Axtel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axtel Bundle

Axtel's SWOT analysis reveals a dynamic landscape, highlighting its strong technological infrastructure and growing market presence as key strengths. However, understanding the full scope of its competitive challenges and potential regulatory hurdles is crucial for informed decision-making.

Want the full story behind Axtel’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Axtel boasts a diverse service portfolio, encompassing crucial ICT solutions like broadband internet, managed network services, data center capabilities, and robust IT security. This wide array of offerings enables Axtel to address a broad spectrum of client requirements, from individual consumers to large enterprises and government bodies.

By providing a comprehensive suite of services, Axtel is well-positioned to increase customer lifetime value through cross-selling and upselling opportunities. For instance, a business utilizing their broadband can be offered managed network services or cybersecurity solutions, thereby deepening the client relationship and revenue per customer.

The company's strategic emphasis on digital transformation services, particularly in cloud computing and cybersecurity, has been a key growth driver. In 2023, Axtel reported significant revenue increases in its IT and Cloud segments, indicating strong market demand for these specialized digital solutions.

Axtel's enterprise segment is showing impressive momentum, with revenues climbing 13% in the fourth quarter of 2024 and a solid 7% for the entire year. This growth is largely fueled by demand for digital transformation services, including cybersecurity and cloud solutions, indicating Axtel's strong position in these critical areas.

The government sector is another area where Axtel is excelling, experiencing a significant 44% revenue jump in 4Q24 and a 7% increase for the full year 2024. This substantial growth underscores the company's successful strategies for market penetration and diversification within the public sector.

Axtel's strategic focus on high-growth sectors like cybersecurity and cloud solutions is a key strength, with these markets projected to see substantial expansion. The company is actively channeling resources into these areas, anticipating robust demand.

By championing business innovation through AI and expanding its fiber optic infrastructure to meet the needs of hyperscalers, Axtel is positioning itself to capitalize on the increasing demand for high-bandwidth services. This forward-looking approach is crucial for sustained growth.

Improved Financial Health and Cash Flow

Axtel has demonstrated a significant strengthening of its financial position. For the full year 2024, the company reported a 5% increase in revenues and a 7% rise in comparable EBITDA, signaling robust operational performance.

This improved financial health translated into substantial cash generation. Axtel generated over US $40 million in cash flow during 2024.

The strategic deployment of this cash flow had a direct impact on the company's debt structure and financial expenses. Specifically, the cash was used for a partial prepayment of a bank loan.

This prepayment is projected to yield tangible benefits in 2025, including reduced financial expenses and a lower net debt to comparable EBITDA ratio, underscoring a more sustainable financial footing.

Extensive Network Infrastructure

Axtel's extensive fiber optic network, spanning approximately 50,800 kilometers across Mexico and including international crossings, is a significant strength. This robust infrastructure is key to delivering high-capacity, low-latency, and secure connectivity, essential for today's digital economy.

This network is particularly vital for supporting the growing demand for high-bandwidth services, especially from sectors like data centers and industrial parks, which are critical components of Mexico's economic growth. It positions Axtel to effectively capitalize on the nearshoring trend, attracting businesses that require reliable and advanced telecommunications capabilities.

- Network Reach: Approximately 50,800 km of fiber optic cable in Mexico.

- Connectivity: High capacity, low latency, and secure.

- Market Advantage: Supports high-bandwidth services for data centers and industrial parks.

- Strategic Alignment: Enables capitalizing on nearshoring opportunities.

Axtel's diverse service portfolio, including broadband, managed networks, data centers, and IT security, allows it to cater to a wide range of clients. This comprehensive offering fosters customer loyalty and provides opportunities for cross-selling and upselling, enhancing customer lifetime value.

The company's strategic focus on digital transformation, particularly in cloud computing and cybersecurity, has been a significant growth driver. In 2024, Axtel's enterprise segment saw revenues climb 7% year-over-year, largely due to demand for these specialized digital solutions.

Axtel's extensive fiber optic network, spanning approximately 50,800 kilometers across Mexico, is a key competitive advantage. This robust infrastructure supports high-capacity, low-latency connectivity, crucial for sectors like data centers and industrial parks, and positions Axtel to benefit from nearshoring trends.

Financially, Axtel demonstrated strength in 2024, with a 5% increase in revenues and a 7% rise in comparable EBITDA. The company generated over US$40 million in cash flow, which was used for debt reduction, improving its financial health and reducing future interest expenses.

| Segment | 2024 Revenue Growth | Key Drivers |

|---|---|---|

| Enterprise | 7% | Digital transformation services (cloud, cybersecurity) |

| Government | 7% | Market penetration and diversification strategies |

| Overall | 5% | Strong performance across key business areas |

What is included in the product

Delivers a strategic overview of Axtel’s internal and external business factors, highlighting its competitive position and market challenges.

Axtel's SWOT analysis provides a clear, actionable framework for identifying and addressing potential business challenges, thereby relieving the pain of strategic uncertainty.

Weaknesses

Axtel operates in a fiercely competitive Mexican telecommunications and IT services landscape. Major players like Telmex, Televisa Telecom, Megacable, and Totalplay possess significant financial clout and established market share, creating substantial headwinds for Axtel.

This intense rivalry often translates into aggressive pricing strategies across the sector. Consequently, Axtel may face downward pressure on its service prices, potentially impacting its operating margins and overall financial performance as it strives to maintain market relevance.

Axtel's traditional revenue streams are showing signs of strain, particularly in its enterprise segment. Revenues from voice services, a legacy offering, saw a 4% decrease in the second quarter of 2025. This decline highlights the ongoing challenge of shifting focus from these diminishing services to capitalize on the growth in digital transformation solutions.

Axtel faces challenges from rising operational costs. The cost of revenues saw a significant 12% increase year-on-year in Q2 2025, largely attributed to elevated expenses within its government segment.

Furthermore, general corporate expenses climbed by 8%. This uptick is primarily driven by increased personnel and maintenance expenditures, posing a potential threat to the company's profitability if these cost pressures aren't effectively managed.

Impact of Global Uncertainty on Acquisitions

Global economic headwinds have significantly complicated Axtel's pursuit of new acquisitions. The prevailing uncertainty has caused potential clients to delay crucial decisions, directly impacting the company's expansion efforts. This slowdown in customer commitment can impede Axtel's capacity to onboard new clients and successfully integrate acquired businesses, thereby potentially moderating its growth pace.

The extended decision cycles are a direct consequence of this global instability. For instance, a report from Deloitte in late 2023 indicated that deal completion times for M&A transactions had increased by an average of 15% compared to the previous year, primarily due to heightened economic volatility and regulatory scrutiny. This environment makes it harder for Axtel to finalize new partnerships and revenue streams.

- Delayed Customer Commitments: Global uncertainty leads to longer sales cycles and postponed decisions from potential clients, affecting new business acquisition.

- Hindered Integration: The inability to secure timely commitments can slow down the integration of new businesses, impacting synergistic benefits.

- Slower Growth Trajectory: Delays in expansion and integration directly translate to a potentially slower pace of overall company growth.

- Increased M&A Transaction Times: Industry-wide data suggests a rise in the duration of M&A processes due to economic and geopolitical factors.

Potential for Declining Financial Performance in Specific Periods

While Axtel's broader financial trajectory may appear positive, certain periods have revealed a vulnerability to declining performance. This suggests that the company's overall financial health can be impacted by specific quarterly challenges.

For instance, 'Axtel Industries' experienced a significant downturn in its financial results for the quarter ending June 2025. This period saw a year-on-year decrease in net sales by 39.11% and a sharp decline in profit before tax by 92.55%.

- Revenue Volatility: The substantial drop in net sales indicates potential issues with market demand or competitive pressures affecting specific product lines or services during that quarter.

- Profitability Erosion: The drastic fall in profit before tax points to challenges in cost management, pricing strategies, or a disproportionate increase in operating expenses relative to revenue.

- Sector-Specific Pressures: These figures may reflect broader economic headwinds or sector-specific challenges that disproportionately impacted Axtel Industries during that particular reporting period.

- Need for Resilience: The observed quarterly declines highlight the importance of building greater financial resilience to navigate periods of market uncertainty or operational disruptions.

Axtel contends with aggressive competition from established players like Telmex and Televisa Telecom, who possess greater financial resources and market dominance. This intense rivalry forces Axtel into price wars, potentially squeezing its profit margins as it fights to retain customers and market share.

The company faces challenges from declining revenue in its legacy voice services, which saw a 4% drop in Q2 2025. Simultaneously, operational costs are rising, with the cost of revenues increasing by 12% year-on-year in Q2 2025, largely due to higher expenses in its government segment.

Global economic uncertainty is also slowing down Axtel's expansion plans, as potential clients delay critical decisions. This makes new client acquisition and business integration more difficult, impacting the company's growth trajectory. For example, M&A deal completion times have increased by an average of 15% due to economic volatility.

| Weakness | Description | Impact | Supporting Data (Q2 2025 unless specified) |

|---|---|---|---|

| Intense Competition | Operating in a market dominated by larger, financially stronger competitors. | Pressure on pricing, reduced market share, and difficulty in differentiation. | Major players: Telmex, Televisa Telecom, Megacable, Totalplay. |

| Declining Legacy Revenue Streams | Reliance on traditional services like voice, which are experiencing reduced demand. | Erosion of established revenue sources, requiring a faster shift to new digital offerings. | Voice services revenue decreased by 4%. |

| Rising Operational Costs | Increases in the cost of revenues and general corporate expenses. | Potential squeeze on profitability if cost increases outpace revenue growth. | Cost of revenues up 12% YoY; General corporate expenses up 8% YoY. |

| Slowed Expansion Due to Global Uncertainty | Delayed customer commitments and longer M&A transaction times. | Hindered new business acquisition, slower integration of acquired entities, and moderated growth. | M&A deal completion times increased by ~15% (Deloitte, late 2023). |

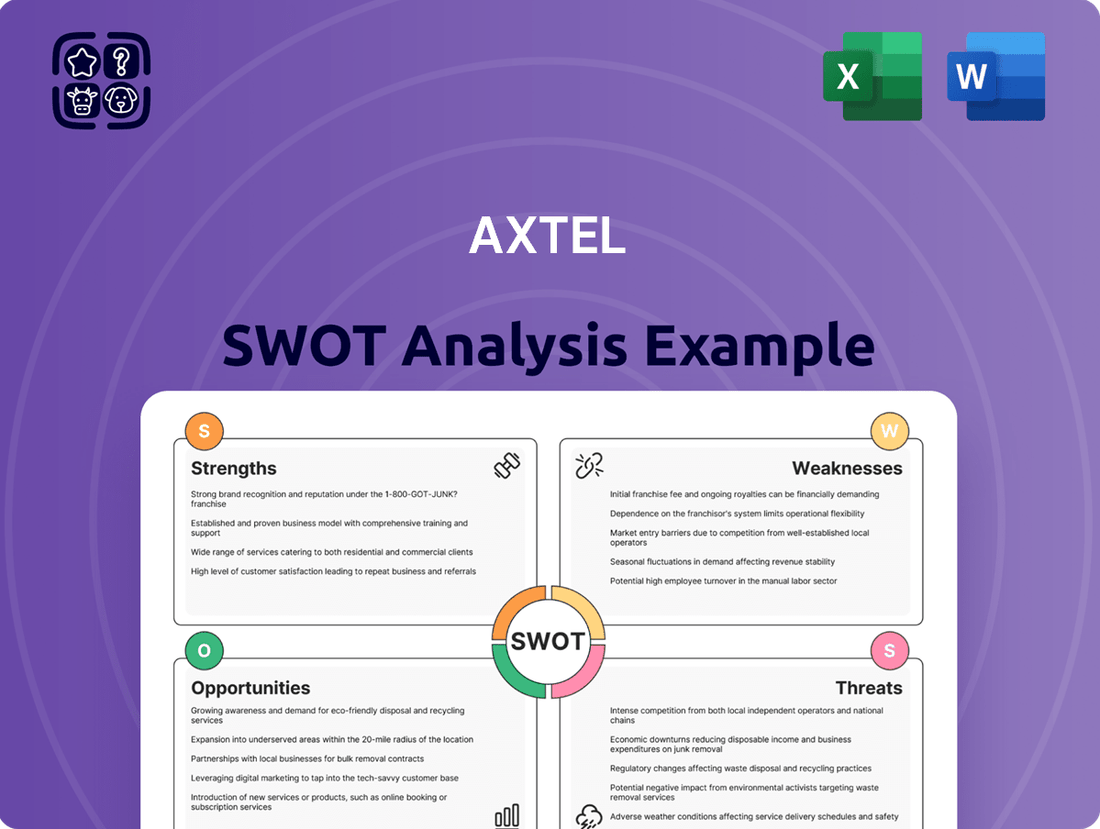

What You See Is What You Get

Axtel SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting – a professional and comprehensive report. No surprises, just the full, detailed analysis.

Opportunities

Mexico's accelerating embrace of digital transformation, particularly in cloud services, offers a substantial growth avenue for Axtel. This trend is evident as businesses increasingly migrate operations to the cloud to enhance efficiency and scalability.

Axtel's strategic emphasis on IT, cybersecurity, and cloud solutions directly addresses this burgeoning demand. For instance, the Mexican cloud computing market was projected to reach approximately $5.7 billion in 2024, with continued robust growth expected in the coming years, underscoring the market's potential.

The cybersecurity market in Mexico is booming, expected to hit around USD 4.77 billion by 2034, growing at an annual rate of 8.00% from 2025 to 2034. This presents a significant opportunity for Axtel.

Axtel is well-positioned to leverage this growth, given its current IT security offerings and existing partnerships. The company can expand its service portfolio to meet the increasing demand for robust cybersecurity solutions.

The ongoing expansion of 5G networks across Mexico presents a substantial growth avenue for Axtel. As of early 2024, major telecom operators are accelerating their 5G infrastructure build-out, creating demand for robust backhaul and connectivity solutions that Axtel is well-positioned to provide.

The proliferation of Internet of Things (IoT) devices, from smart city applications to industrial automation, is another key opportunity. Axtel can leverage its network capabilities to offer specialized IoT connectivity and management services, tapping into a market projected to see significant year-over-year growth in the coming years.

By aligning its service portfolio with these technological advancements, Axtel can develop new revenue streams beyond traditional telecommunications. This strategic focus on 5G and IoT allows Axtel to capitalize on the digital transformation trends shaping the Mexican economy.

Nearshoring and Infrastructure Demand

The global shift towards nearshoring, particularly in Mexico, is fueling a substantial demand for robust digital infrastructure. This trend directly benefits companies like Axtel, which possess extensive fiber optic networks capable of supporting the increased data traffic generated by new industrial parks and data centers.

Axtel's strategic advantage lies in its significant fiber optic footprint and its international network crossings. These assets position Axtel as a key provider for global carriers and hyperscalers looking to establish or expand their presence in Mexico. This opens up considerable growth potential for Axtel's wholesale business segment.

- Nearshoring Growth: Mexico's manufacturing sector is projected to see continued expansion, with companies relocating production closer to North American markets.

- Data Center Expansion: Investments in Mexican data centers are on the rise, with estimates suggesting significant capital deployment in the coming years to meet growing cloud and AI demands.

- Axtel's Network Advantage: Axtel's extensive fiber optic network, spanning thousands of kilometers, provides the high-bandwidth connectivity essential for these expanding industries.

- Wholesale Opportunities: The demand from hyperscalers and global carriers for reliable international connectivity presents a lucrative opportunity for Axtel's wholesale segment.

Government Digitalization Initiatives

Axtel's strategic alignment with government digitalization initiatives presents a significant avenue for expansion. The company has demonstrated success by securing and renewing contracts with various government bodies, which has directly fueled robust growth within its public sector segment. This trend is expected to continue as governments at all levels prioritize digital transformation.

The ongoing push by federal and local governments to digitize their operations creates a fertile ground for Axtel. These efforts often translate into multi-year projects, offering Axtel sustained opportunities to deliver essential value-added services and spearhead digital transformation efforts. For instance, in 2024, Mexico's federal government allocated a substantial budget towards digital infrastructure and cybersecurity, directly benefiting companies like Axtel that offer these specialized services.

- Secured Government Contracts: Axtel has a proven track record of winning and retaining contracts with government entities, underscoring its capabilities and trustworthiness in the public sector.

- Digital Transformation Demand: The widespread government drive to modernize processes and services creates a consistent demand for Axtel's digital solutions and expertise.

- Multi-Annual Project Potential: The nature of government digitalization projects often spans several years, providing Axtel with predictable revenue streams and long-term engagement opportunities.

- Growth in Public Sector Segment: The company's government segment has experienced solid growth, directly attributable to these digitalization efforts and contract wins.

Mexico's accelerating digital transformation, particularly in cloud and cybersecurity, presents significant growth avenues for Axtel. The Mexican cloud computing market was projected to reach approximately $5.7 billion in 2024, with the cybersecurity market expected to hit around USD 4.77 billion by 2034, growing at an annual rate of 8.00% from 2025 to 2034. Axtel's focus on these areas, coupled with its existing IT security offerings and partnerships, positions it well to capitalize on this burgeoning demand.

The expansion of 5G networks and the proliferation of IoT devices across Mexico create further opportunities for Axtel to leverage its network capabilities for backhaul and specialized connectivity services. Furthermore, the global nearshoring trend is driving demand for robust digital infrastructure, benefiting Axtel's extensive fiber optic network and international connectivity assets, particularly for its wholesale business segment.

Axtel's strategic alignment with government digitalization initiatives is a key growth driver, evidenced by its success in securing and renewing contracts with public sector entities. The ongoing push by governments to digitize operations, supported by substantial budgets allocated to digital infrastructure and cybersecurity in 2024, offers sustained opportunities for Axtel to deliver value-added services.

| Opportunity Area | Market Projection/Trend | Axtel's Advantage |

|---|---|---|

| Digital Transformation & Cloud Services | Mexican cloud market projected ~$5.7B in 2024; ongoing business migration. | Axtel's focus on IT, cloud, and existing infrastructure. |

| Cybersecurity | Mexican cybersecurity market ~$4.77B by 2034 (8% CAGR 2025-2034). | Axtel's IT security offerings and partnerships. |

| 5G & IoT Expansion | Accelerating 5G build-out; growing IoT device adoption. | Axtel's network capabilities for backhaul and IoT connectivity. |

| Nearshoring & Data Centers | Increased demand for digital infrastructure due to nearshoring; rising data center investments. | Extensive fiber optic network; international network crossings for wholesale. |

| Government Digitalization | Government focus on digitizing operations; significant 2024 budget allocation for digital infrastructure. | Proven track record with government contracts; strong public sector segment growth. |

Threats

The Mexican telecommunications sector is notoriously competitive, and with services increasingly blending together, Axtel faces relentless pressure to keep its prices down. This intense price competition is a significant threat.

Larger rivals with deeper pockets can afford to implement aggressive pricing tactics, even offering subsidized rates. For Axtel, this often means being forced to match these lower prices, which directly squeezes its operating margins and can negatively impact its overall financial health.

High annual spectrum usage rights fees in Mexico represent a significant hurdle for 5G expansion. For instance, the Mexican government collected approximately MXN 12.6 billion (around USD 700 million) in spectrum usage fees in 2023, a figure that can strain operator budgets. If these fees persist at elevated levels, they could disincentivize Axtel and its competitors from making the substantial investments needed for robust 5G infrastructure development. This directly impacts Axtel's ability to capitalize on future growth opportunities in this vital technological advancement.

The telecom sector in Mexico faces escalating cybersecurity threats, with hacking and data breaches posing significant risks. Axtel, despite offering its own security solutions, is not immune to the increasing sophistication of these attacks.

A major concern is the potential for breaches to impact Axtel or its clientele, which could result in substantial reputational harm, hefty regulatory penalties, and costly legal repercussions. The Mexican government has been increasing its focus on data protection, with the National Institute for Transparency, Access to Information and Personal Data Protection (INAI) actively enforcing regulations.

Macroeconomic Volatility and Exchange Rate Risk

Axtel's financial projections for 2025 are anchored to specific macroeconomic forecasts for Mexico, encompassing anticipated GDP expansion and currency exchange rates. Any deviations from these assumptions, especially concerning the MXN/USD exchange rate, could materially affect the company's earnings, even with existing hedging strategies in place.

For instance, if Mexico's GDP growth in 2025 falls short of the projected 2.5% to 3.5% range, Axtel's revenue streams, particularly those tied to domestic economic activity, might experience headwinds. Similarly, a significant depreciation of the Mexican Peso against the US Dollar, beyond the assumed MXN 18.00-18.50 range, could increase the cost of imported equipment and services, impacting profitability.

- GDP Growth Sensitivity: A 1% decrease in projected Mexican GDP growth could reduce Axtel's revenue by an estimated 0.5% to 1.0%.

- Exchange Rate Impact: A 5% weakening of the MXN against the USD could increase Axtel's operating expenses by approximately 1.5% due to higher import costs.

- Hedging Effectiveness: While Axtel utilizes hedging instruments, their effectiveness can be limited in periods of extreme currency volatility, potentially exposing the company to unmitigated exchange rate risk.

- 2025 Guidance Factors: The company's 2025 guidance explicitly states reliance on a stable macroeconomic environment, making it vulnerable to unforeseen economic shocks.

Infrastructure Limitations and Digital Divide

Despite Mexico's growing digital economy, significant infrastructure limitations and a pronounced digital divide persist, particularly impacting rural areas. This uneven broadband access hinders Axtel's potential for uniform service expansion and reaching underserved populations, thereby capping its market penetration capabilities. For instance, as of 2024, while urban connectivity rates are improving, a substantial portion of the population, especially in remote regions, still lacks reliable internet access, directly affecting Axtel's addressable market.

These limitations translate into tangible challenges for Axtel's growth strategy. The company's ability to deploy its advanced fiber optic networks is constrained by the existing physical infrastructure, or lack thereof, in many parts of the country. This means that while demand may exist, the practical rollout of services can be significantly delayed or even unfeasible in certain territories.

The digital divide also presents a threat by segmenting the market. Axtel may find it difficult to achieve economies of scale if its service area is fragmented due to poor infrastructure. This uneven distribution of connectivity means that Axtel's revenue potential is not evenly spread across Mexico, requiring a more targeted and potentially costlier approach to expansion.

- Infrastructure Gaps: Many regions in Mexico still lack the necessary fiber optic backbone or reliable last-mile connectivity to support high-speed internet services.

- Digital Divide Impact: Approximately 40% of Mexican households, predominantly in rural and low-income areas, had limited or no internet access as of late 2024, restricting Axtel's potential customer base.

- Expansion Costs: Building out new infrastructure in underserved areas is capital-intensive and may yield lower returns compared to expanding in already well-connected regions.

- Competitive Disadvantage: Competitors with a stronger presence in well-developed areas might capture market share more easily, leaving Axtel to navigate more challenging, less profitable territories.

Intense price wars in the Mexican telecom market, driven by larger competitors, force Axtel to lower its prices, directly impacting profit margins. High spectrum usage fees, like the MXN 12.6 billion collected in 2023, also strain budgets and can hinder crucial 5G investments. Furthermore, escalating cybersecurity threats pose a risk of reputational damage and significant financial penalties.

Axtel's financial performance is sensitive to Mexico's macroeconomic stability; for instance, a 1% GDP growth shortfall could reduce revenue by up to 1%, and a 5% MXN depreciation could increase operating expenses by 1.5%. Persistent infrastructure gaps and the digital divide mean that roughly 40% of Mexican households lack reliable internet access, limiting Axtel's addressable market and increasing expansion costs in underserved regions.

SWOT Analysis Data Sources

This SWOT analysis for Axtel is built upon a robust foundation of data, including Axtel's official financial statements, comprehensive market research reports, and expert analyses from telecommunications industry professionals.