Axcelis Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Axcelis Bundle

Unlock the strategic core of Axcelis's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Perfect for anyone seeking to understand or replicate their winning formula.

Partnerships

Axcelis Technologies cultivates strategic alliances with major global semiconductor manufacturers, fostering deep collaborative relationships. These partnerships are crucial for joint development and optimization of ion implantation processes, directly addressing the dynamic technological needs of high-performance chip production.

In 2024, Axcelis continued to strengthen these vital ties, with a significant portion of its revenue generated through these ongoing collaborations. For instance, the company reported robust demand from key partners, contributing to its strong financial performance and underscoring the value of these strategic alliances in driving innovation and market share.

Axcelis Technologies depends on a robust network of suppliers for critical components and specialized materials essential for building its advanced ion implantation systems. These partnerships are foundational to maintaining manufacturing efficiency and the high quality of its products.

In 2024, securing a stable and reliable supply chain remained a top priority. Axcelis's ability to deliver its cutting-edge Purion product line, which saw significant customer adoption throughout the year, directly correlates with the performance and responsiveness of its supplier base.

Axcelis actively partners with leading universities and research centers, fostering innovation in ion implantation. These collaborations are crucial for developing cutting-edge technologies, such as advanced beam control and novel implant processes, that will define the future of semiconductor manufacturing.

In 2024, Axcelis continued its commitment to R&D collaboration, investing significantly in projects aimed at enhancing the performance and efficiency of its ion implanters. These partnerships are vital for staying ahead in the rapidly evolving semiconductor industry, ensuring the company's solutions meet the increasingly demanding requirements of chipmakers.

Aftermarket Service and Parts Providers

Axcelis collaborates with third-party suppliers for various parts and consumables that are not covered by their patents. This strategic alliance is crucial for their Customer Solutions and Innovation (CS&I) segment, ensuring customers receive complete life cycle support for their installed equipment.

These partnerships are vital for maintaining Axcelis’s extensive installed base, offering readily available parts and consumables that complement their proprietary offerings. This approach enhances customer satisfaction and strengthens the company's recurring revenue streams through service agreements and part sales.

- Partnerships for Non-Proprietary Parts: Axcelis engages third-party suppliers for components not protected by patents, ensuring a broad availability of parts for their installed base.

- Life Cycle Support: These collaborations enable comprehensive service and parts provision throughout the equipment's operational life, enhancing customer value.

- Recurring Revenue Generation: By offering a complete support ecosystem, Axcelis solidifies recurring revenue through service contracts and the sale of these partnered parts.

- Market Competitiveness: Access to a wider range of parts through these partnerships helps maintain the competitiveness and operational efficiency of Axcelis's installed systems.

Industry Associations and Forums

Axcelis leverages its involvement in industry associations and forums, such as SEMICON China and SEMICON Korea, to foster crucial connections. These platforms are vital for gaining up-to-date market intelligence and participating in technology exchanges. In 2023, Axcelis reported a significant increase in its order backlog, reflecting strong demand within the semiconductor industry, underscoring the value of these networking opportunities.

These partnerships enable Axcelis to stay ahead of technological trends and understand evolving customer needs. By sponsoring and actively participating in events, the company strengthens its brand visibility and builds relationships with key players across the semiconductor supply chain. This strategic engagement is instrumental in driving innovation and securing future business opportunities.

- Market Insights: Direct access to industry trends and competitive analysis through association reports and discussions.

- Technology Exchange: Collaboration opportunities and early awareness of emerging semiconductor manufacturing technologies.

- Networking: Building relationships with potential customers, suppliers, and technology partners within the global semiconductor ecosystem.

- Brand Visibility: Increased recognition and credibility through sponsorship and active participation in leading industry events.

Axcelis's key partnerships extend to equipment manufacturers and service providers, crucial for integrating their ion implanters into broader manufacturing workflows and ensuring seamless customer operations. These collaborations are vital for offering comprehensive solutions and maintaining high levels of customer support. In 2024, the company continued to expand its network of integration partners, recognizing the increasing complexity of semiconductor fabrication environments and the need for end-to-end solutions.

The company also partners with technology providers for complementary equipment and software, enhancing the overall value proposition of its ion implantation systems. These alliances allow Axcelis to offer more integrated and efficient solutions to its customers, addressing the evolving demands of advanced chip manufacturing. For example, partnerships in metrology and process control software are critical for optimizing yield and performance in modern fabs.

Axcelis actively collaborates with original equipment manufacturers (OEMs) and system integrators to ensure their ion implanters work seamlessly within diverse semiconductor manufacturing lines. These relationships are essential for providing customers with complete, optimized solutions, rather than standalone equipment. In 2024, Axcelis saw increased demand for integrated solutions, highlighting the importance of these OEM partnerships in securing larger deals and expanding market reach.

These partnerships are fundamental to Axcelis's ability to provide comprehensive, integrated solutions that meet the sophisticated needs of advanced semiconductor manufacturing. By working closely with complementary technology providers and system integrators, Axcelis enhances its offering and strengthens its position in the market. The company's commitment to fostering these relationships is a key driver of its growth and innovation.

| Partnership Type | Objective | 2024 Impact/Focus |

|---|---|---|

| Global Semiconductor Manufacturers | Joint development, process optimization, high-volume production | Significant revenue driver, continued strong demand, innovation acceleration |

| Suppliers (Critical Components & Materials) | Ensuring manufacturing efficiency, product quality, supply chain stability | Securing stable supply for Purion line, meeting increased customer orders |

| Universities & Research Centers | Developing cutting-edge technologies, R&D collaboration | Investing in advanced beam control, novel implant processes |

| Third-Party Suppliers (Non-Proprietary Parts) | Life cycle support, Customer Solutions & Innovation (CS&I) segment | Enhancing installed base support, strengthening recurring revenue |

| Industry Associations & Forums | Market intelligence, technology exchange, networking | Strengthening brand visibility, building key relationships, understanding market trends |

| Equipment Manufacturers & System Integrators | Seamless integration into manufacturing workflows, comprehensive solutions | Meeting demand for integrated solutions, expanding market reach |

| Technology Providers (Complementary Equipment & Software) | Enhancing value proposition, integrated and efficient solutions | Optimizing yield and performance through metrology and process control partnerships |

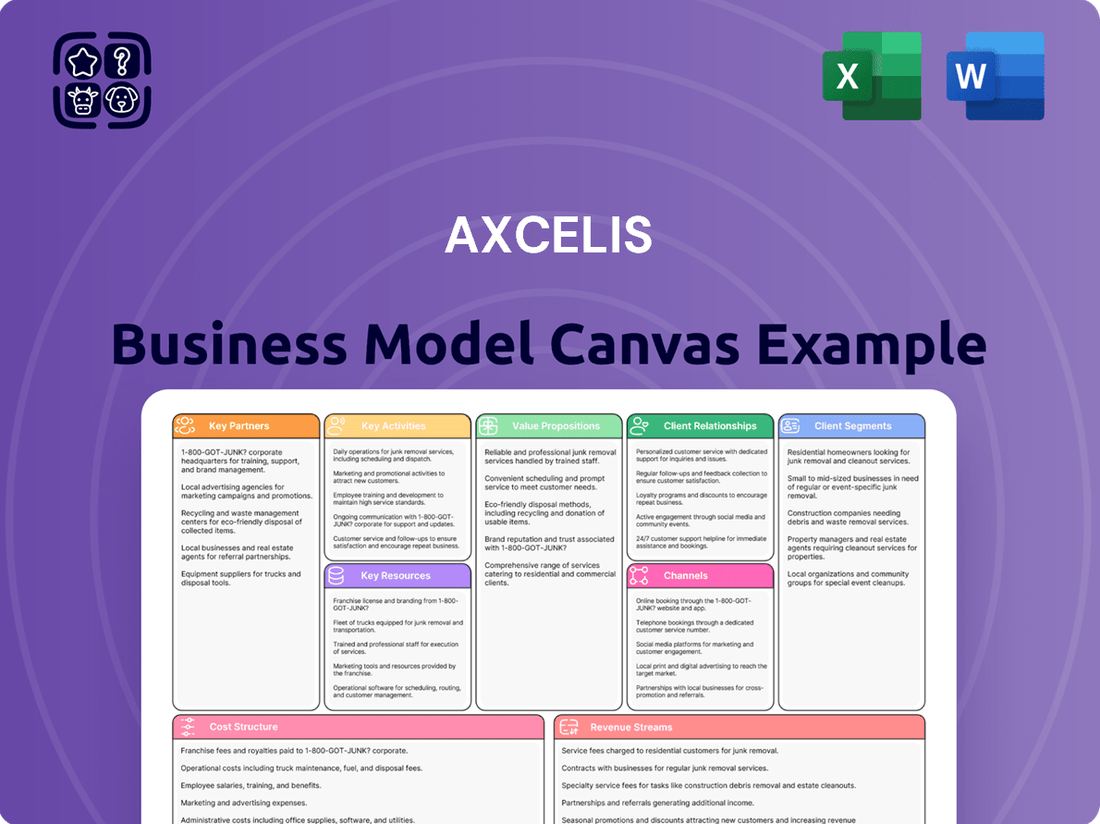

What is included in the product

A detailed breakdown of Axcelis's business model, covering its core value propositions, customer relationships, and key resources within the 9 classic Business Model Canvas blocks.

This model highlights Axcelis's focus on ion implantation technology for the semiconductor industry, outlining its revenue streams and cost structure.

Axcelis' Business Model Canvas acts as a pain point reliever by condensing complex strategic elements into a single, easily digestible page, allowing for rapid understanding and identification of areas needing improvement.

It provides a clear, visual representation of Axcelis' operations, enabling teams to quickly pinpoint inefficiencies and collaboratively develop solutions, thereby alleviating the pain of scattered or unclear business strategy.

Activities

Axcelis Technologies' core activity centers on the intricate design and engineering of ion implantation systems, exemplified by their cutting-edge Purion product line. This involves constant innovation to boost precision, purity, and overall productivity for semiconductor manufacturers.

The company's engineering efforts directly address the evolving needs of advanced chipmaking, ensuring their equipment can handle the increasingly complex doping processes required for next-generation semiconductors. This focus on technological advancement is crucial for maintaining a competitive edge in the dynamic semiconductor industry.

Axcelis' core activity involves the meticulous manufacturing and assembly of its sophisticated ion implanter equipment. This process takes place in key global locations, including their facilities in Beverly, Massachusetts, and in South Korea. These sites are crucial for the final assembly and rigorous testing of their high-tech systems, ensuring they meet stringent performance standards before reaching customers.

Maintaining a responsive and agile global manufacturing and assembly network is paramount for Axcelis. This strategic footprint allows them to efficiently address the dynamic demands of their worldwide customer base, ensuring timely delivery and support for their advanced semiconductor manufacturing solutions. As of the first quarter of 2024, Axcelis reported a significant increase in their backlog, underscoring the importance of this efficient production capability.

Axcelis dedicates substantial resources to research and development, focusing on enhancing current systems and launching novel products. This commitment ensures they stay ahead in the rapidly evolving semiconductor industry.

In 2023, Axcelis reported R&D expenses of $156.8 million, a notable increase from $134.6 million in 2022, underscoring their strategic focus on innovation to meet future technological demands and maintain market leadership.

Global Sales and Marketing

Axcelis actively pursues global sales and marketing, directly engaging with major semiconductor manufacturers worldwide to promote its advanced ion implantation solutions. This involves a multi-faceted approach, including direct sales teams, strategic participation in key industry conferences, and digital marketing to highlight their technological leadership and product benefits.

The company's efforts are geared towards solidifying its presence in critical semiconductor manufacturing hubs across North America, Europe, and Asia. In 2024, Axcelis reported strong revenue growth, underscoring the effectiveness of its global outreach and the increasing demand for its specialized equipment.

- Global Reach: Axcelis serves leading semiconductor manufacturers across diverse geographical regions.

- Direct Engagement: The company utilizes direct sales forces to build relationships and understand customer needs.

- Industry Presence: Participation in major semiconductor trade shows and events is a key marketing activity.

- Technological Showcase: Marketing efforts emphasize Axcelis's technological innovations and competitive advantages.

Customer Support and Aftermarket Services (CS&I)

Axcelis Technologies' Customer Support and Aftermarket Services (CS&I) are crucial for maintaining equipment uptime and optimizing performance throughout its lifecycle. This includes offering essential services like maintenance, proactive upgrades, and the timely provision of spare parts. These activities not only ensure customer satisfaction but also build enduring relationships, which are a significant driver of Axcelis's recurring revenue streams.

The CS&I segment is designed to maximize the operational efficiency of Axcelis's ion implant and related systems. By focusing on comprehensive life cycle support, the company solidifies its position as a reliable partner for its customers in the semiconductor manufacturing industry. For instance, in 2023, Axcelis reported that its service segment generated over $500 million in revenue, highlighting the substantial contribution of these activities to the company's overall financial health.

- Life Cycle Support: Providing ongoing maintenance, repairs, and technical assistance to ensure equipment longevity.

- Upgrades and Enhancements: Offering system upgrades to improve performance, introduce new capabilities, and extend product relevance.

- Spare Parts Management: Ensuring availability of critical spare parts to minimize downtime and maintain operational continuity for customers.

- Revenue Generation: CS&I activities contribute significantly to Axcelis's revenue, with the service segment representing a substantial portion of total sales, demonstrating the value placed on ongoing customer support.

Axcelis's key activities encompass the intricate design and engineering of ion implantation systems, exemplified by their advanced Purion product line. This involves continuous innovation to enhance precision, purity, and productivity for semiconductor manufacturers, directly addressing the complex doping requirements of next-generation chips. The company also focuses on the meticulous manufacturing and assembly of these sophisticated systems at global sites, including Beverly, Massachusetts, and South Korea, ensuring timely delivery and robust performance. Furthermore, Axcelis dedicates significant resources to research and development, investing $156.8 million in 2023 to drive technological advancements and maintain market leadership.

Global sales and marketing efforts are central to Axcelis's strategy, directly engaging with leading semiconductor manufacturers worldwide. This outreach, supported by a strong presence at industry events and digital marketing, aims to showcase their technological innovations and competitive advantages in key manufacturing hubs. Complementing these efforts, Axcelis provides comprehensive customer support and aftermarket services, including maintenance, upgrades, and spare parts management. This life cycle support is vital for equipment uptime and customer satisfaction, with the service segment generating over $500 million in revenue in 2023.

| Key Activity | Description | Financial Impact/Data Point |

| Design & Engineering | Developing cutting-edge ion implantation systems like the Purion line. | Focus on precision, purity, and productivity for advanced chipmaking. |

| Manufacturing & Assembly | Producing and assembling ion implanters at global facilities. | Ensures timely delivery and adherence to stringent performance standards. Q1 2024 backlog increase highlights production importance. |

| Research & Development | Investing in system enhancements and new product launches. | R&D expenses were $156.8 million in 2023, up from $134.6 million in 2022. |

| Sales & Marketing | Direct engagement with global semiconductor manufacturers. | Strong revenue growth in 2024 reflects effective global outreach and demand. |

| Customer Support & Aftermarket Services (CS&I) | Providing maintenance, upgrades, and spare parts. | Service segment revenue exceeded $500 million in 2023, crucial for recurring revenue. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This means you can be confident that the structure, content, and formatting are precisely what you'll be working with. Upon completing your order, you'll gain full access to this comprehensive, ready-to-use Business Model Canvas, allowing you to immediately begin strategizing and refining your business.

Resources

Axcelis's core competitive edge is its proprietary ion implantation technology, notably its Purion platform. This includes specialized series like the Purion Power and Purion XE, which are protected by numerous patents.

These patented innovations are crucial for semiconductor manufacturing, enabling higher performance and efficiency. For instance, the Purion XE system is designed for advanced silicon carbide (SiC) device fabrication, a rapidly growing market segment.

In 2023, Axcelis reported that its Purion family of products accounted for a significant portion of its revenue, underscoring the commercial success and market demand for its patented technologies.

Axcelis's success hinges on its highly specialized engineering and R&D talent. This team of scientists and engineers is essential for creating and refining the sophisticated ion implantation systems that the company offers.

Their deep expertise fuels innovation, allowing Axcelis to tackle complex technical challenges and develop cutting-edge solutions for advanced semiconductor manufacturing needs. This talent pool directly translates into competitive advantage and the ability to meet evolving market demands.

Axcelis operates ISO-certified manufacturing facilities strategically located in the U.S. and Asia. This global manufacturing presence is crucial for producing its advanced ion implantation systems efficiently.

Complementing its production sites, Axcelis maintains a network of logistics centers. These centers are vital for managing the complex supply chain and ensuring the timely delivery of equipment and spare parts to its international customer base.

In 2023, Axcelis reported total revenue of $1.15 billion, underscoring the scale of its global operations and the demand for its specialized manufacturing capabilities.

Strong Financial Position and Capital

Axcelis boasts a powerful financial foundation, characterized by a substantial cash reserve and a complete absence of debt. This healthy balance sheet, as of the first quarter of 2024, showed approximately $229 million in cash and cash equivalents, allowing the company significant flexibility. This financial strength is crucial for funding innovation through research and development, pursuing strategic growth opportunities, and returning value to shareholders via share buybacks.

This robust financial position acts as a critical buffer against economic downturns and market volatility, ensuring the company can maintain its investment in long-term growth strategies. For instance, in 2023, Axcelis generated $1.1 billion in revenue, demonstrating its operational success and capacity to build strong financial reserves.

- Zero Debt: Axcelis operates with no outstanding long-term debt, providing significant financial flexibility and reducing risk.

- Strong Cash Position: As of Q1 2024, the company held approximately $229 million in cash and cash equivalents, enabling strategic investments and shareholder returns.

- Investment Capacity: The company's financial stability supports continued investment in research and development to drive technological advancements.

- Resilience and Growth: A strong balance sheet allows Axcelis to navigate market fluctuations effectively and pursue its long-term growth objectives.

Established Global Customer Base and Relationships

Axcelis leverages its established global customer base, which includes major semiconductor manufacturers worldwide. This long-standing presence fosters deep relationships, ensuring a consistent stream of recurring business and valuable feedback for innovation.

These strong customer ties are a significant competitive advantage. For instance, in 2023, Axcelis reported that its top customers represented a substantial portion of its revenue, highlighting the importance of these enduring partnerships.

- Long-standing relationships with leading semiconductor manufacturers globally.

- Recurring revenue generated from established customer loyalty.

- Valuable insights from customers drive future product development and enhancements.

- Geographic diversification of the customer base mitigates regional market risks.

Axcelis's key resources include its proprietary ion implantation technology, particularly the Purion platform, which is protected by numerous patents. This technological leadership is further bolstered by a highly skilled team of engineers and scientists dedicated to research and development. The company's operational backbone consists of ISO-certified manufacturing facilities in the U.S. and Asia, supported by a robust global logistics network to ensure efficient product delivery.

Financially, Axcelis stands out with a debt-free balance sheet and a substantial cash reserve, providing significant flexibility for investments and growth. As of Q1 2024, this included approximately $229 million in cash and cash equivalents. This strong financial footing, combined with deep, long-standing relationships with major semiconductor manufacturers, forms the cornerstone of Axcelis's competitive advantage and market position.

Value Propositions

Axcelis Technologies is a key enabler for the semiconductor industry, supplying vital ion implantation equipment that allows manufacturers to create sophisticated integrated circuits. This technology is fundamental for producing advanced memory, logic, and power devices, forming the bedrock of today's electronic devices.

Their Purion® product line, for instance, is designed to deliver high performance and reliability in fabricating cutting-edge semiconductor chips. In 2023, Axcelis reported revenue of $1.1 billion, demonstrating their significant market presence and the demand for their advanced fabrication solutions.

Axcelis stands as a dominant force in ion implantation for Silicon Carbide (SiC), a material pivotal for the booming electric vehicle and data center sectors. Their advanced Purion Power Series is specifically engineered for efficient SiC wafer processing.

In 2024, the demand for SiC devices continued its upward trajectory, driven by the electrification of transportation and the expansion of 5G infrastructure. Axcelis's leadership in this niche segment positions them to capitalize on this growth, as their technology enables the production of higher-performing SiC components.

The Purion family of products from Axcelis delivers unparalleled process control and implant purity, crucial for boosting semiconductor device performance and manufacturing yield. This superior quality directly translates into significant cost savings for their clients.

In 2024, Axcelis reported strong demand for its advanced ion implantation solutions, with customers increasingly prioritizing equipment that enhances productivity and reduces operational expenses. The Purion line is central to meeting these demands.

By enabling higher purity and more precise control over the ion implantation process, Axcelis's Purion systems help manufacturers achieve better device characteristics and fewer defects, ultimately improving their overall profitability and competitive edge.

Comprehensive Life Cycle Support and Service

Axcelis’s Customer Service and Support (CS&I) segment goes far beyond simply selling ion implanters. It offers comprehensive support throughout the entire lifecycle of the equipment. This commitment ensures customers achieve maximum operational excellence and uptime for their critical manufacturing processes.

This robust support structure is vital for maintaining the performance of Axcelis systems in demanding semiconductor fabrication environments. For instance, in 2023, Axcelis reported that its CS&I segment revenue reached $294.4 million, representing a significant portion of its overall business and highlighting the importance customers place on ongoing service and support.

- Extended Equipment Uptime: Proactive maintenance and rapid response minimize downtime, directly impacting customer production yields.

- Valuable Upgrades and Services: Axcelis provides ongoing technology enhancements and specialized services to keep customer equipment competitive.

- Long-Term Partnership: This lifecycle support fosters strong customer relationships and ensures continued satisfaction with Axcelis solutions.

Solutions for Diverse Semiconductor Applications

Axcelis Technologies offers a comprehensive suite of ion implanters designed to meet the diverse needs of the semiconductor industry. Their product line encompasses high-energy, high-current, and medium-current systems, providing flexibility for various manufacturing processes.

This broad portfolio allows Axcelis to effectively serve a wide spectrum of semiconductor applications. Whether it's mature node production or the cutting-edge demands of advanced logic and power devices, their solutions are engineered for optimal performance and yield.

- Versatile Ion Implanter Portfolio: Axcelis provides high-energy, high-current, and medium-current systems.

- Broad Application Coverage: Solutions cater to mature nodes through advanced logic and power devices.

- Market Leadership: Axcelis is a key player in the ion implantation market, essential for semiconductor manufacturing.

- Technological Advancement: Their systems enable the production of next-generation chips.

Axcelis's value proposition centers on delivering highly reliable and performant ion implantation equipment, crucial for advanced semiconductor fabrication. Their Purion product line, particularly for Silicon Carbide (SiC), directly addresses the growing demand in electric vehicles and data centers. This technological leadership enables clients to produce higher-quality chips with improved yields and reduced costs.

Beyond equipment sales, Axcelis provides extensive customer service and support, ensuring maximum uptime and operational excellence. This lifecycle support, which generated $294.4 million in revenue in 2023, fosters long-term partnerships and keeps customer operations competitive through upgrades and specialized services.

The company's broad portfolio of ion implanters, spanning high-energy to medium-current systems, caters to diverse semiconductor applications from mature nodes to cutting-edge logic and power devices. This versatility, combined with their market leadership and commitment to technological advancement, makes Axcelis an indispensable partner for semiconductor manufacturers aiming for next-generation chip production.

Customer Relationships

Axcelis invests in dedicated sales and service teams spread across the globe, fostering direct interaction with their clientele. This approach ensures each customer receives tailored support and prompt attention to their specific technical and operational requirements, a key aspect of their customer relationship strategy.

Axcelis Technologies cultivates deep, long-term relationships with its clients, aiming to be more than just a supplier. They focus on becoming strategic partners by understanding each customer's unique development path and offering ongoing support and cutting-edge solutions.

This partnership model is evident in their commitment to continuous innovation and service. For instance, in 2024, Axcelis reported a significant portion of its revenue derived from repeat business and aftermarket services, underscoring the success of its customer retention strategies and the value placed on these enduring relationships.

Axcelis's Customer Solutions and Innovation (CS&I) segment is key to fostering strong customer relationships by providing essential aftermarket support and upgrades. This includes ongoing service contracts, readily available spare parts, and crucial system upgrades designed to enhance performance and extend the life of their ion implantation equipment.

This continuous engagement is vital for ensuring customers achieve optimized performance and longevity from their installed base. For instance, in 2023, Axcelis reported that its CS&I segment revenue grew by 20% year-over-year, reaching $380.7 million, highlighting the significant value customers place on these services.

Technical Collaboration and Application Development

Axcelis actively engages in technical collaboration with its clients, working hand-in-hand to develop new process applications and tackle unique fabrication challenges. This deep partnership is crucial for pushing the boundaries of semiconductor manufacturing.

This collaborative approach directly translates into tangible benefits for customers. By co-developing solutions, Axcelis helps clients achieve significant improvements in their manufacturing productivity and the overall performance of their semiconductor devices. For instance, in 2024, Axcelis reported that its advanced ion implantation solutions, developed in close partnership with leading foundries, enabled customers to achieve up to a 15% increase in wafer throughput for specific advanced logic nodes.

- Enabling Process Applications: Axcelis works with customers to create and refine processes that utilize its ion implantation technology for novel device architectures.

- Addressing Fabrication Challenges: The company partners with clients to overcome specific manufacturing hurdles, ensuring optimal yield and performance.

- Boosting Productivity: Through joint development, customers can realize enhanced wafer output and more efficient production cycles.

- Improving Device Performance: Technical collaboration leads to fine-tuned processes that result in superior semiconductor device characteristics.

Customer Recognition and Feedback Integration

Axcelis places a high premium on customer satisfaction, a commitment frequently recognized through supplier excellence awards from its clients. For instance, in 2023, the company received multiple such accolades, underscoring its dedication to quality and service.

This focus on customer relationships involves actively soliciting and integrating feedback into their product development cycles and service enhancements. This ensures that Axcelis’ offerings consistently meet and exceed evolving customer expectations, thereby increasing overall value delivered.

- Customer Awards: Axcelis has a history of receiving supplier excellence awards, demonstrating strong customer satisfaction.

- Feedback Integration: Customer input is systematically incorporated into product design and service improvements.

- Value Enhancement: This feedback loop directly contributes to increasing the value proposition for their customer base.

Axcelis cultivates enduring partnerships by offering dedicated global support and technical collaboration, ensuring clients receive tailored solutions. This commitment is reflected in substantial repeat business and aftermarket revenue, demonstrating the value placed on these long-term relationships.

The Customer Solutions and Innovation segment is central to this strategy, providing essential upgrades and services that enhance equipment performance and longevity. In 2023, this segment saw a 20% revenue increase, reaching $380.7 million, highlighting customer reliance on these offerings.

| Aspect | Description | Impact |

|---|---|---|

| Global Sales & Service | Dedicated teams for direct client interaction and tailored support. | Ensures prompt attention to specific technical and operational needs. |

| Strategic Partnerships | Focus on understanding customer development paths and offering ongoing solutions. | Fosters long-term relationships beyond mere supply. |

| Aftermarket Services (CS&I) | Service contracts, spare parts, and system upgrades. | Enhances equipment performance and extends operational life. |

| Technical Collaboration | Joint development for new process applications and fabrication challenges. | Drives innovation and improves customer manufacturing productivity. |

Channels

Axcelis relies heavily on its direct sales force to connect with major semiconductor manufacturers globally. This approach enables them to offer customized solutions and foster robust relationships with crucial decision-makers.

In 2024, Axcelis reported that its direct sales force was instrumental in securing significant deals, contributing to a substantial portion of their revenue growth. This direct engagement allows for a deep understanding of customer needs in the rapidly evolving chip industry.

Axcelis maintains a robust global footprint, with employees stationed in 28 countries, underscoring its commitment to serving diverse markets. This expansive network is strategically anchored by principal locations in critical semiconductor hubs such as China, Japan, Korea, and across Europe.

This widespread geographic presence is crucial for delivering localized support and sales operations, enabling Axcelis to effectively engage with its international customer base. For instance, their presence in key Asian markets directly supports the region's significant semiconductor manufacturing output.

Axcelis leverages industry conferences like SEMICON China and SEMICON Korea to display its latest ion implantation innovations. These events are crucial for direct customer engagement and lead generation, with participation in 2024 expected to yield significant networking opportunities.

Online Presence and Investor Relations Portal

Axcelis Technologies actively manages its online presence through its official website and a dedicated investor relations portal. This digital hub is crucial for disseminating comprehensive information about their advanced semiconductor manufacturing equipment, financial results, and corporate news to a global audience.

These channels are vital for transparency and engagement, offering stakeholders easy access to quarterly earnings reports, investor presentations, and news releases. For instance, in the first quarter of 2024, Axcelis reported a revenue of $244 million, showcasing the tangible results of their operations that are readily available to investors online.

- Official Website: Serves as the primary gateway for product information, company history, and career opportunities.

- Investor Relations Portal: Provides in-depth financial data, SEC filings, and webcast archives.

- Information Dissemination: Key channel for sharing performance metrics, such as the 2023 full-year revenue of $926.5 million, directly with stakeholders.

- Stakeholder Engagement: Facilitates communication and access to crucial updates for investors, analysts, and the broader financial community.

Aftermarket Service and Support Network

Axcelis maintains a comprehensive global aftermarket service and support network. This network is crucial for providing customers with essential spare parts, expert technical assistance, and on-site field service. The aim is to ensure their installed base of ion implanters operates continuously and efficiently, thereby maximizing the return on investment for their clients.

This robust support infrastructure is a key component of Axcelis's business model, contributing significantly to customer satisfaction and long-term partnerships. For instance, in 2024, Axcelis reported that its service and aftermarket segment generated substantial revenue, underscoring the importance of this customer-facing operation. Their commitment to rapid response times and high-quality support helps differentiate them in the competitive semiconductor equipment market.

- Global Reach: Axcelis's service network spans key semiconductor manufacturing regions worldwide, ensuring localized support.

- Comprehensive Offerings: Services include spare parts, technical support, field engineering, and equipment upgrades.

- Customer Value: The focus is on maximizing equipment uptime and performance for their customers.

- Revenue Driver: The aftermarket segment is a significant and growing contributor to Axcelis's overall financial performance.

Axcelis utilizes a multi-faceted channel strategy, blending direct sales with strategic engagement at industry events and a strong online presence. This approach ensures comprehensive customer reach and effective communication of their technological advancements.

Their direct sales force, operating in 28 countries, is pivotal for building relationships with major semiconductor manufacturers, understanding their specific needs, and closing significant deals. This global network, with key presences in Asia and Europe, directly supports the high volume of semiconductor production in these regions.

Industry conferences, such as SEMICON China and SEMICON Korea, serve as crucial platforms for showcasing new products and generating leads. Furthermore, Axcelis maintains a robust digital channel through its official website and investor relations portal, providing easy access to financial reports and company news, exemplified by their Q1 2024 revenue of $244 million.

The aftermarket service and support network is another vital channel, ensuring customer satisfaction and continued equipment performance through spare parts, technical assistance, and field service. This segment is a significant revenue contributor, reflecting the importance of ongoing customer relationships.

| Channel | Description | Key Activities/Focus | 2024 Impact/Data |

|---|---|---|---|

| Direct Sales Force | Global team engaging directly with semiconductor manufacturers. | Customized solutions, relationship building, securing major deals. | Instrumental in revenue growth; deep customer need understanding. |

| Industry Conferences | Participation in key semiconductor trade shows. | Product showcases, lead generation, networking. | Expected significant networking opportunities (e.g., SEMICON China, SEMICON Korea). |

| Online Presence (Website/Investor Relations) | Digital platforms for information dissemination. | Product details, financial results, corporate news, investor data. | Transparency and stakeholder engagement; Q1 2024 revenue reported online. |

| Aftermarket Service & Support | Global network for post-sale customer assistance. | Spare parts, technical support, field service, equipment upgrades. | Significant revenue contributor; focus on equipment uptime and customer satisfaction. |

Customer Segments

Axcelis Technologies primarily serves leading global semiconductor chip manufacturers. These companies are the backbone of the electronics industry, producing the advanced integrated circuits that power everything from smartphones to data centers. For instance, in 2023, the global semiconductor market was valued at approximately $520 billion, with major players heavily investing in cutting-edge fabrication technologies.

These manufacturers are the direct purchasers of Axcelis's ion implantation systems, crucial equipment for creating the precise electrical characteristics of semiconductor devices. Companies like Intel, TSMC, and Samsung are prime examples of the clientele Axcelis caters to, all of whom are engaged in intense competition and rapid innovation within the chipmaking landscape.

Memory device manufacturers, particularly those focused on DRAM and NAND flash memory, represent a crucial customer segment for Axcelis. These companies rely heavily on ion implantation technology to precisely engineer the semiconductor layers essential for high-performance memory chips. The demand from this segment is directly tied to the cyclical nature of the memory market.

The memory market experienced a downturn in 2023, impacting capital expenditures for memory manufacturers. However, analysts projected a strong recovery for 2024, with memory chip revenues expected to grow significantly. This anticipated rebound directly translates to increased demand for advanced fabrication equipment like Axcelis' ion implanters.

Logic device manufacturers building chips for demanding sectors like high-performance computing and AI represent a crucial customer base for Axcelis. These companies require cutting-edge ion implantation technology to achieve the precise doping levels needed for advanced semiconductor designs.

Axcelis is actively growing its presence in this high-value logic segment, evidenced by the development and introduction of products such as the Purion Dragon, specifically engineered for these advanced applications. This strategic focus aims to capture a larger share of the market for next-generation logic devices.

Power Device Manufacturers (SiC and GaN)

Power device manufacturers, especially those focused on Silicon Carbide (SiC) and Gallium Nitride (GaN) technologies, represent a rapidly expanding and vital customer base for Axcelis. These companies are at the forefront of innovation in high-growth sectors like electric vehicles (EVs), renewable energy infrastructure, and advanced data centers. Axcelis's leadership position in providing the necessary ion implantation equipment for these advanced materials is a key strength.

The demand for SiC and GaN devices is soaring, driven by their superior efficiency and performance characteristics compared to traditional silicon. For instance, the global SiC power semiconductor market was projected to reach approximately $7.4 billion in 2024, with significant compound annual growth rates expected in the coming years. This growth directly translates into increased demand for the specialized manufacturing tools that Axcelis offers.

- Key Applications: Electric vehicles, renewable energy systems (solar, wind), and high-performance data centers are primary drivers for SiC and GaN adoption.

- Market Growth: The SiC and GaN markets are experiencing exponential growth, with projections indicating continued robust expansion through 2025 and beyond.

- Axcelis's Role: Axcelis is a critical enabler for these manufacturers, providing essential ion implantation technology required for producing these advanced power semiconductors.

- Strategic Importance: The ability to efficiently manufacture SiC and GaN devices is crucial for achieving energy efficiency and performance goals across multiple industries.

Mature Node and General Mature Application Manufacturers

Axcelis Technologies caters to manufacturers of chips for general applications, particularly those focused on mature process nodes. This segment includes vital industries like automotive and industrial sectors, which rely on these established technologies for their products.

While the automotive and industrial chip market experienced some inventory digestion in 2025, it continues to represent a significant and relevant customer base for Axcelis. These sectors demand reliable and cost-effective semiconductor solutions.

- Automotive Sector Demand: Continued need for chips in vehicle electronics, safety systems, and infotainment, often utilizing mature nodes.

- Industrial Applications: Growth in IoT devices, automation, and power management systems driving demand for robust, mature node semiconductors.

- Market Resilience: Despite short-term inventory adjustments in 2025, the underlying demand drivers for these applications remain strong.

Axcelis's customer base is primarily comprised of leading global semiconductor chip manufacturers, encompassing those who produce memory devices, logic devices, and power devices. These manufacturers are the direct buyers of Axcelis's ion implantation systems, which are critical for semiconductor fabrication. The company also serves manufacturers of chips for general applications, particularly in the automotive and industrial sectors.

| Customer Segment | Key Focus Areas | 2024 Market Relevance/Projections |

|---|---|---|

| Global Semiconductor Chip Manufacturers | Advanced integrated circuits, leading fabrication technologies | Global market valued ~$520 billion in 2023; continued heavy investment in innovation. |

| Memory Device Manufacturers | DRAM, NAND flash memory | Market recovery projected for 2024 after 2023 downturn, driving demand for fabrication equipment. |

| Logic Device Manufacturers | High-performance computing, AI, advanced semiconductor designs | Growing demand for cutting-edge ion implantation technology; Axcelis's Purion Dragon targets this segment. |

| Power Device Manufacturers | Silicon Carbide (SiC), Gallium Nitride (GaN) | SiC market projected to reach ~$7.4 billion in 2024, with significant growth driven by EVs and renewables. |

| General Application Chip Manufacturers | Automotive, industrial sectors, mature process nodes | Continued demand for reliable, cost-effective solutions; resilience despite 2025 inventory adjustments. |

Cost Structure

Research and Development (R&D) is a significant cost driver for Axcelis, reflecting its commitment to innovation in the ion implantation sector. In 2024, the company continued to invest heavily in developing next-generation technologies to meet the evolving demands of semiconductor manufacturers. These R&D expenditures are vital for staying ahead in a highly competitive and fast-paced industry.

Personnel costs are the most significant part of Axcelis's operating expenses. This category encompasses everything related to their employees, like salaries, commissions, bonuses, and the cost of stock-based compensation. They also include the expenses for employee benefits, which are crucial for attracting and retaining talent.

The substantial investment in personnel is a direct result of the specialized skills needed across Axcelis's operations. This includes highly qualified engineers for product design, skilled technicians for manufacturing the complex ion implantation systems, and dedicated professionals for providing essential customer support and service.

For the first quarter of 2024, Axcelis reported total operating expenses of $171.3 million. While the exact breakdown isn't provided, personnel costs are consistently the largest driver within this figure for companies in the semiconductor equipment manufacturing sector, reflecting the high demand for specialized engineering and technical talent.

Manufacturing and production costs are a substantial part of Axcelis's business model. These expenses encompass the raw materials and components needed to build their sophisticated ion implantation systems, along with the overhead associated with running their manufacturing facilities. For instance, in 2023, Axcelis reported cost of revenue at $592.9 million, highlighting the significant investment in bringing their products to market.

Maintaining efficient manufacturing processes is absolutely crucial for Axcelis to achieve and sustain healthy gross margins. By optimizing production, they can better control expenses and ensure profitability. The company's focus on operational excellence directly impacts its ability to compete and invest in future innovation.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses for Axcelis are crucial for its operations, covering everything from direct sales efforts to the back-office functions that keep the company running. These costs are vital for market penetration and maintaining a professional corporate presence.

Efficient management of SG&A is particularly important for Axcelis, given the cyclical nature of the semiconductor equipment industry. For example, in the first quarter of 2024, Axcelis reported SG&A expenses of $41.5 million. This figure highlights the ongoing investment in sales infrastructure and administrative support necessary to navigate market dynamics.

- Sales and Marketing: Costs associated with generating demand and supporting customer relationships.

- General and Administrative: Expenses related to corporate management, finance, legal, and human resources.

- Overhead: Costs not directly tied to production but essential for overall business functioning.

- Impact on Profitability: Effective SG&A control directly influences the company's bottom line, especially when revenue experiences volatility.

Customer Support and Service Delivery Costs

Axcelis incurs significant expenses in its cost structure for customer support and service delivery. These include the costs associated with providing comprehensive technical assistance, on-site field service by skilled engineers, and the logistics of delivering aftermarket parts and upgrades. These investments are crucial for ensuring customer satisfaction and fostering long-term relationships.

These customer-facing costs directly impact the company's ability to maintain its installed base and generate recurring revenue. For instance, in 2024, Axcelis reported that its service and support segment, which encompasses these activities, contributed substantially to its overall revenue, highlighting the importance of these operational expenditures.

- Field Service Personnel: Salaries, training, and travel expenses for engineers who maintain and repair customer equipment globally.

- Aftermarket Parts: Costs of manufacturing or sourcing spare parts, inventory management, and distribution logistics.

- Technical Support Centers: Operating expenses for call centers and remote diagnostic capabilities to assist customers.

- Customer Training Programs: Development and delivery of training for customer personnel on equipment operation and maintenance.

Axcelis's cost structure is heavily influenced by its commitment to innovation and the complex nature of its semiconductor manufacturing equipment. Key cost drivers include substantial investments in Research and Development (R&D) to develop next-generation ion implantation technologies, ensuring they remain competitive. Personnel costs, encompassing salaries, benefits, and stock-based compensation for highly skilled engineers and technicians, represent the largest portion of operating expenses. Manufacturing and production costs, including raw materials, components, and facility overhead, are also significant, directly impacting gross margins.

| Cost Category | Description | 2024 Data (Q1) | 2023 Data (Full Year) |

|---|---|---|---|

| Research & Development | Investment in new technologies and product innovation. | Included in Operating Expenses | N/A |

| Personnel Costs | Salaries, benefits, stock compensation for employees. | Largest component of Operating Expenses | N/A |

| Manufacturing & Production | Raw materials, components, facility overhead. | N/A | Cost of Revenue: $592.9 million |

| Sales, General & Administrative (SG&A) | Sales, marketing, corporate management, legal, HR. | $41.5 million | N/A |

| Customer Support & Service | Field service, parts, technical support, training. | Substantial revenue contributor | N/A |

Revenue Streams

Axcelis' main way of making money is by selling its high-tech ion implantation machines, especially the Purion line. These are crucial for making the tiny chips that power all sorts of electronics.

In 2023, Axcelis reported total revenue of $1.19 billion, with equipment sales being the largest contributor. The demand for these systems is driven by the ongoing need for advanced semiconductors across various industries.

The Purion family of systems is designed for high-volume manufacturing, enabling chipmakers to produce more powerful and efficient devices. This equipment is a significant capital expenditure for semiconductor foundries globally.

Axcelis Technologies' Customer Solutions and Innovation (CS&I) segment is a crucial driver of high-margin revenue. This segment encompasses aftermarket parts, service contracts, and system upgrades, forming a stable, recurring income base.

In 2024, CS&I services represented a significant portion of Axcelis's financial performance. For instance, the company reported substantial growth in its service revenue, often exceeding 20% year-over-year in recent periods, highlighting the increasing reliance on this high-margin business.

Revenue from selling equipment to manufacturers of power devices, particularly those working with Silicon Carbide (SiC), is a major income source for Axcelis. This market segment has experienced significant expansion lately.

In 2023, Axcelis reported that its Power Device segment accounted for a significant portion of its total revenue, driven by strong demand for its ion implantation systems used in SiC device fabrication.

Memory and Logic Device Segment Sales

Axcelis Technologies earns significant revenue from selling its ion implantation equipment to manufacturers producing memory and logic integrated circuits. This segment is crucial as it addresses core applications for their advanced technology.

While the semiconductor industry, particularly memory and logic device manufacturing, can experience cyclical fluctuations, these sectors remain foundational for Axcelis's business. The demand for sophisticated ion implantation is directly tied to the production volumes and technological advancements within these critical areas of chipmaking.

For instance, in the first quarter of 2024, Axcelis reported that its revenue from the memory segment was approximately 45% of its total revenue, highlighting its importance. The logic segment contributed another 30% during the same period. This demonstrates a strong reliance on these two key areas for overall financial performance.

- Memory Device Sales: A substantial portion of Axcelis revenue stems from supplying equipment for memory chip production, a sector known for its significant capital expenditure cycles.

- Logic Device Sales: Revenue is also generated from sales to manufacturers of logic integrated circuits, which are essential components in a wide array of electronic devices.

- Cyclical Nature: Both memory and logic segments are recognized for their cyclicality, influenced by global demand for semiconductors and inventory levels.

- Core Technology Application: These segments represent the primary markets where Axcelis's ion implantation technology is applied, underpinning its strategic focus.

International Sales

International sales are a cornerstone of Axcelis's business, with a significant portion of its total revenue originating from markets outside the United States. Asia, in particular, represents a key region for these sales.

This global footprint is crucial for revenue diversification, spreading risk across different economic cycles and customer bases. However, it also means that Axcelis's performance can be influenced by international economic conditions and geopolitical events.

- Asia Dominance: A substantial majority of Axcelis's international revenue is derived from Asian countries, reflecting the concentration of semiconductor manufacturing in that region.

- Revenue Diversification: The reliance on international markets helps to buffer against downturns in any single domestic market.

- Geopolitical Sensitivity: Fluctuations in global trade policies, tariffs, and political stability in key international markets can impact sales and profitability.

- 2024 Outlook: Analysts anticipate continued strong demand from Asian semiconductor manufacturers in 2024, bolstering Axcelis's international sales projections.

Axcelis Technologies generates revenue through the sale of its advanced ion implantation equipment, crucial for semiconductor manufacturing. Beyond new equipment, a significant and growing stream comes from its Customer Solutions and Innovation (CS&I) segment, which includes aftermarket parts, service, and upgrades, providing a stable, high-margin recurring revenue base.

The company's equipment sales are segmented by the type of semiconductor device being produced. In 2023, revenue from power devices, particularly those utilizing Silicon Carbide (SiC), saw substantial growth, driven by increasing demand for electric vehicles and renewable energy solutions. Memory and logic device segments also remain foundational, though subject to industry cycles.

International markets, especially in Asia, are vital for Axcelis's revenue, with a substantial portion of sales originating from this region. This global presence diversifies revenue but also exposes the company to international economic and geopolitical factors.

| Revenue Segment | 2023 Revenue (Approx.) | Key Drivers | 2024 Outlook (General) |

|---|---|---|---|

| Equipment Sales (Total) | ~$1.19 Billion (2023) | Demand for advanced chips, new fab construction | Continued strong demand |

| Power Devices (SiC) | Significant portion of 2023 revenue | EVs, renewable energy | Robust growth expected |

| Memory Devices | ~45% of Q1 2024 revenue | Consumer electronics, data centers | Cyclical, but foundational |

| Logic Devices | ~30% of Q1 2024 revenue | AI, computing, mobile | Cyclical, but foundational |

| Customer Solutions & Innovation (CS&I) | High-margin, recurring | Service contracts, parts, upgrades | Strong growth, exceeding 20% YoY in recent periods |

Business Model Canvas Data Sources

The Axcelis Business Model Canvas is informed by a blend of internal financial data, market research reports, and competitive intelligence. These sources provide a comprehensive view of our operational landscape and strategic positioning.