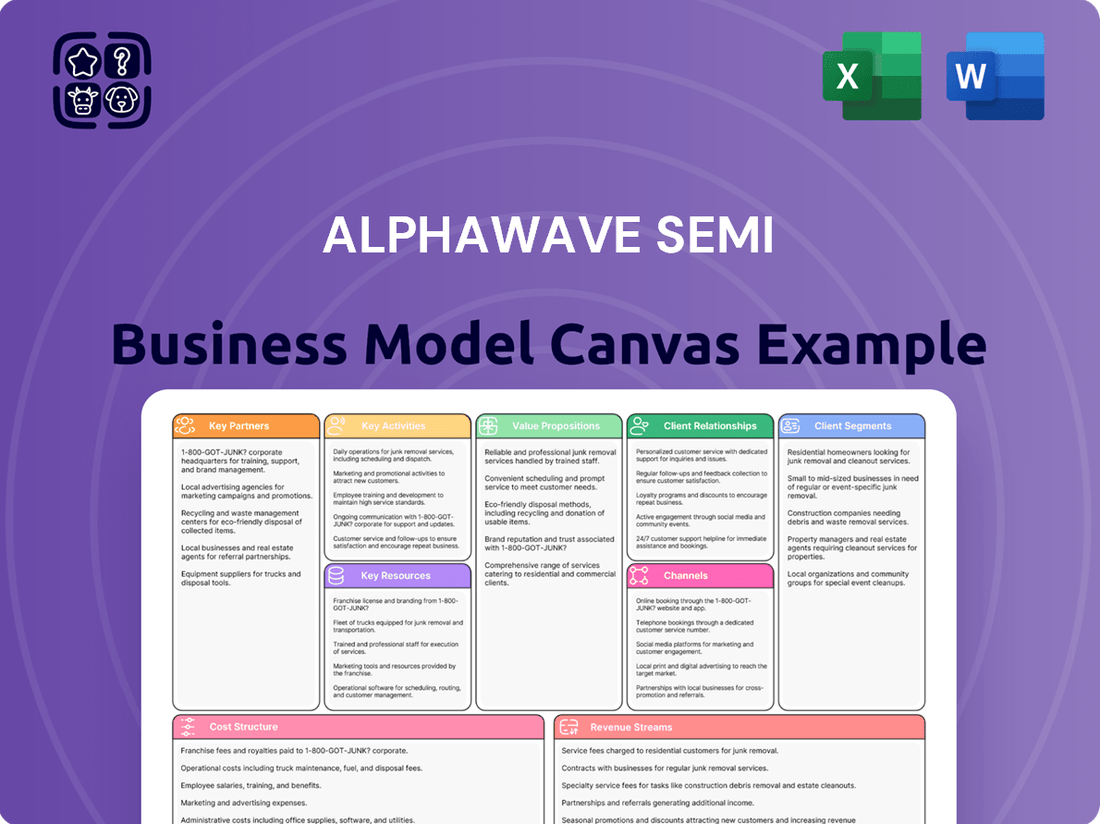

ALPHAWAVE SEMI Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ALPHAWAVE SEMI Bundle

Unlock the strategic DNA of ALPHAWAVE SEMI with our comprehensive Business Model Canvas. Discover how they leverage key resources and partnerships to deliver innovative solutions and capture market share. This detailed canvas is your key to understanding their success.

Partnerships

Alphawave Semi relies heavily on its foundry partners, notably TSMC and Samsung Foundry, to bring its advanced chip designs to life. These collaborations are essential for accessing leading-edge process technologies, such as the 3nm and upcoming 2nm nodes, which are critical for manufacturing their high-performance silicon IP and chiplets.

These partnerships ensure Alphawave Semi can leverage the most advanced manufacturing capabilities available, a vital step in translating their innovative designs into physical silicon products. For instance, TSMC's continued leadership in advanced process nodes directly enables Alphawave Semi to deliver cutting-edge connectivity solutions for demanding applications.

Alphawave Semi actively partners with key players in the AI and hyperscaler space, including Rebellions Inc. and other prominent semiconductor firms. These collaborations focus on creating advanced high-speed connectivity solutions specifically designed for AI accelerators and the demanding infrastructure of data centers.

These strategic alliances are crucial for Alphawave Semi, often leading to early design wins. This means their intellectual property (IP) and chiplets are integrated into the very first versions of new, cutting-edge systems, giving them a significant head start in emerging markets.

Alphawave Semi collaborates with Electronic Design Automation (EDA) giants like Siemens EDA. This partnership is crucial for extending their sales channels and making their intellectual property (IP) more accessible to a wider range of customers working on System-on-Chip (SoC) and 3D-Integrated Circuit (3D-IC) designs.

Beyond EDA, Alphawave Semi actively cultivates relationships with other design ecosystem partners. These collaborations are vital for ensuring seamless interoperability between different design tools and components, ultimately speeding up the development process for their clients.

Industry Standard Organizations and Consortia

Alphawave Semi's engagement with industry standard organizations like UALink, OIF, and PCI-SIG is crucial. These partnerships allow them to actively shape the future of connectivity, ensuring their innovations are aligned with market demands. For instance, their leadership in UALink, a consortium focused on advanced chip-to-chip communication, directly influences the development of next-generation interconnects. This proactive involvement guarantees interoperability and adoption of their technologies within the broader semiconductor ecosystem.

Their participation in these groups, which often involve extensive technical working groups and annual meetings, helps Alphawave Semi stay ahead of technological curves. By contributing to standards development, they foster an environment where their proprietary solutions can seamlessly integrate with other industry offerings. This strategic alignment is vital for driving widespread adoption and solidifying their market position.

- Participation in UALink: Alphawave Semi is a key player in defining the UALink standard for high-speed chip-to-chip communication, critical for advanced computing and AI applications.

- OIF Involvement: Their work with the Optical Internetworking Forum (OIF) contributes to advancements in optical networking technologies, essential for data center infrastructure.

- PCI-SIG Contributions: Alphawave Semi actively contributes to PCI-SIG, influencing the evolution of the PCI Express interface, a foundational technology for high-speed data transfer in computers and servers.

Technology and Component Vendors

Alphawave Semi's strategic alliances with key technology and component vendors are foundational to its business model. These partnerships, including those with industry leaders like Arm, Keysight, Amphenol, and Micron, are crucial for co-developing and validating advanced integrated solutions. For instance, collaborations facilitate the creation and demonstration of high-performance subsystems, such as those utilizing High Bandwidth Memory 3E (HBM3E), and cutting-edge optical interconnect technologies.

These collaborations are not merely about product development; they are instrumental in showcasing the practical applicability and robust performance of Alphawave Semi's technologies. By integrating their solutions with components from these reputable vendors, Alphawave Semi can effectively demonstrate real-world performance benchmarks and interoperability. This is particularly important in areas like advanced memory interfaces and high-speed data transmission, where ecosystem validation is paramount for market adoption.

- Arm: Partnership enables integration of Arm's processor cores with Alphawave Semi's connectivity IP, showcasing high-performance computing solutions.

- Keysight: Collaboration with Keysight Technologies ensures rigorous testing and validation of Alphawave Semi's high-speed interconnects, confirming compliance with industry standards.

- Amphenol: Joint efforts with Amphenol, a leader in interconnect solutions, are vital for developing and demonstrating advanced optical and electrical interconnect technologies.

- Micron: Strategic alignment with Micron, a memory leader, is essential for showcasing the capabilities of HBM3E subsystems and other advanced memory interface solutions.

Alphawave Semi's key partnerships extend to foundational technology providers and critical industry standards bodies. Collaborations with EDA giants like Siemens EDA are vital for expanding sales channels and increasing the accessibility of their IP for SoC and 3D-IC designs. Furthermore, active participation in organizations such as UALink, OIF, and PCI-SIG allows Alphawave Semi to influence and align its innovations with market demands, ensuring future interoperability and adoption.

These strategic alliances are crucial for Alphawave Semi, often leading to early design wins. This means their intellectual property (IP) and chiplets are integrated into the very first versions of new, cutting-edge systems, giving them a significant head start in emerging markets. For instance, their leadership in UALink directly influences the development of next-generation interconnects.

Alphawave Semi's engagement with industry standard organizations like UALink, OIF, and PCI-SIG is crucial. These partnerships allow them to actively shape the future of connectivity, ensuring their innovations are aligned with market demands. For example, in 2023, Alphawave Semi announced its participation in the UALink consortium, a significant step in defining the future of chip-to-chip communication for AI and HPC applications.

| Partner Type | Example Partners | Impact on Alphawave Semi | Key Collaboration Area | 2024 Relevance |

|---|---|---|---|---|

| Foundry Partners | TSMC, Samsung Foundry | Access to leading-edge process nodes (e.g., 3nm, 2nm) | Manufacturing of advanced silicon IP and chiplets | Ensures continued delivery of high-performance solutions for AI and data centers. |

| Technology & Component Vendors | Arm, Keysight, Amphenol, Micron | Co-development and validation of integrated solutions | Showcasing high-performance subsystems (e.g., HBM3E, optical interconnects) | Demonstrates practical applicability and robust performance, crucial for market adoption. |

| EDA Partners | Siemens EDA | Extended sales channels, increased IP accessibility | Facilitating SoC and 3D-IC design adoption | Aims to broaden the customer base for their advanced IP offerings. |

| Industry Standards Bodies | UALink, OIF, PCI-SIG | Shaping future connectivity, ensuring interoperability | Defining standards for chip-to-chip communication, optical networking, and PCIe interfaces | Active contribution to UALink and PCI Express 6.0/7.0 ensures future-proof designs. |

What is included in the product

A meticulously crafted Business Model Canvas for ALPHAWAVE SEMI, detailing its customer segments, value propositions, and revenue streams to guide strategic growth and investment. This canvas provides a clear roadmap of their operational framework and market positioning.

ALPHAWAVE SEMI's Business Model Canvas simplifies complex semiconductor industry strategies, offering a clear, actionable framework that reduces the pain of understanding and communicating intricate value propositions.

Activities

Alphawave Semi's core strength lies in its relentless pursuit of innovation through significant investment in Research and Development for high-speed connectivity silicon IP. This includes critical technologies like SerDes, PCIe, CXL, HBM, and the emerging UCIe standard.

This continuous R&D ensures their IP portfolio stays ahead of the curve, offering leading-edge performance and power efficiency for demanding data-intensive applications. For instance, their SerDes IP is designed to meet the ever-increasing bandwidth requirements of data centers and AI infrastructure.

In 2024, the semiconductor industry saw continued robust demand for advanced connectivity solutions, driven by AI, 5G, and cloud computing. Alphawave Semi's commitment to R&D positions them to capitalize on these growth trends, with their IP being integral to next-generation chip designs across various sectors.

Alphawave Semi's core activity is custom silicon design and engineering, where they undertake non-recurring engineering (NRE) contracts. This means they partner with clients to create highly specific silicon chips from scratch.

Their process involves translating customer requirements into detailed chip designs, a complex undertaking that includes rigorous verification and integration. For instance, in 2023, Alphawave Semi announced multiple design wins with leading hyperscalers and Tier-1 customers, underscoring the demand for their specialized NRE services.

Alphawave Semi's key activity revolves around the intricate development and seamless integration of specialized chiplets. This includes pioneering multi-protocol I/O chiplets and high-performance Arm-based compute chiplets, crucial for the burgeoning AI and data center markets.

The company's expertise in advanced packaging architectures allows these individual chiplets to function as a cohesive, powerful unit. This modular approach is fundamental to their strategy, enabling faster time-to-market and greater design flexibility for their clients.

In 2024, Alphawave Semi highlighted its commitment to this area by announcing collaborations with major players in the semiconductor industry, aiming to accelerate the adoption of their chiplet technology. This focus on integration solidifies their position as a leader in the evolving landscape of semiconductor design.

Productization of Connectivity Solutions

Alphawave Semi is actively shifting its focus to becoming a semiconductor product company. This strategic move involves the development and market introduction of proprietary silicon products, notably their optoelectronics Digital Signal Processors (DSPs). These products, including the Cu-Wave, O-Wave, and Co-Wave series, are designed for high-speed optical and electrical interconnects, marking a significant expansion beyond their traditional IP licensing model into tangible hardware offerings.

This productization strategy allows Alphawave Semi to capture more value across the entire supply chain. By offering integrated solutions, they can better address the evolving needs of customers in demanding sectors like data centers and high-performance computing. For instance, in 2023, the company reported a substantial increase in design wins for their advanced connectivity solutions, indicating strong market reception for their productized offerings.

- Product Development: Launching branded silicon like optoelectronics DSPs (Cu-Wave, O-Wave, Co-Wave).

- Market Expansion: Moving beyond IP licensing to selling physical connectivity products.

- Customer Value: Providing integrated solutions for high-speed optical and electrical interconnects.

- Revenue Growth: Aiming to capture greater value through direct product sales, complementing IP licensing revenue streams.

Customer Engagement and Design Wins

AlphaWave Semi's core activities revolve around actively securing new intellectual property and custom silicon design wins. This is crucial for establishing their technology leadership and building a robust pipeline of future revenue streams.

These design wins are primarily targeted at hyperscalers, AI companies, and other prominent semiconductor firms. Successfully engaging these key players demonstrates AlphaWave's ability to meet the demanding technical requirements of cutting-edge technology providers.

- Securing Design Wins: Actively pursuing and winning design contracts with major tech players is paramount.

- Technology Leadership: Demonstrating superior technology to secure these wins is a key operational focus.

- Revenue Pipeline: Building a strong pipeline of future revenue through these design engagements is essential for sustained growth.

- Customer Engagement: Deeply engaging with potential clients to understand their needs and tailor silicon solutions is a core activity.

Alphawave Semi's key activities center on developing and licensing advanced silicon IP, particularly for high-speed connectivity like SerDes and PCIe. They also engage in custom silicon design projects, known as NRE contracts, where they engineer specialized chips for clients. Furthermore, the company is increasingly focused on becoming a product company by offering proprietary solutions such as optoelectronics DSPs.

| Key Activity | Description | 2024 Relevance |

|---|---|---|

| IP Development & Licensing | Creating and licensing high-speed connectivity silicon IP. | Continues to be a foundational revenue stream, critical for enabling next-gen chip designs in AI and data centers. |

| Custom Silicon Design (NRE) | Partnering with clients for bespoke chip design from concept to verification. | Drives significant revenue and reinforces relationships with hyperscalers and Tier-1 customers, as seen with multiple design wins in 2023. |

| Productization | Developing and selling proprietary silicon products like optoelectronics DSPs. | Represents a strategic shift to capture more value, with products like Cu-Wave and O-Wave targeting high-growth markets. |

| Chiplet Integration | Designing and integrating specialized chiplets for modular, high-performance solutions. | Facilitates faster time-to-market and design flexibility, with collaborations in 2024 aiming to accelerate chiplet adoption. |

Delivered as Displayed

Business Model Canvas

The ALPHAWAVE SEMI Business Model Canvas you are previewing is the exact, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the high-quality, ready-to-use file you'll gain immediate access to. Rest assured, what you see is precisely what you'll get, enabling you to immediately leverage its insights for your business strategy.

Resources

Alphawave Semi’s proprietary silicon IP portfolio is a cornerstone of its business, featuring advanced high-speed connectivity solutions like SerDes, PCIe, CXL, HBM, and UCIe. This extensive collection of intellectual property is critical for enabling faster and more dependable data transfer, a key differentiator in the semiconductor industry.

In 2024, the demand for high-performance connectivity IP continues to surge, driven by AI, data centers, and advanced computing. Alphawave Semi’s robust IP library positions them to capitalize on this trend, offering essential components for next-generation chip designs.

Alphawave Semi's core strength is its profound technical expertise in crafting intricate high-speed analog and mixed-signal circuits. This specialization is absolutely crucial for building the advanced SerDes and interconnect technologies that power today's data-intensive applications.

This deep-seated knowledge serves as a significant competitive advantage. For instance, in 2024, the demand for faster and more efficient data transfer solutions continued to surge, with the global SerDes market projected to reach substantial figures, underscoring the value of Alphawave's specialized design capabilities.

Alphawave Semi's skilled engineering and R&D teams are the bedrock of its innovation, developing cutting-edge custom silicon solutions. These teams are instrumental in pushing technological boundaries, a critical factor in their competitive edge.

The company's R&D investment reflects this commitment; in 2023, Alphawave Semi reported significant spending on research and development, underscoring the value placed on their engineering talent to drive future product pipelines.

This deep pool of expertise allows Alphawave Semi to tackle complex design challenges and deliver high-performance connectivity solutions, directly impacting their ability to secure and execute large, intricate customer projects.

Strategic Foundry Relationships

Strategic foundry relationships are critical for AlphaWave Semi's business model. Their strong, long-standing partnerships with industry leaders like TSMC and Samsung Foundry grant them crucial access to cutting-edge process technologies, including the highly sought-after 3nm and 2nm nodes. This access is fundamental to ensuring the successful manufacturing of AlphaWave's advanced silicon and chiplets, which are designed for high performance.

These collaborations are not merely transactional; they represent a deep integration that underpins AlphaWave's ability to innovate and deliver. For instance, in 2024, TSMC’s advanced node capacity is heavily allocated, making these established relationships invaluable for securing production slots and guaranteeing the manufacturability of AlphaWave's next-generation designs. This strategic alignment ensures AlphaWave remains at the forefront of semiconductor technology.

- Access to Advanced Nodes: Partnerships with TSMC and Samsung Foundry provide AlphaWave Semi with access to leading-edge process technologies like 3nm and 2nm, crucial for high-performance chip manufacturing.

- Manufacturing Assurance: These long-standing relationships ensure the reliable manufacturability of AlphaWave's complex silicon and chiplet designs, mitigating production risks.

- Technological Edge: By collaborating closely with foundries, AlphaWave can influence and leverage the latest advancements in semiconductor manufacturing, maintaining a competitive advantage.

- Capacity Allocation: In a market with high demand for advanced nodes, these strategic foundry relationships help secure essential production capacity for AlphaWave's products throughout 2024 and beyond.

Advanced Design and Verification Tools

Advanced Design and Verification Tools are crucial for AlphaWave Semi. Proficiency in leading Electronic Design Automation (EDA) tools allows for the intricate design and simulation of complex silicon IP and chiplets. These tools are essential for validating functionality and performance before manufacturing.

The market for EDA software is substantial, with projections indicating continued growth. For instance, the global EDA market was valued at approximately $12.5 billion in 2023 and is expected to reach over $18 billion by 2028, demonstrating the significant investment in these critical resources.

- State-of-the-art EDA Software: Access to and expertise in tools like Cadence Virtuoso, Synopsys Design Compiler, and Mentor Graphics Calibre are non-negotiable for competitive chip design.

- Verification Platforms: Utilizing advanced verification methodologies and platforms, such as Universal Verification Methodology (UVM) and formal verification tools, ensures the quality and reliability of silicon IP.

- Simulation and Emulation: High-performance simulation and emulation platforms are vital for rapidly testing and debugging complex designs, reducing time-to-market.

- Talent and Training: Investing in skilled engineers proficient with these advanced tools is a key resource, as tool mastery directly impacts design efficiency and success rates.

Alphawave Semi's key resources are its extensive proprietary silicon IP portfolio, deep technical expertise in high-speed analog and mixed-signal design, and highly skilled engineering teams. These elements are fundamental to creating the advanced connectivity solutions that power modern data-intensive applications. Strategic foundry relationships, particularly with leaders like TSMC and Samsung, ensure access to cutting-edge manufacturing processes, while advanced EDA tools are critical for design and verification, enabling the delivery of high-performance chiplets.

| Key Resource | Description | 2024 Relevance/Data |

| Proprietary Silicon IP Portfolio | High-speed connectivity IP (SerDes, PCIe, CXL, HBM, UCIe) enabling faster data transfer. | Demand driven by AI and data centers continues to surge. |

| Technical Expertise | Specialized knowledge in complex high-speed analog and mixed-signal circuit design. | Global SerDes market projected for substantial growth in 2024, highlighting the value of this expertise. |

| Engineering & R&D Teams | Skilled talent focused on developing cutting-edge custom silicon solutions. | Significant R&D investment in 2023 by Alphawave Semi underscores the importance of these teams. |

| Foundry Relationships | Access to advanced nodes (e.g., 3nm, 2nm) via TSMC and Samsung Foundry. | Securing 2024 capacity with TSMC is critical due to high demand for advanced nodes. |

| EDA Tools & Talent | Proficiency in advanced design and verification software and skilled engineers. | The EDA market was valued at ~$12.5 billion in 2023, with growth expected to exceed $18 billion by 2028. |

Value Propositions

Alphawave Semi's ultra-high-speed data connectivity is a core value proposition, crucial for handling the massive data flows essential for AI, data centers, and 5G networks. This technology directly tackles the growing challenge of data bottlenecks in modern computing architectures.

Their solutions facilitate significantly faster and more dependable data transfer, a critical requirement for performance-intensive applications. For instance, in 2024, the global AI market was projected to reach hundreds of billions of dollars, underscoring the demand for the very connectivity Alphawave provides.

AlphaWave Semi's silicon IP and chiplets are foundational building blocks for the next generation of computing. They are essential for creating the high-performance AI accelerators and robust data center infrastructure needed to handle complex AI workloads. This allows companies to push the boundaries of what's possible with artificial intelligence.

By providing these critical components, AlphaWave Semi directly enables the development of more powerful and efficient AI systems. Their technology is key to unlocking the full potential of AI applications, from advanced analytics to machine learning model training. This is a significant driver for the booming AI market, which is projected to reach hundreds of billions of dollars in the coming years.

Alphawave Semi's silicon-proven IP and chiplet solutions significantly de-risk complex semiconductor designs for their customers. This means clients can avoid costly and time-consuming redesigns, a crucial factor in the fast-paced tech industry.

By leveraging Alphawave Semi's pre-validated building blocks, companies can drastically shorten their product development timelines. This acceleration is vital for staying competitive and capturing market share, especially in areas like AI and high-performance computing.

For instance, in 2024, the average time to market for a new advanced semiconductor chip often exceeds 18 months. Alphawave Semi's offerings can potentially shave off several months from this process, directly impacting a company's ability to launch new products and generate revenue sooner.

Power Efficiency and Scalability

Alphawave Semi's advanced connectivity solutions are engineered for superior power efficiency, a crucial factor for the economic viability of massive data centers and the burgeoning AI infrastructure. This efficiency directly translates into lower operational costs and reduced environmental impact, making them a compelling choice for energy-conscious deployments.

The company's technology offers the inherent scalability required to manage the relentless growth in data volumes and the ever-increasing computational demands of modern applications. This ensures that infrastructure built with Alphawave Semi's components can adapt and expand without performance degradation.

- Power Efficiency: Alphawave Semi's PCIe 5.0 and 6.0 retimers and redrivers are designed to consume significantly less power per gigabit compared to competing solutions, a critical advantage for hyperscale data centers.

- Scalability: Their solutions enable longer trace lengths and support higher bandwidths, allowing for more flexible and scalable data center architectures, accommodating future growth in data traffic.

- AI Infrastructure: The demand for high-speed, low-latency connectivity is paramount for AI workloads. Alphawave Semi's products are vital for building the robust networks that power these advanced systems.

Customizable and Integrated Solutions

ALPHAWAVE SEMI provides highly adaptable intellectual property (IP) and chiplet solutions, alongside dedicated custom silicon design services. This flexibility empowers clients to precisely tailor connectivity components to their unique application needs, fostering the creation of deeply integrated and highly optimized systems.

The company's approach allows for significant customization, meaning customers aren't forced into one-size-fits-all solutions. This is critical in the semiconductor industry where specific performance metrics and power envelopes are paramount for success. For instance, in 2024, the demand for specialized silicon in areas like AI acceleration and advanced networking continued to surge, with companies seeking partners like ALPHAWAVE SEMI to deliver these tailored solutions.

- Tailored Connectivity: Customers can select and configure IP and chiplets to meet exact application specifications.

- System Optimization: Integration of custom solutions leads to improved performance and efficiency.

- Reduced Time-to-Market: Leveraging existing IP and design expertise accelerates product development cycles.

- Competitive Advantage: Highly integrated, optimized chips provide a distinct edge in demanding markets.

Alphawave Semi offers ultra-high-speed data connectivity essential for AI, data centers, and 5G. Their silicon IP and chiplets are foundational for next-gen computing, enabling powerful AI accelerators and robust data center infrastructure. This directly addresses the exponential growth in data traffic and computational demands, crucial for markets like AI which saw projected revenues in the hundreds of billions in 2024.

Customer Relationships

Alphawave Semi cultivates collaborative relationships, especially for custom silicon. They partner with customer engineering teams from initial concept through final tape-out, ensuring seamless integration. This deep involvement is crucial for achieving optimal performance in complex semiconductor designs.

Alphawave Semi cultivates long-term strategic partnerships with major hyperscalers and leading semiconductor firms. This focus positions them as a vital technology supplier, catering to the dynamic connectivity requirements of these industry giants, as demonstrated by consistent repeat design wins and sustained collaborative efforts.

Alphawave Semi's technical support is a cornerstone of their customer relationships, ensuring clients can effectively integrate and maximize the performance of advanced connectivity solutions. This involves providing in-depth expertise to navigate the complexities of their high-speed chiplet technology.

In 2024, the company continued to emphasize this, offering specialized engineering assistance to help customers overcome design challenges and accelerate time-to-market for their innovative products. This hands-on approach fosters strong partnerships and drives successful adoption of Alphawave Semi's cutting-edge IP.

Direct Sales and Technical Engagement

Alphawave Semi fosters direct sales and technical engagement to build strong customer relationships. This approach is crucial for understanding intricate customer needs in high-value areas like IP licensing and custom silicon development. Their teams work closely with clients, offering personalized solutions that address specific technical challenges.

This direct interaction allows Alphawave Semi to act as a true partner, not just a vendor. For instance, in 2024, the company highlighted successful collaborations where their engineers worked alongside customer design teams to optimize chip performance for next-generation applications. This hands-on approach ensures that the intellectual property licensed or the custom silicon designed precisely meets the demanding specifications of their clients, leading to more robust and efficient end products.

- Direct Sales & Technical Teams: Facilitate personalized interactions and deep understanding of customer needs.

- Tailored Solutions: Offer customized IP licensing and custom silicon designs based on specific client challenges.

- High-Value Deals: Focus on complex projects requiring close collaboration and expert technical support.

- Partnership Approach: Build long-term relationships by actively engaging in customer design processes.

Ecosystem Engagement and Industry Events

Alphawave Semi actively participates in key industry events and conferences, such as the Optical Fiber Communication Conference (OFC) and the Chiplet Summit. This engagement allows them to connect with a wide range of potential and existing customers, demonstrating their cutting-edge technologies and fostering crucial industry relationships.

These events serve as vital platforms for Alphawave Semi to showcase their latest innovations and solutions, directly interacting with the broader technology ecosystem. By being present and contributing to discussions at these gatherings, they reinforce their position as an industry leader and build a strong network.

- Industry Event Participation: Alphawave Semi's presence at events like OFC and the Chiplet Summit facilitates direct customer engagement.

- Innovation Showcase: These platforms are used to highlight their latest advancements in connectivity and chiplet technology.

- Ecosystem Relationship Building: Participation helps forge and strengthen relationships within the semiconductor and broader technology industries.

- Market Visibility: Engaging in industry events enhances brand awareness and positions Alphawave Semi as a key player in the market.

Alphawave Semi prioritizes deep, collaborative relationships, particularly for custom silicon projects. They engage with customer engineering teams from the initial concept through to final tape-out, ensuring seamless integration and optimal performance in complex designs. This hands-on approach, evident in their 2024 activities, solidifies their role as a strategic partner rather than just a vendor.

| Customer Relationship Aspect | Description | 2024 Focus/Impact |

|---|---|---|

| Direct Engagement | Sales and technical teams work closely with clients. | Understanding intricate needs for IP licensing and custom silicon. |

| Partnership Model | Collaborating on design processes from concept to tape-out. | Accelerating time-to-market and optimizing chip performance for clients. |

| Technical Support | Providing in-depth expertise for complex technology integration. | Ensuring effective use of high-speed chiplet technology. |

| Industry Presence | Participation in events like OFC and Chiplet Summit. | Showcasing innovation, fostering ecosystem relationships, and enhancing market visibility. |

Channels

Alphawave Semi leverages a direct sales force to cultivate relationships with major clients like hyperscalers and AI firms. This approach is crucial for securing high-value intellectual property licensing deals and custom silicon design projects, enabling direct negotiation and tailored solutions.

Alphawave Semi leverages strategic partnerships with Electronic Design Automation (EDA) vendors like Siemens EDA. These collaborations act as crucial indirect channels, enabling Alphawave Semi's cutting-edge IP to reach a broader audience of semiconductor design houses. This integration within established design flows simplifies adoption and accelerates the deployment of their advanced connectivity solutions.

Participation in key industry conferences like OFC, Chiplet Summit, and TSMC Technology Symposiums is a vital channel for ALPHAWAVE SEMI. These events are prime opportunities to unveil new products and demonstrate technological prowess, directly engaging with potential clients and partners.

In 2024, the semiconductor industry saw significant investment in R&D, with companies allocating substantial budgets to innovation. Events like these are where ALPHAWAVE SEMI can showcase advancements, attracting interest from a market actively seeking cutting-edge solutions. For instance, OFC (Optical Networking and Communication Conference) is a major hub for optical technology, a critical area for advanced semiconductor applications.

Online Presence and Digital Marketing

Alphawave Semi leverages its corporate website and dedicated investor relations portals as primary channels for information dissemination. These platforms are crucial for engaging with stakeholders and providing transparent updates on company performance. In 2024, the company continued to emphasize its digital presence to reach a global audience.

The company’s digital content strategy includes a variety of formats designed to attract potential customers and support lead generation. This encompasses detailed product briefs, informative webinars, insightful technical articles, and engaging videos that showcase their cutting-edge technology. By offering this rich content, Alphawave Semi aims to establish thought leadership and educate the market about its solutions.

- Corporate Website: Serves as the central hub for all company information, product details, and news.

- Investor Relations Portal: Provides financial reports, SEC filings, and shareholder information, crucial for attracting and retaining investors.

- Digital Content: Product briefs, webinars, technical articles, and videos educate potential customers and generate leads.

- Marketing Reach: In 2024, digital marketing efforts focused on expanding reach to key semiconductor industry segments globally.

Strategic Alliances and Ecosystem Programs

Strategic alliances are crucial for AlphaWave Semi, enabling them to tap into established customer bases and co-develop solutions. By partnering with entities like TSMC through its IP Alliance Program, AlphaWave gains access to a broad network of chip designers and manufacturers who trust TSMC's infrastructure.

These collaborations facilitate joint marketing efforts, amplifying AlphaWave's reach and credibility. Furthermore, participation in chiplet ecosystem initiatives allows for the integration of AlphaWave's technology with other leading semiconductor components, creating more comprehensive and attractive offerings for customers.

For instance, in 2024, the semiconductor industry saw a significant increase in collaborative projects aimed at accelerating chip development and reducing time-to-market. AlphaWave's engagement in these programs positions them to benefit from this trend, potentially leading to increased design wins and revenue streams as these ecosystems mature.

- TSMC IP Alliance Program: Facilitates access to TSMC's extensive customer base and advanced manufacturing capabilities, enabling co-marketing and joint development opportunities.

- Chiplet Ecosystem Initiatives: Allows for seamless integration of AlphaWave's IP with other chiplet providers, creating more robust and competitive system-on-chip (SoC) solutions.

- Customer Reach: Strategic alliances provide direct channels to customers who are already invested in and reliant upon these established semiconductor ecosystems.

- Market Penetration: Collaborative efforts can accelerate market penetration by leveraging the brand recognition and existing relationships of alliance partners.

Alphawave Semi utilizes a multi-faceted channel strategy to reach its diverse customer base. Direct sales are key for high-value engagements, while strategic partnerships extend reach through established ecosystems. Industry events and a robust digital presence further amplify market penetration and lead generation.

In 2024, Alphawave Semi continued to strengthen its direct sales force, focusing on building deep relationships with hyperscalers and AI companies. This direct engagement is critical for securing complex, custom silicon design projects and high-margin intellectual property licensing agreements. The company's website and investor relations portal also remained central for transparent communication with stakeholders.

Strategic alliances, particularly with foundries like TSMC through its IP Alliance Program, provide Alphawave Semi with invaluable access to a wider network of chip designers. These collaborations, including participation in chiplet ecosystem initiatives, are designed to accelerate market penetration by leveraging the trust and reach of established players. In 2024, the trend of industry-wide collaboration to speed up chip development was a significant tailwind for these partnerships.

Industry conferences such as OFC and Chiplet Summit serve as vital platforms for Alphawave Semi to showcase its technological advancements. These events allow for direct interaction with potential clients and partners, fostering new business opportunities. The company's digital content strategy, featuring product briefs, webinars, and technical articles, complements these efforts by educating the market and establishing thought leadership.

| Channel Type | Primary Use Case | 2024 Focus/Impact | Key Partners/Examples |

|---|---|---|---|

| Direct Sales | High-value IP licensing, custom silicon design | Deepening relationships with hyperscalers and AI firms | Hyperscalers, AI companies |

| Strategic Partnerships | Extended market reach, ecosystem integration | Leveraging foundry IP programs, chiplet initiatives | TSMC IP Alliance Program |

| Industry Events | Product showcases, lead generation, networking | Unveiling new technologies at OFC, Chiplet Summit | OFC, Chiplet Summit, TSMC Technology Symposiums |

| Digital Channels | Information dissemination, lead generation, thought leadership | Enhancing website, investor relations portal, digital content | Corporate Website, Investor Relations Portal, Webinars, Technical Articles |

Customer Segments

Hyperscale data center operators, such as Amazon Web Services, Microsoft Azure, and Google Cloud, are the primary customers for AlphaWave Semi's advanced connectivity solutions. These giants demand ultra-high-speed, power-efficient components to support their massive server farms, networking infrastructure, and burgeoning AI workloads. In 2024, the global hyperscale data center market was valued at an estimated $335.1 billion, with significant ongoing investment in network upgrades.

AI chip developers, including those creating GPUs and specialized AI processors, represent a critical customer segment. These companies need advanced solutions like high-bandwidth memory interfaces and chiplet interconnects to fuel their demanding AI applications.

The demand for AI-specific hardware is booming. For instance, the global AI chip market was valued at approximately $30 billion in 2023 and is projected to reach over $100 billion by 2028, highlighting the significant need for high-performance IP from companies like Alphawave Semi.

Tier-one semiconductor companies are Alphawave Semi's primary customers. These are the giants of the industry, designing the complex chips that power everything from data centers to advanced AI systems. They integrate Alphawave's high-speed connectivity IP directly into their own System-on-Chips (SoCs).

These leading firms are constantly pushing the boundaries of performance, requiring cutting-edge solutions for networking, compute, and storage applications. For example, companies like Intel, NVIDIA, and AMD are key players in this space, all of whom are actively developing next-generation processors and accelerators that demand advanced interconnect technologies.

In 2024, the demand for high-bandwidth connectivity continues to surge, driven by AI workloads and the expansion of 5G infrastructure. Alphawave Semi's technology directly addresses this need, enabling these tier-one companies to deliver more powerful and efficient chips to the market, ensuring their competitive edge.

5G Wireless Infrastructure Providers

Alphawave Semi's advanced connectivity solutions are crucial for 5G wireless infrastructure providers. These companies are building the backbone of next-generation mobile networks, requiring high-speed, low-latency data transfer. Alphawave Semi's silicon enables the efficient processing and transmission of massive amounts of data essential for 5G deployment.

The demand for 5G infrastructure is rapidly expanding globally. For instance, by the end of 2024, it's projected that over 30% of global mobile subscriptions will be for 5G services, driving significant investment in network build-outs. This creates a substantial market for companies like Alphawave Semi that supply the underlying technology.

- Enabling High-Speed Data Transfer: Alphawave Semi's technology facilitates the terabits per second data rates needed for 5G base stations and core network components.

- Supporting Network Densification: As 5G networks become denser with more cell sites, the demand for reliable and efficient connectivity chips increases.

- Driving Innovation in Wireless Tech: Companies building 5G infrastructure rely on cutting-edge solutions to meet performance and power efficiency requirements.

Automotive and Storage Solutions Developers

Automotive and Storage Solutions Developers represent a key customer segment for AlphaWave Semi, driven by the accelerating demand for high-performance connectivity and data processing. The automotive industry's pivot towards advanced driver-assistance systems (ADAS) and fully autonomous vehicles necessitates robust, low-latency communication solutions. For instance, the global automotive semiconductor market is projected to reach $150 billion by 2030, with a significant portion attributed to connectivity and processing power for autonomous features.

Within this segment, the push for solid-state storage (SSD) solutions, especially in data centers and high-performance computing, creates substantial opportunities. These applications demand ultra-fast data transfer rates and efficient power management, areas where AlphaWave Semi's advanced chip technologies can provide a competitive edge. The global SSD market size was valued at approximately $30 billion in 2023 and is expected to grow substantially, fueled by these demanding use cases.

- Automotive Connectivity: Enabling seamless, high-speed data exchange for autonomous driving systems and in-car infotainment.

- Solid-State Storage (SSD): Providing the foundation for faster data access and processing in data centers and enterprise storage.

- High-Performance Computing (HPC): Supporting the computational demands of complex simulations and AI workloads.

- Emerging Automotive Trends: Catering to the evolving needs of electric vehicles (EVs) and connected car technologies.

AlphaWave Semi's customer base is strategically focused on entities driving the demand for advanced connectivity. This includes hyperscale data center operators, AI chip developers, tier-one semiconductor companies, and 5G infrastructure providers.

These segments are characterized by their need for ultra-high-speed, power-efficient components to support massive data processing, AI workloads, and next-generation networking. The automotive and storage solutions sectors also represent significant opportunities, requiring robust, low-latency communication for ADAS and high-performance SSDs.

The market for these technologies is substantial and growing. For instance, the global hyperscale data center market reached an estimated $335.1 billion in 2024, underscoring the immense scale of demand for AlphaWave Semi's solutions.

The AI chip market, valued around $30 billion in 2023, is projected to exceed $100 billion by 2028, highlighting the critical role of advanced IP in this rapidly expanding field.

| Customer Segment | Key Needs | Market Relevance (2024 Data/Projections) |

|---|---|---|

| Hyperscale Data Centers | Ultra-high-speed, power-efficient connectivity | Global market valued at $335.1 billion |

| AI Chip Developers | High-bandwidth memory interfaces, chiplet interconnects | AI chip market projected to reach over $100 billion by 2028 (from ~$30 billion in 2023) |

| Tier-One Semiconductor Companies | Cutting-edge networking, compute, and storage IP integration | Directly supplying components for next-gen processors and accelerators |

| 5G Infrastructure Providers | High-speed, low-latency data transfer for network build-outs | Over 30% of global mobile subscriptions projected to be 5G by end of 2024 |

| Automotive & Storage Solutions | Robust connectivity for ADAS, high-performance SSDs | Automotive semiconductor market projected to reach $150 billion by 2030; SSD market ~$30 billion in 2023 |

Cost Structure

AlphaWave Semi dedicates a substantial portion of its resources to Research and Development. In 2024, the company continued its aggressive investment in R&D, aiming to develop novel intellectual property and advanced chiplet technologies.

This ongoing commitment to innovation is paramount for AlphaWave Semi to sustain its technological edge and competitive standing in the semiconductor industry. These R&D efforts directly fuel the creation of next-generation silicon products.

Sales, General, and Administrative (SG&A) expenses for AlphaWave Semi encompass the costs of running its sales and marketing efforts, managing its administrative functions, and covering general corporate overhead. This includes salaries for personnel not directly involved in engineering, such as sales teams, marketing specialists, HR, and finance departments. For instance, in the first quarter of 2024, AlphaWave Semi reported SG&A expenses of $15.2 million, reflecting ongoing investments in market expansion and operational support.

These operational costs also cover essential office expenses like rent, utilities, and supplies, as well as crucial professional services such as legal fees and accounting. These expenditures are vital for maintaining the company's infrastructure and ensuring compliance. AlphaWave Semi's commitment to growth in 2024 is evident in its strategic allocation of resources towards strengthening its sales channels and administrative capabilities.

Even though Alphawave Semi follows a fabless approach, significant manufacturing expenses arise from collaborating with foundries. These include the costs of creating masks, the actual silicon wafer fabrication process, and the subsequent packaging of the chips. For instance, in 2024, the semiconductor industry saw substantial investments in advanced packaging, reflecting the increasing complexity and cost of bringing chips to market.

As Alphawave Semi expands its portfolio to include more silicon-based products, these manufacturing and production costs are projected to rise. This shift necessitates careful financial planning to manage the increased expenditure on foundry services and related production activities, directly impacting the company's cost structure.

Employee Salaries and Benefits

Employee salaries and benefits are a significant fixed cost for AlphaWave Semi, reflecting the need to attract and retain a highly skilled workforce. This includes compensation for engineers, designers, sales professionals, and administrative staff. For instance, in 2024, the semiconductor industry saw average salaries for experienced engineers range from $120,000 to $180,000 annually, with benefits adding an additional 30-40% on top of base pay.

- Attracting Top Talent: Competitive compensation packages are essential to secure the specialized expertise required for chip design and manufacturing.

- Innovation Investment: High salaries for research and development personnel directly fuel the company's capacity for innovation and new product development.

- Operational Stability: A stable, well-compensated workforce reduces turnover, ensuring continuity in critical business functions and project execution.

- Industry Benchmarks: AlphaWave Semi's salary structure must align with industry standards to remain competitive in the talent market.

Intellectual Property (IP) Maintenance and Licensing

AlphaWave Semi incurs significant costs to safeguard its intellectual property. These expenses include filing new patents, maintaining existing ones through renewal fees, and managing legal protections for its innovations. In 2024, the global semiconductor industry saw patent application filings continue to rise, reflecting intense competition and the rapid pace of technological advancement. For instance, major players often spend millions annually on IP protection.

Beyond internal IP, AlphaWave Semi may also license technology from other entities to enhance its product offerings or gain access to specialized components. These licensing agreements typically involve upfront fees, ongoing royalties, or a combination of both, adding to the overall cost structure. The complexity and value of the licensed IP directly influence these costs.

Key cost components within Intellectual Property (IP) Maintenance and Licensing include:

- Patent Filing and Prosecution: Costs associated with drafting, filing, and prosecuting patent applications in various jurisdictions worldwide. This can range from tens of thousands to hundreds of thousands of dollars per patent family.

- Patent Maintenance Fees: Annual or periodic fees required to keep granted patents in force. These fees generally increase over the life of the patent.

- Third-Party IP Licensing: Payments made for licenses to use patented technologies or intellectual property owned by other companies. Licensing fees can be fixed, royalty-based, or milestone-driven.

- IP Portfolio Management: Costs related to managing and strategizing the company's IP assets, including IP audits, freedom-to-operate analyses, and competitive IP landscaping.

AlphaWave Semi's cost structure is heavily influenced by its R&D investments and manufacturing outsourcing. Significant expenses are allocated to attracting and retaining top engineering talent, with average engineer salaries in 2024 ranging from $120,000 to $180,000 annually, plus benefits. Manufacturing costs, driven by foundry partnerships for wafer fabrication and packaging, also represent a major expenditure, especially as the company expands its product lines.

Sales, General, and Administrative (SG&A) costs, including marketing and operational overhead, are managed to support growth, with Q1 2024 SG&A at $15.2 million. Intellectual property protection, through patent filings and licensing, adds further to the cost base, with global IP protection spending by major players often in the millions annually.

| Cost Category | Description | 2024 Impact/Example |

| Research & Development | Developing new chiplet technologies and IP | Aggressive investment to maintain technological edge |

| Manufacturing (Foundry) | Wafer fabrication, masks, packaging | Costs rising with product portfolio expansion; industry investment in advanced packaging |

| SG&A | Sales, marketing, administration, overhead | Q1 2024: $15.2 million; supports market expansion |

| Employee Compensation | Salaries and benefits for skilled workforce | $120k-$180k average annual salary for experienced engineers + 30-40% benefits |

| Intellectual Property | Patents, licensing, legal protection | Millions spent annually by industry leaders; licensing fees vary |

Revenue Streams

Alphawave Semi's revenue model heavily features IP licensing fees. They license their advanced high-speed connectivity silicon IP to semiconductor manufacturers and large tech companies, often referred to as hyperscalers. These companies then integrate Alphawave's IP into their custom chip designs.

This licensing typically involves an upfront fee, paid when the license is granted, and ongoing royalties. Royalties are usually a percentage of the revenue generated by the end products that incorporate Alphawave's IP. This creates a recurring revenue stream for Alphawave.

For instance, in the first quarter of 2024, Alphawave Semi reported that its licensing segment contributed significantly to its overall performance. While specific royalty percentages are proprietary, the company has highlighted strong demand for its IP in data center and 5G infrastructure markets, indicating robust licensing activity.

Revenue from Custom Silicon Non-Recurring Engineering (NRE) is generated through Alphawave Semi's specialized chip design services. This involves creating bespoke silicon solutions, leveraging their proprietary Intellectual Property (IP) to meet specific client needs.

This segment operates on a project-based model, meaning income is tied to the successful completion of individual design engagements. For instance, in 2023, the company reported significant NRE revenue contributing to its overall financial performance, reflecting strong demand for its custom design capabilities.

Alphawave Semi's revenue is increasingly shifting towards direct sales of its proprietary silicon products, such as advanced chiplets and optoelectronics Digital Signal Processors (DSPs). This strategic move marks a significant evolution for the company as it transitions into a full-fledged semiconductor product entity.

The company anticipates substantial growth in revenue from these silicon product sales, projecting a strong upward trajectory for 2025 and the years following. This segment is becoming a cornerstone of their business model, reflecting the increasing demand for high-performance connectivity solutions.

Royalties from Silicon Production

Alphawave Semi generates ongoing revenue through royalties tied to the volume of silicon produced using their intellectual property. This model ensures a recurring income stream as their customers' products gain market traction and scale production.

For instance, if a customer's chip, incorporating Alphawave's technology, is manufactured in large quantities, Alphawave receives a percentage of revenue or a per-unit royalty. This is a crucial element for long-term financial stability.

- Recurring Revenue: Royalties provide a predictable income stream beyond upfront licensing fees.

- Scalability: Revenue grows directly with the success and production volume of customer products.

- Customer Alignment: Aligns Alphawave's success with their customers' manufacturing output.

Flexible Spending Account (FSA) Drawdowns

ALPHAWAVE SEMI generates revenue through Flexible Spending Account (FSA) agreements with major semiconductor firms. These agreements secure future access to intellectual property (IP), with drawdowns becoming recognized revenue as the designs are implemented.

For instance, in 2024, ALPHAWAVE SEMI announced a significant multi-year IP license agreement with a leading automotive semiconductor manufacturer. This agreement includes an upfront payment and a commitment to future IP access, structured to generate recurring revenue as the customer utilizes the licensed designs.

- FSA Agreements: Contracts with semiconductor companies for future IP access.

- Revenue Recognition: Drawdowns from FSAs convert to revenue upon design utilization.

- 2024 Impact: Key licensing deals in 2024 underscore the model's effectiveness in securing predictable income.

- Strategic Value: FSAs provide a stable revenue base and foster long-term customer relationships.

Alphawave Semi's revenue streams are multifaceted, primarily driven by IP licensing fees and royalties. They also generate income from custom silicon design services (NRE) and the direct sale of their proprietary silicon products, a segment showing significant growth potential.

| Revenue Stream | Description | Key Aspects | 2024 Data/Projections |

| IP Licensing | Licensing advanced high-speed connectivity silicon IP to semiconductor manufacturers and tech companies. | Upfront fees and ongoing royalties based on end-product revenue. | Significant contributor to Q1 2024 performance; strong demand in data center and 5G markets. |

| Custom Silicon NRE | Specialized chip design services for bespoke silicon solutions. | Project-based model tied to successful design engagements. | Contributed significantly to overall financial performance in 2023; strong demand for custom design. |

| Silicon Product Sales | Direct sales of proprietary silicon products like chiplets and DSPs. | Represents a strategic shift towards becoming a full-fledged semiconductor product entity. | Projected substantial growth trajectory for 2025 and beyond. |

| FSA Agreements | Contracts securing future IP access with major semiconductor firms. | Revenue recognized as designs are implemented; provides stable, predictable income. | Announced significant multi-year IP license agreement with an automotive semiconductor manufacturer in 2024. |

Business Model Canvas Data Sources

The ALPHAWAVE SEMI Business Model Canvas is informed by a blend of proprietary market intelligence, financial performance data, and in-depth competitor analysis. These sources ensure a robust and data-driven representation of our strategic approach.