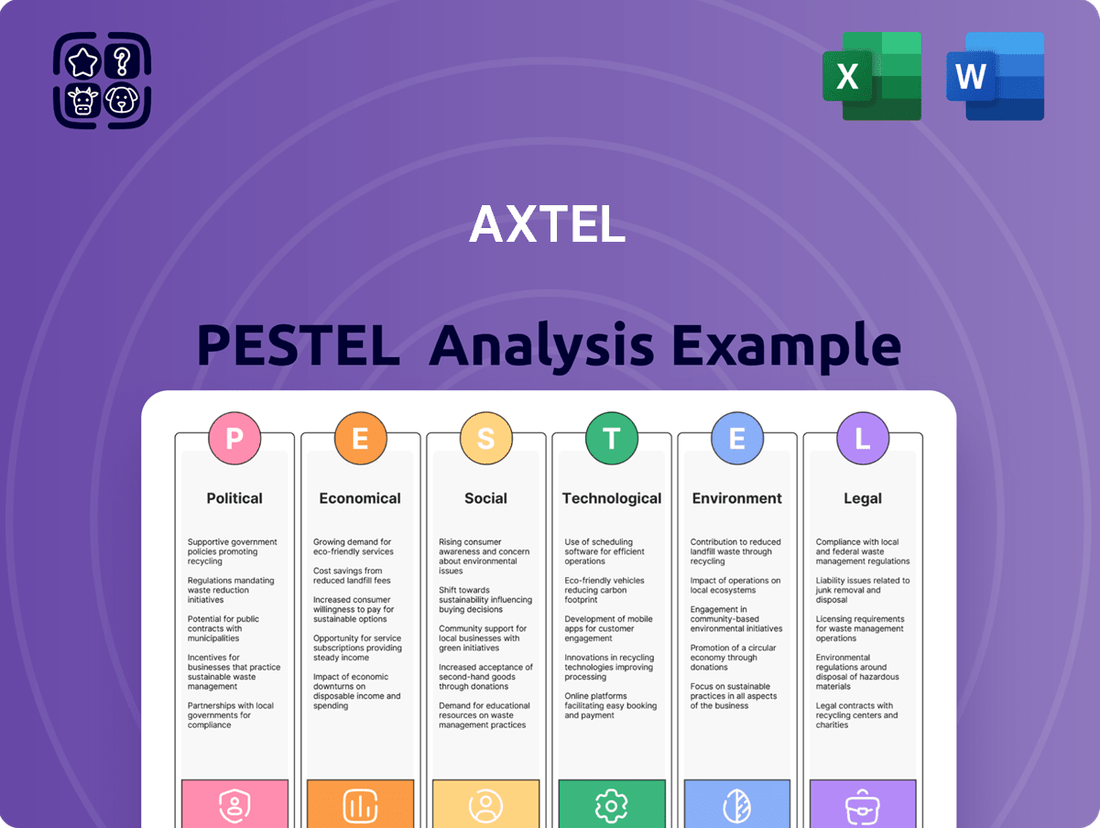

Axtel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axtel Bundle

Uncover the hidden forces shaping Axtel's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to emerging technological advancements, this report provides the critical context you need to make informed decisions. Don't get left behind – download the full analysis now and gain a strategic advantage.

Political factors

Mexico's telecommunications sector is experiencing a major overhaul with the phasing out of the Federal Telecommunications Institute (IFT) and the creation of the Agency of Digital Transformation and Telecommunications (ATDT). This change, stemming from a constitutional reform in late 2024 and a bill in April 2025, will significantly alter the rules for companies like Axtel.

The ATDT will now be the central body responsible for setting telecommunications and broadcasting policies. This consolidation of power aims to streamline regulation and potentially accelerate digital transformation initiatives across the country, impacting Axtel's operational strategies and market access.

A significant shift in Mexico's telecommunications landscape is on the horizon with the June 2025 telecoms reform bill, which designates the Mexican State as a direct commercial and public internet service provider. This move could fundamentally alter the competitive environment for companies like Axtel.

Under this new framework, public institutions may find themselves competing directly with private entities in public spectrum tenders. Furthermore, the bill proposes granting free spectrum access to governmental and social coverage objectives, potentially creating an uneven playing field for established private providers.

New telecommunications laws empower the ATDT to directly assign spectrum for commercial use, bypassing auctions. This shift from the previous auction-based system could significantly alter Axtel's access to crucial radio frequencies, potentially impacting the speed and cost of their network expansion.

The legislation mandates a broader reform of spectrum management, integrating international standards and permitting spectrum allocation or reduced fees in exchange for coverage commitments. This reform directly influences Axtel's operational costs and strategic decisions regarding network build-out, especially in underserved areas.

Universal Broadband Access Initiatives

Mexico's commitment to universal broadband access, reinforced by a 2024 constitutional reform, positions internet connectivity as a governmental responsibility. This policy shift presents Axtel with avenues to engage in state-sponsored projects aimed at expanding digital inclusion, particularly in rural and underserved territories. However, this also signals a potential for greater competition from state-backed entities in these same markets.

The Mexican government's strategy to bridge the digital divide is a significant political factor. By declaring affordable connectivity a state obligation, the administration is actively seeking to connect millions of currently unconnected citizens. For Axtel, this translates into potential partnerships and contracts for infrastructure development in areas where commercial viability has historically been a challenge. For instance, the government aims to connect 92% of households by 2028, a target that will likely involve public-private collaborations.

- Government Mandate: Universal broadband access is now a constitutional right in Mexico, driving public investment.

- Digital Divide Focus: Initiatives prioritize connecting rural and low-income populations, creating new market segments.

- Public-Private Partnerships: Opportunities exist for Axtel to collaborate on government-funded broadband deployment projects.

- Potential State Competition: Increased government involvement could lead to state-owned or subsidized competitors in certain areas.

Political Stability and Policy Continuity

The political landscape in Mexico, particularly with President Claudia Sheinbaum and the ruling party's congressional majority, is poised to facilitate the passage of a new telecommunications law. This political alignment suggests a degree of policy continuity, which can be beneficial for businesses like Axtel by offering a clearer regulatory path. However, the proposed shift of power from an autonomous body to a government agency could introduce uncertainties regarding regulatory independence and future policy adjustments.

The current administration's legislative strength, demonstrated by its majority in both the Chamber of Deputies and the Senate following the June 2024 elections, underpins the expectation of a swift approval for the new telecommunications framework. This majority is a significant factor for Axtel, as it reduces the risk of legislative gridlock on crucial sector reforms. The government's stated aim is to modernize and streamline telecommunications regulation, potentially leading to increased competition and investment opportunities.

- Presidential Mandate: President Sheinbaum's party holds a strong position, influencing the legislative agenda.

- Congressional Majority: The ruling party's control of Congress and Senate simplifies the legislative process for new laws.

- Regulatory Reform Focus: The government prioritizes telecommunications law updates, impacting Axtel's operating environment.

Mexico's political landscape is actively shaping its telecommunications future, with a strong presidential mandate and congressional majority expected to expedite the passage of new sector laws by mid-2025. This political stability, particularly under President Claudia Sheinbaum, signals a direct government approach to digital transformation, potentially impacting Axtel's strategic planning.

The upcoming telecommunications reform, driven by a constitutional amendment in late 2024 and a new bill in April 2025, centralizes regulatory power under the Agency of Digital Transformation and Telecommunications (ATDT). This move aims to streamline operations and fulfill the government's commitment to universal broadband access, a key political objective for connecting an estimated 92% of households by 2028.

A significant political shift involves the Mexican State acting as a direct internet service provider, potentially altering competitive dynamics for Axtel. Furthermore, the direct assignment of spectrum by the ATDT, bypassing auctions, represents a substantial political intervention in market access, impacting Axtel's operational costs and expansion strategies.

| Political Factor | Description | Implication for Axtel |

|---|---|---|

| Regulatory Consolidation | IFT phased out, ATDT created (effective April 2025) | Streamlined but potentially more centralized regulatory control |

| State as ISP | Mexican State to become direct internet provider (June 2025 bill) | Increased competition from state-backed entities |

| Spectrum Allocation | ATDT can directly assign spectrum, bypassing auctions | Altered access to crucial radio frequencies, potential cost impacts |

| Universal Broadband Mandate | Constitutional reform (2024) makes connectivity a state responsibility | Opportunities for state-sponsored projects, but also potential for state competition |

| Legislative Stability | President Sheinbaum's party holds congressional majority | Smoother passage of reforms, but potential for policy shifts based on government priorities |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external forces impacting Axtel, detailing how political, economic, social, technological, environmental, and legal factors create both challenges and avenues for growth.

A structured PESTLE analysis for Axtel that highlights key external factors, simplifying complex market dynamics for strategic decision-making.

Economic factors

Mexico's economic growth is anticipated to moderate, with GDP forecasts for 2025 revised to approximately 1%. This general economic slowdown could dampen overall business activity and consumer spending, potentially affecting demand for Axtel's ICT services across its enterprise, government, and residential customer segments.

However, the telecommunications sector is demonstrating resilience and is expected to remain a stabilizing force within the economy. This sector's inherent demand, driven by digitalization and connectivity needs, may provide a buffer against broader economic headwinds for companies like Axtel.

Inflation in Mexico has been a persistent concern, exceeding the central bank's target for multiple years. Forecasts for 2025 suggest inflation will settle around 3.91%. This sustained inflationary pressure directly impacts Axtel's operational expenses, especially for imported technology and services, potentially increasing costs.

Currency exchange rate dynamics also play a crucial role. Projections indicate a gradual depreciation of the Mexican peso against the US dollar. For Axtel, this could affect the cost of USD-denominated debt and the value of its dollar-based revenues, influencing overall financial performance.

The Mexican telecommunications market is poised for substantial expansion, projected to grow by USD 18.1 billion from 2024 to 2029, reflecting an 8.2% compound annual growth rate. This upward trend is fueled by technological advancements like 5G deployment and increased smartphone adoption, creating a fertile ground for Axtel's services.

The increasing penetration of smartphones, expected to reach 80% of the population by 2025, directly correlates with higher demand for data and connectivity, benefiting telecom providers like Axtel. Furthermore, the burgeoning use of mobile financial services in Mexico is driving further innovation and infrastructure investment within the sector.

Investment in Infrastructure and Digital Transformation

The Mexican government's commitment to infrastructure modernization, especially in broadband access, is a significant tailwind. For instance, the Federal Electricity Commission (CFE) continues to expand its fiber optic backbone, aiming to reach underserved areas. This push directly fuels the increasing demand for high-speed data services across the nation.

Axtel's strategic focus on expanding its fiber optic network and bolstering its IT and cybersecurity solutions is well-positioned to capitalize on these trends. These investments are vital for Axtel to meet the burgeoning demand for digital transformation across various industries, from finance to manufacturing.

- Infrastructure Investment: Mexico's National Development Plan prioritizes digital infrastructure, with significant allocations towards broadband expansion and connectivity projects.

- Digital Transformation Demand: Businesses across Mexico are increasingly adopting cloud services, data analytics, and cybersecurity solutions, driving demand for robust digital infrastructure.

- Axtel's Strategy: Axtel's continued investment in its fiber optic network and its expansion into IT and cybersecurity services directly align with and benefit from these national and sectoral trends.

Competition and Pricing Pressures

The Mexican telecommunications sector is intensely competitive, with major players like América Móvil, AT&T, and Telmex actively competing for subscribers. This rivalry significantly impacts pricing, forcing companies like Axtel to constantly innovate and consider strategic moves, such as acquisitions, to secure and expand their revenue streams amidst market growth.

Axtel faces substantial pricing pressures due to the aggressive strategies of its larger competitors. For instance, in 2023, the average revenue per user (ARPU) in the Mexican mobile market remained a key battleground, with providers offering competitive plans to attract and retain customers. This environment necessitates Axtel to differentiate its offerings beyond just price, focusing on service quality and specialized solutions.

- Intense Market Rivalry: América Móvil, AT&T, and Telmex dominate the Mexican telecom landscape, creating a challenging environment for smaller players like Axtel.

- Pricing Sensitivity: Fierce competition often translates into downward pressure on prices for both mobile and fixed-line services, impacting Axtel's revenue margins.

- Need for Differentiation: To thrive, Axtel must focus on unique value propositions and service quality to stand out in a crowded market.

- Strategic Acquisitions: The competitive nature of the market may drive Axtel to explore mergers or acquisitions to gain scale and market share.

Mexico's economic growth is projected to slow in 2025, with GDP forecasts around 1%. This moderation could impact consumer spending and overall business activity, potentially affecting demand for Axtel's services. However, the telecommunications sector is expected to remain robust, driven by ongoing digitalization and connectivity needs, offering a stabilizing influence.

Inflation in Mexico is anticipated to ease to approximately 3.91% in 2025, though it remains a concern for operational costs, particularly for imported technology. The Mexican peso is also projected to depreciate gradually against the US dollar, influencing Axtel's debt servicing and dollar-denominated revenues.

The Mexican telecommunications market is set for significant expansion, expected to grow by USD 18.1 billion between 2024 and 2029, at an 8.2% CAGR. This growth is propelled by 5G deployment and increasing smartphone penetration, which is forecast to reach 80% by 2025, directly boosting demand for data services.

| Economic Indicator | 2024 Projection | 2025 Projection | Impact on Axtel |

| GDP Growth | ~2.5% | ~1.0% | Potential slowdown in demand, but sector resilience offers buffer. |

| Inflation Rate | ~4.5% | ~3.91% | Increased operational costs, especially for imported tech. |

| Peso Depreciation | Gradual | Gradual | Higher USD-denominated debt costs, impact on dollar revenues. |

| Telecom Market Growth (2024-2029) | N/A | 8.2% CAGR | Significant opportunity for service expansion and revenue growth. |

Same Document Delivered

Axtel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Axtel PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed strategic overview for informed decision-making.

Sociological factors

Mexico continues to grapple with a significant digital divide, where around 70% of households in rural areas lack reliable internet access, a stark contrast to urban centers. This disparity impacts education, economic opportunities, and access to essential services for a large segment of the population.

Axtel can leverage this challenge as a strategic opportunity by aligning with government programs focused on expanding broadband infrastructure. For instance, the Mexican government's National Digital Strategy aims for universal connectivity by 2030, creating a favorable environment for companies investing in underserved regions.

Mexico's population is growing, and with it, internet access and smartphone use are also on the rise. By the end of 2024, it's projected that over 90 million Mexicans will be online, a significant increase from previous years. This expanding digital footprint means more individuals and businesses are comfortable with technology.

This surge in digital literacy directly benefits companies like Axtel. As more people and enterprises embrace online activities, the demand for reliable broadband internet and sophisticated ICT solutions, such as managed network services, naturally climbs. Axtel is well-positioned to capitalize on this trend, offering services that cater to this growing digitally engaged population.

The shift towards remote work and online education, accelerated by global events, continues to shape how people learn and conduct business. This trend directly impacts the need for robust internet infrastructure. For instance, a 2024 report indicated that over 60% of companies worldwide now offer hybrid or fully remote work options, underscoring the sustained reliance on digital connectivity.

Axtel can capitalize on this evolution by focusing on its broadband services for homes, ensuring reliable high-speed internet for remote workers and students. Furthermore, the company’s managed network and IT security solutions are crucial for businesses navigating hybrid work models, offering them the tools to maintain productivity and data protection in a decentralized environment.

Demand for Digital and Mobile Services

Mexican consumers are increasingly embracing digital and mobile platforms for a wide array of services, including financial transactions. This societal shift is particularly evident in the growing demand for mobile financial services, indicating a strong preference for convenience and accessibility.

This trend directly fuels the need for advanced telecommunications infrastructure capable of supporting these digital interactions. Axtel's focus on broadband and IT security aligns perfectly with this evolving consumer behavior, positioning the company to capitalize on the growing digital economy.

For example, in 2024, it's estimated that over 80% of internet users in Mexico engage with online services regularly, with a significant portion of these interactions occurring via mobile devices. This widespread adoption underscores the importance of reliable digital connectivity for businesses like Axtel.

- Growing Mobile Penetration: Mexico's mobile penetration rate is expected to reach over 90% by the end of 2024, driving demand for mobile-first services.

- Digital Payment Adoption: A significant portion of the Mexican population, particularly younger demographics, is shifting towards digital payment methods, reducing reliance on cash.

- E-commerce Growth: The e-commerce sector in Mexico saw substantial growth in 2023, projected to continue its upward trajectory in 2024, further emphasizing the need for robust digital infrastructure.

Cybersecurity Awareness and Trust

As more people and businesses rely on digital services, there's a growing worry about cybersecurity. This societal shift is a significant advantage for Axtel, whose IT security solutions directly address these concerns. Building and maintaining trust in secure digital spaces is paramount for Axtel to attract and keep customers.

The increasing digital footprint means more potential targets for cyberattacks. For instance, a 2024 report indicated a 15% rise in reported cyber incidents compared to the previous year. This trend underscores the public's growing demand for robust security measures, a demand Axtel is positioned to meet.

- Growing Public Concern: Surveys in late 2024 showed that over 70% of consumers are more concerned about their online data privacy than they were a year ago.

- Demand for Secure Services: Businesses are increasingly investing in cybersecurity, with global spending projected to reach $250 billion in 2025, up from $200 billion in 2023.

- Trust as a Differentiator: Axtel's ability to demonstrate a strong track record in cybersecurity directly impacts customer confidence and adoption of its digital platforms.

Societal shifts in Mexico highlight a growing digital divide, with rural areas lagging in internet access, impacting opportunities. However, increasing mobile penetration, projected over 90% by late 2024, and a surge in online service adoption, with over 80% of users engaging digitally in 2024, present significant growth avenues for Axtel. The rising concern for cybersecurity, with over 70% of consumers expressing increased worry about data privacy in late 2024, further positions Axtel's IT security solutions as a critical offering.

| Sociological Factor | 2024/2025 Data Point | Implication for Axtel |

|---|---|---|

| Digital Divide | ~70% of rural Mexican households lack reliable internet access. | Opportunity for infrastructure expansion aligned with government initiatives. |

| Internet & Smartphone Adoption | Over 90 million Mexicans online by end of 2024; mobile penetration >90% by end of 2024. | Increased demand for broadband and ICT solutions. |

| Remote Work & Online Education | Over 60% of global companies offer hybrid/remote work (2024). | Sustained need for robust home broadband and business network solutions. |

| Digital Payment & E-commerce | E-commerce growth projected to continue in 2024; over 80% of internet users engage online (2024). | Reinforces demand for advanced telecommunications infrastructure. |

| Cybersecurity Concerns | Over 70% of consumers more concerned about online privacy (late 2024); 15% rise in cyber incidents (2024). | Directly benefits Axtel's IT security solutions, driving customer acquisition and trust. |

Technological factors

Mexico's 5G rollout is accelerating, with forecasts indicating 16.9 million connected mobile devices by 2025 and an impressive 87 million by 2030. This substantial network expansion creates a significant opening for Axtel to deliver cutting-edge, high-speed connectivity services.

Axtel can capitalize on this technological shift by developing innovative solutions tailored for its enterprise and government clientele, leveraging the enhanced capabilities of 5G for new service offerings.

The expansion of the Internet of Things (IoT) and cloud computing is a major force in Mexico's telecommunications sector. By the end of 2024, it's estimated that over 30 billion IoT devices will be connected globally, a trend that directly fuels demand for robust network infrastructure and data management services.

Axtel is strategically positioned to capitalize on this trend, particularly with its data center offerings and managed network solutions. The company's infrastructure is designed to support the increasing data traffic and processing needs generated by IoT deployments and the migration of businesses to cloud environments, a market segment projected for significant growth through 2025.

The escalating threat of cybersecurity breaches presents a significant challenge for Mexico's telecom sector. Axtel's focus on providing advanced IT security solutions for businesses and government clients directly addresses this growing concern, positioning its expertise as a key driver of demand.

In 2024, the Mexican cybersecurity market is projected to reach approximately USD 2.5 billion, with a compound annual growth rate of over 15% expected through 2028. This robust growth underscores the critical need for companies like Axtel to continuously invest in and offer sophisticated cybersecurity services, directly impacting their revenue streams and market positioning.

Integration of Artificial Intelligence (AI)

Axtel is making significant strides in integrating Artificial Intelligence (AI) into its operations, a key technological factor. The company recently launched its first AI-based financial analysis assistant, a product of its collaboration with a software factory in India. This initiative underscores Axtel's dedication to enhancing internal efficiency through advanced technology.

This AI integration is not just about streamlining internal processes; it signals Axtel's forward-thinking approach. The company is likely exploring how these AI capabilities can be translated into novel services and solutions for its clientele. This strategic move positions Axtel to capitalize on the growing demand for AI-driven insights in the financial sector, potentially opening new revenue streams and strengthening its competitive edge.

- AI-Powered Efficiency: Axtel's AI assistant aims to automate complex financial analysis, reducing manual effort and accelerating decision-making.

- Innovation Pipeline: The development of this AI tool suggests a broader strategy to embed AI across Axtel's service offerings, creating differentiated value for customers.

- Market Responsiveness: By embracing AI, Axtel is aligning with industry trends and preparing to meet evolving client expectations for technologically advanced financial solutions.

Fiber Optic Network Expansion

Axtel is making significant strides in its fiber optic network expansion, a key technological factor. The company is investing heavily in this area, including a notable project to add over 1,100 kilometers of fiber optic cable connecting Querétaro and Texas. This strategic move is designed to bolster cross-border connectivity, a crucial element in today's interconnected digital economy.

This expansion directly addresses the escalating demand for high-capacity data transmission. Emerging technologies such as artificial intelligence, cloud computing, and the growing needs of global carriers and hyperscale data centers are all pushing the boundaries of current network capabilities. Axtel's investment positions them to capitalize on this trend.

- Fiber Optic Network Expansion: Axtel is adding over 1,100 km of fiber between Querétaro and Texas.

- Transborder Connectivity: This expansion is vital for strengthening links between Mexico and the United States.

- Demand Drivers: The growth is fueled by AI, global carriers, and hyperscaler services requiring high-capacity data.

- Strategic Investment: Axtel's commitment to network infrastructure underpins its future growth strategy.

Mexico's 5G network is rapidly expanding, with projections of 16.9 million connected mobile devices by 2025, creating a prime opportunity for Axtel to offer advanced high-speed connectivity.

The burgeoning IoT and cloud computing sectors are driving demand for robust network infrastructure, a trend Axtel is well-positioned to leverage with its data center and managed network solutions.

Axtel's investment in AI, demonstrated by its new financial analysis assistant developed with an Indian software factory, highlights its commitment to enhancing operational efficiency and exploring new AI-driven services.

The company's substantial fiber optic network expansion, including over 1,100 km between Querétaro and Texas, directly supports the high-capacity data needs of AI, cloud computing, and global carriers.

| Technological Factor | Description | Axtel's Strategy/Impact | Market Data/Projections |

| 5G Rollout | Expansion of 5G networks in Mexico | Opportunity for high-speed connectivity services | 16.9 million connected mobile devices by 2025 |

| IoT & Cloud Computing | Growth in connected devices and cloud adoption | Increased demand for network infrastructure and data management | Global IoT devices to exceed 30 billion by end of 2024 |

| Cybersecurity | Increasing threat of data breaches | Demand for advanced IT security solutions | Mexican cybersecurity market projected at USD 2.5 billion in 2024, growing >15% annually |

| Artificial Intelligence (AI) | Integration of AI into operations and services | Enhanced internal efficiency, potential for new AI-driven client services | Axtel launched AI-based financial analysis assistant |

| Fiber Optic Expansion | Investment in high-capacity data transmission infrastructure | Supports growing data needs of new technologies and global clients | Adding over 1,100 km of fiber between Querétaro and Texas |

Legal factors

A significant legal shift occurred in July 2025 with the publication of the New Telecommunications and Broadcasting Law, which supersedes the prior Federal Telecommunications and Broadcasting Law. This new framework, a product of reforms initiated in late 2024, marks the dissolution of the Federal Telecommunications Institute (IFT) and the establishment of the Telecommunications Regulatory Commission (CRT) as the primary regulatory body. Axtel must now adapt its strategies to comply with this revised legal and institutional landscape.

Mexico's Federal Law for the Protection of Personal Data in Possession of Private Parties, effective March 2025, significantly updates data protection standards. This new legislation, replacing the previous law, introduces stricter consent requirements and elaborates on ARCO rights, which grant individuals access, rectification, cancellation, and opposition to their personal data. Axtel must align its data processing activities with these enhanced legal mandates to ensure compliance and safeguard customer information.

Regulatory oversight for these data protection laws has been transferred to the Secretariat of Anti-Corruption and Good Governance (SABG). This shift underscores a greater emphasis on accountability and enforcement within the Mexican regulatory landscape. Axtel's adherence to the updated data protection framework will be crucial for maintaining operational integrity and avoiding potential penalties under the new SABG purview.

Starting July 1, 2025, Mexico's IFT will mandate a new IFT Seal for all telecommunications devices. This change, coupled with updated homologation guidelines that permit more flexible labeling, including digital methods, directly impacts Axtel. As a significant player in ICT services, Axtel must ensure all its hardware complies with these evolving certification and labeling mandates.

Antitrust and Competition Regulation Changes

Recent telecommunications reforms in Mexico have significantly altered the antitrust landscape for companies like Axtel. These changes transfer the authority for overseeing antitrust matters within the telecommunications sector from the Federal Institute of Telecommunications (IFT) to the National Antitrust Commission (CNA). This transition means Axtel will now navigate a different regulatory body for competition-related issues.

The shift in authority to the CNA could introduce new dynamics and potentially alter the intensity of regulatory scrutiny concerning Axtel's market position. For instance, the CNA's approach to defining and addressing market dominance in the telecommunications sector may differ from the IFT's past practices, impacting Axtel's strategic planning and compliance efforts.

- Regulatory Authority Shift: Antitrust oversight for telecommunications moves from IFT to CNA.

- Impact on Market Dynamics: Axtel faces a new competition regulator, potentially altering market scrutiny.

- Potential for New Scrutiny: The CNA's interpretation of market dominance could affect Axtel's operations.

Spectrum Usage Rights Fees and Concessions

Spectrum usage rights fees in Mexico represent a substantial operational cost for telecommunications companies like Axtel. Historically, these fees have been high enough to prompt some operators to return spectrum licenses, impacting market dynamics.

A recent legislative development aims to alleviate some of this burden. A new bill proposes discounts on spectrum payments, specifically targeting operators that commit to expanding coverage in rural and underserved regions. This initiative is designed to encourage broader access to telecommunications services across Mexico.

The effectiveness of these discounts and the broader spectrum concession framework, overseen by the new regulatory body, will directly influence Axtel's strategic investment decisions. These factors will shape Axtel's ability to acquire and utilize spectrum efficiently, thereby impacting its operational costs and expansion plans.

- Annual spectrum usage rights fees are a significant financial commitment for Mexican telecom operators.

- New legislation offers discounts on spectrum fees to incentivize coverage in rural areas.

- The regulatory framework for spectrum concessions will continue to shape Axtel's investment strategies and operational expenses.

The legal landscape for Axtel in Mexico has undergone significant transformation with the July 2025 implementation of the New Telecommunications and Broadcasting Law, which centralizes regulatory authority under the Telecommunications Regulatory Commission (CRT) and dissolves the IFT. Furthermore, stricter data protection standards are enforced by the Secretariat of Anti-Corruption and Good Governance (SABG) under the updated Federal Law for the Protection of Personal Data in Possession of Private Parties, impacting Axtel's data handling practices. Antitrust matters within the sector are now managed by the National Antitrust Commission (CNA), potentially altering Axtel's competitive strategy and market oversight.

Axtel must also navigate updated device homologation requirements, including the new IFT Seal mandated from July 1, 2025, which allows for more flexible labeling methods. The company's investment in spectrum usage rights is also influenced by a new bill proposing discounts for operators expanding coverage to underserved regions, a move designed to promote equitable access to telecommunications services across Mexico.

Environmental factors

Axtel's extensive network infrastructure, supporting broadband, data centers, and managed services, is a significant consumer of energy. The telecommunications sector globally is under increasing scrutiny for its carbon footprint, with data centers alone accounting for a substantial portion of electricity usage. For instance, global data center energy consumption was estimated to be around 1% of total electricity demand in 2023, a figure expected to rise with the growth of cloud computing and AI.

As demand for Axtel's services continues to surge, optimizing energy efficiency across its network operations and data centers becomes critical. This not only addresses environmental concerns but also presents an opportunity to manage operational costs effectively. Companies in the sector are increasingly investing in energy-efficient hardware and renewable energy sources to mitigate these impacts.

The telecommunications industry, including companies like Axtel, faces increasing scrutiny regarding electronic waste (e-waste). The lifecycle of network equipment and customer devices contributes to a significant global e-waste stream. For instance, the United Nations reported that global e-waste generation reached 53.6 million metric tons in 2019, with projections indicating it could climb to 74 million metric tons by 2030.

While Axtel's core business is service provision, its involvement in managing IT infrastructure means it's indirectly affected by evolving e-waste regulations and the push for circular economy principles. This could lead to changes in how Axtel procures, maintains, and ultimately disposes of its technology assets, favoring vendors with robust recycling programs and longer product lifecycles.

There's a significant global push for businesses to shrink their carbon footprint. Axtel, like many companies, is likely to feel this pressure from regulators, investors, and customers who increasingly demand environmental responsibility.

This could mean Axtel needs to invest in renewable energy sources for its operations, such as solar or wind power for its data centers and offices. For instance, in 2024, many telecommunication companies are exploring power purchase agreements for renewable energy to meet sustainability targets.

Optimizing network energy consumption through more efficient hardware and software is another key strategy. By 2025, advancements in AI-driven network management are expected to significantly reduce energy usage in the telecom sector.

Sustainable ICT Solutions

Axtel can capitalize on the growing demand for sustainable technology by developing and marketing 'Green ICT' solutions. These offerings can assist enterprise and government clients in reducing their own environmental footprints, a key driver for many organizations in 2024 and beyond.

By providing energy-efficient data center services, cloud solutions that reduce the need for on-premises hardware, or smart building technologies, Axtel can directly support its clients' sustainability objectives. This strategic alignment is crucial for attracting environmentally conscious businesses.

The global market for green IT is expanding rapidly. For instance, the market for sustainable data centers was projected to reach over $50 billion by 2025, indicating a substantial opportunity for companies like Axtel to offer specialized services.

- Energy-Efficient Data Centers: Reducing power consumption and utilizing renewable energy sources for operations.

- Cloud Solutions: Offering scalable cloud services that minimize the need for clients to maintain energy-intensive local hardware.

- Smart Building Technologies: Implementing IoT and AI-driven solutions to optimize energy usage in commercial and government facilities.

Climate Change Adaptation and Infrastructure Resilience

Mexico's vulnerability to natural disasters poses a significant risk to telecommunications infrastructure, impacting service availability and asset integrity. Axtel must prioritize climate change adaptation by investing in resilient network designs and robust disaster recovery protocols to mitigate these environmental threats.

The company's strategic approach should encompass building adaptable infrastructure capable of withstanding extreme weather events and ensuring service continuity. This includes implementing redundant systems and reinforcing physical assets against seismic activity and flooding, which are increasingly prevalent concerns.

For instance, Mexico experiences an average of 40 earthquakes annually that are felt by the population, and in 2023, the country faced significant hurricane activity impacting coastal regions. These events underscore the critical need for proactive infrastructure hardening.

- Infrastructure Hardening: Investing in earthquake-resistant structures and flood defenses for critical network nodes.

- Redundancy and Diversification: Establishing backup power sources and diversifying network routes to prevent single points of failure.

- Disaster Preparedness: Developing comprehensive emergency response plans and conducting regular drills to ensure swift recovery from disruptions.

- Climate Risk Assessment: Continuously evaluating the impact of climate change on network operations and adapting strategies accordingly.

Axtel's operations, particularly its data centers and network infrastructure, are significant energy consumers, contributing to the telecommunications sector's environmental footprint. The global push for sustainability is intensifying, with a growing emphasis on reducing carbon emissions and managing electronic waste. By 2025, advancements in AI-driven network management are expected to significantly improve energy efficiency in the telecom industry.

Mexico's susceptibility to natural disasters like earthquakes and hurricanes necessitates robust infrastructure resilience for Axtel. Proactive investment in adaptable network designs and comprehensive disaster recovery plans is crucial to ensure service continuity and protect assets. For example, Mexico experiences numerous earthquakes annually, and significant hurricane activity impacts coastal regions, highlighting the need for proactive infrastructure hardening.

PESTLE Analysis Data Sources

Our Axtel PESTLE Analysis is meticulously constructed using data from official government publications, reputable market research firms, and international economic bodies. We ensure each insight into political, economic, social, technological, legal, and environmental factors is grounded in current, verifiable information.