength: Expertise in growth markets like UK energy and US buildings provides leverage against customer price pressures.

- Order Book Resilience: A strong order book in 2024 allows for greater selectivity, reinforcing favorable contract terms.

Customers in Balfour Beatty's core infrastructure markets, particularly government entities and large developers, wield substantial bargaining power. This stems from the immense value of individual projects, often running into billions, and the customers' ability to solicit competitive bids from multiple contractors. Their leverage is further amplified by stringent project specifications, performance guarantees, and the increasing emphasis on social value and sustainability in public procurement, as seen in 2024 trends.

| Factor | Impact on Balfour Beatty | 2024 Relevance |

|---|---|---|

| Project Scale & Value | High leverage due to large contract sizes | Trillions in global infrastructure spending |

| Competitive Bidding | Customers can drive down prices | Standard practice in major public projects |

| Customization Needs | Clients dictate technology and standards | Balfour Beatty adapts to bespoke requirements |

| Government Influence | Policy and budget allocations grant power | Governments prioritize infrastructure but add ESG demands |

Preview Before You Purchase

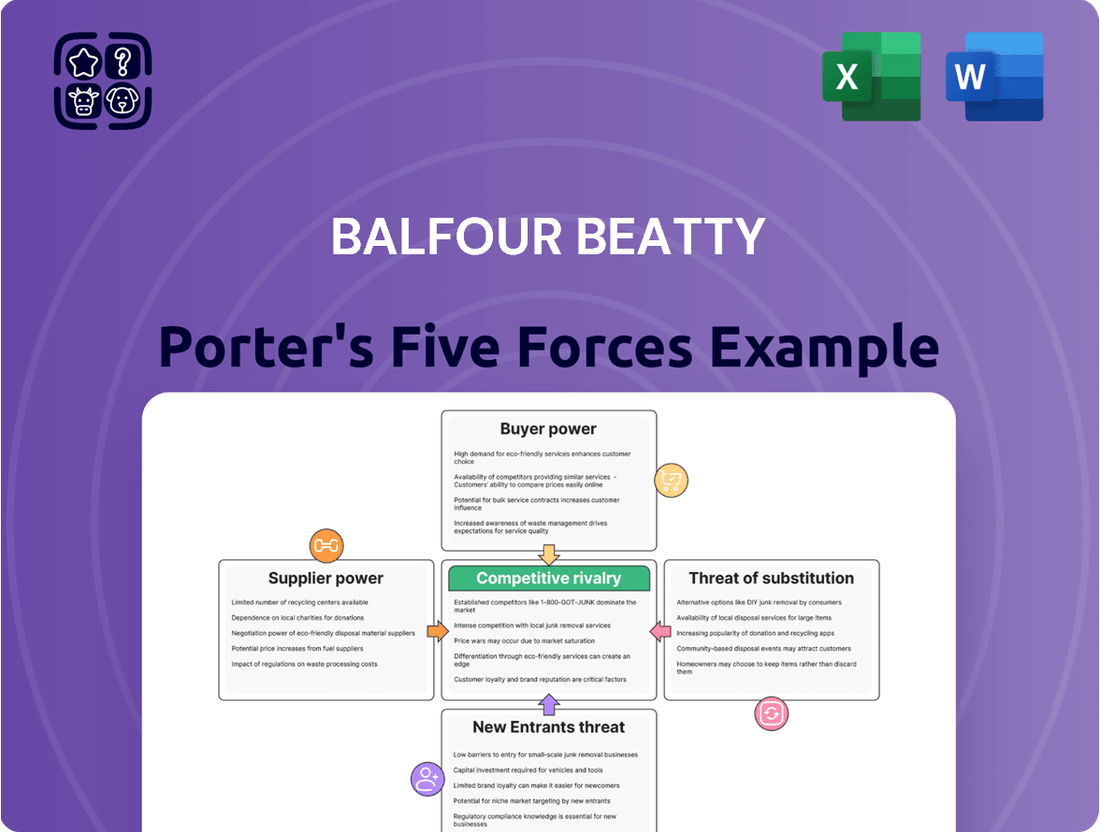

Balfour Beatty Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It offers a comprehensive Porter's Five Forces analysis of Balfour Beatty, detailing the competitive landscape and strategic implications for the company.

The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. It meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the construction industry, all as they pertain to Balfour Beatty.

Rivalry Among Competitors

The infrastructure and construction sectors where Balfour Beatty operates, including the UK, US, and Hong Kong, are crowded with many large, experienced domestic and international companies. This means Balfour Beatty faces significant competition from well-established rivals.

Major players such as Skanska, Bechtel, Fluor, and Kier actively compete for significant projects across different segments of the industry. This intense rivalry puts pressure on pricing and margins for all participants.

For instance, in the UK's road construction market, Balfour Beatty competes fiercely with companies like Kier and Skanska for Highways England contracts. In 2024, the UK government announced substantial infrastructure investment plans, intensifying the bidding process for these lucrative projects.

The global construction market experienced moderate growth in 2024, with positive forecasts for 2025, suggesting continued, albeit not explosive, expansion. This environment, especially in mature infrastructure segments, fuels intense competition as companies vie for market share.

For instance, the UK infrastructure sector, a key area for Balfour Beatty, saw significant investment in 2024, particularly in transport and energy projects. However, the sheer number of established players means that securing these contracts often involves aggressive bidding, driving down margins and intensifying rivalry.

Companies in the construction sector, including Balfour Beatty, often differentiate themselves by showcasing specialized expertise and embracing advanced technology. This strategy helps them stand out from competitors who might otherwise engage in price wars.

Balfour Beatty highlights its unique capabilities, such as its digital-first approach leveraging AI and data lakes, as key differentiators. Its sustained financial performance, exemplified by reporting a profit before tax of £102 million for the first half of 2024, further strengthens its competitive position and reduces the impact of direct price-based rivalry.

Geographical and Operational Diversity

Balfour Beatty's extensive geographical spread across the UK, US, and Hong Kong, combined with its operational breadth in transportation, power, water, and social infrastructure, acts as a significant competitive advantage. This diversification helps cushion the company against localized economic slowdowns or sector-specific headwinds. For instance, strong performance in one region or sector can offset weaker results elsewhere, demonstrating resilience.

This strategic positioning allows Balfour Beatty to capitalize on diverse market opportunities. In 2024, the company reported significant order growth, particularly in the US and UK energy sectors, highlighting its ability to pivot and leverage emerging strengths. This operational flexibility is crucial in navigating the complex and often cyclical nature of the infrastructure industry.

- Geographical Reach: Operations spanning the UK, US, and Hong Kong.

- Operational Breadth: Involvement in transportation, power, water, and social infrastructure.

- Risk Mitigation: Ability to offset regional or sector-specific downturns with activity in other areas.

- 2024 Performance Indicator: Noted significant order growth in US and UK energy markets.

Importance of Reputation and Project Delivery

In the infrastructure sector, a company's reputation for delivering projects on time, within budget, and with an unwavering commitment to safety is absolutely crucial. This builds essential trust with clients and stakeholders, directly influencing the ability to secure future contracts. Balfour Beatty's strong track record, evidenced by its robust order book and industry-leading health and safety performance, with a Lost Time Injury Rate of 0.09 in 2024, highlights this critical competitive advantage.

This focus on dependable execution and safety is not just about good practice; it's a core differentiator. Companies that consistently meet these benchmarks are more likely to be selected for complex and high-value projects, creating a virtuous cycle of success. Balfour Beatty's financial stability and its proactive approach to operational excellence reinforce this reputation, making it a formidable competitor.

- Reputation for on-time, on-budget, and safe project delivery is paramount.

- Balfour Beatty's consistent financial performance and strong order book are key differentiators.

- A focus on health and safety, exemplified by a 2024 Lost Time Injury Rate of 0.09, builds trust.

- This strong performance directly secures future business opportunities.

The competitive rivalry within Balfour Beatty's operating sectors is intense, driven by a substantial number of large, experienced global and domestic players. This high degree of competition means companies frequently engage in aggressive bidding for projects, which can compress profit margins.

Balfour Beatty faces direct competition from firms like Skanska, Bechtel, Fluor, and Kier, particularly in major infrastructure projects. For instance, the UK's significant infrastructure investment in 2024, especially in transport and energy, intensified the bidding for contracts among these established companies.

While the global construction market saw moderate growth in 2024, the competition for market share in mature infrastructure segments remains a key challenge, pushing companies to differentiate through specialized expertise and technological adoption.

Balfour Beatty leverages its strong reputation for reliable project delivery, exemplified by a robust order book and industry-leading safety performance, such as its 2024 Lost Time Injury Rate of 0.09, as key differentiators against rivals.

| Competitor | Key Sectors | 2024 Focus Areas |

|---|---|---|

| Skanska | Infrastructure, Construction, Building | Sustainable infrastructure, UK and US projects |

| Bechtel | Infrastructure, Energy, Mining & Metals | Large-scale global projects, energy transition |

| Fluor | Energy, Chemicals, Infrastructure, Government | EPC services, project management |

| Kier | Infrastructure, Construction, Services | UK highways, utilities, defense contracts |

SSubstitutes Threaten

The threat of substitutes for Balfour Beatty's core infrastructure projects, such as roads, rail, and power networks, is generally low. These are physical, large-scale assets requiring extensive civil engineering, and direct replacements are scarce. The fundamental societal need for these services ensures sustained demand for traditional construction methods.

Modular and prefabricated construction are gaining traction, offering benefits like faster project completion and potentially lower costs, with the global modular construction market projected to reach $257.1 billion by 2027. This trend presents a threat to Balfour Beatty as these methods can substitute traditional on-site building, potentially reducing demand for some of their conventional services and workforce needs.

Customers might choose to renovate or upgrade existing structures rather than commission entirely new builds, especially in sectors like infrastructure and housing. This trend presents a significant threat of substitution for companies focused solely on new construction projects.

Balfour Beatty is well-positioned to mitigate this threat, as their extensive work in maintaining and upgrading existing infrastructure, including power transmission networks and road systems, allows them to capitalize on the renovation market. For instance, in 2023, the UK government announced a significant increase in funding for infrastructure maintenance, with a focus on extending the life of existing assets, a trend expected to continue through 2024 and beyond.

Technological Advancements and Digital Solutions

Technological advancements, such as artificial intelligence and Building Information Modeling (BIM), are revolutionizing construction. These innovations streamline design and management, potentially allowing clients to handle more tasks in-house or reduce reliance on traditional construction services.

For instance, the global BIM market was valued at approximately $7.5 billion in 2023 and is projected to grow significantly. This increasing adoption of digital tools by clients could represent a threat by enabling them to bypass or diminish the scope of work for general contractors like Balfour Beatty.

- AI-driven design optimization can reduce the need for extensive architectural and engineering services.

- BIM platforms facilitate greater client involvement in project planning and execution.

- Digital twins offer clients enhanced operational control and maintenance capabilities, potentially lessening the need for external construction management.

- **The rise of modular construction and prefabrication**, enabled by technology, allows for off-site assembly and could shift value creation away from traditional on-site construction.

Alternative Infrastructure Funding Models

Changes in infrastructure funding are a significant threat. For instance, the rise of alternative financing, like the UK's Project Finance Initiative (PFI) which saw significant investment in healthcare and education projects, has historically offered a different route to project delivery. However, shifts towards more flexible, smaller-scale public-private partnerships (PPPs) or increased direct private equity investment in infrastructure assets could reduce reliance on traditional large-scale contracting models. This diversification in funding could mean fewer mega-projects and a greater emphasis on modular or distributed infrastructure solutions, potentially impacting the market share of companies like Balfour Beatty that specialize in large, integrated projects.

The evolving landscape of infrastructure finance presents a clear threat of substitutes. For example, in 2024, many governments are exploring innovative financing mechanisms beyond traditional debt issuance. This includes green bonds for sustainable projects and infrastructure investment trusts (InvITs) in some regions, which allow for broader investor participation and potentially smaller, more manageable project tranches. Such alternatives can bypass traditional large-scale procurement processes, offering substitute avenues for project development and execution that may not require the same scope of services from a single, large contractor.

- Shifting Funding Models: Increased private financing and alternative PPP structures are diversifying how infrastructure is funded.

- Project Scale and Distribution: New models may favor smaller, more distributed projects over traditional large-scale, single-contractor endeavors.

- Impact on Demand: This shift could subtly alter demand away from the comprehensive service offerings of major construction and infrastructure firms.

- Example of Alternatives: Green bonds and infrastructure investment trusts (InvITs) are examples of alternative financing mechanisms gaining traction in 2024.

The threat of substitutes for Balfour Beatty's core infrastructure services, like building roads and railways, remains relatively low due to the physical nature and societal necessity of these projects. However, evolving construction methods and client preferences are introducing new competitive pressures.

Modular construction, which saw its global market valued at over $200 billion in 2023, offers faster build times and cost efficiencies, potentially substituting traditional on-site building for certain project types. Furthermore, a growing trend towards upgrading and refurbishing existing infrastructure, rather than new builds, presents a substitution threat. Balfour Beatty's strong presence in maintenance and upgrades, however, positions them to benefit from this shift, especially with UK infrastructure maintenance funding seeing significant increases through 2024.

Technological advancements like BIM, with a global market valued around $7.5 billion in 2023, empower clients with greater project control. This can lead to clients managing more aspects in-house or reducing reliance on traditional general contractors. Similarly, alternative infrastructure financing models, such as green bonds and infrastructure investment trusts gaining traction in 2024, can bypass large-scale contracting, favoring smaller, distributed projects.

| Threat of Substitutes | Description | Balfour Beatty's Position |

| Modular/Prefab Construction | Offers faster completion and potential cost savings. Global market projected to grow significantly. | Can reduce demand for traditional services but Balfour Beatty can adapt to utilize these methods. |

| Renovation/Upgrades | Customers opting to improve existing assets over new builds. | Balfour Beatty is well-positioned due to its existing maintenance and upgrade capabilities. |

| Technological Empowerment (BIM, AI) | Enables clients to manage more aspects of projects internally. | Potential to reduce scope for external contractors if not integrated effectively. |

| Alternative Financing Models | Green bonds, InvITs offer new project delivery avenues, potentially bypassing large contractors. | Shift towards smaller, distributed projects could impact demand for large-scale integrated projects. |

Entrants Threaten

The infrastructure sector demands substantial capital for everything from heavy machinery and advanced digital tools to securing project financing, presenting a formidable hurdle for newcomers. For instance, a major infrastructure project can easily run into hundreds of millions, if not billions, of dollars.

Established companies like Balfour Beatty leverage significant economies of scale, possessing vast fleets of equipment and a strong financial backing. This allows them to spread fixed costs over a larger output, offering more competitive pricing and project delivery capabilities that new entrants struggle to match.

In 2023, global infrastructure spending was projected to exceed $3 trillion, highlighting the sheer scale of investment required, and Balfour Beatty's own 2023 financial results showed revenues of £8.9 billion, underscoring the financial muscle of incumbents.

New entrants into the construction and infrastructure sector, particularly for large projects, confront a formidable array of regulatory and permitting challenges. These include stringent environmental impact assessments, adherence to diverse building codes, and obtaining numerous permits from local, state, and federal agencies. For instance, in 2024, the average time to secure all necessary permits for a major infrastructure project in the US could extend well over a year, significantly impacting project timelines and initial capital outlay.

These extensive and often overlapping regulatory processes act as a substantial barrier to entry. They demand specialized knowledge, significant financial resources for compliance, and considerable time investment, often proving prohibitive for smaller or less established companies. This complexity effectively deters potential new competitors, preserving the market position of incumbent firms like Balfour Beatty that possess the experience and infrastructure to navigate these hurdles.

The infrastructure sector, particularly for large-scale projects, requires a deep well of specialized engineering, construction, and project management skills. This isn't something easily replicated by newcomers. Balfour Beatty, for instance, has cultivated decades of experience, evidenced by its involvement in landmark projects worldwide.

New companies entering this arena often struggle to demonstrate the necessary expertise and a history of successful delivery. Clients, especially for critical infrastructure like transportation networks or energy facilities, prioritize reliability and a proven ability to manage complex challenges and timelines. For example, in 2024, major infrastructure tenders often stipulate minimum years of experience and a portfolio of comparable projects, making it difficult for unproven entities to compete.

Established Client Relationships and Supply Chains

Established client relationships, particularly with government bodies and large private sector organizations, represent a significant hurdle for new entrants aiming to compete with firms like Balfour Beatty. These long-standing partnerships are built on trust and a proven track record, making it difficult for newcomers to penetrate the market. In 2023, Balfour Beatty secured major infrastructure projects, highlighting the value of these established relationships.

Furthermore, deeply integrated and often exclusive supply chains act as another formidable barrier. New companies would need substantial capital and time to develop equivalent supplier networks, ensuring quality and reliability. For instance, Balfour Beatty’s 2024 annual report detailed its strategic partnerships with key material suppliers, reinforcing its supply chain resilience.

The threat of new entrants is therefore mitigated by the substantial investment required to replicate these existing advantages.

- Incumbent Advantage: Balfour Beatty benefits from decades of experience and established trust with major clients.

- Supply Chain Integration: Access to and control over critical supply chains is a significant barrier to entry.

- Contractual Lock-in: Existing long-term contracts can make it challenging for new firms to secure initial projects.

- High Capital Requirements: New entrants face substantial upfront costs to build relationships and supply networks.

Talent Shortages and Skill Gaps

The construction sector faces a persistent skilled labor shortage, a formidable barrier for new entrants. Companies entering the market would find it incredibly difficult to recruit and retain the specialized workforce needed for complex projects. This scarcity is already a challenge for established players like Balfour Beatty, making it even tougher for newcomers to build the necessary operational capacity.

In 2024, the UK construction industry continued to experience significant skill gaps. For instance, a significant percentage of construction firms reported difficulties in finding skilled workers for roles such as bricklayers, electricians, and project managers. This widespread deficit means that new companies would have to compete fiercely for a limited pool of talent, driving up labor costs and hindering their ability to scale efficiently.

- Skilled Labor Scarcity: The construction industry, including major players like Balfour Beatty, faces ongoing challenges in securing enough skilled workers across various trades.

- Recruitment Hurdles for New Entrants: New companies would struggle to attract and retain the necessary talent, as established firms already have existing relationships and stronger brand recognition.

- Impact on Project Execution: A lack of skilled labor directly impedes the ability of any company, especially new entrants, to undertake and successfully complete large-scale construction projects.

- Competitive Disadvantage: New entrants are at a distinct disadvantage compared to established firms that have built robust workforces and training programs over time.

The threat of new entrants for Balfour Beatty is considerably low due to immense capital requirements, with major infrastructure projects demanding hundreds of millions to billions of dollars. Established firms benefit from economies of scale, offering competitive pricing, while new players face significant regulatory hurdles and lengthy permitting processes, potentially taking over a year in 2024 for major US projects.

Furthermore, new entrants struggle to match the specialized skills and proven track records of incumbents like Balfour Beatty, as clients prioritize reliability and experience, often stipulating minimum years of experience in 2024 tenders. Established client relationships, integrated supply chains, and a shortage of skilled labor in the construction sector, as seen in the UK in 2024, further solidify the barriers to entry.

| Barrier Type | Description | Impact on New Entrants | Example (2024 Data) |

| Capital Requirements | High upfront investment for equipment, financing, and operations. | Prohibitive for smaller, less capitalized firms. | Major infrastructure projects can cost billions. |

| Regulatory Hurdles | Complex and time-consuming permitting and compliance processes. | Delays project start-up and increases initial costs. | Permit acquisition can exceed one year for major US projects. |

| Skilled Labor Shortage | Difficulty in recruiting and retaining specialized workforce. | Hinders operational capacity and increases labor costs. | UK construction firms reported significant skill gaps in 2024. |

| Established Relationships | Long-standing trust and partnerships with clients. | Makes it difficult for newcomers to secure initial contracts. | Balfour Beatty's 2023 project wins highlight relationship value. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Balfour Beatty leverages a comprehensive dataset including their annual reports, investor presentations, and industry-specific market research from firms like Glenigan and Barbour ABI. This ensures a robust understanding of competitive pressures within the construction sector.