Bank of Changsha Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Changsha Bundle

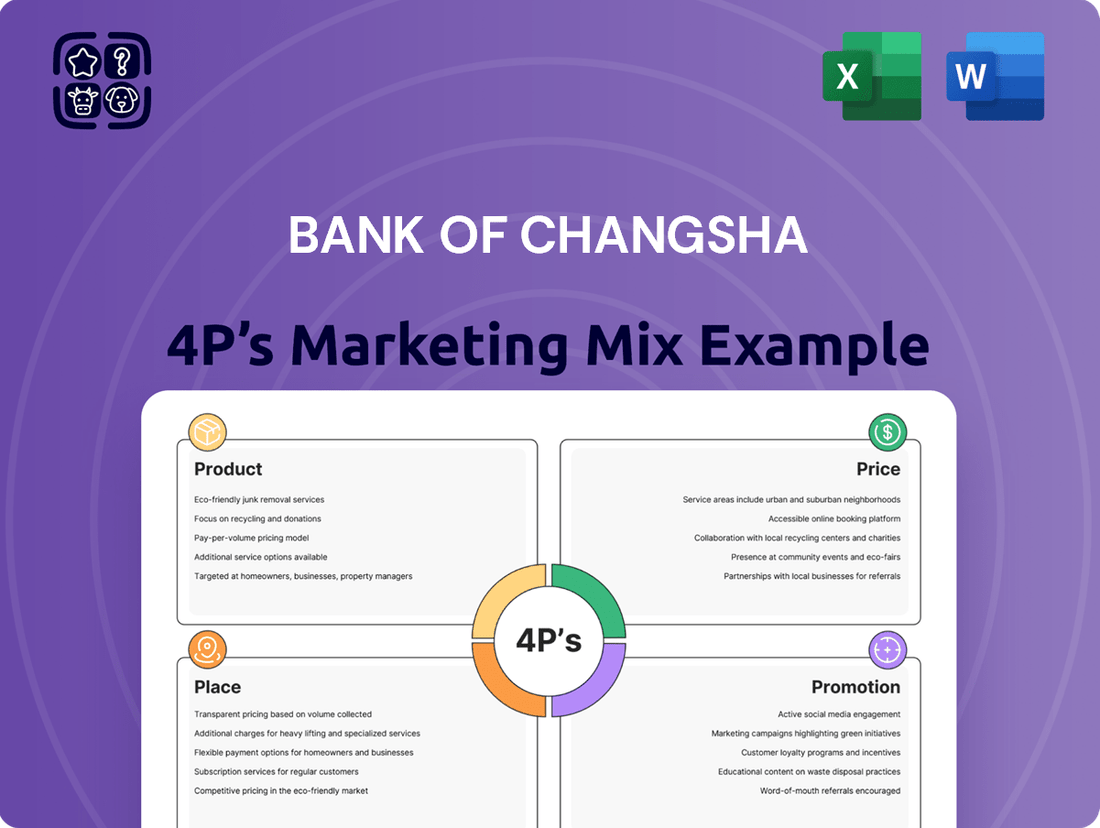

The Bank of Changsha skillfully crafts its marketing by focusing on diverse financial products tailored to local needs, competitive pricing that attracts a broad customer base, and a strategic placement of branches and digital channels for accessibility. Their promotional efforts, encompassing community engagement and digital outreach, further solidify their market presence.

Go beyond this overview—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for the Bank of Changsha. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Bank of Changsha’s comprehensive financial services are designed to meet a broad spectrum of client needs. For individuals, this includes everything from savings and checking accounts to a variety of loan options, supporting personal financial goals. In 2023, the bank’s personal loan portfolio saw significant growth, reflecting increased demand for consumer credit.

Corporate clients benefit from tailored lending solutions, efficient cash management, and advanced payment systems crucial for business operations. The bank’s commitment to supporting businesses was evident in its 2024 first-quarter lending to small and medium-sized enterprises, which increased by 15% year-over-year, highlighting its role in economic development.

Government entities can access specialized financial products and services, including public finance management and infrastructure financing. Bank of Changsha’s participation in municipal bond issuances in late 2024 underscored its capacity to handle large-scale public sector financial requirements, contributing to regional public works.

Bank of Changsha's tailored lending solutions cater to diverse needs, offering short, medium, and long-term credit for individuals and businesses. These include everything from personal loans and mortgages to crucial working capital and fixed asset financing for enterprises.

The bank also provides specialized financing like equity pledge loans and digital 'e-loans,' demonstrating a commitment to innovative credit delivery. This comprehensive suite aims to support a broad spectrum of financial requirements, enhancing customer access to capital.

For instance, the bank's commitment to small and medium-sized enterprises (SMEs) is evident in its targeted working capital loans, a vital component for business continuity and growth. In 2024, the SME lending sector saw significant expansion, with financial institutions like Bank of Changsha playing a crucial role in facilitating this economic activity.

Bank of Changsha's Corporate and Investment Banking division offers a full suite of services to its corporate clients, including essential deposit, loan, settlement, and trade finance solutions. This comprehensive offering supports the daily operational needs of businesses.

The investment banking segment is particularly robust, focusing on critical areas like urban development funds and industry-specific funds, aiming to foster economic growth. They also specialize in structured financing and various debt instruments, providing tailored capital solutions.

Further enhancing their financial advisory capabilities, the bank facilitates asset securitization and arranges syndicated loans, demonstrating their capacity to manage complex financial transactions and provide significant liquidity to large-scale projects. For instance, in 2024, Bank of Changsha reported significant growth in its corporate loan portfolio, exceeding RMB 150 billion, underscoring its commitment to serving the corporate sector.

Digital and Rural Finance Innovations

Bank of Changsha is heavily investing in digital and rural finance, a key aspect of its product strategy. This focus is evident in their development of digital products specifically designed to bolster rural revitalization efforts. By leveraging financial technology, the bank aims to bridge the gap in financial service accessibility for agricultural communities and those in county-level regions.

Key digital innovations include the 'Xiangcun Express Loan' and 'Xiangnong Express Loan'. These products utilize technology to streamline the lending process for rural customers, making it faster and more convenient. The bank also launched the 'Xiangcun Online' platform, a significant step in expanding digital service reach within these areas. As of late 2024, digital lending platforms in China have seen substantial growth, with rural finance initiatives often reporting double-digit increases in user adoption and transaction volumes, reflecting a strong market response to such innovations.

- Xiangcun Express Loan: Digital loan product for rural revitalization.

- Xiangnong Express Loan: Technology-driven lending for agricultural clients.

- Xiangcun Online: Platform enhancing digital service accessibility in rural areas.

- Digital Adoption: Driven by increased smartphone penetration and demand for convenient financial services in underserved regions.

Specialized Financial Market Offerings

Bank of Changsha extends its reach beyond traditional banking by actively participating in financial market operations. This includes managing interbank deposits and call money, engaging in repurchase and repo agreements, and undertaking various investment activities. These operations are crucial for managing liquidity and generating additional revenue streams.

The bank also boasts a comprehensive suite of trade finance services designed to support businesses involved in international commerce. These offerings encompass handling export and import bills, issuing letters of credit, and providing essential foreign exchange solutions to facilitate global transactions.

Demonstrating a commitment to innovation and future growth, Bank of Changsha recently issued technology innovation bonds. These bonds are specifically earmarked to finance advancements in scientific and technological fields, aligning with national and regional development priorities.

Key specialized financial market offerings include:

- Interbank Market Operations: Engaging in deposit, call money, and repurchase agreements to manage liquidity and capital.

- Investment Activities: Undertaking strategic investments to diversify income and enhance asset growth.

- Trade Finance Solutions: Providing comprehensive services for export/import bills, letters of credit, and foreign exchange.

- Technology Innovation Bonds: Issuing bonds to fund advancements in science and technology, showcasing a forward-looking investment strategy.

Bank of Changsha's product strategy is a diverse mix, offering everything from basic savings and checking accounts to specialized loans for individuals, businesses, and government entities. This broad range includes innovative digital products like the 'Xiangcun Express Loan' and 'Xiangnong Express Loan,' reflecting a strong push into rural and agricultural finance. By late 2024, these digital initiatives saw significant user adoption, with rural finance platforms reporting double-digit increases in transactions.

What is included in the product

This analysis offers a comprehensive overview of the Bank of Changsha's marketing strategies, dissecting its Product, Price, Place, and Promotion tactics to reveal its market positioning and competitive advantages.

It is designed for professionals seeking a detailed understanding of the Bank of Changsha's marketing approach, providing actionable insights grounded in real-world practices.

This analysis distills the Bank of Changsha's 4Ps marketing mix into actionable insights that address common banking pain points, offering a clear roadmap for customer satisfaction.

Place

Bank of Changsha leverages its extensive branch network as a cornerstone of its marketing strategy. As of December 31, 2024, the bank operated 411 branches, a significant physical footprint designed to maximize customer reach and accessibility.

This network is strategically concentrated within Hunan Province, with a notable presence of 166 branches in the Changsha region alone, complemented by 13 branches in other key cities. Furthermore, the bank has expanded its reach into Guangdong Province, broadening its service area.

This widespread distribution ensures that a large customer base can easily access the bank's services and products. The physical presence reinforces trust and provides a tangible point of contact, crucial in the banking sector.

Bank of Changsha demonstrates a profound commitment to county-level penetration, boasting service networks that extend across all cities and counties within Hunan Province. This extensive reach, covering 100% of the province's counties, is a cornerstone of their strategy.

By deeply cultivating characteristic areas and fostering integrated urban and rural development, the bank effectively maximizes convenience for its local customer base. This granular approach ensures that even remote communities have access to essential financial services.

As of early 2024, Bank of Changsha reported a significant presence in these county-level markets, with over 300 branches and service points strategically located to serve the diverse needs of Hunan's population. This deep penetration translates into a strong competitive advantage and customer loyalty.

Bank of Changsha has built robust digital channels to complement its physical presence, offering customers convenient access to banking services anytime, anywhere.

These digital offerings include 24/7 mobile banking, online banking platforms, and integration with popular social media like WeChat banking.

The bank saw significant digital adoption, with over 10.9 million online banking users by the end of 2023.

Furthermore, an average of 2.39 million users actively engaged with its online services monthly, demonstrating a strong and consistent digital user base.

Strategic Regional Presence

Bank of Changsha’s strategic regional presence extends well beyond its home city, reflecting a calculated expansion. By establishing branches in key urban centers like Zhuzhou, Changde, Xiangtan, and even the major metropolis of Guangzhou, the bank is actively broadening its market reach. This geographic diversification is crucial for capturing a larger share of the regional banking landscape.

This expansion allows Bank of Changsha to tap into new customer bases and economic opportunities across different locales. It’s a clear move to solidify its position and compete more effectively in a dynamic financial environment.

- Regional Footprint: Operates in multiple cities including Zhuzhou, Changde, Xiangtan, and Guangzhou.

- Market Share Growth: Expansion aims to capture increased market share beyond its primary Changsha base.

- Strategic Importance: Guangzhou presence, a major economic hub, signifies significant ambition.

Subsidiary and Affiliate Integration

Bank of Changsha strategically enhances its market presence and service capabilities through a network of subsidiaries and affiliates. This approach diversifies its offerings and extends its reach into various consumer segments and geographical areas.

Key investments include rural banks such as Xiangxi Changhang Rural Bank, Qiyang Rural Bank, and Yizhang Changhang Rural Bank. These partnerships allow the bank to tap into local markets and cater to the specific financial needs of rural communities. For instance, rural banks often play a crucial role in agricultural lending and small business development within their regions.

Furthermore, the establishment of Changyin 58 Consumer Finance Company signifies a dedicated effort to capture the growing consumer finance market. This venture likely focuses on providing accessible credit and financial products tailored to individual consumers, a segment experiencing significant growth in China.

To bolster its digital service delivery, Bank of Changsha founded Hunan Changyin Digital Technology Co., Ltd. This move underscores the bank's commitment to leveraging technology for enhanced customer experiences, efficient operations, and the development of innovative digital financial solutions. As of Q3 2024, digital channels accounted for over 70% of the bank's customer transactions, highlighting the importance of this subsidiary.

- Subsidiaries: Xiangxi Changhang Rural Bank, Qiyang Rural Bank, Yizhang Changhang Rural Bank.

- Affiliate: Changyin 58 Consumer Finance Company.

- Digital Arm: Hunan Changyin Digital Technology Co., Ltd.

- Strategic Goal: Market expansion and enhanced digital service delivery.

Bank of Changsha strategically utilizes its physical presence, operating 411 branches as of December 31, 2024, primarily within Hunan Province, demonstrating a commitment to accessibility. This network is deeply ingrained in county-level markets, covering all of Hunan's counties, ensuring widespread service availability and customer convenience.

The bank complements its physical footprint with robust digital channels, including a mobile banking app and online platforms, evidenced by over 10.9 million online banking users by the end of 2023. Digital engagement is strong, with an average of 2.39 million monthly active users on its online services.

Bank of Changsha’s expansion into key cities like Guangzhou and its operation through subsidiaries such as Hunan Changyin Digital Technology Co., Ltd. highlight a strategy to broaden market reach and enhance digital service delivery, with digital channels accounting for over 70% of transactions by Q3 2024.

| Metric | Value (as of end 2023/early 2024) | Significance |

|---|---|---|

| Total Branches | 411 (as of Dec 31, 2024) | Maximizes physical customer reach and accessibility. |

| Hunan County Penetration | 100% of counties | Ensures deep local market coverage and convenience. |

| Online Banking Users | 10.9 million+ | Indicates substantial digital adoption. |

| Monthly Active Online Users | 2.39 million (average) | Demonstrates consistent digital engagement. |

| Digital Transaction Share | Over 70% (by Q3 2024) | Highlights the critical role of digital channels. |

What You Preview Is What You Download

Bank of Changsha 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This detailed 4P's Marketing Mix analysis for the Bank of Changsha covers Product, Price, Place, and Promotion strategies. It offers comprehensive insights into how the bank positions itself in the market. You can be confident that the information presented is exactly what you'll download, ready for your immediate use.

Promotion

Bank of Changsha's customer-centric brand philosophy, encapsulated by its mission 'walking the right path and benefiting the public,' is central to its marketing efforts. This focus translates into core values of customer focus, pragmatism, and joyful collaboration, shaping how the bank interacts with its clientele.

This philosophy directly impacts their product and service development, ensuring offerings are designed with customer needs at the forefront. For instance, in 2024, Bank of Changsha reported a 15% year-over-year increase in customer satisfaction scores related to digital banking services, a direct result of this customer-first approach.

Bank of Changsha actively uses digital channels for significant promotional efforts. In 2024, the bank successfully executed over 1,000 digital business activities.

These initiatives connected with a substantial audience, reaching more than 7 million customers across various platforms. This digital outreach demonstrates a commitment to broad customer engagement.

Further enhancing its digital strategy, Bank of Changsha developed over 40 specialized customer base business scenarios. This targeted approach allows for more refined and effective engagement with specific customer segments.

Bank of Changsha demonstrates a strong commitment to social responsibility, actively engaging in public welfare, charitable endeavors, rural revitalization efforts, and disaster relief. These actions, though not always the subject of explicit promotional campaigns, significantly bolster the bank's brand image and foster positive public relations. For instance, by supporting local communities, the bank aligns itself with national development goals, such as the ongoing rural revitalization strategy, which aims to improve living standards and economic opportunities in less developed areas.

Industry Recognition and Rankings

Bank of Changsha actively leverages its prominent industry standing as a key promotional element. This is clearly demonstrated through its consistent appearance in respected financial rankings, reinforcing its market credibility.

These recognitions serve to bolster the bank's image and trustworthiness among its stakeholders. For instance, its performance in recent evaluations highlights its competitive strength within the financial sector.

- Global Standing: Ranked 186th in the 2023 Global Bank 1000.

- National Recognition: Placed 36th in the 2023 China Top 100 Banks.

- City Commercial Bank Leadership: Achieved 9th position among national city commercial banks in the 2023 'Gyro' evaluation.

Such accolades are crucial for building customer confidence and attracting new business, effectively communicating the bank's robust performance and market position.

Investor Relations and Transparency

Bank of Changsha prioritizes investor relations and transparency, offering stakeholders clear access to vital information. This includes readily available annual reports, transcripts from earnings calls, and timely financial announcements, all designed to foster trust and encourage investment. For instance, in their 2024 interim report, Bank of Changsha detailed a net profit of RMB 5.12 billion, a 7.2% increase year-on-year, demonstrating solid performance and consistent communication practices. This dedication to openness is crucial for attracting and retaining capital.

The bank's commitment to transparency extends to proactive engagement with both individual and institutional investors. By providing platforms for dialogue and detailed financial disclosures, Bank of Changsha aims to cultivate a strong reputation in the market. This approach not only builds confidence but also helps in attracting the necessary capital for continued growth and operations. In 2024, the bank reported a capital adequacy ratio of 13.8%, underscoring its financial strength and the positive impact of its transparent investor relations strategy.

- Annual Reports: Accessible online, providing comprehensive financial statements and operational highlights.

- Earnings Calls: Regular opportunities for investors to hear directly from management and ask questions.

- Financial Announcements: Timely dissemination of key financial data and strategic updates.

- Stakeholder Engagement: Proactive communication to build trust and attract capital.

Bank of Changsha's promotion strategy heavily relies on digital outreach, successfully executing over 1,000 digital activities in 2024 that reached more than 7 million customers. The bank also emphasizes social responsibility, contributing to public welfare and rural revitalization, which enhances its brand image. Furthermore, its strong industry standing, evidenced by rankings like 186th in the 2023 Global Bank 1000, serves as a key promotional tool, building credibility and customer confidence.

Price

Bank of Changsha actively manages its pricing strategy by offering competitive interest rates on a wide array of deposit products. This includes attractive rates for demand, time, notice, and structured deposits, designed to draw in and retain customer funds. For instance, as of early 2024, their 3-year fixed deposit rates were reportedly competitive within the regional market, aiming to capture a larger share of household savings.

On the lending side, the bank provides a diverse range of interest rates for consumer, business, and mortgage loans. These rates are carefully calibrated to align with prevailing market conditions and adhere to all regulatory guidelines, ensuring both profitability and responsible lending practices. In 2024, their mortgage rates were observed to be in the range of 3.5% to 4.2%, reflecting a strategic positioning against other commercial banks in its operating regions.

Bank of Changsha's pricing strategy is deeply intertwined with its commitment to shareholder value, as evidenced by its dividend policy. The bank announced an annual dividend payable in June 2025, a move designed to directly reward its investors.

Further solidifying this focus, the dividend ratio saw an increase in 2024. This upward adjustment signals a deliberate strategy to distribute profits more generously, thereby enhancing the attractiveness of holding Bank of Changsha shares and fostering investor loyalty.

Bank of Changsha's fee-based services are a crucial revenue stream, moving beyond traditional interest income. In 2023, the bank reported a substantial increase in its fee and commission income, which grew by 15% year-over-year, highlighting the success of its diverse product offerings.

Key contributors to this fee revenue include wealth management services, where assets under management reached over ¥120 billion by the end of 2023, and a growing portfolio of cross-border banking solutions catering to international trade and investments.

The pricing strategy for these services is carefully calibrated to align with the value delivered to clients, incorporating tiered management fees for wealth products and transaction-based charges for international services, ensuring competitive positioning and profitability.

Capital Market Instrument Pricing

Bank of Changsha leverages capital markets to secure funding, evidenced by its issuance of substantial financial instruments. For instance, in July 2025, the bank successfully launched 4 billion yuan in Technology Innovation Bonds.

These bonds, priced with a competitive fixed interest rate of 1.78%, highlight the bank's proficiency in assessing market conditions and investor appetite to raise capital efficiently.

This strategic approach allows Bank of Changsha to finance key growth areas and technological advancements. The pricing of these instruments reflects a deep understanding of financial risk and return, crucial for maintaining market confidence and access to diverse funding sources.

- Instrument: Technology Innovation Bonds

- Issue Size: 4 billion yuan

- Issuance Date: July 2025

- Interest Rate: 1.78% (fixed)

Risk-Adjusted Pricing Models

Bank of Changsha utilizes risk-adjusted pricing for its loan offerings, a common strategy among commercial banks to align interest rates with borrower risk. This approach aims to maintain healthy profit margins while safeguarding the quality of its loan portfolio. For instance, in 2024, the average interest rate on corporate loans in China, which would influence Changsha's pricing, ranged from 4.0% to 5.5%, varying based on the borrower's credit standing.

This methodology allows the bank to:

- Tailor loan pricing: Interest rates are adjusted based on factors like a borrower's credit score, collateral, and industry risk.

- Manage credit risk: Higher risk borrowers are charged higher rates, compensating for potential defaults.

- Ensure profitability: By pricing for risk, the bank can achieve sustainable returns on its lending activities.

- Maintain asset quality: A prudent pricing strategy contributes to a stronger, healthier loan book.

Bank of Changsha's pricing strategy encompasses competitive interest rates on deposits, aiming to attract and retain customer funds. For lending, rates are calibrated to market conditions and regulatory guidelines, exemplified by their 2024 mortgage rates ranging from 3.5% to 4.2%. The bank also generates revenue through fee-based services, with wealth management assets under management exceeding ¥120 billion by the end of 2023, and employs risk-adjusted pricing for loans to manage credit risk and ensure profitability.

| Pricing Element | Description | 2023/2024/2025 Data |

| Deposit Interest Rates | Competitive rates on demand, time, notice, and structured deposits. | 3-year fixed deposit rates competitive in early 2024. |

| Loan Interest Rates | Calibrated to market conditions and regulatory guidelines. | Mortgage rates observed between 3.5%-4.2% in 2024. Corporate loan rates influenced by China's 4.0%-5.5% range (2024). |

| Fee-Based Services | Revenue from wealth management, cross-border banking, etc. | Fee and commission income grew 15% YoY in 2023. Wealth management AUM > ¥120 billion (end of 2023). |

| Capital Markets Instruments | Pricing of issued financial instruments for funding. | 4 billion yuan in Technology Innovation Bonds issued July 2025 at 1.78% fixed rate. |

4P's Marketing Mix Analysis Data Sources

Our Bank of Changsha 4P's Marketing Mix Analysis draws from official annual reports, investor relations materials, and public disclosures. We supplement this with data from industry-specific financial news outlets and reputable banking sector analysis reports to ensure a comprehensive view of their strategy.