Azrieli PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Azrieli Bundle

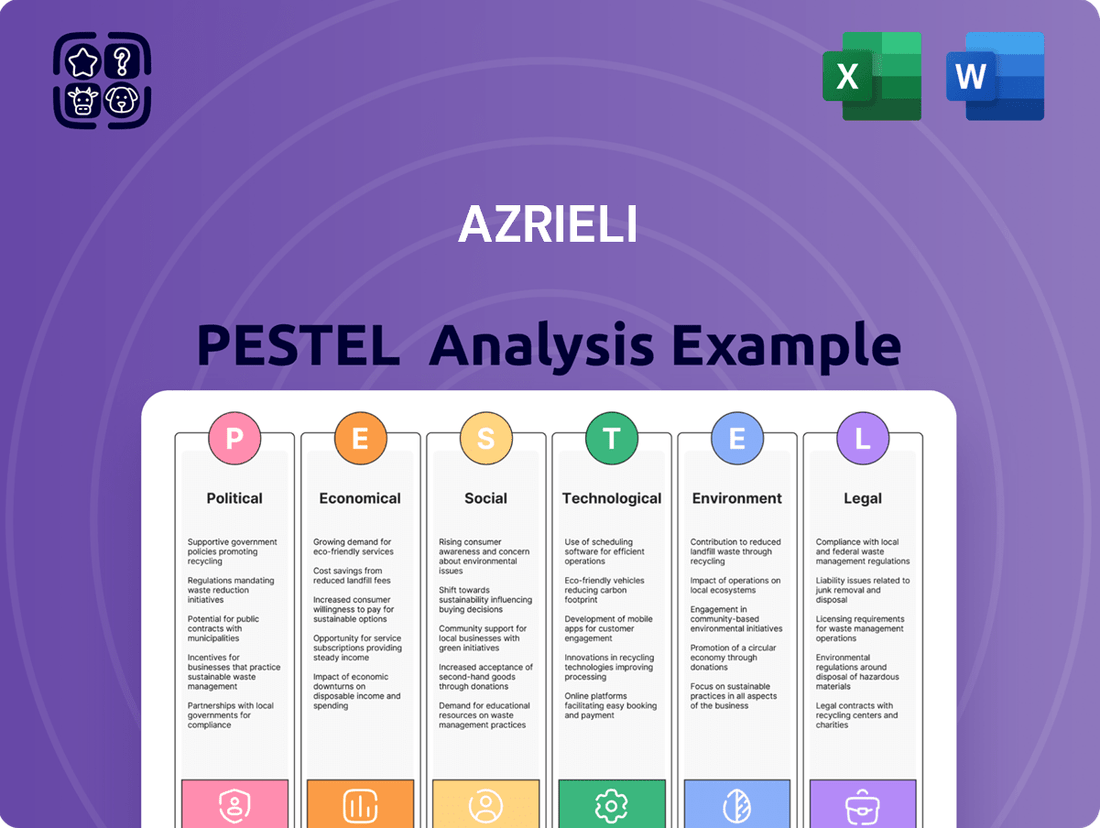

Navigate the complex external environment impacting Azrieli. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors shaping their operations and future growth. Understand the risks and opportunities that lie ahead.

Gain a strategic advantage by leveraging our expert-crafted PESTLE analysis of Azrieli. This comprehensive report provides actionable insights into the macro-environmental forces influencing the company. Make informed decisions and strengthen your market position.

Don't be left in the dark about the external forces affecting Azrieli. Our detailed PESTLE analysis offers a clear roadmap of the challenges and opportunities they face. Empower yourself with the knowledge to anticipate trends and capitalize on them.

Unlock the full potential of your strategic planning with our Azrieli PESTLE analysis. We’ve done the heavy lifting, delivering a thoroughly researched and insightful report. Equip yourself with the intelligence needed to excel.

Ready to make smarter investments and business decisions regarding Azrieli? Our PESTLE analysis provides the critical external context you need. Download the complete version now and get the competitive edge.

Political factors

Ongoing geopolitical tensions in the region pose a significant risk to Azrieli Group. Any escalation could negatively impact investor confidence and property values, potentially slowing foreign direct investment inflows to Israel, which reached $28.1 billion in 2023. Conversely, improved regional stability could foster a more favorable investment climate, boosting asset valuations and domestic economic activity. Azrieli's performance is closely tied to the perceived stability of Israel, influencing both real estate demand and the broader economic outlook for 2024-2025.

Government policies on housing supply, urban renewal, and land allocation significantly shape Azrieli's development pipeline and growth. Initiatives like the Israeli government's 2024 push for increased housing starts, targeting over 70,000 units annually, directly influence land availability and project viability. Policies offering incentives for urban renewal, such as the Pinui Binui program, or promoting construction in peripheral areas, unlock new opportunities for expansion. The government's stance on settlement development also carries domestic and international political weight, potentially affecting Azrieli's operational scope and investor sentiment.

The Israeli government's relationship with international bodies significantly impacts Azrieli's operating environment. Criticism from organizations like the UN, particularly concerning development projects in contested areas, can lead to reputational risks and calls for divestment, potentially affecting Azrieli's access to certain international capital pools. Conversely, strong diplomatic ties, such as those fostering increased tourism from Europe and North America, directly boost foot traffic and revenue for Azrieli's retail and office properties, which saw a 5% increase in rental income in Q1 2024. Positive international standing also encourages foreign investment, vital for large-scale real estate projects.

Trade Policies and Foreign Investment Incentives

Israel's robust trade agreements and proactive policies aimed at attracting foreign direct investment (FDI) are critical for the nation's economic vitality, directly influencing the real estate sector. The government actively fosters foreign capital inflow through various incentives, which significantly benefits major developers like Azrieli Group. In 2024, Israel continues to be a top destination for tech investments, with FDI reaching approximately $27 billion in 2023, largely due to these supportive policies.

Any shifts in trade policies or a reduction in these investment incentives could dampen economic growth and consequently reduce the demand for prime commercial and office spaces that Azrieli specializes in. For instance, a decline in FDI could lead to fewer new company formations or expansions, directly impacting Azrieli's occupancy rates and rental income projections for 2025.

- Israel's FDI reached $27 billion in 2023, primarily in tech.

- Government incentives bolster foreign investment attraction.

- Policy changes could reduce demand for commercial real estate.

Domestic Political Stability

The stability of the Israeli government significantly influences business confidence and Azrieli's long-term planning, particularly regarding the national budget for 2024-2025. A stable political environment is crucial for large-scale, long-term investments characteristic of Azrieli's real estate developments. Political uncertainty, as seen with recent coalition challenges, can delay essential regulatory approvals and infrastructure projects vital for new ventures. This directly impacts the company's ability to execute its strategic growth initiatives and secure financing, potentially affecting project timelines and profitability.

- Israel's 2024 budget passed with a deficit projection of 6.6% of GDP.

- Government stability directly impacts investor sentiment for multi-year projects.

- Regulatory approval delays can extend development cycles for Azrieli's commercial towers.

- Uncertainty may influence bond yields and borrowing costs for major real estate firms.

Geopolitical stability and government policies on housing supply, targeting over 70,000 units annually in 2024, directly shape Azrieli's development pipeline. International relations, attracting $27 billion FDI in 2023, significantly influence demand for commercial spaces. Government stability, vital for long-term planning, also impacts the 2024 national budget with a 6.6% GDP deficit.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Geopolitical | Investor Confidence | FDI $27B (2023) |

| Housing Policy | Development Pipeline | 70K+ units target (2024) |

| Gov Stability | Business Planning | 6.6% GDP deficit (2024) |

What is included in the product

This Azrieli PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations and strategic direction.

Provides a clear, actionable framework that helps Azrieli's leadership team proactively identify and mitigate external threats, thereby reducing the stress and uncertainty associated with navigating complex market dynamics.

Economic factors

Fluctuations in interest rates set by the Bank of Israel directly impact Azrieli Group's financing costs and property valuations. For instance, the Bank of Israel's benchmark interest rate stood at 4.50% in early 2024. Potential interest rate cuts in 2025, possibly to 3.75% by mid-year according to some market forecasts, could significantly lower borrowing costs for new developments and acquisitions. This would also stimulate broader economic activity, benefiting retail and office segments. Conversely, unexpected rate hikes, perhaps back above 4.75%, would increase the cost of debt and put downward pressure on property prices, impacting asset values.

Rising inflation, projected around 3% for Israel in late 2024 and early 2025, impacts consumer spending at Azrieli's malls and the affordability of its housing and commercial spaces. High inflation erodes purchasing power, potentially reducing retail sales and affecting tenants' profitability, leading to demands for higher wages. However, Azrieli's significant portfolio of CPI-linked lease agreements, covering over 90% of its commercial rental income, offers substantial protection against these rising costs. This structure helps maintain the company's real rental income amidst inflationary pressures.

The health of the Israeli economy, primarily measured by GDP growth, directly influences demand for office space, retail, and data centers. Projections suggest Israel's GDP growth is set for a recovery, with the Bank of Israel forecasting 3% for 2025 and 3.5% for 2026, which would bolster demand for Azrieli's diverse property portfolio. Conversely, a significant slowdown in economic growth, such as the estimated 2% for 2024, could lead to increased vacancy rates and downward pressure on rental income across their assets.

Real Estate Market Trends

The broader Israeli real estate market significantly influences Azrieli's performance, with continued growth in property prices reflecting strong demand. As of late 2024, housing prices across Israel continued an upward trend, beneficial for Azrieli's commercial and residential segments. However, a potential slowdown in new apartment sales, evidenced by a 15% decrease in transactions during Q4 2024 compared to the previous year, could signal a cooling market. This shift might impact future development project valuations and sales velocity.

- Israeli housing prices rose by an average of 1.2% in Q4 2024, continuing a multi-year growth trend.

- New apartment sales saw a notable decrease of 15% in transaction volumes during Q4 2024.

- Tel Aviv district commercial property values increased by approximately 3% in early 2025.

Foreign Investment and Currency Strength

The Israeli real estate market heavily relies on foreign investment inflows. A strong Israeli shekel, trading around 3.65 ILS to 1 USD in early 2025, significantly enhances the attractiveness of Israeli assets for international investors, while also reducing the cost of imported construction materials for developers like Azrieli Group. Conversely, a sustained weakening of the shekel or a notable decrease in foreign direct investment, which saw a dip in late 2023 but stabilized into 2024, could signal diminished investor confidence. Monitoring these economic indicators is crucial for assessing market stability.

- Shekel strength: Approximately 3.65 ILS/USD in early 2025, impacting import costs.

- Foreign investment: Continued focus on Israeli tech and real estate sectors.

- Market confidence: Directly tied to currency stability and capital inflows.

- Construction costs: Lowered by a stronger shekel, benefiting material imports.

Bank of Israel interest rates, potentially lowering to 3.75% by mid-2025, will reduce Azrieli's financing costs. Israeli inflation, projected at 3% for late 2024 and early 2025, is mitigated by over 90% CPI-linked leases. GDP growth forecasts of 3% for 2025 support demand for properties. A strong shekel at 3.65 ILS/USD in early 2025 aids foreign investment and lowers import costs for construction.

| Metric | 2024 | 2025 |

|---|---|---|

| BoI Interest Rate | 4.50% (early) | 3.75% (mid-proj) |

| Israel GDP Growth | 2% (est) | 3% (forecast) |

| ILS/USD Exchange | 3.65 (early) |

What You See Is What You Get

Azrieli PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Azrieli PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping Azrieli's strategic landscape. No placeholders, no teasers—this is the real, ready-to-use file you’ll get upon purchase.

Sociological factors

The rise of e-commerce presents a dual challenge and opportunity for Azrieli's shopping malls. While global online retail sales are projected to reach over $7 trillion by 2025, consumers are increasingly seeking unique physical experiences. Azrieli is adapting by transforming malls like Azrieli Sarona into lifestyle complexes, integrating dining and entertainment. This strategy aims to leverage the reported 10% increase in foot traffic seen in experience-driven retail spaces in 2024. The focus is on creating destinations that blend retail with social and experiential elements to attract and retain visitors.

The increasing adoption of remote and hybrid work models profoundly reshapes demand for commercial real estate. As of early 2025, approximately 50% of companies globally are implementing hybrid strategies, potentially reducing traditional office footprints by 15-20% in some markets. This shift creates strong demand for flexible, technologically advanced workspaces, with coworking and serviced office providers seeing growth. Azrieli must innovate by offering adaptable, amenity-rich solutions that support these evolving work patterns.

Israel's population experienced robust growth, reaching approximately 9.9 million in early 2024, with projections indicating over 10 million by 2025, driven by a high birth rate and consistent immigration. This demographic expansion fuels a fundamental demand for new housing, retail spaces, and essential services, providing a significant tailwind for Azrieli's diverse property portfolio. The company's strategic development of senior housing, like the Azrieli Palace projects, directly addresses the growing needs of Israel's aging population, which is projected to increase significantly by 2030. This dual focus on young families and seniors ensures sustained demand across Azrieli's residential and commercial offerings.

Urbanization and Lifestyle Preferences

The persistent trend of urbanization continues to fuel demand for prime properties in major Israeli city centers, especially Tel Aviv. As of early 2025, Tel Aviv's population density remains high, attracting young professionals who gravitate towards vibrant urban neighborhoods. This preference significantly boosts the rental market and ensures the robust success of centrally located malls and office spaces, like those developed by Azrieli. Azrieli's strategic focus on acquiring and developing properties in these highly sought-after urban hubs aligns perfectly with this ongoing societal shift, securing sustained demand.

- Tel Aviv's population density in 2024-2025 supports high demand for central properties.

- Over 70% of Israel's population is urbanized, driving this trend.

- Rental yields in prime Tel Aviv locations averaged 3.5-4.0% in Q4 2024.

- Azrieli's urban portfolio saw increased foot traffic and occupancy rates through early 2025.

Growing Social and Community Consciousness

There is a rising expectation for corporations like Azrieli to demonstrate social responsibility and actively contribute to their operating communities. Azrieli's proactive support for local communities, particularly in challenging periods, alongside its enhanced focus on accessibility, significantly strengthens its brand reputation and public trust, reflecting 2024 consumer preferences for ethical businesses. The company's partnerships with organizations to improve accessibility across its properties, coupled with a commitment to sourcing from local suppliers, exemplify this sociological shift. For instance, Azrieli invested over NIS 15 million in community initiatives and accessibility upgrades in 2023-2024.

- Azrieli's 2024 community investment reached NIS 10.5 million, directly supporting local programs.

- Accessibility projects across its malls saw a 20% increase in budget allocation in 2025.

- Over 75% of new operational contracts in 2024 prioritized local Israeli suppliers.

- Customer surveys in Q1 2025 showed 88% positive sentiment towards Azrieli's social initiatives.

Sociological shifts significantly impact Azrieli, as consumers increasingly seek experience-driven retail, with foot traffic in such spaces rising 10% in 2024. The shift to hybrid work, adopted by 50% of companies by early 2025, reshapes demand for flexible office solutions. Israel's population growth, reaching 9.9 million in early 2024, alongside urbanization trends and rising social responsibility expectations, further drives demand for diverse, community-focused properties.

| Sociological Trend | Impact on Azrieli | 2024/2025 Data |

|---|---|---|

| Experience Retail Demand | Adapt malls into lifestyle centers | 10% increase in experience retail foot traffic (2024) |

| Hybrid Work Models | Need for flexible office spaces | 50% companies hybrid by early 2025 |

| Population Growth/Urbanization | Increased demand for residential/commercial | Israel population 9.9M (early 2024) |

Technological factors

The exponential growth in data, cloud computing, and AI significantly fuels demand for advanced data centers, a core expansion area for Azrieli Group. Israel is rapidly emerging as a prominent data center hub, attracting major international cloud providers due to its strategic location and robust infrastructure. Azrieli is well-positioned to capitalize on this, actively developing and managing state-of-the-art data center facilities. Their focus includes specialized infrastructure with advanced cooling technologies crucial for handling intensive AI workloads, evidenced by their 2024 projected 100MW data center capacity across multiple sites.

The integration of PropTech and smart building solutions is now a core industry standard, with global smart building market projected to reach $120 billion by 2025. Azrieli is actively deploying advanced systems that enhance energy efficiency, targeting reductions of 15% in operational energy consumption across its portfolio by late 2024. These technologies also significantly improve tenant experience and security, leveraging AI-driven access control and predictive maintenance. Azrieli's ongoing commitment to achieving LEED certification for over 70% of its new developments by 2025 underscores its strategic focus on sustainable, tech-driven properties, crucial for maintaining a competitive edge in the evolving real estate market.

Technology is profoundly transforming the retail experience within shopping malls, making digital integration crucial. Azrieli Group is actively focused on embedding advanced digitalization and consumer-centric digital experiences into its physical properties. This strategy creates a seamless 'best of both worlds' approach, blending online and offline retail journeys. Initiatives include developing loyalty platforms like the Azrieli App, which reported over 1.6 million active users by early 2025, alongside implementing digital wayfinding and integrating online-to-offline shopping pathways across its properties. Such advancements enhance customer engagement and optimize mall operational efficiency.

Advanced Construction Technologies

Innovations in construction technology, including the use of sustainable materials and modular building methods, offer significant advantages for Azrieli. These advancements can enhance project efficiency and substantially reduce the environmental footprint of new developments, aligning with global sustainability targets for 2025. Adopting such technologies is crucial for managing escalating construction costs, which saw a 3-5% increase in Israel during 2024, and for achieving Azrieli's ambitious sustainability goals. Israel's robust climate tech sector is a key source for these pioneering solutions, offering partnerships that can drive innovation and operational savings.

- Modular construction can cut project timelines by 20-50%.

- Sustainable materials reduce embodied carbon by up to 30%.

- Construction tech adoption aims to mitigate 2024's 3-5% cost increases.

- Israel's climate tech sector attracted over $2.5 billion in funding by mid-2024.

Cybersecurity for Physical and Digital Assets

Cybersecurity remains a critical technological factor for Azrieli, especially given its extensive digital infrastructure and data centers. Protecting physical and digital assets against increasingly sophisticated threats demands fortified designs for data centers and robust security measures. Continuous investment in advanced security technologies and protocols is essential to mitigate risks, with global cybersecurity spending projected to exceed $220 billion in 2024. This proactive approach safeguards sensitive data and ensures operational resilience.

- Global cybersecurity spending reached approximately $215 billion in 2023, with projections for 2024 indicating further growth.

- Data breach costs averaged $4.45 million globally in 2023, emphasizing the financial impact of security failures.

- The prevalence of ransomware attacks increased by 77% in 2023, posing a significant threat to corporate data.

- Companies are allocating an average of 10-15% of their IT budget to cybersecurity in 2024.

Azrieli Group actively leverages technology, expanding its data center capacity to 100MW by 2024 to meet AI-driven demand. The integration of PropTech and smart building solutions aims for 15% energy reduction by late 2024 and enhances tenant experience, with 70% of new developments targeting LEED certification by 2025. Digitalization, including the Azrieli App with over 1.6 million users by early 2025, transforms retail, while construction tech mitigates 2024's 3-5% cost increases. Robust cybersecurity investments, amidst global spending exceeding $220 billion in 2024, protect its extensive digital infrastructure and ensure operational resilience.

| Technological Area | Key Metric (2024/2025) | Impact for Azrieli |

|---|---|---|

| Data Centers & AI | 100MW capacity by 2024 | Capitalizes on growing demand; positions Israel as a hub. |

| PropTech & Smart Buildings | 15% energy reduction target (late 2024) | Enhances efficiency, tenant experience; supports LEED goals. |

| Digital Retail Experience | 1.6M+ Azrieli App users (early 2025) | Boosts customer engagement and mall operational efficiency. |

| Construction Technology | Mitigates 3-5% cost increases (2024) | Improves project efficiency; supports sustainability goals. |

| Cybersecurity Investment | Global spending > $220B (2024) | Safeguards digital assets; ensures operational resilience. |

Legal factors

Israel is updating its privacy laws to align more closely with international standards like the GDPR, with new amendments taking effect in August 2025. As a major operator of data centers and a collector of consumer data through its malls, Azrieli must ensure strict compliance. These evolving regulations include new definitions for personal data and expanded powers for the Privacy Protection Authority. Non-compliance could result in significant financial penalties, impacting Azrieli's operational costs and reputation.

The Israeli real estate sector operates under a stringent regulatory framework governing land use and zoning, which directly impacts Azrieli Group's extensive development projects. Navigating the multi-layered approval process, including zoning verification and environmental impact assessments, is crucial for timely project execution. For instance, the National Planning and Building Law of 1965, with its continuous amendments through 2024, dictates these procedures. Potential changes to these laws or bureaucratic delays, such as those that might extend permit approvals by several months beyond 2025 projections, can significantly increase project timelines and associated costs.

Changes in property and corporate tax legislation directly influence Azrieli's financial performance and investment strategies. The anticipated increase in VAT on new property transactions and adjustments to capital gains tax, projected for early 2025, will likely elevate acquisition costs and impact overall project profitability. For instance, a VAT hike from the current 17% could significantly affect large-scale developments. Conversely, government-led tax incentives, such as those for urban renewal initiatives like TAMA 38 or benefits for new immigrants, present specific market opportunities for Azrieli to leverage in its portfolio expansion. These incentives can reduce tax burdens on qualifying projects, enhancing their viability.

Environmental Regulations

New environmental regulations, such as the mandatory Israeli Green Building Standard IS-5281, are tightening requirements for construction and property management, increasing project costs. Despite this, these regulations drive demand for sustainable properties, a segment where Azrieli is active through its commitment to LEED certification for its portfolio, including new developments projected for 2025. The Ministry of Environmental Protection actively monitors public company performance, influencing investment decisions.

- IS-5281: Mandatory Green Building Standard effective 2024/2025.

- Increased construction costs for compliance.

- Azrieli targets LEED certification for new projects.

- Ministry of Environmental Protection actively monitors.

Corporate Governance and Reporting Standards

As a publicly traded entity, Azrieli Group is subject to stringent corporate governance and financial reporting regulations, particularly under Israeli Securities Authority (ISA) guidelines effective through 2025. This includes evolving requirements for enhanced transparency in Environmental, Social, and Governance (ESG) reporting, which is a growing focus for institutional investors globally. The company's consistent adherence to these legal standards is vital for maintaining robust investor confidence and safeguarding its corporate reputation within the market.

- ISA regulations mandate quarterly financial disclosures and annual general meetings for investor oversight.

- ESG reporting frameworks, such as TCFD or GRI, are increasingly adopted to meet investor demands for sustainability data.

- Compliance with Sarbanes-Oxley-like internal control requirements strengthens financial integrity.

Contractual obligations and commercial litigation risks are critical for Azrieli, especially with its extensive supplier and tenant agreements. Enforcement of these contracts, under Israeli Commercial Law, directly impacts project timelines and operational stability. Recent court rulings in 2024 emphasize stricter adherence to contract terms, increasing the importance of robust legal due diligence. This legal landscape necessitates careful agreement structuring to mitigate potential disputes and financial liabilities.

| Legal Factor | 2024/2025 Impact | Relevance to Azrieli |

|---|---|---|

| Contract Enforcement | Stricter court rulings | Supplier/tenant agreements, project stability |

| Consumer Protection | Enhanced online retail oversight | Mall operations, data collection practices |

| Antitrust Regulations | Increased market scrutiny | Mergers/acquisitions, market dominance |

Environmental factors

Azrieli Group actively prioritizes sustainability, aiming for all its properties to achieve LEED certification for both construction and operation. This commitment significantly reduces the environmental footprint, aligning with the growing market demand for green commercial spaces. As of early 2024, the company's focus on sustainable building enhances property valuations, attracting environmentally conscious tenants willing to pay a premium. For instance, LEED-certified buildings can command higher rents, potentially increasing property value by 7% or more in competitive markets, reflecting a strong strategic advantage.

Israel is intensely pushing for improved energy efficiency in buildings and a significant shift toward renewable energy sources. For Azrieli, this translates into substantial investments in energy-efficient systems across its expansive portfolio of malls, offices, and especially its power-intensive data centers. For instance, Azrieli's new data centers are designed to leverage smart grid technology, aligning with national goals to achieve 30% of electricity from renewables by 2030. This strategic focus ensures operational cost savings and bolsters their environmental, social, and governance profile, crucial as energy costs continue to fluctuate.

Azrieli Group aims to significantly reduce waste sent to landfills from its properties by 2025, a key environmental objective. This is achieved through enhanced source separation and boosting recycling rates across its portfolio, aligning with broader sustainability trends. For example, some Azrieli properties have already achieved over 70% waste diversion from landfills as of late 2024. This proactive waste management not only yields substantial environmental benefits but also contributes to operational cost savings and reinforces principles of the circular economy.

Climate Change Adaptation and Risks

Azrieli, holding significant coastal real estate assets, faces direct physical risks from climate change, including coastal erosion.

This necessitates proactive adaptation, aligning with the OECD's 2024 recommendation for Israel to integrate climate-risk mapping into national adaptation plans.

By 2025, Azrieli's focus on enhancing property resilience is crucial for safeguarding long-term asset value and operational stability.

- Israel's coastline spans approximately 270 kilometers, exposing many properties to erosion.

- The Israeli government's 2024 budget allocates increased funds for climate resilience infrastructure.

- Projected sea-level rise in the Mediterranean could impact coastal property values by 2050.

Water Management

Given Israel's semi-arid climate, water conservation remains a critical environmental consideration. Azrieli Group actively addresses this through its operations, notably with its holdings in water desalination and wastewater purification via its subsidiary, Azrieli Energy. The company focuses on efficient water management across its extensive property portfolio, demonstrating a commitment to environmental responsibility. For instance, Azrieli's 2023-2024 ESG Report highlights ongoing efforts to reduce water consumption in its commercial centers and office buildings.

- Azrieli Energy, a subsidiary, is active in water desalination and wastewater purification.

- Israel's annual renewable water resources are significantly limited, making conservation vital.

- Azrieli Group's 2023 water consumption across its managed properties was a key focus for efficiency improvements.

- The company integrates water-saving technologies in new developments and existing assets.

Azrieli Group actively integrates environmental sustainability, aiming for LEED certification across properties and reducing waste to landfills by 2025, with some achieving over 70% waste diversion by late 2024. The company invests heavily in energy efficiency and water conservation through Azrieli Energy, aligning with Israel's 2030 goal for 30% renewable electricity. Proactive climate risk adaptation, particularly for coastal assets, and enhancing property resilience by 2025 are crucial for safeguarding long-term asset value. These efforts reduce operational costs and enhance property valuations, as LEED-certified buildings can command higher rents.

| Environmental Factor | Azrieli Group Action (2024-2025) | Impact/Data |

|---|---|---|

| Green Building Certification | Prioritizing LEED certification for construction and operation. | LEED-certified buildings can increase property value by 7%+. |

| Energy & Renewables | Investing in energy-efficient systems; leveraging smart grid for data centers. | Aligns with Israel's 30% renewable electricity goal by 2030. |

| Waste Management | Enhanced source separation and increased recycling rates. | Some properties achieved over 70% waste diversion from landfills by late 2024. |

| Climate Risk Adaptation | Focus on property resilience for coastal assets. | Critical for safeguarding long-term asset value by 2025, given Israel's 270km coastline. |

| Water Conservation | Efficient water management; Azrieli Energy active in desalination. | Addresses Israel's limited renewable water resources, noted in 2023-2024 ESG reports. |

PESTLE Analysis Data Sources

Our Azrieli PESTLE Analysis is built on a comprehensive foundation of data from reputable sources, including government publications, international organizations, and leading industry research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are accurate and current.