Axsome PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axsome Bundle

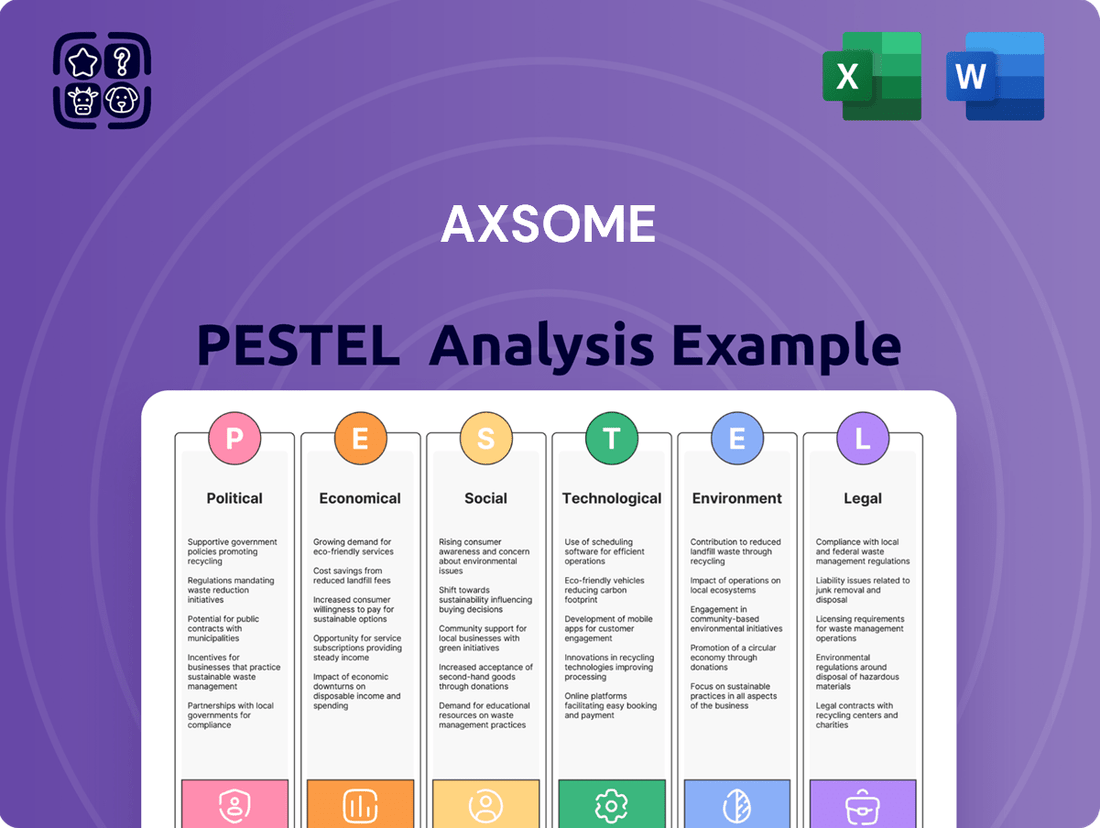

Uncover the critical political, economic, social, technological, environmental, and legal factors influencing Axsome's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and identify strategic opportunities. Don't get left behind; download the full version now to gain a crucial competitive advantage.

Political factors

Government regulations are a cornerstone of the pharmaceutical sector, directly shaping Axsome Therapeutics' operational landscape. The company's success hinges on navigating complex approval processes, like those managed by the U.S. Food and Drug Administration (FDA). For example, the FDA's recent actions, such as the approval of new Alzheimer's treatments or changes in post-market surveillance requirements, can significantly influence Axsome's development timelines and market access strategies for its own CNS therapies.

Government healthcare policies, particularly those concerning drug pricing and reimbursement, significantly shape the market success of pharmaceutical companies like Axsome. The ability of Axsome's treatments, such as Auvelity for major depressive disorder and Sunosi for narcolepsy, to gain broad insurance coverage and favorable reimbursement rates from both public and private payers is paramount for their commercial viability and revenue growth.

In 2024, the landscape of drug pricing is under continued scrutiny, with potential legislative actions impacting how new therapies are valued and paid for. For instance, the Inflation Reduction Act of 2022 continues to influence Medicare drug price negotiations, which could eventually affect the pricing power of specialty CNS medications. Axsome's success hinges on navigating these evolving reimbursement frameworks, ensuring their innovative treatments are accessible and financially sustainable for patients and the healthcare system.

International trade policies and geopolitical tensions significantly impact global supply chains and market access for pharmaceutical firms. For Axsome, shifts in these dynamics can influence its manufacturing strategies and partnerships.

Legislation like the Biosecure Act, aiming to curb reliance on foreign manufacturing, could prompt Axsome to re-evaluate its supply chain resilience and international collaborations. This focus on domestic production could reshape how pharmaceutical companies source raw materials and conduct research and development, potentially increasing costs or creating new opportunities.

Intellectual Property Protection

Government policies on intellectual property (IP) rights, particularly patent laws and their enforcement, are critical for biopharmaceutical firms like Axsome Therapeutics. These regulations directly influence a company's ability to protect its innovations and recover substantial research and development expenditures. Strong IP protection is essential for maintaining market exclusivity for novel treatments.

Axsome’s experience highlights the importance of IP. For instance, the company reached a settlement in a patent lawsuit concerning its drug Auvelity, which effectively extended the drug's period of market exclusivity. This demonstrates how legal frameworks governing patents can significantly impact a company's revenue streams and long-term strategic planning.

- Patent Exclusivity: Biopharmaceutical companies rely on patent protection to prevent competitors from marketing generic versions of their drugs for a set period, typically 20 years from the filing date.

- R&D Investment Recovery: Strong IP rights are crucial for recouping the billions of dollars invested in drug discovery and development, a process that can take over a decade and has a high failure rate.

- Market Competition: The strength and duration of patent protection directly influence the competitive landscape, impacting pricing strategies and market share for innovative therapies.

- Litigation Impact: Patent litigation, as seen with Auvelity, can have substantial financial implications, either by reinforcing exclusivity or by shortening the period of market protection.

Public Health Initiatives and Priorities

Government-backed public health drives, like the increased focus on mental well-being and expanded funding for neurological disorder research, present a dual-edged sword for companies like Axsome. These initiatives can significantly boost the market for central nervous system (CNS) therapies, directly benefiting Axsome's product pipeline.

For instance, the U.S. Department of Health and Human Services (HHS) has consistently emphasized mental health as a priority, with significant investments allocated to research and treatment accessibility. In 2024, the National Institute of Mental Health (NIMH) announced a budget increase to support innovative research into mental health conditions, a sector where Axsome operates.

- Increased Demand: Public health campaigns promoting mental health awareness can drive higher patient engagement and demand for effective treatments, aligning with Axsome's therapeutic areas.

- Research Funding: Government grants and funding for neurological research create opportunities for collaboration and validation of novel CNS therapies.

- Regulatory Scrutiny: Heightened government focus on public health may also lead to more stringent regulatory oversight and pricing pressures on pharmaceutical companies.

- Competitive Landscape: Areas receiving significant government attention, such as depression and Alzheimer's disease, are likely to attract more competitors, intensifying the market.

Government regulations, particularly those from the FDA, are critical for Axsome's drug approvals and market access. The Inflation Reduction Act of 2022 continues to shape drug pricing discussions, potentially impacting Axsome's revenue from its CNS therapies like Auvelity and Sunosi.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Axsome, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions with data-backed insights.

It is designed to equip executives and consultants with actionable intelligence for strategic decision-making, identifying both emerging threats and promising opportunities within Axsome's operating landscape.

This PESTLE analysis provides a clean, summarized version of Axsome's external landscape, acting as a pain point reliver by highlighting key opportunities and challenges in the pain management market for easy referencing during meetings.

Economic factors

Overall healthcare spending is a critical factor for Axsome, as it directly influences the market size and accessibility of its products. In 2023, U.S. national health expenditures reached an estimated $4.7 trillion, representing a significant portion of the economy.

Employer-sponsored health care costs also continue to rise, putting pressure on businesses and potentially affecting patient out-of-pocket expenses. Projections for 2024 and 2025 anticipate continued growth in healthcare spending, fueled by an aging population and increasing demand for advanced medical treatments.

Economic pressures from governments and private insurers are intensifying, pushing for lower drug prices and greater affordability. This trend directly impacts Axsome's revenue prospects, as payers scrutinize the cost-effectiveness of new treatments.

While Axsome's innovative therapies target significant unmet medical needs, the market's price sensitivity is a critical consideration. For instance, in 2024, Medicare's Inflation Reduction Act (IRA) provisions continue to exert pressure on drug manufacturers by allowing Medicare to negotiate prices for certain high-cost drugs, a factor Axsome must navigate.

The potential for increased competition from biosimilars or generics in the future also necessitates strategic pricing and market access planning. Axsome's approach to demonstrating value and securing favorable reimbursement will be key to mitigating these economic headwinds.

Economic conditions directly impact Axsome's ability to invest in crucial research and development. A strong economy typically translates to increased R&D budgets, fueling the pipeline for new central nervous system (CNS) therapies. For instance, in 2024, the pharmaceutical industry's R&D spending is projected to remain robust, with many companies prioritizing innovation despite economic fluctuations, which benefits Axsome's growth strategy.

Market Access and Reimbursement Policies

The economic environment for market access and reimbursement significantly shapes the commercial trajectory of pharmaceutical companies like Axsome. Payer coverage decisions and the overall structure of health insurance directly influence which patients can access and afford treatments, thereby impacting sales volumes and revenue generation.

Expanded commercial payer coverage for Axsome’s flagship product, Auvelity (dextromethorphan HBr and bupropion HBr) extended release tablets, is a critical positive economic factor. This increased coverage broadens the addressable patient population, leading to greater market penetration and revenue potential. For instance, by late 2023, Axsome reported that Auvelity had achieved broad commercial payer coverage, reaching an estimated 90% of the U.S. commercial market. This access is crucial for driving prescription volume and achieving commercial success.

- Broad Payer Coverage: Axsome secured broad commercial payer coverage for Auvelity, reaching approximately 90% of the U.S. commercial market by late 2023, a key economic enabler.

- Impact on Addressable Market: This extensive coverage directly expands the number of patients who can potentially access and benefit from Auvelity, driving commercial success.

- Reimbursement Landscape: Navigating and securing favorable reimbursement terms from private insurers and government programs is paramount for Axsome's revenue streams.

- Value-Based Pricing: The ongoing trend towards value-based pricing models in healthcare necessitates demonstrating Auvelity's clinical and economic benefits to payers.

Mergers, Acquisitions, and Funding Environment

The M&A and funding environment significantly shapes Axsome's strategic maneuvers. A dynamic biotech M&A market, particularly for innovative assets, can unlock opportunities for expansion and strategic partnerships. For instance, in 2023, the biopharmaceutical sector saw a notable increase in deal activity compared to 2022, with approximately $150 billion in M&A value recorded globally, signaling robust investor confidence in promising therapeutic areas.

Increased venture capital funding, especially directed towards areas like AI in healthcare and novel drug development, directly impacts Axsome's ability to secure capital for research, development, and potential acquisitions. Venture funding in the U.S. biotech sector reached roughly $20 billion in 2023, showing sustained investor interest in cutting-edge medical advancements.

- Biopharma M&A Value: Global biopharma M&A reached approximately $150 billion in 2023, a rebound from the previous year, indicating a more active deal environment.

- Venture Capital Investment: US biotech venture funding stood around $20 billion in 2023, highlighting continued investor appetite for innovation.

- AI in Healthcare Funding: Investments in AI-driven healthcare solutions saw significant growth, with specific AI drug discovery platforms attracting substantial capital rounds.

The economic landscape significantly influences Axsome's market access and revenue potential. Continued growth in U.S. healthcare spending, projected to exceed $4.7 trillion in 2023, underscores the market size for its therapies. However, rising employer-sponsored healthcare costs and payer pressure for affordability, amplified by initiatives like Medicare's drug price negotiations under the Inflation Reduction Act, necessitate strategic pricing and value demonstration.

Axsome's ability to secure broad payer coverage, as seen with Auvelity's estimated 90% U.S. commercial market access by late 2023, is a critical economic driver. This access directly expands the addressable patient population and revenue opportunities. The biopharmaceutical M&A market also presents strategic avenues; global M&A value reached approximately $150 billion in 2023, with U.S. biotech venture funding around $20 billion, indicating continued investor confidence in innovative drug development.

| Economic Factor | 2023 Data/Projection | Impact on Axsome |

|---|---|---|

| U.S. National Health Expenditures | Estimated $4.7 trillion (2023) | Indicates market size and demand for CNS therapies. |

| Commercial Payer Coverage (Auvelity) | Approx. 90% of U.S. commercial market (late 2023) | Expands addressable patient population and revenue potential. |

| Biopharma M&A Value (Global) | Approx. $150 billion (2023) | Offers opportunities for strategic partnerships and expansion. |

| Biotech Venture Funding (U.S.) | Around $20 billion (2023) | Supports R&D investment and potential capital acquisition. |

Preview Before You Purchase

Axsome PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Axsome.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Axsome.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into Axsome's strategic landscape.

Sociological factors

The rising incidence of central nervous system (CNS) disorders like depression, Alzheimer's disease agitation, migraine, and narcolepsy highlights a significant societal demand for better treatments. For instance, in 2024, an estimated 280 million people worldwide experienced depression, underscoring the vast patient pool seeking relief.

Axsome Therapeutics' strategic focus on developing innovative therapies for these prevalent conditions directly addresses this growing need. Their pipeline targets conditions with substantial unmet medical needs, positioning them to serve a large and expanding patient population actively seeking effective solutions.

The global population is aging rapidly. By 2050, it's projected that one in six people worldwide will be over 65, a significant increase from one in eleven in 2015. This demographic trend directly fuels the demand for treatments addressing age-related neurological conditions, a core focus for Axsome Therapeutics.

This growing elderly population means a larger patient pool for conditions like Alzheimer's disease, which disproportionately affects older individuals. Axsome's pipeline, including therapies for Alzheimer's and other CNS disorders, is therefore positioned to benefit from this expanding market segment, with the global Alzheimer's disease market alone expected to reach over $100 billion by 2029.

Growing patient advocacy for central nervous system (CNS) disorders is a significant sociological factor. These groups are increasingly vocal, pushing for better treatment options and greater research funding. For instance, the National Alliance on Mental Illness (NAMI) reported that in 2024, over 50 million Americans experienced a mental health condition, highlighting the widespread need for effective therapies.

This heightened awareness directly translates into increased demand for innovative treatments like those Axsome Therapeutics develops. As patients and their families become more informed through these advocacy efforts, they are more likely to seek out and embrace new therapeutic solutions, potentially accelerating market adoption for companies addressing these unmet needs.

Lifestyle and Mental Health Trends

Shifting lifestyle patterns and a heightened societal focus on mental well-being are directly influencing the market for psychiatric and neurological treatments. As the stigma surrounding mental health conditions continues to diminish, more individuals are proactively seeking and engaging with therapies for issues such as depression and excessive daytime sleepiness. This evolving societal attitude supports increased demand for the treatments Axsome Therapeutics develops.

The growing acceptance and understanding of mental health challenges are translating into tangible market growth. For instance, the global mental health market was valued at approximately $383.1 billion in 2023 and is projected to reach $500 billion by 2028, demonstrating a compound annual growth rate of around 5.5%. This expansion is fueled by increased awareness and a greater willingness to invest in mental wellness.

- Increased Demand: Societal destigmatization of mental health conditions drives higher patient engagement with treatments.

- Market Growth: The global mental health market is expanding, with projections indicating continued strong growth through 2028.

- Treatment Adoption: Greater understanding of conditions like depression and sleep disorders encourages the adoption of new therapeutic solutions.

Healthcare Access and Equity

Societal considerations around healthcare access and equity significantly shape how pharmaceutical companies like Axsome can penetrate markets. Disparities in care and treatment availability among different demographic groups can create barriers, impacting patient reach and adoption of new therapies. For instance, in 2024, reports highlighted persistent racial and socioeconomic gaps in access to specialized neurological care in the US, a key area for Axsome's focus.

Axsome's stated commitment to ensuring broad access to its medications is therefore crucial. This involves not only developing effective treatments but also engaging in ethical promotional practices and potentially exploring patient assistance programs. By addressing these societal factors proactively, Axsome can build trust and foster greater market acceptance, particularly as it aims to bring novel treatments for conditions like major depressive disorder and narcolepsy to a wider patient population.

The availability of treatment options is also a critical component of healthcare equity. If certain patient populations have limited access to effective treatments due to cost, geography, or insurance coverage, it directly impacts market penetration. Axsome's strategy must therefore consider how to make its innovative therapies accessible across diverse patient profiles to maximize its societal and commercial impact.

- Healthcare Disparities: Studies in 2024 indicated that individuals from minority ethnic groups and lower socioeconomic backgrounds often face longer wait times for specialist appointments and have less access to cutting-edge treatments for neurological disorders.

- Axsome's Access Strategy: The company's focus on developing therapies for underserved neurological conditions positions it to address some of these access gaps, but effective distribution and affordability remain key challenges.

- Market Penetration Impact: Unequal access can limit the real-world patient numbers benefiting from new drugs, thereby affecting sales forecasts and the overall market penetration of Axsome's product pipeline.

- Ethical Promotion: Responsible marketing practices are essential to avoid exacerbating existing disparities and to ensure that information about treatments reaches all relevant patient communities.

Societal attitudes towards mental health are evolving, with increasing destigmatization leading to greater patient engagement with treatments. This shift is a key driver for companies like Axsome, focusing on CNS disorders. The global mental health market is projected to grow significantly, reflecting this positive trend.

Demographic shifts, particularly an aging global population, are increasing the prevalence of age-related neurological conditions. This trend directly expands the potential patient pool for therapies targeting disorders such as Alzheimer's disease, a core area for Axsome's development pipeline.

Patient advocacy groups are becoming more influential, pushing for improved treatments and research funding for CNS disorders. This heightened awareness and demand for better solutions directly benefit companies like Axsome that are developing innovative therapies for these conditions.

| Sociological Factor | Impact on Axsome | Supporting Data (2024/2025) |

| Destigmatization of Mental Health | Increased demand for psychiatric treatments, greater patient willingness to seek care. | Global mental health market projected to reach $500 billion by 2028 (from ~$383.1 billion in 2023). |

| Aging Population | Growing patient pool for age-related neurological disorders like Alzheimer's. | By 2050, 1 in 6 people worldwide will be over 65. Alzheimer's market expected to exceed $100 billion by 2029. |

| Patient Advocacy | Heightened awareness and demand for novel CNS therapies, potential for faster market adoption. | Over 50 million Americans experienced a mental health condition in 2024 (NAMI). |

Technological factors

Technological leaps in drug discovery, particularly the integration of artificial intelligence (AI) and advanced disease modeling, are revolutionizing how new medicines are found. These innovations are crucial for companies like Axsome, enabling faster identification of promising drug candidates and streamlining early-stage research.

By embracing AI and sophisticated preclinical models, Axsome can significantly boost efficiency, potentially lowering the substantial costs and lengthy timelines typically associated with developing novel Central Nervous System (CNS) therapies. For instance, AI platforms are demonstrating success in predicting drug efficacy and identifying potential side effects earlier in the process, a critical advantage in the competitive pharmaceutical landscape.

Breakthroughs in biotechnology, including CRISPR gene editing and advancements in biologics and gene therapies, are creating novel treatment pathways for challenging diseases. While Axsome primarily focuses on small molecules, these broader biotech developments signal a dynamic and evolving market, potentially impacting future research and competitive dynamics.

The growing adoption of digital health tools, including wearables and remote monitoring devices, is transforming healthcare delivery and research. These technologies are crucial for collecting Real-World Evidence (RWE), which offers invaluable insights into how treatments perform in everyday patient populations, moving beyond controlled clinical trial settings. For Axsome, this means potentially faster and more efficient clinical trials, as RWE can supplement traditional data, providing a more comprehensive understanding of drug efficacy and safety profiles. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly, indicating a strong trend towards tech-enabled patient care and data collection.

Precision Medicine and Personalized Therapies

The technological landscape is being reshaped by the ascent of precision medicine, a paradigm shift that tailors treatments to an individual's unique biological makeup. This involves sophisticated genetic profiling and the identification of specific biomarkers, allowing for highly personalized therapeutic strategies. For instance, advancements in genomic sequencing, with costs dropping dramatically, now enable routine analysis for many patients, facilitating more targeted drug development and treatment selection.

Leveraging artificial intelligence (AI) is central to this personalized approach, enabling the development of therapies that are more finely tuned to individual patient needs, especially in managing complex and chronic diseases. This focus on maximizing treatment impact and demonstrating clear value aligns perfectly with the pharmaceutical industry's evolving emphasis on outcomes-based healthcare and the efficient allocation of resources. The global precision medicine market was valued at approximately $62.5 billion in 2023 and is projected to grow significantly, reaching an estimated $140 billion by 2030, reflecting its increasing importance.

- Genomic Sequencing Costs: The cost of sequencing a human genome has fallen from over $3 billion in 2003 to under $1,000 in recent years, making it more accessible for clinical applications.

- AI in Drug Discovery: AI platforms are accelerating drug discovery and development timelines, with some studies suggesting potential reductions of up to 40% in early-stage research.

- Biomarker Identification: The identification and validation of novel biomarkers for disease diagnosis, prognosis, and treatment response are critical enablers of precision medicine, with ongoing research identifying hundreds of new targets annually.

- Market Growth: The precision medicine market is experiencing robust growth, driven by increasing R&D investments and a growing understanding of the genetic basis of diseases.

Manufacturing and Supply Chain Technologies

Technological advancements are significantly reshaping pharmaceutical manufacturing and supply chains. Innovations like advanced automation, including robotic process automation (RPA) for repetitive tasks and sophisticated AI-driven analytics for predictive maintenance, are enhancing operational efficiency. For instance, the global pharmaceutical automation market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a strong industry trend towards technological integration.

Blockchain technology offers unprecedented transparency and security in the pharmaceutical supply chain, crucial for tracking drug provenance and preventing counterfeiting. This can lead to improved regulatory compliance and reduced risks. While specific blockchain adoption rates for companies like Axsome are not publicly detailed, the broader biopharmaceutical industry is exploring its potential, with pilot programs demonstrating enhanced traceability.

These technological factors contribute to overall operational effectiveness and cost control within the biopharmaceutical sector, indirectly benefiting companies like Axsome by fostering a more efficient and resilient industry ecosystem. The ability to streamline production processes and ensure supply chain integrity is paramount for delivering innovative therapies to market.

- Automation in Pharma: The pharmaceutical automation market is expected to reach over $80 billion by 2028, reflecting a compound annual growth rate of around 7.5% from 2023.

- Blockchain Adoption: Industry reports suggest that by 2025, over 60% of pharmaceutical companies will have implemented blockchain solutions for supply chain management.

- Efficiency Gains: Companies leveraging advanced manufacturing technologies have reported up to a 20% reduction in production cycle times and a 15% decrease in operational costs.

Technological advancements in drug discovery, particularly AI and advanced disease modeling, are accelerating the identification of new therapies. AI platforms are proving effective in predicting drug efficacy and identifying potential side effects earlier, a significant advantage for companies like Axsome operating in the CNS space.

The rise of digital health tools and wearables is transforming patient monitoring and clinical trial data collection. Real-World Evidence (RWE) gathered through these technologies offers deeper insights into treatment performance in diverse patient populations, potentially streamlining clinical development for Axsome. The global digital health market was valued at approximately $200 billion in 2023 and is projected for substantial growth.

Precision medicine, driven by genomic sequencing and biomarker identification, enables tailored treatment strategies. AI plays a crucial role in developing these personalized therapies, aligning with the industry's focus on outcomes-based healthcare. The precision medicine market was valued at roughly $62.5 billion in 2023, with strong growth anticipated.

Innovations in pharmaceutical manufacturing and supply chains, including automation and blockchain, are enhancing efficiency and security. The pharmaceutical automation market was valued at about $50 billion in 2023, signaling a trend toward greater technological integration.

Legal factors

The pharmaceutical industry operates under intensely strict legal and regulatory oversight, with agencies like the U.S. Food and Drug Administration (FDA) dictating everything from initial product approval to ongoing post-market surveillance and marketing conduct. Axsome's success hinges on navigating these complex requirements, which include rigorous clinical trial data submission and adherence to manufacturing standards. For instance, the FDA's accelerated approval pathway, while offering faster market entry, often mandates post-approval confirmatory trials, adding to compliance burdens and timelines.

Compliance with evolving marketing practices, such as those outlined in the Uniform Code of Pharmaceutical Marketing Practices, is critical for Axsome to maintain its license to operate and avoid significant legal repercussions, including hefty fines and reputational damage. The company must ensure its promotional activities are transparent and scientifically accurate. In 2023, the pharmaceutical industry faced increased scrutiny over drug pricing and marketing, with regulatory bodies actively investigating and penalizing companies for non-compliance, underscoring the importance of robust internal controls for Axsome.

Intellectual property disputes are a major concern in the biopharmaceutical sector, directly impacting a company's market exclusivity and revenue streams. These legal battles, often involving patent infringement claims, can significantly alter a drug's commercial lifespan and profitability.

Axsome Therapeutics' strategic settlement of a patent lawsuit concerning its flagship drug Auvelity, securing its patent protection until at least 2038, underscores the immense value of strong IP. This successful defense is crucial for safeguarding its commercial assets and ensuring continued market presence for its innovative therapies.

Increasing global data privacy regulations, such as the EU's General Data Protection Regulation (GDPR) and various U.S. state laws like the California Consumer Privacy Act (CCPA), significantly influence how pharmaceutical companies like Axsome manage sensitive patient data. These laws dictate how clinical trial information and commercial engagement data can be collected, stored, processed, and shared, requiring robust compliance measures.

Axsome must meticulously adhere to these evolving legal frameworks to safeguard patient privacy and mitigate the risk of substantial fines and reputational damage. For instance, GDPR violations can lead to penalties of up to 4% of annual global turnover or €20 million, whichever is greater, underscoring the critical importance of data security and privacy compliance in Axsome's operations.

Antitrust and Competition Laws

Antitrust laws are crucial in the pharmaceutical sector, aiming to prevent monopolies and ensure fair competition. These regulations can impact how companies like Axsome grow and operate, particularly concerning mergers, acquisitions, and the potential for market dominance. As Axsome's product portfolio expands, particularly with its migraine treatments, it may face increased scrutiny if its market share becomes substantial.

For instance, the U.S. Federal Trade Commission (FTC) actively monitors the pharmaceutical industry for anti-competitive practices. In 2023, the FTC continued its focus on drug pricing and patent settlements that could stifle competition. While Axsome's current market share in its key therapeutic areas is not dominant, any significant increase in market penetration for its approved products, such as AUVELITY or AXS-07, could trigger closer examination of its business strategies under existing antitrust frameworks.

- Regulatory Scrutiny: Increased market share for Axsome's products could lead to greater attention from antitrust regulators like the FTC.

- Merger & Acquisition Impact: Antitrust laws can influence the feasibility and terms of any future strategic partnerships or acquisitions Axsome might pursue.

- Competitive Landscape: The ongoing enforcement of competition laws ensures that Axsome operates within a market designed to foster innovation and patient access, rather than market manipulation.

Clinical Trial Laws and Ethics

Clinical trial laws and ethical considerations, including informed consent and diversity mandates, are paramount for drug development. Axsome must navigate these regulations diligently. For instance, by late 2024, the FDA's ongoing review of diversity in clinical trials, following legislative pushes, will continue to shape requirements for patient representation. Axsome's adherence to these evolving standards is a critical legal and ethical imperative.

Protecting human rights throughout clinical research and ensuring robust patient privacy are non-negotiable legal and ethical obligations for Axsome. Failure to comply with regulations like HIPAA in the US or GDPR in Europe can result in significant penalties. Data breaches or ethical lapses in consent processes could lead to costly litigation and reputational damage, impacting investor confidence and future drug approvals.

Key legal and ethical factors impacting Axsome's clinical trials include:

- Informed Consent: Ensuring participants fully understand trial risks, benefits, and procedures before agreeing to participate.

- Patient Privacy: Strict adherence to data protection laws like HIPAA and GDPR to safeguard sensitive health information.

- Diversity Requirements: Meeting evolving FDA and international guidelines for diverse patient populations in clinical trials to ensure generalizability of results.

- Good Clinical Practice (GCP): Compliance with international ethical and scientific quality standards for designing, conducting, recording, and reporting trials.

Axsome's operations are heavily influenced by stringent pharmaceutical regulations, particularly from the FDA, governing drug approval, manufacturing, and marketing. The company's ability to navigate these complex rules, including post-market surveillance and adherence to evolving marketing codes, is crucial for its sustained market presence and to avoid significant penalties.

Intellectual property law is a critical determinant of Axsome's market exclusivity and revenue. The company's successful defense of its patents, such as the one securing Auvelity until 2038, highlights the substantial financial implications of IP protection in the biopharmaceutical sector.

Data privacy laws like GDPR and CCPA impose strict requirements on how Axsome handles sensitive patient data, necessitating robust compliance measures to prevent hefty fines, such as the potential 4% of global turnover for GDPR violations.

Antitrust regulations are also a key legal consideration, potentially impacting Axsome's growth strategies, especially if its market share for products like AUVELITY or AXS-07 grows significantly, drawing scrutiny from bodies like the FTC regarding competitive practices.

Environmental factors

The pharmaceutical industry, including Axsome, faces increasing pressure to adopt environmentally sustainable practices. This translates to a focus on reducing resource use, minimizing waste, and curbing pollution across all operational facets.

Axsome's commitment is evident in its choice of LEED Gold certified office spaces, demonstrating a dedication to energy efficiency and responsible building design. Furthermore, the company is actively incorporating renewable energy sources into its operations, aligning with global efforts to decarbonize.

Growing concerns over global warming are pushing corporations to actively measure and lower their carbon emissions. Axsome Therapeutics is addressing these environmental factors by focusing on reducing greenhouse gas impact throughout its product development lifecycle. This includes exploring more sustainable manufacturing processes and packaging solutions.

Furthermore, Axsome's embrace of hybrid remote work policies for its employees demonstrably contributes to reducing its operational carbon footprint. By enabling employees to work from home more frequently, the company lessens commuting-related emissions, a significant component of many corporate environmental impacts. For instance, a typical employee commuting 20 miles roundtrip five days a week can save approximately 4,800 pounds of CO2 annually by working remotely two days a week.

Environmental regulations concerning pharmaceutical waste and pollution are tightening globally. Axsome is committed to reducing its environmental footprint by minimizing hazardous substances and maximizing recycling and composting efforts across its operations, demonstrating proactive compliance with these evolving standards.

In 2024, the pharmaceutical industry faced increased scrutiny over its waste streams, with many regions implementing stricter disposal protocols. Axsome's focus on sustainable practices, including waste reduction and recycling initiatives, positions it favorably to meet these growing environmental expectations and regulatory demands.

Resource Scarcity and Supply Chain Resilience

Resource scarcity poses a significant environmental challenge for pharmaceutical companies like Axsome, potentially impacting the cost and availability of essential raw materials for drug development and manufacturing. For instance, the increasing global demand for specialized chemicals and active pharmaceutical ingredients (APIs) can lead to price volatility and supply disruptions.

The pharmaceutical sector is increasingly focused on building resilient supply chains in response to environmental risks. This involves diversifying sourcing locations and investing in technologies that reduce reliance on single-source materials. For example, in 2024, many companies are exploring advanced manufacturing techniques that can utilize more readily available or recycled inputs.

- Increased input costs: Environmental pressures can drive up the price of key chemicals and biological materials used in drug production.

- Supply chain disruptions: Extreme weather events or resource depletion in specific regions can interrupt the flow of necessary components.

- Focus on sustainable sourcing: Companies are prioritizing suppliers with strong environmental, social, and governance (ESG) credentials, which can influence material availability and cost.

- Investment in alternative materials: Research into bio-based or synthetic alternatives to traditional raw materials is growing to mitigate scarcity risks.

Green Chemistry and Sustainable Manufacturing

The pharmaceutical sector, including companies like Axsome, is seeing a significant push towards green chemistry and sustainable manufacturing. This shift aims to minimize the environmental footprint associated with drug development and production. For instance, the European Union's Green Deal initiatives are driving stricter regulations on chemical usage and waste management in manufacturing processes.

These evolving environmental standards directly impact operational costs. Companies must invest in cleaner technologies and more sustainable sourcing for raw materials and packaging. A report by the ACS Green Chemistry Institute highlighted that implementing green chemistry principles can lead to cost savings through reduced energy consumption and waste disposal fees. For example, optimizing reaction pathways can decrease solvent usage, a major cost driver in pharmaceutical manufacturing.

Market entry strategies are also being reshaped by these eco-friendly requirements. Companies that can demonstrate a commitment to sustainability may gain a competitive advantage, particularly in environmentally conscious markets. Axsome, like its peers, will need to adapt its supply chain and manufacturing processes to meet these global expectations.

- Increased investment in sustainable technologies: Pharmaceutical companies are projected to allocate billions towards upgrading facilities and adopting greener manufacturing methods by 2025.

- Regulatory compliance costs: Adherence to stricter environmental regulations, especially in Europe, could add an estimated 5-10% to manufacturing overheads for non-compliant processes.

- Market access and brand reputation: Companies demonstrating strong ESG (Environmental, Social, and Governance) performance are increasingly favored by investors and consumers, influencing market share and valuation.

- Innovation in eco-friendly packaging: The demand for biodegradable and recyclable packaging materials is growing, pushing R&D efforts to find cost-effective and sustainable solutions.

Axsome's environmental strategy is increasingly shaped by global sustainability trends and regulatory shifts. The company's focus on reducing its carbon footprint, exemplified by its LEED Gold certified facilities and hybrid work policies, aligns with broader industry movements towards decarbonization. By 2025, the pharmaceutical sector is expected to see significant investment in greener manufacturing, with compliance costs potentially rising for those lagging behind.

Resource scarcity and the demand for sustainable sourcing are also critical environmental factors. Axsome, like its peers, must navigate potential price volatility and supply disruptions for raw materials, driving innovation in alternative materials and resilient supply chains. Companies prioritizing ESG credentials are increasingly favored, impacting market access and brand reputation.

| Environmental Factor | Impact on Axsome | Industry Trend/Data (2024-2025) |

|---|---|---|

| Carbon Footprint Reduction | Operational efficiency, reduced emissions | Global push for net-zero targets; pharmaceutical sector investing in renewable energy. |

| Resource Scarcity | Potential for increased input costs, supply chain vulnerability | Growing demand for specialized chemicals; focus on diversifying raw material sourcing. |

| Green Chemistry & Manufacturing | Higher compliance costs for non-adopters, competitive advantage for leaders | EU Green Deal driving stricter chemical usage regulations; estimated 5-10% overhead increase for non-compliant processes. |

| Waste Management & Pollution | Increased scrutiny on disposal protocols, need for sustainable practices | Stricter regional regulations on pharmaceutical waste; focus on waste reduction and recycling initiatives. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Axsome Therapeutics is built on a robust foundation of data from leading pharmaceutical industry reports, regulatory agency filings (FDA, EMA), and reputable financial news outlets. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.