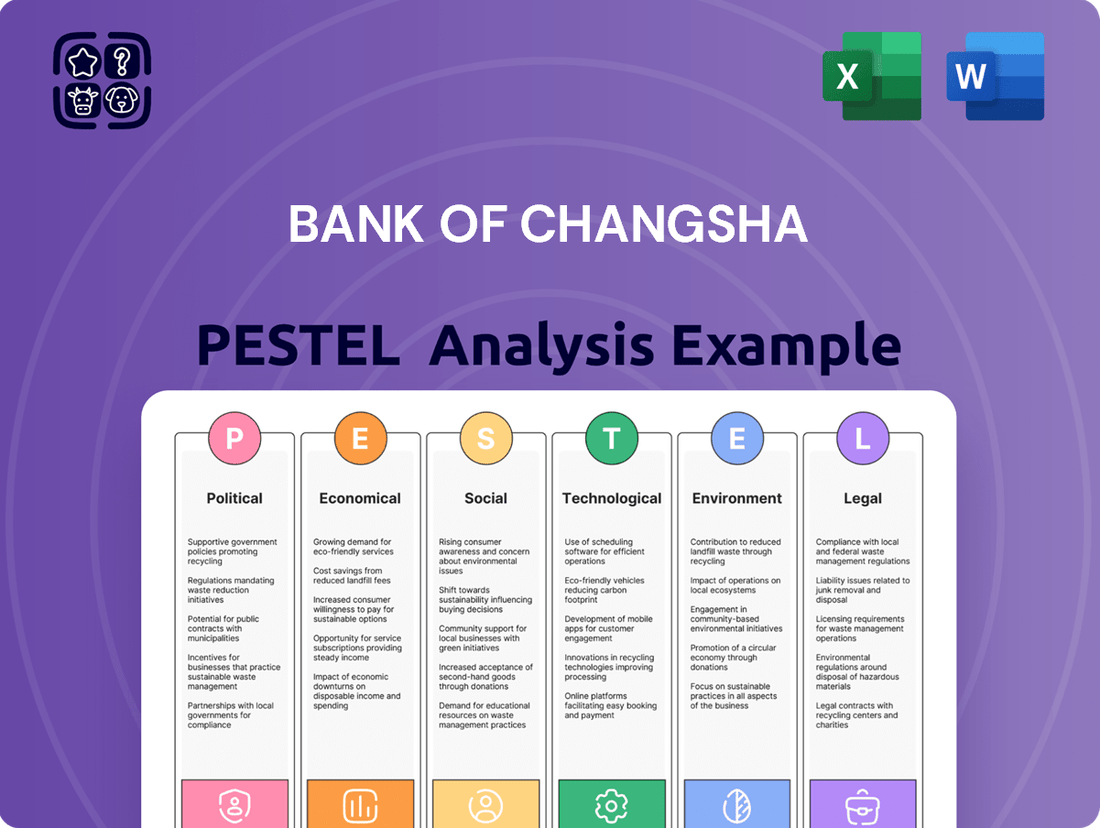

Bank of Changsha PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Changsha Bundle

Unlock the critical external factors shaping Bank of Changsha's trajectory. Our PESTLE analysis delves into the political stability, economic shifts, and technological advancements impacting its operations. Understand the social trends and environmental regulations influencing its market position. This comprehensive analysis provides the strategic intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now and gain a competitive edge.

Political factors

The Chinese government, through bodies like the People's Bank of China (PBOC) and the National Financial Regulatory Administration (NFRA), maintains a dynamic approach to its banking sector. Recent directives in 2024 have focused on balancing robust economic growth with stringent financial stability, impacting regional banks such as Bank of Changsha. Policies around lending targets, capital adequacy ratios, and risk management are continuously updated.

For instance, directives in early 2025 are expected to further refine digital banking regulations and cybersecurity standards, requiring significant investment from institutions like Bank of Changsha. The government’s stance on supporting small and medium-sized enterprises (SMEs) through targeted credit policies directly influences the lending strategies and risk appetite of regional banks. These policy shifts, whether easing or tightening, directly shape the operational landscape and strategic decision-making for Bank of Changsha.

Broader geopolitical shifts, like ongoing US-China trade friction, can indirectly impact China's economic stability, which in turn affects its banking sector. These tensions could influence cross-border transactions and foreign investment, creating a more challenging operating environment for banks like Bank of Changsha.

For instance, disruptions in international trade due to sanctions or tariffs might reduce demand for trade finance services. This could particularly affect Bank of Changsha's exposure to businesses heavily involved in global supply chains or export markets, potentially impacting their ability to repay loans.

In 2024, for example, global trade volumes are projected to grow at a more moderate pace, partly due to these geopolitical uncertainties, which could limit opportunities for international financing and foreign exchange services offered by banks operating within China.

The People's Bank of China's (PBOC) monetary policy directly shapes Bank of Changsha's operating environment. For instance, the PBOC's decision to maintain a relatively stable benchmark lending rate in early 2024, following a series of targeted easing measures in previous years, influences the bank's cost of funds and its ability to price loans competitively. Adjustments to reserve requirement ratios also play a crucial role; a reduction, as seen in some periods of 2023, frees up more capital for lending, potentially boosting Bank of Changsha's loan book growth and profitability. Conversely, any tightening measures would increase funding costs and potentially dampen credit demand.

Government Support for Regional Banks

The Chinese government actively supports regional banks through various initiatives designed to bolster their stability and lending capacity. Policies often include directed lending programs and regulatory frameworks that encourage mergers and acquisitions to create stronger, more resilient institutions. For instance, the People's Bank of China (PBOC) and the China Banking and Insurance Regulatory Commission (CBIRC) have historically provided liquidity support and encouraged asset management companies to address non-performing loans within the sector. This support is crucial for regional banks like Bank of Changsha, enabling them to participate in local economic development initiatives and maintain a stable deposit base.

Recent data indicates continued government focus on this area. In 2024, authorities continued to emphasize the importance of financial stability, with specific guidance issued for strengthening the risk management and capital adequacy of smaller financial institutions. This includes potential for further consolidation and enhanced supervision to prevent systemic risks. Such governmental interventions directly influence Bank of Changsha's operating environment, offering a degree of protection against economic downturns and facilitating its role in supporting local economies.

- Government Oversight: The China Banking and Insurance Regulatory Commission (CBIRC), now under the National Financial Regulatory Administration (NFRA), maintains a watchful eye on regional banks, implementing policies that can influence capital requirements and operational mandates.

- Financial Stability Initiatives: Programs aimed at resolving risks within the banking sector, including potential government-backed asset disposals or recapitalization efforts, directly impact the financial health and strategic options for regional players.

- Support for Local Development: Preferential policies for lending to small and medium-sized enterprises (SMEs) and local development projects often benefit regional banks, aligning their growth with national economic priorities.

Anti-Corruption Campaigns and Governance

China's persistent anti-corruption campaigns, intensified in recent years, directly impact the banking sector by demanding greater transparency and accountability in lending. These initiatives aim to curb illicit activities that can inflate non-performing loans (NPLs) and encourage more prudent risk management by bank leadership. For instance, the Central Commission for Discipline Inspection's ongoing scrutiny encourages banks to strengthen internal controls and due diligence, potentially reducing NPLs tied to bribery or favoritously awarded credit.

The focus on clean governance can reshape corporate client relationships, as businesses with strong ethical practices are favored, while those involved in corruption face increased scrutiny and potential financing restrictions. This shift compels banks like Bank of Changsha to enhance their compliance frameworks and potentially alter their risk appetite, prioritizing long-term stability over short-term gains derived from questionable dealings. The campaigns, therefore, serve as a catalyst for improved operational integrity and a more robust financial ecosystem.

- Enhanced Transparency: Anti-corruption drives push for clearer lending processes and reduced opportunities for illicit influence, fostering greater trust in financial institutions.

- Reduced NPLs: By targeting corruption in lending, these campaigns can help shrink NPLs stemming from deals influenced by bribery or unethical practices.

- Shifted Risk Appetite: Bank management may adopt a more conservative approach to lending, prioritizing compliance and ethical conduct over potentially risky, albeit profitable, relationships.

- Strengthened Compliance: Increased regulatory oversight necessitates more rigorous internal compliance measures and due diligence, impacting how banks onboard and manage corporate clients.

Government policies in China, overseen by entities like the National Financial Regulatory Administration (NFRA), aim to balance economic growth with financial stability. Directives in 2024 and anticipated in early 2025 focus on strengthening regional banks, including Bank of Changsha, through updated capital adequacy and risk management standards, alongside evolving digital banking regulations.

Geopolitical tensions, particularly US-China trade friction, create an indirect impact by potentially slowing global trade growth. This moderation in trade volumes, as projected for 2024, could limit opportunities for banks like Bank of Changsha in areas such as trade finance and foreign exchange services.

The People's Bank of China's monetary policy directly influences Bank of Changsha's operational costs and lending strategies. For example, maintaining stable benchmark lending rates in 2024 impacts the bank's cost of funds, while adjustments to reserve requirement ratios affect capital availability for lending.

China's anti-corruption campaigns are fostering greater transparency and accountability in lending practices. These initiatives encourage banks to enhance internal controls and due diligence, potentially reducing non-performing loans linked to unethical dealings and shifting risk appetite towards more compliant relationships.

What is included in the product

This PESTLE analysis examines the Bank of Changsha's operating environment, detailing how political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks present both challenges and strategic opportunities.

The Bank of Changsha PESTLE analysis offers a streamlined, easy-to-digest overview, simplifying complex external factors for rapid decision-making and strategic alignment.

Economic factors

China's economic growth is a crucial driver for Bank of Changsha. The nation's GDP growth trajectory directly shapes the demand for banking services, from corporate lending to individual deposit accounts. For instance, in Q1 2024, China's GDP grew by 5.3%, indicating a robust environment for financial institutions. This growth influences the credit quality of the bank's clients; a faster economy generally means stronger repayment capabilities for businesses and individuals alike.

A slowdown in China's national economic expansion, however, can negatively impact Bank of Changsha. Such a slowdown would likely lead to reduced demand for loans and potentially slower deposit growth. More critically, it could signal deteriorating credit quality among the bank's corporate and individual borrowers, increasing the risk of loan defaults. This economic deceleration also dampens business expansion plans and erodes consumer confidence within the bank's service areas.

The prevailing interest rate environment in China significantly impacts Bank of Changsha's lending profitability. As of mid-2025, the People's Bank of China's benchmark lending rates hover around 3.85%, while deposit rates are considerably lower, creating a base for net interest margin (NIM) generation.

A low interest rate environment, while potentially stimulating borrowing and economic activity, can compress Bank of Changsha's NIM. This is because the spread between loan yields and deposit costs narrows, directly affecting revenue from core lending operations.

Conversely, a high interest rate environment can boost NIM, but it also carries risks. Higher borrowing costs for customers might lead to increased loan defaults, impacting asset quality and potentially offsetting the benefits of wider interest rate spreads.

Competitive pressures from other banks and financial institutions in China force Bank of Changsha to carefully manage its pricing strategies for both loans and deposits to remain competitive while safeguarding profitability.

Inflation significantly impacts consumer and business purchasing power, directly influencing demand for Bank of Changsha's financial products. For instance, persistent inflation in 2024 could erode savings, potentially reducing demand for long-term deposits while increasing interest in inflation-protected investments. High inflation also means the real value of the bank's fixed-rate loans decreases, while its operational costs, like salaries and technology, tend to rise.

The bank's asset values, particularly those with fixed returns, face a decline in real terms during inflationary periods. Conversely, liabilities tied to variable rates might become more expensive. This dynamic requires careful management of the bank's balance sheet to mitigate these effects. For example, if the consumer price index (CPI) in China averaged 2.5% in early 2024, a loan with a 4% fixed rate would yield a real return of only 1.5%.

Inflationary pressures necessitate strategic adjustments in investment decisions and loan portfolio management for Bank of Changsha. The bank might favor lending at variable rates or to sectors less sensitive to price increases. Furthermore, managing the duration of its asset and liability portfolios becomes crucial to minimize the impact of interest rate fluctuations driven by inflation, with central bank policy closely watched.

Real Estate Market Conditions

The health of China's real estate sector is a critical factor for Bank of Changsha, given the industry's substantial role in the Chinese economy and the bank's exposure to property-related lending. Fluctuations in property prices and developer solvency directly affect the bank's asset quality. For instance, a downturn in the property market can lead to an increase in non-performing loans (NPLs) as borrowers struggle to meet their repayment obligations.

Recent trends indicate a challenging environment for Chinese developers, with several high-profile defaults impacting market confidence. Government policies aimed at deleveraging the sector, such as "three red lines" regulations, continue to influence developer liquidity and project completion. This creates both risks, such as increased NPLs, and potential opportunities for banks that can navigate the complexities, perhaps through restructuring distressed assets or focusing on more resilient segments of the market.

Data from early 2024 suggests ongoing pressure on property sales and prices in many cities. For example, national property price indices showed a slight year-on-year decline in key urban centers.

- Developer Defaults: High-profile defaults by major developers have shaken investor confidence and increased scrutiny on bank lending to the sector.

- Property Price Volatility: While some markets show resilience, others have experienced price corrections, impacting collateral values for loans.

- Government Policy Impact: Ongoing regulatory efforts to manage systemic risk in real estate continue to shape market dynamics and developer access to financing.

- NPL Risk: A sustained downturn in property values or developer financial health poses a direct risk to Bank of Changsha's loan portfolio quality.

Consumer Spending and Corporate Investment Trends

Consumer spending in China has shown resilience, a key driver for banking services. In 2024, retail sales of consumer goods were projected to continue their upward trajectory, influencing the demand for personal loans and credit products. This robust spending directly translates to opportunities for Bank of Changsha to expand its offerings in credit cards and wealth management as households seek to finance purchases and grow their assets.

Corporate investment is another critical factor. In 2023, China's fixed-asset investment in manufacturing saw a notable increase, indicating a positive environment for business lending. As businesses expand operations and invest in new technologies, the demand for business loans, trade finance, and other corporate banking solutions from institutions like Bank of Changsha is expected to grow significantly.

- Consumer Spending Impact: Strong household consumption fuels demand for personal loans and credit cards, while also driving interest in wealth management products as disposable incomes rise.

- Corporate Investment Impact: Increased private sector investment, particularly in manufacturing and technology, creates a higher demand for business loans and corporate banking services.

- 2024 Trends: Projections indicate continued growth in retail sales, directly benefiting banks offering consumer credit and investment products.

- 2023 Data: A significant uptick in manufacturing fixed-asset investment highlights a favorable climate for corporate banking services.

China's economic expansion remains a primary driver for Bank of Changsha, with GDP growth directly influencing loan demand and deposit accretion. For instance, China's GDP grew by 5.3% in Q1 2024, signaling a supportive environment for banking operations and improved borrower creditworthiness.

Interest rates are a key determinant of Bank of Changsha's profitability, with the People's Bank of China's benchmark lending rate around 3.85% in mid-2025. This rate environment directly shapes the bank's net interest margin (NIM), balancing loan yields against deposit costs.

Inflationary pressures, with China's CPI averaging 2.5% in early 2024, impact purchasing power and the real value of bank assets and liabilities. This necessitates strategic adjustments in lending and investment portfolios to mitigate erosion of returns.

The real estate sector's health is crucial for Bank of Changsha, as property market volatility and developer defaults, observed in early 2024 with slight year-on-year property price declines in key cities, can increase non-performing loans.

Preview Before You Purchase

Bank of Changsha PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Bank of Changsha delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand key market dynamics and strategic considerations that shape the bank's future. This is your complete guide to navigating the Bank of Changsha's external environment.

Sociological factors

China's demographic landscape is rapidly evolving, with an aging population and increasing urbanization shaping banking needs. By the end of 2024, China's elderly population (60 and above) is projected to exceed 290 million, creating a growing demand for retirement planning, healthcare financing, and wealth management services. Bank of Changsha is responding by developing specialized products and advisory services tailored to the financial security and lifestyle aspirations of this segment.

Shifts in wealth distribution significantly influence demand for financial products. As the middle class expands, there's a greater need for diversified investment options beyond basic savings accounts, including mutual funds, wealth management products, and potentially even more sophisticated investment vehicles. The bank observes this trend and is expanding its investment advisory and product shelf to cater to individuals seeking to grow and preserve their capital.

The bank's strategy involves segmenting its customer base to address varying needs. For younger, urbanizing populations, digital banking solutions and accessible credit products are paramount. Conversely, for older demographics and those with accumulated wealth, the focus shifts to estate planning, long-term investment strategies, and personalized financial guidance. Bank of Changsha's product development reflects this nuanced understanding of evolving customer profiles and their financial journeys.

Sociological factors highlight a significant shift in how people in China interact with financial institutions. There's a clear and growing preference for digital banking services among both consumers and businesses. This trend is fueled by the incredibly high adoption rates of smartphones and widespread internet access across the country.

This demand translates into a need for convenient, on-the-go banking solutions. People expect to be able to manage their accounts, make payments, and even access lending services entirely through online and mobile platforms. For instance, by the end of 2023, China's mobile payment penetration rate was estimated to be over 87%, showcasing this deep integration of digital finance into daily life.

To stay competitive, Bank of Changsha must continue to invest heavily in and refine its digital channels. This means ensuring a smooth, user-friendly experience for all digital interactions, from account opening to complex transactions. Failing to meet these evolving customer expectations could lead to a loss of market share as customers migrate to more digitally adept competitors.

Financial literacy in China is growing, with a significant portion of the population, particularly younger demographics, showing increased interest in financial planning and investment. Despite this, a gap persists, especially among older generations and those in rural areas, impacting their engagement with sophisticated banking products. For instance, a 2023 report indicated that while over 60% of urban Chinese adults understood basic financial concepts, comprehension of more complex instruments like derivatives remained lower.

Public education initiatives are crucial for fostering responsible financial behavior and building trust in institutions like Bank of Changsha. Campaigns focusing on digital banking security and investment risk management can significantly boost consumer confidence. The People's Bank of China, for example, has been actively promoting financial education, with nationwide campaigns reaching millions in 2024.

Bank of Changsha can enhance customer engagement by segmenting its communication strategies. Offering simplified product explanations, interactive tutorials, and dedicated support for less financially literate customers would be beneficial. Tailoring product design to include clearer risk disclosures and user-friendly interfaces can also address varying levels of financial understanding.

Public Trust in the Banking System

Public trust in China's banking system is a critical factor influencing Bank of Changsha's operations. While the sector has generally remained stable, past events, such as the 2008 global financial crisis and localized banking issues, have created occasional ripples in public confidence. High levels of trust are essential for encouraging deposit inflows and fostering customer loyalty, directly impacting a bank's liquidity and growth potential. For Bank of Changsha, demonstrating transparent operations and robust governance is paramount to solidifying this trust.

The Chinese government's proactive regulatory stance and deposit insurance scheme aim to bolster public confidence. For instance, the People's Bank of China (PBOC) consistently monitors and intervenes to ensure financial stability. This environment generally supports strong deposit growth across the banking sector. In 2023, China's total deposits in financial institutions reached approximately 258.5 trillion yuan, indicating a high propensity for savings and a foundational level of trust. However, individual bank performance and adherence to ethical practices remain key differentiators for customer retention.

- Government guarantees and deposit insurance schemes are crucial for maintaining public confidence in China's banking sector.

- Instances of financial misconduct or instability at individual institutions can temporarily erode trust across the broader system.

- Transparent communication and strong corporate governance are vital for Bank of Changsha to build and maintain customer loyalty.

- The overall stability of the Chinese economy significantly underpins public trust in its financial institutions.

Urbanization Trends and Regional Development

China's rapid urbanization is significantly reshaping the demand for banking services. As more people move to cities, particularly in China's central and western regions where Bank of Changsha operates, the need for financial products and services, from retail banking to corporate lending, intensifies. This demographic shift creates fertile ground for banking expansion. For instance, by the end of 2023, China's urbanization rate reached 66.16%, an increase from previous years, indicating a substantial urban population growth that Bank of Changsha can tap into.

The growth of regional economic hubs, often fueled by urbanization, presents direct opportunities for Bank of Changsha. These hubs require specialized lending for local industries, such as manufacturing and technology, and demand tailored financial solutions for a growing urban workforce and businesses. Bank of Changsha's strategic focus on supporting local economic development aligns with these trends, as demonstrated by its lending activities to small and medium-sized enterprises (SMEs) which are crucial for urban economic vitality. In 2024, the bank continued its commitment to supporting Hunan's economic growth, a province experiencing significant urban development.

- Urbanization Rate: China's urbanization rate stood at 66.16% by the end of 2023, a key indicator of shifting population centers.

- Regional Focus: Bank of Changsha's operations are concentrated in Hunan province, a region experiencing notable urban development and economic diversification.

- SME Support: The bank actively provides financial support to SMEs, which are vital for job creation and economic activity in urban areas.

- Economic Contribution: Bank of Changsha's lending practices aim to foster local economic development, directly benefiting from and contributing to urban growth patterns.

China's evolving demographic profile, particularly its aging population and increasing urbanization, directly impacts banking needs and strategies. By the end of 2024, the elderly population (60+) is expected to surpass 290 million, driving demand for retirement planning and wealth management services. Bank of Changsha is adapting by developing specialized offerings for this growing segment.

Shifts in wealth distribution are also crucial, with an expanding middle class seeking diversified investment options beyond traditional savings. The bank is responding by broadening its investment advisory services and product range to cater to individuals focused on capital growth and preservation.

Customer segmentation is key, with younger, urban populations prioritizing digital banking and accessible credit, while older or wealthier demographics seek estate planning and long-term investment guidance. Bank of Changsha's product development reflects this nuanced understanding of diverse customer needs and financial journeys.

Technological factors

China's FinTech landscape is evolving at breakneck speed, with mobile payment giants like Alipay and WeChat Pay dominating transactions. In 2023, mobile payments accounted for over 70% of all consumer payments in China, a testament to their widespread adoption. This digital shift presents Bank of Changsha with a dual challenge: it must either collaborate with these FinTech innovators or develop its own competitive digital offerings to avoid losing market share.

The rise of online lending platforms and digital wallets means customers increasingly expect seamless, digital-first banking experiences. Failing to adapt could alienate younger demographics and tech-savvy consumers who are comfortable managing their finances entirely through apps. For instance, by the end of 2024, it's projected that over 90% of urban Chinese consumers will utilize digital payment methods for daily purchases.

Bank of Changsha faces an imperative to integrate these emerging technologies. This could involve partnering with FinTech firms to offer enhanced services or investing heavily in its own digital infrastructure. By doing so, the bank can not only retain its existing customer base but also attract new customers who are drawn to the convenience and efficiency of modern financial solutions.

Bank of Changsha is increasingly integrating AI and big data analytics to sharpen its competitive edge. These technologies are pivotal for improving credit scoring accuracy, bolstering fraud detection capabilities, and tailoring customer marketing efforts. For instance, AI-driven credit models can process vast datasets to identify nuanced risk patterns, potentially leading to more informed lending decisions and reduced defaults.

By leveraging big data, the bank can gain deeper customer insights, enabling personalized product offerings and enhanced customer service. This proactive approach aims to boost customer loyalty and drive revenue growth. In 2024, financial institutions globally reported that AI adoption led to an average of 15% improvement in operational efficiency.

However, implementing these advanced technologies presents challenges, particularly concerning data privacy regulations and the significant investment required for infrastructure and talent. Ensuring robust data security and compliance with evolving privacy laws, such as those governing personal financial information, is paramount for Bank of Changsha's successful adoption.

Bank of Changsha faces escalating cybersecurity threats, demanding significant investment in advanced defense systems. The increasing sophistication of attacks means that even well-established financial institutions are vulnerable.

China's Personal Information Protection Law (PIPL), enacted in 2021, imposes stringent requirements on data handling and privacy. This legislation mandates robust measures to safeguard sensitive customer information, with potential fines for non-compliance reaching up to 5% of annual turnover or RMB 50 million.

A data breach could severely damage Bank of Changsha's reputation, leading to customer attrition and loss of trust. The financial repercussions can also be substantial, encompassing remediation costs, regulatory penalties, and potential lawsuits, impacting profitability and market standing.

Cloud Computing Adoption for Banking Infrastructure

Cloud computing adoption is a significant technological trend reshaping the banking sector. Bank of Changsha can leverage this by migrating its IT infrastructure to cloud platforms, unlocking benefits like enhanced scalability to handle fluctuating customer demands and cost efficiencies through reduced hardware maintenance. Improved data accessibility across departments is another key advantage, fostering quicker decision-making.

However, the transition to cloud services for a financial institution like Bank of Changsha necessitates careful consideration of regulatory compliance. Stringent data residency laws and robust security protocols are paramount, especially given the sensitive nature of financial data. For instance, the adoption of cloud services in the Asia-Pacific region is projected to see substantial growth, with financial services being a key driver, indicating a strong market trend towards these solutions.

- Scalability: Enables rapid adjustment of IT resources to meet fluctuating transaction volumes and customer growth.

- Cost Efficiency: Reduces capital expenditure on physical infrastructure and lowers operational costs through pay-as-you-go models.

- Data Accessibility: Facilitates real-time access to data for analytics, risk management, and customer service improvements.

- Regulatory Compliance: Requires adherence to specific data protection, privacy, and geographical data storage regulations, such as those enforced by the China Banking and Insurance Regulatory Commission (CBIRC).

Blockchain Technology for Financial Transactions

Blockchain and distributed ledger technology (DLT) present significant opportunities for the banking sector. Bank of Changsha could leverage these technologies to streamline cross-border payments, making them faster and more cost-effective. Its application in trade finance and supply chain finance can enhance transparency and reduce settlement times, which are critical for businesses operating in these areas.

The adoption of blockchain in China's financial industry is still evolving, with regulators closely monitoring its development. While the People's Bank of China has been exploring a central bank digital currency (CBDC), widespread adoption of private blockchain solutions for commercial banking transactions is gaining traction. Bank of Changsha might explore pilot programs to test the efficacy of DLT for specific use cases, aiming to improve operational efficiency and customer experience.

- Enhanced Security: Blockchain's inherent cryptographic security can reduce fraud and errors in financial transactions.

- Increased Efficiency: DLT can automate processes and reduce the need for intermediaries, leading to faster transaction settlements.

- Improved Transparency: Shared ledgers offer greater visibility into transaction flows, beneficial for compliance and auditing.

- Cost Reduction: By minimizing manual processes and third-party involvement, blockchain can lower transaction costs.

Bank of Changsha must embrace digital transformation, integrating mobile payments and online lending to meet evolving customer expectations. By the end of 2024, over 90% of urban Chinese consumers are projected to use digital payment methods daily, highlighting the urgency to adapt.

The bank is leveraging AI and big data for improved credit scoring and customer insights, with global financial institutions reporting a 15% operational efficiency boost from AI in 2024. However, significant investment and adherence to China's Personal Information Protection Law (PIPL) are crucial for successful implementation and data security.

Cloud computing offers Bank of Changsha scalability and cost efficiencies, but requires careful navigation of data residency and security regulations. Blockchain and DLT present opportunities for streamlined payments and enhanced transparency, though adoption in China's financial sector is still developing.

Legal factors

The National Financial Regulatory Administration (NFRA) and the People's Bank of China (PBOC) are the primary bodies shaping China's banking landscape, and their directives significantly influence the Bank of Changsha. These regulations mandate stringent capital adequacy ratios, for instance, requiring commercial banks to maintain a core capital adequacy ratio of at least 7.5% as of early 2024, directly impacting how Bank of Changsha manages its lending and investment strategies.

Furthermore, rules on asset quality, such as non-performing loan (NPL) ratios, and robust corporate governance frameworks are critical. Bank of Changsha must continually align its risk management practices with evolving PBOC guidelines to ensure stability and compliance, which affects its operational efficiency and strategic growth planning.

Recent directives, such as those focusing on digital financial services and consumer protection, introduce new compliance requirements. For example, the PBOC's push for greater data security in financial transactions in 2024 means Bank of Changsha needs to invest in advanced cybersecurity measures to protect customer information.

China's robust Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws impose significant compliance burdens on institutions like Bank of Changsha. These regulations mandate rigorous customer due diligence (CDD) processes, requiring thorough verification of customer identities and beneficial ownership. For instance, the People's Bank of China (PBOC) continually updates its AML guidelines, most recently with enhanced focus on digital transactions and cross-border flows.

Bank of Changsha must implement comprehensive systems for suspicious transaction reporting (STR) to relevant authorities, such as the PBOC's Financial Intelligence Unit. This includes establishing internal control systems with clear policies, procedures, and staff training to detect and report potential financial crimes. Failure to comply can result in substantial penalties, including hefty fines and reputational damage.

In response to evolving threats, Bank of Changsha is actively investing in advanced technologies and data analytics to bolster its financial crime prevention capabilities. This includes enhancing Know Your Customer (KYC) platforms and transaction monitoring systems. The bank's commitment to strengthening its AML/CTF defenses is crucial for maintaining operational integrity and regulatory trust in the dynamic Chinese financial landscape.

China's Personal Information Protection Law (PIPL), effective November 1, 2021, significantly reshapes data handling for institutions like Bank of Changsha. PIPL mandates explicit consent for collecting and processing personal information, impacting how the bank acquires and utilizes customer data. Ensuring robust data security measures and clear protocols for data breach notification are now critical operational requirements, with potential penalties for non-compliance.

The Bank of Changsha must navigate stringent rules around cross-border data transfers under PIPL. This involves meeting specific conditions, such as obtaining separate consent from individuals for transfers or undergoing government security assessments, which could add complexity to international operations or partnerships involving customer data. Failure to comply can result in substantial fines, impacting profitability and reputation.

Consumer Protection Laws in Financial Services

Bank of Changsha operates within China's stringent legal framework for consumer protection in financial services, designed to safeguard individuals from unfair or deceptive practices. Key regulations govern fair lending, requiring transparent disclosure of all terms, fees, and interest rates for loans. In 2023, the China Banking and Insurance Regulatory Commission (CBIRC), now part of the National Financial Regulatory Administration (NFRA), continued to emphasize consumer rights, with a focus on preventing predatory lending and ensuring accessible complaint resolution channels.

The bank must adhere to disclosure requirements for all financial products, including savings accounts, loans, and investment offerings, ensuring customers fully understand the risks and benefits. This transparency is crucial for building trust and preventing mis-selling. The legal landscape mandates robust mechanisms for handling customer complaints, with regulatory bodies often intervening to ensure fair outcomes. For instance, in 2024, the NFRA reported a significant increase in consumer complaints related to digital financial services, prompting stricter oversight on data privacy and cybersecurity measures.

Bank of Changsha's compliance strategy must prioritize ethical conduct and transparency in every customer interaction. This includes robust internal policies and training to prevent predatory practices, such as excessive fees or misleading advertising. The regulatory environment is dynamic, with ongoing efforts to enhance consumer protection, especially in light of rapid technological advancements in financial services. For example, new guidelines issued in late 2024 aimed to clarify responsibilities for financial institutions offering online wealth management products, underscoring the need for continuous adaptation.

Key areas of regulatory focus for Bank of Changsha include:

- Fair Lending Practices: Adherence to regulations that prevent discriminatory lending and ensure clear, understandable loan terms.

- Disclosure Requirements: Providing comprehensive and easily accessible information about all financial products and services.

- Complaint Resolution: Establishing efficient and fair processes for addressing customer grievances.

- Protection Against Predatory Practices: Implementing safeguards against deceptive marketing, excessive fees, and unfair contract terms.

Loan Recovery and Bankruptcy Laws

China's legal framework for loan recovery and bankruptcy, while evolving, presents both opportunities and challenges for institutions like the Bank of Changsha. The effectiveness of these laws directly influences the bank's capacity to manage non-performing loans (NPLs) and control credit risk.

Recent years have seen efforts to streamline these processes. For instance, reforms aimed at improving the efficiency of the judicial system and strengthening creditor rights are in place, though their consistent application and impact on recovery rates can vary. The efficiency of these legal mechanisms is crucial for financial stability.

The Bank of Changsha, like other lenders, navigates these laws to secure assets and recover outstanding debts. The success rate in these recoveries is a key performance indicator, directly impacting the bank's financial health and its ability to extend new credit.

- Loan Recovery Mechanisms: China's legal system provides various avenues for loan recovery, including judicial enforcement, asset auctions, and out-of-court settlements, all of which the Bank of Changsha utilizes.

- Bankruptcy Law Reforms: China's Enterprise Bankruptcy Law (2007) and ongoing discussions around individual bankruptcy legislation aim to create a more orderly process for insolvency, potentially improving recovery for creditors.

- Judicial Efficiency: While improvements are noted, the speed and predictability of judicial proceedings for debt recovery can still be a factor affecting the Bank of Changsha's NPL resolution timelines.

- Creditor Rights Enforcement: The legal framework's strength in enforcing creditor rights is paramount; recent trends indicate a continued focus on ensuring lenders can reclaim assets and debts effectively.

Bank of Changsha operates under a complex web of financial regulations, with the National Financial Regulatory Administration (NFRA) and the People's Bank of China (PBOC) setting the pace. These bodies enforce strict capital adequacy ratios, requiring banks to maintain a minimum core capital adequacy ratio, which stood at 7.5% in early 2024, directly influencing lending strategies and investment decisions.

Compliance with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws is paramount, necessitating robust Know Your Customer (KYC) processes and suspicious transaction reporting. China's Personal Information Protection Law (PIPL), effective from late 2021, also imposes significant data handling requirements, demanding explicit consent for data usage and stringent security measures, with potential fines for breaches.

Furthermore, consumer protection laws are actively enforced, mandating transparent disclosures for all financial products and fair lending practices, with the NFRA increasing its oversight on digital financial services following a rise in consumer complaints in 2024.

Environmental factors

China's national commitment to green finance is a significant environmental factor influencing banks like Bank of Changsha. This includes a growing focus on Environmental, Social, and Governance (ESG) principles in lending and investment decisions. In 2023, China's outstanding green loans reached approximately 31.07 trillion yuan, a 22.1% increase year-on-year, demonstrating the robust market for sustainable finance.

Bank of Changsha is actively integrating ESG factors into its credit assessment frameworks. This involves evaluating the environmental impact and sustainability practices of borrowers. The bank is also developing and offering green financial products, such as green bonds and loans specifically for projects with positive environmental outcomes, aligning with regulatory incentives and increasing market demand for sustainable investments.

Climate change presents significant physical and transition risks to Bank of Changsha's loan portfolio. Extreme weather events, such as floods and typhoons, which are becoming more frequent and intense in regions like Hunan province, can directly damage assets financed by loans, leading to defaults. For instance, the devastating floods in July 2021 across China, impacting several provinces, highlighted the vulnerability of infrastructure and businesses to such events.

Transition risks also pose a threat, as policy changes and technological advancements drive a shift towards a low-carbon economy. Industries heavily reliant on fossil fuels, like coal mining and certain heavy manufacturing sectors where Bank of Changsha may have exposure, could face financial distress. This distress can translate into increased credit risk for the bank as these borrowers struggle to adapt or remain competitive.

Consequently, Bank of Changsha must integrate robust climate risk assessment and stress testing into its lending practices. Understanding the specific climate vulnerabilities of its borrowers and the sectors they operate in is crucial for managing potential losses. This proactive approach will help safeguard the bank's financial stability amidst evolving environmental challenges.

China's Ministry of Ecology and Environment continues to tighten environmental regulations across numerous sectors. For instance, recent updates in 2024 and proposed frameworks for 2025 are increasing scrutiny on heavy industries like manufacturing and energy, sectors where Bank of Changsha likely holds significant loan exposure. Stricter emissions standards and waste disposal mandates can directly translate to higher operational costs for these businesses, potentially impacting their ability to service debt and affecting the financial health of their loan portfolios.

These evolving environmental compliance requirements mean Bank of Changsha must proactively assess and monitor its corporate clients' environmental performance. Failure to do so could expose the bank to reputational risks and potential losses from non-compliant borrowers. For example, companies facing substantial fines for environmental violations may default on loans, a scenario that robust environmental due diligence aims to mitigate.

Bank's Own Carbon Footprint and Sustainability Initiatives

Bank of Changsha is actively working to shrink its direct environmental impact. For instance, in 2023, the bank reported a reduction in energy consumption across its branches by 8% compared to the previous year, primarily through upgrades to energy-efficient lighting and HVAC systems. This focus extends to waste management, with a 15% increase in recycling rates observed across its operations in the same period.

Beyond operational efficiency, the bank champions sustainability through its services and employee engagement. Initiatives like promoting digital banking to reduce paper usage have seen a 20% year-over-year increase in paperless transactions. Furthermore, Bank of Changsha has invested in solar panel installations at 10 of its newer branches, aiming to power a significant portion of their energy needs renewably.

The bank's commitment to corporate social responsibility is evident in its broader environmental programs. These include:

- Employee Green Commute Programs: Encouraging and incentivizing employees to use public transport or carpool, leading to an estimated 5% reduction in commuting-related emissions among participating staff in 2024.

- Branch Energy Audits: Regular assessments of branch energy usage to identify further opportunities for efficiency improvements.

- Community Greening Projects: Participation in local tree-planting drives and environmental clean-up events, demonstrating a commitment beyond its immediate operational scope.

Public and Regulatory Pressure for Sustainable Banking

The financial sector, including Bank of Changsha, faces mounting pressure from both governments and the public to embrace sustainable banking. This includes a growing demand for environmentally conscious lending and investment. For instance, by early 2024, many global financial institutions were increasing their commitments to net-zero portfolios, signaling a shift in investment strategy that could impact companies like Bank of Changsha.

These heightened stakeholder expectations, particularly concerning climate change and broader corporate responsibility, directly influence Bank of Changsha's public image, its investment choices, and its overarching long-term business approach. A strong Environmental, Social, and Governance (ESG) performance is becoming a critical differentiator.

- Regulatory Scrutiny: Banks are increasingly subject to regulations requiring them to disclose climate-related financial risks and to integrate ESG factors into their decision-making processes.

- Investor Demand: A significant portion of global assets under management are now directed towards ESG-compliant investments, pushing banks to align their offerings with these preferences.

- Public Perception: Consumers and civil society groups are more vocal, expecting banks to demonstrate tangible contributions to environmental protection and social well-being.

- Reputational Risk: Failure to meet sustainability standards can lead to reputational damage, affecting customer loyalty and market share.

China's push for green finance, with outstanding green loans reaching approximately 31.07 trillion yuan in 2023, creates opportunities and expectations for Bank of Changsha. The bank is responding by integrating ESG into its lending and offering green financial products, aligning with national goals and market demand.

Climate change presents tangible risks, as seen in the 2021 floods impacting infrastructure, potentially leading to loan defaults for Bank of Changsha. Additionally, the transition to a low-carbon economy poses risks to industries heavily reliant on fossil fuels, which may be part of the bank's portfolio.

Stricter environmental regulations, with updates anticipated through 2025, will increase operational costs for many businesses, potentially affecting their ability to repay loans held by Bank of Changsha. Proactive environmental due diligence is therefore crucial to mitigate these risks and protect the bank's financial health.

Bank of Changsha itself is reducing its environmental footprint, reporting an 8% decrease in energy consumption and a 15% increase in recycling rates in 2023. Initiatives like promoting digital banking and installing solar panels at new branches further underscore this commitment.

PESTLE Analysis Data Sources

Our PESTLE analysis for the Bank of Changsha is grounded in comprehensive data from official Chinese government publications, reports from the People's Bank of China, and reputable financial news outlets. We also incorporate insights from international financial institutions and market research firms focusing on the banking sector.