Aviapartner PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aviapartner Bundle

Unlock the forces shaping Aviapartner's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities. Don't get left behind; download the full report to gain actionable intelligence for strategic decision-making.

Political factors

The European Union Aviation Safety Agency (EASA) is set to introduce new ground handling regulations, with a three-year transition period anticipated to begin in late 2024 or early 2025. This significant regulatory shift is designed to enhance safety and standardize ground operations for the estimated 300,000 individuals employed in this sector across Europe.

Aviapartner, with its extensive network of operations spanning numerous European airports, faces the imperative to align its practices with these forthcoming EASA standards. Compliance is crucial not only for maintaining operational licenses but also for ensuring the continued safety and efficiency of its ground handling services.

The ongoing privatization of airports across Europe continues to reshape the industry. For instance, in 2024, several European countries, including Italy and Germany, have advanced plans or initiated sales of significant stakes in major airports, signaling a clear trend away from full state ownership. This transition directly impacts ground handling services, as new private operators may implement different strategies regarding outsourcing and contract negotiations.

Aviapartner must closely monitor these privatization efforts. For example, the sale of a majority stake in a key European hub could lead to a review of existing ground handling agreements, potentially opening doors for Aviapartner to secure new business or facing intensified competition from operators aligned with the new private ownership's objectives.

Geopolitical tensions and rising trade protectionism can significantly disrupt global air travel and cargo. For example, escalating trade disputes, such as those seen between major economic blocs in recent years, have historically led to slower GDP growth and consequently, reduced demand for air freight. This directly impacts Aviapartner's business by potentially decreasing the volume of cargo handled at airports, and could also influence passenger traffic, affecting demand for ground handling services.

Labor Laws and Union Influence

Labor negotiations and wage demands are a constant in the aviation sector, directly affecting companies like Aviapartner. Recent industry-wide discussions have focused on increasing pay for essential aviation personnel, from ground handlers to flight crews. These negotiations can significantly impact Aviapartner's operational expenses and overall profitability.

The ground handling industry, in particular, has grappled with high staff turnover, with some reports indicating annual rates as high as 70% in the period following COVID-19. This dynamic underscores the critical need for robust labor relations and effective employee retention strategies to maintain operational stability and control costs.

- Ongoing Wage Negotiations: Aviation personnel, including ground handling staff, are involved in continuous labor talks concerning wage increases.

- Cost Impact: These negotiations directly influence Aviapartner's operational costs and, consequently, its profitability.

- High Turnover Challenge: Post-COVID-19, the ground handling sector has seen significant staff turnover, with figures sometimes reaching 70% annually, emphasizing the importance of labor relations and retention.

International Aviation Agreements and Standards

Aviapartner's operations are significantly shaped by international aviation agreements and standards, with adherence to bodies like the International Civil Aviation Organization (ICAO) being paramount for smooth cross-border activities. These global benchmarks ensure a consistent level of safety and operational efficiency, which is vital for a company providing ground handling services across multiple countries.

The European Union Aviation Safety Agency (EASA) is actively integrating international standards into its new ground handling regulations. This move towards harmonization underscores a global effort to elevate safety protocols and streamline operations. For Aviapartner, this means navigating and complying with these evolving international frameworks is not just a matter of best practice, but a necessity for maintaining its operational licenses and competitive edge throughout Europe.

- ICAO Standards: Aviapartner must align with ICAO's Annexes, particularly those concerning aerodromes and air traffic services, to ensure interoperability and safety in international flight operations.

- EASA Ground Handling Regulations: The upcoming EASA regulations, expected to fully integrate ICAO's Safety Management Systems (SMS) principles by 2025, will mandate stricter compliance for ground handlers, impacting everything from equipment maintenance to personnel training.

- Harmonization Benefits: Compliance with harmonized international standards allows Aviapartner to leverage economies of scale in training and equipment, while also reducing the complexity of managing diverse national regulations.

The European Union's ongoing efforts to harmonize aviation safety regulations, particularly through EASA, present both challenges and opportunities for Aviapartner. The upcoming ground handling regulations, with a transition expected to begin late 2024 or early 2025, aim to standardize safety and operational procedures across the continent.

Airport privatization trends continue across Europe, with significant stake sales in major airports in countries like Germany and Italy observed in 2024. This shift can alter existing ground handling contracts and introduce new competitive dynamics for companies like Aviapartner.

Geopolitical instability and protectionist policies can impact global trade and travel, directly affecting air cargo volumes and passenger numbers, which in turn influence Aviapartner's demand for services.

Labor relations remain a critical factor, with ongoing wage negotiations impacting operational costs. The high staff turnover, sometimes reaching 70% annually post-COVID-19, further emphasizes the need for effective labor management and retention strategies.

What is included in the product

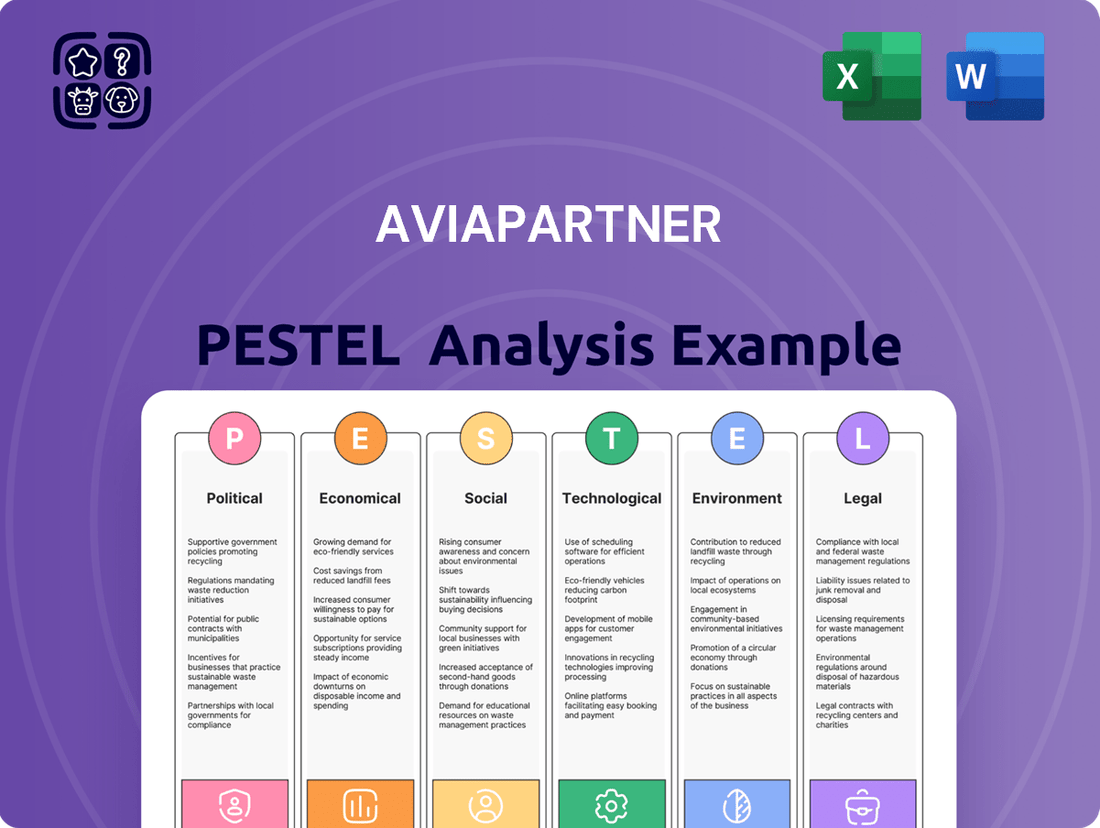

This Aviapartner PESTLE analysis thoroughly examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of the operating landscape.

A clear, actionable summary of Aviapartner's PESTLE factors, transforming complex external analysis into easily digestible insights for strategic decision-making.

Economic factors

Global air travel is showing robust recovery, with projections indicating a 6.5% growth in 2024 and continued expansion expected into 2025. This surge in passenger numbers directly translates to increased demand for essential ground handling services.

Aviapartner stands to gain significantly from this aviation industry rebound. The company's ability to efficiently manage a higher volume of aircraft and passengers will be crucial for capitalizing on this growing market, requiring optimized operational strategies.

Fuel price volatility is a major concern for airlines, directly influencing their operational budgets and, consequently, their demand for ground handling services like those provided by Aviapartner. For instance, if jet fuel prices surge, airlines might reduce flight frequencies or increase ticket prices, potentially dampening travel demand.

While a dip in fuel prices in late 2023 and early 2024 offered some relief, airlines continue to grapple with rising non-fuel operational expenses. Labor costs, for example, have seen significant upward pressure, with many aviation sector unions negotiating for higher wages. This squeeze on airline margins necessitates that ground handling providers like Aviapartner maintain stringent cost control measures to offer competitive pricing.

Aviapartner must therefore focus on optimizing its own operational efficiencies to remain a viable partner for airlines navigating these fluctuating cost landscapes. Efficient resource allocation and service delivery are critical to offsetting the impact of external economic pressures on both Aviapartner and its airline clients.

Airline profitability is showing a positive trend, with projections indicating continued improvement through 2024 and into 2025. However, this recovery is not without its risks, as ongoing economic uncertainties and geopolitical instability could easily disrupt this upward trajectory.

The financial strength of airlines is a critical determinant of their capacity to invest in essential services and upgrades, including vital ground handling operations. For instance, improved airline margins in 2024 could translate into increased spending on new equipment and technology for ground support.

A healthy and growing airline industry is a significant boon for ground handling service providers like Aviapartner. It signifies a reliable client base and opens doors for expanding service offerings, potentially leading to higher demand for specialized ground support solutions.

Cargo Volume Growth and E-commerce Impact

The surge in air cargo volumes, significantly fueled by the expansion of e-commerce and global trade, presents a substantial opportunity for ground handling services like Aviapartner. This escalating demand, notably strong in the Asia-Pacific region, underscores the critical need for robust cargo handling infrastructure and advanced service capabilities.

Aviapartner's cargo handling segment is directly influenced by these dynamic market shifts, compelling strategic investments in expanding capacity and adopting new technologies to meet the growing requirements. For instance, global air cargo traffic saw a notable increase, with volumes reaching approximately 65 million tonnes in 2023, a figure expected to continue its upward trajectory in 2024 and 2025.

- E-commerce Boom: Online retail sales are projected to reach over $7 trillion globally by 2025, directly boosting demand for air cargo to facilitate rapid delivery.

- Regional Growth: Asia-Pacific, a key manufacturing and consumption hub, is expected to lead air cargo demand growth, with an estimated compound annual growth rate of over 5% in the coming years.

- Infrastructure Needs: Handling this increased volume requires significant investment in specialized equipment, larger warehousing facilities, and advanced tracking systems.

- Technological Adoption: Companies like Aviapartner must integrate technologies such as automation and AI for more efficient sorting, tracking, and processing of shipments.

Investment in Airport Infrastructure and Technology

Significant investment is flowing into European airport infrastructure, with projections indicating substantial growth in the ground handling systems market. This expansion is fueled by the development of new airports and the modernization of existing ones. For instance, the European airport infrastructure market is expected to see considerable investment in the coming years as nations upgrade their air travel capacity.

The adoption of advanced technologies, such as automated baggage handling systems, is a key driver of this market growth. These technological advancements are crucial for improving efficiency and passenger experience. A report from 2024 highlighted that spending on airport technology, including automation, is on an upward trend across the continent.

Aviapartner can capitalize on these trends by strategically investing in equipment and systems that align with these infrastructure upgrades. This proactive approach will allow the company to enhance its service capabilities and maintain a competitive edge in the evolving airport services landscape.

- Market Growth: The European airport ground handling systems market is poised for significant expansion.

- Investment Drivers: New airport construction and upgrades to existing facilities are primary catalysts.

- Technological Adoption: Automation, particularly in baggage handling, is a key trend.

- Aviapartner Opportunity: Investment in compatible technology can bolster service offerings.

The global economic outlook for 2024-2025 indicates a robust recovery in air travel, with passenger numbers projected to grow, directly benefiting ground handling services. However, airlines face rising non-fuel operational costs, such as labor, necessitating cost-efficiency from providers like Aviapartner. Fuel price volatility remains a concern, impacting airline budgets and, consequently, their demand for services.

Preview the Actual Deliverable

Aviapartner PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Aviapartner provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

The ground handling sector grapples with persistent staff shortages and elevated labor turnover, a situation exacerbated by the post-COVID-19 environment. Some industry players have reported staggering annual turnover rates reaching as high as 70%, directly undermining operational consistency and the quality of services provided.

These staffing challenges create a critical need for companies like Aviapartner to implement comprehensive strategies focused on attracting, developing, and retaining talent. Investing in effective recruitment drives, thorough training programs, and competitive retention initiatives is paramount to cultivating a dependable and proficient workforce.

New European Union Aviation Safety Agency (EASA) regulations, effective from 2024, are significantly raising the bar for ground handling personnel training. These mandates require thorough instruction in technical proficiencies, human factors awareness, and robust emergency response protocols, with continuous competence assessments becoming standard practice. This means companies like Aviapartner must allocate substantial resources to develop and implement comprehensive training initiatives to cultivate a highly skilled and consistently capable workforce, directly impacting operational safety and efficiency.

Passenger experience is paramount, with a growing emphasis on seamless travel. This directly translates to higher expectations for ground handling services, pushing providers like Aviapartner to ensure efficient aircraft turnaround. Airlines are increasingly scrutinizing ground handlers, as even minor delays can lead to significant drops in passenger satisfaction, impacting brand loyalty.

Aviapartner's performance is directly tied to airline client satisfaction. In 2024, the aviation industry saw a renewed focus on operational efficiency, with ground handling playing a critical role. Maintaining a strong on-time performance record and delivering consistent service quality are therefore essential for Aviapartner to retain its airline partnerships and bolster its own reputation in a competitive market.

Public Perception of Aviation and Sustainability

Public awareness of aviation's environmental footprint, encompassing noise pollution and contributions to climate change, is significantly increasing. This heightened scrutiny is a powerful catalyst pushing the aviation sector toward more sustainable operational models.

Societal pressure is directly influencing the industry's trajectory, demanding greater accountability and innovation in reducing environmental impact. For instance, by 2024, many major airports are implementing stricter noise regulations and emissions targets.

Aviapartner's proactive integration of eco-sensitive ground support equipment and sustainable operational procedures can significantly bolster its public image. This strategic alignment with evolving societal values not only addresses environmental concerns but also enhances brand reputation and customer loyalty.

- Growing Public Concern: Surveys in 2024 indicate that over 70% of air travelers are concerned about the environmental impact of their flights.

- Demand for Sustainability: Airlines are reporting a noticeable increase in passenger preference for carriers demonstrating strong sustainability commitments.

- Regulatory Impact: Environmental regulations, particularly concerning carbon emissions and noise levels, are becoming more stringent globally, influencing airport operations.

- Brand Differentiation: Companies like Aviapartner can leverage their commitment to sustainability as a key differentiator in a competitive market, attracting environmentally conscious clients and partners.

Diversity and Inclusion Initiatives

Aviapartner's establishment of Colossal Aviapartner in South Africa, a joint venture majority-owned and led by black women, directly addresses the growing societal emphasis on diversity and inclusion. This strategic move aligns with increasing client and stakeholder expectations for businesses to demonstrate a commitment to social equity, particularly within the global aviation services sector.

Such initiatives are crucial for building a robust corporate social responsibility (CSR) profile. For instance, companies with strong DEI (Diversity, Equity, and Inclusion) programs often report better financial performance and enhanced brand reputation. In 2023, studies indicated that companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability compared to those in the fourth quartile.

- South African Joint Venture: Colossal Aviapartner, a significant partnership in South Africa, is majority-owned and managed by black women, reflecting a commitment to local empowerment and diverse leadership.

- Societal Expectations: The increasing global demand for businesses to actively promote diversity and inclusion influences client choices and stakeholder perceptions.

- CSR Enhancement: Investing in diversity initiatives strengthens Aviapartner's corporate social responsibility standing, potentially leading to improved brand image and competitive advantage.

- Financial Impact: Research consistently links strong DEI practices to enhanced financial outcomes, with companies demonstrating higher profitability and innovation.

Societal expectations are increasingly shaping the aviation industry, with a strong emphasis on sustainability and diversity. Public concern over aviation's environmental impact is high; in 2024, over 70% of air travelers expressed concern about flight emissions, driving demand for greener operations.

Companies like Aviapartner must integrate eco-friendly practices and champion diversity to meet these evolving societal demands. For example, Aviapartner's South African joint venture, Colossal Aviapartner, majority-owned and led by black women, directly addresses the growing call for social equity and inclusion in business operations.

This focus on diversity is not just ethical but also financially beneficial; studies from 2023 showed companies with strong gender diversity on executive teams were 25% more likely to outperform financially. Therefore, aligning with these societal trends is crucial for Aviapartner's brand reputation and competitive edge.

| Societal Factor | 2024/2025 Trend | Impact on Aviapartner | Supporting Data |

|---|---|---|---|

| Environmental Awareness | Increasing | Demand for sustainable ground handling solutions | 70% of air travelers concerned about flight emissions (2024 survey) |

| Diversity & Inclusion | Growing Emphasis | Need to demonstrate commitment to social equity | Companies with strong DEI are more profitable (2023 studies) |

| Customer Expectations | Rising | Pressure for seamless and efficient passenger experiences | Airlines scrutinizing ground handlers for on-time performance |

Technological factors

The ground handling sector is increasingly adopting automation and robotics for tasks such as baggage handling, aircraft refueling, and towing. This technological shift aims to boost efficiency, decrease the need for manual labor, and elevate safety standards across airport operations.

For instance, companies are investing in autonomous baggage tractors and robotic baggage loaders, with some trials showing significant reductions in baggage mishandling rates. The global market for airport automation is projected to reach over $10 billion by 2027, highlighting the scale of this transformation.

Aviapartner can capitalize on these advancements by integrating automated systems to optimize its service delivery, minimize operational errors, and accelerate aircraft turnaround times, a critical factor in airline profitability and passenger satisfaction.

The ground handling sector is rapidly embracing digitalization and advanced data analytics, fundamentally reshaping how services are delivered. This shift allows for unprecedented real-time monitoring of aircraft, ground equipment, and personnel, leading to more agile responses to operational demands.

Predictive maintenance, powered by AI and machine learning, is becoming a cornerstone for efficiency. For instance, by analyzing sensor data from ground support equipment (GSE), companies like Aviapartner can anticipate failures before they occur. This proactive approach minimizes costly downtime; industry reports suggest that predictive maintenance can reduce unexpected equipment failures by up to 30% and lower maintenance costs by 10-40%.

Data-driven decision-making is also paramount. By leveraging analytics, Aviapartner can optimize resource allocation, such as strategically positioning baggage handling systems or staff based on anticipated flight schedules and passenger loads. This granular insight allows for significant improvements in operational efficiency and a reduction in overall costs, potentially impacting profitability by a measurable percentage in the coming years.

The shift towards enhanced Ground Support Equipment (GSE), particularly electric and hybrid models, is a significant technological driver. This transition is fueled by environmental mandates and a growing emphasis on ramp safety, with new GSE often incorporating proximity sensors. For instance, by 2025, many major airports are expected to have a substantial portion of their GSE fleet electrified, with some studies indicating over 30% adoption in key European hubs.

Aviapartner's strategic investment in these eco-friendly and technologically advanced GSE solutions directly addresses sustainability targets. This upgrade not only helps in reducing the company's carbon emissions, a critical factor in the aviation industry's net-zero ambitions, but also promises to boost operational efficiency through features like predictive maintenance and optimized energy consumption.

Cybersecurity in Aviation Operations

As aviation operations increasingly rely on digital systems, the threat of cyberattacks grows. This digitalization, while enhancing efficiency, exposes critical infrastructure to new vulnerabilities. Protecting these interconnected systems is paramount for maintaining safety and operational integrity.

The European Union Aviation Safety Agency (EASA) recognizes this escalating risk. Its European Plan for Aviation Safety (EPAS) for 2024-2028 includes specific initiatives to address the evolving cybersecurity landscape. For instance, EASA has identified new rulemaking tasks aimed at mitigating the impact of cyber threats on aviation.

For Aviapartner, this translates to a clear need for proactive cybersecurity measures. Implementing robust protocols is essential to safeguard its operational systems, sensitive passenger data, and proprietary information from malicious actors. This includes continuous monitoring, regular security audits, and employee training.

- EASA's EPAS 2024-2028 prioritizes addressing cybersecurity risks in aviation.

- Increased digitalization in aviation operations elevates the potential for cyber threats.

- Aviapartner must invest in advanced cybersecurity solutions to protect its digital assets.

Integration of AI for Predictive Maintenance and Operations

The integration of AI for predictive maintenance and operations is a significant technological factor for Aviapartner. AI-powered solutions can forecast equipment failures, thereby minimizing unexpected operational disruptions and reducing overall maintenance expenditures. For instance, by analyzing sensor data from ground support equipment, AI can predict potential malfunctions before they occur, allowing for proactive servicing. This proactive approach is crucial in the aviation industry where downtime directly translates to significant financial losses and customer dissatisfaction.

Beyond maintenance, AI also enhances operational efficiency through intelligent task allocation and disruption forecasting. This means AI can optimize the deployment of ground staff and equipment based on real-time flight schedules and predicted operational challenges. For example, if a flight is experiencing a delay, AI can automatically reallocate resources to other flights that are on schedule, ensuring a smoother workflow. This level of dynamic resource management is becoming increasingly vital for maintaining high service standards in a complex and fast-paced environment.

Aviapartner can leverage these AI applications to achieve several key benefits. Firstly, improving equipment uptime directly contributes to better service delivery and reduced operational costs. Secondly, ensuring smoother operations leads to enhanced customer satisfaction and a more reliable brand image. The aviation industry is increasingly adopting AI, with the global AI in aviation market projected to reach USD 3.4 billion by 2026, growing at a CAGR of 23.1%, highlighting the significant potential for companies like Aviapartner to gain a competitive edge through these advancements.

- AI-driven predictive maintenance can reduce unscheduled downtime by up to 30%, according to industry reports.

- Intelligent task allocation powered by AI can improve operational efficiency by 15-20% in logistics and ground handling.

- The global AI in aviation market is expected to grow significantly, indicating a strong trend towards AI adoption for operational improvements.

- Reduced maintenance costs are a direct benefit, with AI potentially lowering maintenance expenses by 10-25% through optimized scheduling and part replacement.

The increasing reliance on digital systems in aviation operations amplifies the risk of cyberattacks. Protecting these interconnected systems is crucial for maintaining safety and operational integrity.

The European Plan for Aviation Safety (EPAS) for 2024-2028 specifically addresses the evolving cybersecurity landscape, highlighting the need for enhanced security measures across the sector.

Aviapartner must implement robust cybersecurity protocols, including continuous monitoring and regular security audits, to safeguard its operational systems and sensitive data from potential threats.

Legal factors

The European Commission's introduction of the EASA Ground Handling Regulations (EU 2025/20) in March 2025 marks a significant legal shift. These regulations, fully applicable by March 2028, impose rigorous safety management systems, comprehensive operational manuals, and ongoing personnel competency checks on ground handling providers.

Aviapartner faces the imperative to adapt its operations to meet these stringent new legal requirements. Non-compliance could lead to penalties, impacting operational continuity and financial performance within the European aviation sector.

New EU regulations, effective January 1, 2025, mandate the tracking and reporting of non-CO2 aviation emissions like NOx and contrails within the European Economic Area. This directly impacts airlines and, consequently, their ground handling partners like Aviapartner.

Compliance with these evolving environmental standards is crucial for Aviapartner to support its airline clients effectively and potentially adapt its own operational practices to minimize environmental impact and associated costs.

Aviapartner's operations are heavily influenced by national and European labor laws, covering everything from minimum wages to working conditions and collective bargaining. For instance, in 2024, the EU continued to emphasize fair wages and safe workplaces across member states, impacting ground handling service providers like Aviapartner. Failure to comply can lead to significant fines and operational disruptions.

The aviation sector, including ground handling, often experiences complex union negotiations. In 2024 and early 2025, several European countries saw ongoing discussions around wage adjustments and improved working conditions for aviation staff, directly affecting Aviapartner's cost structure and workforce stability. These negotiations are crucial for maintaining a harmonious industrial relations environment.

Safety and Security Regulations

Aviapartner must navigate a complex web of aviation safety and security regulations that extend beyond ground handling specifics. These include stringent rules on identity verification for all consignments and comprehensive screening protocols. For instance, the EU has implemented new aviation security regulations, with specific personnel certification measures set to take effect from January 1, 2026, underscoring a continuous evolution in compliance requirements.

Maintaining the highest safety and security standards is not merely a regulatory obligation but a core operational imperative for Aviapartner. This commitment is crucial for building and retaining trust with airlines, passengers, and regulatory bodies. Failure to adhere to these evolving standards can lead to significant penalties, operational disruptions, and reputational damage.

- EU Aviation Security Regulations: New measures, including personnel certification, become applicable from January 1, 2026.

- Identity Verification: Strict protocols for confirming the identity of all consignments are mandatory.

- Screening Protocols: Comprehensive screening procedures are essential for all aspects of ground handling operations.

- Operational Imperative: Adherence to safety and security standards is critical for maintaining trust and avoiding penalties.

Competition Law and Market Access

Competition in the ground handling sector is fierce, with numerous players vying for contracts. Aviapartner must navigate these competitive dynamics, which are shaped by regulations designed to ensure fair play and market access. For instance, the European Commission has historically intervened to prevent ground handling monopolies, underscoring the critical role of competition law in this industry.

Antitrust regulations and market access rules directly impact Aviapartner's strategic options, particularly concerning mergers, acquisitions, and new market entries. The ongoing scrutiny of market concentration means that any expansion plans must be carefully evaluated to comply with competition frameworks. In 2024, for example, several European aviation authorities continued to monitor market share distribution among ground handlers to prevent undue dominance.

- Regulatory Oversight: Competition authorities actively monitor the ground handling market for anti-competitive practices.

- Market Access Barriers: Regulations can influence how easily new or existing players can enter and operate in different airport markets.

- Merger Control: Aviapartner's potential acquisitions or partnerships face rigorous review under competition law to prevent market monopolization.

- Historical Precedents: Past actions by bodies like the European Commission demonstrate a commitment to fostering a competitive ground handling landscape.

Aviapartner must adhere to evolving EU safety regulations, such as EASA Ground Handling Regulations (EU 2025/20) effective March 2028, mandating robust safety systems and personnel checks. New environmental tracking rules for non-CO2 emissions, in effect from January 1, 2025, also necessitate compliance, impacting operational practices and costs.

Environmental factors

The aviation industry faces intense pressure to reduce its carbon footprint, with initiatives like the ReFuelEU Aviation Regulation mandating a significant increase in Sustainable Aviation Fuels (SAF) at European airports. This regulation sets a minimum SAF blending obligation starting at 2% in 2025, escalating to 6% by 2030. While airlines are the primary focus, these decarbonization efforts ripple through the entire sector, impacting ground handling services through a growing demand for environmentally friendly operations and equipment.

The aviation industry is increasingly focused on electrifying Ground Support Equipment (GSE) to curb emissions and lessen reliance on fossil fuels. This strategic shift is projected to slash emissions by as much as 48% per aircraft turnaround, a substantial environmental improvement.

Aviapartner is actively participating in this transition, having already invested in electric and hybrid-powered GSE. These investments underscore the company's dedication to reducing its environmental impact and boosting operational effectiveness.

Airports and ground handling services, like those provided by Aviapartner, are under increasing pressure regarding noise pollution. This scrutiny is driving stricter regulations, particularly in urban areas surrounding airports. For instance, in 2023, several European cities, including Amsterdam and Paris, saw continued discussions and potential adjustments to flight paths and operating hours to mitigate noise impacts on residents.

Future environmental assessments will undoubtedly focus on the aviation industry’s noise footprint. Aviapartner might need to invest in noise-reducing technologies for ground equipment or adapt operational procedures to comply with these evolving standards. This could involve quieter vehicles or optimized aircraft turnaround processes to minimize noise during sensitive hours, especially as urban sprawl brings more communities closer to airport perimeters.

Waste Management and Recycling

Ground handling services, like those provided by Aviapartner, inherently produce a range of waste, including materials from aircraft maintenance, catering, and general operations. The growing global emphasis on environmental sustainability and stricter governmental mandates are pushing for more effective waste management and recycling protocols across all industries.

To address this, Aviapartner must develop and implement comprehensive waste management strategies. These strategies are crucial for reducing the company's ecological footprint and ensuring adherence to environmental laws. For instance, by 2025, the European Union aims to recycle at least 65% of municipal waste, a target that will undoubtedly influence airport operations and the handling companies within them.

Key areas for Aviapartner's waste management focus include:

- Waste Segregation: Implementing clear systems for separating recyclable materials, organic waste, and general refuse at the source.

- Recycling Programs: Establishing partnerships with recycling facilities to process materials like plastics, paper, metals, and potentially even specific aircraft components.

- Waste Reduction Initiatives: Exploring ways to minimize waste generation, such as optimizing catering supplies and promoting the use of reusable materials in operations.

- Regulatory Compliance: Staying abreast of evolving environmental regulations in the various countries Aviapartner operates in, ensuring all waste disposal practices are compliant.

Climate Change Adaptation and Resilience

The aviation industry is increasingly vulnerable to climate change, with extreme weather events like heatwaves and storms posing significant operational risks. For instance, the European Aviation Environmental Report 2024 highlighted that rising temperatures can lead to reduced aircraft lift capacity, impacting flight schedules and fuel efficiency. Aviapartner must proactively integrate climate adaptation strategies to safeguard its services.

Building resilience is paramount for Aviapartner to navigate the disruptions caused by climate change. This involves developing robust contingency plans for weather-related delays and implementing infrastructure upgrades to withstand more frequent extreme events. The goal is to ensure uninterrupted service delivery and maintain business continuity in a changing climate.

Key adaptation measures for Aviapartner could include:

- Developing advanced weather forecasting and response protocols to minimize the impact of extreme events on ground operations.

- Investing in climate-resilient infrastructure such as reinforced aprons and improved drainage systems to handle increased rainfall or heat.

- Diversifying operational strategies to offer flexibility during climate-induced disruptions, potentially through alternative resource allocation.

The aviation sector is under immense pressure to decarbonize, with regulations like ReFuelEU Aviation mandating increased Sustainable Aviation Fuel (SAF) usage, starting with 2% in 2025. This push for greener operations extends to ground handling, driving demand for electric and hybrid Ground Support Equipment (GSE), which could cut emissions by nearly half per aircraft turnaround.

Noise pollution is another significant environmental concern, leading to stricter regulations and potential flight path adjustments in urban areas. Aviapartner must consider investing in quieter GSE and optimizing operations to minimize noise, especially during sensitive hours, as urban development encroaches on airport peripheries.

Effective waste management is crucial, with the EU targeting 65% municipal waste recycling by 2025. Aviapartner needs robust strategies for waste segregation, recycling, and reduction to minimize its ecological footprint and comply with environmental laws.

Climate change poses operational risks, with extreme weather impacting aircraft performance and fuel efficiency. Aviapartner must build resilience through advanced weather forecasting, climate-resilient infrastructure, and diversified operational strategies to ensure service continuity.

PESTLE Analysis Data Sources

Our Aviapartner PESTLE Analysis is meticulously constructed using data from reputable aviation industry bodies, international regulatory agencies, and leading economic forecasting firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the aviation sector.