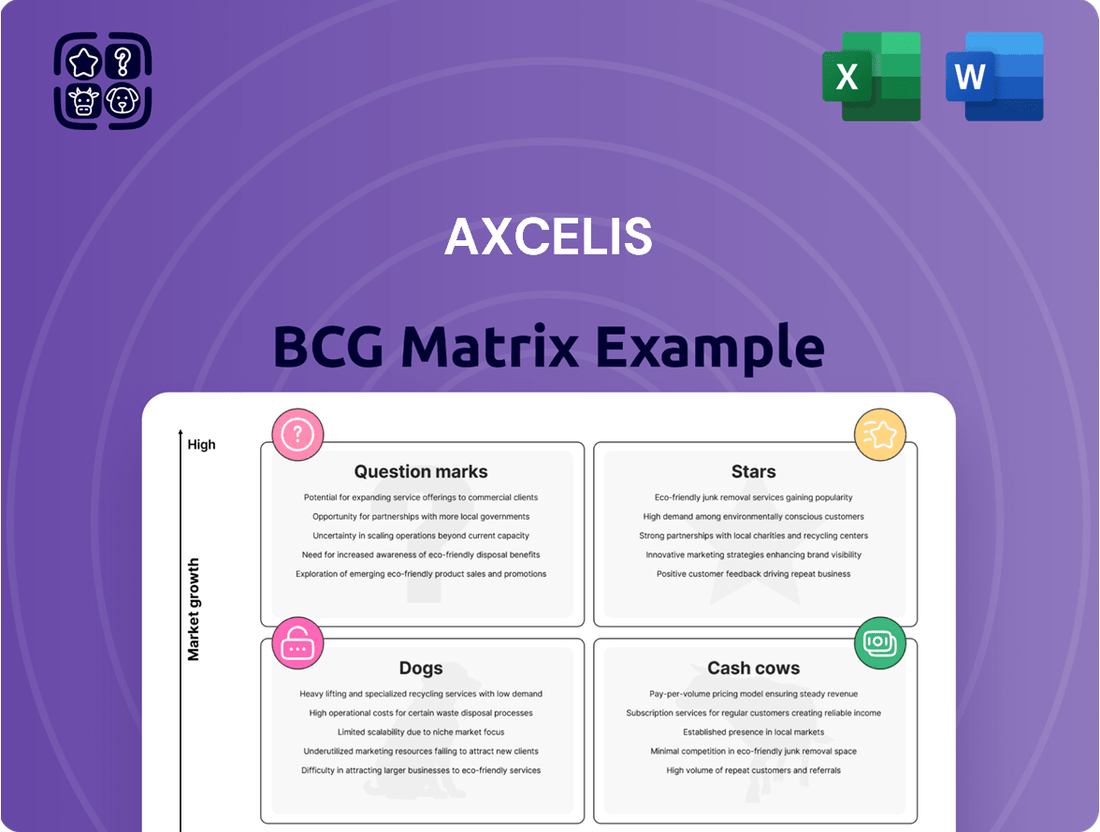

Axcelis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axcelis Bundle

Unlock the strategic potential of Axcelis's product portfolio with our comprehensive BCG Matrix. Understand which innovations are poised for growth and which are generating consistent returns, providing a clear roadmap for resource allocation.

Don't just guess where Axcelis's business is headed; know it. Purchase the full BCG Matrix for a detailed quadrant breakdown, actionable insights, and a strategic advantage in the competitive semiconductor equipment market.

This preview offers a glimpse into Axcelis's market positioning. Invest in the complete BCG Matrix to receive a data-driven analysis and strategic recommendations that will empower your investment and product development decisions.

Stars

Axcelis' Purion Power Series for Silicon Carbide (SiC) devices is a definite star in their BCG matrix. The silicon carbide market is booming, fueled by the rapid expansion of electric vehicles, the push for renewable energy, and the rollout of 5G technology. This surge in demand directly translates to strong performance for Axcelis' SiC implant solutions.

In 2024, Axcelis saw a substantial uptick in system shipments for their Purion Power Series targeting SiC. This growth underscores the market's increasing embrace of their technology and solidifies Axcelis' position as a leader in this high-potential segment. The company's strategic focus on this area is clearly paying off.

Looking ahead, the outlook for SiC technology remains exceptionally bright, and Axcelis is well-positioned to capitalize on this continued expansion. The Purion Power Series is expected to drive significant future revenue and growth for Axcelis, making it a crucial area for ongoing investment and development.

The Purion H™ Series from Axcelis is a clear star in their BCG matrix. This product line is built for high-current applications, a segment experiencing robust demand. The semiconductor industry's relentless push for faster and smaller chips directly fuels the need for the high purity and precision this series offers. In 2024, the global semiconductor market is projected to reach over $600 billion, underscoring the significant growth potential for components like the Purion H™ Series that enable advanced manufacturing.

The Purion XE™ Series, especially the XEmax with its Boost Technology, is a shining star for Axcelis. It dominates the high-energy implantation market, a critical component for advanced image sensors and next-generation logic chips.

This strong performance is fueled by the robust demand in the image sensor sector and the increasing need for advanced logic in AI and high-performance computing. In 2024, the semiconductor industry saw continued growth, with specialized equipment like the Purion XE™ Series playing a vital role in enabling technological advancements.

Customer Solutions and Innovation (CS&I) Upgrades

Axcelis' Customer Solutions and Innovation (CS&I) upgrades are shining stars in their product portfolio. These aren't just minor tweaks; they represent significant advancements designed to boost performance and efficiency for their customers. Think of it as giving their existing equipment a powerful, cutting-edge overhaul.

These innovations include exciting new source technologies and comprehensive product life cycle packages. The focus is on tangible benefits for their clients, ensuring they get the most out of their Axcelis equipment. This strategic push into upgrades highlights Axcelis' commitment to ongoing customer support and technological leadership.

The demand for these CS&I sales was particularly strong in Q4 2024, underscoring their market appeal.

- Strong Q4 2024 Demand: Axcelis reported robust sales for its CS&I offerings in the final quarter of 2024, signaling significant customer adoption.

- Higher Margins: These upgrade packages typically carry higher profit margins compared to standard equipment sales, contributing positively to Axcelis' overall profitability.

- Product Life Cycle Focus: The inclusion of product life cycle packages demonstrates a strategy to extend the value and utility of their installed base.

- Technological Advancement: Innovations in source technology are key drivers of these upgrade sales, offering customers improved processing capabilities.

Ion Implantation Solutions for Advanced Logic

Axcelis Technologies is making significant strides in the Advanced Logic sector, focusing on ion implantation solutions crucial for next-generation semiconductor manufacturing. This strategic focus positions them well within the semiconductor industry's growth trajectory.

The Advanced Logic market is a star for Axcelis due to its projected long-term, multi-year expansion. This growth is fueled by the escalating complexity of semiconductor designs and the surging demand for high-performance chips essential for artificial intelligence (AI) and data center applications.

- Targeting Advanced Logic: Axcelis is developing innovative ion implantation technologies to meet the stringent requirements of advanced logic chip production.

- Market Drivers: Growth is propelled by the increasing demand for AI, high-performance computing, and advanced data center infrastructure.

- Growth Potential: The segment is characterized by its potential for sustained, multi-year growth as semiconductor complexity continues to rise.

- Revenue Contribution: While specific figures for this segment are often embedded within broader reporting, Axcelis has noted strong demand from leading logic manufacturers, contributing to their overall revenue growth. For instance, in the first quarter of 2024, Axcelis reported total revenue of $224.5 million, with a significant portion attributed to their advanced technology platforms serving logic and other high-growth markets.

Axcelis' Purion Power Series for Silicon Carbide (SiC) devices is a definite star in their BCG matrix. The SiC market is booming, driven by electric vehicles and renewable energy. In 2024, Axcelis saw a substantial uptick in system shipments for their Purion Power Series targeting SiC, solidifying their leadership in this high-potential segment.

The Purion H™ Series is another star, built for high-current applications with robust demand. The semiconductor industry's push for faster chips fuels the need for the precision this series offers. In 2024, the global semiconductor market exceeded $600 billion, highlighting the growth potential for enabling components like the Purion H™ Series.

Axcelis' Customer Solutions and Innovation (CS&I) upgrades are also stars, representing significant advancements for their customers. The demand for these upgrades was particularly strong in Q4 2024, demonstrating their market appeal and contributing to higher profit margins for Axcelis.

The Advanced Logic sector represents a star for Axcelis, driven by the multi-year expansion fueled by AI and data center applications. Axcelis is developing innovative ion implantation technologies to meet these stringent requirements. In Q1 2024, Axcelis reported total revenue of $224.5 million, with advanced technology platforms serving logic markets contributing significantly.

| Product Line | BCG Category | Key Market Drivers | 2024 Performance Highlight | Future Outlook |

|---|---|---|---|---|

| Purion Power Series (SiC) | Star | Electric Vehicles, Renewable Energy, 5G | Substantial increase in system shipments | Continued strong growth expected |

| Purion H™ Series | Star | High-current applications, advanced chip manufacturing | Robust demand in a market exceeding $600 billion | Significant growth potential |

| CS&I Upgrades | Star | Performance enhancement, efficiency improvements | Strong Q4 2024 demand, higher profit margins | Continued customer adoption and value extension |

| Advanced Logic Solutions | Star | AI, Data Centers, complex chip designs | Strong demand from leading logic manufacturers, contributing to $224.5M Q1 2024 revenue | Projected multi-year expansion |

What is included in the product

This BCG Matrix overview provides strategic guidance on investing in Axcelis' product portfolio.

It highlights which business units to invest in, hold, or divest based on market growth and share.

Visualizes product portfolio, identifying underperformers for strategic divestment or resource reallocation.

Cash Cows

The Purion Platform is Axcelis's flagship product line, firmly positioned as a cash cow within their portfolio. This advanced ion implantation technology caters to a broad spectrum of semiconductor manufacturing needs, from high, medium, and low current to medium and high energy requirements.

Its widespread adoption across both established and developing semiconductor applications, in a mature market, translates into a reliable and consistent stream of revenue for Axcelis. For instance, in the first quarter of 2024, Axcelis reported total revenue of $230 million, with their implant systems, including the Purion platform, being the primary driver of this financial performance.

The Purion M™ Series from Axcelis is a prime example of a cash cow within their product portfolio. This medium-current implanter is recognized for its extensive capabilities in delivering mid-current doses while maintaining impressive energy efficiency. Its role in manufacturing memory and power devices, critical components in a growing technology landscape, ensures consistent and reliable revenue for the company.

Axcelis' equipment designed for general mature node applications, including older semiconductor technologies, serves as a significant cash cow for the company. These established products, despite facing a cyclical digestion period anticipated in 2025, maintain a strong market share. This high penetration ensures consistent revenue generation, effectively funding Axcelis' broader operational needs and investments.

Service and Support for Installed Base

Axcelis’s service and support for its installed base of ion implantation systems is a significant cash cow. This segment generates recurring revenue through essential offerings like maintenance contracts, spare parts sales, and expert technical assistance for their global customer base.

The company's commitment to the complete life cycle support of its equipment ensures a steady income stream. This ongoing support is crucial for customers who rely on the uptime and performance of their Axcelis systems.

For instance, in the first quarter of 2024, Axcelis reported that its service revenue reached $67.9 million. This demonstrates the substantial and consistent financial contribution from this segment, often characterized by high profit margins due to the inherent demand for operational continuity.

- Recurring Revenue: Maintenance contracts and spare parts sales provide predictable income.

- High Profit Margins: The specialized nature of the service leads to strong profitability.

- Installed Base: A large, deployed base of systems globally fuels demand for support.

- Q1 2024 Performance: Service revenue hit $67.9 million, highlighting its financial strength.

Legacy Business Group Aftermarket Sales

Axcelis' Legacy Business Group, driven by aftermarket sales for older processing systems, functions as a cash cow. These sales, though contributing a modest 1.7% to total revenue in 2024, offer a consistent and predictable income stream from mature products.

This segment benefits from a loyal customer base that continues to rely on established Axcelis equipment. The stability of these aftermarket sales provides a reliable source of cash flow, supporting other strategic initiatives within the company.

- Revenue Contribution: 1.7% of total revenue in 2024.

- Product Focus: Aftermarket sales for legacy processing systems.

- Growth Trajectory: Stable, low-growth income stream.

- Strategic Role: Provides consistent cash flow from established products.

Axcelis's Purion platform and its associated services represent significant cash cows, generating consistent revenue from a mature market. The company's focus on providing ongoing support and aftermarket sales for its installed base ensures a reliable income stream, even for older but still functional equipment. This strategy allows Axcelis to maintain strong financial performance and fund its research and development efforts.

| Product/Segment | BCG Category | 2024 Revenue Contribution (Approx.) | Key Characteristics |

|---|---|---|---|

| Purion Platform (Implant Systems) | Cash Cow | Primary driver of total revenue (e.g., $230 million in Q1 2024 total revenue) | Mature market, broad adoption, reliable revenue stream |

| Service and Support | Cash Cow | $67.9 million in Q1 2024 | Recurring revenue, high profit margins, essential for customer uptime |

| Legacy Business Group (Aftermarket) | Cash Cow | 1.7% of total revenue in 2024 | Stable, low-growth income from established products, loyal customer base |

Delivered as Shown

Axcelis BCG Matrix

The preview you are currently viewing is the complete and final Axcelis BCG Matrix document you will receive upon purchase. This means you can confidently assess the quality, depth of analysis, and professional formatting before committing, as there will be no hidden charges, additional content, or watermarks in the version you download. You'll gain immediate access to a ready-to-use strategic tool, perfectly aligned with the preview, enabling you to effectively analyze Axcelis's product portfolio and make informed business decisions.

Dogs

Older Silicon IGBT systems are currently categorized as a 'dog' within the BCG Matrix. This classification stems from a noticeable sales decline observed in late 2024, with projections indicating continued softening through 2025.

Several factors contribute to this downturn. Customers are actively managing their existing capacity, which naturally dampens the need for new equipment. Furthermore, the industrial automotive sector, a key consumer of these systems, is experiencing a slow recovery, further impacting demand and, consequently, profitability for this product line.

Products that heavily depend on China's mature node semiconductor capacity are currently positioned as dogs within Axcelis's BCG Matrix. This segment faces a cyclical digestion period, with the company forecasting a revenue downturn in 2025.

This situation points to a market with limited growth prospects. Furthermore, customers absorbing previous capital expenditures could lead to a reduction in Axcelis's market share within this specific product category.

NAND equipment sales experienced a downturn in 2024. Axcelis Technologies, a key player, noted that their NAND equipment sales ceased entirely in the third quarter of 2024, highlighting the significant slump in this sector.

This segment is classified as a dog within the BCG matrix due to persistently weak demand. The inherent cyclicality of the memory market further exacerbates this, leading to very limited cash generation for companies operating in this space.

Segments Significantly Impacted by US Export Restrictions

Certain segments of Axcelis' business can be classified as dogs within the BCG matrix due to the significant impact of U.S. export control restrictions. These restrictions directly limit the company's capacity to deliver its advanced ion implantation equipment to specific markets and customers. This inability to serve certain geographic regions or customer types curtails revenue generation and market penetration in those areas, directly affecting growth potential.

For instance, if Axcelis faces stringent export controls impacting its ability to sell to a particular country or a specific type of semiconductor manufacturer, that business line would likely exhibit characteristics of a dog. This scenario means low market share in that restricted segment, coupled with limited growth prospects due to the external regulatory environment. The company's overall performance is thus influenced by these geopolitical factors, creating challenges for expansion in affected areas.

- Impact of Export Controls: U.S. export restrictions can prevent Axcelis from selling its advanced ion implanters to certain countries or companies, directly hindering revenue growth in those specific segments.

- Market Share Reduction: The inability to access certain markets due to these controls leads to a reduced market share in those affected areas, a key characteristic of a dog in the BCG matrix.

- Limited Growth Prospects: Geopolitical and regulatory barriers create inherently low growth prospects for business segments subject to these export limitations.

Any Outdated or Discontinued Product Lines

Any outdated or discontinued product lines at Axcelis, not categorized under legacy aftermarket support, would be considered 'dogs' in the BCG Matrix. These products typically struggle with low market share within shrinking market segments. Their continued existence drains resources, offering minimal profit potential and making them prime candidates for divestiture or phase-out.

These 'dog' products, by their nature, represent a drain on company resources. For instance, if Axcelis had a product line from the early 2000s that was superseded by newer technology and had very few active users, it would fit this category. Such products are unlikely to see significant future growth and may even incur costs for maintenance or support without commensurate revenue. In 2024, companies are increasingly scrutinizing such portfolios to streamline operations and reallocate capital to more promising areas.

- Low Market Share: Products in this category have a minimal presence in their respective markets.

- Declining Markets: The industries or applications these products serve are experiencing contraction.

- Resource Drain: They consume capital, R&D, and support resources without yielding substantial returns.

- Divestiture Candidates: These are often prime candidates for sale, discontinuation, or strategic wind-down.

Older Silicon IGBT systems, along with products tied to China's mature node capacity, represent 'dogs' in Axcelis's BCG Matrix. These segments are experiencing sales declines and market digestion periods, with revenue forecasts for 2025 indicating a downturn. The industrial automotive sector's slow recovery and customer capacity absorption further dampen demand for IGBT systems. Similarly, segments impacted by U.S. export controls also fall into the 'dog' category due to restricted market access and limited growth potential.

NAND equipment sales have ceased entirely in Q3 2024, classifying this segment as a 'dog' due to weak demand and market cyclicality. Discontinued product lines, not under aftermarket support, are also 'dogs' due to low market share in shrinking segments, draining resources with minimal profit potential. Companies in 2024 are actively streamlining such portfolios.

| Product Category | BCG Classification | Key Challenges | 2024/2025 Outlook |

|---|---|---|---|

| Older Silicon IGBT Systems | Dog | Declining sales, slow industrial automotive recovery, customer capacity management | Continued sales softening through 2025 |

| China Mature Node Capacity Dependent Products | Dog | Cyclical digestion, limited growth prospects, customer capital expenditure absorption | Revenue downturn forecast for 2025 |

| NAND Equipment | Dog | Persistently weak demand, memory market cyclicality | Sales ceased in Q3 2024, very limited cash generation |

| Segments Affected by U.S. Export Controls | Dog | Restrictions on advanced ion implanter sales to specific markets/customers | Limited revenue generation and market penetration in affected areas |

| Outdated/Discontinued Product Lines (Non-Aftermarket) | Dog | Low market share in shrinking segments, resource drain | Minimal profit potential, candidates for divestiture/phase-out |

Question Marks

New ion implanter technologies targeting emerging applications, like advanced materials or specialized medical devices, are currently in the question mark phase for companies like Axcelis. These represent potential high-growth areas, but their market penetration is minimal as adoption is still nascent. For instance, while the broader semiconductor market is robust, these niche applications are still finding their footing.

The challenge for these question mark technologies lies in their unproven market demand and the substantial investment needed for research, development, and market education. Companies must commit significant capital to prove the value proposition and overcome early adopter hurdles. This is a classic BCG matrix scenario where future success hinges on strategic investment and market development.

Axcelis' venture into new territories like Japan exemplifies a question mark in its business portfolio. These markets hold significant potential for revenue growth, but they also demand considerable upfront investment. For instance, establishing a foothold in Japan requires building out sales networks, service infrastructure, and understanding local regulatory landscapes, all of which are resource-intensive endeavors.

The company's success in these nascent markets hinges on its ability to gain market share against established competitors. In 2024, the semiconductor industry in Japan, a key target for Axcelis, continued its robust growth, with significant investments in advanced manufacturing. Axcelis' strategy in these regions will likely involve aggressive marketing and product localization to carve out its space.

Axcelis' engagement in early-stage advanced packaging solutions presents a classic question mark scenario within the BCG matrix. While the advanced packaging market is poised for substantial growth, with projections indicating significant expansion fueled by AI and data center demands, Axcelis' current penetration in this niche might be nascent.

The advanced packaging market is expected to reach approximately $100 billion by 2028, a compound annual growth rate of over 10%. This rapid evolution, however, requires substantial R&D and market development investment for Axcelis to establish a strong foothold and capture a meaningful share of this lucrative segment.

High-Energy Implanters for Sub-5nm Nodes

The market for high-energy implanters targeting sub-5nm semiconductor nodes presents a significant opportunity, but also considerable challenges for Axcelis. This segment is characterized by rapid technological advancement driven by the relentless pursuit of smaller, more powerful chips. For instance, in 2024, the demand for advanced logic and memory chips requiring these sophisticated processes continued to grow, pushing the boundaries of semiconductor fabrication.

Axcelis's position in this high-growth, high-risk area is akin to a question mark within the BCG matrix. While the potential for market share capture is substantial due to the ongoing miniaturization trend in electronics, the substantial investment required in research and development to maintain a competitive edge is a critical factor. Companies in this space must continuously innovate to meet the exacting demands of sub-5nm manufacturing.

- High Growth Potential: The sub-5nm node segment is expected to see robust growth as chip manufacturers push for greater performance and efficiency.

- Technological Intensity: Developing and manufacturing high-energy implanters for these advanced nodes requires cutting-edge technology and significant R&D expenditure.

- Competitive Landscape: The market is highly competitive, with established players and new entrants vying for dominance, necessitating substantial investment to secure market share.

- Strategic Investment: Axcelis must strategically invest in R&D and manufacturing capabilities to capitalize on the growth opportunities in this demanding segment.

Products Targeting Advanced Memory Recovery (beyond 2025)

Products specifically targeting the anticipated recovery in the advanced memory market, such as DRAM and NAND, by 2026 are currently categorized as question marks within Axcelis' BCG Matrix.

While the memory market is projected to experience a rebound, driven by the increasing demand from AI and cloud computing technologies, Axcelis' current market share and product portfolio in this segment may necessitate significant investment and strategic adjustments to effectively capitalize on future growth opportunities.

For instance, the global semiconductor market, which includes memory chips, saw a notable increase in capital expenditures in 2024, with companies investing heavily in advanced manufacturing capabilities. Axcelis' success in the question mark category will depend on its ability to secure a strong position in this evolving landscape.

- Anticipated Memory Market Recovery: Projections indicate a strong rebound in DRAM and NAND markets by 2026.

- Growth Drivers: AI and cloud computing are key catalysts for this expected memory market expansion.

- Axcelis' Position: Products targeting this segment are considered question marks, requiring strategic evaluation.

- Investment Needs: Substantial investment and strategic positioning are crucial for capturing future growth.

Question marks in Axcelis' portfolio represent new or emerging technologies and markets with high growth potential but currently low market share. These ventures require significant investment to develop and gain traction, making their future success uncertain.

For example, Axcelis' focus on ion implanters for advanced materials or specialized medical devices falls into this category, as these niche applications are still developing their market presence.

The company's expansion into new geographical markets, such as Japan, also exemplifies a question mark, demanding substantial upfront investment in infrastructure and market penetration strategies to compete effectively.

Success in these question mark areas hinges on Axcelis' ability to execute its strategy, overcome market entry challenges, and secure a competitive position in rapidly evolving sectors.

| Category | Description | Growth Potential | Market Share | Investment Required |

|---|---|---|---|---|

| Emerging Technologies | New ion implanter applications (e.g., advanced materials, medical devices) | High | Low | High |

| Geographic Expansion | Entry into new markets (e.g., Japan) | High | Low | High |

| Advanced Packaging | Solutions for next-generation chip packaging | High | Nascent | High |

| Sub-5nm Nodes | High-energy implanters for leading-edge semiconductor manufacturing | High | Moderate | Very High |

| Memory Market Recovery | Products targeting anticipated DRAM/NAND rebound | High | Low to Moderate | Moderate to High |

BCG Matrix Data Sources

Our Axcelis BCG Matrix is constructed using comprehensive market data, including financial reports, industry growth rates, and competitive analysis to provide strategic clarity.