Balfour Beatty Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balfour Beatty Bundle

Discover how Balfour Beatty leverages its extensive infrastructure projects and diverse service offerings within its product strategy. This analysis delves into their pricing models, from competitive bidding to long-term contracts, and explores their strategic placement in key markets and project pipelines. Understand the promotional efforts that build brand reputation and secure major contracts.

Unlock a comprehensive understanding of Balfour Beatty's marketing prowess by accessing the full 4Ps analysis. This in-depth report offers actionable insights into their product, price, place, and promotion strategies, providing a valuable resource for business professionals, students, and consultants seeking strategic advantage.

Product

Balfour Beatty's Product offering in infrastructure construction is broad, covering everything from civil engineering and building to specialized areas like ground engineering and mechanical & electrical services. This comprehensive approach ensures they can manage the full lifecycle of major infrastructure projects, from initial design through to completion. Their expertise is crucial for developing vital public and private sector assets.

The company's extensive capabilities are demonstrated by its involvement in significant projects. For instance, Balfour Beatty secured a £1.7 billion contract in early 2024 to upgrade the UK's rail network, highlighting their capacity for large-scale, complex infrastructure development. This commitment to delivering high-quality, critical infrastructure globally underscores their product's value proposition.

Balfour Beatty's support services are crucial for maintaining and operating vital infrastructure like electricity networks, rail systems, and highways. This division ensures these assets continue to function efficiently, providing essential ongoing capabilities for clients.

This focus on existing infrastructure generates predictable, recurring revenue streams. The company's long-term frameworks with clients in these sectors provide a stable foundation for its business, fostering deep client relationships.

In fiscal year 2023, Balfour Beatty reported that its Support Services segment achieved revenues of £1.7 billion, demonstrating the significant contribution of these ongoing maintenance and operational contracts. This segment is a key driver of profitable, recurring income for the company.

Balfour Beatty actively finances and develops infrastructure, holding a diverse investments portfolio. This strategic approach includes ventures in student accommodation and residential projects, allowing them to leverage their core expertise and seize emerging market opportunities. For instance, in their 2023 financial results, Balfour Beatty reported a robust order book, indicating strong future revenue streams from their infrastructure development activities.

Specialized Sector Focus

Balfour Beatty's specialized sector focus is a key element of its marketing strategy, allowing it to concentrate on areas where it holds a competitive advantage. This approach targets high-growth segments within its primary operational geographies, such as the UK's energy, transport, and defense sectors, alongside buildings in the United States.

This deliberate concentration enables Balfour Beatty to effectively deploy its market-leading expertise and capitalize on substantial new business prospects. The company has observed a notable uptick in orders across various sectors, including education, aviation, and hospitality.

- UK Energy: Doubled backlog in power transmission and distribution work.

- UK Transport: Continued strong performance in rail and highways.

- US Buildings: Significant growth in infrastructure and commercial projects.

- Defence: Secured key contracts for military infrastructure upgrades.

Sustainable Infrastructure Solutions

Balfour Beatty's product offering, particularly in sustainable infrastructure solutions, is deeply embedded in its commitment to ethical and environmentally conscious operations. This focus is not just a talking point but a strategic imperative, influencing how they deliver projects and engage with stakeholders.

Their approach integrates key sustainability pillars: climate change mitigation, fostering nature positive outcomes, enhancing resource efficiency, ensuring supply chain integrity, actively engaging with communities, and promoting diversity, equity, and inclusion among employees. This holistic strategy aims to build infrastructure that benefits society and the environment long-term.

The company has set ambitious net-zero targets, aiming for Scope 1 and 2 emissions to be neutralized by 2045 and Scope 3 by 2050. A tangible step towards this is their goal to reduce onsite construction waste by 25% by 2025, largely through the adoption of offsite and modular building techniques, which also improve efficiency and safety.

- Net Zero Targets: Scope 1 & 2 by 2045, Scope 3 by 2050.

- Waste Reduction: 25% reduction in onsite construction waste by 2025.

- Innovation: Increased use of offsite and modular construction methods.

- Sustainability Integration: Climate change, nature positive, resource efficiency, supply chain integrity, community engagement, DEI are core to strategy.

Balfour Beatty's product is its comprehensive construction and infrastructure services, encompassing design, build, and maintenance across critical sectors like rail, energy, and defense. Their offering extends to specialized areas such as ground engineering and M&E services, enabling them to manage entire project lifecycles and deliver essential public and private assets.

The company's product strength is evident in its significant project wins, such as the £1.7 billion rail network upgrade contract secured in early 2024. This demonstrates their capacity for large-scale, complex developments and their commitment to delivering high-quality infrastructure globally.

Furthermore, Balfour Beatty's product portfolio includes vital support services for maintaining existing infrastructure, generating predictable, recurring revenue. In fiscal year 2023, this segment alone achieved revenues of £1.7 billion, highlighting its importance to the company's financial stability.

Their strategic focus on specialized sectors, including UK energy and transport, and US buildings, allows them to leverage market-leading expertise and capitalize on growth opportunities. This specialization is supported by a robust order book, indicating strong future revenue streams from their infrastructure development activities.

| Product Area | Key Offerings | Recent Performance/Data |

|---|---|---|

| Infrastructure Construction | Civil engineering, building, ground engineering, M&E services | £1.7 billion rail network upgrade contract (early 2024) |

| Support Services | Maintenance and operation of existing infrastructure | £1.7 billion revenue in FY23 |

| Specialized Sectors | UK Energy, UK Transport, US Buildings, Defense | Doubled backlog in UK power transmission & distribution |

What is included in the product

This analysis provides a comprehensive review of Balfour Beatty's marketing strategies, detailing their approach to Product, Price, Place, and Promotion.

Provides a clear, actionable framework for understanding Balfour Beatty's marketing strategy, simplifying complex decisions and aligning teams on key initiatives.

Place

Balfour Beatty's global presence is anchored in the United Kingdom, the United States, and Hong Kong, demonstrating a strategic international footprint. This geographical diversification is a significant asset, contributing to the stability and consistency of its financial performance. The company actively manages its operations and project delivery through established offices in these key regions, ensuring effective market penetration and service provision.

Balfour Beatty's 'Place' strategy centers on direct, on-site project delivery, managing everything from major infrastructure like HS2's Old Oak Common station to building schools and hospitals. This hands-on approach allows them to directly control quality, safety, and schedules across diverse projects.

Their physical presence is evident in the numerous construction sites and regional offices across the UK and US, ensuring proximity to clients and project locations. In 2023, Balfour Beatty reported revenue of £9.5 billion, with a significant portion generated through these directly managed projects, highlighting the importance of their on-the-ground operations.

Balfour Beatty actively pursues strategic partnerships and joint ventures, exemplified by its significant presence through Gammon in Hong Kong. This strategy is crucial for expanding market reach and enhancing operational capabilities in specialized sectors.

These collaborations are instrumental in securing and executing large-scale, intricate projects by pooling diverse expertise and resources. For instance, in 2023, Balfour Beatty's UK construction services division reported revenue of £4.7 billion, with a substantial portion likely supported by its collaborative ventures.

By partnering, Balfour Beatty effectively navigates local market dynamics and shares project-related risks. This approach allows for greater agility and access to opportunities that might be too challenging or resource-intensive to pursue independently.

Decentralized Operational Hubs

Balfour Beatty's decentralized operational hubs are a cornerstone of its 'Think Global, Act Local' strategy, allowing for a highly responsive approach to diverse markets. This structure enables the company to adapt its services and strategies to the unique demands and regulatory landscapes of each region it operates in.

This localized presence fosters stronger client relationships and enhances the company's ability to meet specific regional needs effectively. For instance, in 2024, Balfour Beatty reported significant project wins in the UK's infrastructure sector, leveraging its regional expertise to secure contracts tailored to local government priorities.

- Decentralized Structure: Facilitates tailored regional strategies.

- 'Think Global, Act Local': Enables adaptation to specific market demands.

- Enhanced Responsiveness: Improves client engagement and project delivery.

- 2024 UK Infrastructure Focus: Demonstrates successful regional project acquisition.

Digital-First Approach for Efficiency

Balfour Beatty is increasingly embracing a digital-first strategy to boost efficiency and safety across its projects. This involves using advanced technologies like artificial intelligence and data lakes to streamline how projects are managed and delivered, aiming for better outcomes with less on-site presence.

This technological push is designed to make operations smoother and more effective. For instance, by 2024, Balfour Beatty reported a significant increase in digital tool adoption, with over 70% of site teams utilizing digital platforms for daily reporting and progress tracking. This shift is crucial for improving productivity and ensuring quality control.

- Enhanced Safety: Digital tools provide real-time data on site conditions, allowing for quicker identification and mitigation of potential hazards, contributing to a reduction in incident rates.

- Productivity Gains: AI-powered scheduling and resource allocation optimize workflows, leading to faster project completion times.

- Data-Driven Assurance: Leveraging data lakes ensures project compliance and quality standards are met consistently through automated checks and analytics.

- Reduced On-Site Dependency: Digital collaboration platforms and remote monitoring capabilities minimize the need for extensive physical presence, saving time and resources.

Balfour Beatty's 'Place' in its marketing mix is defined by its direct, on-site project delivery across key global regions like the UK and US, supported by strategic partnerships such as Gammon in Hong Kong. This approach emphasizes localized operational hubs and a decentralized structure, enabling tailored regional strategies and enhanced responsiveness to diverse market demands, as seen in its 2024 UK infrastructure wins.

| Aspect | Description | Impact |

|---|---|---|

| Geographic Footprint | UK, US, Hong Kong | Stability, market penetration |

| Delivery Model | Direct, on-site project management | Quality & safety control |

| Strategic Partnerships | e.g., Gammon in Hong Kong | Market reach, expertise pooling |

| Operational Strategy | Decentralized hubs, 'Think Global, Act Local' | Regional adaptation, client relationships |

Preview the Actual Deliverable

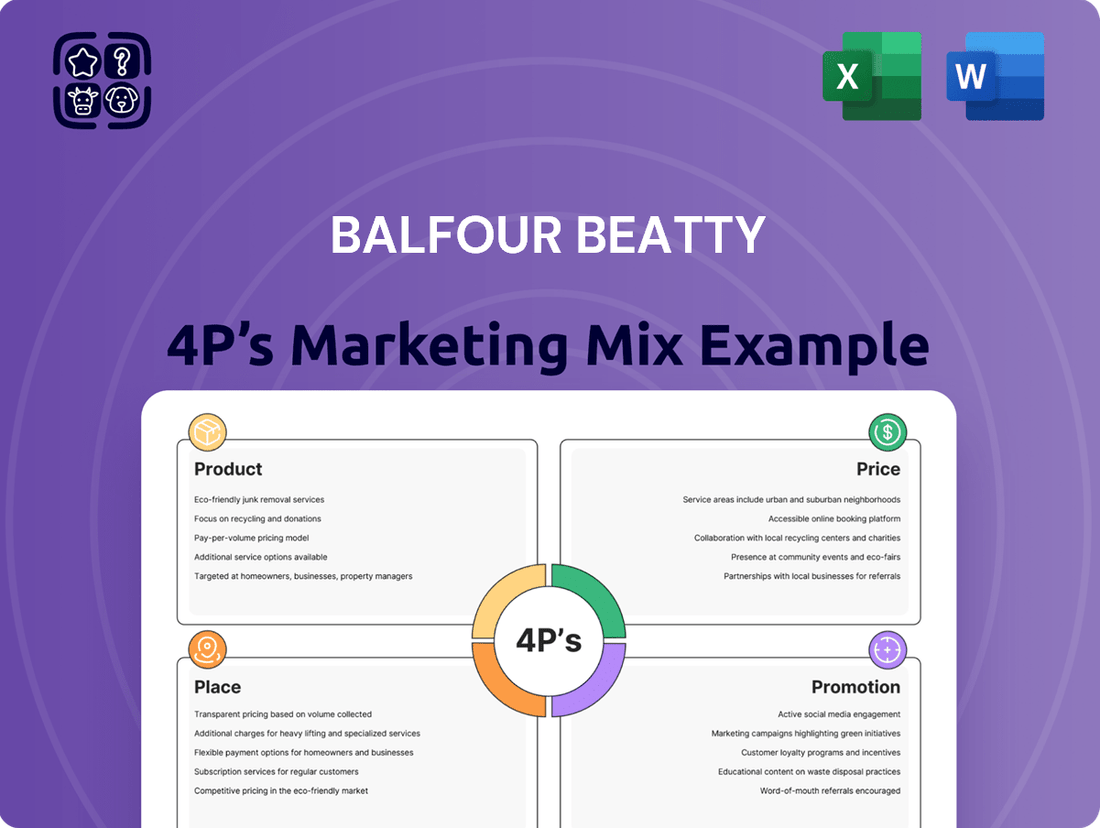

Balfour Beatty 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Balfour Beatty 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Balfour Beatty prioritizes strong investor relations, regularly releasing annual reports, interim results, and trading updates. This commitment to transparency ensures shareholders and the wider financial community are well-informed about the company's performance and direction. For instance, their 2023 annual report detailed a revenue of £9.2 billion, showcasing their operational scale and financial health.

The company further enhances communication through detailed presentations and webcasts, offering insights into their financial results and strategic vision. This proactive approach, exemplified by their consistent engagement with analysts and investors throughout 2024, fosters trust and helps attract necessary capital for future growth and projects.

Balfour Beatty leverages public relations to showcase its successes, from project completions to its commitment to corporate social responsibility. This proactive approach, utilizing news releases and media engagement, is crucial for cultivating a favorable public perception and keeping stakeholders informed about its impact on infrastructure.

Recent communications have prominently featured Balfour Beatty's ambitious sustainability strategy and its dedication to achieving specific social value targets. For example, in 2023, the company reported generating £1.4 billion in social value, a testament to its focus on community impact alongside its construction projects.

Balfour Beatty actively shapes industry conversations through participation in forums and the release of influential policy papers. Their commitment to sharing best practices, exemplified by publications like '25% by 2025: Streamlined construction,' highlights their dedication to sector advancement.

This proactive stance establishes Balfour Beatty as a thought leader, driving innovation and influencing both industry standards and governmental policy. Their engagement underscores a clear vision for the future of infrastructure development.

Employer Branding and Talent Attraction

Balfour Beatty actively cultivates its employer brand by highlighting its commitment to an inclusive culture and showcasing its diverse capabilities. This strategy is crucial for attracting top talent, especially given the company's involvement in significant national infrastructure projects. In 2024, for instance, Balfour Beatty continued its substantial investment in talent development through apprenticeships and graduate programs, aiming to build a pipeline of skilled professionals for its complex projects.

The company's 'Build to Last' strategy and its established cultural framework are central to its employer proposition. These elements communicate a stable and forward-thinking environment, appealing to individuals seeking long-term career growth and meaningful work. Partnerships, such as their ongoing collaboration with STEM Learning, further solidify their commitment to nurturing future talent within the industry.

- Inclusive Culture: Balfour Beatty emphasizes a workplace that values diversity and inclusion to attract a broad range of candidates.

- Talent Development: Significant investment in apprenticeships and graduate schemes underscores their commitment to nurturing future talent, with over 1,000 apprentices in training in recent years.

- Project Impact: Highlighting involvement in nationally critical infrastructure projects provides a sense of purpose and attracts individuals motivated by large-scale impact.

- Strategic Alignment: The 'Build to Last' strategy and cultural framework are used to attract talent aligned with the company's long-term vision and values.

Project-Specific Marketing and Visibility

Balfour Beatty leverages its extensive project portfolio as a primary marketing asset, demonstrating tangible expertise and successful execution to potential clients. High-profile undertakings, such as the ongoing work at Hinkley Point C, which has seen significant investment and progress through 2024, serve as powerful endorsements of their capabilities. Similarly, the Grand Hyatt Miami Beach and the extensive Interstate 30 reconstruction project in the US showcase their ability to manage complex, large-scale infrastructure and construction developments.

The company actively promotes these successes through various channels, reinforcing its brand and attracting new business. This project-centric approach to marketing is crucial in the business-to-business construction sector, where past performance is a key indicator of future success.

- Project Showcase: Balfour Beatty's completed and in-progress projects act as direct marketing tools, highlighting their technical proficiency and delivery record.

- Client Attraction: High-visibility projects like Hinkley Point C and infrastructure upgrades demonstrate the company's capacity to handle significant national and international schemes, drawing in future contract opportunities.

- Digital Presence: Achievements are amplified via Balfour Beatty's corporate website and published materials, ensuring broad visibility among industry stakeholders and potential clients.

Balfour Beatty's promotion strategy heavily relies on showcasing its financial health and operational achievements to stakeholders. Their 2023 annual report, detailing £9.2 billion in revenue, underscores their market position and ability to deliver large-scale projects. This transparency, coupled with regular trading updates and investor presentations throughout 2024, builds confidence and attracts investment.

The company actively uses public relations to highlight its corporate social responsibility and sustainability efforts, such as generating £1.4 billion in social value in 2023. This narrative positions Balfour Beatty as a responsible industry leader, resonating with clients and investors who value ethical business practices.

Furthermore, Balfour Beatty promotes its employer brand by emphasizing an inclusive culture and talent development, exemplified by their continued investment in apprenticeships and graduate programs in 2024. This focus on people and purpose attracts skilled professionals essential for their complex infrastructure projects.

Their project portfolio, including work on Hinkley Point C and major US infrastructure upgrades, serves as a powerful marketing tool, demonstrating proven execution capabilities. These high-profile successes are amplified through digital channels, reinforcing their reputation and securing future business opportunities.

Price

Balfour Beatty's pricing strategy is deeply rooted in project-based models, meaning each infrastructure development comes with a unique price tag. This isn't a one-size-fits-all approach; instead, they engage in intricate bidding processes and craft contracts specifically for the project at hand. For instance, in 2023, Balfour Beatty secured a significant £500 million contract to upgrade the A96 road in Scotland, a prime example of their project-specific pricing in action.

These project-based prices can take various forms, such as fixed-price contracts where the cost is agreed upon upfront, or cost-plus agreements where the final price is based on the actual costs incurred plus a predetermined profit margin. They also frequently utilize public-private partnerships, which involve complex financial structures and risk-sharing. This flexibility allows them to adapt to the diverse scopes, inherent risks, and lengthy timelines typical of major infrastructure projects.

Crucially, Balfour Beatty employs a selective bidding strategy. This means they don't bid on every project. Instead, they meticulously choose opportunities that align with their expertise and risk appetite, aiming to build a strong forward order book. Their focus is on securing work that offers a good balance between project quality and a manageable level of financial risk, ensuring long-term stability and profitability.

Balfour Beatty's pricing strategy for complex infrastructure projects is fundamentally value-driven. This means their prices aren't just about covering costs; they reflect the immense value, specialized expertise, and enduring benefits delivered to clients. For instance, projects like the £1.1 billion High Speed 2 (HS2) enabling works showcase this, where advanced engineering and stringent safety protocols are paramount.

The company factors in the significant investment in advanced engineering capabilities, adherence to rigorous safety standards, and commitment to sustainability initiatives. These elements, crucial for large-scale, critical infrastructure, justify a premium pricing approach, ensuring the delivery of high-quality, profitable outcomes.

In 2024, infrastructure spending globally is projected to reach trillions, with a significant portion allocated to complex, long-term projects. Balfour Beatty's ability to secure contracts in this environment, such as their role in the £3.5 billion Northern Ireland water program, underscores their success in demonstrating and pricing the value they bring.

Balfour Beatty navigates a fiercely competitive sector, where winning contracts hinges on strategic pricing that balances market competitiveness with healthy profit margins. This pricing strategy is heavily shaped by fluctuating market demand, the pricing strategies of rivals, and the broader economic climate, all of which Balfour Beatty must constantly monitor.

The company's impressive order book, standing at £18.4 billion as of 2024, is a testament to its success in securing substantial projects even amidst intense competition. This substantial backlog underscores their capability to effectively position themselves and win business in challenging market conditions, reflecting a well-executed pricing and tendering approach.

Risk-Adjusted Pricing

Balfour Beatty strategically embeds risk assessment into its pricing, especially for complex, long-term infrastructure projects. This proactive approach acknowledges potential issues like project delays, volatile material costs, and other unpredictable hurdles.

Their commitment to cultivating a low-risk project portfolio directly shapes their pricing strategies and the terms they negotiate in contracts. For instance, Balfour Beatty's 2023 annual report highlighted a strong focus on risk management, contributing to a robust order book valued at £18.4 billion as of December 31, 2023.

- Risk Mitigation in Pricing: Incorporating contingency for unforeseen project challenges.

- Portfolio Strategy: Prioritizing projects with manageable risk profiles.

- Contractual Terms: Negotiating agreements that reflect assessed project risks.

- Financial Resilience: Aiming for stable profitability through controlled risk exposure.

Long-Term Contractual Agreements

Balfour Beatty leverages long-term contractual agreements, particularly for support and maintenance services, to create a predictable revenue base. These framework agreements, often spanning multiple years, are crucial for stable earnings. For instance, in their 2023 financial results, Balfour Beatty highlighted the resilience of their Services division, which is heavily reliant on such contracts, contributing significantly to their overall performance. This strategy underpins consistent income generation and strengthens client partnerships.

These agreements frequently feature performance-based pricing or pre-negotiated rates, ensuring predictable income streams over extended periods. This contractual stability is a cornerstone of Balfour Beatty's financial planning and operational efficiency. The company's focus on securing these long-term commitments directly supports their objective of delivering consistent financial results year after year.

- Framework Agreements: Provide recurring revenue for support and maintenance.

- Predictable Income: Achieved through multi-year contracts with negotiated rates.

- Client Relationships: Fostered by the stability and reliability of long-term partnerships.

- Earnings Consistency: Supported by the predictable nature of these contractual revenue streams.

Balfour Beatty's pricing is value-driven, reflecting specialized expertise and long-term benefits rather than just cost recovery. This approach is evident in projects like the £1.1 billion HS2 enabling works, where advanced engineering and safety justify premium pricing. The company's 2024 success in securing a role in the £3.5 billion Northern Ireland water program highlights their ability to price and deliver significant value in a growing infrastructure market.

| Metric | 2023 Data | 2024 Projection/Data |

| Order Book | £18.4 billion (as of Dec 2023) | £18.4 billion (as of 2024) |

| Key Project Example (Value) | £500 million (A96 upgrade) | £3.5 billion (NI Water program role) |

| Market Context | Trillions in global infrastructure spending | Trillions in global infrastructure spending |

4P's Marketing Mix Analysis Data Sources

Our Balfour Beatty 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations. We also incorporate insights from industry-specific publications and news outlets to capture their strategic positioning and market activities.