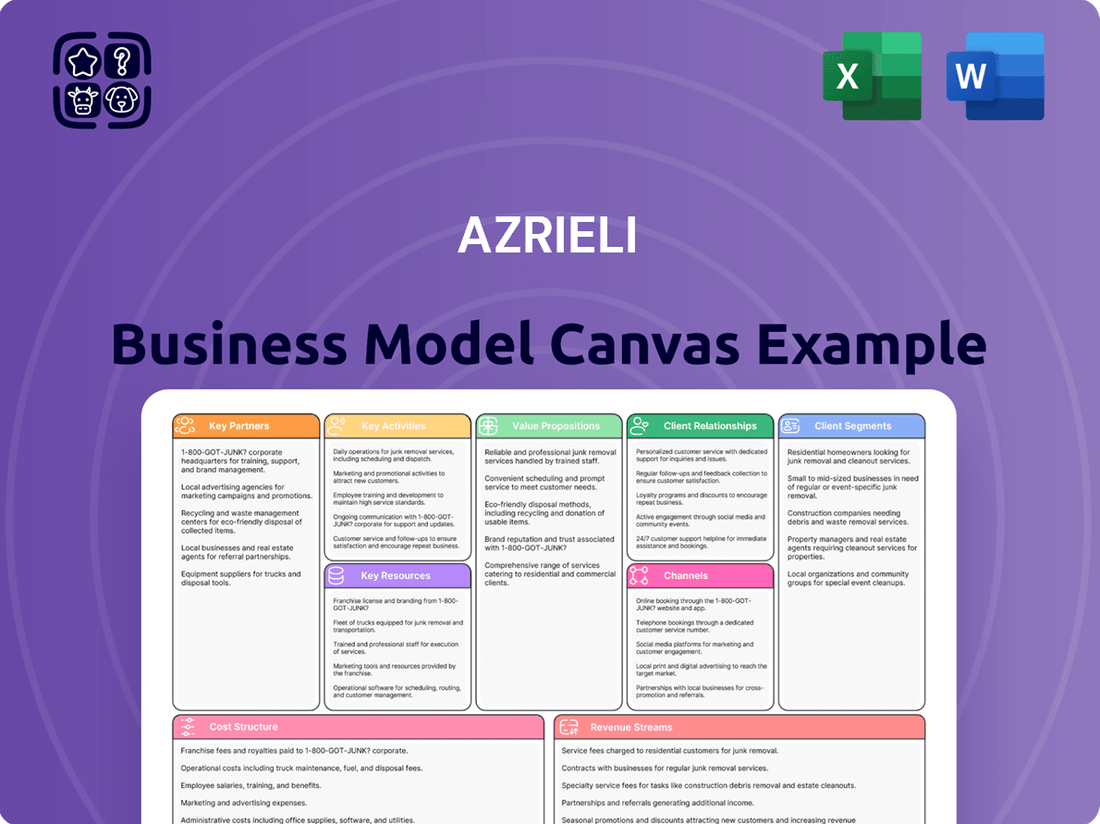

Azrieli Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Azrieli Bundle

Unlock the strategic blueprint behind Azrieli's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how Azrieli effectively delivers value, manages key resources, and builds strong customer relationships. It's an invaluable tool for anyone looking to understand the mechanics of a thriving business.

Dive deeper into Azrieli's operational framework with the full Business Model Canvas. This professionally crafted document breaks down their customer segments, value propositions, revenue streams, and cost structures, offering clear, actionable insights for strategic planning.

See exactly how Azrieli structures its business for growth and profitability. Our detailed canvas illuminates their key partnerships, activities, and channels, providing a clear roadmap for understanding their competitive advantage.

Want to benchmark your own business against a leader? The complete Azrieli Business Model Canvas is your key to uncovering their proven strategies and identifying opportunities for innovation.

Transform your understanding of corporate strategy. Download the full Azrieli Business Model Canvas to gain a clear, section-by-section view of their business model, perfect for analysis and inspiration.

Partnerships

Construction and engineering firms are fundamental for Azrieli Group's new property development and large-scale renovations. Azrieli relies on their expertise for project execution, ensuring quality control, and adhering to strict timelines and budgets. For example, Azrieli's 2024 development pipeline includes significant projects like Azrieli Town, with planned investments in construction totaling hundreds of millions of NIS. Strong relationships with top-tier firms ensure access to the best talent and technology for efficient project delivery.

Given the capital-intensive nature of real estate development, Azrieli Group critically relies on partnerships with major banks and investment funds. These financial institutions provide essential debt and equity financing for strategic acquisitions, new construction projects, and refinancing existing obligations. For instance, in 2024, such relationships continue to be vital for securing capital, ensuring liquidity, and supporting the group's ambitious growth strategy across its diverse portfolio.

Collaborating with national and local government bodies is crucial for Azrieli, ensuring the smooth acquisition of essential zoning approvals and building permits for their diverse projects across Israel. These partnerships are vital for securing infrastructure support, such as the new light rail connections planned near Azrieli's Tel Aviv properties, enhancing accessibility and project viability. By fostering strong relationships, Azrieli can expedite regulatory processes, a significant advantage given that municipal permit processing times in Israel can vary widely, impacting project timelines in 2024. This close cooperation mitigates regulatory risks and ensures developments align with national urban planning goals, supporting large-scale urban renewal initiatives.

Major Corporate & Anchor Tenants

Azrieli Group’s predictable cash flow relies heavily on long-term partnerships with major corporate tenants in its office towers and anchor retailers in its shopping malls. These leading multinational and domestic companies, such as high-tech firms occupying Azrieli Sarona Tower, provide a robust, secure income base. For instance, in 2024, their high occupancy rates, often exceeding 95% across prime office assets, underscore their stability. These strategic relationships also act as magnets, attracting smaller tenants to their properties, enhancing overall value.

- Major corporate tenants ensure stable rental income.

- Anchor retailers drive foot traffic to shopping centers.

- High occupancy rates reflect tenant commitment.

- These partnerships attract diverse smaller businesses.

Technology & Data Center Providers

Azrieli Data Centers, a key segment, strategically partners with global technology leaders, major power utilities like Israel Electric Corporation, and leading connectivity providers. These collaborations are crucial for developing and operating state-of-the-art data facilities that meet the stringent demands of hyperscale and enterprise clients. For instance, ensuring redundant power and cooling systems is paramount, with Azrieli Data Centers reportedly having a total IT load capacity exceeding 100 MW by early 2024. High-speed fiber optic networks are also vital, facilitated through partnerships with major telecom companies.

- Partnerships with global tech vendors ensure cutting-edge hardware and software.

- Collaborations with power utilities guarantee stable and redundant electricity supply.

- Agreements with connectivity providers deliver high-speed fiber optic networks.

- These alliances support Azrieli Data Centers' capacity exceeding 100 MW by 2024.

Azrieli Group's strategic partnerships are fundamental for its robust growth across real estate and data centers. Collaborations with construction firms, financial institutions, and government bodies ensure seamless development and regulatory compliance for projects like Azrieli Town. Key tenants provide stable income with high occupancy rates, while tech partners enable state-of-the-art data centers, supporting over 100 MW IT load by 2024.

| Partner Type | Key Benefit | 2024 Impact |

|---|---|---|

| Construction Firms | Project Execution | Hundreds of millions NIS investments |

| Corporate Tenants | Stable Income | Over 95% office occupancy |

| Tech/Utility Providers | Data Center Infrastructure | Over 100 MW IT load capacity |

What is included in the product

A strategic framework detailing Azrieli Group's operational blueprint, encompassing all nine essential business model components with in-depth analysis.

This canvas provides a clear, visual representation of Azrieli's value creation, delivery, and capture mechanisms, serving as a vital tool for strategic planning and stakeholder communication.

The Azrieli Business Model Canvas acts as a pain point reliver by offering a structured framework to visualize and address complex business challenges.

It simplifies the process of identifying and resolving operational bottlenecks and strategic misalignments.

Activities

Property development and construction stand as core activities for Azrieli, encompassing the full asset lifecycle from land acquisition and meticulous planning through to managing construction and final delivery. Azrieli's significant expertise in large-scale development enables the creation of iconic assets like office towers, shopping malls, and data centers. This activity is a primary driver of portfolio growth and value creation, with the company progressing on major projects in 2024, such as the Azrieli Town project in Tel Aviv. Their focus on strategic, high-value developments consistently expands their real estate footprint.

Asset and property management for Azrieli involves the meticulous day-to-day operation of its extensive portfolio, aiming to maximize performance and intrinsic value. Key activities encompass proactive maintenance, advanced facility management, and robust security measures, ensuring a high-quality environment for all tenants. This operational excellence directly contributes to enhanced tenant retention, with Azrieli's high occupancy rates reflecting this focus. Efficient management sustains the premium status of assets, driving stable income streams and long-term appreciation in the Israeli real estate market throughout 2024.

Leasing and marketing are central to Azrieli's operations, focusing on attracting and retaining tenants across its retail, office, and data center properties. This involves targeted campaigns and direct outreach to secure high occupancy rates, like the office sector's approximately 98% occupancy in Q1 2024. Negotiations ensure optimal rental income, contributing significantly to Azrieli's NOI, which stood at NIS 1.83 billion in 2023. Leasing teams meticulously curate a balanced tenant mix for each property, enhancing long-term value and visitor engagement.

Capital Allocation & Strategic Investment

Azrieli Group actively manages its capital, making strategic decisions on acquisitions and divestitures to shape its portfolio. This includes rigorous financial analysis for opportunities aligning with long-term growth and diversification, notably into energy and logistics. For instance, in 2024, the group continued to assess major infrastructure projects, aiming to enhance future profitability.

- Ongoing evaluations of new sector investments.

- Strategic divestments to optimize asset allocation.

- Rigorous financial due diligence for all major transactions.

- Focus on projects enhancing long-term value in 2024.

Financial Management & Reporting

Financial management for Azrieli Group involves meticulous oversight of the balance sheet and cash flow, ensuring liquidity and sustainable growth. Securing diverse financing, like the NIS 1 billion bond issuance in 2024, is crucial for funding new projects and managing existing debt. Transparent and timely financial reporting to shareholders and regulators, such as their 2024 Q1 results, reinforces investor confidence. Prudent management is vital for maintaining a strong credit rating, such as their AA+ rating from S&P Maalot.

- Managing the company balance sheet and cash flow for optimal liquidity.

- Securing diverse financing, exemplified by 2024 bond issuances.

- Providing transparent and timely financial reporting to stakeholders.

- Maintaining a strong credit rating, like Azrieli's AA+ from S&P Maalot.

Azrieli's key activities span property development, building iconic assets like Azrieli Town, and meticulous asset management ensuring high occupancy, such as ~98% for offices in Q1 2024. Strategic leasing and marketing drive robust rental income, contributing to a strong NOI. Capital and financial management, including a NIS 1 billion bond issuance in 2024, optimize the portfolio and maintain a stable AA+ S&P Maalot rating.

| Key Activity | 2024 Focus | Impact |

|---|---|---|

| Property Development | Azrieli Town project | Portfolio growth, value creation |

| Asset Management | High occupancy rates | Stable income, tenant retention |

| Financial Management | NIS 1B bond issuance | Funding, liquidity, credit rating |

Full Document Unlocks After Purchase

Business Model Canvas

The Azrieli Business Model Canvas preview you're seeing is the exact document you will receive upon purchase. This isn't a mockup or a sample; it's a direct representation of the complete, ready-to-use file. You'll gain immediate access to this professionally structured and formatted Business Model Canvas, ensuring no surprises and full utility.

Resources

Azrieli Group’s most significant resource is its extensive portfolio of high-quality, income-producing properties, including iconic malls and office buildings in prime locations across Israel. The value of this portfolio is driven by its strategic location, premium quality, and consistently high occupancy rates, which stood at approximately 97% for its income-producing properties as of Q1 2024. This robust physical asset base, valued at over NIS 50 billion in 2024, forms the foundation of the company's substantial revenue streams and solidifies its market leadership in commercial real estate.

A robust financial position, underscored by Azrieli Group’s strong credit rating, for example, an A+ from S&P Maalot as of early 2024, is crucial. This financial strength, coupled with established relationships in capital markets, allows Azrieli to fund large-scale development projects, such as their ongoing expansion of data centers. Their solid balance sheet, with over NIS 23 billion in equity reported in Q1 2024, provides a significant competitive advantage. This enables the company to make strategic acquisitions when opportunities arise and maintains resilience through various economic cycles.

Azrieli Group holds a significant strategic land bank, primarily in prime locations across Israel, which is crucial for its sustained growth. This extensive inventory, a core asset, provides a robust pipeline of future development projects, ensuring long-term expansion. As of 2024, this land bank allows Azrieli to strategically control its development timeline and respond effectively to evolving market demands. This resource underpins the company's ability to consistently deliver new commercial and residential properties.

Management Expertise & Human Capital

Azrieli Group's core strength lies in its exceptional management expertise and human capital. The company's seasoned leadership team, coupled with highly skilled professionals across development, finance, leasing, and asset management, are invaluable resources. This human capital ensures strategic decision-making and drives innovation, navigating the complex Israeli real estate market effectively. Their deep industry knowledge is critical for Azrieli's continued expansion and operational excellence, evident in their 2024 project pipeline.

- Experienced leadership guides Azrieli's strategic direction.

- Skilled teams manage a diverse portfolio of over 1.4 million sqm.

- Human capital drives innovation in real estate development.

- Expertise is crucial for Azrieli's 2024 growth initiatives.

Brand Reputation & Market Leadership

The Azrieli brand is undeniably synonymous with quality, reliability, and landmark properties across Israel, making it a critical resource. This robust brand reputation is pivotal, attracting premium tenants like international corporations and fostering valuable partnerships. Its market leadership, reflected in a substantial portfolio, instills strong confidence among investors and financial institutions. For instance, Azrieli Group reported a net operating income (NOI) of approximately NIS 2.7 billion for 2023, underscoring its operational strength.

- Azrieli's brand equity enhances tenant acquisition and retention.

- Market leadership provides significant competitive barriers to entry.

- Investor confidence is bolstered by a proven track record.

- The group's 2023 NOI was approximately NIS 2.7 billion.

Azrieli's key resources include its extensive portfolio of prime income-producing properties, valued at over NIS 50 billion in 2024, with Q1 2024 occupancy near 97%. A robust financial position, marked by an A+ S&P Maalot rating and NIS 23 billion in Q1 2024 equity, supports strategic growth and land bank development. Expert human capital and a strong brand reputation further solidify its market leadership and tenant relationships.

| Resource | 2024 Data Point | Impact |

|---|---|---|

| Property Portfolio Value | >NIS 50 Billion | Generates core revenue |

| Q1 2024 Occupancy | ~97% | Ensures stable income |

| Q1 2024 Equity | NIS 23 Billion | Funds expansion and stability |

Value Propositions

Azrieli Group provides retail tenants prime spaces within dominant, high-traffic shopping malls, strategically located in Israel's top urban centers. This ensures direct access to a vast and diverse consumer base, significantly boosting sales and brand visibility for retailers. For example, Azrieli Malls reported robust footfall in 2024, demonstrating consistent consumer engagement. These premier shopping destinations are meticulously managed, attracting millions of visitors annually, enhancing tenant performance.

Azrieli offers state-of-the-art, secure commercial spaces, a key value proposition for corporate and data center clients. Their office buildings provide modern amenities in central business districts, with occupancy rates remaining strong in 2024, reflecting demand for premium locations. Data centers deliver robust power, cooling, and connectivity, crucial for mission-critical operations, exemplified by their high-tier certifications. This comprehensive infrastructure ensures business continuity and peak operational efficiency for tenants.

For investors, Azrieli Group offers a stable, diversified real estate investment through its publicly-traded security. This provides exposure to a high-quality portfolio of income-producing assets across various segments. The company maintains a strong track record of consistent cash flows, with its 2023 financial results reflecting robust operational performance that continued into 2024. Investors benefit from reliable dividend payments and the potential for long-term capital appreciation, blending income stability with growth prospects in the real estate market. Azrieli Group reported a net operating income of approximately NIS 3.2 billion in 2023, showcasing its stable income generation.

Integrated 'Live-Work-Play' Environments

Azrieli excels in developing large-scale, mixed-use environments that seamlessly integrate office, retail, and sometimes residential or hotel components. This approach cultivates vibrant, self-contained destinations highly appealing to tenants and the broader public. By fostering a holistic live-work-play ecosystem, Azrieli significantly enhances the long-term value and attractiveness of its properties. As of early 2024, Azrieli Group reported a substantial portfolio of income-producing properties, with a significant portion dedicated to these integrated complexes.

- Azrieli's income-producing properties stood at approximately NIS 41.6 billion as of December 31, 2023, reflecting strong asset value in their integrated model.

- The company's office portfolio, a core component of these mixed-use sites, maintained high occupancy rates, around 98% in 2024.

- Retail centers, like the Azrieli Sarona Tower, exemplify this integration, drawing high foot traffic and diverse tenants.

- This strategy drives consistent rental income and capital appreciation across their diverse property segments.

Professional Management & Partnership

Azrieli provides professional property management, ensuring reliability and operational excellence for all tenants. The company positions itself as a long-term partner, supporting tenant success through high-quality service. This commitment significantly enhances tenant satisfaction and retention, contributing to stable occupancy rates. For instance, Azrieli Group reported an average occupancy rate of approximately 98% across its income-producing properties in 2024, reflecting strong tenant relationships.

- High operational excellence maintains property value.

- Partnership approach fosters long-term tenant loyalty.

- Tenant satisfaction drives high retention rates.

- Stable occupancy contributes to consistent revenue streams.

Azrieli Group offers premier retail spaces ensuring high footfall and sales, alongside state-of-the-art commercial and data center facilities with robust infrastructure. For investors, it provides stable, diversified real estate exposure with consistent cash flows and dividend potential. Their integrated mixed-use developments create vibrant ecosystems, while professional property management ensures high tenant satisfaction and retention across their portfolio.

| Value Proposition | Key Metric | 2024 Data |

|---|---|---|

| Retail & Commercial Spaces | Average Occupancy Rate | Approx. 98% |

| Investor Returns | 2023 Net Operating Income | NIS 3.2 Billion |

| Portfolio Value | Income-Producing Properties (2023) | NIS 41.6 Billion |

Customer Relationships

The primary customer relationship for Azrieli with its office and retail tenants is built upon long-term lease agreements, often extending for multiple years. This strategic approach ensures highly stable and predictable partnerships, generating recurring revenue streams critical for financial planning. For instance, Azrieli's office and retail segments maintained strong occupancy rates exceeding 95% in 2024, reflecting the stability of these agreements. The formal management of these relationships is handled by dedicated leasing and property management teams, ensuring consistent tenant satisfaction and operational efficiency.

For its major corporate and data center clients, Azrieli provides dedicated account managers who act as a singular point of contact, fostering deeper, collaborative relationships. This high-touch approach ensures tailored solutions and responsive service, which is crucial for retaining high-value tenants within their extensive portfolio. As of early 2024, Azrieli Group’s income-producing property portfolio reached approximately NIS 41.5 billion, highlighting the significance of these key client relationships for sustained revenue. This strategy enhances client satisfaction and secures long-term occupancy agreements.

Azrieli maintains an active, transparent relationship with its shareholders and the financial community through a dedicated investor relations department. This department provides regular financial reports, presentations, and conference calls, ensuring clear communication. For example, in Q1 2024, Azrieli Group reported a Net Operating Income (NOI) from income-producing properties of approximately NIS 902 million, reflecting robust performance shared directly with investors. The goal is to build trust and provide clear insight into the company's strategy and performance, fostering informed investment decisions.

On-Site Property Management

On-site property management teams are crucial for Azrieli's customer relationships, directly managing day-to-day tenant interactions. These teams handle maintenance requests and ensure operational smoothness, maintaining high property quality standards across their portfolio. This direct engagement is vital for tenant satisfaction, reflecting Azrieli's commitment to service excellence. For instance, maintaining a high occupancy rate, such as Azrieli's reported 97.4% for income-producing properties in 2024, relies heavily on strong tenant relationships fostered by on-site teams.

- Directly manages tenant communications and service requests.

- Ensures timely resolution of maintenance issues to minimize disruption.

- Upholds property quality, which is key to tenant retention.

- Contributes to high tenant satisfaction and strong occupancy rates.

Tenant Support & Co-Marketing Initiatives

Azrieli fosters strong tenant relationships through comprehensive support and co-marketing initiatives, crucial for mutual success. This includes orchestrating mall-wide advertising campaigns and vibrant seasonal events, such as the 2024 holiday promotions that saw increased foot traffic across their retail centers. Digital promotions further amplify reach, ensuring tenants benefit from heightened visibility and customer engagement.

- Azrieli's 2024 marketing budget allocation for tenant support programs emphasizes digital outreach.

- Collaborative campaigns aim to boost tenant sales, with some reporting double-digit growth in specific periods.

- Tenant satisfaction surveys in late 2023 indicated high appreciation for co-marketing efforts.

- Foot traffic data for Q1 2024 showed positive trends in key Azrieli malls, partly due to these partnerships.

Azrieli builds strong tenant relationships through long-term leases and dedicated account management, ensuring high retention and stable revenue streams. Their 2024 occupancy rates exceeded 95% across office and retail. Proactive property management and co-marketing initiatives, like 2024 digital outreach, foster satisfaction and boost tenant visibility. This approach yielded a Q1 2024 NOI of NIS 902 million.

| Metric | 2024 Data | Impact |

|---|---|---|

| Occupancy Rate | >95% (Office/Retail) | Stable Revenue |

| NOI (Q1 2024) | NIS 902 Million | Robust Performance |

| Property Portfolio | NIS 41.5 Billion | High Value Clients |

Channels

Azrieli's primary channel for reaching potential tenants is its own experienced, in-house leasing teams. These dedicated teams possess deep market knowledge and directly handle negotiations for office, retail, and data center spaces across their portfolio. This direct approach allows Azrieli greater control over the leasing process and tenant mix, ensuring strategic alignment. For instance, in Q1 2024, their office segment maintained a high occupancy rate, driven by these direct engagements. This self-reliance optimizes tenant relationships and operational efficiency.

Azrieli Group significantly broadens its market reach by leveraging robust partnerships with external commercial real estate brokerage firms. These specialized brokers are crucial in connecting Azrieli with a diverse pool of potential domestic and international tenants, expanding beyond direct marketing efforts. This channel is particularly vital for attracting clients who prefer or require third-party representation in their property searches. For instance, in 2024, such networks continued to contribute significantly to Azrieli's high occupancy rates, which stood at approximately 96% across its income-producing properties, showcasing the channel's effectiveness in tenant acquisition.

The Azrieli Group's corporate website serves as a primary information hub and marketing channel, showcasing its extensive property portfolio, which included over 2.4 million square meters of income-producing properties by late 2024. It provides comprehensive investor relations information and virtual tours of available spaces. Digital marketing efforts on professional platforms are crucial for targeting specific customer segments like commercial tenants and potential investors. This integrated digital approach supports tenant acquisition and investor engagement, contributing to the group's robust financial standing.

Tel Aviv Stock Exchange (TASE)

The Tel Aviv Stock Exchange (TASE) is Azrieli Group's primary channel for engaging public and institutional investors, providing the essential platform for trading the company's shares. This ensures vital liquidity and access to capital for the company, supporting its growth initiatives. All official financial disclosures, including 2024 quarterly reports, are released through TASE's MAGNA system, ensuring transparency and broad dissemination to the market.

- Azrieli Group (TASE: AZRG) had a market capitalization of approximately NIS 30 billion as of mid-2024.

- TASE recorded an average daily trading volume of approximately NIS 1.8 billion across all securities in Q1 2024.

- The TASE serves over 600 listed companies, including major real estate firms like Azrieli.

- Digital disclosure via the MAGNA system ensures instantaneous access for investors to Azrieli's 2024 financial statements.

Industry Conferences & Public Relations

Azrieli actively participates in leading real estate, technology, and investment conferences, such as MIPIM or local Israeli tech summits, to foster crucial networking with potential tenants, strategic partners, and investors. A proactive public relations strategy, often highlighted by major project milestones like the ongoing development of the Azrieli Spiral Tower in Tel Aviv, reinforces its brand and prominent market presence. This concerted effort significantly builds visibility and enhances credibility within the competitive industry, supporting their market leadership in commercial and office properties. In 2024, Azrieli continues to leverage these channels to showcase its robust portfolio and innovation.

- Azrieli Group's 2023 net operating income (NOI) from investment properties reached approximately NIS 2.1 billion, reflecting the success of their strategic market positioning.

- The company's focus on high-tech tenants in its office spaces, like the Azrieli Sarona Tower, aligns with participation in tech-focused industry events.

- Major project announcements, such as the progress on the Azrieli Spiral Tower expected to be completed by 2026, are central to their public relations campaigns.

- Azrieli's extensive property portfolio, including 19 shopping malls and numerous office buildings across Israel, provides a strong foundation for consistent media coverage and conference engagement.

Azrieli Group utilizes diverse channels, including in-house leasing teams and external brokers, which contributed to its approximately 96% occupancy across properties in 2024. Its corporate website and digital marketing showcase a portfolio exceeding 2.4 million square meters by late 2024. The Tel Aviv Stock Exchange (TASE) provides capital access, with a mid-2024 market cap of NIS 30 billion. Industry conferences and public relations further enhance its market presence and tenant engagement.

| Channel | 2024 Data Point | Impact |

|---|---|---|

| In-house Leasing | High Q1 2024 office occupancy | Direct control, tenant retention |

| External Brokers | ~96% overall occupancy (2024) | Broadened market reach |

| Corporate Website | >2.4M sqm portfolio (late 2024) | Information hub, digital marketing |

| TASE | ~NIS 30B market cap (mid-2024) | Capital access, investor engagement |

| Conferences/PR | Ongoing Spiral Tower development | Brand visibility, networking |

Customer Segments

Retail and commercial tenants form a core customer segment for Azrieli, encompassing a wide array of businesses that lease space within their extensive shopping mall portfolio. This diverse group includes prominent international and national fashion brands, a variety of food and beverage outlets, entertainment venues, and essential service providers. These tenants primarily seek high-traffic, strategically located properties to maximize their customer reach and sales potential. Azrieli’s retail segment reported strong performance, with its malls maintaining high occupancy rates, reaching approximately 97% as of early 2024, demonstrating their appeal to businesses aiming for significant customer engagement and robust commercial activity.

This key customer segment encompasses companies leasing premium office space within Azrieli's diverse portfolio of commercial buildings across Israel. Major clients include leading technology firms, prominent financial services companies, reputable law firms, and various multinational corporations seeking modern, well-located facilities. These tenants prioritize high-spec office environments, with Azrieli maintaining a strong 97% occupancy rate in its office properties as of Q1 2024. They require advanced infrastructure and amenities to support their operations and attract top talent in a competitive market.

Data Center Clients represent a crucial growth segment for Azrieli, encompassing hyperscale cloud providers, large enterprises, and technology companies. These customers demand secure, scalable, and highly-connected data center capacity, with stringent requirements for power, cooling, and security. In 2024, Azrieli's Green Mountain data center division continued to expand, reflecting the strong market demand. These engagements typically involve long-term contracts, providing stable revenue streams.

Public & Institutional Investors

Public and institutional investors represent a crucial customer segment for Azrieli Group, comprising individuals and entities that acquire shares in the company. This group includes major players like pension funds, mutual funds, insurance companies, and private investors. Their primary motivation is to secure stable, long-term returns from a leading blue-chip real estate company, often seeking dividend income and capital appreciation. Interactions primarily occur through stock market transactions and direct investor relations activities, such as quarterly earnings calls for 2024 financial results. Azrieli Group reported a 2024 net operating income (NOI) of NIS 2.05 billion for its income-producing properties, demonstrating its strong operational performance for these investors.

- Pension funds and mutual funds held significant stakes in Azrieli Group's equity in 2024.

- Private investors seek Azrieli's stable dividend yield, which was approximately 3.5% in early 2024.

- Institutional holdings accounted for over 70% of Azrieli Group shares in 2024.

- Investor relations actively engaged shareholders following the release of Azrieli's Q1 2024 financial results, highlighting strong occupancy rates.

Shoppers & General Public

The millions of people who visit Azrieli's shopping malls are a pivotal customer segment, even though they are not direct financial customers. Their consistent presence and spending are what make the mall spaces incredibly valuable to retail tenants, driving tenant demand and rental income for Azrieli. Azrieli actively markets to this segment to ensure high footfall, aiming to create vibrant community hubs that attract diverse visitors and support tenant success. For instance, Azrieli Group's malls collectively reported millions of visitors across Israel in 2023, a trend continuing into 2024.

- Tenant Value: Shoppers' presence directly increases the appeal and value of retail spaces for tenants.

- Footfall Focus: Azrieli invests in marketing to attract visitors and maintain high traffic.

- Community Hubs: Malls are designed to be vibrant centers, drawing diverse crowds.

- Revenue Driver: Shopper activity underpins rental income for Azrieli’s commercial properties.

Azrieli caters to key customer segments including retail and office tenants, with 97% occupancy in 2024, seeking prime locations. Data center clients, a growth area in 2024, demand secure, scalable capacity. Public and institutional investors, holding over 70% of shares, target stable returns, supported by Azrieli’s NIS 2.05 billion 2024 NOI and a 3.5% dividend yield for private investors. Millions of mall visitors drive value for retail tenants, ensuring high footfall.

| Segment | Focus | 2024 Data |

|---|---|---|

| Retail/Office | Location/Facilities | 97% Occupancy |

| Data Center | Scalability/Security | Green Mountain Expansion |

| Investors | Returns/Dividends | NIS 2.05B NOI, 3.5% Yield |

Cost Structure

Property development and construction costs are Azrieli Group's primary capital expenditure, reflecting a substantial investment in their portfolio. These encompass all expenses for new builds and redevelopments, including land acquisition, raw materials, labor, and essential architectural and engineering fees. In 2024, such investments continue to be crucial for expanding their income-generating assets, like the Azrieli Town project. These are long-term commitments designed to drive future rental income and asset value for the company.

Property Operating Expenses represent the ongoing costs essential for running and maintaining Azrieli Group's diverse real estate portfolio. These include significant outlays for utilities, cleaning services, robust security measures, and routine repairs, alongside salaries for dedicated maintenance staff. For instance, in 2024, such expenses are a substantial component of the company's operational budget, directly impacting net operating income. These costs are partially mitigated by management fees collected from tenants, a standard practice in commercial real estate to help offset the burden of property upkeep.

As a highly capital-intensive real estate enterprise, Azrieli Group carries substantial debt to fund its extensive development projects and acquisitions. The interest expense on its various financial instruments, including bonds and bank loans, represents a significant and ongoing cost. For instance, Azrieli's net financial expenses for the first quarter of 2024 were approximately NIS 186 million, highlighting the scale of these recurring outlays. Efficiently managing these financing costs is paramount to maintaining strong profitability and ensuring sustainable growth within the company's business model.

General & Administrative Expenses (G&A)

General and Administrative Expenses for Azrieli Group encompass crucial corporate overheads not directly tied to specific properties, ensuring smooth operations. This category covers salaries for executive management, marketing, finance, and administrative staff, which are vital for strategic direction and support functions. Office costs, including rent and utilities for corporate headquarters, also fall under G&A. Additionally, professional fees for legal, auditing, and consulting services are included, supporting compliance and growth.

- Azrieli's G&A reflects the corporate entity's operational backbone.

- Salaries for key personnel, including executives, are a major component.

- Office costs and professional fees ensure regulatory adherence and strategic advice.

- These expenses are essential for the company's overall management and governance.

Property Taxes & Insurance

Owning a vast portfolio of premium real estate, like Azrieli Group's, incurs substantial property tax liabilities to numerous municipalities across Israel. These annual obligations are significant, with municipal property tax rates varying but consistently representing a major non-discretionary operating cost. Additionally, comprehensive insurance coverage for the entire portfolio is a critical and necessary expense to mitigate risks such as property damage, natural disasters, and liability claims.

- For 2024, property taxes and insurance are projected to remain among Azrieli Group's largest recurring operational expenditures, reflecting their extensive asset base.

- These costs are largely fixed, irrespective of property occupancy rates, making them a consistent financial burden.

- Insurance premiums can be influenced by inflation and the increasing value of properties, alongside a growing risk landscape.

- Effective risk management and negotiation of insurance terms are vital to contain these substantial outflows.

Azrieli Group's cost structure is primarily driven by capital-intensive property development and significant operational expenses for its extensive portfolio.

Substantial interest expenses, like NIS 186 million in Q1 2024, are key due to high debt financing for growth and acquisitions.

General and administrative overheads, coupled with recurring property taxes and insurance, complete the major cost categories for ongoing operations.

| Cost Category | Primary Focus | 2024 Impact |

|---|---|---|

| Development | Expansion, asset value | Crucial for growth |

| Operating | Portfolio upkeep | Directly impacts NOI |

| Financing | Debt servicing | NIS 186M Q1 2024 |

Revenue Streams

Azrieli Group's core and most stable revenue stream is the substantial rental income collected from tenants across its extensive portfolio of office buildings and shopping malls. This income is primarily secured through long-term lease agreements, providing a highly predictable and recurring cash flow that forms the bedrock of the company's financial performance. For instance, Azrieli Group's Net Operating Income (NOI) from rental properties reached approximately NIS 3.4 billion in 2023, demonstrating the continued strength of this segment into 2024. This consistent cash generation allows for strategic investments and stable dividends.

Azrieli's data center operations represent a rapidly expanding revenue stream, driven by leasing space and providing essential services. Revenue is primarily generated through colocation contracts, power consumption, and connectivity services offered to both hyperscale and enterprise clients. These arrangements are typically long-term and high-value, underscoring stable income. For instance, Azrieli's Compass facility, acquired in 2023, is expected to contribute significantly to this segment's growth into 2024 and beyond.

Azrieli generates revenue from management fees, particularly in its malls, which cover the operational costs of common areas. These fees are a significant component beyond base rent, contributing to overall property profitability. Additional income streams include charges for parking, which supports the operational efficiency of their properties. Furthermore, temporary specialty leasing within their commercial centers adds to the diverse revenue base. In Q1 2024, Azrieli Group's total revenue reached approximately NIS 1.35 billion, with these diverse charges contributing to the overall financial strength.

Gains on Sale of Investment Property

Azrieli strategically optimizes its portfolio by divesting properties that have matured or no longer align with its long-term objectives. The capital gains realized from these sales generate significant, though non-recurring, revenue. This approach is a core component of its capital recycling strategy, allowing funds to be reinvested into higher-growth opportunities or new developments.

For example, in 2024, Azrieli Group continued its asset rotation, contributing to its financial flexibility and portfolio enhancement.

- Strategic portfolio optimization through divestment.

- Capital gains as a significant, non-recurring revenue source.

- Key element of Azrieli's capital recycling strategy.

- Funds reinvested into new growth opportunities.

Dividends & Income from Holdings

Azrieli Group diversifies its revenue streams by operating as a holding company, generating income from its strategic investments in sectors beyond real estate. A prime example is its significant stake in the energy company Supergas, from which it receives consistent dividends. This income also includes potential gains realized from the sale of these non-real estate holdings, like the 2024 sale of its remaining stake in Supergas. Such diversified income streams enhance the group's financial resilience and overall stability.

- Azrieli sold its remaining 40% stake in Supergas in the first quarter of 2024.

- This sale generated a capital gain of approximately NIS 358 million.

- The transaction contributed to the group's robust financial results in Q1 2024.

Azrieli Group's diverse revenue streams include stable rental income from its properties, with 2023 NOI around NIS 3.4 billion, continuing strong into 2024. Rapidly growing data center operations, along with management fees and parking, contribute significantly. Non-recurring capital gains from property divestments and strategic investment sales, like the NIS 358 million from Supergas in Q1 2024, further bolster income.

| Revenue Stream | 2023 Data | 2024 Data |

|---|---|---|

| Rental NOI | NIS 3.4B | Strong |

| Q1 Total Revenue | - | NIS 1.35B |

| Supergas Sale Gain | - | NIS 358M |

Business Model Canvas Data Sources

The Azrieli Business Model Canvas is informed by a blend of internal financial reports, comprehensive market research studies, and direct customer feedback. These sources provide a robust foundation for understanding our operational landscape and strategic direction.