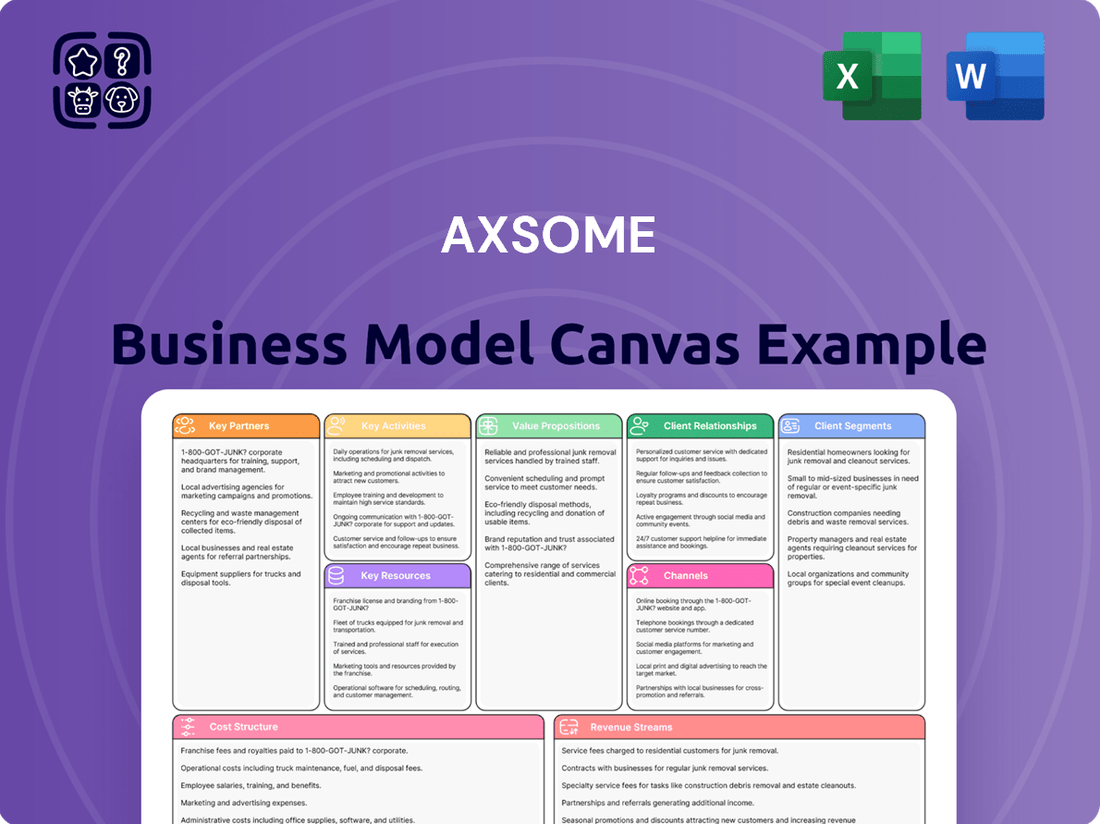

Axsome Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axsome Bundle

Unlock the full strategic blueprint behind Axsome's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Axsome Therapeutics heavily relies on Contract Research Organizations (CROs) to manage its extensive clinical trial pipeline, spanning all phases from early-stage research to late-stage development. These partnerships are fundamental to the company's operational efficiency, enabling effective patient recruitment and the meticulous collection of data essential for regulatory approvals.

In 2023, the global CRO market was valued at approximately $45 billion, highlighting the significant investment companies like Axsome make in outsourcing clinical research. This strategic outsourcing allows Axsome to maintain flexibility and scale its research capabilities without the substantial fixed costs associated with building and maintaining a large internal clinical operations department.

Axsome actively partners with prestigious academic and research institutions, tapping into their specialized scientific knowledge and cutting-edge research infrastructure. These collaborations are crucial for deepening our understanding of complex central nervous system (CNS) conditions and identifying promising new therapeutic targets. For instance, their work with institutions like the University of California, San Diego, has been instrumental in advancing their research programs.

Axsome Therapeutics' key partnerships with healthcare providers and clinical sites are fundamental to its business model. These collaborations are crucial for successfully enrolling patients in clinical trials, a vital step in bringing new treatments to market. For instance, Axsome's Phase 3 trials for its migraine treatments, like AXS-07 and AXS-12, directly involved numerous clinical sites across the United States, enabling them to gather the necessary data for regulatory submissions.

These direct relationships with hospitals, clinics, and individual physicians are not only about patient recruitment but also about laying the groundwork for the future adoption of Axsome's therapies. By engaging with providers early, Axsome can educate them about its innovative treatments and ensure a smoother transition once products are approved. This proactive approach is key to driving prescription and distribution in clinical practice.

The strength of these partnerships directly impacts Axsome's ability to execute its development pipeline and commercialize its products. For example, the successful completion of their pivotal trials, which relied heavily on the cooperation of these clinical sites, demonstrated the effectiveness of their collaboration strategy. This ensures that when new therapies become available, they can reach the patients who need them efficiently.

Pharmaceutical Distributors and Specialty Pharmacies

For commercialized products such as Auvelity, Sunosi, and the anticipated Symbravo, Axsome Therapeutics heavily relies on pharmaceutical distributors and specialty pharmacies. These partnerships are fundamental to guaranteeing broad availability and seamless patient access to their treatments.

These essential partners manage the intricate logistics of the drug supply chain, including maintaining optimal inventory levels and efficiently dispensing medications directly to patients. Their role is critical for Axsome’s revenue generation and achieving significant market penetration for its therapeutic offerings.

- Distribution Network: Axsome leverages established networks of national and regional pharmaceutical distributors to ensure its products reach pharmacies and healthcare providers across the United States.

- Specialty Pharmacy Engagement: For complex or high-cost medications, partnerships with specialty pharmacies are crucial for managing patient support programs, reimbursement assistance, and adherence monitoring.

- Supply Chain Efficiency: In 2024, the pharmaceutical distribution sector continued to focus on optimizing supply chain resilience and reducing lead times, a critical factor for Axsome in meeting demand for its growing portfolio.

- Market Access: Effective collaboration with these channel partners directly impacts Axsome's ability to capture market share and achieve its commercial objectives for its key brands.

Payer Organizations and Managed Care Providers

Axsome actively cultivates relationships with major health insurance companies, including UnitedHealth Group and CVS Health, along with government programs like Medicare and Medicaid. These partnerships are fundamental for achieving favorable formulary placement, which is essential for patient access to Axsome's treatments. For instance, securing broad coverage is a key driver of commercial success, directly influencing prescription volume and revenue.

The company's strategic focus in 2024 and beyond involves expanding the number of covered lives for its approved therapies, such as Auvelity. This expansion is critical for maximizing market penetration and ensuring that a wider patient population can benefit from their innovative treatments. Success in these negotiations directly translates to the financial viability and growth trajectory of Axsome's product portfolio.

- Formulary Access: Partnerships with payers are vital for ensuring Axsome's medications are included on insurance formularies, making them accessible to patients.

- Reimbursement Rates: Negotiating favorable reimbursement rates with health insurance companies and government programs directly impacts the net revenue generated by Axsome's products.

- Patient Access Expansion: A primary objective is to increase the number of individuals covered by these payer organizations, thereby expanding the potential patient base for Axsome's therapies.

- Commercial Success: The strength of these payer relationships is a direct determinant of the commercial success and market adoption of Axsome's pharmaceutical offerings.

Axsome's key partnerships extend to contract manufacturing organizations (CMOs) responsible for producing its pharmaceutical products. These collaborations are vital for ensuring consistent product quality and timely supply to meet market demand.

In 2024, the biopharmaceutical contract manufacturing market was projected to reach over $200 billion, underscoring the critical role these external partners play in the industry's capacity. By leveraging CMOs, Axsome can scale production efficiently without the significant capital investment required for in-house manufacturing facilities.

These manufacturing partnerships are crucial for maintaining the integrity and availability of Axsome's therapies, ensuring that patients receive safe and effective treatments. The ability to manage production through these specialized partners directly supports Axsome's commercialization efforts and its commitment to patient access.

| Partner Type | Role | Strategic Importance |

| Contract Research Organizations (CROs) | Clinical trial management, data collection | Operational efficiency, regulatory compliance |

| Academic & Research Institutions | Scientific expertise, target identification | Deepening CNS understanding, novel therapies |

| Healthcare Providers & Clinical Sites | Patient recruitment, trial execution | Data generation, future market adoption |

| Distributors & Specialty Pharmacies | Logistics, patient access, supply chain | Market penetration, revenue generation |

| Health Insurance Companies & Payers | Formulary access, reimbursement | Patient access, commercial success |

| Contract Manufacturing Organizations (CMOs) | Product manufacturing, quality control | Consistent supply, product availability |

What is included in the product

This Axsome Business Model Canvas provides a comprehensive, pre-written overview of their strategy, detailing customer segments, channels, and value propositions for their CNS therapies.

It reflects Axsome's real-world operations and plans, offering insights into their competitive advantages and designed for presentations and funding discussions.

Axsome's Business Model Canvas offers a clear, one-page snapshot of how they address unmet needs in neurology, providing a concise overview of their value proposition for patients and healthcare providers.

This visual tool effectively communicates Axsome's strategy for delivering novel treatments, acting as a pain point reliever by simplifying complex pharmaceutical development and market access into an easily understandable format.

Activities

Axsome's primary activity centers on the discovery and development of innovative treatments for central nervous system disorders. This encompasses everything from initial research to identify potential drug candidates to rigorous preclinical evaluations, aiming to bring novel therapies to patients. Their efforts are specifically targeted at unmet medical needs in serious neurological and psychiatric conditions.

In 2024, Axsome continued to advance its pipeline, with a significant focus on its CNS portfolio. For instance, their development programs for conditions like migraine and major depressive disorder are key components of their research and development efforts. The company's investment in R&D reflects its commitment to innovation in this complex therapeutic area.

Axsome's core operations hinge on the meticulous design, execution, and ongoing management of clinical trials. This critical activity spans all phases, from initial safety assessments in Phase 1 to large-scale efficacy studies in Phase 3, ensuring robust data collection for regulatory submissions.

The company's commitment to clinical trial execution is underscored by recent successes. In 2024, Axsome announced positive Phase 3 results for AXS-05, a novel treatment for agitation associated with Alzheimer's disease. Furthermore, Phase 3 data for AXS-12, targeting narcolepsy, also demonstrated significant efficacy and safety.

Navigating the intricate maze of regulatory pathways is a cornerstone of Axsome's operations. This involves meticulously preparing and submitting New Drug Applications (NDAs) and supplemental NDAs (sNDAs) to agencies like the U.S. Food and Drug Administration (FDA), a process crucial for bringing new treatments to market.

Securing these vital approvals directly impacts the company's ability to commercialize its innovative therapies. For instance, Axsome achieved a significant milestone with the FDA approval of Symbravo for acute migraine in January 2025, demonstrating their proficiency in this area.

Looking ahead, Axsome is actively progressing with further regulatory submissions. They are on track for an sNDA submission for AXS-05 in the third quarter of 2025 and an NDA for AXS-12 in the fourth quarter of 2025, underscoring their commitment to expanding their product pipeline through successful regulatory engagement.

Commercialization and Market Penetration

Axsome's commercialization strategy focuses on robust marketing, sales, and distribution to ensure market penetration post-approval. This includes strategic expansion of their sales force and targeted marketing campaigns to reach key healthcare providers and patients.

The company actively works on securing market access and favorable reimbursement for its therapies, which is crucial for uptake. For instance, Axsome expanded its Auvelity sales force in preparation for broader market reach and the launch of new products.

- Sales Force Expansion: Axsome significantly grew its sales team to support the commercialization of its approved therapies, aiming for comprehensive market coverage.

- Marketing Campaigns: Development and execution of targeted marketing initiatives are key to raising awareness and driving adoption among prescribers and patients.

- Market Access & Reimbursement: Securing favorable reimbursement and market access is a critical step to ensure patient affordability and product uptake.

- Product Launches: The successful launch of products like Symbravo in June 2025 demonstrates Axsome's ability to execute its commercialization plan effectively.

Intellectual Property Management

Axsome's intellectual property management is central to its strategy, focusing on safeguarding its novel therapeutic candidates. This involves actively pursuing and maintaining patents to protect its discoveries and ensure market exclusivity for its innovative treatments.

Securing long-term market exclusivity is paramount in the biopharmaceutical sector. Axsome's commitment to robust patent protection provides a crucial competitive edge, allowing them to recoup research and development investments.

Strategic patent litigation settlements are a key activity. For instance, the settlement regarding Auvelity (dextromethorphan HBr-bupropion HBr) extended its market exclusivity, underscoring the importance of these legal maneuvers in maintaining market presence and profitability.

- Patent Portfolio Development: Continuously filing and maintaining patents for novel drug candidates and formulations.

- Freedom to Operate Analysis: Ensuring their products do not infringe on existing patents held by competitors.

- Patent Enforcement and Litigation: Actively defending their intellectual property rights through legal means, including settlements and potential litigation.

- Lifecycle Management: Strategically managing patent expiries and exploring opportunities for new patent filings to extend market exclusivity.

Axsome's key activities encompass the entire drug development lifecycle, from initial research and discovery of novel CNS treatments to the meticulous execution of clinical trials across all phases. They also focus on navigating complex regulatory pathways, including submitting NDAs and sNDAs to agencies like the FDA, to secure market approval for their innovative therapies.

In 2024, Axsome continued to advance its pipeline, with a significant focus on its CNS portfolio. For instance, their development programs for conditions like migraine and major depressive disorder are key components of their research and development efforts. The company's investment in R&D reflects its commitment to innovation in this complex therapeutic area.

The company's commercialization efforts are also a vital activity, involving strategic sales force expansion, targeted marketing campaigns, and securing market access and favorable reimbursement to ensure product uptake. Furthermore, robust intellectual property management, including patent protection and strategic litigation settlements, is crucial for safeguarding their discoveries and maintaining market exclusivity.

| Key Activity | Description | 2024/2025 Milestones |

|---|---|---|

| Research & Development | Discovery and development of novel CNS treatments. | Advancing pipeline for migraine and major depressive disorder. |

| Clinical Trials | Design, execution, and management of all trial phases. | Positive Phase 3 results for AXS-05 (Alzheimer's agitation) and AXS-12 (narcolepsy) in 2024. |

| Regulatory Affairs | Navigating regulatory pathways and submitting applications. | FDA approval of Symbravo (migraine) in Jan 2025; sNDA for AXS-05 Q3 2025; NDA for AXS-12 Q4 2025. |

| Commercialization | Marketing, sales, distribution, market access, and reimbursement. | Sales force expansion for Auvelity; Symbravo launch in June 2025. |

| Intellectual Property | Patent protection, freedom to operate, and litigation. | Patent litigation settlement extending Auvelity market exclusivity. |

What You See Is What You Get

Business Model Canvas

The Axsome Business Model Canvas preview you are seeing is the exact document you will receive upon purchase. This means you get a direct, unedited view of the comprehensive analysis, ensuring no surprises and full transparency. Once your order is complete, you'll gain access to this same, professionally structured Business Model Canvas, ready for your strategic planning.

Resources

Axsome's most critical asset is its robust pipeline of drug candidates, especially those focused on central nervous system (CNS) disorders. This includes promising treatments like AXS-05 and AXS-12, along with approved medications such as solriamfetol.

These drug candidates are safeguarded by extensive patent protection, representing a significant investment in research and development. This intellectual property is the bedrock of Axsome's future revenue potential and market position.

The value of this proprietary pipeline is directly tied to its ability to generate future sales and profitability. For instance, AXS-05 has shown strong efficacy in clinical trials for major depressive disorder, a market with substantial unmet needs.

Axsome's business model heavily leverages its scientific and medical expertise. This human capital includes a team of highly skilled scientists, clinicians, and regulatory affairs professionals. Their deep knowledge in neuroscience, drug development, and clinical trial design is crucial for identifying unmet medical needs and bringing innovative therapies to market.

This expertise is directly applied to the company's core activities, such as identifying promising drug candidates and designing rigorous clinical trials. For instance, in 2024, Axsome continued to advance its pipeline, with clinical trial data for its lead assets like AXS-07 and AXS-05 demonstrating significant progress, underscoring the team's capability in executing complex research and development.

Axsome's financial capital is a cornerstone of its business model, providing the necessary fuel for its ambitious research and development programs. This includes the significant investment required to navigate the complex and expensive process of clinical trials.

The company's ability to maintain substantial cash reserves and access credit facilities is paramount. As of the first quarter of 2024, Axsome reported cash and cash equivalents of approximately $650 million, a figure crucial for sustaining its operations and driving its product pipeline forward.

Axsome's management has expressed confidence that its existing financial resources are adequate to support operations until the company achieves cash flow positivity, a key milestone in its growth strategy.

Clinical Data and Regulatory Approvals

Axsome's clinical trial data is a cornerstone, showcasing the effectiveness and safety of its drug candidates. This robust evidence is critical for navigating the regulatory landscape, leading to approvals like Symbravo by the FDA. The company also has planned submissions for AXS-05 and AXS-12, underscoring the ongoing value of this data.

Positive clinical results directly translate into market acceptance and build essential trust among healthcare professionals. For instance, the FDA approval of Symbravo for major depressive disorder in adults highlights the success of their data-driven regulatory strategy.

- Demonstrated Efficacy: Clinical trial data proving a drug candidate's ability to treat a specific condition.

- Safety Profiles: Comprehensive data detailing the safety and tolerability of drug candidates.

- Regulatory Submissions: The compilation of clinical data for review by regulatory bodies like the FDA.

- Market Adoption: Positive clinical outcomes are key drivers for physician prescribing habits and patient acceptance.

Commercial Infrastructure and Sales Force

Axsome's commercial infrastructure, including its sales force, is a critical asset for engaging healthcare professionals and driving the adoption of its therapies, such as Auvelity. This established network allows for direct interaction with prescribers, which is vital for effective market penetration and building brand recognition.

The strategic expansion of the sales team in 2024 is designed to broaden reach and enhance market presence. By increasing the number of sales representatives, Axsome aims to cover a larger segment of the healthcare provider landscape, ensuring that information about its products reaches a wider audience of potential prescribers.

- Established Commercial Infrastructure: Axsome possesses an established commercial infrastructure, crucial for reaching healthcare professionals and driving product adoption.

- Expanded Sales Force: In 2024, Axsome continued to expand its sales force, enhancing its capacity for direct engagement with prescribers.

- Market Penetration: This infrastructure and sales force are key resources for achieving effective market penetration and increasing brand awareness for products like Auvelity.

Axsome's key resources also encompass its intellectual property portfolio, including patents and regulatory exclusivities, which protect its innovative drug candidates and approved products. This legal protection is vital for ensuring market exclusivity and maximizing the return on its significant R&D investments.

The company's robust clinical trial data is another critical asset, demonstrating the efficacy and safety of its pipeline drugs. This data is essential for securing regulatory approvals and building confidence among healthcare providers and patients, driving market adoption.

Axsome's financial resources, including its cash reserves and access to capital, are fundamental to funding its extensive research, development, and commercialization activities. As of Q1 2024, Axsome held approximately $650 million in cash and cash equivalents, a substantial amount to advance its pipeline.

| Resource | Description | 2024 Relevance |

|---|---|---|

| Intellectual Property | Patents and regulatory exclusivities protecting drug candidates and approved therapies. | Secures market exclusivity for products like Auvelity and pipeline assets. |

| Clinical Trial Data | Evidence of drug efficacy and safety from ongoing and completed trials. | Crucial for FDA submissions and approvals, supporting market acceptance. |

| Financial Capital | Cash reserves and access to funding for R&D and commercialization. | Approximately $650 million in cash as of Q1 2024, supporting pipeline advancement. |

Value Propositions

Axsome Therapeutics concentrates on creating unique treatments for central nervous system disorders where current therapies fall short. This strategic focus targets significant unmet medical needs in neurology and psychiatry, aiming to improve the lives of millions affected by these conditions.

Axsome's differentiated mechanisms of action set its products and pipeline apart, often targeting novel pathways for improved patient outcomes. This innovation aims to offer significant advancements over existing therapies.

For example, Symbravo (AXS-07) employs a unique, multi-mechanistic approach to migraine treatment, addressing multiple aspects of the migraine pathophysiology. This contrasts with many single-target treatments currently available.

This focus on novel mechanisms can translate into superior efficacy and better safety profiles, a crucial differentiator in competitive therapeutic areas. Axsome's pipeline candidates continue to explore these advanced therapeutic strategies.

Axsome's value proposition centers on providing rapid-acting and effective treatments for debilitating conditions. For patients suffering from major depressive disorder (MDD) and migraines, the company's therapies offer a distinct advantage by delivering quicker relief.

Auvelity, a key product, stands out as the first and only oral NMDA receptor antagonist approved for MDD, demonstrating this commitment to speed. This rapid onset of action is a critical benefit for individuals who need immediate symptom management.

Improved Quality of Life for Patients

Axsome's commitment to treating debilitating central nervous system (CNS) conditions like Alzheimer's disease agitation, narcolepsy, and major depressive disorder directly translates to a significantly improved quality of life for patients. By offering novel therapeutic options, they aim to reduce the severe symptoms that often impair daily functioning.

Their focus on patient well-being is paramount. For instance, therapies targeting Alzheimer's agitation can lessen distress for both the patient and their caregivers, fostering a more stable home environment. This patient-centric approach is a core tenet of their value proposition.

- Alleviating Severe Symptoms: Axsome's drug development targets conditions with significant symptom burden, aiming to provide relief where existing treatments may be insufficient.

- Enhancing Daily Functioning: By managing symptoms effectively, their therapies empower patients to engage more fully in daily activities and improve overall well-being.

- Supporting Caregivers: Improvements in patient condition often lead to reduced caregiver stress and a better quality of life for those providing support.

- Addressing Unmet Needs: Axsome focuses on CNS disorders with substantial unmet medical needs, offering hope and improved outcomes for patient populations.

Addressing a Broad Range of Serious CNS Conditions

Axsome Therapeutics is tackling a wide array of significant central nervous system (CNS) conditions, offering hope to a vast patient population. This comprehensive strategy addresses multiple critical unmet needs within the CNS therapeutic landscape, thereby broadening their market reach and potential impact.

Their diverse pipeline is designed to treat conditions such as major depressive disorder, narcolepsy, chronic migraine, and Alzheimer's disease. For instance, in 2024, Axsome continued to advance its treatments, with solriamfetol (Sunosi) approved for both narcolepsy and obstructive sleep apnea, demonstrating their commitment to sleep disorder patients. Furthermore, their migraine treatments, like AXS-07, have shown promising results in clinical trials, aiming to provide much-needed relief for chronic migraine sufferers.

- Addressing Major Depressive Disorder: Axsome's lead asset, AXS-07, targets a significant unmet need in acute migraine treatment.

- Expanding Sleep Disorder Solutions: Sunosi (solriamfetol) is approved for both narcolepsy and obstructive sleep apnea, showcasing a dual-application strategy.

- Tackling Neurodegenerative Diseases: The company is also investing in the development of treatments for conditions like Alzheimer's disease, a major area of focus for CNS research.

- Broad Patient Impact: By targeting multiple serious CNS conditions, Axsome aims to improve the lives of millions of patients globally.

Axsome's core value proposition lies in delivering novel, rapid-acting therapies for debilitating central nervous system (CNS) disorders. They focus on conditions with significant unmet medical needs, aiming to provide substantial improvements in patient outcomes and quality of life.

Their approach emphasizes differentiated mechanisms of action, leading to potentially superior efficacy and safety profiles compared to existing treatments. This innovation is crucial for patients suffering from conditions like major depressive disorder and migraines.

By targeting conditions such as MDD, narcolepsy, and chronic migraine, Axsome aims to alleviate severe symptoms and enhance daily functioning for millions. For example, Auvelity (dextromethorphan HBr-bupropion HBr) became the first and only oral NMDA receptor antagonist approved for MDD in 2022, offering a new treatment option.

The company's commitment extends to addressing caregiver burden, as improved patient well-being directly reduces stress for those providing care. Axsome's pipeline, including developments in Alzheimer's disease agitation and sleep disorders, underscores this patient-centric mission.

| Therapeutic Area | Key Product/Pipeline | Value Proposition Highlight |

|---|---|---|

| Major Depressive Disorder (MDD) | Auvelity (dextromethorphan HBr-bupropion HBr) | First and only oral NMDA receptor antagonist for MDD, offering rapid symptom relief. |

| Migraine | Symbravo (AXS-07) | Multi-mechanistic approach for acute migraine treatment, aiming for faster and more complete pain relief. |

| Sleep Disorders | Sunosi (solriamfetol) | Approved for narcolepsy and obstructive sleep apnea, improving wakefulness. |

| Alzheimer's Disease Agitation | AXS-07 development | Addressing agitation in Alzheimer's patients to improve patient and caregiver quality of life. |

Customer Relationships

Axsome Therapeutics cultivates robust relationships with key healthcare professionals, including neurologists and psychiatrists, by employing a dedicated sales force. This direct engagement is crucial for educating physicians about Axsome's innovative treatments, disseminating vital clinical trial data, and gaining insights into the evolving needs of medical practitioners.

In 2024, Axsome strategically expanded its Auvelity sales force, a move designed to amplify this direct outreach and strengthen its connection with the medical community. This expansion underscores the company's commitment to ensuring healthcare providers are well-informed and equipped to utilize their therapies effectively.

Axsome actively engages the scientific community by fostering relationships with Key Opinion Leaders (KOLs) and researchers. This is achieved through robust medical affairs initiatives, including presenting data at major medical conferences and publishing findings in peer-reviewed journals. For instance, in 2023, Axsome presented data from its pivotal trials for AXS-07 and AXS-12 at key neurology congresses, reinforcing its commitment to scientific transparency and education.

These efforts are crucial for disseminating vital clinical information and building trust and credibility within the medical landscape. Axsome further strengthens these ties by hosting Research and Development (R&D) Days, inviting expert clinicians to discuss the company's promising pipeline. This direct engagement ensures that the latest scientific advancements and clinical perspectives are shared effectively.

Axsome Therapeutics is dedicated to fostering strong patient relationships through comprehensive support programs and resources. These initiatives are designed to empower patients navigating their health journeys, particularly those with central nervous system disorders.

These programs often focus on improving medication access and affordability, a critical factor for patient adherence. For instance, in 2024, many pharmaceutical companies continued to invest heavily in patient assistance programs, with some reporting that over 70% of eligible patients utilized these services to manage out-of-pocket costs.

Beyond access, Axsome's resources aim to enhance patient understanding of their conditions and treatment plans. This educational component is vital for effective self-management and can lead to better treatment outcomes, as studies consistently show a correlation between patient education and improved therapeutic results.

Investor Relations and Transparency

Axsome Therapeutics prioritizes clear and open communication with its investors. This involves regular updates on their progress, financial performance, and strategic direction to foster trust within the financial community.

The company actively engages with stakeholders through various channels. For instance, in their Q1 2024 earnings call, Axsome provided detailed updates on their pipeline advancements and commercialization efforts, highlighting key milestones achieved.

- Financial Reporting: Axsome adheres to strict financial reporting schedules, providing quarterly and annual reports that detail their revenue, expenses, and cash flow, ensuring accountability to shareholders.

- Investor Communications: The company hosts investor conferences and webcasts to discuss performance and answer questions, demonstrating a commitment to transparency. For example, their 2024 Investor Day provided in-depth insights into their long-term strategy.

- Pipeline Updates: Regular updates on clinical trial progress and regulatory submissions are shared, keeping investors informed about the potential of their drug candidates.

- Market Engagement: Axsome actively participates in industry conferences and engages with financial analysts to disseminate information and gather feedback.

Pharmacovigilance and Post-Market Surveillance

Following product launch, Axsome actively manages its customer relationships through robust pharmacovigilance and post-market surveillance. This crucial phase involves continuously monitoring the safety and effectiveness of its marketed therapies in real-world settings. For instance, in 2024, the company would be diligently tracking data related to its approved treatments, such as the collection and analysis of adverse event reports to ensure patient well-being and product integrity.

This ongoing commitment to patient safety and product performance is fundamental to building and maintaining long-term trust with healthcare providers and patients. By proactively addressing any identified safety concerns or performance issues, Axsome reinforces its dedication to delivering reliable and effective treatments. This also ensures continued adherence to stringent regulatory compliance standards, a key aspect of sustained market presence.

- Ongoing Safety Monitoring: Post-launch, Axsome collects and analyzes real-world data to track the safety profile of its therapies.

- Adverse Event Management: The company addresses any reported adverse events promptly, ensuring patient safety and product integrity.

- Building Trust: This dedication to safety and performance fosters long-term trust with healthcare professionals and patients.

- Regulatory Compliance: Continuous surveillance ensures ongoing adherence to regulatory requirements, critical for market sustainment.

Axsome Therapeutics cultivates strong relationships with healthcare professionals through a dedicated sales force, focusing on educating them about innovative treatments and gathering market insights. In 2024, the company strategically expanded its sales team for Auvelity to enhance this direct engagement and ensure providers are well-informed.

The company also actively engages the scientific community via medical affairs, presenting data at conferences and publishing research, exemplified by their 2023 presentations of pivotal trial data for AXS-07 and AXS-12. Furthermore, Axsome fosters patient relationships through support programs that improve medication access and understanding, with a notable trend in 2024 of patient assistance programs reaching over 70% utilization for eligible patients.

| Relationship Type | Engagement Strategy | 2024 Focus/Example |

|---|---|---|

| Healthcare Professionals | Direct Sales Force Engagement, Medical Affairs | Auvelity sales force expansion, KOL engagement, conference presentations |

| Patients | Support Programs, Educational Resources | Improving medication access and adherence, condition understanding |

| Investors | Financial Reporting, Investor Communications | Quarterly reports, Investor Day events, pipeline updates |

Channels

Axsome's business model heavily relies on its specialized pharmaceutical sales force to engage directly with healthcare providers, educating them on its key treatments like Auvelity, Sunosi, and Symbravo. This direct promotional channel is vital for building prescriber relationships and driving adoption of its neuroscience therapies.

The company strategically expanded its sales force in 2023 and continued this growth into 2024 to bolster market penetration and reach a wider audience of physicians. This investment in field personnel is a core component of their strategy to maximize prescription volume and revenue for their approved products.

Axsome Therapeutics leverages a network of specialty pharmacies and pharmaceutical distributors to deliver its approved therapies. This channel is critical for ensuring that complex medications reach patients efficiently and safely, adhering to stringent handling and dispensing protocols. For instance, in 2024, the specialty pharmacy market continued its robust growth, with estimates placing its value well over $300 billion globally, highlighting the importance of these specialized distribution partners for pharmaceutical companies like Axsome.

Axsome leverages prestigious healthcare conferences and leading medical journals to showcase its scientific advancements. For instance, in 2024, the company presented data on its migraine treatments at key events like the American Academy of Neurology Annual Meeting, reaching thousands of neurologists and researchers.

These platforms are crucial for disseminating clinical trial results and real-world evidence, reinforcing the efficacy and safety of Axsome's therapies. Publications in high-impact journals, such as JAMA Neurology or Cephalalgia, further validate their research and reach a global audience of medical professionals.

By actively participating in these channels, Axsome effectively communicates the value proposition of its products to healthcare providers and key opinion leaders, driving awareness and adoption within the medical community.

Digital Marketing and Online Platforms

Axsome Therapeutics actively leverages digital marketing and online platforms to connect with its key stakeholders. Their corporate website serves as a central hub for detailed information on their pipeline, clinical trial data, and corporate news, reaching healthcare professionals and investors alike. In 2024, pharmaceutical companies continued to see significant engagement through digital channels, with many reporting increased website traffic and social media interaction as primary drivers for awareness.

Social media channels and specialized online medical platforms are crucial for disseminating information about Axsome's therapeutic areas and engaging with the medical community. This digital presence is vital for building brand awareness and fostering understanding of their innovative treatments. For instance, a significant portion of healthcare providers now rely on online resources for continuing medical education and drug information, highlighting the importance of a robust digital strategy.

The company's digital strategy is designed to inform and educate, thereby driving engagement and supporting their commercial objectives. Key aspects include:

- Corporate Website: A primary source for detailed product information, investor relations, and company news.

- Social Media Engagement: Utilizing platforms to share updates, educational content, and engage with the broader healthcare ecosystem.

- Online Medical Platforms: Participating in or leveraging platforms frequented by healthcare professionals for information dissemination.

- Digital Advertising: Targeted campaigns to reach specific demographics of healthcare providers and patients.

Direct-to-Consumer (DTC) Advertising

Axsome strategically employs direct-to-consumer (DTC) advertising to build patient awareness for specific approved products, fostering conversations with healthcare professionals. A significant DTC campaign for Auvelity is anticipated, aiming to directly inform the public about treatment options and stimulate patient-driven demand, ultimately leading to increased prescriptions.

- Patient Awareness: DTC campaigns directly educate the public about conditions and available treatments.

- Prescription Generation: Increased patient knowledge can lead to more proactive discussions with doctors.

- Brand Building: For products like Auvelity, DTC advertising helps establish brand recognition and trust.

- Market Penetration: Reaching a broad audience can accelerate market penetration and adoption rates.

Axsome's channels encompass a multi-faceted approach, blending direct engagement with healthcare professionals through its specialized sales force with broad reach via digital platforms and targeted DTC advertising. This integrated strategy aims to educate, build awareness, and ultimately drive prescription volume for its neuroscience therapies.

The company's investment in its sales force, continuing into 2024, underscores the importance of personal relationships in the pharmaceutical sector. Concurrently, digital channels and medical conferences provide scalable avenues for disseminating scientific data and fostering broad engagement within the medical community.

Specialty pharmacies and distributors are critical for the efficient and safe delivery of Axsome's treatments, a segment that saw continued robust growth in 2024. This network ensures that complex medications reach patients reliably, supporting therapeutic adherence and outcomes.

| Channel Type | Key Activities | 2024 Focus/Data Point |

|---|---|---|

| Direct Sales Force | Educating healthcare providers, building relationships | Continued expansion of sales force to drive market penetration |

| Digital Marketing & Online Platforms | Corporate website, social media, online medical platforms | Increased website traffic and social media engagement as key awareness drivers |

| Medical Conferences & Journals | Presenting clinical data, publishing research | Data presentations at key neurology meetings reaching thousands of professionals |

| Specialty Pharmacies & Distributors | Efficient and safe delivery of therapies | Leveraging a market segment valued well over $300 billion globally |

| Direct-to-Consumer (DTC) Advertising | Building patient awareness, stimulating patient-driven demand | Anticipated campaigns for Auvelity to increase patient conversations with doctors |

Customer Segments

Patients with Central Nervous System (CNS) Conditions represent Axsome Therapeutics' core customer base. This segment encompasses individuals grappling with significant neurological and psychiatric challenges, including major depressive disorder (MDD), narcolepsy, obstructive sleep apnea (OSA), migraine, and agitation associated with Alzheimer's disease. These patients are actively searching for novel and more effective therapeutic solutions to manage their debilitating symptoms and enhance their daily lives.

The prevalence of these conditions underscores the substantial market need. For instance, in 2024, it's estimated that over 20 million adults in the United States experience at least one major depressive episode annually, highlighting the vast patient population seeking improved treatment outcomes. Similarly, millions more suffer from chronic migraine, narcolepsy, and OSA, all conditions where Axsome aims to make a significant impact with its innovative pipeline.

Neurologists, psychiatrists, and other Central Nervous System (CNS) specialists are the core customer segment for Axsome Therapeutics. These physicians are the primary decision-makers when it comes to prescribing treatments for conditions like migraine, depression, and Alzheimer's disease, which are key areas of focus for Axsome. Their prescribing habits are heavily shaped by robust clinical trial data, demonstrated efficacy, and favorable safety profiles of new therapies.

Axsome's commercial strategy places significant emphasis on reaching and educating these specialists. The company's sales force and medical science liaisons are dedicated to providing detailed information on Axsome's products, including their mechanisms of action and patient outcomes. For instance, the successful launch of Auvelity (dextromethorphan HBr-bupropion HBr) for major depressive disorder in 2022 relied heavily on engaging these prescribers with compelling clinical evidence.

As of early 2024, the market for CNS disorders remains substantial, with significant unmet needs driving demand for innovative treatments. Neurologists and psychiatrists are constantly seeking novel therapeutic options that offer improved efficacy and tolerability for their patients. Axsome's pipeline, including potential treatments for conditions like narcolepsy and Parkinson's disease, directly targets these ongoing needs, making these specialists a critical audience for future product adoption.

Primary Care Physicians (PCPs) are crucial for identifying patients with central nervous system (CNS) conditions, even if specialists handle complex cases. They make initial diagnoses and manage milder presentations, making them a key channel for broader market penetration.

For instance, Axsome's Auvelity, approved for major depressive disorder, can be prescribed by PCPs, highlighting their importance in reaching a wider patient population. In 2024, the demand for effective depression treatments continues to grow, underscoring the PCP's role in early intervention.

Healthcare Payers and Insurance Providers

Healthcare payers and insurance providers, including commercial insurers, government programs like Medicare and Medicaid, and managed care organizations, are critical customer segments for Axsome Therapeutics. Their formulary decisions and reimbursement rates directly influence patient access to Axsome's treatments and, consequently, the company's revenue. For instance, in 2024, securing favorable reimbursement for migraine treatments like Sunosi and potentially the upcoming AXS-07 is paramount for market penetration. Axsome's engagement with these entities aims to ensure broad coverage and reasonable co-pays, facilitating patient uptake.

Axsome's strategy involves demonstrating the clinical and economic value of its therapies to these payers. This often includes presenting real-world evidence and cost-effectiveness data. By securing preferred formulary status, Axsome can reduce out-of-pocket costs for patients, thereby increasing prescription volume. The company's efforts in 2024 are focused on expanding this access, understanding that positive coverage decisions are foundational to commercial success in the pharmaceutical market.

- Commercial Insurance Companies: These form a significant portion of the payer landscape, dictating coverage for a large insured population.

- Government Healthcare Programs: Medicare and Medicaid represent substantial patient bases, with coverage decisions heavily influencing market access.

- Managed Care Organizations (MCOs): MCOs play a crucial role in managing healthcare costs and patient access through negotiated contracts and formularies.

- Formulary Access & Reimbursement Rates: These are key decision points for payers, directly impacting patient affordability and physician prescribing habits.

Caregivers and Patient Advocacy Organizations

Caregivers are instrumental in managing patients with conditions like Alzheimer's disease agitation, significantly influencing treatment adherence and decisions. Their daily involvement makes them key stakeholders in the effectiveness of therapies.

Patient advocacy organizations are powerful voices that shape treatment guidelines, boost public awareness, and provide vital support networks for patients and their families. These groups can champion innovative treatments like those from Axsome, impacting market perception and adoption.

While not the direct purchasers of medication, these segments are critical influencers. For instance, in 2024, awareness campaigns for neurodegenerative diseases continued to grow, highlighting the importance of patient and caregiver voices in driving demand for new therapeutic options.

- Caregiver Influence: Caregivers often research and recommend treatments to healthcare providers, directly impacting prescription patterns.

- Advocacy Group Impact: Organizations lobby for better access to care and funding for research, creating a more favorable environment for new drugs.

- Patient-Centric Approach: Axsome's focus on conditions with significant caregiver burden aligns with the needs of this influential segment.

Axsome's customer segments are multifaceted, encompassing patients seeking relief, healthcare professionals making prescribing decisions, and payers influencing market access. The company's strategy must effectively engage each of these groups to ensure successful product adoption and commercial viability.

For instance, in 2024, the focus remains on demonstrating value to both prescribers and payers. Neurologists and psychiatrists are key targets due to their direct influence on patient treatment, while payers like commercial insurers and government programs are critical for securing broad reimbursement and formulary access, which directly impacts patient affordability and prescription volume.

Furthermore, patient advocacy groups and caregivers play an increasingly vital role in shaping treatment landscapes and driving awareness for CNS conditions. Their influence in 2024 continues to grow, emphasizing the need for Axsome to maintain strong relationships and communication channels with these stakeholders.

| Customer Segment | Key Characteristics | Axsome's Engagement Strategy | 2024 Relevance |

| Patients | Seeking effective treatments for CNS disorders (MDD, narcolepsy, OSA, migraine). | Focus on product efficacy, safety, and improved quality of life. | High unmet need drives demand for innovative therapies. |

| Healthcare Professionals (HCPs) | Neurologists, Psychiatrists, Primary Care Physicians. | Provide robust clinical data, sales force education, medical science liaisons. | Crucial for diagnosis, prescription, and patient management. |

| Healthcare Payers | Commercial insurers, Medicare, Medicaid, MCOs. | Demonstrate clinical and economic value, secure favorable formulary status. | Determine patient access and reimbursement, impacting market penetration. |

| Caregivers & Advocacy Groups | Influence treatment adherence, decisions, and public awareness. | Build relationships, support patient communities, raise disease awareness. | Shape treatment guidelines and drive demand for new options. |

Cost Structure

Research and Development (R&D) represents a substantial cost for Axsome, reflecting the capital-intensive nature of pharmaceutical innovation. These expenses fuel the entire lifecycle of drug development, from initial discovery and laboratory testing to rigorous clinical trials necessary for regulatory approval.

For the full year 2024, Axsome reported R&D expenses totaling $187.1 million. This significant investment underscores their commitment to advancing their pipeline of novel therapeutics for central nervous system disorders.

Looking ahead to the second quarter of 2025, R&D expenditures were $49.5 million. These ongoing investments are crucial for progressing their drug candidates through various stages of clinical testing and ultimately bringing them to market.

Sales, General, and Administrative (SG&A) expenses are a significant component of Axsome's cost structure, directly tied to bringing their treatments to market and running the company. These costs cover everything from advertising and sales team salaries to the general overhead needed to operate a pharmaceutical business.

As Axsome continues to launch new products, like their migraine treatments, and expand their sales force to reach more patients and healthcare providers, these SG&A costs naturally climb. This investment is crucial for building brand awareness and ensuring their therapies are accessible.

For instance, in the second quarter of 2025, Axsome reported a notable increase in SG&A expenses, which rose by 26% to $130.3 million. This jump highlights their commitment to commercial expansion and supporting their growing product portfolio.

The expenses related to producing drug substances and finished goods, alongside the complexities of supply chain management and distribution, represent a significant component of the cost structure. These expenditures scale directly with the quantity of products that are sold.

For the second quarter of 2025, Axsome reported a total cost of revenue amounting to $13.4 million, reflecting the direct costs associated with bringing their pharmaceutical products to market.

Regulatory and Legal Expenses

Axsome's cost structure includes substantial regulatory and legal expenses, essential for navigating the pharmaceutical landscape. Complying with stringent FDA and other global regulatory requirements necessitates significant investment in preparing extensive submission dossiers and ongoing post-market surveillance.

Managing intellectual property is also a critical cost driver. For instance, in 2024, Axsome reached a patent settlement for its Auvelity product, which likely involved legal fees and potential royalty payments, underscoring the financial impact of protecting their innovations.

- Regulatory Compliance: Costs associated with meeting FDA and international drug approval standards.

- Intellectual Property Management: Expenses for patent filings, maintenance, and litigation to protect market exclusivity.

- Legal Counsel: Fees for legal expertise in regulatory affairs, contract negotiation, and dispute resolution.

- Submission Preparation: Significant investment in compiling and submitting the detailed documentation required for new drug applications.

Personnel Costs and Compensation

Personnel costs are a significant driver of Axsome's operational expenses. These include salaries, benefits, and various forms of compensation for their scientific, clinical, commercial, and administrative teams. For instance, the company's strategic decision to expand its research and development (R&D) and commercial teams, particularly its sales force for Auvelity, directly contributes to this cost category.

The growth in headcount, especially in areas supporting product launches and ongoing clinical trials, is a key factor influencing personnel expenditures. This investment in human capital is crucial for advancing their pipeline and commercializing their therapies.

- Salaries and Wages: Covering compensation for a growing team of scientists, researchers, clinical operations staff, and commercial personnel.

- Employee Benefits: Including health insurance, retirement plans, and other benefits that support the workforce.

- Sales Force Expansion: Direct costs associated with hiring, training, and compensating an expanded sales team, such as for Auvelity.

- R&D Personnel: Investment in scientific and clinical staff crucial for drug discovery, development, and regulatory affairs.

Axsome's cost structure is heavily influenced by its significant investments in research and development, essential for bringing new therapies to market. These R&D expenses, totaling $187.1 million for the full year 2024 and $49.5 million in Q2 2025, are fundamental to their innovation pipeline.

Sales, General, and Administrative (SG&A) expenses are another major cost driver, reflecting the company's efforts in commercializing its products and managing operations. SG&A costs saw a notable increase of 26% to $130.3 million in Q2 2025, indicating a strategic push for market presence.

The cost of revenue, representing expenses for drug production and distribution, was $13.4 million in Q2 2025. Alongside these, regulatory compliance and intellectual property management contribute substantially to overall costs, as seen with patent settlements and the extensive documentation required for drug approvals.

Personnel costs are also a key component, encompassing salaries, benefits, and expansion of teams like the sales force for Auvelity. These investments in human capital are vital for both pipeline advancement and commercial success.

| Cost Category | 2024 (Full Year) | Q2 2025 | Significance |

|---|---|---|---|

| R&D Expenses | $187.1 million | $49.5 million | Fueling drug discovery and clinical trials |

| SG&A Expenses | N/A | $130.3 million | Commercialization and operational management |

| Cost of Revenue | N/A | $13.4 million | Manufacturing and distribution costs |

| Regulatory & Legal | Included in overall operations | Ongoing investment for compliance and IP protection | Navigating regulatory approvals and protecting innovations |

| Personnel Costs | Integral to R&D and SG&A | Supporting R&D and commercial expansion | Investment in scientific, clinical, and commercial teams |

Revenue Streams

Axsome's main income source is the net product sales from its approved medications. These include Auvelity for major depressive disorder, Sunosi for excessive daytime sleepiness, and the recently introduced Symbravo for acute migraine.

Auvelity has been a key contributor, achieving $119.6 million in sales during the second quarter of 2025. This strong performance helped drive total net product revenue to $150.0 million in the same quarter.

Future product launches are a critical component of Axsome's growth strategy, with anticipated new revenue streams from candidates like AXS-05 for Alzheimer's disease agitation and AXS-12 for narcolepsy. These potential additions aim to broaden the company's commercial offerings and tap into substantial patient bases.

The company's ambition is to bring as many as seven products to market by 2027, a significant expansion that underscores their pipeline's potential. This forward-looking approach is designed to diversify revenue and solidify Axsome's position in key therapeutic areas.

Axsome Therapeutics can secure revenue through royalties on products they've out-licensed to other pharmaceutical firms for sales in specific regions. This strategy allows Axsome to benefit from its innovations without directly managing all commercialization efforts globally. For instance, Sunosi, a narcolepsy treatment, contributes royalty income from its sales in territories where it's handled by partners.

Milestone Payments from Partnerships

Milestone payments represent a crucial, albeit non-recurring, revenue stream for Axsome through its strategic collaborations. These payments are triggered by the successful attainment of predefined development, regulatory, or commercial targets by its partners. For instance, in 2023, Axsome reported significant progress in its partnerships, which are designed to unlock these milestone-based financial injections.

These lump-sum payments are vital for bolstering Axsome's financial health and providing essential capital to fuel ongoing research and development initiatives. They offer a flexible funding source, allowing the company to invest in pipeline advancement without solely relying on traditional sales or equity financing. The structure of these agreements means that successful partner execution directly translates into tangible financial benefits for Axsome.

- Partnership Milestones: Payments contingent on partner achievements in development, regulatory, or commercial phases.

- Financial Impact: Provides significant lump sums, enhancing financial stability and R&D funding.

- Non-Recurring Nature: These are event-driven payments, not a consistent sales revenue.

Geographic Expansion and New Indications

Expanding the market reach of existing approved products into new geographic regions or securing approvals for new indications for their current therapies will generate additional revenue. This strategy diversifies income sources and leverages existing R&D investments. For example, developing solriamfetol for ADHD or binge eating disorder expands its market potential beyond narcolepsy and obstructive sleep apnea (OSA).

Axsome reported that Sunosi (solriamfetol) net sales reached $174.2 million in 2023, a significant increase from $119.7 million in 2022. This growth highlights the revenue potential of expanding indications and market penetration.

- Geographic Expansion: Targeting new countries for existing drug approvals increases the customer base and sales volume.

- New Indications: Obtaining FDA approval for new uses of approved drugs, like solriamfetol for ADHD, unlocks previously untapped patient populations and revenue streams.

- Market Penetration: Increasing market share within existing approved indications and geographies also contributes to revenue growth.

- Pipeline Development: Advancing drugs in clinical trials for new indications represents future revenue opportunities.

Axsome's revenue streams are primarily driven by net product sales from its approved medications, with Auvelity and Sunosi being key contributors. The company is actively expanding its product portfolio, anticipating new revenue from pipeline candidates like Symbravo and potential future approvals for conditions such as Alzheimer's disease agitation. This diversification strategy aims to capture significant patient populations and solidify market presence.

| Product | 2023 Net Sales | 2024 Q1 Net Sales | 2024 Q2 Net Sales |

| Auvelity | $226.8 million | $75.1 million | $119.6 million |

| Sunosi | $174.2 million | $47.0 million | $51.0 million |

| Symbravo | N/A | N/A | $1.0 million |

Business Model Canvas Data Sources

The Axsome Business Model Canvas is built using comprehensive market research, clinical trial data, and financial disclosures. These sources ensure each canvas block is filled with accurate, up-to-date information regarding patient populations, therapeutic efficacy, and revenue potential.