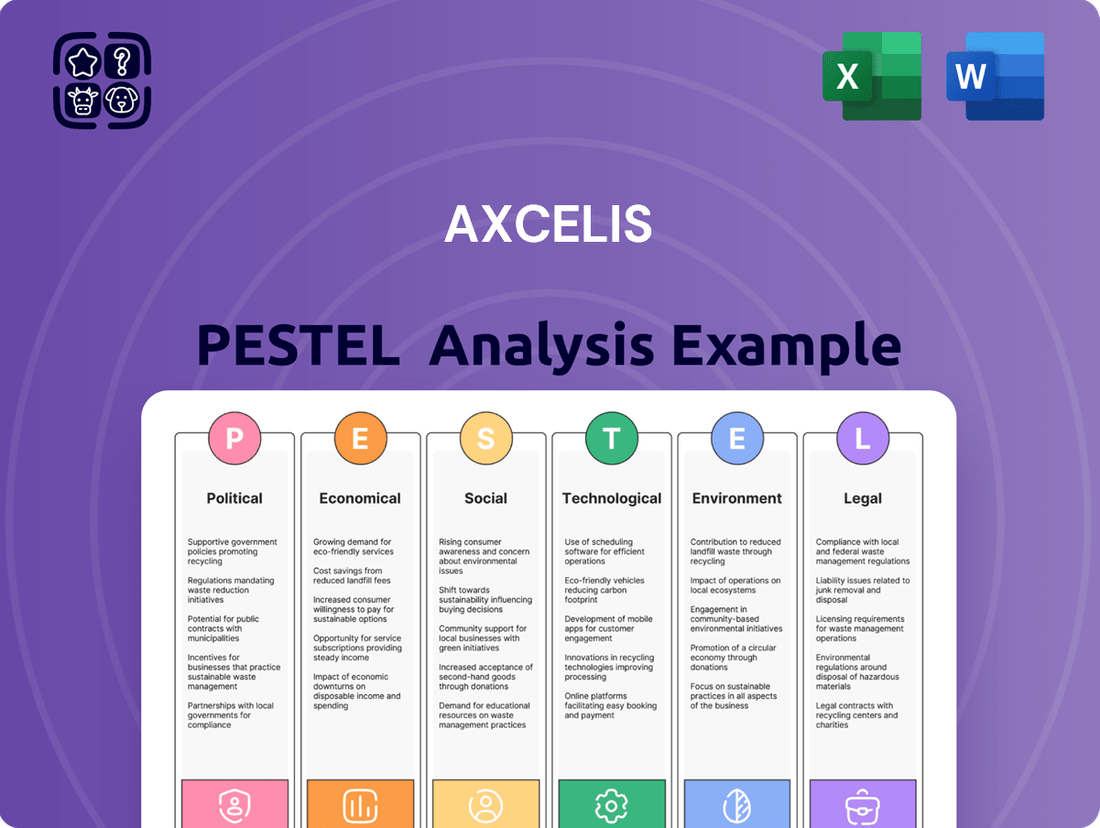

Axcelis PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axcelis Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Axcelis's trajectory. This comprehensive PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain actionable intelligence and refine your competitive strategy.

Political factors

Global political dynamics, especially the ongoing strategic competition between the United States and China, profoundly shape the semiconductor industry. These tensions directly affect companies like Axcelis by influencing market access and the flow of technology.

Trade restrictions and export controls implemented by governments, particularly concerning advanced semiconductor manufacturing equipment, can create significant headwinds for Axcelis. For instance, in late 2023, the US Department of Commerce expanded its export control measures on certain semiconductor manufacturing equipment and technologies to China, aiming to curb its access to advanced chipmaking capabilities.

Successfully navigating these complex international relations and adapting to evolving trade policies is absolutely crucial for Axcelis's continued global operations and market penetration, especially in key regions like Asia.

Government subsidies and incentives, such as the US CHIPS and Science Act, are significantly reshaping the semiconductor landscape. This act, with its substantial funding, aims to bolster domestic chip manufacturing, directly benefiting companies like Axcelis that supply essential equipment to these fabrication plants. These initiatives are expected to drive increased capital expenditure in the sector through 2025.

National security concerns are significantly shaping the semiconductor industry, directly impacting companies like Axcelis. The increasing view of advanced chip technology as critical for defense and economic stability has led governments worldwide to implement stricter oversight. This translates to potential restrictions on where and how Axcelis can export its ion implantation equipment, particularly to countries deemed strategic rivals. For instance, in 2023, the US government expanded export controls on advanced semiconductor technology and equipment to China, a major market for many industry players, underscoring the growing geopolitical influence on business operations. Compliance with these evolving security regulations is therefore not just a legal necessity but a strategic imperative for Axcelis to maintain market access and avoid penalties.

Export Control Regulations

Export control regulations, particularly those targeting advanced semiconductor manufacturing equipment, pose a significant challenge for companies like Axcelis. These rules directly impact its ability to access and serve specific global markets, potentially limiting revenue streams. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) has increasingly tightened controls on technology exports to countries like China, affecting companies supplying critical components for chip production.

Changes in these export policies, which can occur with shifts in geopolitical relations, necessitate swift adaptation of business strategies. Axcelis, as a key player in ion implantation technology, must continually monitor these evolving regulations to ensure compliance and mitigate disruptions to its international sales pipelines. In 2023, the semiconductor industry faced ongoing scrutiny and adjustments related to export controls, highlighting the dynamic nature of this factor.

Adherence to these stringent controls is not merely a matter of compliance but a fundamental requirement for sustained international trade and market access. Failure to comply can result in severe penalties, including fines and the revocation of export privileges, directly impacting Axcelis's global operational capacity and financial performance.

Intellectual Property Protection Policies

Government policies surrounding intellectual property (IP) protection are paramount for a company like Axcelis, which thrives on technological innovation. Strong IP laws, both domestically and internationally, are essential for safeguarding the company's patented technologies and trade secrets, thereby securing its competitive edge in the semiconductor equipment market. For instance, the United States Patent and Trademark Office (USPTO) granted over 300,000 utility patents in 2023 alone, highlighting the active landscape of IP creation and protection.

Axcelis actively engages with and adheres to a complex web of international IP laws and treaties, such as those administered by the World Intellectual Property Organization (WIPO). This compliance is not merely a legal necessity but a strategic imperative, enabling Axcelis to confidently invest in research and development, knowing its innovations will be protected in key global markets. In 2024, WIPO reported a continued increase in international patent filings, underscoring the global importance of IP.

- Robust IP Laws: Government policies that provide strong patent, copyright, and trade secret protection are vital for Axcelis to secure its technological advancements.

- Global Enforcement: Effective enforcement of IP rights across different jurisdictions is crucial for preventing infringement and maintaining market exclusivity for Axcelis's innovations.

- International Treaties: Adherence to international IP agreements ensures that Axcelis's intellectual assets are recognized and protected in the diverse markets it serves.

- R&D Investment: Predictable and strong IP protection encourages continued investment in research and development, which is the lifeblood of a technology-focused enterprise like Axcelis.

Geopolitical tensions, particularly between the US and China, significantly impact Axcelis by influencing market access and technology flow in the semiconductor sector. Government subsidies, like the US CHIPS Act, are expected to boost capital expenditure through 2025, benefiting equipment suppliers. National security concerns lead to stricter oversight and potential export restrictions on advanced technologies, requiring Axcelis to navigate compliance carefully.

| Factor | Description | Impact on Axcelis | 2024/2025 Relevance |

|---|---|---|---|

| Geopolitical Tensions | Strategic competition between major powers | Affects market access and technology transfer | Ongoing US-China trade dynamics continue to shape supply chains and market opportunities. |

| Government Subsidies | Financial incentives for domestic manufacturing | Drives increased capital expenditure in semiconductor fabrication | Acts like the CHIPS Act are expected to stimulate demand for manufacturing equipment through 2025. |

| National Security Concerns | Protection of critical technologies | Leads to export controls and increased regulatory scrutiny | Governments are likely to maintain or increase restrictions on sensitive technology exports, impacting global sales strategies. |

What is included in the product

The Axcelis PESTLE analysis meticulously examines how external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—shape the company's strategic landscape, identifying critical threats and opportunities.

Provides a concise version of Axcelis's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly address external challenges.

Economic factors

The global semiconductor market is experiencing robust growth, projected to reach approximately $600 billion in 2024, driven by increasing demand for AI, automotive, and high-performance computing applications. This upward trend directly benefits Axcelis, a key supplier of ion implantation systems essential for chip manufacturing.

Axcelis's performance is closely tied to capital expenditure cycles in the semiconductor industry. As foundries and logic manufacturers invest heavily in expanding capacity and upgrading technology, the demand for Axcelis's advanced equipment, like its Purion M and Purion XE systems, escalates. For instance, leading foundries announced significant capital spending increases for 2024, signaling strong future demand for manufacturing tools.

The market for specialized chips, such as those used in electric vehicles and advanced driver-assistance systems (ADAS), is a particular tailwind for Axcelis. These sectors require sophisticated semiconductor manufacturing processes, directly translating into higher sales volumes for the company's cutting-edge implantation solutions, with the automotive semiconductor market alone expected to grow by over 10% in 2024.

Rising inflation presents a significant challenge for Axcelis Technologies. For instance, the US Consumer Price Index (CPI) saw a notable increase in 2024, impacting the cost of essential materials and skilled labor needed for their advanced semiconductor manufacturing equipment. This upward pressure on input costs directly threatens to erode Axcelis's profit margins if not effectively managed through pricing strategies or operational efficiencies.

Furthermore, the prevailing interest rate environment, with central banks in major economies like the US and Europe maintaining or even slightly increasing rates through early 2025 to combat inflation, can dampen customer appetite for large capital expenditures. Companies in the semiconductor industry, facing higher borrowing costs, may delay or scale back investments in new equipment, potentially extending Axcelis's sales cycles and impacting revenue growth.

Economic disruptions like the semiconductor shortages experienced in 2021-2022 directly impacted manufacturing timelines for many tech companies, and Axcelis, as a supplier of advanced semiconductor manufacturing equipment, would have faced similar pressures in sourcing critical components. These events underscore the vulnerability of global supply chains to geopolitical instability and unforeseen events, potentially delaying production and increasing costs for specialized materials.

The ongoing efforts to build more resilient supply chains, including nearshoring or dual-sourcing strategies, are likely to increase operational expenses for companies like Axcelis. For instance, a report from Kearney in late 2023 suggested that reshoring manufacturing could add 10-15% to production costs due to higher labor and regulatory expenses in developed economies. This means that maintaining robust inventory levels and diversifying supplier bases, while crucial for reliability, comes with a tangible financial cost.

In the face of persistent inflation and potential trade policy shifts anticipated through 2024 and 2025, ensuring supply chain robustness is paramount. Companies that proactively manage these risks by securing key suppliers and building redundancy can mitigate the impact of price volatility and delivery delays, thereby maintaining their competitive edge in a dynamic market.

Capital Expenditure Cycles of Customers

Axcelis Technologies' financial performance is significantly influenced by the capital expenditure (CapEx) cycles of its semiconductor manufacturing clients. When the broader economy experiences uncertainty or a downturn in demand for electronic devices, chipmakers often postpone or scale back their investments in new fabrication equipment. This directly impacts Axcelis's order intake and revenue streams.

For instance, the semiconductor industry's CapEx is notoriously cyclical. While forecasts for 2024 and 2025 suggest a rebound after a softer 2023, the pace and extent of this recovery are subject to various economic pressures. Companies like Intel, for example, have adjusted their CapEx plans in response to market conditions, highlighting the sensitivity of equipment suppliers to these shifts. Understanding these customer investment patterns is crucial for Axcelis's strategic planning and resource allocation.

- Customer CapEx Sensitivity: Axcelis's revenue directly correlates with semiconductor manufacturers' willingness and ability to invest in new equipment.

- Economic Impact on Investment: Economic downturns or uncertain market demand can lead to deferred or reduced capital spending by Axcelis's customers.

- Forecasting Importance: Accurately predicting customer CapEx cycles is vital for Axcelis's business planning and managing inventory and production.

- Industry Trends: Semiconductor industry CapEx is expected to see growth in 2024-2025, but this is contingent on global economic stability and consumer demand for electronics.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for global companies like Axcelis Technologies. As Axcelis operates internationally, its reported revenues and costs are impacted when converting earnings and expenses from foreign currencies back to its reporting currency, typically the US dollar. For instance, a stronger US dollar can make Axcelis's products more expensive for international buyers, potentially dampening demand. Conversely, a weaker dollar can boost foreign sales when translated back into dollars.

The volatility in exchange rates can directly affect Axcelis's profitability and its competitive positioning in key overseas markets. For example, if the Euro weakens considerably against the dollar, European customers might find Axcelis's ion implant systems less affordable compared to local competitors. This dynamic necessitates careful management of international pricing strategies and cost structures.

To counter these risks, Axcelis, like many global enterprises, may implement hedging strategies. These can include forward contracts or options to lock in exchange rates for future transactions, thereby providing greater certainty over future revenues and expenses. As of late 2024 and early 2025, major currency pairs like EUR/USD and USD/JPY have experienced notable shifts, underscoring the importance of these financial tools for companies with substantial international operations.

- Impact on Revenue: A stronger USD can decrease the dollar value of foreign sales.

- Impact on Costs: A weaker USD can increase the dollar cost of goods manufactured or sourced abroad.

- Competitiveness: Exchange rate shifts can alter the relative pricing of Axcelis's products in international markets.

- Mitigation Strategies: Hedging instruments are employed to reduce exposure to adverse currency movements.

The global economic landscape in 2024 and early 2025 presents a mixed outlook for Axcelis Technologies, with growth opportunities tempered by inflationary pressures and interest rate hikes. While the semiconductor industry continues its expansion, driven by AI and automotive demand, higher input costs and borrowing expenses could impact both Axcelis and its customers' investment decisions.

Currency fluctuations also remain a key economic consideration. A strong US dollar, for instance, can make Axcelis's advanced ion implantation systems more expensive for international buyers, potentially affecting sales volumes. Conversely, hedging strategies are crucial for mitigating these risks and ensuring stable profitability in a volatile global market.

The cyclical nature of capital expenditures within the semiconductor sector means Axcelis's performance is closely tied to its clients' investment cycles. While forecasts for 2024-2025 indicate a rebound in industry spending, economic uncertainties could lead to shifts in these investment plans, directly influencing Axcelis's order intake and revenue.

| Economic Factor | Impact on Axcelis | 2024/2025 Data/Trend |

|---|---|---|

| Global Semiconductor Market Growth | Increased demand for ion implantation systems | Projected to reach ~$600 billion in 2024 |

| Inflation | Higher input costs (materials, labor) | US CPI saw notable increases in 2024 |

| Interest Rates | Potential dampening of customer CapEx | Central banks maintaining/increasing rates to combat inflation |

| Currency Exchange Rates (e.g., USD) | Affects international pricing and profitability | Notable shifts in EUR/USD and USD/JPY observed |

| Customer Capital Expenditures (CapEx) | Directly impacts Axcelis's order intake | Expected rebound in 2024-2025, but sensitive to economic conditions |

Same Document Delivered

Axcelis PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Axcelis provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

The content and structure shown in the preview is the same document you’ll download after payment. Gain valuable insights into Axcelis's strategic landscape and competitive positioning through this thorough report.

Sociological factors

The semiconductor industry, which Axcelis serves, is heavily reliant on a highly specialized workforce, encompassing everything from design engineers to manufacturing technicians. A significant challenge for companies like Axcelis is the ongoing shortage of this specialized talent. For instance, reports in late 2024 and early 2025 highlight a persistent gap in experienced semiconductor engineers, impacting R&D and production timelines across the sector.

This talent deficit directly affects Axcelis's capacity for innovation, the efficiency of its manufacturing processes, and its ability to provide timely and effective servicing for its sophisticated ion implantation systems. To counter this, Axcelis, like its peers, must prioritize robust investment in talent development programs, including apprenticeships and continuous training, alongside aggressive strategies for talent retention to ensure a stable and skilled operational base.

Societal trends are significantly reshaping consumer electronics demand, directly impacting the need for advanced semiconductor chips. The rapid adoption of AI-powered devices, the burgeoning electric vehicle (EV) market, and the widespread rollout of 5G technology all necessitate more sophisticated and powerful chips. For instance, the global AI chip market was projected to reach $119.4 billion in 2024, highlighting the immense growth in this area.

These evolving consumer preferences indirectly but powerfully influence the demand for the manufacturing equipment that Axcelis Technologies provides. As consumers increasingly seek out AI-integrated smartphones, connected cars, and faster mobile networks, the underlying semiconductor manufacturing processes must keep pace. The automotive semiconductor market alone is expected to grow considerably, reaching an estimated $135 billion by 2030, driven largely by EV adoption.

Staying ahead of these societal shifts is crucial for Axcelis's long-term strategic planning and continued relevance. Understanding that consumers are gravitating towards more technologically advanced and connected products means a sustained demand for the advanced ion implantation and processing solutions Axcelis offers. The semiconductor industry's capital expenditure is anticipated to reach approximately $190 billion in 2024, a testament to the investment required to meet this evolving demand.

Global demographic trends, such as the aging workforce in developed economies like Japan and Germany, directly influence labor availability and associated costs for manufacturing. For instance, the average age of workers in Japan's manufacturing sector has been steadily increasing, presenting challenges for companies seeking younger talent. This necessitates proactive workforce planning and potentially increased investment in automation or upskilling existing employees.

Skilled professionals' willingness to relocate for opportunities is a critical factor in staffing international operations, especially for specialized roles in the semiconductor equipment industry where Axcelis operates. As of 2024, many advanced economies are experiencing a shortage of highly specialized engineers, making cross-border talent acquisition more crucial. Companies must therefore consider relocation incentives and global talent pipelines to ensure operational continuity and growth.

Public Perception of the Semiconductor Industry

Public perception significantly shapes the semiconductor industry's trajectory. A general understanding of its critical role in driving technological innovation and economic expansion, such as the industry's projected global market growth to over $700 billion by 2025, can foster crucial policy support and attract a skilled workforce.

A positive public image is not merely about brand awareness; it directly impacts recruitment efforts and strengthens relationships with various stakeholders, including investors and government bodies. For instance, initiatives highlighting the industry's contribution to advancements in AI and renewable energy can boost its appeal.

The industry's value proposition, encompassing job creation and national security implications, needs consistent promotion. This proactive communication can counter potential negative narratives and ensure continued public and governmental backing for research and development.

- Technological Advancement: Public recognition of semiconductors as the backbone of modern technology, from smartphones to advanced medical equipment.

- Economic Growth: Awareness of the industry's substantial contribution to GDP and job creation, with the semiconductor sector directly and indirectly supporting millions of jobs globally.

- Talent Attraction: A positive perception can draw more young talent into STEM fields, addressing the critical need for skilled engineers and researchers.

- Policy Support: Favorable public opinion can translate into government incentives, R&D funding, and supportive trade policies, as seen with initiatives like the US CHIPS Act.

Focus on Diversity and Inclusion

Societal expectations are increasingly highlighting the importance of diversity, equity, and inclusion (DEI) within organizations. This focus directly influences how companies recruit and shape their internal environments. Axcelis's dedication to these principles can significantly boost its appeal as an employer, drawing in a wider range of skilled individuals and cultivating a more dynamic and creative atmosphere.

Embracing DEI is becoming a standard expectation for businesses. For instance, in 2024, companies that demonstrably prioritize DEI often see improved employee retention rates and enhanced brand reputation. Axcelis's proactive stance on these issues positions it favorably in the competitive talent market.

- Talent Acquisition: A strong DEI commitment can broaden the applicant pool, potentially increasing the number of qualified candidates by 15-20% in certain sectors, according to industry reports from early 2025.

- Innovation: Diverse teams are linked to higher innovation rates, with studies in 2024 showing companies with greater diversity reporting a 19% increase in innovation revenue.

- Employee Engagement: A 2024 survey indicated that 70% of employees feel more engaged when their company actively promotes DEI initiatives.

- Brand Reputation: Public perception of companies with strong DEI practices is generally more positive, influencing customer loyalty and investor confidence.

Societal shifts are profoundly impacting the demand for semiconductors, with trends like AI adoption and the electric vehicle revolution driving the need for advanced chips. For instance, the global AI chip market was projected to reach $119.4 billion in 2024, underscoring this demand. This directly translates into a need for sophisticated manufacturing equipment, such as Axcelis's ion implanters, to meet the growing requirements for these specialized components. The automotive semiconductor market, in particular, is expected to reach an estimated $135 billion by 2030, fueled by EV growth.

Technological factors

Axcelis's competitive strength hinges on its ongoing advancements in ion implantation technology, directly addressing the increasingly complex demands of modern chip designs. The company’s commitment to R&D, evidenced by its significant investment in developing more precise, efficient, and scalable ion implantation solutions, is paramount for retaining its market leadership.

For instance, Axcelis's Purion® line of ion implanters, critical for advanced semiconductor manufacturing, continues to see development focused on enabling smaller feature sizes and higher production yields. The semiconductor industry’s push for next-generation devices, such as those utilizing 3D NAND and advanced logic nodes, directly fuels the need for Axcelis’s technological innovations in this space.

The semiconductor industry is rapidly evolving with the emergence of new materials like silicon carbide (SiC) and gallium nitride (GaN), alongside advanced chip architectures such as 3D stacking and gate-all-around (GAA) transistors. Axcelis, a key equipment supplier, faces the imperative to adapt its ion implantation and other processing tools to accommodate these innovations, which demand specialized manufacturing techniques. This adaptation is crucial for maintaining relevance and competitiveness in a market that increasingly values performance and efficiency gains offered by these next-generation technologies.

The integration of AI and machine learning is revolutionizing semiconductor manufacturing. These technologies are crucial for predictive maintenance, optimizing complex fabrication processes, and significantly enhancing chip yields. For instance, by analyzing vast datasets from equipment, AI can anticipate potential failures, reducing costly downtime. This proactive approach is becoming standard in leading fabrication facilities.

Axcelis can harness AI and machine learning to elevate the performance of its ion implantation systems. By embedding these advanced analytics, Axcelis can offer customers solutions that predict maintenance needs, fine-tune process parameters in real-time, and ultimately boost the output quality and quantity of manufactured semiconductors. This technological leap directly translates to improved operational efficiency and a stronger competitive edge for Axcelis and its clientele.

Miniaturization and Advanced Packaging Trends

The semiconductor industry's relentless pursuit of smaller, more powerful, and energy-efficient chips directly impacts Axcelis. This miniaturization trend, exemplified by the move towards sub-3nm process nodes, demands sophisticated ion implantation equipment capable of precise doping at atomic levels. Advanced packaging techniques, such as chiplets and 3D stacking, require integration with manufacturing steps that Axcelis's solutions must accommodate.

Axcelis's ability to support these evolving technological factors is crucial for its market position. For instance, the increasing complexity of advanced packaging, which can involve multiple die integration, necessitates ion implantation solutions that can handle diverse wafer sizes and configurations. The company's investment in research and development, aiming to enhance the precision and throughput of its implant systems, directly addresses these industry demands.

- Miniaturization: The drive towards smaller transistors, like those in the 2nm and sub-2nm nodes, requires ion implanters with unprecedented control over ion placement and energy.

- Advanced Packaging: Technologies like heterogeneous integration and 3D stacking create new requirements for doping uniformity and process compatibility across different materials and structures.

- Energy Efficiency: As chips become more powerful, the manufacturing processes themselves must also become more energy-efficient, influencing equipment design and operation.

- Lithography Advancements: Innovations in lithography, such as High-NA EUV, will enable smaller feature sizes, placing further demands on the precision of subsequent processes like ion implantation.

R&D Investment and Innovation Pace

The semiconductor equipment sector thrives on rapid technological evolution, demanding significant investment in research and development. Axcelis Technologies, a key player, must continuously fund R&D to bring advanced products to market and maintain its competitive edge. For instance, in 2023, Axcelis reported approximately $100 million in R&D expenses, a testament to this industry's high intensity. This ongoing commitment directly correlates with a company's ability to lead the market.

The pace at which new technologies are developed and commercialized is a critical determinant of market leadership in semiconductor manufacturing equipment. Companies that can innovate faster and more effectively are better positioned to capture market share. Axcelis's strategy focuses on accelerating its innovation pipeline to meet the evolving demands of chipmakers.

- R&D Spending: Axcelis invested roughly $100 million in R&D during 2023, highlighting the sector's capital-intensive nature.

- Innovation Cycle: The industry faces short product lifecycles, necessitating constant development of next-generation equipment.

- Market Leadership: A faster pace of innovation directly translates to a stronger competitive position and greater market share.

The semiconductor industry's relentless pursuit of smaller, more powerful, and energy-efficient chips directly impacts Axcelis. This miniaturization trend, exemplified by the move towards sub-3nm process nodes, demands sophisticated ion implantation equipment capable of precise doping at atomic levels. Advanced packaging techniques, such as chiplets and 3D stacking, require integration with manufacturing steps that Axcelis's solutions must accommodate.

Axcelis's ability to support these evolving technological factors is crucial for its market position. For instance, the increasing complexity of advanced packaging, which can involve multiple die integration, necessitates ion implantation solutions that can handle diverse wafer sizes and configurations. The company's investment in research and development, aiming to enhance the precision and throughput of its implant systems, directly addresses these industry demands.

The semiconductor equipment sector thrives on rapid technological evolution, demanding significant investment in research and development. Axcelis Technologies, a key player, must continuously fund R&D to bring advanced products to market and maintain its competitive edge. For instance, in 2023, Axcelis reported approximately $100 million in R&D expenses, a testament to this industry's high intensity. This ongoing commitment directly correlates with a company's ability to lead the market.

The pace at which new technologies are developed and commercialized is a critical determinant of market leadership in semiconductor manufacturing equipment. Companies that can innovate faster and more effectively are better positioned to capture market share. Axcelis's strategy focuses on accelerating its innovation pipeline to meet the evolving demands of chipmakers.

| Technological Factor | Impact on Axcelis | Key Developments/Data |

| Miniaturization (e.g., sub-3nm nodes) | Requires higher precision and control in ion implantation. | Axcelis's Purion® line is designed for advanced nodes. R&D investment supports development for smaller feature sizes. |

| Advanced Packaging (e.g., 3D stacking, chiplets) | Demands adaptability for diverse wafer sizes and integration with new manufacturing steps. | Axcelis's solutions need to accommodate complex multi-die integration and varied material interfaces. |

| New Materials (e.g., SiC, GaN) | Requires specialized processing tools for unique doping requirements. | Axcelis must adapt ion implantation techniques to handle the specific characteristics of these wide-bandgap semiconductors. |

| AI & Machine Learning Integration | Enhances equipment performance, predictive maintenance, and process optimization. | Axcelis can leverage AI to improve yield and reduce downtime for its customers' fabrication processes. |

Legal factors

Axcelis Technologies, a global semiconductor equipment manufacturer, navigates a complex web of international trade laws and tariffs. For instance, in 2024, the United States maintained tariffs on certain goods imported from China, which could affect the cost of components Axcelis sources or the competitiveness of its offerings in that market. Similarly, the European Union's evolving trade policies and customs procedures require diligent compliance to ensure seamless import and export of their advanced ion implantation systems.

Axcelis operates under stringent export control regulations, notably those from the U.S. government, which dictate technology sales to specific nations and organizations. These rules directly impact Axcelis's ability to market its sophisticated semiconductor manufacturing equipment globally.

Failure to comply with these complex legal frameworks can result in significant financial penalties and considerable damage to Axcelis's reputation. For instance, violations of the Export Administration Regulations (EAR) can lead to fines and restrictions on future exports.

Navigating these evolving legal requirements is paramount for Axcelis's international business strategy and its continued access to key markets. Staying abreast of sanctions and export licensing requirements is a critical operational necessity.

Axcelis Technologies heavily relies on its intellectual property, particularly patents protecting its advanced ion implantation technology, to maintain its edge in the semiconductor equipment market. For instance, as of early 2024, the company actively manages a robust patent portfolio, a critical asset in a sector driven by technological innovation.

The legal landscape surrounding patent enforcement and the threat of infringement are significant considerations for Axcelis. Navigating these complex legal frameworks, including potential litigation, directly impacts the company's ability to safeguard its proprietary innovations and market position.

Consequently, a proactive strategy of maintaining and vigorously defending its patent portfolio is paramount for Axcelis. This legal vigilance is essential to prevent competitors from leveraging its technological advancements without authorization, thereby preserving its competitive advantage and revenue streams.

Environmental, Health, and Safety (EHS) Regulations

Axcelis Technologies navigates a complex web of Environmental, Health, and Safety (EHS) regulations impacting its manufacturing, product design, and chemical usage. These rules are dynamic and differ across global operating regions, demanding constant vigilance and adjustments to uphold worker safety and environmental stewardship. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent standards under the Clean Air Act and Resource Conservation and Recovery Act (RCRA), which directly affect chemical handling and emissions from manufacturing facilities like Axcelis.

Failure to comply with these diverse EHS mandates can lead to significant legal repercussions, including substantial fines and operational disruptions. Axcelis's commitment to robust EHS programs is therefore crucial for mitigating these risks and ensuring uninterrupted business operations. The company's 2023 sustainability report highlighted ongoing investments in process improvements to meet evolving international EHS benchmarks, such as those set by the European Chemicals Agency (ECHA) regarding chemical registration, evaluation, authorization, and restriction (REACH).

- Global Regulatory Landscape: Axcelis must adhere to varying EHS standards in the U.S., Europe, and Asia, impacting everything from factory emissions to the materials used in its ion implant systems.

- Worker Safety Focus: Regulations like OSHA's Process Safety Management (PSM) standard in the U.S. mandate rigorous safety protocols for handling hazardous chemicals, directly relevant to Axcelis's operations.

- Environmental Protection: Compliance with directives such as the EU's Restriction of Hazardous Substances (RoHS) and Waste Electrical and Electronic Equipment (WEEE) affects the design and end-of-life management of Axcelis's semiconductor manufacturing equipment.

- Financial Impact of Non-Compliance: In 2024, companies in the manufacturing sector faced an average of $50,000 in fines for minor EHS violations, with much higher penalties for significant breaches, underscoring the financial imperative for strict adherence.

Data Privacy and Cybersecurity Laws

As a technology firm, Axcelis Technologies is entrusted with sensitive data, encompassing customer details and intricate proprietary designs. Navigating the complex landscape of data privacy and cybersecurity laws is paramount for the company's operations and reputation.

Compliance with regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, alongside evolving cybersecurity mandates, presents ongoing challenges. These legal frameworks dictate how personal data is collected, processed, and stored, with significant penalties for non-compliance. For instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher. The CCPA, while offering different enforcement mechanisms, also imposes substantial penalties for violations.

Protecting the integrity of this data and proactively preventing breaches are not merely legal obligations but critical business imperatives. Cybersecurity incidents can lead to substantial financial losses, reputational damage, and erosion of customer trust. In 2024, the average cost of a data breach globally reached an estimated $4.45 million, underscoring the financial risk associated with inadequate security measures.

- Data Privacy Compliance: Adherence to GDPR, CCPA, and similar global regulations is essential for handling customer and proprietary information.

- Cybersecurity Mandates: Meeting evolving cybersecurity standards is a legal requirement to protect sensitive data from breaches.

- Financial Impact of Breaches: The average cost of a data breach in 2024 was approximately $4.45 million, highlighting the financial risks of non-compliance.

- Reputational Risk: Data breaches can severely damage customer trust and Axcelis's brand reputation.

Axcelis Technologies operates within a dynamic international trade environment, subject to evolving tariffs and import/export regulations. For instance, in 2024, continued trade tensions between major economic blocs necessitated careful navigation of customs procedures and compliance with varying duties on advanced manufacturing equipment. These legal frameworks directly influence the cost of goods and market access for Axcelis's sophisticated ion implantation systems.

The company's global operations are also governed by stringent export control laws, particularly those enforced by the United States. These regulations dictate the permissible destinations and end-users for its high-technology products, impacting market reach and requiring diligent oversight to prevent unauthorized transfers. Non-compliance risks severe penalties, including substantial fines and restrictions on future business activities.

Intellectual property law is a critical legal factor for Axcelis, given its reliance on patented technologies. Protecting its innovations through robust patent portfolios is essential for maintaining a competitive edge against rivals. Navigating potential patent disputes and ensuring the integrity of its intellectual property requires ongoing legal vigilance and strategic enforcement efforts.

Environmental factors

Semiconductor fabrication, the core of Axcelis's business, is inherently energy-hungry. Their ion implantation systems, while essential for chip production, do add to the overall energy footprint of semiconductor fabs. For instance, a typical fab can consume hundreds of megawatts of power daily, with equipment like Axcelis's being significant contributors.

The global push for decarbonization directly impacts Axcelis. There's growing demand for equipment that minimizes energy usage and supports sustainable manufacturing. This means Axcelis must continue innovating to design more energy-efficient ion implanters and assist customers in reducing their operational carbon emissions.

Axcelis, like other semiconductor equipment manufacturers, handles materials that require careful waste management. In 2024, the semiconductor industry continued to face scrutiny over its environmental footprint, with a particular focus on hazardous waste. Companies like Axcelis must adhere to strict regulations, such as the Resource Conservation and Recovery Act (RCRA) in the United States, governing the disposal and recycling of chemicals and byproducts used in manufacturing and equipment operation.

Effective waste management isn't just about compliance; it's a key sustainability metric. Axcelis's commitment to responsible practices, including minimizing hazardous waste generation and promoting recycling, directly impacts its environmental stewardship and can influence investor perception. For instance, the global waste management market, which includes industrial waste, was projected to reach over $2 trillion by 2025, highlighting the significant economic and environmental considerations involved.

Semiconductor fabrication plants, the primary customers for Axcelis's ion implantation equipment, are incredibly water-intensive. These facilities can consume millions of gallons of ultrapure water daily, a significant factor in their environmental footprint and operational costs. For instance, a single advanced fab might use upwards of 5 million gallons of water per day, with a substantial portion dedicated to cleaning and rinsing processes.

While Axcelis does not directly operate these fabs, the design of their equipment, particularly ion implanters, can indirectly influence water consumption. Innovations that reduce the need for extensive post-processing or improve the efficiency of rinsing cycles within the fab can contribute to overall water conservation goals. The industry's increasing focus on sustainability means that water-efficient solutions are becoming a key consideration for fab operators when selecting manufacturing partners and equipment.

Supply Chain Environmental Impact

Axcelis Technologies' supply chain, encompassing everything from the sourcing of raw materials for its ion implantation systems to the final delivery of components and finished products, inherently carries an environmental footprint. This impact spans energy consumption, waste generation, and emissions throughout the manufacturing and logistics processes.

The company's commitment to sustainability involves actively evaluating and collaborating with suppliers who demonstrate strong adherence to environmental standards. This focus on responsible sourcing is crucial for mitigating Axcelis's overall environmental impact, with a growing emphasis on promoting sustainable practices across its entire value chain.

For instance, in 2024, many companies in the semiconductor equipment sector are reporting increased scrutiny on their Scope 3 emissions, which largely originate from their supply chains. Axcelis, like its peers, is likely investing in supplier audits and engagement programs to encourage greener manufacturing processes and reduced transportation-related emissions. Specific data on Axcelis's supply chain environmental performance for 2024 is still emerging, but industry trends point towards a significant push for transparency and reduction in this area.

- Supply Chain Footprint: Axcelis's operations involve raw material extraction, component manufacturing, and global transportation, all contributing to its environmental impact.

- Supplier Environmental Standards: Evaluating and partnering with suppliers who meet environmental criteria helps reduce the company's overall ecological footprint.

- Sustainable Sourcing: Promoting and implementing sustainable sourcing practices is becoming a key differentiator and a necessity for environmentally conscious businesses.

- Industry Trend: The semiconductor equipment industry is increasingly focused on reducing Scope 3 emissions, with supply chain management being a primary area of attention in 2024 and beyond.

Circular Economy Principles

The shift towards a circular economy, emphasizing reduced waste and extended material lifecycles through reuse and recycling, is a significant environmental trend. Axcelis can actively participate by developing ion implantation equipment that is inherently more durable, easier to repair, and designed for efficient recycling when it reaches its end of service life.

This commitment to circularity not only aligns with growing global sustainability mandates but can also unlock new value streams. For instance, by 2024, the global market for circular economy solutions was projected to reach $4.5 trillion, according to some industry reports, highlighting the economic potential of these principles.

Axcelis's adoption of these principles can be demonstrated through:

- Designing for longevity: Creating equipment with extended operational lifespans.

- Modular repairability: Enabling easier and more cost-effective component replacement.

- Material recovery: Implementing processes to reclaim and reuse valuable materials from retired systems.

- Reducing energy consumption: Optimizing equipment for lower power usage during operation.

By integrating these practices, Axcelis can solidify its position as an environmentally responsible leader in the semiconductor manufacturing equipment sector, potentially leading to cost savings through reduced material sourcing and waste disposal.

Environmental regulations continue to tighten globally, impacting semiconductor manufacturing. Axcelis must navigate evolving standards for emissions, waste, and water usage, particularly as regions like the EU push for stricter environmental controls. For instance, the European Green Deal aims for climate neutrality by 2050, influencing manufacturing processes and equipment design worldwide.

The semiconductor industry's significant energy and water demands are under increasing scrutiny. As of 2024, advanced semiconductor fabrication plants can consume millions of gallons of water daily and hundreds of megawatts of power, making efficiency a critical factor. Axcelis's ion implanter technology, while vital, must align with customer goals for reduced resource consumption.

Sustainable sourcing and supply chain transparency are paramount. In 2024, many companies, including those in the semiconductor equipment sector, are focusing on Scope 3 emissions, which are largely driven by their supply chains. Axcelis's efforts to promote greener manufacturing and reduce transportation-related emissions throughout its value chain are crucial.

The push towards a circular economy presents opportunities for Axcelis. By 2024, the global market for circular economy solutions was projected to reach $4.5 trillion, indicating the economic significance of designing for durability, repairability, and material recovery. Axcelis's development of longer-lasting, more easily serviced equipment aligns with this trend.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Axcelis is built upon a robust foundation of data from leading industry analysts, government regulatory bodies, and reputable financial news outlets. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the semiconductor equipment industry.