ALPHAWAVE SEMI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALPHAWAVE SEMI Bundle

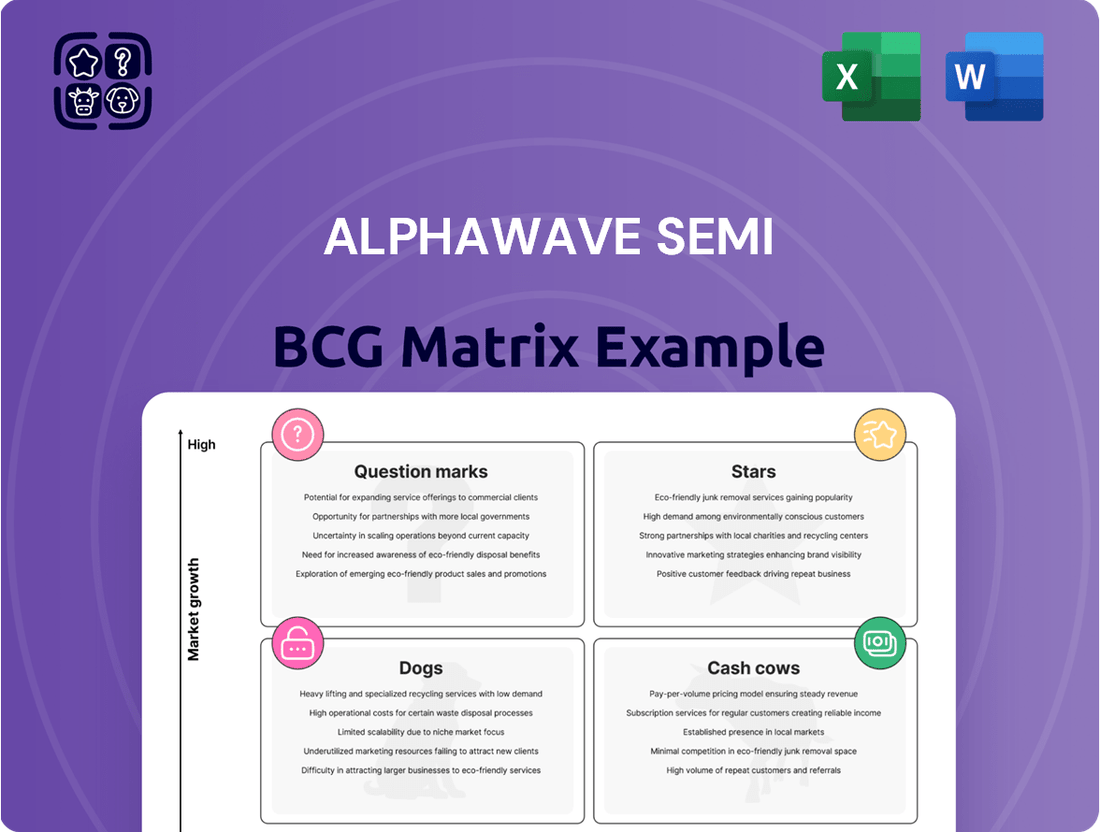

Unlock the strategic potential of ALPHAWAVE SEMI with a glimpse into its BCG Matrix. See how its products are categorized as Stars, Cash Cows, Dogs, or Question Marks, offering a foundational understanding of its market performance. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to guide your investment and product development strategies.

Stars

Alphawave Semi's AI-focused chiplets represent a strong potential growth area, aligning with the industry's move towards modular AI hardware. These chiplets are designed for high-performance AI tasks, utilizing advanced packaging techniques and collaborations with key players in the hyperscale and AI infrastructure markets.

The company's strategy includes Arm-based compute chiplets, positioning them to capitalize on the increasing demand for scalable AI solutions. Alphawave Semi has already secured notable design wins, indicating significant market traction for these AI-centric products.

Looking ahead, Alphawave Semi anticipates substantial revenue expansion from these chiplet offerings, with projections pointing to strong growth in 2025 and subsequent years. This segment is a critical component of their strategy to address the evolving needs of the AI computing landscape.

Alphawave Semi is at the forefront of next-generation high-speed interconnects, including PCIe 7.0 and CXL 3.1. These technologies are vital for the booming data center and AI sectors, facilitating incredibly fast and dependable data movement. The company's dedication to advancing these critical areas solidifies its position as a key player in a rapidly growing market segment.

Alphawave Semi's Universal Chiplet Interconnect Express (UCIe) IP and subsystems represent a significant advancement in enabling high-bandwidth die-to-die communication. Their breakthroughs, such as achieving 64 Gbps and 36G UCIe on TSMC's 2nm process, are crucial for the next generation of chiplet-based architectures.

These advanced UCIe solutions are foundational for scaling the performance of AI and high-performance computing systems. Alphawave Semi's strong market position, evidenced by continued design wins, highlights their role as a key enabler of the burgeoning chiplet revolution.

Optoelectronics Products for AI/Datacenter

Alphawave Semi is making significant strides in the optoelectronics sector, particularly with its new product line designed for the high-growth AI and datacenter interconnect market. This strategic move positions them to capitalize on a market segment expected to surpass $4 billion by 2028.

The company has unveiled advanced optoelectronics products, including PAM4 and Coherent-lite DSPs. These are engineered to support 800G and 1.6T interconnect speeds, crucial for the escalating demands of AI compute and hyperscale data centers. The initial sampling and positive market reception suggest a robust growth path ahead for these offerings.

- Market Focus: Targeting the hyperscaler datacenter and AI interconnect market, projected to exceed $4 billion by 2028.

- Product Innovation: Introduction of PAM4 and Coherent-lite DSPs enabling 800G and 1.6T interconnect solutions.

- Growth Potential: Strong initial sampling and market potential indicate a significant growth trajectory for the new optoelectronics products.

- AI Enablement: Products directly address the increasing need for accelerated AI compute capabilities through enhanced data transfer speeds.

Custom Silicon for Hyperscalers

Alphawave Semi is strategically shifting its focus towards custom silicon solutions, a move that directly targets the burgeoning needs of hyperscalers and North American AI companies. This pivot leverages their advanced IP and chiplet technology to deliver tailor-made designs that offer significant advantages to their clients.

These custom silicon engagements are designed to provide customers with enhanced design flexibility and a distinct competitive advantage in the rapidly evolving AI landscape. The company's commitment to these specialized solutions underscores a significant growth opportunity.

The strong demand for these bespoke offerings is clearly reflected in Alphawave Semi's financial performance. The company achieved record bookings in 2024, a testament to the trust and confidence placed in them by major hyperscale clients.

- Custom Silicon Focus: Alphawave Semi's strategic emphasis on custom silicon for hyperscalers and North American AI customers.

- Technological Advantage: Utilization of leading IP and chiplets for greater design flexibility and competitive edge for clients.

- 2024 Performance: Record bookings in 2024 demonstrate robust demand and strong client relationships in this segment.

Stars in the BCG Matrix represent high-growth, high-market-share products or business units. For Alphawave Semi, their AI-focused chiplets and advanced interconnect technologies, such as UCIe and optoelectronics for AI/datacenter markets, are prime examples of Stars. These segments are experiencing rapid expansion and Alphawave Semi holds a leading position within them.

The company's investment in these areas is crucial for maintaining their competitive edge and driving future revenue growth. Their recent advancements in UCIe, achieving 64 Gbps on TSMC's 2nm process, and their optoelectronics targeting an over $4 billion market by 2028, underscore their Star status.

Alphawave Semi's record bookings in 2024, driven by custom silicon for hyperscalers, further solidify the high-growth, high-share nature of their AI-related offerings, positioning them as Stars within their portfolio.

| Product Segment | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| AI-Focused Chiplets | Very High | High | Star |

| High-Speed Interconnects (PCIe 7.0, CXL 3.1) | Very High | High | Star |

| UCIe IP and Subsystems | Very High | High | Star |

| Optoelectronics (AI/Datacenter) | High (Projected >$4B by 2028) | High | Star |

| Custom Silicon Solutions | Very High | High (Record bookings in 2024) | Star |

What is included in the product

ALPHAWAVE SEMI BCG Matrix analyzes product portfolio by market growth and share.

ALPHAWAVE SEMI BCG Matrix offers a clear, visual breakdown of your portfolio, instantly relieving the pain of strategic ambiguity.

Cash Cows

Alphawave Semi's established high-speed SerDes IP represents a cornerstone of its business, consistently delivering robust licensing revenue. This foundational technology, refined across numerous process nodes, underpins critical data transmission in applications like data centers and AI infrastructure.

In 2024, the demand for high-bandwidth connectivity continues to surge, directly benefiting Alphawave Semi's mature SerDes portfolio. The company's IP is integrated into a wide array of leading-edge semiconductor devices, ensuring its ongoing relevance and profitability.

Alphawave Semi's Multi-Standard Connectivity IP Portfolio acts as a strong cash cow. These silicon IP building blocks are integrated by customers into their chip designs, creating a predictable and stable revenue stream. The company reported that its connectivity IPs, including those for PCIe, USB, and SerDes, are used in a vast array of applications from data centers to automotive, driving consistent demand.

The maturity and breadth of this IP portfolio contribute to high profit margins. Because these are established technologies, Alphawave Semi doesn't need to pour significant resources into developing entirely new markets. In 2023, the company highlighted that its IP licensing and royalty revenue, largely driven by these mature connectivity solutions, represented a substantial portion of its overall financial performance, demonstrating their cash-generating power.

Alphawave Semi's existing license and NRE contracts represent a significant portion of its revenue, acting as a stable financial bedrock. These agreements generate predictable, high-margin cash flows, which are vital for funding ongoing operations and crucial research and development initiatives.

In 2023, Alphawave Semi reported that its recurring revenue, largely driven by these existing contracts, provided a substantial and reliable income stream. This existing contract base offers a degree of financial resilience, even as the company pursues new business opportunities.

Mature 5G Wireless Infrastructure IP

Alphawave Semi's mature 5G wireless infrastructure IP represents a solid Cash Cow. While the initial explosive growth of 5G deployment is moderating, the ongoing need for network maintenance, upgrades, and enhanced performance ensures sustained demand for their reliable connectivity solutions. This segment provides a stable revenue stream, allowing for consistent cash generation with less need for aggressive reinvestment compared to newer, high-growth markets.

The 5G infrastructure market, though maturing, still presents significant opportunities. For instance, global 5G subscriptions were projected to reach over 1.5 billion by the end of 2024, indicating a substantial installed base requiring ongoing support and evolution. Alphawave Semi's established IP is well-positioned to capitalize on this continued demand.

- Stable Revenue: The ongoing operation and enhancement of existing 5G networks provide a predictable revenue base for Alphawave Semi's IP solutions.

- Market Maturity: While growth rates may slow, the sheer scale of 5G deployment ensures a large and enduring market for critical infrastructure components.

- Lower Investment Needs: Compared to emerging technologies, the mature 5G segment requires less capital for R&D and market penetration, leading to higher cash flow generation.

- Proven Technology: Alphawave Semi's established IP in this area offers a competitive advantage due to its reliability and performance, meeting the stringent demands of network operators.

Legacy Production Silicon Royalties

Alphawave Semi's legacy custom silicon production continues to be a significant source of royalty revenue. These established design wins, now in full production, generate passive income with minimal ongoing investment, bolstering the company's financial stability.

This royalty stream is a prime example of a Cash Cow within the BCG Matrix framework. It represents a mature, high-margin business that requires little capital to maintain its market position, effectively funding other strategic initiatives.

- Revenue Generation: Legacy silicon royalties contribute a consistent, low-risk cash flow.

- Low Investment: Once designs are in production, ongoing capital expenditure is minimal.

- Profitability: These royalties represent high-margin revenue, enhancing overall profitability.

- Strategic Funding: The cash generated can be reinvested in growth areas or returned to shareholders.

Alphawave Semi's SerDes IP, Multi-Standard Connectivity IP, and mature 5G wireless infrastructure IP all function as strong Cash Cows. These established technologies provide stable, high-margin revenue streams with minimal ongoing investment, effectively generating consistent cash flow for the company. The legacy custom silicon production further bolsters this position through passive royalty income.

These mature product lines, benefiting from significant market adoption and proven performance, require less capital for research and development compared to emerging technologies. This allows Alphawave Semi to leverage their existing intellectual property for sustained profitability. For instance, the company's connectivity IPs are integrated into a vast array of applications, driving consistent demand and predictable revenue.

The financial performance in 2023 highlighted the substantial contribution of these mature solutions to Alphawave Semi's overall revenue, underscoring their cash-generating power. The ongoing demand in sectors like data centers and automotive ensures the continued relevance and profitability of these foundational technologies.

The company's existing license and NRE contracts further solidify its financial stability, providing predictable, high-margin cash flows. This robust contract base acts as a financial bedrock, enabling investment in future growth areas.

| Product Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Illustrative) |

|---|---|---|---|

| SerDes IP | Cash Cow | High demand, mature technology, strong licensing revenue | Significant portion of IP licensing revenue |

| Multi-Standard Connectivity IP | Cash Cow | Broad application base (data centers, automotive), predictable revenue | Substantial recurring revenue |

| Mature 5G Wireless Infrastructure IP | Cash Cow | Sustained demand for network maintenance/upgrades, proven reliability | Stable revenue stream |

| Legacy Custom Silicon Royalties | Cash Cow | Passive income from established design wins, minimal ongoing investment | Consistent, low-risk cash flow |

Delivered as Shown

ALPHAWAVE SEMI BCG Matrix

The ALPHAWAVE SEMI BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no alterations—just the complete, analysis-ready strategic tool designed for immediate application in your business planning.

Dogs

The legacy OpenFive custom silicon business, primarily consisting of lower-margin backlog acquired in prior periods, was largely fulfilled by the first half of 2023. This strategic divestment aligns with AlphaWave Semi's focus on higher-margin opportunities, suggesting a deliberate phasing out of this segment to optimize profitability and resource allocation.

Revenue from the WiseWave subscription license agreement is recognized as a legacy stream within Alphawave Semi's portfolio. In 2023, this segment contributed a diminishing portion to the company's overall revenue, reflecting a strategic shift away from this particular offering. This trend is indicative of a product line that no longer aligns with the company's core growth objectives.

Alphawave Semi's decision to divest its entire interest in WiseWave underscores its commitment to focusing on high-growth areas. The company officially completed the disposal of its WiseWave assets, signaling a clear move to streamline its business and allocate resources towards more promising ventures. This strategic maneuver is designed to enhance overall profitability and market competitiveness.

Non-strategic, low-margin custom design engagements represent projects that don't leverage advanced semiconductor nodes or target high-growth areas like AI and data centers. These deals, characterized by significantly lower profit margins, are being deprioritized by Alphawave Semi as the company shifts its focus towards more lucrative opportunities.

Alphawave Semi's stated strategy emphasizes a transition to higher-margin engagements, signaling a deliberate move away from these less profitable custom design projects. Such engagements, while potentially generating revenue, consume valuable resources that could be better allocated to strategic initiatives with greater potential for growth and profitability.

Outdated IP for Slowing Markets

Outdated IP for Slowing Markets represents a challenge for Alphawave Semi. These are older intellectual property solutions that were developed for markets experiencing little to no growth, or even decline. Their market share is typically very small, meaning they contribute minimally to the company's overall expansion and profits.

While these assets might still bring in some income, the resources needed to keep them competitive and functional often outweigh the financial benefits. This situation is particularly relevant as the semiconductor industry navigates periods of market slowdown, making the efficient allocation of R&D and maintenance resources critical.

- Low Market Share: These IP assets typically hold a negligible percentage of their respective market share.

- Stagnant/Declining Markets: They are designed for industries with minimal or negative growth prospects.

- High Maintenance Costs: The effort and capital required to maintain these IP solutions are often disproportionate to their revenue generation.

- Limited Growth Contribution: They offer little to no potential for future revenue growth or profitability enhancement.

Underperforming Non-Core Ventures

Underperforming non-core ventures for Alphawave Semi, if any exist and fit this description, would be classified as Dogs within the BCG Matrix. These are typically smaller product lines or initiatives that haven't captured significant market share and are not contributing meaningfully to revenue or strategic goals. For example, if Alphawave Semi had a venture into a niche semiconductor market that saw minimal adoption, it would fall into this category.

Such ventures are often resource drains, consuming capital and management attention without generating adequate returns. Their lack of growth and low market share means they are unlikely to become stars or cash cows. In 2023, Alphawave Semi's primary focus remained on its high-speed connectivity solutions for AI and data centers, areas where it demonstrated strong growth and market positioning.

The company's reported revenue for the fiscal year 2023 was $326.4 million, a significant increase driven by its core products. Any ventures not contributing to this growth, and instead requiring substantial investment for minimal return, would be considered Dogs. These would be candidates for divestiture or significant restructuring to align with Alphawave Semi's strategic direction.

- Low Market Share: Initiatives failing to gain traction in their respective niche markets.

- Resource Drain: Consuming capital and operational resources without commensurate returns.

- Strategic Misalignment: Diverting focus from core, high-growth areas like AI and data infrastructure connectivity.

- Potential Divestiture: Candidates for sale or discontinuation to reallocate resources to more promising ventures.

Dogs in the BCG Matrix represent business units or products with low market share in slow-growing industries. For Alphawave Semi, these would be legacy projects or ventures that are not contributing to the company's strategic focus on high-margin, high-growth areas like AI and data centers. These are essentially resource drains that offer minimal future potential.

The company's 2023 revenue of $326.4 million was largely driven by its core connectivity solutions. Any ventures outside of these key growth drivers that exhibit low market penetration and stagnant revenue would be categorized as Dogs. These are prime candidates for divestment or discontinuation to optimize resource allocation.

These underperforming segments, if they exist, would likely be characterized by low profitability and minimal strategic value, diverting attention from more lucrative opportunities. Alphawave Semi's deliberate shift away from lower-margin backlog and non-strategic custom design engagements in 2023 exemplifies this strategic pruning.

Consider the divestment of WiseWave, a legacy subscription license agreement, as a move to eliminate a Dog. Such actions are crucial for maintaining a lean and focused business model aimed at maximizing returns from core competencies.

| Category | Description | Alphawave Semi Relevance (2023/2024 Focus) |

| Dogs | Low Market Share, Low Growth Industry | Legacy IP for slowing markets, non-strategic low-margin engagements, potentially divested ventures like WiseWave. |

Question Marks

Alphawave Semi is investing in Intellectual Property (IP) for emerging 6G network infrastructure, positioning itself for a future high-growth market. This strategic move anticipates the next generation of wireless technology, which promises significantly faster speeds and lower latency than current 5G networks. The company's focus on 6G IP development reflects a commitment to innovation and capturing future market share.

While 6G represents a significant opportunity, it's still in its early development phase, meaning market adoption and the identification of dominant players are not yet solidified. This creates a degree of uncertainty regarding the timeline and specific requirements for successful market entry. The company's investment in this area is therefore a long-term play, requiring sustained research and development efforts.

Significant R&D investment is crucial for Alphawave Semi to establish a strong position in the nascent 6G market. The potential returns are substantial but also uncertain, given the early stage of the technology and the competitive landscape that is still taking shape. By focusing on IP development now, Alphawave Semi aims to be a key enabler of this future technology.

Alphawave Semi is potentially venturing into highly specialized chiplet applications beyond AI and data centers. These niche markets, while smaller, could offer significant growth opportunities. Developing these would demand considerable investment, with uncertain market capture and profitability.

Examples of such niche applications could include advanced memory or input/output (I/O) chiplets that are not yet mainstream. For instance, in 2024, the demand for specialized high-bandwidth memory (HBM) chiplets for advanced computing tasks outside of traditional AI acceleration is growing, with the HBM market projected to reach over $10 billion by 2027, indicating potential for tailored solutions.

Alphawave Semi's high-speed wired connectivity IP is crucial for autonomous vehicles, a segment poised for significant growth. The automotive industry is projected to see connected car services revenue reach $228 billion by 2025, highlighting the market's potential. However, this sector presents considerable challenges, including long design cycles and intense competition, which could mean Alphawave Semi's current penetration is relatively low compared to its data center operations, necessitating substantial investment to capture market share.

Early-Stage Optical Interconnect Products Beyond Hyperscalers

While Alphawave Semi's established optical interconnect products are performing strongly in the hyperscaler market, representing a clear Star in their portfolio, their nascent efforts in broader enterprise or emerging market segments present a different picture.

These early-stage optical interconnect solutions, targeting areas beyond hyperscalers, are considered Question Marks. They possess significant growth potential as new markets develop, but currently hold a low market share for Alphawave Semi. For instance, the broader enterprise data center market, while growing, requires substantial investment in customer education and product adoption to gain traction against established players.

The challenge lies in navigating intense competition and the need for significant market development. For example, the demand for optical interconnects in industrial automation or automotive applications is still in its infancy, requiring Alphawave Semi to invest heavily in R&D and market penetration strategies. In 2024, the global optical interconnect market, excluding hyperscalers, is projected to grow, but the specific segments Alphawave Semi is targeting may still be in the early adoption phase, demanding careful strategic execution.

- Market Potential: High growth expected in enterprise, industrial, and automotive sectors for optical interconnects.

- Current Share: Low market share for Alphawave Semi in these emerging segments.

- Challenges: Intense competition, need for market education, and substantial R&D investment.

- Strategic Focus: Requires careful investment and market development to transition from Question Mark to Star.

New Geographic Market Expansion Initiatives

Alphawave Semi's recent geographic expansion initiatives, particularly into markets with nascent brand recognition, represent classic Question Marks within the BCG framework. These ventures offer significant upside potential, aligning with the high growth characteristic of this quadrant.

For instance, while Alphawave Semi has been actively growing its presence in established tech hubs, aggressive pushes into emerging markets in Southeast Asia or Eastern Europe, where their market share is currently minimal, would fall into this category. These efforts require substantial capital allocation for building local sales teams, marketing campaigns, and adapting products to regional needs.

- High Growth Potential: Targeting underserved or rapidly developing economies presents an opportunity for Alphawave Semi to capture significant market share early on.

- Significant Investment Required: Successful penetration necessitates considerable upfront spending on localization, distribution networks, and brand building.

- Risk of Low Market Share: Entering markets with low existing brand awareness means Alphawave Semi starts from a disadvantage, facing established competitors or the need to educate the market.

- Uncertain Future Returns: The success of these initiatives is not guaranteed, and they could become Stars if market adoption is strong, or Dogs if they fail to gain traction.

Question Marks in Alphawave Semi's portfolio represent areas with high growth potential but currently low market share. These segments, such as emerging optical interconnect markets beyond hyperscalers and new geographic expansions, require substantial investment and strategic development. Success hinges on navigating competitive landscapes and fostering market adoption, with the potential to evolve into Stars or falter into Dogs.

BCG Matrix Data Sources

Our ALPHAWAVE SEMI BCG Matrix is built on robust data, integrating semiconductor industry reports, financial disclosures, and market growth forecasts to provide strategic clarity.