Axsome Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axsome Bundle

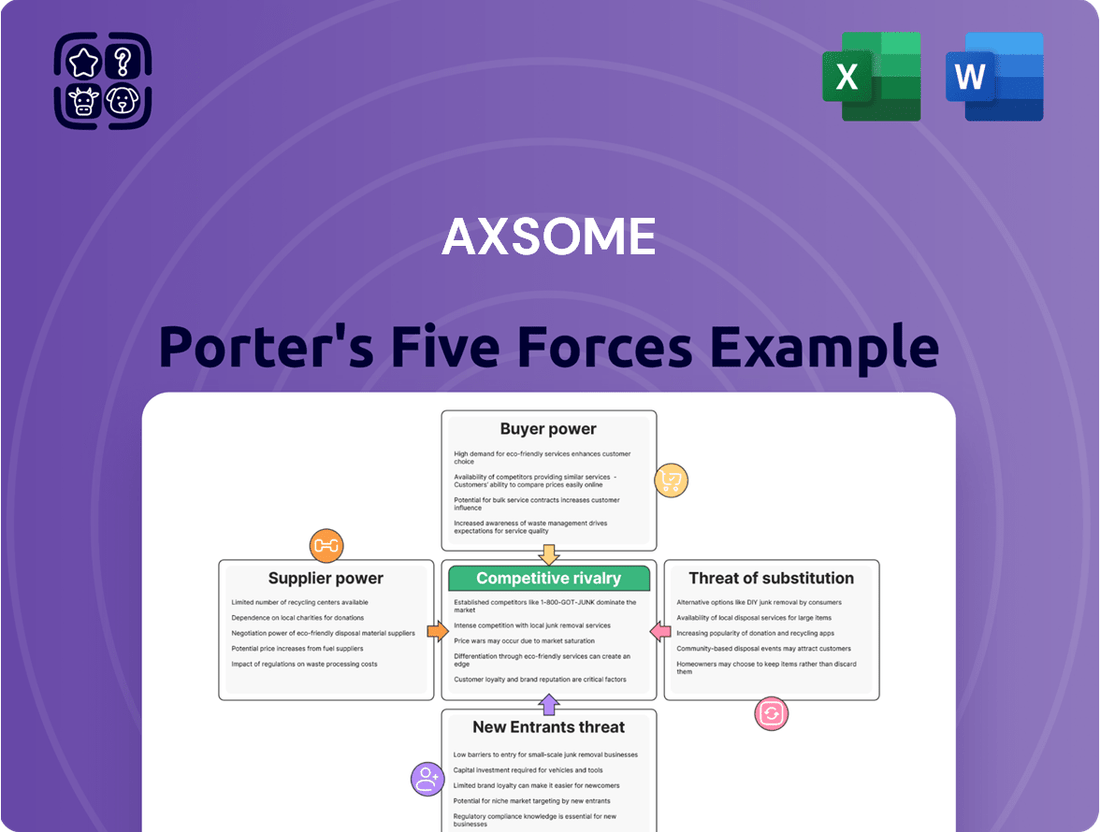

Axsome's competitive landscape is shaped by intense rivalry, the threat of powerful buyers, and the constant pressure of substitute products. Understanding these forces is crucial for navigating its market.

The complete report reveals the real forces shaping Axsome’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Axsome Therapeutics' dependence on a select group of specialized suppliers for crucial components like active pharmaceutical ingredients (APIs) grants these suppliers significant leverage. For instance, in 2024, the biopharmaceutical industry continued to see consolidation among API manufacturers, with only a handful possessing the advanced capabilities needed for complex drug synthesis, thereby strengthening their negotiating position.

Strict regulatory requirements significantly bolster the bargaining power of suppliers in the pharmaceutical sector. Adherence to Good Manufacturing Practice (GMP) standards, for instance, is non-negotiable, creating a high barrier to entry for potential suppliers. This rigorous compliance means fewer companies can qualify, concentrating supply and giving the qualified few considerable leverage. Axsome, like any pharmaceutical company, must navigate this landscape, ensuring its supply chain meets these demanding standards to avoid costly disruptions.

High switching costs are a major factor in the biopharmaceutical industry, significantly impacting a company like Axsome. Switching suppliers isn't as simple as changing vendors for office supplies; it involves extensive qualification processes, rigorous regulatory approvals, and the potential for serious disruption to critical ongoing clinical trials or even established commercial supply chains. These hurdles mean that once a supplier is established, it's very costly and time-consuming for a company like Axsome to move to a different one, effectively locking them in.

Proprietary Manufacturing Processes

Proprietary manufacturing processes held by suppliers can significantly bolster their bargaining power with Axsome. If a supplier possesses unique intellectual property or specialized production techniques crucial for Axsome's therapies, this creates a dependency. For instance, if Axsome relies on a supplier for a complex active pharmaceutical ingredient (API) synthesized through a patented method, that supplier gains considerable leverage. This is particularly true for novel treatments where alternative sourcing might be limited or nonexistent in the short to medium term. Axsome needs to cultivate strong, collaborative relationships with such suppliers to ensure consistent and reliable access to these vital components, potentially through long-term supply agreements or strategic partnerships.

Consider the implications for therapies like Axsome's Sunosi (solriamfetol) or the pipeline candidates. If the manufacturing of these complex molecules involves patented steps or specialized equipment owned by a single supplier, Axsome's ability to negotiate pricing or terms becomes constrained. This leverage allows suppliers to potentially command higher prices or dictate supply volumes, impacting Axsome's cost of goods sold and overall profitability. By the end of 2023, Axsome reported a Cost of Revenue of $329.4 million, highlighting the importance of managing supplier costs effectively.

- Supplier Dependency: Proprietary processes create a reliance on specific suppliers for critical components.

- Pricing Leverage: Suppliers with unique manufacturing capabilities can influence pricing due to limited alternatives.

- Supply Chain Risk: Dependence on a single supplier for patented processes introduces potential supply chain disruptions.

- Strategic Relationship Management: Axsome must foster strong ties with these suppliers to secure access and favorable terms.

Global Supply Chain Vulnerabilities

Geopolitical events, natural disasters, and global health crises can significantly disrupt supply chains, impacting the availability and cost of essential raw materials for companies like Axsome. While not a direct measure of supplier power, these external shocks can indirectly bolster supplier leverage by creating scarcity and driving up prices for critical inputs. For instance, the semiconductor shortage that began in late 2020, exacerbated by pandemic-related factory shutdowns and increased demand, demonstrated how disruptions could empower component suppliers. This led to widespread production delays and price hikes across various industries, including pharmaceuticals where specialized equipment and materials are crucial.

Axsome Therapeutics, like many in the pharmaceutical sector, must maintain robust supply chain management to navigate these vulnerabilities. The company relies on a steady supply of active pharmaceutical ingredients (APIs), excipients, and packaging materials. Disruptions in these areas, whether due to a natural disaster affecting a key manufacturing region or a geopolitical conflict impacting shipping routes, can directly affect production timelines and profitability. For example, the ongoing tensions in Eastern Europe have led to increased shipping costs and longer lead times for certain components, a challenge many businesses faced throughout 2024.

- Supply Chain Disruptions: Events like the COVID-19 pandemic highlighted the fragility of global supply chains, leading to shortages and price increases for critical pharmaceutical components in 2024.

- Indirect Supplier Leverage: External shocks create scarcity, indirectly strengthening the bargaining power of suppliers who control essential raw materials or manufacturing capacity.

- Mitigation Strategies: Axsome needs diversified sourcing, strong supplier relationships, and inventory management to counter these risks.

- Cost Implications: Increased raw material costs and logistical challenges directly impact Axsome's cost of goods sold and overall financial performance.

Axsome's reliance on a limited number of specialized suppliers for critical components like active pharmaceutical ingredients (APIs) grants these suppliers significant negotiating power. The biopharmaceutical industry's ongoing consolidation among API manufacturers in 2024, with few possessing the advanced synthesis capabilities, further concentrates this leverage.

The stringent regulatory environment, demanding adherence to Good Manufacturing Practice (GMP) standards, creates high barriers to entry for suppliers. This limited supplier pool means those who meet the rigorous compliance requirements hold substantial influence over pricing and terms for companies like Axsome.

High switching costs for Axsome, stemming from extensive supplier qualification, regulatory hurdles, and potential disruptions to clinical trials or commercial supply, effectively lock the company into existing supplier relationships. This dependency strengthens the suppliers' bargaining position, as changing vendors is both costly and time-consuming.

Proprietary manufacturing processes and intellectual property held by suppliers create a critical dependency for Axsome, particularly for novel therapies with limited alternative sourcing. This exclusivity allows suppliers to command higher prices, as seen in Axsome's Cost of Revenue, which was $329.4 million by the end of 2023, underscoring the importance of managing these supplier relationships effectively.

| Factor | Impact on Axsome | Supplier Leverage | 2024 Context |

|---|---|---|---|

| Limited Supplier Pool | Dependency on few specialized API providers | High | Industry consolidation continues |

| Regulatory Compliance (GMP) | High barriers to entry for new suppliers | High | Essential for all pharmaceutical production |

| High Switching Costs | Difficulty in changing suppliers due to qualification and regulatory hurdles | High | Affects clinical trials and commercial supply chains |

| Proprietary Processes/IP | Reliance on suppliers with unique manufacturing capabilities | Very High | Crucial for novel therapies, impacts COGS |

What is included in the product

This analysis unpacks the competitive forces impacting Axsome, examining the threat of new entrants, the power of buyers and suppliers, the intensity of rivalry, and the potential for substitute products.

Instantly understand competitive pressures with a dynamic Porter's Five Forces analysis, highlighting Axsome's strategic advantages in the pain relief market.

Customers Bargaining Power

The bargaining power of customers for Axsome is substantial, primarily driven by payers and insurers. These entities, including major insurance companies, Medicare, and Medicaid, wield considerable influence over drug pricing and market access. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to negotiate prices for certain high-cost drugs, setting a precedent for broader cost containment efforts.

These powerful intermediaries can dictate formulary placement and reimbursement rates, directly impacting Axsome's revenue potential and patient access to its treatments. Securing favorable terms with these payers is therefore critical for Axsome's commercial viability, as their decisions can significantly shape prescription volumes and overall market penetration for its therapies.

The looming threat of generic and biosimilar alternatives significantly curtails Axsome's ability to dictate prices for its current and future medications. Even without immediate competition, the mere potential for these lower-cost substitutes puts a cap on Axsome's pricing power.

As patents on Axsome's drugs eventually expire, the market entry of generics and biosimilars will inevitably lead to a substantial decline in both market share and revenue. This competitive pressure will compel Axsome to adopt more flexible pricing strategies to remain viable.

Axsome has already experienced the reality of this pressure through patent litigation concerning its products, underscoring the constant vigilance required to defend its market position against potential generic entrants.

Physicians are central to medication adoption, acting as gatekeepers for patient treatment. Their choices are heavily swayed by a drug's proven clinical effectiveness, safety record, and how well it improves patient health. In 2024, the push for cost-effectiveness is intensifying, meaning Axsome needs to clearly demonstrate the economic benefits of its central nervous system (CNS) therapies to gain traction with these crucial decision-makers.

Patient Out-of-Pocket Costs

High patient out-of-pocket costs can significantly impact demand for Axsome's treatments, particularly for chronic central nervous system conditions where long-term adherence is crucial. For instance, in 2024, the average deductible for employer-sponsored health plans in the US was around $1,700, meaning many patients would face substantial upfront costs before insurance fully kicks in for expensive therapies.

While Axsome provides co-pay assistance programs for commercially insured patients, aiming to mitigate these immediate financial burdens, the overall cost of treatment remains a factor. These programs, while helpful, do not eliminate the underlying price sensitivity, and patients may still seek more affordable alternatives if available, or delay treatment, indirectly affecting Axsome's sales volume.

- Patient Cost Sensitivity: High deductibles and co-insurance can deter patients from initiating or continuing treatment, especially for chronic conditions requiring ongoing medication.

- Impact on Adherence: Financial barriers are a known contributor to medication non-adherence, which can lead to poorer health outcomes and increased healthcare system costs.

- Axsome's Mitigation Efforts: Co-pay assistance programs are designed to offset immediate out-of-pocket expenses for eligible patients.

- Market Dynamics: The bargaining power of customers is amplified when payers and patients can more easily compare and switch to lower-cost alternatives, or delay treatment due to cost.

Clinical Efficacy and Differentiation

The bargaining power of customers is somewhat tempered by the demonstrated clinical efficacy and unique differentiation of Axsome's novel therapies. These treatments target significant unmet needs within central nervous system (CNS) conditions, offering a distinct advantage.

When Axsome's products provide substantial improvements compared to current treatment options, or when alternative therapies are scarce, the leverage of customers, including insurance providers and healthcare systems, to negotiate lower prices is diminished. For instance, AXS-07, a treatment for migraine, aims to provide rapid relief, a key differentiator in a crowded market.

Axsome's pipeline also includes treatments for conditions like Alzheimer's disease, where effective options are limited. This lack of alternatives can significantly reduce customer bargaining power. By 2024, the market for migraine treatments alone was valued in the billions, highlighting the potential impact of effective differentiation.

- Clinical Superiority: Axsome's therapies are designed to offer clear advantages over existing treatments, impacting patient outcomes and physician preference.

- Addressing Unmet Needs: Focusing on conditions with limited or no effective therapies inherently reduces customer pressure for price concessions.

- Market Differentiation: Unique mechanisms of action and improved patient experience contribute to a stronger market position, lessening customer price sensitivity.

- Limited Alternatives: In therapeutic areas with few competing drugs, patients and payers have fewer options, thus decreasing their bargaining power.

The bargaining power of customers for Axsome is significant, primarily due to payers and insurers who influence drug pricing and access. These entities, including major insurance companies and government programs, can dictate formulary placement and reimbursement rates, directly impacting Axsome's revenue and patient access. For example, in 2024, CMS continued negotiations on drug prices, signaling ongoing cost containment efforts.

Physicians also hold considerable sway, acting as gatekeepers for treatment decisions. Their choices are driven by a drug's efficacy, safety, and cost-effectiveness. Axsome must clearly demonstrate the economic benefits of its central nervous system therapies to gain physician adoption, especially as cost-effectiveness becomes a more prominent factor in 2024, with a growing emphasis on value-based care.

Patient cost sensitivity, exacerbated by high deductibles and co-pays, can also limit demand. In 2024, the average deductible for employer-sponsored health plans was around $1,700, meaning many patients face substantial upfront costs. While Axsome offers co-pay assistance, the overall price remains a consideration for patients, potentially affecting adherence and sales volume.

| Customer Segment | Influence Factor | Impact on Axsome | 2024 Data Point |

|---|---|---|---|

| Payers/Insurers | Formulary placement, Reimbursement rates | Controls market access and pricing power | CMS drug price negotiations ongoing |

| Physicians | Clinical efficacy, Safety, Cost-effectiveness | Drives prescription volume and market adoption | Intensifying focus on value-based care |

| Patients | Out-of-pocket costs, Co-pays | Affects treatment adherence and demand | Average employer deductible ~$1,700 |

Preview Before You Purchase

Axsome Porter's Five Forces Analysis

This preview showcases the complete Axsome Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the pharmaceutical industry. You are viewing the exact document that will be delivered to you instantly upon purchase, ensuring you receive a professionally formatted and ready-to-use strategic assessment. This detailed analysis will equip you with critical insights into Axsome's market position and competitive landscape.

Rivalry Among Competitors

The central nervous system (CNS) therapeutic area is a battleground for many large, established pharmaceutical giants. These companies, including giants like Jazz Pharmaceuticals and Teva Pharmaceutical Industries, bring formidable resources, significant existing market share, and well-stocked drug pipelines to the fight. Their deep financial reserves allow for substantial investment in research and development, aggressive marketing campaigns, and efficient commercialization of new treatments.

Competitive rivalry in the central nervous system (CNS) therapeutics market is fierce, driven by relentless research and development. Companies are pouring resources into discovering and advancing new treatments, aiming to capture market share by addressing significant unmet patient needs or offering improved clinical outcomes. This constant innovation cycle means the competitive landscape is always shifting.

The drive for innovation is evident in the substantial R&D spending across the pharmaceutical sector. For instance, in 2024, major pharmaceutical companies continued to allocate billions towards drug discovery and clinical trials, with a significant portion dedicated to CNS disorders. Axsome Therapeutics, a key player, exemplifies this trend with its own substantial investment in a promising late-stage pipeline, showcasing the industry's commitment to developing novel therapies.

Patent protection and market exclusivity significantly influence competitive rivalry for Axsome. While current products benefit from patent safeguards, the pharmaceutical landscape is dynamic, with competitors actively pursuing alternative therapeutic mechanisms and challenging existing intellectual property.

The eventual expiration of key patents poses a direct threat, paving the way for generic manufacturers and intensifying market competition. Axsome's recent settlements in patent litigation underscore the critical role intellectual property plays in maintaining its competitive edge and market position.

Marketing and Sales Capabilities

Effective marketing and sales capabilities are paramount in the pharmaceutical sector, directly impacting a company's ability to reach prescribers and patients. Established, larger pharmaceutical companies often leverage their extensive sales forces and deep-rooted relationships with healthcare providers, creating a significant barrier to entry for smaller, emerging players like Axsome.

Axsome Therapeutics has been strategically investing in and expanding its sales force to bolster its commercial reach and compete more effectively. For instance, by mid-2024, Axsome had built a commercial team focused on its key therapeutic areas, aiming to replicate the success seen with its product launches.

- Sales Force Expansion: Axsome has been actively growing its sales team to ensure broad physician engagement and product awareness.

- Competitive Landscape: Larger pharmaceutical firms typically possess greater resources for marketing and sales, including larger sales forces and established physician networks.

- Market Penetration: Building strong relationships with healthcare professionals is critical for gaining market share and driving prescription volume.

- Commercialization Efforts: Axsome's investment in its sales and marketing infrastructure is a direct response to the competitive intensity in the pharmaceutical market.

Therapeutic Area Focus and Overlap

Axsome Therapeutics primarily targets Central Nervous System (CNS) disorders, but this focus doesn't eliminate intense competition. Many pharmaceutical companies are also developing treatments for prevalent conditions like depression and migraine, creating direct rivalry for market access and physician adoption.

This overlap means multiple companies are vying for the same patient populations and physician prescriptions. For instance, in the migraine space, Axsome's Sunvimo is competing with established players and emerging therapies from companies like AbbVie and Biohaven Pharmaceuticals.

- Therapeutic Overlap: Competitors often target the same CNS indications, such as major depressive disorder and migraine, leading to direct competition.

- Market Share Battles: Multiple companies developing drugs for the same condition create intense competition for market share and physician preference.

- Pipeline Competition: Companies like AbbVie, Eli Lilly, and Pfizer have robust CNS pipelines that directly challenge Axsome's market position.

The competitive rivalry within the CNS therapeutic area is exceptionally high, with numerous large pharmaceutical companies possessing substantial resources and established market presence. These established players, including giants like Pfizer and AbbVie, actively invest in R&D and marketing, creating a challenging environment for companies like Axsome. The constant pursuit of innovation and the race to secure market share for similar indications intensifies this rivalry, making it crucial for Axsome to differentiate its offerings and build strong commercial capabilities.

| Company | 2024 CNS R&D Investment (Estimated Billions USD) | Key CNS Indications | Market Share (Migraine, 2024 Est.) |

|---|---|---|---|

| Pfizer | $2.0 - $3.0 | Migraine, Depression, Alzheimer's | 5-10% |

| AbbVie | $1.5 - $2.5 | Migraine, Depression, Parkinson's | 15-20% |

| Eli Lilly | $2.5 - $3.5 | Migraine, Depression, Alzheimer's | 10-15% |

| Axsome Therapeutics | $0.5 - $0.8 | Migraine, Depression, Narcolepsy | 3-5% |

SSubstitutes Threaten

The threat of substitutes for Axsome's central nervous system (CNS) therapies extends beyond just other pharmaceutical options. Patients and doctors might consider non-drug approaches like psychotherapy or cognitive behavioral therapy, especially for conditions like depression or anxiety. Lifestyle changes, such as diet and exercise, also play a role in managing chronic CNS conditions.

Furthermore, advancements in medical devices and even surgical interventions present alternative treatment modalities. For instance, deep brain stimulation is an option for Parkinson's disease, and neuromodulation devices are emerging for various neurological disorders. These alternatives can be attractive due to differing efficacy profiles, cost considerations, or patient preferences, potentially impacting demand for Axsome's drug-based treatments.

Physicians might prescribe existing medications for conditions Axsome's drugs aim to treat, even if those drugs aren't officially approved for that specific use. This off-label prescribing presents a significant threat, as these alternatives are often more accessible and less costly, especially when supported by growing clinical evidence or widespread physician adoption.

For instance, in the neurology space, where Axsome is active, off-label use of certain antidepressants or anticonvulsants for conditions like migraine prevention or neuropathic pain has been common. While not directly comparable to Axsome's targeted therapies, these established treatments can serve as substitutes, particularly for patients seeking immediate relief or facing cost constraints. The market for migraine treatments alone was estimated to be around $4.3 billion in 2023, and a portion of this market could be influenced by these readily available off-label options.

For certain central nervous system (CNS) symptoms, patients may opt for over-the-counter (OTC) medications, dietary supplements, or herbal remedies as substitutes. These alternatives are particularly appealing for less severe conditions or as initial self-treatment strategies, offering convenience and a lower price point. While their efficacy might not match prescription drugs, their accessibility makes them a viable consideration for some consumers.

Generics from Different Therapeutic Classes

Generic drugs from different therapeutic classes can emerge as substitutes for Axsome's treatments, even if they aren't direct chemical matches. These alternatives might target similar symptoms or conditions, offering patients and prescribers different options. For example, if Axsome has a new migraine therapy, older, established pain relievers or even non-pharmacological approaches could serve as substitutes.

The availability of less expensive, established generic medications for conditions like depression or pain presents a significant threat. For instance, if Axsome's flagship product is a novel antidepressant, patients might opt for well-known generics like fluoxetine or sertraline if their symptoms are manageable. This is particularly relevant as the U.S. generic drug market is substantial, with billions of dollars in annual sales across various therapeutic areas.

- Market Share of Generics: In 2023, generics accounted for approximately 90% of all prescriptions dispensed in the United States, highlighting their broad accessibility and cost-effectiveness.

- Cost Differential: Branded drugs can be 80-85% more expensive than their generic counterparts, creating a strong incentive for substitution when therapeutic efficacy is comparable.

- Therapeutic Overlap: Many conditions, such as chronic pain or mood disorders, can be managed by multiple drug classes, increasing the potential for substitution. For example, non-opioid analgesics can substitute for certain pain management strategies.

Emerging Technologies and Digital Therapeutics

The central nervous system (CNS) treatment sector is seeing a significant shift with the rise of digital therapeutics and wearable devices. These innovations offer alternative or complementary approaches to traditional drug-based therapies, particularly for conditions impacting mental well-being and cognitive abilities.

These technological advancements pose a threat of substitution to established pharmaceutical products. For instance, digital cognitive behavioral therapy (dCBT) apps are increasingly used for mild to moderate depression and anxiety, potentially reducing reliance on antidepressant medications for certain patient segments. By 2024, the digital therapeutics market was projected to reach over $14 billion globally, indicating substantial growth and adoption.

- Digital Therapeutics Market Growth: The global digital therapeutics market was estimated to be worth approximately $14.1 billion in 2024, with a projected compound annual growth rate (CAGR) of around 18% from 2023 to 2030.

- Wearable Device Adoption: Consumer adoption of health-tracking wearables, such as smartwatches capable of monitoring heart rate variability and sleep patterns, continues to rise, providing data that can inform or even influence treatment decisions in CNS disorders.

- Decline in Traditional Treatment Reliance: For less severe conditions, patients may opt for digital interventions as a first line of treatment, thereby substituting or delaying the need for prescription pharmaceuticals.

The threat of substitutes for Axsome's CNS therapies is multifaceted, encompassing non-drug approaches, off-label prescriptions, and even over-the-counter options. Patients and physicians may consider psychotherapy, lifestyle changes, or existing, less expensive medications, especially for less severe conditions or when cost is a primary concern. The substantial generic drug market, where generics represent about 90% of U.S. prescriptions in 2023, underscores the accessibility and cost-effectiveness of alternatives, with branded drugs often costing 80-85% more.

Emerging digital therapeutics and wearable devices also present a growing threat. These technologies offer alternative or complementary treatment pathways for CNS disorders. For instance, digital cognitive behavioral therapy apps are gaining traction for mild to moderate depression and anxiety, potentially reducing the need for traditional pharmaceuticals. The global digital therapeutics market was valued at approximately $14.1 billion in 2024, highlighting the significant adoption and growth of these innovative substitutes.

| Threat Category | Examples | Impact on Axsome |

| Non-Drug Therapies | Psychotherapy, lifestyle changes | May reduce demand for pharmacological treatments for certain patient segments. |

| Off-Label Prescriptions | Existing drugs used for unapproved indications | Can capture market share if perceived as effective and accessible. |

| Over-the-Counter (OTC) & Supplements | Dietary supplements, herbal remedies | Appeal for mild symptoms or initial self-treatment, offering convenience and lower cost. |

| Digital Therapeutics | dCBT apps, health-tracking wearables | Offer alternative or complementary treatment modalities, potentially delaying or replacing prescription drug use. |

Entrants Threaten

The biopharmaceutical industry, particularly in the realm of central nervous system (CNS) drug development, presents a formidable hurdle for new entrants due to exceptionally high capital requirements. Developing a new drug from initial research through preclinical studies, multiple phases of clinical trials, and finally to regulatory approval can cost hundreds of millions, even billions, of dollars. For instance, the average cost to develop a new drug was estimated to be around $2.6 billion in 2023, a figure that continues to climb.

New pharmaceutical companies confront a formidable and protracted regulatory approval pathway, overseen by bodies like the U.S. Food and Drug Administration (FDA). This process necessitates the demonstration of both safety and efficacy through extensive, multi-phase clinical trials, a journey that can span numerous years and is marked by a considerable risk of failure. For instance, the average cost to bring a new drug to market in 2023 was estimated to be over $2 billion, highlighting the immense financial barrier.

The development of innovative central nervous system (CNS) therapies, like those pursued by Axsome, demands a very specific and deep pool of knowledge. This includes expertise in neuroscience, pharmacology, and the intricate process of designing and running clinical trials. For any new company looking to enter this space, securing individuals with these highly specialized skills is paramount.

Attracting and keeping the best talent in these critical fields presents a substantial hurdle and a significant cost. For instance, in 2024, the competition for experienced neuroscientists and clinical development professionals remained intense, with compensation packages often reflecting the scarcity of qualified candidates. This talent acquisition challenge directly impacts a new entrant's ability to progress their drug candidates effectively.

Intellectual Property Protection

The threat of new entrants is significantly mitigated by robust intellectual property protection. Established companies like Axsome Therapeutics possess extensive patent portfolios covering their drug candidates and marketed therapies. For instance, Axsome's lead asset, AXS-07, for migraine, is protected by multiple patents, with some extending into the late 2030s. This creates a substantial barrier for any new company aiming to enter the market with similar treatments, as they would need to develop entirely novel compounds or formulations to circumvent existing intellectual property rights, a process that is both expensive and time-consuming.

Navigating this complex patent landscape requires substantial investment in research and development to create truly innovative solutions. New entrants face the challenge of designing around existing patents, which often involves significant scientific and legal expertise. Failure to do so can lead to costly patent infringement lawsuits, further deterring market entry. This legal and scientific hurdle effectively limits the number of viable new competitors.

- Patent Exclusivity: Axsome's key assets benefit from patent protection that extends well into the future, providing a significant competitive moat.

- R&D Investment: New entrants must commit substantial resources to research and development to create non-infringing and novel therapeutic solutions.

- Legal Hurdles: The threat of patent infringement litigation acts as a strong deterrent for potential new market participants.

- Market Entry Costs: The combined costs of R&D and legal compliance make market entry for new entities in Axsome's therapeutic areas exceptionally high.

Brand Recognition and Established Relationships

Existing pharmaceutical companies enjoy significant advantages due to their well-established brand recognition and deep-rooted relationships with healthcare providers. This allows them to leverage trust and familiarity, making it harder for newcomers to gain traction. For example, in 2024, major pharmaceutical players continued to benefit from decades of marketing and clinical trial data that solidify their reputations.

New entrants face the daunting task of investing heavily in marketing and sales to build comparable awareness and trust. They must also overcome the entrenched networks that current players have cultivated over years. Axsome Therapeutics, recognizing this challenge, has been actively expanding its sales force to bolster its market presence and compete effectively.

- Brand Loyalty: Established pharmaceutical brands often command patient and physician loyalty, making switching difficult.

- Commercial Infrastructure: Existing companies possess robust sales forces, distribution channels, and marketing capabilities.

- Market Access: Long-standing relationships can facilitate easier market access and formulary inclusion for established drugs.

- Axsome's Strategy: Axsome's sales force expansion in 2024 is a direct response to the need to build these critical relationships and brand awareness.

The threat of new entrants into Axsome's CNS drug development space is considerably low. The immense capital required for drug development, with average costs exceeding $2 billion in 2023, creates a significant financial barrier. Furthermore, the rigorous and lengthy regulatory approval process, demanding extensive clinical trials, deters many potential competitors.

Deep scientific expertise in neuroscience and pharmacology is essential, and attracting top talent in these niche fields is both challenging and costly, as evidenced by the competitive compensation for neuroscientists in 2024. Robust intellectual property protection, with patents for key assets like AXS-07 extending into the late 2030s, further shields established players like Axsome from new competition by necessitating entirely novel approaches from entrants.

The established brand recognition and strong relationships that companies like Axsome have cultivated with healthcare providers also present a substantial hurdle for newcomers. Building comparable market trust and access requires significant investment in sales and marketing, a challenge Axsome is actively addressing by expanding its sales force.

| Factor | Impact on New Entrants | Axsome's Position |

| Capital Requirements | Extremely High (>$2 billion avg. development cost in 2023) | Established funding and revenue streams |

| Regulatory Hurdles | Lengthy and complex FDA approval process | Experience navigating regulatory pathways |

| Specialized Expertise | Difficulty in acquiring top neuroscience talent | Existing team of experienced professionals |

| Intellectual Property | Need to design around extensive patent portfolios (e.g., AXS-07 into late 2030s) | Strong patent protection providing market exclusivity |

| Brand Recognition & Relationships | Challenging to build trust and access with healthcare providers | Existing market presence and physician relationships |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Axsome Therapeutics is built upon a foundation of robust data, including SEC filings, analyst reports, and industry-specific market research. This comprehensive approach ensures an accurate assessment of competitive pressures.