Axtel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axtel Bundle

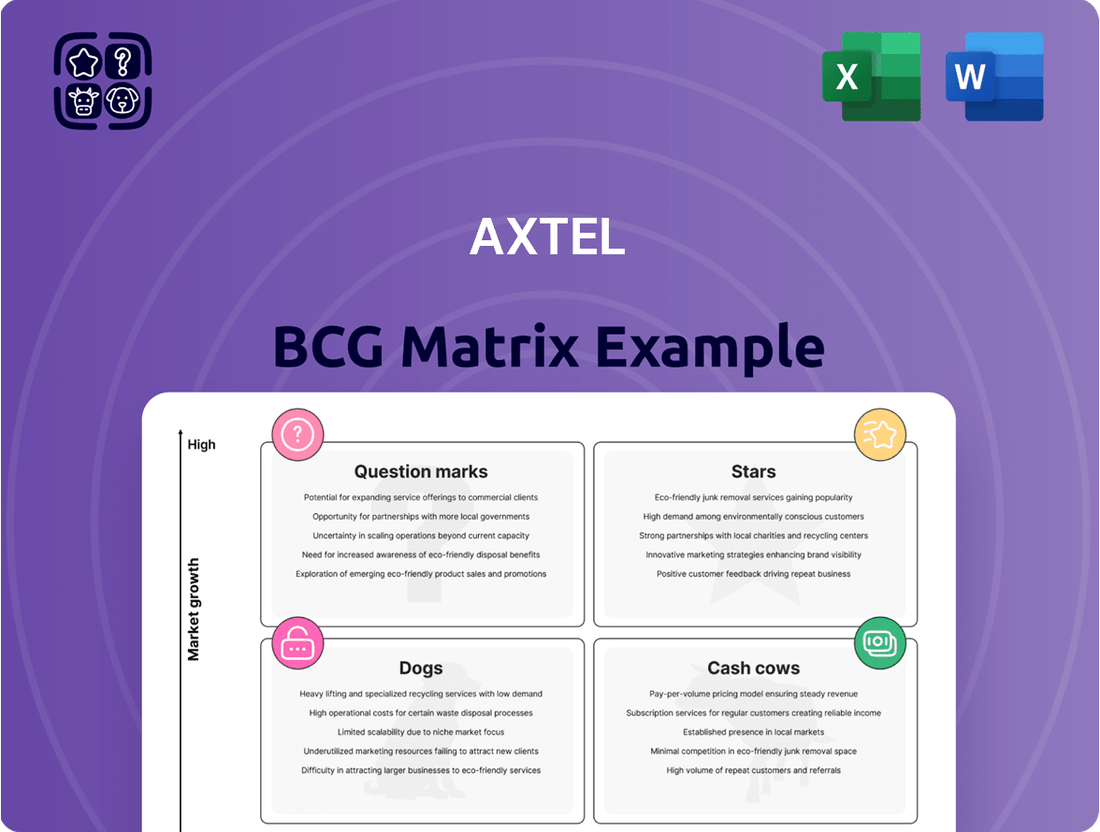

Curious about Axtel's strategic positioning? This glimpse into their BCG Matrix reveals the foundational understanding of their product portfolio's market share and growth potential. Unlock the full strategic picture and make informed decisions by purchasing the complete BCG Matrix, which details each product's placement and offers actionable insights for optimizing Axtel's growth trajectory.

Stars

Axtel's cybersecurity solutions are a strong performer, demonstrating robust growth. In 2024, cybersecurity revenues surged by 57%, and Q2 2025 saw this momentum continue, with an impressive 82% growth in the government sector and 12% in the B2B segment. This expansion aligns perfectly with the increasing cybersecurity threats in the Mexican telecom market, positioning Axtel in a high-growth area.

Further solidifying its market standing, Axtel has been recognized as a leading growth partner in Latin America for data protection and resiliency. Achieving Diamond Innovator status with Palo Alto Networks underscores Axtel's advanced capabilities and strong partnerships in the rapidly evolving cybersecurity landscape.

Axtel's cloud services demonstrated robust performance in 2024, experiencing double-digit growth. This segment, alongside cybersecurity solutions, collectively drove a 33% expansion for Axtel in the same year.

The demand for cloud-based services continues to surge across Mexico, fueled by widespread digital transformation efforts in numerous industries. This trend presents a significant opportunity for Axtel's continued expansion in this dynamic market.

Further strengthening its position, Axtel obtained an Oracle Cloud Infrastructure certification. This achievement underscores the quality and reliability of its cloud offerings, enhancing its competitive edge in this high-growth sector.

Axtel's Enterprise and Government divisions are robust performers, showcasing significant revenue expansion. The Enterprise segment experienced a 7% growth in fiscal year 2024, continuing with 5% growth in both the first and second quarters of fiscal year 2025. This steady upward trend highlights the increasing adoption of digital solutions within businesses.

The Government segment has seen even more dramatic acceleration, with impressive growth rates of 44% in the fourth quarter of fiscal year 2024, followed by 54% in the first quarter and 44% in the second quarter of fiscal year 2025. This surge indicates a strong governmental push towards digitalization and modernization.

This remarkable performance is fueled by the high demand for digital transformation services across both enterprise and government sectors. Axtel's strategic approach, which includes a specialized commercial model offering customized solutions for key industries such as finance, commerce, and logistics, is a key driver of this success.

High-Capacity Services for Hyperscalers and Data Centers

Axtel's wholesale segment, Axnet, is experiencing robust expansion in high-capacity services, particularly for hyperscalers and data centers. This growth is directly linked to the increasing need for advanced fiber optic solutions and connectivity, with the company reporting a significant 21% rise in non-recurrent dark fiber contract revenues in both the fourth quarter of 2024 and the second quarter of 2025, and an impressive 31% surge in the first quarter of 2025.

This upward trend is fueled by the insatiable demand from hyperscalers and data centers for robust infrastructure, a demand Axtel is strategically meeting by enhancing its network connectivity to the United States. The company's commitment to supporting this high-growth sector is further underscored by the ICREA Level 5 certification achieved by its Tultitlán data center, signifying the highest standards in availability and redundancy.

- Axnet's non-recurrent dark fiber contract revenues increased by 21% in 4Q24 and 2Q25.

- A 31% increase in wholesale connectivity access was observed in 1Q25.

- Demand from hyperscalers and data centers is driving this growth.

- Axtel is strengthening its US connectivity to support this demand.

- The Tultitlán data center has achieved ICREA Level 5 certification for availability and redundancy.

AI-Driven Solutions and Partnerships

Axtel is doubling down on innovation by heavily investing in artificial intelligence, anticipating significant growth in this sector. This strategic focus is evidenced by their partnership with HP Enterprise to offer private infrastructure tailored for AI model processing. This move positions Axtel to capture opportunities in the burgeoning AI market, which is expected to see substantial expansion in the coming years.

This alliance with HP Enterprise is a key component of Axtel's strategy to leverage AI's potential. By providing the necessary infrastructure, Axtel aims to facilitate the deployment and operation of AI models for businesses. This initiative is particularly relevant as global spending on AI is projected to reach hundreds of billions of dollars annually by the late 2020s, with infrastructure being a critical enabler.

- AI Investment: Axtel is actively channeling resources into AI development and deployment.

- Strategic Alliance: Partnership with HP Enterprise for AI infrastructure solutions.

- Market Positioning: Targeting the rapidly growing market for AI connectivity and processing.

- Growth Driver: Expects AI initiatives to boost enterprise and wholesale segment revenue.

Axtel's cybersecurity and cloud services are clear stars in its portfolio, showing impressive growth. In 2024, cybersecurity revenue jumped 57%, with cloud services also seeing double-digit growth, contributing to a combined 33% expansion for Axtel that year. These segments are well-positioned to capitalize on Mexico's digital transformation trends.

The company's enterprise and government divisions are also shining, driven by strong demand for digital solutions. The government segment, in particular, experienced a remarkable 44% revenue growth in Q4 2024, continuing with 54% in Q1 2025 and 44% in Q2 2025, underscoring Axtel's success in capturing this expanding market.

Axtel's wholesale business, Axnet, is a star due to its robust expansion in high-capacity services for hyperscalers and data centers. This is evidenced by a 21% rise in dark fiber contract revenues in Q4 2024 and Q2 2025, and a 31% surge in Q1 2025, highlighting the critical role Axtel plays in supporting advanced digital infrastructure.

Axtel's strategic investments in AI, including a partnership with HP Enterprise for AI infrastructure, position it for future growth. This focus on AI is expected to further bolster its enterprise and wholesale segments, tapping into a market projected for significant global expansion.

| Business Segment | 2024 Performance | Q1 2025 Performance | Q2 2025 Performance | Key Drivers |

|---|---|---|---|---|

| Cybersecurity | 57% Revenue Growth | N/A | 82% Govt, 12% B2B Growth | Increasing threats, digital transformation |

| Cloud Services | Double-digit Growth | N/A | N/A | Digital transformation, Oracle certification |

| Enterprise | 7% Revenue Growth | 5% Growth | 5% Growth | Digital solution adoption |

| Government | 44% Revenue Growth (Q4) | 54% Growth | 44% Growth | Digitalization push, specialized solutions |

| Wholesale (Axnet) | 21% Dark Fiber Growth (Q4) | 31% Wholesale Connectivity Growth | 21% Dark Fiber Growth | Hyperscaler demand, US connectivity enhancement |

| AI | Investment Focus | N/A | N/A | HP Enterprise partnership, market growth |

What is included in the product

The Axtel BCG Matrix analyzes Axtel's business units by market share and growth, guiding strategic decisions for each quadrant.

Axtel BCG Matrix offers a clear, visual overview of your portfolio, simplifying strategic decisions and alleviating the pain of information overload.

Cash Cows

Axtel's enterprise connectivity solutions, a core offering, are a significant revenue driver. These services saw a 3% revenue increase in fiscal year 2024 and the first quarter of 2025, along with a 4% rise in the fourth quarter of 2024, demonstrating steady performance.

These established connectivity services, while not experiencing explosive growth, are crucial for generating consistent and substantial cash flow. They form a stable foundation for Axtel's overall business operations, acting as reliable cash cows.

Managed services represent a significant cash cow for Axtel's Enterprise segment, providing a steady stream of recurring revenue. These value-added solutions are critical for businesses seeking reliable IT support and infrastructure management. In 2024, Axtel's managed services portfolio continued to demonstrate its strength, with a reported 12% year-over-year growth in this specific revenue category.

The inherent stability of managed services stems from their essential nature for ongoing business operations, minimizing the need for heavy promotional spending. This consistent income generation is vital, allowing Axtel to allocate robust cash flow to fuel growth initiatives in other business units. For instance, the company leveraged a portion of this stable revenue to invest in expanding its cloud offerings in late 2024.

Axtel's Government segment is a prime example of a Cash Cow, driven by the consistent recurring revenues from long-term contracts. In 2024, the company demonstrated exceptional performance by renewing a remarkable 99% of its expiring government contracts. This high renewal rate directly translated into a substantial 17% increase in recurring revenues for the entire year.

This strong performance underscores Axtel's deeply entrenched market position within the government sector. The stability afforded by these long-term agreements provides a predictable and significant stream of cash flow, a hallmark characteristic of a Cash Cow business unit.

Established Data Center Infrastructure Services

Axtel's established data center infrastructure, exemplified by its certified Tultitlán facility, represents a significant Cash Cow. This infrastructure delivers dependable revenue streams through colocation, hosting, and managed services, benefiting from high availability and redundancy features. In 2024, the demand for secure and reliable data center services continued to grow, with the global data center market projected to reach over $300 billion by 2025. Axtel's existing footprint captures a substantial portion of this mature market.

These established facilities are critical for generating consistent cash flow, supporting Axtel's overall financial stability. While the company explores new high-capacity offerings, the core data center services provide a bedrock of predictable income. This mature, high-market-share segment effectively functions as a "cash cow," funding other strategic initiatives within the company's portfolio.

- Established Data Centers: High availability and redundancy, like at the Tultitlán facility.

- Consistent Revenue: Generated from colocation, hosting, and related services.

- Mature Market Share: Forms a stable, high-volume base.

- Reliable Cash Flow: Supports other business segments and investments.

Core Fixed Broadband Services for Business

Axtel's core fixed broadband services for businesses are firmly positioned as Cash Cows within its BCG Matrix. This is largely due to the company's substantial fiber optic network, which extends over 50,000 kilometers, providing a robust foundation for these essential connectivity offerings.

These services operate within a mature market segment where Axtel has a well-established footprint. The consistent and widespread demand for reliable business internet ensures that these offerings generate significant and predictable cash flow, supporting other areas of the company's portfolio.

- Extensive Fiber Network: Over 50,000 kilometers of fiber optic infrastructure.

- Mature Market Segment: Established presence in business broadband.

- Stable Demand: Consistent high profit margins and steady cash generation.

Axtel's enterprise connectivity solutions are a prime example of a Cash Cow, demonstrating steady performance with a 3% revenue increase in fiscal year 2024 and the first quarter of 2025. These services, while not experiencing explosive growth, are crucial for generating consistent and substantial cash flow, forming a stable foundation for Axtel's overall business operations.

Managed services represent another significant cash cow for Axtel's Enterprise segment, providing a steady stream of recurring revenue. In 2024, Axtel's managed services portfolio saw a reported 12% year-over-year growth in this specific revenue category, highlighting its essential nature for ongoing business operations and minimal promotional spending needs.

Axtel's Government segment is also a strong Cash Cow, driven by consistent recurring revenues from long-term contracts. The company demonstrated exceptional performance by renewing a remarkable 99% of its expiring government contracts in 2024, translating into a substantial 17% increase in recurring revenues for the year.

Established data center infrastructure, like the Tultitlán facility, acts as a significant Cash Cow, delivering dependable revenue streams through colocation and hosting services. The global data center market is projected to exceed $300 billion by 2025, and Axtel's existing footprint captures a substantial portion of this mature market, providing a bedrock of predictable income.

| Business Unit | BCG Category | 2024 Performance Highlight | Key Driver | Financial Impact |

| Enterprise Connectivity | Cash Cow | 3% revenue increase (FY24 & Q1'25) | Established services, steady demand | Consistent, substantial cash flow |

| Managed Services | Cash Cow | 12% YoY revenue growth (2024) | Recurring revenue, essential IT support | Stable income, funds growth initiatives |

| Government Segment | Cash Cow | 99% contract renewal rate (2024) | Long-term contracts, market entrenchment | 17% increase in recurring revenue |

| Data Centers | Cash Cow | Captures mature market share | High availability, colocation/hosting demand | Predictable income, financial stability |

What You See Is What You Get

Axtel BCG Matrix

The BCG Matrix document you are currently previewing is the complete and final version you will receive upon purchase. This means you'll get the fully detailed analysis and strategic insights without any alterations or watermarks, ready for immediate application in your business planning. The preview accurately represents the professional, ready-to-use report that will be delivered directly to you, ensuring no surprises and full value.

Dogs

Axtel's legacy voice services, particularly within the Enterprise segment, saw a 7% contraction in 2024. This decline reflects a mature and shrinking market for traditional voice communication.

Despite wireless voice maintaining a notable share in Mexico, the overall trend points towards a structural shift. The increasing adoption of Voice over Internet Protocol (VoIP) is accelerating this decline, signaling that legacy voice is a low-growth area.

Given these market dynamics and Axtel's likely position within them, these traditional voice services are categorized as a 'Dog' in the BCG matrix. This classification suggests they have low growth prospects and potentially a smaller market share compared to other Axtel offerings.

Continuity services stemming from the 2019 mass-market divestment are now categorized as a question mark in Axtel's BCG Matrix. In fiscal year 2024, these services contributed to a 1% overall decline in the wholesale segment's revenue.

More specifically, second-quarter 2024 wholesale revenues experienced an 8% year-over-year decrease directly attributed to the winding down of these continuity services. This strategic phase-out signifies a clear termination of offerings from a previous business strategy, resulting in a product with a shrinking market presence and minimal growth potential.

Within the government sector, while digital transformation initiatives are driving overall growth, standard connectivity solutions are facing headwinds. In fiscal year 2024, revenues from these standard services saw a significant drop of 18%.

This decline in connectivity solutions specifically within the government segment suggests a maturing or contracting market for these offerings. It indicates that Axtel may be losing market share or that demand for these particular services is waning.

Given this performance, standard connectivity solutions in the government segment are positioned as a 'Dog' in the BCG Matrix. This classification highlights it as a low-growth, low-market-share area where Axtel needs to carefully consider its strategy, potentially involving divestment or a significant overhaul.

Residential Broadband Services

Axtel's residential broadband services, while launched in select municipalities, operate within a fiercely competitive Mexican market. The company's primary strategic focus remains on the B2B and government sectors, meaning residential broadband likely represents a smaller, less prioritized segment for Axtel.

In 2024, the Mexican residential broadband landscape is dominated by major providers, leaving Axtel with a potentially minimal market share in this area. Growth prospects for Axtel's residential offerings appear challenging without substantial, targeted investment to compete against established giants.

- Low Market Share: Axtel's presence in the residential broadband market is likely minimal compared to market leaders.

- Competitive Landscape: The Mexican residential broadband market is highly concentrated with established players.

- Challenging Growth: Significant investment would be needed for Axtel to gain meaningful traction in this segment.

Select Wholesale Connectivity Access Revenues

Axtel's wholesale connectivity access revenues faced headwinds in fiscal year 2024, contributing to a 1% dip in the segment. This decline was primarily driven by reduced contributions from multinational operators.

The data suggests that specific wholesale connectivity services, particularly those geared towards multinational clients, are either stagnating or shrinking. These particular offerings likely represent a smaller portion of Axtel's overall wholesale business in a highly competitive market.

- FY2024 Wholesale Revenue Impact: Axtel's wholesale segment saw a 1% decline for the year.

- Key Driver: Lower wholesale connectivity access revenues from multinational operators.

- Market Position Implication: Suggests low growth or decline in specific connectivity offerings targeting multinational clients.

- Competitive Landscape: These niche services likely have a low market share for Axtel.

Axtel's legacy voice services, experiencing a 7% contraction in 2024, are firmly in the 'Dog' category due to their low growth and likely declining market share. Similarly, standard connectivity solutions within the government segment, which saw an 18% revenue drop in 2024, are also classified as 'Dogs'. These services face a contracting market and intense competition, suggesting limited future potential for Axtel.

| Business Segment | Product/Service | 2024 Performance | BCG Category |

|---|---|---|---|

| Enterprise | Legacy Voice Services | 7% Contraction | Dog |

| Government | Standard Connectivity Solutions | 18% Revenue Drop | Dog |

Question Marks

Axtel is strategically positioning itself in the burgeoning AI market, exemplified by its recent agreement with HP Enterprise to offer private infrastructure for AI models. This move taps into a sector projected for substantial growth, with global AI market size estimates reaching hundreds of billions of dollars by 2024 and expected to surpass a trillion dollars in the coming years.

However, Axtel's specific market share and the maturity of its AI-driven solutions are still in their early stages, characteristic of a 'Question Mark' in the BCG matrix. These ventures demand considerable capital outlay to establish a foothold and demonstrate commercial success.

The high investment required, coupled with the inherent uncertainty of returns in a rapidly evolving and competitive AI landscape, underscores the 'Question Mark' status. Axtel's success will hinge on its ability to effectively scale these offerings and capture a meaningful share of this high-potential, albeit volatile, market.

Axtel is signaling a significant increase in its capital expenditures for 2025, pointing towards ambitious new ventures or substantial expansions into promising, high-growth sectors. This strategic shift suggests a focus on areas with considerable future potential, aligning with the characteristics of a Question Mark in the BCG matrix.

While the specific details and market penetration strategies for these new initiatives remain undisclosed, the planned investments imply a recognition of high market growth potential. However, Axtel's current market share within these nascent offerings is likely low, as they are still in the development or early launch phases.

For instance, if Axtel were to invest heavily in a burgeoning AI-driven cybersecurity solution, the cybersecurity market is projected to grow significantly, potentially reaching over $372 billion by 2025 according to some industry forecasts. Axtel's initial share in this competitive space would be minimal, requiring substantial investment to gain traction.

Axtel's recent Oracle Cloud Infrastructure certification enables them to offer Oracle hybrid cloud services. This positions them within a high-growth market where they are actively building their presence.

While cloud services broadly are a strong area for Axtel, the market share for these specific new Oracle offerings is currently low. This is typical as Axtel establishes its client base and operational track record for this particular partnership.

Expansion into New Geographic Areas with Fiber Optic Network

Axtel's strategy of expanding its fiber optic network, averaging over 2,000 kilometers annually, positions its new geographic areas as potential Stars in the BCG matrix. These deployments are capital-intensive but target high-growth, often underserved markets, aiming to build significant market share.

- Fiber Network Growth: Axtel's consistent annual expansion of over 2,000 km signifies a commitment to increasing its geographic footprint.

- Market Penetration: New areas, especially emerging or underserved regions, represent opportunities for Axtel to establish a strong initial market presence.

- Investment and Returns: These expansions require substantial upfront capital, but the potential for capturing new customers and achieving market leadership justifies the investment.

- Strategic Positioning: By entering new territories, Axtel aims to diversify its revenue streams and capitalize on the growing demand for high-speed connectivity.

Highly Specialized New System Integration Solutions

Axtel's highly specialized new system integration solutions likely fall into the question mark category within the BCG matrix. While the overall value-added services, including system integration, experienced robust growth, with a 19% increase in 3Q24 and 12% in 1Q25, these new, niche offerings might still be in their nascent stages of market penetration.

- Market Share: Despite a strong overall growth trajectory for Axtel's digital transformation services, the highly specialized nature of these new integrations suggests a potentially low initial market share in these specific segments.

- Industry Growth: The broader digital transformation market is experiencing high growth, providing a fertile ground for new solutions.

- Investment Needs: To capture significant market share in these specialized areas, Axtel will likely need continued investment to build brand recognition and customer adoption.

- Future Potential: The success of these question mark offerings hinges on their ability to gain traction and eventually transition into stars or cash cows.

Axtel's new ventures, particularly in AI infrastructure and specialized system integration, are classic examples of Question Marks. These areas demand significant investment to establish market presence, with uncertain but potentially high returns.

The company's strategic expansion into new geographic regions with its fiber network, while capital-intensive, aims to build market share in high-growth areas, mirroring the characteristics of Question Marks that require nurturing to become Stars.

Axtel's recent Oracle Cloud Infrastructure certification places it in a growing market. However, the market share for these specific, newer offerings is currently low, typical of a Question Mark needing time and investment to gain traction.

The company's increased capital expenditures for 2025 signal a strong commitment to these high-potential, yet unproven, market segments, reinforcing their Question Mark status.

| Business Unit/Initiative | Market Growth Rate | Relative Market Share | BCG Matrix Classification | Strategic Implication |

|---|---|---|---|---|

| AI Infrastructure (e.g., Private AI Models) | Very High | Low | Question Mark | Requires significant investment to gain share; potential for future Star. |

| New Geographic Fiber Expansion | High | Low (in new areas) | Question Mark | Capital intensive; aim to capture new customers and build leadership. |

| Specialized System Integration Solutions | High (overall digital transformation) | Low (for niche offerings) | Question Mark | Needs continued investment for brand recognition and adoption. |

| Oracle Cloud Infrastructure Services | High | Low | Question Mark | Establishing client base and track record for specific partnership. |

BCG Matrix Data Sources

Our BCG Matrix leverages Axtel's internal financial statements and operational performance data, alongside external market research and competitor analysis, to accurately position each business unit.