Axsome Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axsome Bundle

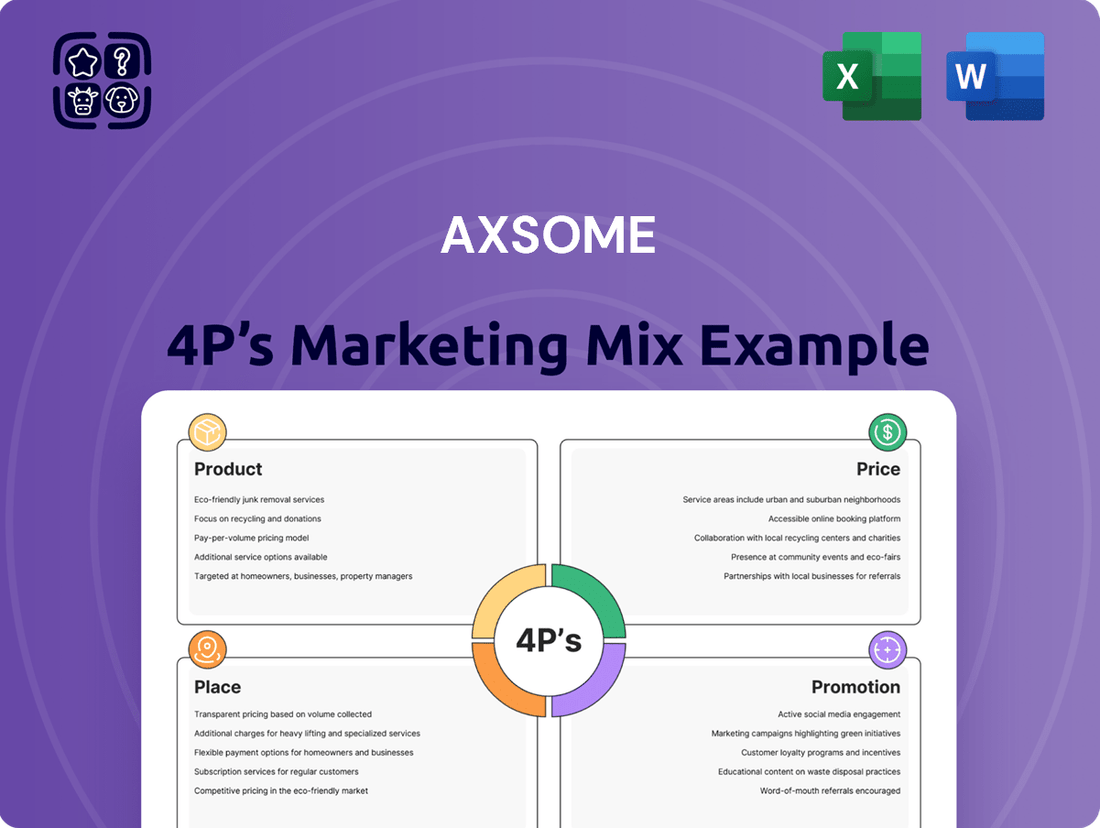

Uncover the strategic brilliance behind Axsome's market dominance by delving into their meticulously crafted 4Ps. This analysis reveals how their innovative product pipeline, precise pricing strategies, targeted distribution, and impactful promotional campaigns create a powerful synergy.

Go beyond the surface-level understanding of Axsome's marketing. Gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Axsome Therapeutics is dedicated to bringing new treatments for central nervous system (CNS) disorders to market, targeting areas with significant unmet medical needs. Their approach centers on creating therapies that offer unique benefits for patients suffering from serious neurological and psychiatric conditions.

The company's pipeline, including treatments for conditions like major depressive disorder and narcolepsy, aims to fill critical gaps in current treatment options. For instance, their drug Sunosi, approved for excessive daytime sleepiness in narcolepsy and obstructive sleep apnea, generated $108 million in net sales in 2023, demonstrating market traction.

Axsome's strategy emphasizes developing drugs with novel mechanisms of action to achieve better patient results. Their commitment to innovation is further highlighted by their late-stage pipeline, which includes potential treatments for Alzheimer's disease agitation and postpartum depression, areas with substantial patient populations and limited effective therapies.

Axsome's product portfolio features Auvelity, Sunosi, and Symbravo, each targeting distinct therapeutic areas. Auvelity, a combination of dextromethorphan and bupropion, has demonstrated robust prescription growth since its approval for major depressive disorder (MDD) in adults. This indicates strong market adoption and physician confidence in its efficacy for a significant unmet need.

Sunosi addresses excessive daytime sleepiness, a debilitating symptom in patients with narcolepsy and obstructive sleep apnea. Its availability provides a valuable treatment option for individuals struggling with this condition, contributing to improved quality of life and daily functioning.

Symbravo, also known as AXS-07, received FDA approval in January 2025 for the acute treatment of migraine. This approval marks a significant expansion for Axsome, entering a large and active market with substantial patient demand for effective migraine therapies.

Axsome's late-stage pipeline is a key driver for future growth, featuring AXS-05 for Alzheimer's disease agitation and smoking cessation, AXS-12 for narcolepsy, and AXS-14 for fibromyalgia. The company anticipates filing New Drug Applications (NDAs) for AXS-05 in Alzheimer's disease agitation and AXS-12 in narcolepsy in 2025, following successful completion of Phase 3 trials.

Mechanism-Driven Innovation

Axsome Therapeutics' product development strategy centers on mechanism-driven innovation, prioritizing novel mechanisms of action to deliver first-in-class or best-in-class therapies. This approach is exemplified by Auvelity, a groundbreaking oral treatment for major depressive disorder (MDD) that represents the first new oral mechanism of action approved for depression in over six decades. This focus on scientific advancement aims to address unmet needs by targeting the fundamental pathways of central nervous system (CNS) disorders.

This commitment to scientific breakthroughs is reflected in Axsome's pipeline and recent performance. For example, in the first quarter of 2024, Auvelity generated $63.6 million in net sales, a significant increase from $24.3 million in the same period of 2023, demonstrating market adoption of their innovative approach. The company's pipeline also includes potential treatments for other CNS conditions, such as narcolepsy and Alzheimer's disease, all built upon distinct mechanisms of action.

- Mechanism-Driven Innovation: Axsome focuses on developing therapies with novel mechanisms of action.

- Auvelity's Impact: Represents the first new oral mechanism for depression in over 60 years.

- Financial Performance: Auvelity achieved $63.6 million in net sales in Q1 2024, up from $24.3 million in Q1 2023.

- Pipeline Focus: Expanding innovative treatments for various CNS disorders, including narcolepsy and Alzheimer's.

Addressing High Unmet Medical Needs

Axsome's product strategy is laser-focused on tackling serious medical conditions where patient needs are not being adequately met. This includes areas like major depressive disorder, agitation associated with Alzheimer's disease, and narcolepsy. For instance, in 2023, Axsome's lead product, Auvelity (dextromethorphan-bupropion), continued to gain traction in the treatment of major depressive disorder, a condition affecting millions of Americans annually.

The company's pipeline and commercialized offerings are designed to address significant disease burdens. Conditions such as migraine and fibromyalgia represent substantial patient populations with limited or insufficient treatment options currently available. Axsome aims to fill these therapeutic gaps with innovative solutions.

By targeting these high unmet medical needs, Axsome positions itself to provide meaningful advancements for patients and healthcare providers. This strategic focus on underserved therapeutic areas is a cornerstone of their marketing approach, aiming to deliver substantial value where it's most needed.

Key areas of focus for Axsome include:

- Major Depressive Disorder: Addressing a pervasive mental health challenge with limited effective treatments for many.

- Alzheimer's Disease Agitation: Providing a much-needed option for managing challenging behavioral symptoms in this patient population.

- Migraine: Developing novel therapies for a debilitating neurological condition that impacts a significant portion of the population.

- Narcolepsy: Targeting sleep disorders that severely affect quality of life and daily functioning.

Axsome's product strategy centers on delivering innovative therapies for central nervous system (CNS) disorders with significant unmet needs. Their portfolio includes Auvelity for major depressive disorder (MDD), Sunosi for narcolepsy and obstructive sleep apnea, and Symbravo for migraine. This focused approach aims to capture market share in areas where existing treatments fall short.

| Product | Indication | 2023 Net Sales | Q1 2024 Net Sales | Key Development |

|---|---|---|---|---|

| Auvelity | Major Depressive Disorder | $277.7 million | $63.6 million | First new oral mechanism for MDD in over 60 years. |

| Sunosi | Narcolepsy & Obstructive Sleep Apnea | $108 million | $30.2 million | Addresses excessive daytime sleepiness. |

| Symbravo (AXS-07) | Migraine | N/A | N/A | FDA approved January 2025 for acute migraine treatment. |

What is included in the product

This analysis offers a comprehensive examination of Axsome Therapeutics' marketing mix, detailing their product portfolio, pricing strategies, distribution channels, and promotional efforts within the competitive pharmaceutical landscape.

This Axsome 4P's analysis distills complex marketing strategies into a clear, actionable framework, directly addressing the pain points of understanding and implementing effective pain relief solutions.

Designed to simplify the intricate marketing landscape for Axsome's pain management therapies, this 4P's analysis provides a concise, high-level overview for rapid strategic decision-making.

Place

Axsome Therapeutics employs a dedicated sales force, primarily targeting neurologists and psychiatrists. This direct engagement is vital for explaining the intricate workings and advantages of their central nervous system treatments.

The company is actively growing its Auvelity sales team, aiming for around 300 representatives. This expansion is designed to address increasing demand and broaden market reach for their psychiatric offerings.

Axsome's approved products, including Auvelity, Sunosi, and the anticipated Symbravo, leverage established pharmaceutical distribution networks. These channels are critical for getting medications from the manufacturer to the end-user, ensuring they reach patients efficiently.

The primary distribution points include retail pharmacies, hospital pharmacies, and other healthcare institutions. This broad reach is essential for patient access, allowing them to fill prescriptions conveniently after a doctor's order. For instance, in 2023, the U.S. pharmaceutical market saw significant growth in specialty pharmacy, a key channel for many innovative treatments.

Axsome's strategy aims to optimize logistics, making their treatments readily available and minimizing any potential delays in patient care. This focus on efficient distribution is paramount in the competitive pharmaceutical landscape, where timely access can significantly impact treatment outcomes and patient satisfaction.

Securing robust payer coverage is paramount for pharmaceutical product accessibility and patient affordability. Axsome has prioritized expanding this access for its therapies.

As of early 2024, Axsome reported that Auvelity has achieved approximately 78% payer coverage across all major channels, encompassing both commercial and government insurance plans.

This broad market access is a crucial factor for driving commercial success and ensuring that patients can readily obtain and benefit from Axsome's innovative treatments.

Strategic Commercialization Preparations

Axsome is diligently preparing for the commercial launch of its newly approved or anticipated products, aiming for a swift and impactful market entry. This proactive approach is crucial for maximizing early adoption and revenue generation. For example, the company was targeting June 2025 for the commercial availability of Symbravo, indicating robust pre-launch activities.

These preparations encompass a multi-faceted strategy to ensure seamless market penetration. Key elements include establishing efficient distribution channels to guarantee product accessibility and building robust supply chain capabilities to meet anticipated demand. The focus is on having the product readily available in target markets from day one.

- Distribution Network Establishment: Axsome is actively setting up and finalizing its distribution networks to ensure Symbravo, and future products, can reach patients efficiently upon approval.

- Supply Chain Readiness: The company is ensuring its supply chain is robust and scalable to meet projected demand, a critical factor for a successful product launch.

- Market Access and Reimbursement: Efforts are underway to secure favorable market access and reimbursement status, which is vital for patient affordability and uptake.

- Sales Force Readiness: Axsome is preparing its commercial teams, including sales representatives and medical science liaisons, to effectively engage healthcare providers and educate them about new therapies.

Geographic Focus: United States

Axsome Therapeutics is strategically concentrating its efforts within the United States, a market boasting a substantial patient base for central nervous system (CNS) disorders. This focused approach enables the company to tailor its commercialization and regulatory strategies effectively to meet the specific needs of the U.S. healthcare landscape.

The company's primary commercialization and regulatory activities are centered on the U.S. market, reflecting a deliberate strategy to address significant unmet medical needs in CNS conditions. This geographic concentration allows for optimized resource allocation in marketing and distribution.

This U.S.-centric strategy is supported by the fact that the U.S. pharmaceutical market is the largest globally, offering significant revenue potential. For instance, in 2023, U.S. pharmaceutical sales represented a substantial portion of global pharmaceutical revenue, making it a key market for companies like Axsome.

- U.S. Market Dominance: The United States is the world's largest pharmaceutical market, providing a significant opportunity for Axsome's CNS therapies.

- Targeted Commercialization: Focusing on the U.S. allows for highly specific marketing campaigns and distribution networks tailored to American healthcare providers and patients.

- Regulatory Alignment: Navigating the U.S. Food and Drug Administration (FDA) regulatory pathway is a primary objective, streamlining product approvals and market entry.

- Addressing Unmet Needs: Axsome aims to address critical gaps in treatment for CNS disorders prevalent within the U.S. patient population.

Axsome's place strategy centers on efficient distribution and market access within the United States, its primary focus. The company leverages established pharmaceutical channels, including retail and hospital pharmacies, to ensure its treatments are readily available to patients. As of early 2024, Auvelity achieved approximately 78% payer coverage across major U.S. insurance plans, a testament to their efforts in making therapies accessible and affordable.

| Product | Primary Distribution Channels | Target Market Focus | Payer Coverage (as of early 2024) |

|---|---|---|---|

| Auvelity | Retail Pharmacies, Hospital Pharmacies | United States | ~78% |

| Sunosi | Retail Pharmacies, Hospital Pharmacies | United States | (Data not specified for Sunosi in provided text) |

| Symbravo (anticipated) | Retail Pharmacies, Hospital Pharmacies | United States | (Coverage to be established prior to launch) |

Full Version Awaits

Axsome 4P's Marketing Mix Analysis

The preview shown here is the actual Axsome 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis details Axsome's strategies across Product, Price, Place, and Promotion. You can be confident that the insights and information you see are exactly what you'll get to inform your own marketing efforts.

Promotion

Axsome Therapeutics prioritizes robust medical education and scientific communications to drive product adoption and pipeline awareness. This strategy involves presenting clinical trial data at key medical conferences, such as the American Academy of Neurology (AAN) Annual Meeting, and publishing findings in high-impact, peer-reviewed journals. For instance, data supporting their migraine therapy Sunosi was widely disseminated through these channels.

The company actively hosts R&D Days, like the one held in late 2023, to showcase the scientific underpinnings and unique mechanisms of action of its therapies, including those for CNS disorders. These events are crucial for building trust and educating healthcare professionals on the clinical benefits and differentiation of Axsome's innovative treatments, fostering a deeper understanding of their therapeutic value.

Axsome's promotion strategy heavily emphasizes direct engagement with neurologists and psychiatrists, recognizing them as the core prescribers of central nervous system (CNS) medications. This targeted approach ensures that product information reaches the most influential healthcare professionals.

The company's planned expansion of its sales force for Auvelity in early 2025 underscores a significant investment in increasing direct outreach and educational initiatives. This expansion aims to bolster the frequency and depth of interactions with healthcare providers, reinforcing key messaging.

This focus on direct engagement is crucial for effectively communicating Auvelity's benefits and differentiating factors. By reaching the primary decision-makers in prescribing, Axsome aims to drive adoption and maximize the impact of its promotional efforts.

Axsome Therapeutics places significant emphasis on investor relations and corporate communications, using these channels to foster trust and attract investment. They actively engage with the financial community through participation in investor conferences, quarterly earnings calls, and timely press releases. These interactions are crucial for disseminating information about business progress, financial performance, and key developments in their drug pipeline.

The company’s strategic communications aim to build and maintain investor confidence by providing transparent updates on their research and development efforts, including clinical trial progress and regulatory milestones. For instance, Axsome’s consistent reporting of pipeline advancements, such as updates on their Alzheimer's disease and migraine treatments, directly fuels investor interest and supports their valuation.

Furthermore, high-profile events, such as ringing the NASDAQ Stock Market Opening Bell, serve as powerful promotional tools. These visible activities enhance corporate visibility and brand recognition within the broader investment landscape, reinforcing Axsome's position as a significant player in the biopharmaceutical sector.

Disease Awareness and Patient Engagement

Axsome actively works to boost disease awareness, especially for conditions with significant unmet medical needs. This strategy aims to inform the public and potentially guide patients toward appropriate care options.

Collaborations with groups like Mental Health America (MHA) are key to this effort. These partnerships help shed light on mental health challenges and can serve as a bridge, connecting individuals with resources and information about treatments, including Axsome's own offerings.

For instance, MHA's 2024 initiatives focused on destigmatizing mental health and increasing access to care, aligning with Axsome's goal of patient engagement. This approach not only educates but also empowers patients to seek help.

- Disease Awareness: Axsome targets conditions with high unmet needs.

- Patient Engagement: Partnerships aim to connect patients with treatment information.

- MHA Collaboration: Supports mental health visibility and access to care.

- Treatment Connection: Facilitates patient discovery of available therapies.

Product-Specific Marketing Campaigns

Axsome's product-specific marketing campaigns for Auvelity, Sunosi, and Symbravo are designed to highlight each therapy's distinct advantages and market positioning. These targeted efforts aim to build brand recognition and foster physician adoption. The success of these strategies is evident in Auvelity's impressive prescription growth, demonstrating effective market penetration.

The company's promotional activities for Auvelity, launched in late 2021 for major depressive disorder, have been particularly impactful. By the first quarter of 2024, Auvelity achieved $104.3 million in net sales, a significant increase from $34.4 million in the prior year period, reflecting strong market reception and effective campaign execution.

- Auvelity's net sales reached $104.3 million in Q1 2024, a substantial rise from $34.4 million in Q1 2023.

- Sunosi, approved for narcolepsy and obstructive sleep apnea, also benefits from tailored marketing to physicians and patients.

- Symbravo, an investigational therapy for binge eating disorder, is poised for similar focused marketing upon approval.

Axsome's promotional strategy centers on educating healthcare professionals and raising disease awareness. This includes disseminating clinical data through medical conferences and publications, as seen with Sunosi's data at the AAN Annual Meeting. The company also hosts R&D Days, such as the late 2023 event, to highlight the scientific merits of its CNS therapies.

Direct engagement with neurologists and psychiatrists is paramount, supported by a planned sales force expansion for Auvelity in early 2025 to increase physician outreach. Furthermore, Axsome actively manages investor relations, participating in conferences and calls to communicate pipeline progress, like advancements in Alzheimer's and migraine treatments, and uses high-profile events like ringing the NASDAQ Opening Bell to boost visibility.

Disease awareness campaigns, often in partnership with organizations like Mental Health America (MHA), aim to inform the public about conditions with unmet needs, connecting patients to resources and potential treatments. MHA's 2024 initiatives, for example, focused on destigmatizing mental health and improving care access.

Targeted marketing campaigns for Auvelity, Sunosi, and the investigational Symbravo are designed to highlight unique benefits and drive adoption. Auvelity demonstrated strong market penetration, with net sales reaching $104.3 million in Q1 2024, a significant jump from $34.4 million in Q1 2023.

| Product | Indication | Q1 2024 Net Sales | Q1 2023 Net Sales | Growth YoY |

|---|---|---|---|---|

| Auvelity | Major Depressive Disorder | $104.3 million | $34.4 million | 203% |

| Sunosi | Narcolepsy, Obstructive Sleep Apnea | $72.5 million | $64.1 million | 13% |

| Symbravo (Investigational) | Binge Eating Disorder | N/A | N/A | N/A |

Price

Axsome's pricing strategy for its novel central nervous system (CNS) therapies is expected to be value-based, aligning with the substantial unmet medical needs these treatments address and their innovative mechanisms of action. This approach recognizes the significant clinical benefits, improved patient outcomes, and potential healthcare system cost savings that Axsome's drugs are designed to deliver.

For instance, as of early 2024, the market for migraine treatments alone represents a significant opportunity, with estimates suggesting the global migraine market could reach over $7 billion by 2027. Axsome's Sunosi (solriamfetol) for narcolepsy, approved in 2019, and its pipeline candidates like AXS-07 for acute migraine and AXS-05 for major depressive disorder and Alzheimer's disease agitation, are positioned to capture value by addressing conditions with high patient burden and limited effective treatment options.

Axsome's pricing strategy for its central nervous system (CNS) therapies, like Auvelity for major depressive disorder, is deeply influenced by the competitive environment. For instance, Auvelity launched in late 2021 with a wholesale acquisition cost (WAC) of $1,250 per month, positioning it against established antidepressants and newer entrants.

The company actively analyzes the pricing of both older, generic options and newer branded medications within specific CNS indications. This allows Axsome to set prices that are perceived as competitive while still reflecting the unique benefits and differentiated profile of their own treatments.

For example, while generics might offer a lower price point, Axsome aims to justify a premium for Auvelity's novel mechanism of action and potential for improved patient outcomes, as demonstrated by its clinical trial data.

This careful balancing act ensures Axsome's products are attractively positioned in the market, appealing to both payers and prescribers by offering value that goes beyond mere cost comparison.

Securing favorable reimbursement from commercial payers, Medicare, and Medicaid is a crucial aspect of Axsome's pricing strategy. The company's demonstrated success in achieving broad payer coverage, exemplified by Auvelity's 78% coverage rate, highlights a commitment to ensuring patient access across diverse insurance plans.

This broad access is the result of strategic negotiations where Axsome effectively communicates the pharmacoeconomic value of its therapies. By demonstrating the clinical and economic benefits, Axsome aims to align its pricing with the needs of payers, ultimately facilitating patient uptake.

Future Revenue Projections and Peak Sales Potential

Axsome's financial outlook hinges on robust future revenue projections and the peak sales potential of its key products. For instance, Auvelity is demonstrating strong growth, with analyst consensus pointing towards peak sales in the range of $1 billion to $3 billion. These forecasts are critical in shaping pricing strategies throughout the product's lifecycle, ensuring sustained profitability and value generation.

These revenue projections directly inform pricing decisions, allowing Axsome to optimize revenue capture across different market segments and stages of product maturity. The company's strategic planning incorporates these sales potentials to guide investment in manufacturing, marketing, and further research and development.

- Auvelity Peak Sales Estimates: Analysts project peak sales between $1 billion and $3 billion.

- Revenue Growth Drivers: Focus on expanding market access and indications for key therapies.

- Pricing Strategy Influence: Projections guide lifecycle pricing to maximize long-term value.

Funding for Research and Development

Axsome's pricing strategy for its commercialized products directly supports its robust research and development (R&D) pipeline. The revenue generated from sales is strategically reinvested to advance late-stage clinical candidates and initiate new research programs. This financial approach underscores Axsome's commitment to innovation in treating central nervous system (CNS) disorders.

For instance, Axsome's net sales for the first quarter of 2024 reached $110.5 million, a significant increase driven by the strong performance of its approved therapies. This financial influx is crucial for funding ongoing clinical trials and exploring novel therapeutic avenues. The company's ability to generate substantial revenue allows for sustained investment in R&D, which is essential for its long-term growth and mission to address unmet medical needs in neurology.

- Product Sales Fuel R&D: Revenue from commercialized products like Sunosi and Auvelity is a primary source for funding Axsome's R&D activities.

- Advancing Pipeline: Proceeds are allocated to advance late-stage candidates, such as AXS-07 and AXS-14, through clinical development.

- Investing in New Programs: A portion of revenue is directed towards exploring and initiating new clinical programs, expanding the company's therapeutic reach.

- Strategic Revenue Allocation: This reinvestment strategy reflects a deliberate plan to ensure continuous innovation and future growth in the CNS therapeutic area.

Axsome's pricing strategy is value-based, reflecting the significant unmet needs and clinical benefits of its CNS therapies. For example, Auvelity, launched in late 2021 with a wholesale acquisition cost of $1,250 per month, is positioned against competitors while highlighting its unique mechanism of action. This approach aims to capture market value by demonstrating superior patient outcomes and potential healthcare cost savings.

Securing broad payer coverage is a key element, with Auvelity achieving 78% coverage, demonstrating success in communicating pharmacoeconomic value. Analyst projections for Auvelity's peak sales are between $1 billion and $3 billion, guiding lifecycle pricing to maximize long-term revenue. This revenue directly fuels R&D, with Q1 2024 net sales reaching $110.5 million, supporting pipeline advancement.

| Product | Launch Year | Approximate WAC (per month) | Peak Sales Estimate (Analysts) |

| Auvelity (MDD) | 2021 | $1,250 | $1 billion - $3 billion |

| Sunosi (Narcolepsy) | 2019 | N/A (Pricing varies by dosage) | N/A (Growth driven by market penetration) |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Axsome leverages a comprehensive blend of primary and secondary data. We meticulously gather information from SEC filings, investor relations materials, clinical trial data, and scientific publications to understand their product pipeline and efficacy.