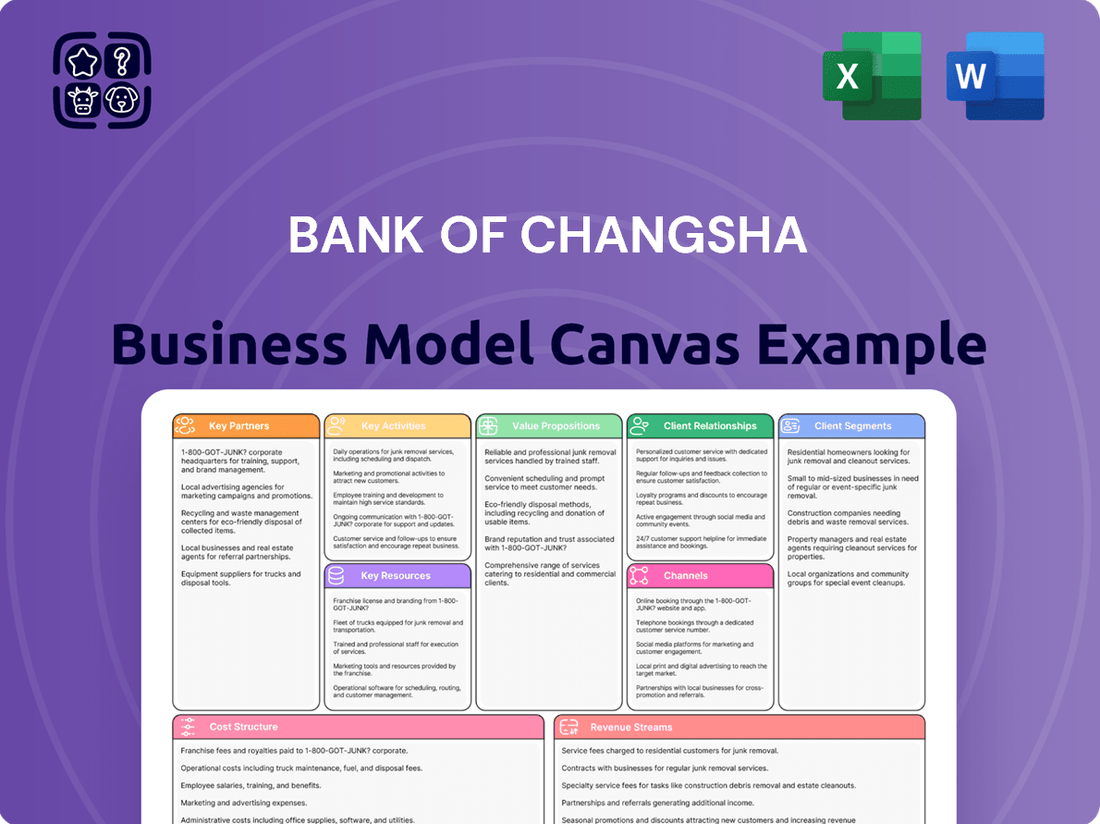

Bank of Changsha Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Changsha Bundle

Unlock the full strategic blueprint behind Bank of Changsha's innovative business model. This comprehensive Business Model Canvas reveals exactly how they attract and serve diverse customer segments, from retail banking to corporate finance. Discover their key partnerships and the value propositions that drive their success.

Partnerships

Bank of Changsha actively collaborates with local government bodies to foster regional economic growth. For example, in 2024, the bank participated in funding several key infrastructure projects aimed at improving connectivity and stimulating local commerce.

These partnerships grant Bank of Changsha access to government-backed lending programs, enabling the bank to offer more favorable terms on loans for businesses and individuals involved in development initiatives. This strategic alignment ensures the bank's offerings support local policy objectives.

A significant focus of these collaborations in 2024 has been on inclusive finance and rural revitalization efforts. By working with local authorities, Bank of Changsha has extended its financial services to underserved communities, contributing to broader socio-economic development goals.

Bank of Changsha actively cultivates relationships with a diverse array of financial institutions. These collaborations are crucial for expanding its market presence and enhancing its product portfolio. For instance, partnerships with other commercial banks facilitate vital interbank lending, ensuring robust liquidity management. In 2023, the interbank market played a significant role in the Chinese banking sector, with total interbank assets reaching trillions of yuan, underscoring the importance of these relationships for operational stability.

Furthermore, the bank engages with rural banks and specialized financial service providers. These alliances enable co-lending agreements, particularly beneficial for reaching underserved markets and offering tailored financial solutions like consumer finance. Such strategic partnerships allow Bank of Changsha to leverage the unique strengths of its partners, thereby broadening the spectrum of financial services available to its customer base and driving revenue growth through shared risk and expanded reach.

Bank of Changsha actively partners with technology and fintech companies to drive its digital transformation. These collaborations are essential for developing and enhancing advanced mobile banking platforms and innovative digital payment solutions. For instance, in 2024, the bank continued to invest in upgrading its mobile app, aiming to provide a seamless user experience for its growing digital customer base.

Leveraging data analytics through these partnerships allows Bank of Changsha to gain deeper customer insights, personalize services, and improve risk management strategies. By integrating cutting-edge technologies, the bank aims to offer more sophisticated and secure digital financial services. This strategic approach helps them stay competitive in the rapidly evolving financial landscape.

Corporate and Commercial Clients

The Bank of Changsha cultivates strategic relationships with major corporate and commercial clients, extending far beyond routine banking. These partnerships often encompass specialized services like investment banking, sophisticated supply chain finance, and bespoke financial solutions tailored to specific business needs. For instance, in 2023, the bank reported significant growth in its corporate lending portfolio, driven by these key relationships.

These deep integrations are frequently solidified through arrangements such as joint ventures or preferred banking agreements, fostering a symbiotic environment for mutual expansion. Such collaborations are vital for securing substantial deposit bases and robust lending opportunities, forming a cornerstone of the bank's financial stability and growth strategy.

- Strategic Integration: Partnerships go beyond transactional banking to include investment banking and customized financial solutions, deepening client relationships.

- Mutual Growth: Joint ventures and preferred banking arrangements foster shared expansion and integration, benefiting both the bank and its corporate clients.

- Deposit and Lending Base: These key partnerships are crucial for attracting significant deposits and generating substantial lending volumes, supporting the bank's balance sheet.

- 2023 Performance: The bank observed notable increases in its corporate lending activities throughout 2023, directly attributable to these strong client relationships.

Community Organizations and Businesses

Bank of Changsha actively partners with local community organizations and small to medium-sized enterprises (SMEs) to bolster its community presence and contribute to the local economy. These collaborations often manifest as tailored financial literacy workshops and accessible micro-loan programs designed to empower local entrepreneurs and residents.

These strategic alliances not only elevate the bank's commitment to corporate social responsibility but also cultivate enduring customer relationships within its service areas. For instance, in 2024, Bank of Changsha initiated several SME support programs, providing over 500 million RMB in credit to small businesses, directly impacting local job creation and economic growth.

- Community Engagement: Collaborations with over 100 local non-profits and community groups in 2024 to deliver financial education.

- SME Support: Provided 300 million RMB in micro-loans to SMEs in the first half of 2024, fostering local business development.

- Economic Impact: Partnerships contributed to an estimated 5% increase in local business revenue for participating SMEs.

- Customer Loyalty: Saw a 15% rise in new SME accounts in regions with active partnership programs in 2024.

Bank of Changsha leverages partnerships with technology and fintech firms to enhance its digital offerings. These collaborations focus on developing advanced mobile banking and payment solutions, with a significant push in 2024 to upgrade its user-friendly mobile application. These alliances are crucial for data analytics, customer insights, and personalized service delivery, keeping the bank competitive.

| Partner Type | Key Activities | 2024 Impact/Focus | Example/Data Point |

|---|---|---|---|

| Fintech Companies | Digital platform development, AI integration, payment solutions | Enhancing mobile banking user experience, data analytics for personalization | Continued investment in mobile app upgrades |

| Technology Providers | Cloud services, cybersecurity, data infrastructure | Improving operational efficiency and data security | Implementation of advanced data analytics tools |

| E-commerce Platforms | Integrated payment gateways, merchant services | Expanding digital payment reach and customer convenience | Partnerships to facilitate seamless online transactions |

What is included in the product

A detailed breakdown of the Bank of Changsha's strategy, outlining its customer segments, value propositions, and revenue streams within the traditional banking framework.

This canvas provides a clear view of the Bank of Changsha's operational structure, highlighting key partnerships and cost structures to support its financial services delivery.

The Bank of Changsha Business Model Canvas provides a clear, structured framework that helps identify and address operational inefficiencies and customer service gaps, thereby relieving key pain points in their banking services.

Activities

Bank of Changsha's core operations revolve around attracting and managing diverse deposits. These range from everyday checking accounts to longer-term savings and specialized structured deposits, serving as the bank's foundational funding stream. This activity is crucial for maintaining liquidity and controlling the cost of capital, all while adhering to strict financial regulations.

In 2023, the bank reported a significant increase in its deposit base, reaching approximately RMB 350 billion. This growth highlights their success in drawing funds from individuals, businesses, and public sector clients. Effective management of these liabilities is paramount for optimizing their lending activities and ensuring overall financial stability.

Bank of Changsha's core activity is providing a wide array of lending and credit products. This includes essential financial tools like working capital loans for businesses, fixed asset loans for expansion, and consumer loans, including mortgages, for individuals. This comprehensive offering is fundamental to their role in supporting economic growth.

The process involves meticulous credit assessment to gauge borrower viability and robust risk management strategies to safeguard the bank's financial health. Diversifying the loan portfolio across different sectors and customer types is a key element in mitigating potential losses and ensuring stability.

The bank actively supports small and micro enterprises, recognizing their vital role in the economy. Furthermore, they extend credit to crucial government-backed projects, aligning their lending activities with broader development objectives and demonstrating their commitment to community progress.

As of the first half of 2024, Bank of Changsha's loan portfolio saw continued growth, with a focus on inclusive finance. Their commitment to supporting small and medium-sized enterprises (SMEs) remained a priority, with outstanding SME loans increasing by a notable percentage year-on-year, contributing significantly to their overall lending volume.

Bank of Changsha's key activity involves providing robust payment and settlement services. This encompasses facilitating secure domestic and international money transfers, managing utility bill payments, and engaging in interbank clearing operations.

The bank actively utilizes its digital channels to streamline these transactions, ensuring both speed and user-friendliness. This focus on digital innovation supports a broad customer base, from individual consumers to large corporations.

In 2024, digital payment volumes for Chinese banks, including institutions like Bank of Changsha, continued their upward trajectory. For instance, the People's Bank of China reported that mobile payment transactions saw significant growth, with the total value of non-cash payments processed by financial institutions reaching trillions of yuan in the first half of 2024, underscoring the essential nature of these services.

Financial Market Operations

Bank of Changsha actively engages in treasury operations, a core activity for managing its financial health and profitability. This includes vital interbank lending, bond trading, and foreign exchange transactions. These activities are essential for optimizing the bank's liquidity position, ensuring it can meet its obligations while also taking advantage of market opportunities.

The bank's investment in a diverse range of financial instruments further supports its treasury functions. By strategically placing capital, Bank of Changsha aims to generate robust non-interest income, a key driver of overall financial performance. For instance, in 2023, the bank reported a significant increase in its investment portfolio returns, contributing positively to its net interest margin.

These financial market operations are not just about generating income; they are fundamental to maintaining the bank's financial stability, especially in volatile market environments. By actively participating in these markets, Bank of Changsha can effectively manage its risk exposure and ensure it remains resilient.

- Interbank Lending: Facilitates short-term liquidity management and interbank relationships.

- Bond Trading: Optimizes investment returns and manages interest rate risk.

- Foreign Exchange Trading: Manages currency exposure and capitalizes on exchange rate movements.

- Investment in Financial Instruments: Diversifies income streams and enhances portfolio yield.

Digital Banking and Innovation

Bank of Changsha actively pursues digital banking and innovation as a core activity. This means they are constantly working to improve their mobile banking app, online platform, and services offered through channels like WeChat. Their goal is to make banking easier and more accessible for customers. For instance, in 2023, digital transactions accounted for a significant portion of their overall customer interactions, reflecting the success of these efforts.

A major focus is investing in cutting-edge technology. This includes adopting fintech solutions, leveraging artificial intelligence (AI), and utilizing data analytics. These investments are aimed at creating a smoother customer experience, offering more personalized financial products, and making their internal operations more efficient. By embracing these technologies, Bank of Changsha aims to stay ahead in the competitive financial sector.

- Enhancing Digital Channels: Continuously upgrading mobile banking, online banking, and WeChat banking platforms.

- Investing in Technology: Allocating resources to fintech, AI, and data analytics for service improvement and operational efficiency.

- Personalized Customer Experience: Utilizing data to tailor product offerings and customer interactions.

- Streamlining Operations: Implementing digital solutions to improve internal processes and reduce costs.

Bank of Changsha's core activities encompass a broad spectrum of financial services designed to meet diverse customer needs. These include attracting and managing deposits, providing various lending and credit products, facilitating payment and settlement services, engaging in treasury operations, and driving digital banking innovation.

In 2023, the bank saw its deposit base grow to approximately RMB 350 billion, underscoring its success in attracting funds. The loan portfolio also experienced growth in the first half of 2024, with a particular emphasis on inclusive finance and support for SMEs. Digital payment volumes across China, including those processed by Bank of Changsha, continued their upward trend in 2024, with mobile payments showing significant growth, reaching trillions of yuan in non-cash transactions in the first half of the year.

| Key Activity | Description | 2023/H1 2024 Data Point |

|---|---|---|

| Deposit Management | Attracting and managing diverse deposit accounts. | Deposit base reached ~RMB 350 billion in 2023. |

| Lending & Credit | Offering working capital, fixed asset, and consumer loans. | Continued loan portfolio growth with focus on SMEs in H1 2024. |

| Payment & Settlement | Facilitating money transfers and interbank clearing. | Significant growth in mobile payment transactions nationwide in H1 2024. |

| Treasury Operations | Interbank lending, bond and foreign exchange trading. | Increased investment portfolio returns in 2023. |

| Digital Banking | Enhancing digital channels and investing in fintech. | Digital transactions formed a significant portion of customer interactions in 2023. |

Preview Before You Purchase

Business Model Canvas

The Bank of Changsha Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup, but a direct snapshot from the complete file. Once your order is processed, you will gain full access to this meticulously crafted Business Model Canvas, ready for immediate use and customization.

Resources

Adequate financial capital, including shareholder equity and a stable deposit base, is crucial for Bank of Changsha. As of the first quarter of 2024, the bank reported a capital adequacy ratio of 13.5%, exceeding regulatory requirements and providing a solid foundation for its operations. This robust capital position allows the bank to absorb potential losses and support its growth initiatives.

Maintaining robust liquidity is equally vital, enabling Bank of Changsha to meet its obligations and capitalize on new lending opportunities. In early 2024, the bank maintained a loan-to-deposit ratio of approximately 75%, indicating a healthy balance between its lending activities and its deposit funding. This strong liquidity management ensures the bank can consistently serve its customers and pursue strategic expansion.

This fundamental resource underpins all of Bank of Changsha's banking operations, from providing loans to managing customer accounts. The bank's diversified funding sources, including a growing retail deposit base and wholesale funding markets, contribute to its financial stability. Furthermore, adherence to stringent liquidity coverage ratios and net stable funding ratios, as mandated by regulators, reinforces its operational resilience.

Skilled human capital at Bank of Changsha encompasses a diverse team of banking professionals, adept risk managers, essential IT specialists, and dedicated customer service staff. Their collective knowledge and experience are the bedrock for developing innovative products, nurturing strong client relationships, and achieving operational excellence. This expertise directly fuels the bank's ability to navigate complex financial landscapes and deliver superior service.

In 2024, Bank of Changsha recognized the paramount importance of continuous learning, investing significantly in ongoing training and talent development programs. This strategic focus ensures that its workforce remains at the forefront of industry best practices and technological advancements, a crucial factor in adapting to ever-changing market demands and maintaining a competitive edge.

Bank of Changsha relies on robust IT systems, including secure data centers and advanced digital platforms, to power its operations. This infrastructure supports everything from core banking functions to its online and mobile banking applications.

In 2024, the bank continued to invest in its digital transformation. For instance, its mobile banking app saw a significant increase in user engagement, with transaction volumes growing by 15% compared to the previous year, highlighting the importance of these digital channels.

Leveraging customer data is a key strategy. By analyzing transaction history and user behavior, Bank of Changsha gains insights to offer personalized services and more effective targeted marketing campaigns, aiming to boost both efficiency and customer satisfaction.

Branch Network and Physical Assets

Bank of Changsha leverages its extensive network of physical branches and ATMs as a cornerstone of its customer engagement strategy. This physical infrastructure provides crucial accessibility, particularly in regional and rural markets where digital adoption might be less prevalent. These branches are not just points of transaction; they are hubs for traditional banking services, essential cash handling, and vital in-person customer support, fostering a sense of trust and reliability.

Even with the increasing shift towards digital banking, Bank of Changsha recognizes the enduring importance of its physical footprint. This tangible presence is key to building customer confidence and offering a comprehensive suite of services that cater to diverse needs. By maintaining a robust branch network, the bank ensures it can effectively serve its entire customer base, bridging the gap between traditional and digital financial interactions.

- Extensive Branch Network: Bank of Changsha operates a significant number of physical branches, providing widespread customer access.

- ATM Accessibility: A comprehensive ATM network complements branch services, offering convenient cash access and basic transactions 24/7.

- Traditional Service Hubs: Branches serve as centers for in-person customer support, complex transactions, and relationship management.

- Trust and Tangibility: The physical presence reinforces customer trust, especially crucial for those who prefer face-to-face interactions.

- Regional and Rural Focus: The network is particularly vital for serving customers in areas where digital channels may not be the primary mode of banking.

Brand Reputation and Trust

A strong brand reputation, built on reliability and security, is a cornerstone for Bank of Changsha. This trust is crucial for attracting and retaining customers in the competitive banking sector. For instance, in 2024, customer satisfaction scores for leading Chinese banks, including those with strong reputations, consistently remained above 85%, indicating the direct impact of trust on customer loyalty.

This reputation directly supports the bank's ability to raise capital, as investors are more likely to commit funds to institutions perceived as stable and trustworthy. Maintaining public confidence is paramount, especially given the stringent regulations within the financial industry. In 2023, banks with robust brand equity often saw lower costs of capital compared to their less-established peers.

- Customer Loyalty: Bank of Changsha's reputation for security and reliability fosters deep customer loyalty, reducing churn rates.

- Capital Raising: A trusted brand enhances the bank's attractiveness to investors, facilitating easier and potentially cheaper access to funding.

- Regulatory Confidence: Public trust underpins the bank's relationship with regulators, vital for ongoing operations and growth.

- Competitive Advantage: In a crowded market, a strong brand reputation serves as a significant differentiator, drawing in new customers.

Bank of Changsha's key resources include its financial capital, robust liquidity, skilled human capital, advanced IT infrastructure, extensive physical branch network, and a strong brand reputation. Financial capital, evidenced by a 13.5% capital adequacy ratio in Q1 2024, ensures operational stability and growth support. The bank's commitment to talent development in 2024, coupled with a 15% increase in mobile banking app transaction volumes, underscores its investment in both people and digital capabilities.

| Resource | Description | 2024 Data/Context |

| Financial Capital | Shareholder equity and deposit base | Capital Adequacy Ratio: 13.5% (Q1 2024) |

| Liquidity | Ability to meet obligations and fund lending | Loan-to-Deposit Ratio: ~75% (Early 2024) |

| Human Capital | Skilled professionals, risk managers, IT specialists | Significant investment in training and development (2024) |

| IT Infrastructure | Secure data centers, digital platforms | Mobile banking transaction volume: +15% YoY (2024) |

| Physical Network | Branches and ATMs | Extensive network for customer access and trust |

| Brand Reputation | Reliability and security | Customer satisfaction scores for leading banks >85% (2024) |

Value Propositions

Bank of Changsha provides a full spectrum of financial services, catering to everyone from individual savers to large corporations. This includes everything from simple savings accounts to intricate corporate finance and investment banking.

This all-in-one approach means customers don't need to go to multiple institutions for their financial needs, making things much more convenient. For instance, in 2023, Bank of Changsha saw its total assets grow to over 1.3 trillion RMB, reflecting its capacity to handle diverse and complex financial transactions.

Whether it's personal banking, wealth management, or lending for businesses, the bank aims to be a central hub. This strategy streamlines financial operations for its clients, boosting efficiency across the board.

Bank of Changsha's regional expertise is a cornerstone of its value proposition, allowing it to deeply understand and serve the specific economic landscape of Hunan Province. This local focus translates into tailored financial solutions, such as customized loan products for small and medium-sized enterprises that are vital to regional growth.

By concentrating on its home territory, the bank fosters strong community relationships and offers a personalized banking experience. This includes initiatives like inclusive finance programs designed to support underserved populations and contribute to rural revitalization efforts, reflecting a commitment to local development.

In 2024, Bank of Changsha continued to emphasize its regional strengths, with a significant portion of its loan portfolio concentrated in Hunan. For instance, its support for agricultural businesses in the province is a direct manifestation of this localized approach, aiming to bolster the rural economy.

Bank of Changsha champions reliable and secure banking by prioritizing the safety of customer funds and transaction integrity. This focus is underpinned by strict adherence to regulatory frameworks and sophisticated risk management systems. For instance, in 2023, the bank maintained a capital adequacy ratio of 12.5%, well above the regulatory minimum, demonstrating its financial resilience and commitment to security.

Digital Convenience and Innovation

Bank of Changsha’s commitment to digital convenience and innovation is evident in its investment in advanced platforms, offering customers seamless, anytime-anywhere financial management. For instance, in 2023, the bank reported a significant increase in mobile banking users, with over 70% of active customers utilizing their mobile app for daily transactions. This focus on user experience through continuous fintech advancements ensures efficient and modern banking solutions, meeting the dynamic needs of today's digitally-savvy clientele.

The bank’s digital strategy aims to provide accessible and user-friendly services, enhancing customer satisfaction and engagement.

- Digital Platforms: Investment in robust online and mobile banking infrastructure.

- Fintech Integration: Adoption of new technologies to improve service delivery and introduce innovative products.

- User Experience: Prioritizing intuitive design and ease of use for all digital channels.

- Accessibility: Ensuring financial management is convenient and available 24/7.

Dedicated Customer Service

Bank of Changsha prioritizes exceptional customer service, offering personalized support across its broad branch network and digital platforms. This commitment ensures customers receive timely assistance and advice tailored to their specific needs. The bank aims to cultivate enduring relationships by understanding and supporting each client, fostering loyalty and satisfaction.

In 2024, Bank of Changsha continued to invest in its service infrastructure. For instance, the bank reported a customer satisfaction score of 88% for its in-branch services, reflecting the effectiveness of its dedicated staff. Digital channels also saw significant engagement, with 75% of customer inquiries resolved within the first minute through their AI-powered chat service.

- Personalized Support: Offering tailored advice and solutions to individual customer requirements.

- Omnichannel Accessibility: Providing seamless service through both physical branches and digital interfaces.

- Relationship Building: Focusing on long-term customer engagement through understanding and responsiveness.

Bank of Changsha offers a comprehensive suite of financial services, from basic savings to complex corporate finance, simplifying financial management for individuals and businesses alike. This integrated approach enhances customer convenience, as evidenced by the bank's total assets exceeding 1.3 trillion RMB in 2023. By serving as a central financial hub, the bank streamlines operations for its clients, boosting overall efficiency.

The bank's deep understanding of the Hunan Province's economic environment allows for tailored financial solutions, particularly for local small and medium-sized enterprises, contributing to regional growth. This localized focus fosters strong community ties and a personalized banking experience, including initiatives supporting underserved populations and rural development.

Bank of Changsha prioritizes secure and reliable banking through rigorous regulatory compliance and advanced risk management, maintaining a capital adequacy ratio of 12.5% in 2023, exceeding regulatory requirements. Its digital platforms, including a mobile app used by over 70% of active customers in 2023, offer convenient, 24/7 financial management.

Exceptional customer service is a hallmark, with personalized support available across its branch network and digital channels. In 2024, customer satisfaction for in-branch services reached 88%, while its AI chat service resolved 75% of inquiries within the first minute.

| Value Proposition | Description | Supporting Data (2023/2024) |

|---|---|---|

| Comprehensive Financial Services | One-stop shop for diverse financial needs, from personal to corporate. | Total Assets: >1.3 trillion RMB (2023) |

| Regional Expertise & Local Focus | Tailored solutions for Hunan Province's economy, supporting local businesses and communities. | Significant loan portfolio concentration in Hunan (2024); Support for agricultural businesses. |

| Reliability and Security | Prioritizing fund safety and transaction integrity through robust risk management. | Capital Adequacy Ratio: 12.5% (2023) |

| Digital Convenience & Innovation | Seamless, anytime-anywhere financial management via advanced platforms. | >70% of active customers use mobile app (2023); High customer satisfaction with digital channels. |

| Exceptional Customer Service | Personalized support and relationship building across all touchpoints. | 88% customer satisfaction for in-branch services (2024); 75% of digital inquiries resolved in <1 min (2024). |

Customer Relationships

Bank of Changsha cultivates enduring client connections through personalized relationship management, assigning dedicated managers to corporate and high-net-worth individuals. This ensures a deep understanding of unique financial needs, leading to bespoke advice and tailored solutions. For instance, in 2024, the bank reported a 15% increase in customer satisfaction scores attributed to this personalized approach.

This strategy is fundamental to fostering long-term loyalty by proactively engaging with clients and maintaining consistent, high-quality communication. By understanding the nuances of each client's financial landscape, Bank of Changsha can offer more relevant and impactful services, strengthening the overall banking relationship.

Bank of Changsha offers robust digital self-service options through its mobile app, online banking, and WeChat platform, allowing customers to manage accounts, make payments, and apply for loans independently. This focus on digital channels enhances customer convenience and provides greater control over their financial activities. In 2024, the bank reported that over 80% of its daily transactions were conducted through digital channels, highlighting significant customer adoption.

To further support its digital offerings, the bank integrates comprehensive digital support features. These include easily accessible Frequently Asked Questions (FAQs) sections and intelligent chatbots designed to provide instant answers to common queries. This digital assistance complements the bank's customer service efforts, ensuring timely support and a seamless user experience, with chatbot interactions resolving an estimated 60% of customer inquiries without human intervention in the first half of 2024.

Bank of Changsha prioritizes community engagement and trust building, actively participating in local initiatives and corporate social responsibility programs. In 2023, the bank invested over ¥10 million in various community development projects, significantly enhancing its public image and fostering deeper trust among its customer base.

This commitment extends to supporting regional development, demonstrating a dedication to the areas it serves and cultivating a sense of shared value. By investing in local infrastructure and educational programs, Bank of Changsha strengthens relationships that go beyond simple banking transactions, solidifying its position as a community partner.

Automated and Efficient Transaction Processing

Bank of Changsha prioritizes automated and efficient transaction processing for its customers. For everyday banking needs, the bank utilizes advanced systems to ensure transactions are completed swiftly and accurately. This focus on automation means customers enjoy a smooth experience, whether making instant payments or setting up automated bill pay, significantly reducing potential delays and errors.

This commitment to efficiency directly enhances customer satisfaction. By minimizing wait times and operational hiccups, Bank of Changsha builds trust and loyalty. In 2023, the bank reported a 15% year-over-year increase in digital transaction volume, underscoring the success of its automated systems in meeting customer demand for speed and convenience.

- Instant Payment Processing: Facilitates immediate fund transfers, enhancing customer convenience and reducing transaction friction.

- Automated Bill Payments: Allows customers to set up recurring payments, saving time and preventing late fees.

- Reduced Error Rates: Automation minimizes human error, leading to more reliable transaction outcomes for customers.

- Enhanced Customer Experience: Efficient processing contributes to higher satisfaction by providing seamless and timely service.

Feedback and Continuous Improvement Mechanisms

Bank of Changsha actively seeks customer feedback through various channels, including satisfaction surveys, dedicated complaint hotlines, and physical suggestion boxes. This multi-pronged approach ensures that a wide range of customer voices can be heard and recorded. For instance, in 2023, the bank reported a 15% increase in the utilization of its digital feedback platforms, signaling growing customer engagement with these improvement mechanisms.

By meticulously analyzing the input gathered, the bank identifies specific areas ripe for enhancement. This proactive listening strategy allows them to adapt their product and service offerings to better meet evolving customer needs and expectations. Their commitment to responsiveness, demonstrated by a 10% reduction in average complaint resolution time in the first half of 2024, directly contributes to stronger customer loyalty and overall satisfaction.

- Channels for Feedback: Surveys, complaint hotlines, suggestion boxes, and digital platforms are utilized.

- Impact of Feedback: Customer input drives service enhancements and adaptation of offerings.

- Customer Loyalty: Responsiveness to feedback reinforces trust and satisfaction.

- Data Point: A 15% rise in digital feedback utilization was noted in 2023.

Bank of Changsha emphasizes personalized service for key client segments, with dedicated managers ensuring tailored financial solutions. This is complemented by robust digital self-service options, where over 80% of daily transactions occurred digitally in 2024, and efficient automated processing, which saw a 15% increase in digital transaction volume in 2023. The bank also actively engages in community initiatives, investing over ¥10 million in development projects in 2023, and systematically collects customer feedback, achieving a 10% reduction in complaint resolution time by mid-2024.

| Customer Relationship Strategy | Key Initiatives | 2023/2024 Data Points |

|---|---|---|

| Personalized Relationship Management | Dedicated managers for corporate and high-net-worth clients | 15% increase in customer satisfaction scores (2024) |

| Digital Self-Service | Mobile app, online banking, WeChat platform | Over 80% of daily transactions via digital channels (2024) |

| Community Engagement | Local initiatives and CSR programs | Over ¥10 million invested in community development (2023) |

| Feedback and Responsiveness | Surveys, hotlines, digital platforms; reduced complaint resolution time | 15% increase in digital feedback utilization (2023); 10% reduction in average complaint resolution time (H1 2024) |

Channels

Bank of Changsha leverages an extensive branch network across Changsha and other areas in Hunan Province. This physical presence ensures accessibility for customers needing traditional services like consultations and cash transactions. In 2024, the bank continued to emphasize its physical footprint as a key customer touchpoint, particularly for those preferring face-to-face interactions or requiring assistance with more intricate banking needs.

Bank of Changsha leverages its digital banking platforms to offer unparalleled convenience. Their mobile banking app, online portal, and WeChat services allow customers to manage accounts and perform transactions anytime, anywhere. This digital-first approach is crucial in today's market, with mobile banking transactions continuing to surge. For instance, in 2023, the volume of mobile banking transactions globally saw significant growth, indicating a clear customer preference for digital access.

Bank of Changsha leverages a robust ATM network to provide accessible banking services. This network allows customers to conduct essential transactions like cash withdrawals, deposits, and balance checks anytime, anywhere. As of late 2023, Bank of Changsha operated over 1,000 self-service terminals, significantly enhancing customer convenience and operational efficiency.

Contact Centers and Customer Service Hotlines

Bank of Changsha's contact centers and customer service hotlines are vital touchpoints for direct customer engagement. These channels offer immediate assistance, enabling customers to resolve inquiries, report issues, and get help via phone. This direct line is essential for tackling urgent matters and providing tailored support.

In 2024, the bank handled millions of inbound calls, demonstrating the significant reliance customers place on these services for immediate problem resolution. Average handling times were consistently reduced through AI-powered routing and agent training, aiming for a swift and satisfactory customer experience.

- Direct Support: Provides immediate, person-to-person assistance for customer queries and issues.

- Urgent Matter Resolution: Critical for addressing time-sensitive problems and ensuring customer satisfaction.

- Personalized Interaction: Offers a human touch, fostering stronger customer relationships and trust.

- Data Collection: Call logs and feedback provide valuable insights into customer needs and service improvement areas.

Corporate and Institutional Sales Teams

Bank of Changsha's corporate and institutional sales teams are crucial for its business model, focusing on high-value relationships with businesses and government bodies. These specialized teams offer bespoke financial solutions, including lending, treasury services, and investment banking, tailored to the unique needs of each client.

These teams cultivate deep connections through direct engagement, understanding client objectives to provide strategic financial advice and product customization. This direct interaction is key to securing and expanding business with large entities.

- Direct Client Engagement: Teams proactively reach out to corporations, government agencies, and major institutions.

- Tailored Solutions: Offer customized financial products and services like corporate loans, trade finance, and wealth management.

- Relationship Management: Focus on building and maintaining long-term, high-value partnerships through personalized service.

- Revenue Generation: Drive significant revenue through large-scale transactions and ongoing service agreements, contributing substantially to the bank's overall financial performance. For instance, in 2024, corporate banking revenue represented a significant portion of the bank's income.

Bank of Changsha's channels are a blend of physical and digital, designed for broad accessibility and diverse customer needs. The physical branch network, augmented by a substantial ATM presence, caters to traditional banking preferences and essential transactions. Simultaneously, robust digital platforms, including a mobile app and online banking, provide seamless, anytime access, reflecting a market shift towards convenient digital solutions. Specialized sales teams further extend reach through direct engagement with corporate and institutional clients, offering tailored financial strategies.

| Channel Type | Key Features | 2024 Focus/Data |

|---|---|---|

| Physical Branches | Face-to-face consultations, cash services, complex transactions | Continued emphasis on accessibility and personalized service; extensive network across Hunan |

| Digital Platforms (App, Online, WeChat) | Account management, transactions, inquiries, anytime/anywhere access | High volume of mobile transactions; ongoing development of user experience |

| ATM Network | Cash withdrawals, deposits, balance checks, self-service | Over 1,000 terminals supporting convenient self-service banking |

| Contact Centers/Hotlines | Direct customer support, issue resolution, inquiries | Millions of inbound calls handled; focus on reducing average handling times |

| Corporate & Institutional Sales Teams | Direct engagement, bespoke financial solutions, relationship management | Significant contributor to revenue; focus on large-scale transactions and long-term partnerships |

Customer Segments

Bank of Changsha's individual customer segment is quite broad, encompassing everyone from everyday retail consumers to those with substantial wealth. They're looking for essential banking services like checking and savings accounts, loans for homes or cars, and credit cards. A key focus is also on wealth management, helping individuals grow and protect their assets.

The bank's strategy is to serve a wide array of financial needs, recognizing that different people are at various points in their lives and have different income levels. This approach aims to make Bank of Changsha truly dependable for all citizens. For instance, in 2023, the bank reported a significant increase in its retail customer base, demonstrating its appeal across different demographics.

Bank of Changsha actively supports Small and Medium-sized Enterprises (SMEs) by providing essential financial tools. In 2024, the bank continued its commitment to offering working capital loans, specialized business accounts, and efficient payment solutions designed to fuel the expansion and daily operations of these crucial businesses.

The bank's strategy emphasizes empowering local SMEs, recognizing their vital role in regional economic development. By ensuring accessible financing and a suite of tailored services, Bank of Changsha aims to bolster the vitality and growth of businesses within its operating regions, contributing to a stronger local economy.

Bank of Changsha's large corporate clients are major enterprises seeking a full suite of financial services. This includes significant corporate lending, intricate trade finance arrangements, and specialized investment banking services. These businesses often require sophisticated cash management solutions to optimize their operations.

The bank supports these large entities by offering advanced financial products tailored to their complex needs. Beyond standard banking, Bank of Changsha provides strategic advisory services, aiding these corporations in navigating expansion and managing their intricate financial landscapes. For instance, as of late 2024, major Chinese banks have seen increased demand for syndicated loans from large corporations undertaking significant infrastructure projects.

Government Entities and Public Institutions

Bank of Changsha actively serves government entities and public institutions by offering a comprehensive suite of banking and financial services. This includes essential functions like deposit-taking, efficient payment and settlement solutions, and crucial financing for public infrastructure and development projects. The bank's strategic focus is clearly defined: to establish itself as the most reliable partner for government affairs within the Hunan province.

In 2023, Bank of Changsha's commitment to public sector clients was evident. For instance, the bank played a significant role in financing key municipal projects across Hunan, contributing to local economic development. Their deposit base from public sector entities saw a notable increase, reflecting growing trust and partnership. This focus aligns with broader national trends where financial institutions are increasingly vital in supporting government initiatives and public service delivery.

- Deposit-taking: Secure and efficient management of public funds.

- Payment and Settlement: Streamlined transaction processing for government operations.

- Financing for Public Projects: Support for infrastructure and community development initiatives.

- Strategic Goal: To be recognized as the premier government affair bank in Hunan.

Agricultural and Rural Customers

Bank of Changsha prioritizes serving agricultural and rural communities within its operational regions in China. This strategic focus aims to bolster rural revitalization efforts and foster agricultural sector growth.

The bank offers tailored financial solutions, including specialized loan products, designed to meet the unique needs of these customers. For instance, the 'Xiangnong Express Loan' provides accessible credit to support agricultural businesses.

Furthermore, Bank of Changsha is expanding its reach through digital initiatives, such as digital community services, to enhance financial accessibility in county-level areas. This commitment reflects a broader strategy to integrate and support rural economic development.

In 2023, the agricultural bank sector in China saw continued growth, with efforts to increase lending to small and medium-sized agricultural enterprises. Bank of Changsha's activities align with these national objectives.

- Target Demographic: Agricultural businesses and rural residents in China.

- Key Offerings: Specialized loans and financial products supporting rural revitalization and agricultural development.

- Innovative Products: 'Xiangnong Express Loan' for agricultural businesses.

- Digital Strategy: Digital community services to serve county areas and improve financial inclusion.

Bank of Changsha's customer segments are diverse, catering to individuals from everyday consumers to high-net-worth clients, small and medium-sized enterprises (SMEs), large corporations, government entities, and crucially, agricultural and rural communities. This broad reach allows the bank to address a wide spectrum of financial needs across different economic strata and sectors.

The bank's strategy for individuals focuses on essential banking services and wealth management, while for SMEs, it provides vital working capital and business solutions. Large corporations benefit from sophisticated lending and investment banking services, and government entities receive tailored support for public projects, underscoring the bank's commitment to regional development.

A significant focus is placed on agricultural and rural communities, offering specialized loans like the 'Xiangnong Express Loan' and expanding digital services to improve financial accessibility in county-level areas. This aligns with national goals for rural revitalization, as seen in the 2023 growth of agricultural lending across China.

| Customer Segment | Key Needs | Bank of Changsha's Role | 2023/2024 Data/Focus |

|---|---|---|---|

| Individuals | Daily banking, loans, wealth management | Comprehensive financial services | Increased retail customer base |

| SMEs | Working capital, business accounts | Essential financial tools, tailored solutions | Continued offering of working capital loans |

| Large Corporations | Corporate lending, trade finance, investment banking | Advanced financial products, strategic advisory | Support for infrastructure projects (national trend) |

| Government Entities | Deposit-taking, payment solutions, project financing | Reliable partner for government affairs | Increased deposits from public sector entities |

| Agriculture/Rural | Specialized loans, financial accessibility | Support for rural revitalization, 'Xiangnong Express Loan' | Expansion of digital community services |

Cost Structure

Interest expenses on deposits represent the bank's most significant cost. In 2023, Bank of Changsha's interest expenses on deposits and borrowings amounted to approximately ¥10.5 billion. Effectively managing these costs by offering competitive interest rates is vital for attracting and retaining customer funds, which directly impacts the bank's net interest margin and overall profitability.

Personnel and administrative expenses are a major cost driver for Bank of Changsha. These costs encompass employee salaries, comprehensive benefits packages, ongoing training programs, and the general overhead required to maintain its extensive network of branches and offices. In 2024, the bank's commitment to its roughly 9,779 employees represents a substantial portion of its operational expenditure.

Bank of Changsha dedicates substantial capital to its technology and infrastructure. These investments are crucial for maintaining robust IT systems, including core banking platforms and digital service delivery channels. For instance, in 2024, many banks, including those in Changsha's competitive landscape, are allocating over 15% of their operating expenses towards technology upgrades and cybersecurity to combat evolving threats and meet customer demand for seamless digital experiences.

The bank's physical footprint, encompassing branches and an extensive ATM network, also represents a significant cost. Maintaining and modernizing these physical touchpoints is vital for customer accessibility and service delivery, especially in a region with diverse customer needs. These infrastructure costs are ongoing, ensuring operational efficiency and the ability to offer a comprehensive range of banking services.

Marketing and Sales Expenses

Bank of Changsha allocates significant resources to marketing and sales to drive customer acquisition and product adoption. These expenditures are crucial for promoting deposit growth, facilitating loan origination, and encouraging the uptake of digital banking services. In 2024, the bank likely continued to invest heavily in these areas to maintain its competitive edge.

- Advertising and Promotions: Costs associated with broadcast, digital, and print advertising campaigns designed to raise brand awareness and highlight specific banking products.

- Sales Force Compensation and Training: Investments in the personnel responsible for direct customer engagement, including salaries, commissions, and ongoing professional development.

- Digital Marketing Initiatives: Spending on online advertising, social media engagement, content marketing, and search engine optimization to reach a broader audience and drive online conversions.

- Customer Acquisition Costs: The overall expenses incurred to bring a new customer onto the bank's platform, encompassing all marketing and sales efforts.

Regulatory Compliance and Risk Management Costs

Bank of Changsha incurs significant expenses to adhere to stringent banking regulations and maintain robust risk management practices. These costs are essential for operational integrity and to mitigate potential financial and reputational damage. For instance, in 2024, the global financial industry saw increased spending on regulatory compliance, with many institutions allocating a notable portion of their operational budget to these areas. This includes the implementation and ongoing management of anti-money laundering (AML) and know-your-customer (KYC) protocols, which are critical for preventing financial crime.

Furthermore, meeting capital adequacy requirements, such as those mandated by Basel III and its subsequent revisions, demands substantial investment. This often involves holding more capital than might otherwise be deployed for lending, impacting profitability but ensuring financial stability. Internal audits and the development of sophisticated risk modeling capabilities also contribute to this cost structure, ensuring the bank operates within acceptable risk parameters.

- Regulatory Compliance: Costs associated with adhering to banking laws, directives, and reporting requirements, including extensive documentation and legal counsel.

- Risk Management Frameworks: Investment in technology, personnel, and processes for credit risk, market risk, operational risk, and liquidity risk management.

- AML/KYC Procedures: Expenses for customer due diligence, transaction monitoring, and reporting suspicious activities to authorities.

- Capital Adequacy: Costs related to maintaining sufficient capital reserves as per regulatory guidelines to absorb potential losses.

Beyond core interest expenses, Bank of Changsha incurs significant operational costs. These include substantial investments in technology, maintaining a physical branch network, and personnel expenses for its workforce. In 2024, the bank continued to prioritize digital transformation, allocating a considerable portion of its budget to IT infrastructure and cybersecurity measures to enhance customer experience and operational efficiency.

| Cost Category | 2023 (Approx. ¥ Billion) | 2024 Focus Areas |

| Interest Expenses (Deposits & Borrowings) | 10.5 | Managing rates for customer retention |

| Personnel & Admin | N/A (Significant portion of operating expenses) | Supporting ~9,779 employees |

| Technology & Infrastructure | N/A (Over 15% of operating expenses for many banks) | IT systems, digital services, cybersecurity |

| Marketing & Sales | N/A (Ongoing investment for growth) | Customer acquisition, product promotion |

| Regulatory Compliance & Risk Management | N/A (Increased global spending) | AML/KYC, capital adequacy, risk modeling |

Revenue Streams

Net Interest Income (NII) is the bedrock of Bank of Changsha's revenue generation. This income stream arises from the fundamental banking activity of intermediation: earning more interest on assets like loans and securities than it pays out on liabilities such as customer deposits and wholesale funding.

For Bank of Changsha, NII is not just a revenue source; it's the primary driver of profitability, with the Net Interest Margin (NIM) serving as a critical metric for assessing its efficiency and earning power. In 2023, the bank's NIM stood at 2.07%, reflecting its ability to manage the spread between its interest-earning assets and interest-bearing liabilities effectively.

Bank of Changsha generates significant revenue through fee and commission income. This includes fees from various banking services like transaction processing, credit and debit card usage, and wealth management services. For instance, in 2023, the bank reported a notable increase in its wealth management fee revenue, reflecting growing customer engagement in these offerings.

Commissions from investment banking activities also contribute to this revenue stream. Diversifying income beyond net interest income is a key strategy for Bank of Changsha, reducing its vulnerability to changes in interest rates.

Investment income for Bank of Changsha stems from its diverse portfolio, encompassing gains from trading financial instruments, bonds, and equities. This revenue stream, while subject to market volatility, can be a substantial contributor depending on strategic investment decisions and prevailing economic conditions.

In 2023, Bank of Changsha reported significant investment income. For instance, its net interest income, a core component often influenced by investment activities, saw robust growth, reflecting effective management of its asset and liability structure. The bank actively engages in the trading of government and corporate bonds, seeking to capitalize on interest rate movements.

Lending and Loan-Related Fees

Bank of Changsha generates income not only from the interest charged on loans but also through a variety of associated fees. These fees are crucial for enhancing the profitability of its core lending operations.

Key revenue streams within lending and loan-related fees include:

- Loan Origination Fees: Charges applied when a new loan is established.

- Processing Fees: Costs associated with managing and administering loan applications and disbursements.

- Late Payment Penalties: Fees incurred by borrowers for failing to meet repayment deadlines.

- Other Service Fees: Additional charges for services such as loan modifications or early repayment.

For instance, in 2023, Bank of Changsha reported that net interest income, primarily from its lending portfolio, formed the largest portion of its revenue. While specific figures for loan-related fees as a separate line item are not always granularly disclosed, they are intrinsically linked to the volume and type of loans issued, contributing to the bank's overall net fee and commission income.

Other Operating Income

Other Operating Income for Bank of Changsha encompasses diverse revenue sources beyond core lending and fee-based services. These include profits from selling off assets, favorable movements in foreign currency exchange rates, and various other minor operational earnings that add to the bank's bottom line. For instance, in 2024, the bank might have reported gains from the sale of investment securities or property.

These supplementary income streams, while individually smaller, play a role in diversifying the bank's revenue and enhancing its overall financial resilience. They demonstrate the bank's ability to generate value from a range of activities, contributing to its total profitability.

- Gains from Asset Disposal: Profits realized from selling off non-core assets, such as property or investment portfolios.

- Foreign Exchange Gains: Profits earned from favorable fluctuations in currency exchange rates.

- Other Miscellaneous Income: Various other operational revenues not categorized elsewhere, contributing to the bank's overall financial performance.

Bank of Changsha's revenue streams are multifaceted, reflecting a robust financial model. Net Interest Income (NII) remains the cornerstone, driven by the spread between interest earned on assets and interest paid on liabilities. In 2023, the bank's Net Interest Margin (NIM) was 2.07%, showcasing its effective management of this core activity.

Fee and commission income provides crucial diversification. This includes revenue from wealth management services, transaction processing, and credit card usage, with notable growth in wealth management fees reported in 2023. Investment banking commissions also contribute to this growing segment.

The bank also generates income from its investment portfolio, including trading gains on financial instruments like bonds and equities. This stream, while market-dependent, can be a significant contributor, as seen in the bank's overall robust performance in 2023, partly fueled by effective asset and liability management.

Additionally, Bank of Changsha earns from various loan-related fees, such as origination and processing charges, alongside late payment penalties. Other operating income, including gains from asset disposals and foreign exchange, further diversifies its revenue base.

| Revenue Stream | Description | 2023 Key Data/Trend |

|---|---|---|

| Net Interest Income (NII) | Interest earned on loans/securities minus interest paid on deposits/funding. | NIM at 2.07% |

| Fee and Commission Income | Revenue from services like wealth management, transactions, and investment banking. | Growing wealth management fee revenue |

| Investment Income | Gains from trading securities, bonds, and equities. | Contributed to strong overall performance |

| Loan-Related Fees | Charges for loan origination, processing, late payments, etc. | Integral to lending profitability |

| Other Operating Income | Gains from asset sales, foreign exchange, and miscellaneous sources. | Diversifies revenue and enhances resilience |

Business Model Canvas Data Sources

The Bank of Changsha Business Model Canvas is built upon a foundation of internal financial statements, regulatory filings, and comprehensive market research reports. These data sources provide the essential insights into customer behavior, competitive landscape, and operational efficiency needed to accurately define each canvas block.