Azrieli SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Azrieli Bundle

Azrieli's current SWOT highlights impressive strengths in its diversified portfolio and strong brand recognition. However, it also points to potential threats from economic downturns and increasing competition within its key sectors.

Understanding these dynamics is crucial for anyone looking to invest or strategize around Azrieli. Our complete SWOT analysis dives deeper, providing actionable insights into their opportunities and weaknesses.

Want the full story behind Azrieli's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Azrieli Group maintains its status as Israel's largest real estate company, holding a substantial portfolio of malls, office spaces, and shopping centers across the nation. This dominant position, evidenced by its NIS 30 billion market capitalization as of early 2025, grants significant competitive advantages. Iconic properties like the Azrieli Towers in Tel Aviv not only solidify brand recognition but also attract premier tenants. Their market leadership ensures premium rental rates and continued high occupancy, reinforcing strong cash flows.

Azrieli boasts a highly diversified portfolio, strategically spread across key real estate segments. As of mid-2024, offices account for 32% of assets, malls for 30%, and the rapidly expanding data center business contributes 17%. This broad diversification, including senior housing and international properties, effectively mitigates market risks. The company's high-quality, prime-location assets ensure strong performance, reflected in impressive occupancy rates of 99% for malls and 98% for offices.

Azrieli Group demonstrates strong and consistent financial performance, marked by robust growth in Net Operating Income and Funds From Operations. For Q1 2025, NOI saw a 21% increase year-over-year, with FFO growing by 15%. The company maintains a healthy balance sheet, boasting an equity-to-assets ratio of 44%, supported by significant liquidity and high credit ratings. This strong financial position allows Azrieli to fund its extensive development pipeline and consistently return value to shareholders through dividends.

Strategic Expansion into Data Centers

Azrieli has strategically expanded into the high-growth data center sector, primarily through its European subsidiary, Green Mountain. This forward-looking move capitalizes on the increasing global demand for data infrastructure. The data center segment has become a significant growth engine, with its Net Operating Income (NOI) increasing by 59% year-over-year in Q2 2024. This strategic pivot positions Azrieli strongly within the digital economy.

- Green Mountain’s Q2 2024 NOI increased by 59% year-over-year.

- Strategic focus on high-demand data center infrastructure.

Robust Development Pipeline

Azrieli Group boasts a robust development pipeline, encompassing over 1 million square meters of new projects under construction or planning across office, retail, and residential sectors. Flagship developments like the Spiral Tower in Tel Aviv, projected for completion in 2026, are set to significantly expand the company's Gross Leasable Area by over 90,000 square meters and boost future Net Operating Income. This extensive commitment to development and urban renewal solidifies Azrieli's future growth trajectory and reinforces its leadership in shaping Israel's modern urban landscapes.

- Over 1 million square meters in development pipeline as of early 2025.

- Spiral Tower in Tel Aviv adds over 90,000 square meters of GLA.

- Projects span office, retail, and residential sectors.

- Enhances future NOI and market leadership.

Azrieli Group's dominant market leadership in Israel, with a NIS 30 billion market cap as of early 2025, ensures strong cash flows and premium rental rates. Its highly diversified portfolio, including a rapidly expanding data center segment (Q2 2024 NOI +59%), mitigates risks and drives growth. Strong financials, with Q1 2025 NOI up 21%, support a robust 1 million sqm development pipeline.

| Metric | Value (2024/2025) | Benefit | ||

|---|---|---|---|---|

| Market Cap | NIS 30 Billion | Dominant position | ||

| Q1 2025 NOI Growth | +21% YoY | Strong financial performance | ||

| Development Pipeline | >1 Million sqm | Future growth trajectory |

What is included in the product

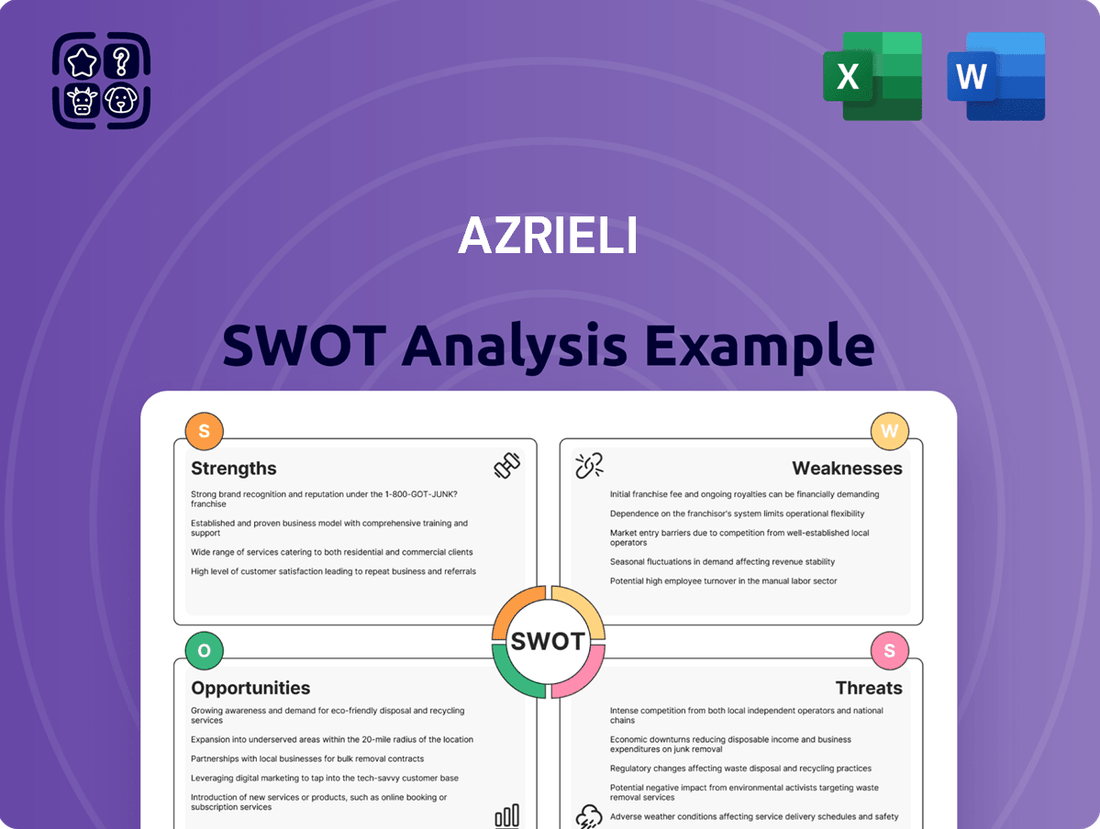

Analyzes Azrieli’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT framework to pinpoint and address strategic weaknesses.

Simplifies complex strategic challenges into an organized, easy-to-understand format.

Weaknesses

Azrieli Group's extensive property portfolio is predominantly concentrated in Israel, with over 90% of its income-producing properties located within the country as of early 2025. This high geographic concentration makes the company highly vulnerable to localized economic downturns, such as the potential impact of geopolitical events on consumer spending and tourism in 2024. Regulatory shifts or increased geopolitical instability within Israel could disproportionately affect Azrieli's rental income and property valuations. Unlike globally diversified real estate investment trusts, this limited geographic spread represents a significant risk profile, hindering its ability to offset regional challenges with performance from other markets.

Azrieli's significant retail portfolio, encompassing shopping malls and commercial centers, faces ongoing vulnerability from the global rise of e-commerce. While their properties maintain strong occupancy rates, often exceeding 95% in 2024, and rising store revenues, the long-term shift in consumer behavior toward online purchasing remains a persistent threat. This necessitates continuous, substantial investment in digital integration and experiential retail to sustain footfall and tenant demand, adapting to a projected 12% annual growth in global e-commerce through 2025.

Azrieli's substantial office portfolio is vulnerable to shifts in work patterns, with remote and hybrid models gaining traction. A slowdown in Israel's high-tech sector, a primary driver of office rentals, has already weakened demand, leading to landlords offering concessions in 2024. This market pressure could increase office vacancy rates, which, for instance, saw slight upticks in key urban centers in early 2024, or decrease rental prices. Such changes directly impact a significant portion of Azrieli's revenue, considering their office segment generated substantial NOI in 2023.

Dependence on Economic Cycles and Interest Rates

Azrieli's financial health is highly sensitive to economic cycles and interest rate shifts. For instance, the Bank of Israel's benchmark interest rate at 4.50% by early 2025 directly elevates borrowing costs for new developments and existing debt refinancing, potentially eroding profit margins. An economic downturn could reduce demand for commercial and retail properties, impacting rental income and increasing vacancy rates across its Israeli portfolio. This dependency means that even a slight market contraction, like a 0.5% decrease in nationwide commercial occupancy, could significantly affect Azrieli's net operating income.

- Bank of Israel policy rate at 4.50% (Q1 2025) directly influences Azrieli's financing expenses.

- A potential 0.5% rise in Azrieli's portfolio-wide vacancy rates could reduce annual rental income by millions.

- Higher interest rates can depress property valuations by 5-10% in the Israeli market, impacting asset values.

Complexity of Holding Structure

Azrieli Group's intricate structure as a holding company, encompassing diverse subsidiaries and minority stakes in sectors like energy and finance, presents significant management challenges. This complexity can dilute strategic focus, making it harder to optimize performance across all ventures. For investors, fully understanding and valuing the company becomes more arduous due to the layered financial reporting and varied asset classes. The market might apply a holding company discount, impacting its share price.

- Azrieli's Q1 2024 results showed a net operating income (NOI) increase, yet the diverse portfolio requires constant capital allocation scrutiny.

- The company's investment in energy via Menahelim and its finance sector interests through Scope increase the complexity of consolidated financial statements.

- Analysts often face challenges in disaggregating performance metrics for each subsidiary, leading to less transparent valuation models.

- Complex structures can hinder agility in pivoting strategies, especially in dynamic markets like real estate and energy.

Azrieli Group's high concentration in Israel, with over 90% of its properties there by early 2025, creates significant vulnerability to regional economic and geopolitical shifts. Its extensive retail and office portfolios face ongoing pressure from e-commerce growth and evolving work patterns, impacting future demand despite strong 2024 occupancy rates. The company's financial health is highly sensitive to interest rate fluctuations, with the Bank of Israel's 4.50% rate in early 2025 directly elevating borrowing costs. Furthermore, its complex holding company structure can dilute strategic focus and complicate investor valuation.

| Weakness Area | Key Metric (2024/2025) | Impact |

|---|---|---|

| Geographic Concentration | >90% Israeli properties (early 2025) | Increased exposure to local downturns. |

| E-commerce Threat | 12% annual e-commerce growth (projected through 2025) | Persistent pressure on retail footfall. |

| Interest Rate Sensitivity | Bank of Israel rate: 4.50% (Q1 2025) | Higher borrowing costs, eroded margins. |

| Office Market Shifts | Slight vacancy upticks in key urban centers (early 2024) | Potential for decreased rental income. |

Full Version Awaits

Azrieli SWOT Analysis

You're viewing a live preview of the actual Azrieli SWOT analysis file. The complete version, packed with strategic insights, becomes available immediately after purchase.

This is not a sample—it’s the real Azrieli SWOT analysis you'll download post-purchase, in full detail and ready for your business planning.

The preview below is taken directly from the full Azrieli SWOT report you'll get. Purchase unlocks the entire in-depth version for your strategic advantage.

This is the same Azrieli SWOT analysis document included in your download. The full content is unlocked after payment, providing comprehensive strategic understanding.

Opportunities

The global data center market is projected to reach approximately $360 billion by 2025, driven by surging digitalization, cloud computing, and AI adoption. Azrieli's Green Mountain subsidiary is strategically positioned to capitalize on this, with over 150 MW of committed capacity under development in Europe. Further strategic acquisitions or greenfield developments, particularly in high-growth European regions like Norway and the UK, present a significant avenue for Azrieli to enhance its recurring revenue streams. This expansion aligns with projected 2024 data center revenue growth of over 10% globally.

Azrieli Group, while strong in Israel, has significant opportunities in international expansion, particularly in North America, where its data center operations are expanding. Diversifying its portfolio geographically, as exemplified by its North American data center assets, can mitigate geopolitical risks and reduce dependence on the Israeli economy. This includes acquiring additional office or retail assets in stable markets or entering new European regions. The global data center market, projected to exceed $170 billion by 2025, offers substantial growth avenues for such strategic diversification.

Israel's ongoing urban renewal and infrastructure boom presents significant opportunities, with the Ministry of Construction and Housing projecting over 70,000 new housing units annually through 2025. Azrieli can leverage its extensive development expertise to lead large-scale mixed-use projects, integrating residential, commercial, and public spaces. Government initiatives, like the National Outline Plan 38 (TAMA 38) for urban renewal, actively support such ventures, generating long-term value. These projects, often strategically located near new transport hubs, solidify Azrieli's role in shaping Israel's urban landscape.

Diversification into New Asset Classes

Azrieli can expand into promising real estate sectors, leveraging current market trends. This includes growing its presence in logistics and industrial properties, which saw a 2024 rental growth projection of 5-7% in key markets due to e-commerce. Further developing senior housing and rental housing segments, where demand is robust with an aging population and urbanization, provides additional revenue streams. Diversifying the asset base helps spread risk, enhancing portfolio resilience against single-sector downturns.

- Logistics and industrial properties are poised for continued growth, with a 2025 forecast for global e-commerce sales reaching $7.4 trillion.

- The senior housing market is expanding, driven by demographics, with the 65+ population projected to increase significantly by 2030.

- Rental housing demand remains strong, particularly in urban centers, reflecting ongoing population shifts and affordability challenges in homeownership.

Focus on ESG and Green Buildings

The increasing demand for sustainable and environmentally friendly properties presents a significant opportunity for Azrieli. By investing further in green building technologies and achieving certifications like LEED or BREEAM, Azrieli can attract premium tenants willing to pay higher rents for high-quality, sustainable spaces, enhancing its brand reputation. A robust ESG strategy, including a target to reduce operational emissions, also improves access to capital, as global sustainable finance is projected to exceed $50 trillion by 2025. This focus creates long-term stakeholder value.

- Global sustainable finance is expected to reach over $50 trillion by 2025.

- Tenants are increasingly prioritizing certified green buildings, often paying a premium of 5-10% for such spaces.

- ESG-focused companies typically see lower costs of capital, benefiting from investor preference for sustainable assets.

- Enhanced brand reputation through green initiatives attracts top-tier corporate tenants.

Azrieli can significantly expand its global data center footprint, capitalizing on the market projected to reach $360 billion by 2025 and 150 MW capacity at Green Mountain. Diversifying into high-demand sectors like logistics, with projected 2024 rental growth of 5-7%, and senior housing addresses evolving market needs. Continued urban renewal in Israel, targeting 70,000 new housing units annually, offers robust development prospects. Embracing sustainable properties, supported by over $50 trillion in global sustainable finance by 2025, attracts premium tenants and lowers capital costs.

| Opportunity Area | Key Metric (2024/2025) | Impact |

|---|---|---|

| Data Centers | Global market $360B (2025) | Enhanced recurring revenue |

| Logistics & Industrial | 5-7% rental growth (2024) | Portfolio diversification, new income streams |

| Sustainable Properties | Sustainable finance >$50T (2025) | Lower capital costs, premium tenants |

Threats

Azrieli's significant concentration in Israel inherently exposes it to the persistent geopolitical volatility of the Middle East. Escalations in regional conflicts, such as those seen in late 2023 and early 2024, can severely disrupt business operations and deter crucial tourism and foreign investment. This instability directly impacts consumer confidence and property valuations across Azrieli’s portfolio, with the Bank of Israel forecasting a 2024 GDP growth rate of 2.0% as of April 2024, reflecting these ongoing uncertainties. Such unpredictable events pose a continuous threat to market stability and Azrieli's operational environment.

Elevated inflation, which saw Israel's CPI around 2.8% in early 2024, and subsequent interest rate hikes by the Bank of Israel, with the key rate at 4.50% as of April 2024, pose a direct threat. Higher interest rates increase borrowing costs for new developments and acquisitions, potentially squeezing profit margins for Azrieli. They also make mortgages more expensive for consumers, evident in the slowdown of new mortgage originations. This can cool the housing market and reduce demand for commercial spaces, impacting rental income and property values.

An economic downturn, either in Israel or globally, poses a significant threat to Azrieli's property demand. Companies may reduce their office footprint, impacting commercial rental income, while decreased consumer spending directly affects mall revenues. For instance, Q1 2025 data indicates a continued cooling in Israel's residential real estate, with transaction volumes down by approximately 15% year-over-year, alongside a slowdown in the tech sector, which could challenge future rental growth and occupancy rates across Azrieli's portfolio.

Increased Competition

While Azrieli remains a market leader, Israel's commercial real estate sector is highly competitive, with both local and international developers actively vying for prime assets and tenants. Significant new construction, particularly in Tel Aviv's office and retail segments, could lead to an oversupply by late 2024 or early 2025. This increased supply risks pressuring rental rates and reducing occupancy levels across the market. For instance, new projects totaling over 500,000 square meters of office space are anticipated in the Tel Aviv district by mid-2025. Azrieli must consistently innovate its offerings and invest in strategic properties to maintain its competitive advantage.

- Expected increase in Tel Aviv office supply by mid-2025: over 500,000 sqm.

- Potential pressure on rental rates and occupancy due to new developments.

- Intensified competition from both local and international real estate firms.

Regulatory and Tax Changes

The Israeli government's potential policy shifts pose a significant threat to Azrieli's real estate operations. Any increase in value-added tax (VAT) or property taxes, known as Arnona, directly elevates costs for both developers and tenants. For instance, a rise in municipal Arnona rates, which are reviewed annually, could reduce net operating income from commercial properties. Furthermore, changes to zoning laws or planning regulations could complicate future development projects and impact the profitability of existing assets during 2024-2025.

- Potential VAT increases impact acquisition and construction costs.

- Arnona rate adjustments can elevate operational expenses for properties.

- Zoning law changes might restrict new project feasibility.

- Regulatory shifts could affect market demand for rental units.

Azrieli faces significant threats from regional geopolitical instability, impacting consumer confidence and property values, reflected in Israel's 2024 GDP forecast of 2.0%. Elevated interest rates, at 4.50% as of April 2024, increase borrowing costs and cool the real estate market. Intense competition and potential oversupply, with over 500,000 sqm of new Tel Aviv office space by mid-2025, threaten rental rates. Furthermore, government policy shifts, like changes to Arnona or zoning, could raise operational expenses and complicate future developments during 2024-2025.

| Threat Category | Key Metric (2024/2025) | Impact |

|---|---|---|

| Geopolitical Risk | Israel 2024 GDP: 2.0% (April 2024) | Reduced confidence, property value dips |

| Economic Headwinds | Bank of Israel Key Rate: 4.50% (April 2024) | Higher borrowing costs, cooled demand |

| Market Competition | Tel Aviv Office Supply: >500,000 sqm (Mid-2025) | Pressured rental rates, occupancy levels |

SWOT Analysis Data Sources

This Azrieli SWOT analysis is built upon a robust foundation of data, drawing from Azrieli's official financial reports, comprehensive market research, and expert industry analyses. These sources provide a well-rounded view of the company's internal capabilities and external environment, ensuring a credible and actionable strategic assessment.