Balfour Beatty Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Balfour Beatty Bundle

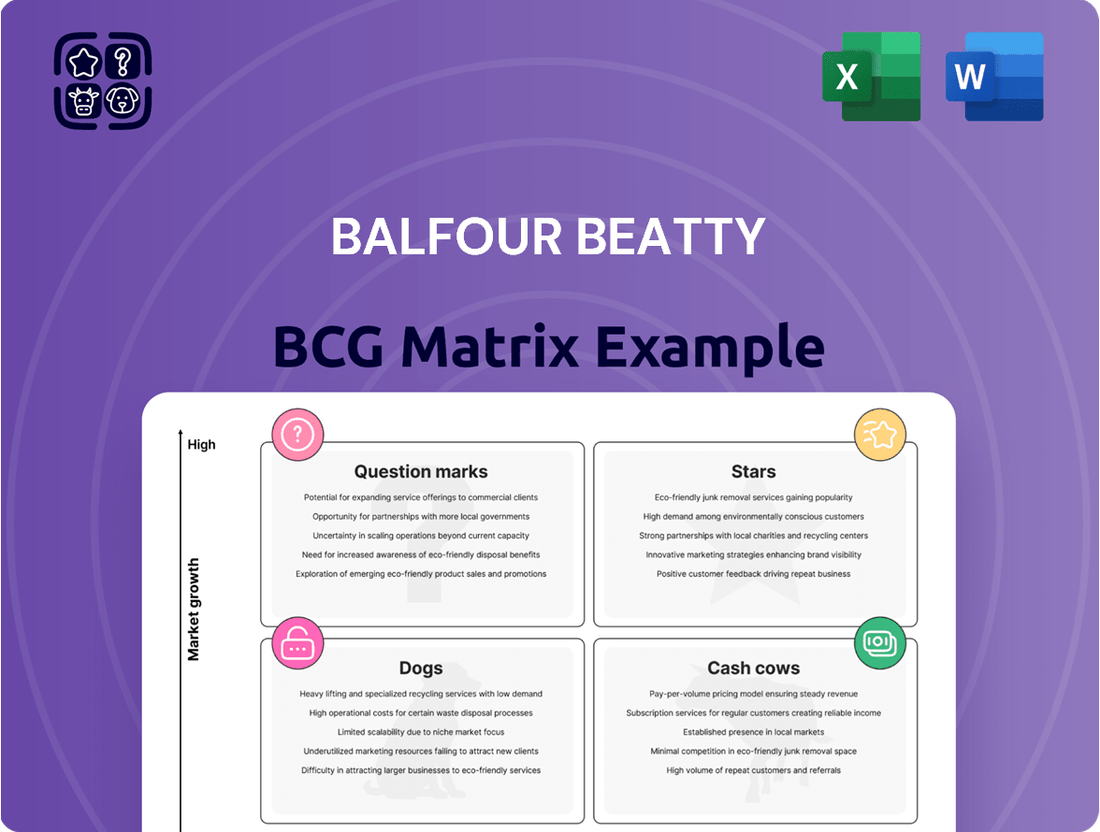

Curious about Balfour Beatty's strategic positioning? Our BCG Matrix analysis reveals which of their ventures are market leaders (Stars), which reliably generate cash (Cash Cows), which are underperforming (Dogs), and which hold future potential but require investment (Question Marks). This snapshot offers a glimpse into their portfolio's health.

Unlock the full potential of this analysis by purchasing the complete Balfour Beatty BCG Matrix report. Gain detailed quadrant placements, data-backed recommendations, and a clear roadmap to optimize their product portfolio and investment strategies for sustained growth and competitive advantage.

Stars

Balfour Beatty views UK energy and transport infrastructure as Stars in its BCG Matrix, reflecting high market share and significant growth potential. The company is actively involved in large-scale projects like offshore wind farm connections and major rail network upgrades, capitalizing on these expanding sectors.

The UK government's substantial infrastructure investment plans, including the £27 billion National Infrastructure Strategy, provide a robust backdrop for Balfour Beatty's growth in these areas. For example, the ongoing electrification of the railway network and the expansion of renewable energy capacity are key drivers for the company's performance in these segments.

The US buildings market represents a key growth avenue for Balfour Beatty. The company is actively pursuing and securing new contracts within this sector, demonstrating a strategic focus. This segment is experiencing a boom, largely fueled by the Bipartisan Infrastructure Investment and Jobs Act (IIJA).

The IIJA is injecting substantial capital into US infrastructure, with a significant portion allocated to buildings. This legislative push creates a high-growth environment for companies like Balfour Beatty. For instance, in 2023, Balfour Beatty reported a substantial increase in its US buildings order book, signaling robust market penetration.

Gammon, Balfour Beatty's joint venture in Hong Kong, has been a powerhouse, consistently boosting the Group's revenue and profit. Its strong market presence is undeniable.

With Hong Kong's infrastructure boom, especially airport upgrades, Gammon is perfectly positioned in a growing market. This strategic advantage solidifies its leading role.

The continuous financial wins and securing of new projects underscore Gammon's 'Star' status within the portfolio. For example, in 2024, Gammon secured significant contracts contributing to the ongoing development of the Hong Kong International Airport Midfield Development project.

Major UK Projects (e.g., HS2, Hinkley Point C)

Balfour Beatty's participation in major UK infrastructure projects like HS2 and Hinkley Point C underscores its dominant position in the national infrastructure market. These ventures are indicative of significant investment in expanding sectors, highlighting the company's strategic vision and industry leadership.

The ongoing development and successful execution of these critical projects reinforce Balfour Beatty's robust market standing. For instance, as of early 2024, HS2's Phase 1 is progressing, with Balfour Beatty involved in significant civil engineering works. Hinkley Point C continues its construction, with Balfour Beatty playing a key role in site preparation and infrastructure development.

- HS2: Balfour Beatty is a key contractor for various sections of the High Speed 2 railway project, contributing to its extensive network development.

- Hinkley Point C: The company is involved in critical infrastructure construction at the Hinkley Point C nuclear power station site, a vital component of the UK's energy strategy.

- Market Share: These large-scale projects contribute significantly to Balfour Beatty's substantial market share in the UK's infrastructure sector, estimated to be a leading position in civil engineering and construction.

- Investment & Growth: The long-term nature of these projects aligns with investment in growing sectors, reflecting a strategic commitment to future economic development and infrastructure enhancement.

Power Transmission and Distribution

Balfour Beatty's Power Transmission and Distribution (T&D) segment in the UK is a strong performer, fitting the profile of a Star in the BCG matrix. The company has been awarded significant contracts, including being named a preferred partner for National Grid's £40 billion electricity network upgrades, a key driver of growth in this sector. This positions Balfour Beatty favorably in a market expanding due to the UK's ambitious net-zero targets and the increasing need for robust electricity infrastructure to support renewable energy sources.

The T&D business is experiencing robust demand, evidenced by Balfour Beatty's substantial order book. In 2024, the company reported a strong pipeline of work within this segment, reflecting the ongoing investment in modernizing and expanding the UK's electricity grid. This sustained activity, coupled with Balfour Beatty's established expertise and market share, suggests continued high growth and profitability for this division.

Key factors contributing to its Star status include:

- High Market Share: Balfour Beatty holds a significant position in the UK power T&D market, benefiting from its long-standing relationships with major utility clients.

- Rapidly Growing Market: The sector is expanding rapidly due to the energy transition, necessitating substantial investment in new transmission lines, substations, and distribution networks.

- Long-Term Contracts: Projects in power T&D are typically long-term, providing revenue visibility and stability for Balfour Beatty.

- Strategic Importance: The critical nature of energy infrastructure means consistent demand and government support for upgrades and expansions.

Balfour Beatty's UK energy and transport infrastructure, alongside its US buildings sector and the Gammon joint venture in Hong Kong, are identified as Stars in its BCG Matrix. These segments exhibit high market share and strong growth potential, driven by significant government investment and a robust demand for infrastructure development.

The company's strategic focus on these areas is yielding tangible results, with substantial order books and the securing of major, long-term contracts. For instance, Balfour Beatty's involvement in UK rail upgrades and offshore wind connections, coupled with the impact of the US Bipartisan Infrastructure Investment and Jobs Act on its building projects, highlights its successful positioning in expanding markets.

The Power Transmission and Distribution (T&D) segment in the UK further solidifies its Star status, evidenced by preferred partner status for National Grid's extensive network upgrades. This segment benefits from the UK's net-zero targets, ensuring sustained demand for grid modernization and expansion.

Gammon's consistent financial performance and its role in Hong Kong's infrastructure boom, particularly airport developments, underscore its Star classification. The company's ability to secure significant new contracts, such as those for the Hong Kong International Airport Midfield Development, demonstrates its market leadership and growth trajectory.

| Segment | BCG Classification | Key Drivers | 2024 Data/Outlook |

| UK Energy & Transport Infrastructure | Star | Govt. investment (e.g., £27bn National Infrastructure Strategy), renewable energy expansion, rail upgrades | Strong order book, participation in HS2 and Hinkley Point C |

| US Buildings | Star | Bipartisan Infrastructure Investment and Jobs Act (IIJA), increased capital for infrastructure | Substantial increase in order book in 2023, continued growth expected |

| Gammon (Hong Kong JV) | Star | Hong Kong infrastructure boom, airport upgrades | Secured significant contracts for HKIA Midfield Development |

| UK Power T&D | Star | Net-zero targets, electricity network upgrades (National Grid £40bn), renewable energy integration | Preferred partner for National Grid, strong pipeline of work |

What is included in the product

This matrix categorizes Balfour Beatty's business units based on market growth and share, guiding strategic decisions.

Balfour Beatty BCG Matrix provides a clear, visual overview of business unit performance, easing the pain of complex strategic analysis.

Cash Cows

Balfour Beatty's UK Construction Services division is a prime example of a Cash Cow within its BCG Matrix. This segment consistently generates substantial and stable cash flows, a testament to its strong market position and efficient operations.

In 2024, the division continued to demonstrate improved margins, reflecting a strategic shift towards a more profitable, lower-risk project portfolio. This focus not only bolsters profitability but also ensures a predictable revenue stream, reinforcing its Cash Cow status.

The mature nature of the UK construction market, coupled with Balfour Beatty's high market share within it, means that significant investment in growth is not required. Instead, the division primarily needs investment to maintain its operational efficiency and market leadership, allowing it to harvest its strong cash-generating capabilities.

Balfour Beatty's Support Services division clearly fits the Cash Cow profile within the BCG Matrix. This segment has demonstrated robust revenue expansion and consistently healthy profit margins, solidifying its role as a dependable income stream for the company.

The division's core business involves providing essential, ongoing services, which points to a mature market characterized by stable and predictable demand. This inherent stability reduces the need for significant marketing or development investment.

For instance, in the fiscal year 2023, Balfour Beatty reported that its Support Services segment contributed significantly to the group's overall performance, with strong operational cash flow. The division's ability to generate substantial profits with minimal reinvestment needs is a hallmark of a mature, high-performing asset.

Balfour Beatty's Infrastructure Investments portfolio is a prime example of a Cash Cow within its BCG Matrix. This segment boasts a high valuation, consistently bolstering the Group's profits through strategic asset disposals and robust net finance income.

These are mature assets, meaning they generate substantial cash flow with minimal need for further capital infusion to maintain their value. The portfolio's valuation has seen a steady upward trend, underscoring its reliable performance and ability to deliver consistent returns.

Established Rail Infrastructure Projects (UK)

Established rail infrastructure projects in the UK are a prime example of Balfour Beatty's Cash Cows. These are mature, stable markets with consistent demand for maintenance and upgrades. Balfour Beatty benefits from its significant market share in this sector, ensuring a reliable stream of revenue.

The company's long-term contracts for these established rail networks provide predictable cash flow, a hallmark of a Cash Cow. For instance, in 2024, Balfour Beatty secured extensions on several key Network Rail contracts, underscoring the ongoing demand and their strong position. These contracts are crucial for maintaining the UK's extensive rail system.

- Stable Revenue: Long-term maintenance and upgrade contracts generate consistent income.

- Strong Market Share: Balfour Beatty holds a dominant position in the UK established rail sector.

- Predictable Cash Flow: The nature of these contracts ensures reliable financial returns.

- Contract Extensions: Recent wins in 2024 highlight the sustained demand and Balfour Beatty's continued relevance.

Long-term US Civils Contracts with Established Clients

Balfour Beatty's US Civils division, despite experiencing some project delays, operates within a mature market segment. The company's strategic approach of selective bidding and prioritizing long-term relationships with established clients, where it possesses proven expertise, points to a focus on projects with high market share and stability. These enduring client partnerships and consistent contract flows generate a dependable revenue stream.

This focus on stable, recurring revenue aligns with the characteristics of a Cash Cow in the BCG Matrix. For instance, Balfour Beatty's commitment to infrastructure projects, often involving multi-year contracts, provides a predictable financial base. In 2024, the company continued to secure significant civil engineering contracts, underscoring the resilience of its established client base.

- Stable Revenue Generation: Long-term contracts with established clients ensure a predictable income stream.

- Market Share Dominance: Focus on areas of proven expertise allows for maintaining a strong market position.

- Reduced Risk Profile: Existing relationships mitigate the risks associated with new client acquisition.

- Cash Flow Generation: The consistent revenue supports ongoing operations and potential investments.

Balfour Beatty's UK Construction Services and Support Services divisions, alongside its Infrastructure Investments portfolio, exemplify Cash Cows within the company's BCG Matrix. These segments are characterized by strong market positions in mature industries, leading to stable and predictable cash flows with minimal need for significant reinvestment. For example, in 2024, the UK Construction Services division saw improved margins, and the Support Services segment continued to deliver robust revenue and healthy profit margins, underscoring their dependable income-generating capabilities.

| Balfour Beatty Segment | BCG Matrix Category | Key Characteristics | 2024/Recent Data Highlight |

|---|---|---|---|

| UK Construction Services | Cash Cow | Strong market share, mature market, stable cash flows | Improved margins, focus on profitable, lower-risk projects |

| Support Services | Cash Cow | Mature market, stable demand, consistent profit margins | Robust revenue expansion, strong operational cash flow |

| Infrastructure Investments | Cash Cow | Mature assets, consistent cash flow, low reinvestment needs | Steady upward valuation trend, reliable returns |

| Established Rail Infrastructure (UK) | Cash Cow | Dominant market share, long-term contracts, predictable revenue | Secured contract extensions with Network Rail |

| US Civils | Cash Cow | Established client base, multi-year contracts, predictable revenue | Secured significant civil engineering contracts |

Full Transparency, Always

Balfour Beatty BCG Matrix

The Balfour Beatty BCG Matrix preview you're seeing is the complete, unwatermarked document you'll receive immediately after purchase. This comprehensive analysis is ready for direct integration into your strategic planning, offering actionable insights without any hidden surprises or additional editing required.

Dogs

Balfour Beatty has identified underperforming US Civils projects, characterized by lower profitability stemming from the costs associated with project delays. These ventures typically represent segments where the company holds a limited market share or faces intense competition, leading to underperformance. For instance, in 2024, the company highlighted that certain US Civils projects were cash consumers without generating adequate returns.

These specific projects align with the 'Dogs' quadrant of the BCG Matrix. They are characterized by low growth and low market share, meaning they require significant investment to maintain but offer minimal returns. Balfour Beatty’s strategy involves a more selective bidding process to actively minimize engagement with such ventures, focusing resources on more promising opportunities.

Legacy liabilities and provisions, such as the non-underlying charge related to the UK Building Safety Act, act as significant drains on Balfour Beatty's resources. These are past issues that necessitate ongoing financial commitment without contributing to current growth or market share expansion.

These liabilities are effectively Dogs in the BCG Matrix framework. They tie up capital and management attention with minimal prospect of future returns, hindering the company's ability to invest in more promising growth areas. For instance, Balfour Beatty reported a £70 million provision in its 2023 results for the Building Safety Act, highlighting the substantial financial impact of these legacy issues.

Divested or non-strategic investment assets within Balfour Beatty's portfolio, even if part of a generally strong Infrastructure Investments segment, would fall into the Dogs category. These are assets Balfour Beatty is actively looking to exit because they no longer fit the company's long-term vision or are underperforming. For instance, if Balfour Beatty sold off a small, aging utility maintenance contract that offered minimal future expansion, that specific asset would be a prime example of a Dog.

Smaller, Non-Core or Ad-Hoc Projects

Smaller, non-core or ad-hoc projects that don't align with Balfour Beatty's primary strategic growth sectors, such as UK energy, transport, defense, and US buildings, can be categorized as Dogs. These ventures typically lack the potential for substantial market share expansion or significant growth.

These might include smaller, one-off contracts that hinder long-term strategic development or the realization of economies of scale. Balfour Beatty's deliberate approach to bidding is designed to steer clear of such projects. For instance, in 2024, the company's focus on winning major infrastructure contracts, like the £1.3 billion A9 Dualling Programme in Scotland, demonstrates this strategic prioritization over smaller, less impactful opportunities.

- Focus on Core Growth Areas: Prioritizing UK energy, transport, defense, and US buildings.

- Avoidance of Small Contracts: Selective bidding strategy to bypass projects with limited strategic value.

- Efficiency and Scale: Seeking projects that allow for economies of scale and long-term positioning.

Highly Competitive, Low-Margin Segments

Highly Competitive, Low-Margin Segments in Balfour Beatty's portfolio would represent areas where the company faces significant rivalry, resulting in persistently thin profit margins and sluggish growth in market share. These segments typically yield modest returns and might be candidates for divestment or a reduced focus if they do not contribute to Balfour Beatty's strategic objective of securing a high-quality order book.

For instance, certain segments within the UK infrastructure maintenance market, particularly those involving routine road repairs or smaller-scale utility works, often attract numerous smaller, localized players. This intense competition can drive down pricing significantly, making it challenging to achieve substantial profit margins. In 2024, the UK construction sector continued to grapple with inflationary pressures and a tight labor market, further squeezing margins in these highly commoditized areas.

- Intense Competition: Many smaller, regional contractors often bid aggressively on smaller infrastructure maintenance contracts, driving down prices.

- Low Profit Margins: The commoditized nature of these services means that differentiation is difficult, leading to price-based competition and compressed profitability.

- Limited Growth Potential: Market share gains in these segments are often incremental and hard-won, with little opportunity for significant expansion.

- Strategic Review: Balfour Beatty may consider reducing its exposure to these segments if they do not align with its focus on larger, more profitable, and strategically important projects.

Projects identified as 'Dogs' within Balfour Beatty's portfolio are characterized by low market share and low growth potential, often requiring significant investment without yielding commensurate returns. These ventures, such as underperforming US Civils projects highlighted in 2024 as cash consumers, demand careful management and strategic review.

Legacy liabilities, like the £70 million provision for the UK Building Safety Act in 2023, also function as Dogs, tying up capital and management focus with minimal future benefit. Balfour Beatty's strategy actively seeks to minimize engagement with these low-return areas, favoring larger, more strategically aligned opportunities.

The company's focus on core growth sectors, including UK energy and transport, and US buildings, signifies a deliberate move away from smaller, non-core projects or highly competitive, low-margin segments that offer limited potential for expansion or profitability.

These 'Dog' assets, whether underperforming projects or divested investments, are managed through selective bidding and a strategic review process to optimize resource allocation and enhance overall portfolio performance.

| BCG Quadrant | Characteristics | Balfour Beatty Examples (2024 Data Focus) | Strategic Approach |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Underperforming US Civils projects (cash consumers); Legacy liabilities (e.g., Building Safety Act provision); Non-core, small contracts; Highly competitive, low-margin segments. | Minimize engagement, selective bidding, potential divestment, focus on core growth areas. |

Question Marks

Balfour Beatty's commitment to a digital-first strategy, including the use of AI in its operations, positions it well for emerging digital infrastructure projects. This sector represents a substantial growth opportunity.

However, Balfour Beatty's current market share in projects that are *exclusively* digital infrastructure, rather than incorporating digital elements into traditional construction, may be relatively small. This dynamic places these ventures in the 'Question Mark' category of the BCG Matrix.

Significant capital investment would be necessary for Balfour Beatty to establish a dominant presence in this high-growth, yet potentially nascent, area for the company. For instance, in 2024, global spending on digital infrastructure is projected to reach trillions, highlighting the market's scale.

Investing in advanced robotics and sustainable materials in construction signifies a high-potential growth sector. Balfour Beatty's commitment here, while potentially leading to a low initial market share in these nascent markets, is crucial for future dominance. These areas demand significant research and development (R&D) and strategic capital allocation to transition from question marks to stars.

The global construction robotics market is projected to reach $4.3 billion by 2026, indicating substantial growth opportunities. Similarly, the sustainable construction materials market is experiencing rapid expansion, driven by environmental regulations and demand for eco-friendly building solutions. Balfour Beatty’s investment in these areas aligns with industry trends, aiming to capture future market share.

Balfour Beatty’s potential expansion into new geographic regions or niche sectors would position them as Stars within the BCG matrix. While their core markets are the UK, US, and Hong Kong, venturing into high-growth emerging markets or specialized infrastructure areas like advanced modular construction or sustainable energy grids represents significant untapped potential. These nascent ventures, if successful, would offer substantial revenue growth opportunities.

Carbon Capture and Storage Infrastructure

Balfour Beatty's involvement in carbon capture and storage (CCS) infrastructure aligns with global net-zero ambitions and the company's own sustainability goals. This burgeoning sector presents a significant growth opportunity, as evidenced by the increasing number of government and private sector commitments to developing CCS projects. For instance, the UK government has pledged substantial investment in CCS clusters, aiming to capture millions of tonnes of CO2 annually by 2030, creating a robust pipeline of potential work.

However, due to the nascent stage of large-scale CCS construction for many firms, Balfour Beatty's current market share in this specific area is likely to be relatively low. This positions CCS infrastructure as a 'Question Mark' within the BCG matrix. The high growth potential is undeniable, with the global CCS market projected to reach tens of billions of dollars in the coming decade, driven by regulatory pressures and corporate decarbonization strategies. Yet, the initial investment and technological learning curve mean that Balfour Beatty, like many competitors, is still establishing its footprint and expertise.

- High Growth Potential: Global investment in CCS is accelerating, with estimates suggesting the market could reach over $100 billion by 2030, fueled by net-zero targets.

- Low Market Share: Balfour Beatty's current penetration in large-scale CCS infrastructure projects is likely limited as it builds experience and secures contracts in this emerging field.

- Strategic Importance: Developing capabilities in CCS aligns with Balfour Beatty's updated sustainability strategy and positions them to capitalize on future decarbonization infrastructure needs.

- Investment Required: Significant capital expenditure and technological development will be necessary for Balfour Beatty to scale its operations and gain a stronger market position in CCS.

New Urban Mobility Solutions (e.g., Light Rail Expansion)

Balfour Beatty's engagement in new urban mobility solutions, such as light rail expansion, positions them within a sector experiencing significant growth due to increasing urbanization and a strong push for sustainability. For instance, their involvement in projects like the Austin, Texas light rail signifies a commitment to this evolving landscape.

However, in these often nascent and specialized areas, Balfour Beatty's current market share might be relatively low. This suggests that these ventures could be classified as 'question marks' within a BCG matrix framework, indicating a need for further strategic investment to capitalize on their growth potential.

- Growth Potential: Urban mobility is a rapidly expanding market, driven by global urbanization trends and environmental concerns.

- Market Share: Balfour Beatty's share in these specific, often new, urban mobility project types may be limited, requiring careful analysis.

- Investment Needs: Projects in this category typically demand substantial capital for development and market penetration.

- Strategic Focus: The company's success in this segment will depend on its ability to secure contracts and build expertise in these specialized infrastructure areas.

The 'Question Mark' category in the BCG Matrix represents business units or projects with low market share but operating in high-growth industries. Balfour Beatty's investment in nascent digital infrastructure, advanced robotics, sustainable materials, and carbon capture and storage (CCS) infrastructure exemplifies this. These areas offer substantial future revenue potential, but currently require significant investment and strategic focus to build market share.

For instance, the global digital infrastructure market is projected to see continued robust growth through 2024 and beyond, while the sustainable construction materials market is also expanding rapidly. Balfour Beatty's strategic allocation of capital and R&D to these segments is aimed at transforming them from question marks into future market leaders.

The company's ventures into new urban mobility solutions also fit this profile, with strong growth drivers like urbanization and sustainability. However, their current market penetration in these specialized areas may be limited, necessitating further investment to secure a stronger competitive position.

| Area of Investment | Market Growth Potential | Current Market Share (Estimated) | Strategic Implication |

|---|---|---|---|

| Digital Infrastructure | High (Trillions globally in 2024) | Low to Moderate | Requires significant capital for market leadership. |

| Construction Robotics | High ($4.3 billion by 2026) | Low | Needs R&D and strategic capital for dominance. |

| Sustainable Materials | High (Rapid expansion) | Low | Investment crucial for capturing future market share. |

| Carbon Capture & Storage (CCS) | High (Tens of billions in coming decade) | Low | Demands investment and technological development. |

| New Urban Mobility Solutions | High (Driven by urbanization) | Low | Needs capital for development and market penetration. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.