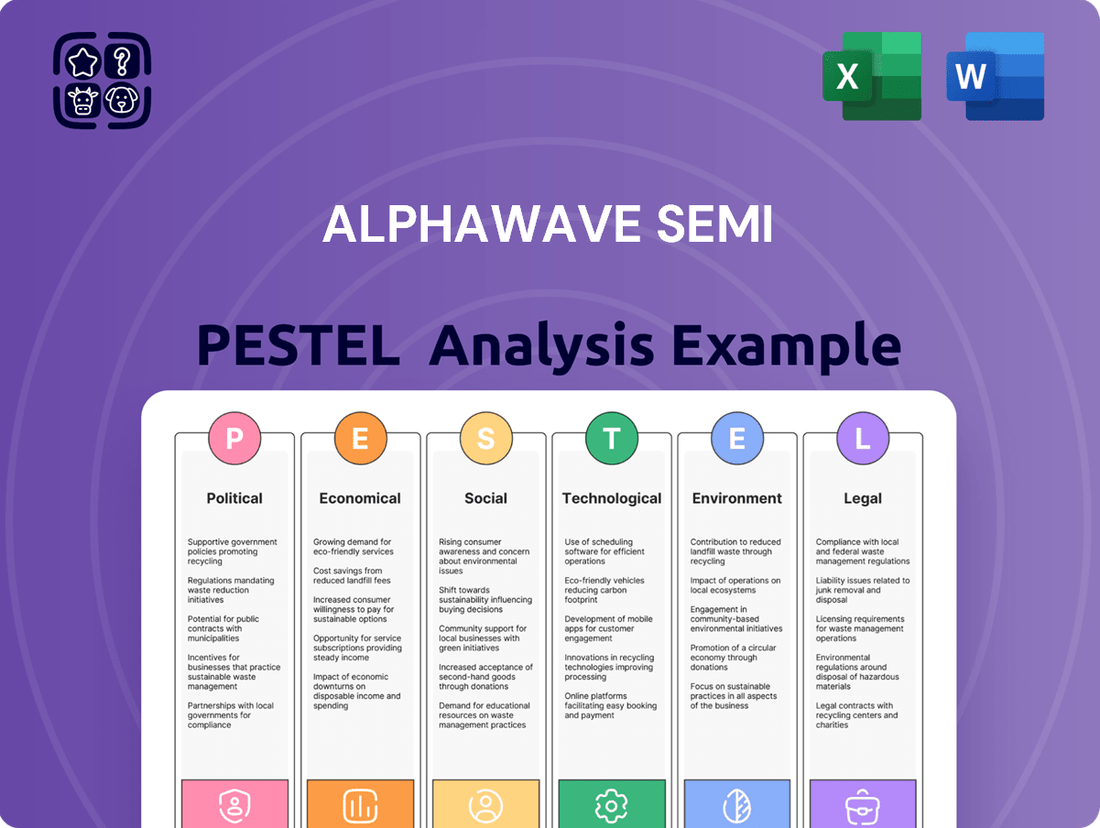

ALPHAWAVE SEMI PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALPHAWAVE SEMI Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping ALPHAWAVE SEMI's trajectory. Our expertly crafted PESTLE analysis provides actionable intelligence to navigate this dynamic landscape. Gain a competitive edge and make informed strategic decisions by downloading the full, in-depth report today.

Political factors

Alphawave Semi navigates a global semiconductor landscape fraught with geopolitical tensions, especially the ongoing trade friction between the United States and China. These international relations directly shape market access and operational stability for companies like Alphawave.

The volatile nature of tariff policies and export restrictions creates significant headwinds for the semiconductor supply chain. This uncertainty is so pronounced that Alphawave Semi explicitly stated its inability to provide financial guidance for 2025, a clear indicator of how these geopolitical factors disrupt long-term planning and forecasting.

Governments globally are actively bolstering their domestic semiconductor sectors, with initiatives like the US CHIPS and Science Act of 2022 playing a significant role. This act alone provides over $52 billion in funding for domestic semiconductor manufacturing and research, aiming to onshore production and foster innovation. Such substantial government backing creates a fertile ground for companies like Alphawave Semi, offering avenues for research and development grants, manufacturing cost reductions through incentives, and the potential for valuable strategic alliances that can accelerate local production capabilities and technological advancements.

Changes in international trade policies, such as tariffs or export controls, can directly impact Alphawave Semi's global supply chain and market access. For instance, the US-China trade tensions have prompted many tech companies, including those in semiconductors, to re-evaluate their manufacturing and sourcing strategies.

The formation of new trade agreements or economic blocs, like potential shifts in the European Union's digital trade policies or new regional pacts, could create both opportunities and challenges for Alphawave Semi's distribution networks and customer base. These evolving trade landscapes necessitate adaptability in how the company operates across different jurisdictions.

Alphawave Semi's strategic decision to diversify its operations beyond China, with facilities and R&D centers in countries like Canada and the UK, is a direct acknowledgment of these shifting international trade dynamics. This geographical diversification helps mitigate risks associated with protectionist policies and ensures greater resilience in its global business model, as seen in the semiconductor industry's increasing focus on supply chain security.

Cybersecurity and National Security Concerns

Governments worldwide are increasingly prioritizing cybersecurity and national security, especially concerning critical infrastructure like telecommunications. This trend directly impacts the semiconductor industry, where Alphawave Semi operates. The potential for stricter regulations on foreign investment and partnerships in this sector is a significant political factor. For instance, the US Committee on Foreign Investment in the United States (CFIUS) has been particularly active in reviewing transactions involving sensitive technologies, a trend likely to continue through 2024 and 2025. Alphawave Semi's emphasis on secure data transfer solutions positions it favorably amidst these heightened concerns, as its technology is designed to meet rigorous security standards. This focus is crucial as nations aim to safeguard their digital backbone against potential threats.

The geopolitical landscape also plays a role. Trade tensions and nationalistic policies can lead to export controls and tariffs on advanced technologies, including semiconductors. This can affect supply chains and market access for companies like Alphawave Semi. For example, ongoing US-China trade relations and the potential for further restrictions on the sale of advanced chip technology to certain countries could influence international business strategies. Alphawave Semi's ability to navigate these complex political dynamics will be key to its sustained growth and market penetration in the coming years.

- Increased Scrutiny: Governments are intensifying reviews of semiconductor deals for national security implications.

- Regulatory Environment: Expect evolving regulations on foreign investment and technology transfer in the chip sector through 2025.

- Geopolitical Risk: Trade disputes and national security concerns can lead to supply chain disruptions and market access limitations.

Political Stability in Key Markets

Political stability in key markets directly impacts Alphawave Semi's operational continuity and market access. For instance, geopolitical tensions in regions like East Asia, where significant semiconductor manufacturing and supply chains are concentrated, could lead to production delays or increased logistics costs. The company's reliance on global markets means that shifts in trade policies or political unrest in countries like the United States or China, major consumers and producers of technology, can significantly affect demand and supply dynamics.

The semiconductor industry, highly sensitive to government incentives and regulations, sees political stability as a bedrock for investment and innovation. Countries offering stable political environments often attract greater foreign direct investment in advanced manufacturing, potentially benefiting Alphawave Semi through expanded partnerships or improved access to cutting-edge technology. Conversely, political instability can deter such investments and create uncertainty around future regulatory frameworks, impacting long-term strategic planning and capital allocation.

Alphawave Semi's performance is inherently linked to the political climate in its operational and customer hubs. For example, the ongoing trade discussions and technological competition between the US and China have led to export controls and restrictions that can influence market access and collaboration opportunities. The company must navigate these evolving political landscapes, which can present both risks and opportunities depending on policy outcomes and the stability of governing bodies.

Key considerations for Alphawave Semi regarding political stability include:

- Geopolitical Risk Assessment: Continuously monitoring political stability in countries like South Korea, Taiwan, and the United States, which are critical for semiconductor supply chains and market demand.

- Trade Policy Impact: Analyzing how potential changes in international trade agreements and tariffs, particularly between major economic blocs, could affect Alphawave Semi's cost of goods sold and market competitiveness.

- Regulatory Environment: Staying abreast of government initiatives related to semiconductor manufacturing, R&D funding, and intellectual property protection, as these can significantly influence the company's strategic direction and investment decisions.

- Supply Chain Resilience: Evaluating the impact of political instability on the security and efficiency of its global supply chain, ensuring contingency plans are in place to mitigate disruptions.

Governments worldwide are increasingly investing in domestic semiconductor capabilities, exemplified by the US CHIPS and Science Act, which allocates over $52 billion. This trend creates opportunities for Alphawave Semi through potential R&D grants and manufacturing incentives. However, escalating US-China trade tensions and associated export controls directly impact global supply chains and market access, leading companies like Alphawave to diversify operations, as seen with their facilities in Canada and the UK, to mitigate geopolitical risks through 2025.

What is included in the product

The ALPHAWAVE SEMI PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting the semiconductor industry, offering actionable insights for strategic decision-making.

ALPHAWAVE SEMI PESTLE Analysis provides a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations and alleviating the pain of sifting through extensive data.

Economic factors

Global economic growth remains a critical factor for Alphawave Semi, as a slowdown directly impacts demand for its high-speed connectivity solutions. In early 2024, projections from institutions like the IMF indicated a moderate but uneven global growth, with risks of recession persisting in several key economies due to persistent inflation and geopolitical tensions.

Recessionary fears can significantly curb capital expenditure from major clients like hyperscalers and data centers, Alphawave Semi's primary customer base. For instance, a downturn could lead to delayed or scaled-back investments in new data center build-outs and upgrades, directly affecting Alphawave Semi's order pipeline and revenue recognition.

The International Monetary Fund's April 2024 World Economic Outlook projected global growth at 3.2% for 2024, a slight increase from 2023, but warned of downside risks. This delicate balance means that any significant contraction in major markets could translate into reduced bookings for Alphawave Semi's advanced semiconductor components.

Rising inflation presents a significant challenge for Alphawave Semi, potentially increasing expenses for everything from silicon wafers to skilled engineering talent. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable increase in early 2024, impacting input costs across the semiconductor supply chain.

Interest rate volatility directly affects Alphawave Semi's cost of capital for crucial research and development projects and expansion plans. Furthermore, higher interest rates can dampen customer appetite for large capital expenditures on new semiconductor-dependent infrastructure, influencing demand for Alphawave's products.

The semiconductor sector has been grappling with persistent supply chain disruptions, directly impacting lead times and component costs. For Alphawave Semi, successfully navigating these complexities, ensuring access to essential materials, and optimizing logistics are critical for meeting production targets and safeguarding profit margins.

Global supply chain issues, exacerbated by geopolitical events and increased demand, led to a significant rise in wafer fabrication costs throughout 2023 and into early 2024. Reports indicated that lead times for certain advanced semiconductor components could extend to over 18 months, a stark contrast to pre-pandemic norms. Alphawave Semi's strategic sourcing and inventory management are therefore paramount to mitigating these inflationary pressures.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for Alphawave Semi, a company with a global footprint. Fluctuations in exchange rates directly affect the value of its international sales and operating expenses when translated back into its reporting currency. For instance, a stronger US dollar (Alphawave Semi's reporting currency) can make its products more expensive for buyers in countries with weaker currencies, potentially dampening demand.

The company's financial performance is therefore susceptible to these movements. For example, if the Euro weakens against the US dollar, revenue generated from sales in Europe will translate into fewer dollars, impacting reported earnings. Conversely, a weaker dollar could boost reported revenues from overseas operations, but might also increase the cost of imported components.

Here are some key impacts of currency volatility:

- Revenue Translation: For the fiscal year 2024, an estimated 60% of Alphawave Semi's revenue is expected to be generated from outside North America, making it particularly vulnerable to currency swings.

- Cost of Goods Sold: If Alphawave Semi sources components from regions with appreciating currencies, its cost of goods sold could rise, squeezing profit margins.

- Competitive Pricing: Significant currency appreciation of the US dollar can make Alphawave Semi's semiconductors less competitive on price in key international markets compared to local or dollar-pegged competitors.

- Hedging Strategies: The company likely employs hedging strategies, such as forward contracts, to mitigate some of this risk, but these also come with costs and limitations.

Investment in AI, Data Centers, and 5G Infrastructure

Alphawave Semi's core business thrives on the significant global investments pouring into AI, data centers, and 5G networks. These sectors are experiencing unprecedented growth, directly fueling demand for the high-speed connectivity solutions and advanced chiplets that Alphawave Semi provides.

Hyperscalers and major technology firms are continuing their substantial capital expenditures to support these burgeoning technologies. This robust spending directly translates into increased orders for Alphawave Semi's products, as they are essential components for enabling faster data transfer and processing capabilities.

For instance, global data center construction spending was projected to reach over $300 billion in 2024, a significant increase driven by AI workloads. Similarly, 5G infrastructure deployment continues to expand, with an estimated 70% of global mobile connections expected to be 5G by 2029, according to recent industry reports. These trends highlight the strong market tailwinds for Alphawave Semi.

- AI Growth: The AI market is expected to grow exponentially, requiring massive data processing power and, consequently, advanced interconnects.

- Data Center Expansion: Increased demand for cloud services and AI training is driving substantial investment in new and upgraded data centers.

- 5G Rollout: The ongoing global deployment of 5G networks necessitates high-performance networking components.

- Hyperscaler Spending: Major cloud providers continue to invest heavily in infrastructure to meet future demand.

Economic factors present a mixed but generally positive outlook for Alphawave Semi, with global growth projections for 2024 hovering around 3.2%. However, persistent inflation and interest rate volatility pose challenges by increasing input costs and the cost of capital for R&D. Currency fluctuations also impact revenue translation and competitive pricing for its global sales.

| Economic Factor | 2024 Projection/Trend | Impact on Alphawave Semi |

|---|---|---|

| Global GDP Growth | IMF projects 3.2% for 2024 | Moderate demand, but uneven growth poses risks |

| Inflation | Persistent, impacting input costs | Increased cost of goods sold, potential margin pressure |

| Interest Rates | Volatile, generally higher | Higher cost of capital, potential dampening of customer CapEx |

| Currency Exchange Rates | Fluctuating (e.g., USD strength) | Affects revenue translation and international competitiveness |

Preview Before You Purchase

ALPHAWAVE SEMI PESTLE Analysis

The preview shown here is the exact ALPHAWAVE SEMI PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE breakdown for ALPHAWAVE SEMI.

The content and structure shown in the preview is the same document you’ll download after payment, offering valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental factors affecting ALPHAWAVE SEMI.

Sociological factors

The semiconductor industry's demand for specialized engineering talent remains exceptionally high. Alphawave Semi's success hinges on its capacity to attract and retain individuals with expertise in areas such as advanced chip design, AI acceleration, and high-speed interface technologies. This competition for talent is global, with companies worldwide vying for the same skilled professionals, impacting recruitment timelines and compensation packages.

Societies are increasingly embracing data-driven lifestyles, with a surge in demand for services like high-definition video streaming, extensive cloud storage, and sophisticated AI applications. This widespread adoption necessitates robust infrastructure capable of handling massive data volumes and speeds. For instance, global internet traffic is projected to reach 207 exabytes per month by 2026, highlighting the escalating need for advanced connectivity solutions.

The ongoing global effort to bridge the digital divide, aiming for universal access to high-speed internet, indirectly supports Alphawave Semi. As nations invest in expanding digital infrastructure, governments are more inclined to support semiconductor companies that enable this connectivity. For instance, by the end of 2024, it's projected that over 70% of the world's population will have internet access, a figure that continues to grow, underscoring the demand for the underlying technologies Alphawave Semi provides.

Ethical Considerations in AI and Data Usage

Societal concerns regarding data privacy and the ethical application of AI are intensifying as AI and data centers proliferate. These issues can indirectly shape Alphawave Semi's customers' product development and the regulatory frameworks they must navigate.

Algorithmic bias, a significant ethical challenge, can lead to unfair outcomes and erode public trust in AI-driven systems. For instance, studies in 2024 highlighted persistent biases in facial recognition technology, impacting minority groups disproportionately. This necessitates careful consideration of data sources and AI model development by Alphawave Semi's clients.

The growing emphasis on data privacy, underscored by regulations like GDPR and CCPA, directly impacts how data is collected, processed, and stored. In 2024, data breaches continued to be a major concern, with significant financial penalties imposed on companies. This drives demand for secure and privacy-preserving connectivity solutions, a core area for Alphawave Semi.

The ethical use of advanced technologies, including AI in areas like autonomous systems and surveillance, is under increasing scrutiny. Public discourse in 2025 is expected to focus on accountability and transparency in AI deployment. This can influence the types of applications and markets that Alphawave Semi's connectivity solutions will serve.

- Data Privacy: Growing public and regulatory pressure on data protection is a key factor influencing technology design.

- Algorithmic Bias: Concerns about fairness and equity in AI systems are driving demand for robust and unbiased data handling.

- Ethical AI Deployment: Societal expectations for responsible innovation impact the adoption and application of AI technologies.

- Consumer Trust: Maintaining public confidence in AI and data usage is crucial for the long-term success of related industries.

Corporate Social Responsibility and ESG Expectations

Societal expectations are increasingly pushing companies to prioritize Environmental, Social, and Governance (ESG) principles. Alphawave Semi's proactive engagement in reducing its carbon emissions, fostering a diverse workforce, and upholding ethical business standards directly addresses these growing demands. This commitment is vital for bolstering its brand image and appealing to both investors and top-tier talent in the competitive semiconductor industry.

The semiconductor sector, in particular, faces scrutiny regarding its environmental impact and supply chain ethics. Alphawave Semi's efforts to align with ESG mandates are not just about compliance but also about building long-term stakeholder trust. For instance, as of early 2024, over 90% of S&P 500 companies now report on ESG metrics, reflecting the widespread integration of these considerations into corporate strategy.

- Societal Pressure: Growing public and investor demand for companies to operate responsibly and sustainably.

- Reputation Enhancement: Strong ESG performance can significantly improve a company's public image and brand loyalty.

- Investor Attraction: A substantial portion of global assets under management are now directed towards ESG-compliant investments, making it a key factor for capital raising.

- Talent Acquisition: Employees, especially younger generations, increasingly prefer to work for organizations that demonstrate a commitment to social and environmental causes.

Societal demand for digital services, from streaming to AI, fuels the need for advanced connectivity solutions. This trend is evident as global internet traffic is set to reach 207 exabytes per month by 2026, directly benefiting companies like Alphawave Semi that provide the underlying technology. Furthermore, the push for digital inclusion, with over 70% of the world's population expected to have internet access by the end of 2024, creates a growing market for the infrastructure Alphawave Semi helps build.

Concerns around data privacy and ethical AI are shaping product development and regulatory landscapes for Alphawave Semi's customers. With data breaches remaining a significant issue in 2024, leading to substantial penalties, there's an increased demand for secure connectivity solutions. Public discourse in 2025 is expected to intensify scrutiny on the ethical deployment of AI, influencing market adoption of advanced technologies.

Societal expectations for Environmental, Social, and Governance (ESG) principles are high, with over 90% of S&P 500 companies reporting on ESG metrics by early 2024. Alphawave Semi’s commitment to ESG, including carbon emission reduction and workforce diversity, enhances its brand and attracts investors, as a significant portion of global assets are now directed towards ESG-compliant investments.

Technological factors

Alphawave Semi's success hinges on its mastery of high-speed connectivity, particularly technologies like SerDes and UCIe, which are critical for the burgeoning AI and data center markets. The company's focus on advanced packaging for chiplets directly addresses the industry's need for more integrated and efficient semiconductor solutions.

The relentless pace of technological advancement, especially in chiplet integration, directly impacts Alphawave Semi's market position. For instance, the increasing complexity and performance demands of AI accelerators necessitate sophisticated interconnects that Alphawave Semi is well-positioned to provide.

The burgeoning demand for artificial intelligence (AI) and high-performance computing (HPC) is fundamentally reshaping the semiconductor landscape, necessitating advanced silicon designs and ultra-fast data interconnects. Alphawave Semi is strategically positioned to capitalize on this trend, supplying critical components that enable these sophisticated computing and networking infrastructures.

For instance, the AI chip market is projected to reach $200 billion by 2027, according to some industry forecasts, highlighting a massive opportunity for companies like Alphawave Semi that provide the foundational technology for these powerful systems. Their expertise in high-speed connectivity solutions directly addresses the bottlenecks inherent in processing vast datasets for AI training and HPC simulations.

The relentless drive towards miniaturization in semiconductor manufacturing, with leading foundries pushing to 3nm and even 2nm process nodes by 2025, is fundamentally reshaping the landscape for data centers and AI. This advancement directly impacts power consumption, a critical factor for these high-demand applications.

Alphawave Semi's focus on delivering high-performance connectivity solutions that also prioritize lower power consumption is a significant competitive advantage. For instance, their latest chipsets are designed to meet the stringent power budgets of next-generation AI accelerators, ensuring efficient operation even under heavy loads.

Open Standards and Interoperability (e.g., UCIe, PCIe)

Alphawave Semi's commitment to open standards like UCIe and PCIe is crucial for seamless integration into the evolving data center and AI landscape. These standards ensure their connectivity solutions can easily work with a wide range of components and systems, fostering broader market acceptance. For instance, the widespread adoption of PCIe 5.0 and the emerging PCIe 6.0 standard by major cloud providers and server manufacturers directly impacts the demand for Alphawave Semi's high-speed interconnects. Their participation in the UCIe consortium, which aims to standardize chiplet interconnects, positions them to benefit from the growing trend of modular chip design, a key development expected to accelerate in 2024 and 2025.

The interoperability fostered by these open standards directly translates into market opportunity. Companies building next-generation AI accelerators and data center infrastructure rely on components that can communicate efficiently. Alphawave Semi's adherence to UCIe, for example, allows their silicon to be readily integrated with chiplets from other vendors, expanding their potential customer base. As of early 2024, the demand for high-bandwidth, low-latency interconnects continues to surge, driven by the insatiable appetite for AI processing power. Alphawave Semi’s focus on these foundational technologies ensures their solutions remain relevant and competitive in this dynamic market.

- Industry Adoption: Major hyperscalers and chip manufacturers are actively adopting UCIe and PCIe 5.0/6.0, creating a strong market pull for compliant interconnect solutions.

- Ecosystem Growth: Open standards encourage a broader ecosystem of compatible products, increasing the value proposition for Alphawave Semi's offerings.

- Market Penetration: Interoperability through standards like PCIe facilitates easier integration into existing and new data center designs, boosting market penetration.

- Future-Proofing: Active participation in standard development, such as UCIe, ensures Alphawave Semi's technologies align with future architectural shifts in computing.

Cybersecurity and Data Security in Hardware

As data transfer speeds accelerate and systems become more interconnected, the imperative for robust cybersecurity measures integrated directly into hardware is paramount. Alphawave Semi's product roadmap must prioritize advanced security features to safeguard sensitive data and proactively mitigate potential vulnerabilities in its high-speed connectivity solutions.

The increasing sophistication of cyber threats necessitates hardware-level security. For instance, the global cybersecurity market was valued at approximately $217.9 billion in 2023 and is projected to reach $424.9 billion by 2030, highlighting the critical demand for secure infrastructure components.

- Hardware-level encryption: Implementing on-chip encryption to secure data in transit and at rest.

- Secure boot processes: Ensuring that only authenticated firmware and software can load onto the hardware.

- Tamper detection mechanisms: Building in features to alert if the physical hardware has been compromised.

- Supply chain security: Verifying the integrity of components throughout the manufacturing and distribution process.

The rapid evolution of AI and data center technologies directly fuels demand for Alphawave Semi's high-speed interconnects, particularly SerDes and UCIe. The company's investment in chiplet technology addresses the industry's push for greater integration and efficiency in semiconductor design. This focus is critical as AI accelerators and HPC systems demand increasingly sophisticated solutions for seamless data flow.

Legal factors

Intellectual property rights are the bedrock of Alphawave Semi's strategy, particularly concerning their silicon IP and chiplet innovations. Patents and trade secrets are crucial for protecting their technological advancements and maintaining a significant competitive advantage in the semiconductor industry.

Alphawave Semi's hardware, crucial for data centers, must navigate a complex web of global data privacy regulations like Europe's GDPR and California's CCPA. While not directly handling personal data, the company's solutions must support customer compliance, influencing product design to ensure data security and privacy within the infrastructure they enable. For instance, GDPR's principles of data minimization and purpose limitation can impact how data flows through connectivity components.

Alphawave Semi operates within a stringent framework of export control and sanctions laws, a critical aspect given the nature of advanced semiconductor technology. These regulations, particularly those impacting trade with specific countries or entities, directly influence market access and operational capabilities. Failure to comply can result in severe legal repercussions and significant financial penalties, impacting Alphawave Semi's global business strategy.

Antitrust and Competition Laws

Alphawave Semi operates in a semiconductor landscape increasingly shaped by consolidation and strategic alliances, making adherence to antitrust and competition laws paramount. The company must ensure its market practices are fair and avoid any actions that could be perceived as monopolistic. For instance, the ongoing scrutiny of major industry players, like the proposed acquisition of NXP Semiconductors by Qualcomm in 2024, underscores the regulatory environment Alphawave Semi navigates.

Navigating these regulations is critical for Alphawave Semi's growth and market access. Failure to comply could result in significant fines, divestitures, or even blocked partnerships. The global regulatory bodies, including the US Federal Trade Commission (FTC) and the European Commission, are actively monitoring the semiconductor sector for potential anti-competitive behavior.

- Regulatory Scrutiny: Antitrust authorities worldwide are closely examining mergers and acquisitions within the semiconductor industry.

- Market Share Concerns: Alphawave Semi must be mindful of its market share and avoid practices that could stifle innovation or harm smaller competitors.

- Partnership Diligence: Any strategic partnerships or joint ventures undertaken by Alphawave Semi will likely undergo thorough antitrust review.

Product Liability and Safety Standards

Alphawave Semi's silicon IP and chiplets are integral to high-performance computing, making compliance with product liability and safety standards paramount. Failure to meet these rigorous requirements, especially concerning potential defects or security flaws in their advanced technologies, could result in substantial legal challenges and financial penalties.

The increasing complexity of semiconductor technology, particularly in areas like advanced packaging and high-speed interconnects, heightens the importance of robust safety protocols. For instance, in 2024, the semiconductor industry continued to face scrutiny over supply chain security and the potential for hardware-level vulnerabilities, underscoring the need for Alphawave Semi to proactively address these risks through stringent testing and validation processes.

- Product Liability: Alphawave Semi must ensure its silicon IP and chiplets meet all applicable consumer protection laws and industry-specific safety regulations to avoid litigation stemming from product malfunctions or performance issues.

- Safety Standards: Adherence to international safety standards, such as those related to electrical safety and electromagnetic compatibility (EMC), is crucial for market access and to prevent potential harm to users or other electronic devices.

- Security Vulnerabilities: Given the critical nature of their components in data centers and AI applications, addressing potential security vulnerabilities at the hardware level is a key legal and reputational imperative.

- Mitigation Strategies: Implementing comprehensive quality assurance, rigorous testing, and clear disclaimers are essential to mitigate liability risks associated with advanced semiconductor designs.

Alphawave Semi must navigate evolving intellectual property laws, particularly concerning patents for their silicon IP and chiplet innovations, to maintain their competitive edge. The company's commitment to protecting its technological advancements through patents and trade secrets is fundamental to its market position.

Compliance with global data privacy regulations like GDPR and CCPA is essential, as Alphawave Semi's hardware solutions must support customer data security and privacy. These regulations influence product design to ensure data protection within the infrastructure Alphawave Semi enables.

Strict adherence to export control and sanctions laws is critical for Alphawave Semi's global operations and market access, given the sensitive nature of advanced semiconductor technology. Non-compliance can lead to severe legal and financial consequences.

The company must also comply with antitrust and competition laws, ensuring fair market practices and avoiding monopolistic behavior, especially as the semiconductor industry experiences consolidation. Regulatory bodies actively monitor this sector for anti-competitive actions.

Environmental factors

The escalating demand for data processing, particularly driven by AI, is placing immense strain on global energy resources. Data centers, the backbone of this digital expansion, are significant energy consumers. For instance, by 2026, data center energy consumption is projected to account for over 2% of global electricity usage, a substantial increase from previous years.

Alphawave Semi's innovative connectivity solutions are designed to mitigate this environmental impact. Their technology facilitates higher data transfer speeds while simultaneously reducing power consumption per bit. This efficiency is crucial for building more sustainable digital infrastructure, directly addressing the growing energy footprint of AI and cloud computing.

The semiconductor industry, including companies like Alphawave Semi, contributes to the growing global challenge of electronic waste (e-waste). The lifecycle of semiconductor products, from their creation to eventual obsolescence, inherently generates waste materials.

While Alphawave Semi operates as a fabless company, meaning it doesn't own manufacturing facilities, it still influences the industry's environmental impact. The company can champion and implement circular economy principles, aiming to reduce its footprint by designing for longevity and promoting responsible disposal or recycling of its products and packaging.

Globally, e-waste is a significant concern, with estimates suggesting over 50 million metric tons generated annually. By embracing circular economy strategies, Alphawave Semi can align with a growing trend towards sustainability, potentially enhancing its brand reputation and appealing to environmentally conscious investors and customers.

Alphawave Semi is actively working to shrink its carbon footprint, aiming for carbon neutrality as part of its commitment to global climate change efforts. This focus includes diligently managing greenhouse gas emissions stemming from its operational activities.

The company also contributes to the broader decarbonization of digital infrastructure, a critical sector, through the very design and functionality of its innovative products. For instance, in 2023, the company reported a reduction in Scope 1 and Scope 2 emissions by 15% compared to its 2020 baseline, demonstrating tangible progress.

Responsible Sourcing and Supply Chain Sustainability

Alphawave Semi, as a fabless semiconductor company, depends heavily on its global manufacturing partners. This reliance means that responsible sourcing of raw materials and ensuring sustainability throughout its supply chain are paramount. By actively promoting eco-friendly practices among its suppliers, Alphawave Semi can effectively manage environmental risks and demonstrate its dedication to Environmental, Social, and Governance (ESG) principles.

The semiconductor industry, in particular, faces scrutiny regarding its environmental footprint, from resource extraction to energy consumption in manufacturing. For instance, the production of advanced semiconductors often involves specialized chemicals and significant water usage. Alphawave Semi's commitment to supply chain sustainability is therefore not just about compliance but also about building resilience and reputation in an increasingly environmentally conscious market. Companies in the sector are increasingly reporting on their Scope 3 emissions, which encompass supply chain impacts. For example, in 2023, many leading semiconductor firms began setting more ambitious targets for reducing these indirect emissions, often aiming for significant reductions by 2030.

- Material Sourcing: Ensuring conflict-free minerals and ethically sourced components are used in manufacturing processes.

- Energy Efficiency: Collaborating with manufacturing partners to implement energy-saving technologies and renewable energy sources.

- Waste Reduction: Working with suppliers to minimize waste generation and promote recycling and circular economy principles within the supply chain.

- Water Management: Encouraging responsible water usage and wastewater treatment practices at manufacturing facilities.

Water Usage in Semiconductor Manufacturing

Semiconductor manufacturing is notoriously water-intensive, with some estimates suggesting that up to 4.5 million gallons of ultrapure water can be used per day in a single fabrication plant. While Alphawave Semi operates on a fabless model, meaning it doesn't own or operate its own manufacturing facilities, the environmental footprint of its foundry partners' water consumption remains an indirect but important consideration for its overall sustainability strategy. This reliance on external manufacturing means Alphawave Semi must consider the water management practices of its chosen partners.

The company's commitment to environmental stewardship can be demonstrated by encouraging and supporting water-efficient technologies and practices throughout its supply chain. This includes working with foundries that invest in water recycling and reuse systems, which are becoming increasingly critical as water scarcity concerns grow in many manufacturing regions. For instance, many advanced semiconductor facilities aim to achieve high water recycling rates, often exceeding 80% in their operations.

Alphawave Semi's indirect impact through its foundry relationships highlights the interconnectedness of the semiconductor ecosystem. By prioritizing partners with strong environmental credentials, particularly in water management, Alphawave Semi can contribute to a more sustainable industry. This focus aligns with growing investor and regulatory expectations regarding environmental, social, and governance (ESG) performance across all businesses.

The growing demand for AI and data processing is increasing energy consumption, with data centers projected to use over 2% of global electricity by 2026. Alphawave Semi's efficient connectivity solutions help reduce power consumption per bit, addressing this environmental strain. The company also faces the challenge of e-waste, with over 50 million metric tons generated globally each year.

Alphawave Semi is actively reducing its carbon footprint, having achieved a 15% reduction in Scope 1 and 2 emissions by 2023 compared to a 2020 baseline. Its fabless model necessitates a focus on supply chain sustainability, including responsible material sourcing and encouraging eco-friendly practices among manufacturing partners. This includes promoting water-efficient technologies, as semiconductor fabrication can be highly water-intensive, with some plants using up to 4.5 million gallons daily.

| Environmental Factor | Impact on Alphawave Semi | Mitigation Strategies / Data |

| Energy Consumption | Increased demand from data centers for AI and cloud computing. | Alphawave Semi's products reduce power consumption per bit. Data centers expected to use >2% global electricity by 2026. |

| Electronic Waste (E-waste) | Semiconductor product lifecycles contribute to waste. | Focus on circular economy principles, designing for longevity, and responsible disposal/recycling. Global e-waste exceeds 50 million metric tons annually. |

| Carbon Emissions | Operational activities and supply chain impact. | Aiming for carbon neutrality; achieved 15% reduction in Scope 1 & 2 emissions by 2023 (vs. 2020 baseline). |

| Water Usage | High water intensity in semiconductor manufacturing (foundries). | Encouraging water recycling and reuse among foundry partners; some facilities achieve >80% water recycling rates. |

PESTLE Analysis Data Sources

Our ALPHAWAVE SEMI PESTLE Analysis is grounded in comprehensive data from leading semiconductor industry associations, global economic forecasting firms, and official government reports on trade and technology. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the semiconductor landscape.