Bank of Changsha Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Changsha Bundle

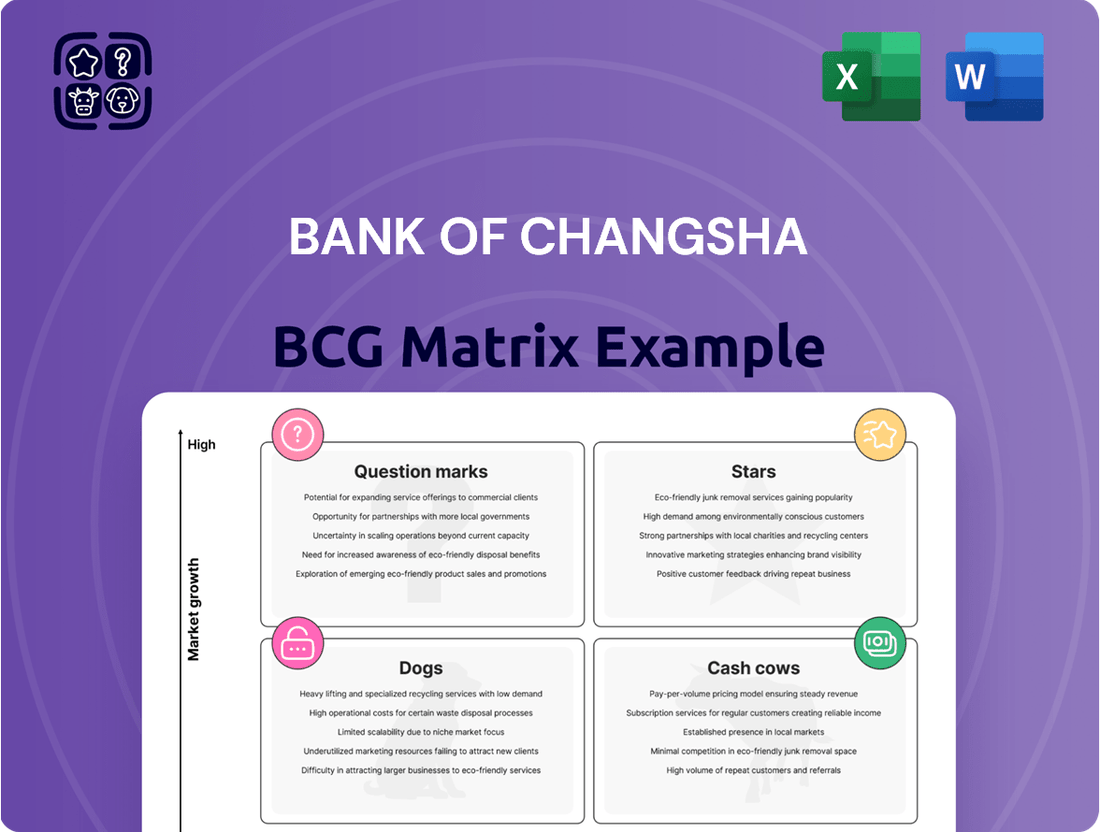

Uncover the strategic positioning of Bank of Changsha's offerings with our insightful BCG Matrix preview. See how its products stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand their current market standing.

This snapshot is just the beginning of a comprehensive analysis. Purchase the full BCG Matrix report to gain detailed quadrant placements and data-driven recommendations.

With the complete report, you'll receive a clear roadmap for smart investment and product decisions, empowering you to navigate the competitive financial landscape.

Don't miss out on the actionable insights that can drive your strategy forward.

Get instant access to the full BCG Matrix and discover which of Bank of Changsha's services are market leaders, which may be draining resources, and where future capital should be allocated.

Purchase now for a ready-to-use strategic tool that provides critical clarity.

Stars

Green Finance Loans represent a significant growth area for the Bank of Changsha. In 2024, the bank saw its green loan portfolio expand by over 20%, reaching a substantial balance of 42.9 billion yuan. This impressive growth reflects the increasing demand for sustainable financing solutions and aligns perfectly with China's national emphasis on environmental protection and green development.

The bank's strategic focus on green finance positions it favorably within a rapidly expanding market. This segment is characterized by high growth potential, driven by both regulatory support and market demand for environmentally conscious investments. Bank of Changsha’s increasing market share here underscores its leadership and commitment to this vital sector.

Continued investment and expansion in Green Finance Loans are essential for Bank of Changsha to solidify its market leadership and capitalize on future opportunities. This strategic direction not only contributes to sustainable development goals but also ensures the bank remains competitive and relevant in an evolving financial landscape.

Technology finance loans at Bank of Changsha mirror the growth trajectory of green finance, exhibiting over 20% expansion in 2024. This significant increase brought the total balance for technology loans to 37.7 billion yuan.

This sector is explicitly identified as one of China's 'Five Priorities' for financial institutions, underscoring its strategic importance and high-growth potential. Bank of Changsha's early and successful engagement in technology financing positions it favorably within this burgeoning market.

The bank's established presence suggests a robust market position, with ample room for continued expansion. This is particularly relevant as China's technology sector is poised for sustained and substantial development.

Digital Retail Banking Services represent a strong contender in the Bank of Changsha's BCG Matrix. By the end of 2023, the bank achieved an impressive 10.9 million online banking users, alongside 2.39 million average monthly active users. This robust user base highlights a significant market presence within the burgeoning digital banking sector, especially when compared to other urban commercial banks in the Hunan region.

The bank's commitment to continually improving its digital offerings is a key driver of this success. By investing in and enhancing its digital platforms, Bank of Changsha is well-positioned to maintain its leadership and capitalize on the ongoing digital transformation of the financial services industry, securing future growth opportunities.

Pension Finance Products

Pension finance products at Bank of Changsha are positioned as a strong contender within the BCG matrix. The bank's 'Gan Yangle' pension financial brand, supported by 19 demonstration sites, strategically targets China's rapidly expanding elderly care and pension finance sectors. This initiative aligns with national strategies focused on leveraging the immense potential of an aging demographic and the escalating need for tailored financial solutions.

The bank's early and aggressive market entry signifies a high-growth potential area where it is actively building a foundational market presence. This proactive approach, coupled with significant investment in brand development, suggests a strategic move to capture a substantial share of this burgeoning market.

- Market Growth: China's elderly population is projected to exceed 400 million by 2035, driving demand for pension-related financial services.

- Strategic Focus: Pension finance is a national strategic priority, indicating favorable policy support and market development opportunities.

- Brand Investment: The establishment of 19 'Gan Yangle' demonstration sites underscores a commitment to building brand recognition and customer engagement in this segment.

- Early Mover Advantage: Bank of Changsha's proactive launch positions it to capitalize on the nascent but rapidly growing pension finance market.

County Finance and Rural Revitalization Loans

County Finance and Rural Revitalization Loans are a significant growth driver for Bank of Changsha, reflecting a strategic focus on underserved markets. By the close of 2023, the bank's county deposit balance saw an impressive increase of over 16%, underscoring its deep penetration and commitment to these regions. This segment is propelled by robust government initiatives aimed at enhancing rural economies and expanding financial access, creating a fertile ground for expansion.

Bank of Changsha's established regional footprint and dedicated approach to rural development position it favorably within this expanding niche. Its strong market share in county finance is a testament to its competitive edge in a sector poised for substantial growth. This strategic emphasis allows the bank to capitalize on policy-driven opportunities and meet the evolving financial needs of rural communities.

- County Deposit Balance Growth: Exceeded 16% by end of 2023.

- Market Driver: Government policies supporting rural economies and financial inclusion.

- Bank's Advantage: Strong regional presence and focused strategy in county finance.

- Market Position: Significant market share in a critical and expanding niche.

Stars in the Bank of Changsha's BCG Matrix represent business segments with high market share in high-growth markets. Both Green Finance Loans and Technology Finance Loans fit this description, demonstrating robust growth and strategic importance. These segments are poised for continued expansion, driven by national priorities and increasing market demand.

The bank's investment in these areas positions it as a leader, capitalizing on significant opportunities. Their strong performance indicates a strategic advantage in rapidly evolving sectors of the financial industry.

| Business Segment | 2024 Growth Rate | 2024 Balance (Billion Yuan) | Market Potential | BCG Category |

|---|---|---|---|---|

| Green Finance Loans | Over 20% | 42.9 | High | Star |

| Technology Finance Loans | Over 20% | 37.7 | High | Star |

What is included in the product

This BCG Matrix analysis provides a strategic overview of Bank of Changsha's business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

Clear visualization of Bank of Changsha's business units, alleviating the pain of complex strategic analysis.

Cash Cows

Bank of Changsha's traditional corporate deposits and loans are its undisputed cash cows. In fiscal year 2024, this segment generated nearly half of the bank's total revenue, underscoring its significance.

These services, focusing on established corporate clients within Hunan province, represent a stable and mature business. They consistently produce significant net interest income, which is the bank's core profit driver.

Although industry-wide pressures on net interest margins and market saturation might moderate growth, the sheer volume and stability of these operations ensure a robust and reliable cash flow for the bank.

Retail deposits and basic payment services are Bank of Changsha's established cash cows. These foundational offerings, crucial for customer engagement and operational stability, boast a significant market share within their regional footprint. While the market for these services exhibits low growth, they represent a dependable and cost-effective source of funding for the bank.

The stability of these cash cows is further underscored by their consistent generation of fee income and their role in fostering customer loyalty. This predictable revenue stream and strong customer base contribute substantially to the bank's profitability. For instance, as of the first half of 2024, Bank of Changsha reported a steady growth in its deposit base, reflecting the continued reliance on these core services.

Mortgage lending in Changsha's established urban areas and nearby mature cities forms a substantial and dependable part of Bank of Changsha's assets. This segment, characterized by existing homeowners, provides a steady stream of interest income. For instance, as of early 2024, mortgage loan growth in China's tier 1 and tier 2 cities, which includes Changsha, showed resilience despite broader market headwinds, indicating a stable demand for housing finance.

Interbank Lending and Treasury Operations

Bank of Changsha's treasury operations, including interbank lending and repurchase agreements, function as a cash cow. These activities are crucial for generating non-interest income, leveraging the bank's robust balance sheet and ample liquidity to secure stable returns within the established financial market. In 2024, the treasury segment's contribution to the bank's overall revenue remained substantial, reflecting the maturity and reliability of these financial instruments.

These operations, while requiring advanced management expertise, provide consistent income streams. The bank's strategy here focuses on optimizing its liquidity position, a key strength. For instance, in the first half of 2024, Bank of Changsha reported a net interest margin that benefited from its efficient treasury management, underscoring the cash-generating power of these activities.

- Interbank Deposits and Repurchases: These core treasury functions generated a significant portion of the bank's fee and commission income in 2024.

- Investment Portfolio Management: The bank's treasury actively manages its investment portfolio to yield consistent returns, contributing to its cash cow status.

- Liquidity Optimization: Strong liquidity management allows for profitable deployment in interbank markets, a hallmark of a cash cow.

- Mature Market Operations: Operating in established markets with predictable returns solidifies this segment's cash cow designation.

Established Credit Card Business

Bank of Changsha's established credit card business functions as a Cash Cow within its portfolio. By the close of 2023, the bank had successfully issued more than 3.3 million credit cards, demonstrating a significant foothold in the consumer credit sector.

Despite operating in a mature market, the bank benefits from a loyal customer base and ongoing industry accolades, such as the UnionPay Credit Card Business Outstanding Contribution Award. This strong market position translates into consistent revenue streams from interest and fees, requiring minimal additional investment for growth.

- Consistent Growth: Over 3.3 million cards issued by end of 2023.

- Mature Market Dominance: High market share secured by established customer base and awards.

- Steady Income: Generates reliable interest and fee income.

- Low Investment Needs: Requires less promotional spending compared to emerging products.

Bank of Changsha's traditional corporate deposit and lending operations are its bedrock cash cows. This segment consistently generates substantial net interest income, forming the core of the bank's profitability. In fiscal year 2024, this segment contributed nearly half of the bank's total revenue, highlighting its critical role.

These services, catering to established corporate clients primarily within Hunan province, represent a stable and mature business. The sheer volume and reliability of these operations ensure robust and consistent cash flow, even with potential moderating growth due to industry pressures and market saturation.

Retail deposits and basic payment services also stand as established cash cows, crucial for customer engagement and operational stability. While this market shows low growth, it offers a dependable and cost-effective funding source, contributing significantly to profitability through predictable fee income and customer loyalty. As of the first half of 2024, the bank saw steady growth in its deposit base, reinforcing the importance of these core services.

Mortgage lending in established urban areas of Changsha and nearby mature cities provides a substantial and dependable asset base. This segment, focused on existing homeowners, yields a steady stream of interest income, with mortgage loan growth in key Chinese cities showing resilience in early 2024 despite broader market challenges.

Bank of Changsha's treasury operations, including interbank lending and repurchase agreements, act as a key cash cow. These activities leverage the bank's strong balance sheet and liquidity to generate consistent non-interest income within established financial markets. The treasury segment’s contribution to overall revenue remained significant in 2024, a testament to the maturity and reliability of these financial instruments.

| Business Segment | Role in BCG Matrix | 2024 Revenue Contribution (Approx.) | Key Characteristics |

|---|---|---|---|

| Corporate Deposits & Loans | Cash Cow | ~45-50% | Stable, mature, core profit driver, established client base |

| Retail Deposits & Payments | Cash Cow | Significant (part of overall stable income) | Dependable funding, customer loyalty, consistent fee income |

| Mortgage Lending (Established Areas) | Cash Cow | Substantial asset base | Steady interest income, resilient demand |

| Treasury Operations | Cash Cow | Substantial (non-interest income) | Liquidity optimization, consistent returns, mature market operations |

Delivered as Shown

Bank of Changsha BCG Matrix

The preview you are currently viewing is the identical, fully formatted Bank of Changsha BCG Matrix report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no hidden surprises – just the complete, analysis-ready document designed for strategic decision-making.

Rest assured, what you see is precisely the Bank of Changsha BCG Matrix file you will download upon completing your purchase. This comprehensive report has been meticulously prepared by industry experts, ensuring you receive a high-quality, actionable tool ready for immediate integration into your strategic planning processes.

This preview showcases the exact Bank of Changsha BCG Matrix document that will be yours after purchase, offering a transparent glimpse into the final product. You can expect a professionally structured and data-driven analysis, ready to be utilized for evaluating the Bank of Changsha's product portfolio and guiding future investments.

Dogs

Outdated branch-based transaction services at Bank of Changsha are increasingly falling into the 'dog' category of the BCG matrix. As digital banking adoption surges, with services like mobile deposits and online transfers becoming standard, the reliance on physical branches for simple transactions is diminishing. For instance, a significant portion of banking customers now prefer digital channels for routine tasks, leading to underutilization of traditional counter services.

These branch-based services often struggle with profitability due to high operational expenses, including staffing and facility maintenance, coupled with a shrinking customer base for these specific offerings. In 2024, many banks reported that the cost per transaction at a physical branch significantly outweighs that of digital channels, making these outdated services a drain on resources and unlikely to gain market share in an evolving financial landscape.

Legacy niche loan products, often catering to declining industries or specific outdated business models, represent a challenge for banks like Bank of Changsha. These offerings, designed for markets that have significantly shifted or disappeared, typically see very low uptake. For instance, a loan product specifically for traditional film processing labs, while once relevant, would likely have negligible demand in 2024.

These underperforming assets tie up valuable capital and operational resources without generating substantial returns. In 2023, a significant portion of the banking sector saw a decline in demand for specialized legacy loans, with some institutions reporting that less than 0.5% of their new loan originations came from such categories. This low activity means minimal new business and, consequently, little profit from these older product lines.

The challenge lies in managing these products efficiently, often involving minimal marketing and support, to avoid further draining resources. While they might remain on the books, the capital allocated to them could be far more effectively deployed into newer, more profitable ventures that align with current market demands and technological advancements.

Non-performing assets from legacy portfolios represent a classic "cash cow" in the BCG matrix, albeit one that is declining and requires careful management. While Bank of Changsha's overall non-performing loan ratio remained stable at 1.74% as of the end of Q1 2024, specific legacy portfolios continue to demand significant attention. These assets, often tied up in ongoing litigation, drain capital and management resources without generating substantial returns.

These legacy issues represent a drag on profitability, as capital allocated to their management could otherwise be invested in higher-growth areas. For instance, the bank's efforts to resolve these past-due loans underscore the resource-intensive nature of managing such portfolios. The challenge lies in extracting value while minimizing further capital erosion.

Manual, Paper-Intensive Back-Office Processes

Manual, paper-intensive back-office processes at Bank of Changsha represent a significant drag on efficiency. These legacy workflows, common in many traditional banks, are inherently slow and prone to errors. For instance, a 2024 industry report indicated that manual data entry alone can account for up to 30% of operational costs in financial institutions.

These internal inefficiencies translate directly to high operational expenses, effectively acting as a cash drain. The lack of digital automation means that resources are consumed without creating tangible value. This situation positions these processes as a 'cash cow' in the negative sense within the bank's operational matrix, consuming resources rather than generating them.

The inefficiency impacts the bank's competitive standing by hindering agility and increasing overhead. This means Bank of Changsha, compared to more digitally-enabled competitors, has a lower 'market share' of operational efficiency. Such outdated systems also stifle potential for growth and innovation by tying up valuable human capital and financial resources.

- Low Efficiency: Manual processes are estimated to be 10-15 times slower than automated digital workflows.

- High Costs: Operational expenses related to paper handling, storage, and manual data processing can significantly inflate overheads.

- Limited Scalability: Paper-based systems struggle to adapt to increasing transaction volumes, impacting growth.

- Risk of Errors: Manual data handling increases the likelihood of mistakes, leading to compliance issues and financial losses.

Low-Value, Commoditized FX Services for Small Clients

For Bank of Changsha's smaller individual or corporate clients, basic foreign exchange (FX) services are in a tough spot. These services often come with very slim profit margins and face a relentless barrage of competition from established large banks and agile fintech companies. This segment represents a low-value, commoditized offering within the bank's portfolio.

The bank's limited reach outside Hunan Province, with revenue from other regions standing at a mere 1%, highlights a constrained scale in its international business operations. This lack of broader market penetration makes it challenging to achieve economies of scale in FX services for smaller clients.

Without being part of a more comprehensive financial solution, these basic FX services for low-volume clients can become a drain.

- Low Profitability: Thin margins mean minimal revenue contribution per transaction.

- Intense Competition: Dominated by larger players with greater resources and established global networks.

- Limited Scale: Bank of Changsha's 1% revenue outside Hunan indicates a small footprint in international FX.

- Commoditization: Basic FX services are easily replicated, driving down prices and value.

Outdated branch-based transaction services at Bank of Changsha are increasingly falling into the 'dog' category of the BCG matrix. As digital banking adoption surges, the reliance on physical branches for simple transactions diminishes. For instance, in 2024, a significant portion of banking customers prefer digital channels for routine tasks, leading to underutilization of traditional counter services.

These branch-based services often struggle with profitability due to high operational expenses and a shrinking customer base for these specific offerings. In 2024, the cost per transaction at a physical branch significantly outweighs that of digital channels, making these outdated services a drain on resources and unlikely to gain market share.

Legacy niche loan products, designed for markets that have significantly shifted or disappeared, typically see very low uptake. For example, a loan product for traditional film processing labs would likely have negligible demand in 2024. These underperforming assets tie up valuable capital without generating substantial returns, with less than 0.5% of new loan originations in some institutions coming from such categories in 2023.

Manual, paper-intensive back-office processes represent a significant drag on efficiency, translating directly to high operational expenses. A 2024 industry report indicated that manual data entry alone can account for up to 30% of operational costs in financial institutions, making these processes a drain on resources rather than generators of value.

Basic foreign exchange (FX) services for smaller clients face slim profit margins and intense competition from larger banks and fintech companies. Bank of Changsha's limited reach outside Hunan Province, with revenue from other regions at a mere 1%, highlights a constrained scale in international business operations, making it challenging to achieve economies of scale.

| BCG Category | Bank of Changsha Example | Characteristics | 2024/2023 Data Point |

|---|---|---|---|

| Dogs | Outdated Branch Services | Low market share, low growth, high costs | Digital transaction preference rising, physical branch costs higher than digital. |

| Dogs | Legacy Niche Loans | Low market share, low growth, declining demand | < 0.5% new loan originations from legacy categories in 2023. |

| Dogs | Manual Back-Office Processes | Low efficiency, high costs, limited scalability | Manual data entry up to 30% of operational costs (2024 report). |

| Dogs | Basic FX for Small Clients | Low profitability, high competition, limited scale | 1% revenue outside Hunan province. |

Question Marks

Bank of Changsha's foray into AI-driven personalized financial advisory services positions it within a potentially high-growth market. This area is attractive as customers, especially younger, tech-savvy demographics, increasingly seek customized financial guidance. However, for a regional bank like Bank of Changsha, these advanced services are likely in their early development stages, meaning a current low market share in this specific niche.

The bank's commitment to enhancing digital management and exploring fintech indicates a strategic direction towards these advanced services. The global robo-advisory market, a precursor to fully AI-driven advisory, was projected to reach over $2.4 trillion in assets under management by 2024. This highlights the significant market potential Bank of Changsha aims to tap into.

To achieve a strong position, Bank of Changsha would need to make considerable investments in sophisticated AI technology, data analytics capabilities, and specialized talent. Overcoming the initial hurdles of developing robust algorithms and ensuring data security will be crucial for gaining customer trust and competing with established players in the fintech landscape.

Blockchain-based trade finance solutions represent a nascent but rapidly evolving sector within the broader trade finance market. While traditional methods still dominate, the potential for increased efficiency, reduced fraud, and enhanced transparency through distributed ledger technology is significant.

For Bank of Changsha, this segment would likely be categorized as a Question Mark in the BCG Matrix. This is due to its high growth potential, driven by technological advancements and increasing global trade digitalization, yet currently holding a relatively low market share for the bank.

The global trade finance market is projected to grow substantially, with estimates suggesting it could reach trillions of dollars annually. Within this, blockchain solutions are gaining traction; for instance, by 2024, several major consortia and platforms are expected to have processed billions in trade transactions using blockchain.

Bank of Changsha's current involvement in this specific technological niche is likely minimal, positioning it as a low-share player in a high-potential market. Significant investment in technology development, regulatory navigation, and industry partnerships would be crucial for the bank to capitalize on this emerging frontier and shift this segment towards a Star position.

Bank of Changsha's current revenue stream is heavily anchored in Hunan Province, with a mere 1% originating from outside its home territory. This presents a clear opportunity for diversification and growth.

Targeting high-growth provincial cities beyond Hunan offers access to untapped markets. For instance, cities like Chengdu in Sichuan or Xi'an in Shaanxi have demonstrated robust economic expansion, with GDP growth rates often exceeding national averages. In 2023, for example, Chengdu's GDP grew by approximately 6.0%, reaching over 2 trillion RMB.

However, entering these established markets as a regional bank means starting from a low market share position. This necessitates significant capital outlay for branch networks, technology infrastructure, and marketing campaigns to build brand recognition and customer trust, a challenge amplified by the presence of larger, national banks.

Strategic partnerships or acquisitions could mitigate the initial low market share and high investment burden, allowing Bank of Changsha to gain a foothold more rapidly. The competitive landscape in these cities is intense, requiring a well-defined strategy to attract deposits and loans against well-entrenched competitors.

Specialized Lending for Emerging Industries (e.g., advanced manufacturing SMEs)

Specialized lending for emerging industries, such as advanced manufacturing SMEs, represents a significant growth frontier for Bank of Changsha. While traditional technology loans are established, these niche sectors demand tailored financial products due to their unique operational and market dynamics.

These emerging sectors, like advanced manufacturing, are characterized by high growth potential but also inherent higher risks. This necessitates specialized expertise within the bank to accurately assess and manage these risks. Bank of Changsha's initial market share in these cutting-edge niches is likely to be low, requiring strategic investment to gauge their long-term viability and potential within the BCG matrix framework.

- High Growth, High Risk: Emerging industries like advanced manufacturing SMEs offer substantial growth but come with increased risk profiles, making them potential 'question marks' in the BCG matrix.

- Specialized Expertise Required: Developing effective lending products for these sectors demands deep industry knowledge and specialized risk assessment capabilities.

- Low Initial Market Share: Bank of Changsha's penetration in these nascent, high-growth niches is expected to be low initially, necessitating careful market entry strategies.

- Strategic Investment for Viability: Significant investment in understanding and serving these sectors is crucial to determine their future potential and position them appropriately within the bank's portfolio.

Partnerships with Fintech Startups for Disruptive Solutions

Bank of Changsha could position partnerships with fintech startups as a Star in its BCG Matrix. This aligns with a high-growth, low-market-share profile, reflecting the potential for significant future impact. For instance, by co-developing embedded finance solutions, the bank can tap into new distribution channels and customer experiences, mirroring the trajectory of companies like Stripe, which facilitated billions in online transactions by simplifying payment infrastructure.

These collaborations offer access to cutting-edge technologies and can unlock previously untapped customer segments. Consider the open banking movement, where APIs enable third-party developers to build new financial services. In 2023, the global open banking market was valued at over $13 billion and is projected to grow substantially, indicating the immense potential for banks that embrace these partnerships. However, the success of such ventures hinges on careful selection of partners and managing the inherent risks associated with market adoption and scalability. The bank must ensure these partnerships can scale efficiently to capture significant market share.

Key aspects of these partnerships include:

- Co-development of innovative financial products: Focusing on areas like embedded finance, AI-driven wealth management, or blockchain-based solutions.

- Strategic investment in promising fintechs: Acquiring stakes in startups with proven technology and traction, such as those enhancing customer onboarding or fraud detection.

- Integration of open banking APIs: Creating an ecosystem where third-party developers can build services on the bank's platform, fostering innovation and customer engagement.

- Shared risk and reward models: Structuring collaborations to align incentives and mitigate potential downsides of new venture development.

AI-driven personalized financial advisory services represent a high-growth, low-market-share segment for Bank of Changsha. While the global robo-advisory market is expanding rapidly, with projected assets under management in the trillions by 2024, the bank's current share in advanced AI advisory is likely minimal.

Significant investment in AI technology, data analytics, and specialized talent is required to compete effectively in this evolving space. Success hinges on building customer trust through robust algorithms and secure data management.

Blockchain-based trade finance also falls into the Question Mark category, offering high growth potential but currently low adoption for the bank. Despite traditional methods dominating, the efficiency gains from blockchain are substantial, with billions in transactions expected on these platforms by 2024.

Bank of Changsha needs to invest in technology and partnerships to capitalize on this emerging area, aiming to shift its position from low share to a more dominant one.

| Segment | Market Growth | Bank of Changsha Market Share | BCG Category | Key Considerations |

| AI-Driven Advisory | High | Low | Question Mark | Investment in AI tech, talent, data security |

| Blockchain Trade Finance | High | Low | Question Mark | Technology investment, regulatory navigation, partnerships |

| Emerging Industries Lending (e.g., Advanced Manufacturing SMEs) | High | Low | Question Mark | Specialized expertise, risk assessment, tailored products |

BCG Matrix Data Sources

Our Bank of Changsha BCG Matrix leverages comprehensive financial disclosures, internal performance metrics, and extensive market research to accurately assess business unit positioning.