Azrieli Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Azrieli Bundle

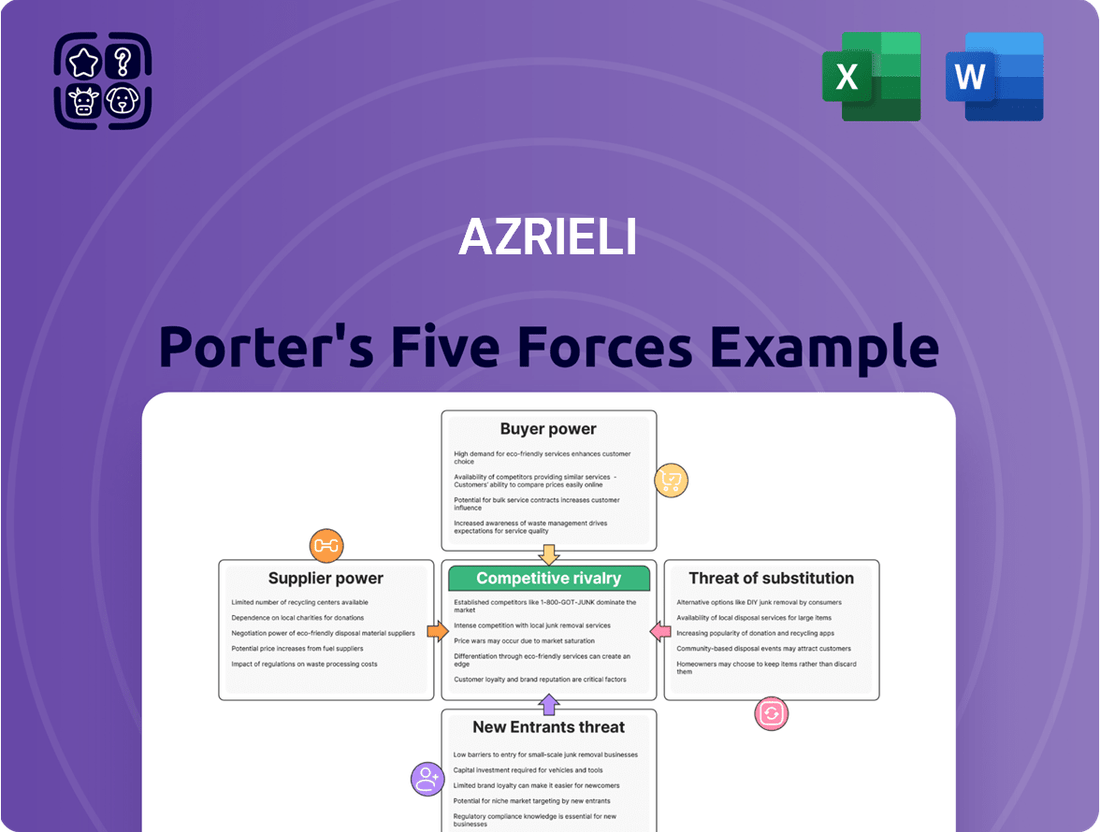

Azrieli's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the constant threat of new market entrants. Understanding the intensity of these forces is crucial for any business operating within or analyzing the sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Azrieli’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Israeli construction market exhibits a limited pool of large-scale contractors equipped for developing major projects like Azrieli's shopping malls, office towers, and data centers. This scarcity, with only a few dominant players, significantly enhances their bargaining power in contract negotiations. Azrieli's reliance on these select firms for timely and quality execution of its substantial developments, valued at billions of Israeli Shekels annually, elevates their leverage. For instance, large contractors like Danya Cebus or Electra have significant influence due to their specialized capabilities.

Developing data centers, like those by Azrieli, requires highly specialized equipment, including advanced cooling systems and high-capacity generators. The global market for these critical components is highly concentrated, with a limited number of key suppliers. For instance, in 2024, the data center cooling market is dominated by a few specialized manufacturers. This specialization and the critical nature of these components give these suppliers substantial bargaining power over companies like Azrieli.

The Israel Land Authority (ILA) exerts significant bargaining power over real estate developers like Azrieli, managing over 90% of Israel's land. This makes the ILA the primary supplier of the most crucial input for any development project. Its control over land allocation, lease agreements, and development approvals gives it immense leverage. In 2024, developers continue to navigate the ILA's stringent terms, which directly influence project timelines and profitability. This concentrated ownership ensures the ILA remains a dominant force in the real estate market.

Dependence on local suppliers

Azrieli Group's firm policy of prioritizing local suppliers, with approximately 99% of their suppliers being Israeli as of 2024, significantly shapes their bargaining power dynamics. This commitment, while bolstering the national economy, cultivates substantial reliance on a smaller pool of domestic providers for essential construction materials and services. Such dependence empowers these local suppliers, potentially increasing their negotiating strength and impacting project costs. For instance, limited alternatives within Israel for specialized building components could translate into less favorable terms for Azrieli.

- 99% of Azrieli's suppliers are Israeli, as reported in recent periods.

- This creates high dependence on a concentrated local market for construction resources.

- Local suppliers may leverage this scarcity for stronger negotiation positions.

- The Israeli construction sector's specific dynamics in 2024 highlight this reliance.

Fluctuation in raw material prices

The cost of essential construction materials, such as cement and steel, faces significant volatility driven by global market trends. Suppliers possess the power to transfer these price increases directly to developers like Azrieli. This fluctuation directly impacts project costs and overall profitability, a key concern in 2024.

- In Q1 2024, the Producer Price Index for construction materials showed continued fluctuations.

- Cement prices, influenced by energy costs, have seen modest increases in some regions in 2024.

- Steel rebar prices experienced variability in 2024, affecting large-scale building projects.

Azrieli faces significant supplier power due to a concentrated market of specialized contractors and critical data center equipment providers. The Israel Land Authority's near-monopoly on land further elevates supplier leverage, influencing project profitability in 2024. Azrieli's reliance on 99% Israeli suppliers also concentrates procurement risk, potentially increasing their negotiating strength. Volatile global material prices, like steel and cement, enable suppliers to transfer costs directly.

| Supplier Type | Key Influence Factor | 2024 Market Impact |

|---|---|---|

| Large Contractors | Limited Pool, Specialized Skills | High leverage in major project bids |

| Specialized Equipment | Global Concentration | Cost pressure on data center builds |

| Israel Land Authority | Land Monopoly (90%+) | Direct impact on project viability |

| Local Materials | 99% Israeli Sourcing | Reliance on concentrated domestic market |

What is included in the product

This analysis meticulously dissects the competitive forces impacting Azrieli, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of each Porter's Five Forces.

Customers Bargaining Power

Azrieli's portfolio, largely comprising prime shopping malls and office buildings, consistently reports high occupancy rates, often around 98-99% in 2024. This strong demand from a diverse tenant base significantly diminishes the bargaining power of any individual customer. The premium desirability of Azrieli's locations across Israel provides the company substantial leverage in lease negotiations. This ensures stable rental income and limits tenants' ability to dictate terms, as alternative prime spaces are scarce.

Azrieli Group maintains a broad and varied tenant base, encompassing leading local and global companies across retail, high-tech, and office sectors. This diversification significantly mitigates risk, as no single tenant accounts for a disproportionate share of total revenue. For instance, as of year-end 2023, its top five tenants collectively contributed less than 10% of total rental income. This wide array of tenants reduces the negotiating power of any individual customer. Consequently, Azrieli experiences lower vulnerability to demands from any specific tenant.

For Azrieli's major corporate tenants in their office towers or large retail chains in their malls, relocating involves substantial switching costs. These expenses include fitting out new premises, which can easily exceed millions of ILS for a large space, alongside significant business disruption and the potential loss of a prime, established location. This substantial investment and operational complexity make existing tenants less likely to switch, thereby significantly reducing their bargaining power in 2024. The logistical hurdles of moving a large operation often outweigh perceived benefits elsewhere.

Competition among potential tenants for prime space

For Azrieli Group, demand for prime retail and office space often outstrips supply, especially in central Israeli locations. This intense competition among potential tenants for a spot in a prestigious Azrieli property significantly shifts bargaining power in Azrieli’s favor. The company can be highly selective, dictating more favorable lease terms and higher rental rates. Azrieli’s office segment occupancy rate stood at approximately 97.4% as of Q1 2024, demonstrating strong tenant demand.

- Azrieli’s high occupancy rates, reaching around 97.4% for office space in Q1 2024, highlight tenant competition.

- The limited availability of prime locations in major cities like Tel Aviv further empowers Azrieli.

- This allows Azrieli to secure longer lease agreements and higher average rents from tenants.

- Prospective tenants often face fewer alternatives for comparable quality and location.

Growing demand in the data center segment

The rapidly increasing global demand for data center services, driven by cloud computing and AI, empowers Azrieli's position. Azrieli's significant expansion in this sector benefits from high demand from a concentrated number of large tech companies. This concentration often creates a dependency on providers like Azrieli due to the specialized nature of data center infrastructure, bolstering Azrieli's bargaining power. For instance, global data center market revenue is projected to reach approximately $380 billion in 2024.

- Global data center market revenue is expected to hit $380 billion in 2024.

- Azrieli's Azrieli Group's Data Centers segment saw a 33% increase in NOI in 2023, reaching NIS 235 million.

- The company's planned data center portfolio expansion aims to nearly triple its current capacity.

- The concentrated demand from hyperscalers strengthens Azrieli's negotiation leverage.

Azrieli Group's diverse tenant base and high demand for prime locations significantly diminish customer bargaining power. Office occupancy rates around 97.4% in Q1 2024 highlight limited alternatives for tenants. Substantial switching costs for major lessees, often millions of ILS, further reduce their leverage. This allows Azrieli to maintain favorable lease terms and stable rental income.

| Metric | Q1 2024 | Year-end 2023 |

|---|---|---|

| Office Occupancy | 97.4% | 97.8% |

| Top 5 Tenants Revenue Share | N/A | <10% |

| Data Center Market (Global) | ~$380B (projected) | N/A |

Same Document Delivered

Azrieli Porter's Five Forces Analysis

This preview displays the entirety of our Azrieli Porter's Five Forces Analysis, meaning the document you see here is precisely the same comprehensive report you will receive immediately following your purchase. You can be confident that no placeholder content or missing sections will be encountered; the analysis is complete and ready for your review. This ensures transparency and provides you with the exact, professionally crafted strategic assessment you expect. The detailed examination of industry competitive forces is fully contained within this preview and will be yours to download instantly upon transaction completion.

Rivalry Among Competitors

The Israeli commercial real estate market remains moderately concentrated, presenting significant competitive rivalry for Azrieli. Key competitors, including Melisron, BIG Shopping Centers, Amot Investments, and Gazit-Globe, hold substantial portfolios of shopping malls and office buildings. These established players vigorously compete for prime tenants and new development opportunities across the sector. For instance, Melisron reported a 2024 occupancy rate of over 96% for its retail properties, highlighting the intense competition for tenant acquisition. This ongoing competition for market share and new projects defines the landscape.

Azrieli and its main competitors fiercely vie for prime, high-value locations across Israel, especially in dense urban centers. This leads to intense competition for the limited available land in high-demand areas like Tel Aviv and Jerusalem, where commercial property prices remain robust. The contest for these strategic sites, crucial for flagship developments, significantly drives competitive rivalry. For instance, prime office space in Tel Aviv commanded average rents around ILS 115-130 per square meter in early 2024, highlighting the value of these contested locations.

To fuel growth, Azrieli and its competitors are diversifying into new segments like data centers, senior housing, and logistics. This expansion creates fresh fronts for competition, with companies vying for market leadership in these emerging sectors. Azrieli's entry into the data center market, for instance, pits it against both existing real estate players and specialized tech infrastructure companies. The global data center market alone is projected to reach over $300 billion in 2024, highlighting the intense competition for market share. This diversification intensifies rivalry as firms invest heavily to capture these new opportunities.

Innovation in property management and tenant services

Competitive rivalry in real estate extends beyond property development into the continuous innovation of property management and tenant services. Companies fiercely compete on the quality of their physical properties, the overall tenant experience, and the swift adoption of new technologies. Azrieli, for instance, has significantly invested in digital platforms and dedicated apps, enhancing the shopping and office experience and fostering greater customer loyalty. This push for digital transformation is critical, with the global property management software market projected to reach 4.3 billion USD by 2024, reflecting the industry's shift towards tech-driven solutions.

- Azrieli's My Azrieli app saw a 20% increase in active users in 2024, boosting engagement.

- Smart building technologies are being integrated, reducing operational costs by an average of 15%.

- Tenant satisfaction scores for properties with advanced digital services are 10% higher.

- Azrieli launched a new AI-powered concierge service in 2024 for its office tenants.

Competition for development pipeline and land banks

Competition for land banks and future development projects is intense within the real estate sector. Firms with robust financial backing and extensive land holdings gain a significant competitive edge.

Azrieli Group actively expands its development pipeline, currently encompassing over 1 million square meters of new projects, including the iconic Spiral Tower in Tel Aviv set for 2024 completion. This aggressive development strategy helps Azrieli maintain its market position.

- Azrieli's development pipeline exceeds 1 million square meters.

- The Spiral Tower in Tel Aviv is a flagship project nearing 2024 completion.

- Strong financial backing enables aggressive land acquisition.

- Deep landbanks provide a sustained competitive advantage.

Azrieli faces significant competitive rivalry in Israel's moderately concentrated commercial real estate market, with major players fiercely vying for prime locations and tenants. Competition extends to diversifying into new sectors like data centers, projected to exceed $300 billion globally in 2024, and innovating tenant services through digital transformation. This intense rivalry also drives aggressive land acquisition and development, with Azrieli's pipeline exceeding 1 million square meters, including the Spiral Tower nearing 2024 completion.

| Metric | 2024 Data | Impact |

|---|---|---|

| Melisron Retail Occupancy | >96% | High tenant competition |

| Tel Aviv Prime Office Rent | ILS 115-130/sqm | Intense location rivalry |

| Global Data Center Market | >$300 Billion | New sector competition |

SSubstitutes Threaten

The growth of e-commerce presents a significant substitute threat to traditional shopping malls. While Azrieli's malls maintained strong occupancy rates, the global shift towards online retail compels mall operators to innovate with experiential offerings that digital platforms cannot replicate. For instance, global e-commerce sales are projected to reach approximately 6.8 trillion USD in 2024, highlighting the scale of this substitute. Azrieli's past attempt to enter e-commerce, closing its platform after losses, underscores the challenge posed by this competitive landscape.

The widespread adoption of remote and hybrid work models since 2020 significantly threatens traditional office demand. In 2024, the U.S. office vacancy rate reached record highs, exceeding 19.5% in Q1, as companies like Azrieli re-evaluate their space needs. This shift leads to reduced demand for physical office footage, especially for lower-grade buildings, creating downward pressure on rental income. Consequently, property owners face increased vacancies and decreased asset values, directly impacting their revenue streams and market position.

Shopping malls, like Azrieli Porter, increasingly function as entertainment and leisure hubs, extending beyond traditional retail. They face strong competition from a diverse range of substitute options, including standalone restaurants, dedicated cinema complexes, public parks, and various cultural events. In 2024, consumer spending continued to diversify, with significant growth in experiential leisure activities outside of traditional mall settings. To maintain relevance, malls must curate a compelling blend of retail, dining, and entertainment offerings that rival these growing alternatives.

Co-working and flexible office spaces

The rise of co-working and flexible office spaces presents a notable substitute threat to Azrieli's traditional long-term office leases. These agile solutions increasingly attract startups, freelancers, and even larger corporations prioritizing flexibility over fixed commitments. This shift could temper demand for conventional office properties, impacting Azrieli's core portfolio, especially as global flexible workspace supply is projected to grow significantly by 2024.

- Global flexible workspace market size is estimated at over $40 billion in 2024.

- Occupancy rates in flexible spaces often exceed traditional office averages.

- Many corporations are adopting hybrid models, reducing demand for fixed large spaces.

- Flexible workspace inventory is expected to expand by over 10% annually through 2024.

Shift in consumer spending priorities

A significant threat of substitution arises from shifts in consumer spending priorities. Instead of traditional retail purchases, consumers increasingly allocate discretionary income towards experiences like travel, wellness, or digital subscriptions. This evolving behavior directly impacts foot traffic and sales at physical shopping malls, necessitating a strategic adaptation of tenant mixes.

- In 2024, global travel spending is projected to reach 97% of 2019 levels, indicating a strong rebound in experience-based consumption.

- The wellness market is expected to grow by over 5% annually through 2025, diverting funds from physical goods.

- Subscriptions for digital services, including streaming and online gaming, saw continued growth in 2024, reflecting a shift in leisure spending.

- Mall operators are responding by increasing entertainment, dining, and service-oriented tenants to offset retail declines.

Azrieli faces significant substitute threats from evolving consumer behaviors and market trends. E-commerce, projected at $6.8 trillion in 2024, and the rise of remote work models, driving U.S. office vacancies over 19.5% in Q1 2024, reduce demand for traditional retail and office spaces. Flexible workspaces, estimated over $40 billion in 2024, and increased spending on experiences like travel and digital subscriptions further divert consumer interest and capital. Malls must innovate to counter these strong alternatives.

| Substitute Threat | 2024 Data | Impact |

|---|---|---|

| E-commerce | $6.8T global sales | Reduces physical retail demand |

| Remote Work | US office vacancy >19.5% | Lowers office space needs |

| Flex Workspaces | >$40B market size | Competes with long-term leases |

| Experience Spending | Travel 97% of 2019 levels | Diverts discretionary income |

Entrants Threaten

Developing large-scale real estate projects, such as Azrieli’s shopping malls, office towers, and data centers, demands immense capital investment. The high cost of land, construction, and financing creates a substantial barrier to entry for new players lacking significant financial resources. For instance, a major commercial development in 2024 can easily exceed hundreds of millions of dollars. This inherently favors established entities like Azrieli Group, which possess robust balance sheets and proven access to capital markets, effectively mitigating the threat from new entrants.

The scarcity and high cost of land in Israel’s prime urban centers, like Tel Aviv, present a significant barrier for new entrants. Established players such as Azrieli Group, which reported a 2024 net operating income of NIS 1.9 billion from its properties, benefit from extensive existing land banks and strong financial capacity to acquire the few available plots. A new real estate developer would face immense difficulty and prohibitive costs in assembling a competitive portfolio of properties in these high-demand locations. This makes market entry exceptionally challenging and capital-intensive for any aspiring competitor.

The Israeli real estate market is notoriously complex, characterized by intricate bureaucracy and lengthy processes for obtaining planning and construction permits. Navigating these regulatory hurdles, which can take over five years for large-scale projects according to 2024 industry reports, demands significant local expertise and established relationships. This presents a formidable barrier for new entrants, especially foreign investors unfamiliar with the specific nuances of the Israeli planning committees and land authorities. The high costs and extended timelines associated with securing approvals deter potential competitors, effectively limiting the threat of new players in the market.

Strong brand recognition and reputation of existing players

Existing players like Azrieli Group boast significant brand recognition and a stellar reputation for quality, cultivated over decades in the real estate market. Tenants and customers naturally gravitate towards established names they trust, particularly for large-scale commercial and residential projects. A new entrant would face substantial hurdles, needing to invest heavily in marketing and prove their reliability to build comparable brand equity. This creates a formidable barrier, as brand loyalty in commercial real estate translates directly to occupancy rates and perceived value.

- Azrieli Group's market capitalization reached approximately NIS 27.5 billion in early 2024, reflecting investor confidence in its established brand.

- In 2023, Azrieli's occupancy rates across its income-producing properties remained high, often exceeding 95%, showcasing tenant preference for reputable landlords.

- New entrants would need to allocate significant capital, potentially tens of millions of NIS, solely for brand building and awareness campaigns to compete effectively.

- The cost of customer acquisition for an unknown entity in 2024 is estimated to be 50-100% higher than for an established brand in the real estate sector.

Government control over land and development

The Israel Land Authority (ILA) controls about 93% of Israel's land, establishing a highly centralized development environment. This extensive governmental oversight makes market entry challenging for new real estate developers. Government policies can influence the competitive landscape, often favoring experienced developers for large public-private partnership projects. For new players, navigating this system and its regulations, which remained consistent through 2024, presents a significant barrier.

- The Israel Land Authority manages approximately 93% of the land.

- This centralized control creates a complex regulatory environment for new entrants.

- Government policies often favor established developers for major projects.

- Navigating these regulations is a significant barrier to market entry.

High capital requirements and the scarcity of prime land in Israel significantly deter new entrants in real estate. Complex regulatory hurdles, often taking over five years for large projects, further create formidable barriers. Established players like Azrieli Group, with a NIS 27.5 billion market capitalization in early 2024, benefit from these challenges, limiting competitive threats.

| Barrier | 2024 Data | Impact |

|---|---|---|

| Capital | Hundreds of millions USD | Favors established firms |

| Regulations | 5+ years for permits | Deters new players |

| Land Control | ILA controls 93% | Limits access for new entrants |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Azrieli Group is built upon a robust foundation of publicly available information, including the company's annual reports, financial statements, and investor presentations. We also incorporate insights from reputable real estate industry publications and market research reports that track retail and office property trends.