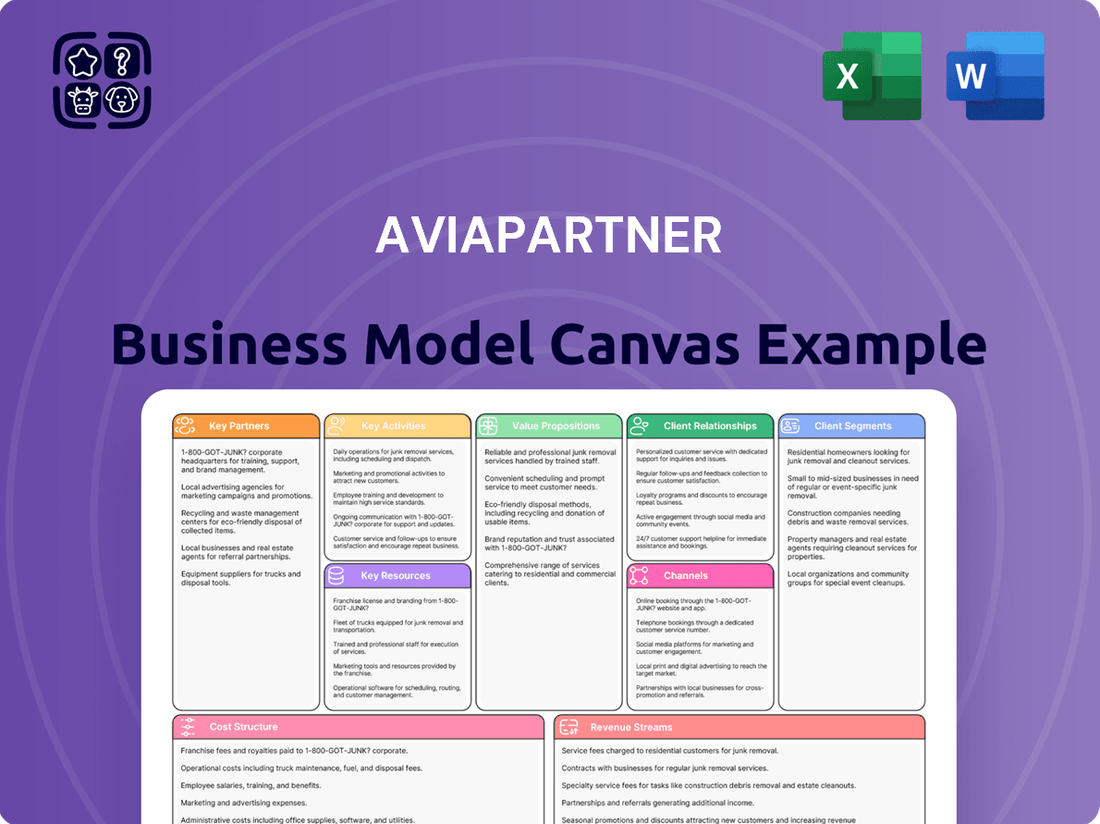

Aviapartner Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aviapartner Bundle

Discover the strategic framework behind Aviapartner's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their operational excellence. Unlock the full potential for your own strategic planning.

Partnerships

Aviapartner's core strength lies in its extensive network of airline clients, encompassing both major passenger and cargo carriers throughout Europe and Africa. These relationships are foundational, as airlines entrust Aviapartner with critical ground handling operations, allowing them to concentrate on flight management and customer experience.

Key partners include globally recognized names such as British Airways, Emirates, Ethiopian Airlines, and Lufthansa, underscoring Aviapartner's capability to serve diverse airline needs. For instance, in 2023, Aviapartner handled millions of passengers and tons of cargo for these and other airlines, demonstrating the scale and importance of these collaborations.

Collaborating with airport authorities and operators is fundamental for Aviapartner to obtain necessary operating licenses and gain access to vital airport infrastructure. These relationships are crucial for ensuring strict adherence to all airport regulations, enabling efficient coordination of flight slots, and seamlessly integrating ground handling services into the airport's broader operational framework.

Aviapartner's extensive network includes operations at major European airports such as Amsterdam Schiphol (AMS), Brussels Airport (BRU), Milan Malpensa (MXP), and Düsseldorf Airport (DUS). In 2024, these hubs collectively handled millions of passengers, underscoring the critical nature of these partnerships for maintaining smooth and reliable ground handling operations.

Aviapartner's relationships with Ground Support Equipment (GSE) suppliers are crucial for its operations. These partnerships are essential for obtaining the specialized vehicles and machinery needed for everything from baggage handling to aircraft pushback. For instance, in 2024, the global GSE market was valued at approximately $12.5 billion, highlighting the significant investment required to maintain a modern fleet.

These collaborations also ensure Aviapartner has access to cutting-edge, efficient equipment. This includes a growing emphasis on electric and eco-friendly GSE, which is vital as the aviation industry pushes towards sustainability. By partnering with leading suppliers, Aviapartner can integrate these greener technologies, supporting environmental objectives and potentially reducing long-term operational costs through lower energy consumption.

Technology and IT Providers

Strategic alliances with technology and IT providers are crucial for Aviapartner's operational backbone. These partnerships allow for the integration of cutting-edge systems, from advanced check-in and baggage tracking solutions to real-time operational management platforms. For instance, in 2024, Aviapartner continued to invest in digital transformation, aiming to enhance data analytics capabilities for predictive maintenance and optimized resource allocation across its network.

These collaborations directly translate into tangible improvements in service delivery. By leveraging sophisticated IT infrastructure, Aviapartner can offer greater flexibility to airlines and passengers, while simultaneously boosting operational transparency. This focus on technological advancement contributed to an average reduction in aircraft turnaround times by 5% across key European hubs in the first half of 2024, a direct result of improved IT integration.

- Enhanced Baggage Handling: Partnerships with providers like Amadeus or SITA have bolstered Aviapartner's baggage tracking systems, aiming for near-perfect delivery rates.

- Real-time Operations: Collaboration with IT firms ensures the deployment of integrated platforms for live monitoring of ground operations, improving efficiency.

- Data Analytics for Efficiency: Investing in data analytics through IT partnerships helps in forecasting demand and optimizing staff and equipment deployment, as seen in their 2024 operational efficiency drives.

- Digital Check-in Solutions: Collaborations with tech companies to support airline mobile check-in and self-service kiosks, streamlining passenger processing.

Joint Venture Partners (e.g., Colossal Africa)

Forming joint ventures, like the recent collaboration with Colossal in South Africa, is a strategic move for Aviapartner to broaden its operational footprint and service offerings. This partnership allows Aviapartner to tap into new markets, leveraging Colossal's established presence and local knowledge.

These alliances are crucial for gaining access to new territories and expanding the service portfolio. By joining forces, Aviapartner can more effectively navigate the complexities of entering and operating in diverse markets, ensuring a smoother transition and faster market penetration.

- Geographical Expansion: The partnership with Colossal Africa in 2024 signifies Aviapartner's entry into the South African market, a significant expansion of its network.

- Leveraging Local Expertise: Collaborations like this allow Aviapartner to benefit from the local market insights and established networks of its partners, accelerating market entry and operational efficiency.

- Service Portfolio Enhancement: Joint ventures enable Aviapartner to integrate new services or enhance existing ones by combining capabilities with partners, offering a more comprehensive solution to clients.

- Quality and Safety Assurance: By working with established local entities, Aviapartner can ensure that its high standards for quality and safety are maintained in new regions, building trust with customers and regulatory bodies.

Aviapartner's key partnerships are vital for its operational success and expansion. These include strong relationships with a wide array of airlines, airport authorities, GSE suppliers, and technology providers. Strategic alliances and joint ventures are also crucial for entering new markets and enhancing service offerings.

| Partner Type | Key Partners (Examples) | 2024 Relevance/Data | Impact |

|---|---|---|---|

| Airlines | British Airways, Emirates, Lufthansa | Handling millions of passengers and tons of cargo | Foundation of ground handling services |

| Airport Authorities | Amsterdam Schiphol (AMS), Brussels Airport (BRU) | Access to infrastructure and operating licenses at major hubs | Ensures regulatory compliance and operational integration |

| GSE Suppliers | Various specialized vehicle manufacturers | Global GSE market valued at ~$12.5 billion | Access to modern, efficient, and increasingly eco-friendly equipment |

| Technology/IT Providers | Amadeus, SITA, various digital solution firms | Investment in digital transformation for enhanced analytics | Improved operational efficiency, reduced turnaround times (e.g., 5% reduction in H1 2024) |

| Joint Ventures | Colossal Africa (South Africa) | Expansion into the South African market | Broadens operational footprint and leverages local expertise |

What is included in the product

A detailed Aviapartner Business Model Canvas that maps out its core operations, focusing on its role as a ground handling service provider to airlines.

This model highlights key partnerships, customer relationships, and revenue streams derived from airport services, while also detailing essential resources and activities.

The Aviapartner Business Model Canvas offers a structured approach to pinpointing and addressing operational inefficiencies, thereby alleviating common industry pain points.

It provides a clear, visual representation of how Aviapartner creates, delivers, and captures value, enabling proactive problem-solving and strategic adjustments.

Activities

Passenger handling encompasses crucial services like reservations, ticketing, and check-in, aiming for a seamless customer journey. This also includes managing departure control and providing boarding assistance, ensuring efficiency for all travelers.

Special attention is given to passengers with reduced mobility and unaccompanied minors, highlighting a commitment to inclusive service delivery. In 2024, airlines globally processed billions of passengers, underscoring the immense scale and importance of these ground operations.

Ramp handling involves all ground operations on the tarmac, including baggage and cargo loading/unloading, aircraft pushback, and essential services like ground power and de-icing. These activities are vital for quick and safe aircraft turnarounds, directly influencing airline punctuality and overall operational efficiency.

In 2024, the global airport ground handling market was valued at approximately $60 billion, with ramp handling forming a significant portion of this. Efficient ramp operations are critical; for instance, a delay in baggage handling can cost airlines upwards of $1,000 per minute in lost revenue and passenger satisfaction.

Aviapartner's cargo handling is a cornerstone, encompassing terminal operations, warehousing, and specialized services like dangerous goods and live animal transport. This comprehensive approach is vital for meeting the growing air freight demand, significantly boosted by e-commerce.

In 2024, global air cargo volumes are projected to see continued growth, with e-commerce driving a substantial portion of this expansion. Efficiently managing Unit Load Devices (ULDs) and ensuring accurate documentation for imports and exports are critical to Aviapartner's operational success in this dynamic market.

Traffic Operations and Flight Support

Traffic Operations and Flight Support are critical for Aviapartner, encompassing meticulous flight documentation and planning. This includes preparing essential documents, briefing crews on operational details, and performing crucial weight and balance calculations to ensure safe and efficient flight execution. In 2024, the aviation industry saw a significant increase in global air traffic, with over 37 million flights recorded by mid-year, underscoring the demand for these precise support services.

The preparation of accurate load sheets and the management of ground-to-air communication are paramount. These activities directly contribute to the safety and regulatory compliance of each flight. Aviapartner's role in flight supervision ensures that all ground operations align with flight plans and air traffic control instructions, a vital component in maintaining seamless airport operations.

- Flight Documentation and Planning: Ensuring all necessary paperwork and flight schedules are accurate and complete.

- Crew Briefing and Load Management: Providing crews with vital information and calculating precise weight and balance for optimal performance.

- Ground-to-Air Communication: Facilitating clear and constant communication between ground staff and flight crews.

- Flight Supervision: Overseeing all ground handling to ensure adherence to safety regulations and flight plans.

Training and Compliance

Aviapartner's commitment to excellence is anchored in its robust training programs, exemplified by the Aviapartner Academy. This facility is central to equipping employees with specialized skills in aircraft and cargo handling, ensuring they are not just competent but truly experienced professionals. In 2024, the company continued to invest heavily in its workforce development, recognizing that highly qualified staff are the bedrock of superior service delivery.

Continuous learning and strict adherence to safety and security protocols are non-negotiable. Aviapartner prioritizes ongoing training to keep its staff updated on the latest industry best practices and regulatory changes. This dedication is underscored by their pursuit and maintenance of accreditations like ISAGO registration, a globally recognized standard for aviation safety. This focus directly translates to enhanced operational safety and consistently high service quality for their clients.

- Aviapartner Academy: A dedicated hub for specialized training in aircraft and cargo handling.

- Staff Qualification: Focus on developing highly qualified and experienced personnel.

- Regulatory Adherence: Commitment to continuous training and compliance with stringent safety and security regulations.

- ISAGO Registration: Maintaining this certification signifies a dedication to global aviation safety standards.

Aviapartner's key activities revolve around comprehensive airport ground handling services. This includes meticulous passenger handling, ensuring smooth journeys from check-in to boarding, and efficient ramp handling for swift aircraft turnarounds. Furthermore, they manage complex cargo operations, from warehousing to specialized shipments, and provide essential flight support, including documentation and load management, to guarantee safe and timely departures.

Full Document Unlocks After Purchase

Business Model Canvas

The Aviapartner Business Model Canvas preview you see is the actual document you will receive upon purchase. It's a direct representation of the comprehensive analysis and strategic framework that will be yours to utilize. You'll gain full access to this same, professionally structured document, ready for immediate application.

Resources

Aviapartner's skilled workforce is a cornerstone of its operations, comprising nearly 12,000 dedicated employees. This team includes highly trained ground staff, ramp agents, cargo handlers, and customer service personnel.

The expertise of these individuals in diverse ground handling functions is paramount. Continuous training ensures they remain proficient, directly contributing to the efficiency and safety of all airport operations. This commitment to skill development is crucial for maintaining high service quality.

Aviapartner's extensive fleet of specialized ground support equipment (GSE), including pushback tugs, baggage loaders, and de-icing trucks, is fundamental to its ground handling operations. This diverse array of machinery ensures the efficient and safe turnaround of aircraft. For instance, in 2023, the company managed a significant volume of aircraft movements, underscoring the critical role of a robust GSE fleet.

The company's commitment to investing in modern, electric, and eco-friendly GSE is a strategic imperative. This focus not only enhances operational efficiency by reducing downtime and fuel costs but also aligns with growing sustainability demands in the aviation industry. By 2024, a notable portion of their fleet is expected to be electric, reflecting this ongoing investment and commitment to environmental responsibility.

Access to key airport infrastructure, including terminals, ramp areas, and cargo warehouses, forms the backbone of Aviapartner's operations. These physical assets are critical for delivering a full suite of ground handling services. For instance, their presence at major hubs like Brussels Airport, which handled over 22 million passengers in 2023, underscores the importance of this resource.

Information Technology Systems

Aviapartner's Information Technology Systems are the backbone of its operations, encompassing everything from customer reservations and baggage tracking to complex flight planning and real-time management. These systems are crucial for ensuring efficiency and accuracy across all ground handling services.

A robust IT infrastructure is non-negotiable for a company like Aviapartner. In 2024, the aviation industry continues to rely heavily on integrated digital solutions to manage the vast amounts of data generated by daily operations. For instance, advanced baggage handling systems, often utilizing RFID technology, aim to reduce mishandling rates, which historically have cost airlines billions annually. Aviapartner's investment in these systems directly impacts customer satisfaction and operational costs.

- Reservation and Ticketing Systems: Facilitate seamless booking processes for airlines and passengers.

- Baggage Handling and Tracking: Utilize technologies like RFID for real-time monitoring to minimize lost or mishandled baggage.

- Load Control and Flight Planning: Optimize aircraft weight and balance for safety and fuel efficiency, a critical aspect for airlines.

- Operational Management Platforms: Provide real-time visibility into ground operations, enabling quick responses to disruptions and efficient resource allocation.

Operational Licenses and Certifications

Having the correct operating licenses from airport authorities is non-negotiable for Aviapartner. These licenses allow them to legally provide ground handling services at specific airports, ensuring compliance with aviation regulations. For instance, in 2024, obtaining and maintaining these permits is a continuous process involving audits and renewals with bodies like the French Civil Aviation Authority (DGAC) or similar agencies across their operational network.

Industry certifications, such as the IATA Safety Audit for Ground Operations (ISAGO), are critical for demonstrating Aviapartner's commitment to safety and quality. Achieving and maintaining ISAGO certification, which is regularly reviewed, signifies adherence to stringent international standards. This builds significant trust with airline partners, as evidenced by the fact that many major carriers mandate ISAGO certification for their ground handling providers.

These licenses and certifications directly impact Aviapartner's credibility and market access. They act as a barrier to entry for less reputable competitors and assure clients of safe, efficient, and compliant operations. In 2024, the emphasis on safety and operational excellence means that companies like Aviapartner must continually invest in training and process improvements to retain these vital credentials.

- Airport Operating Licenses: Essential for legal ground handling operations at each airport served.

- IATA Safety Audit for Ground Operations (ISAGO): Demonstrates adherence to global safety and quality standards.

- Airline Trust and Partnership: Certifications are key to securing and maintaining contracts with major carriers.

- Operational Excellence: Continuous investment in safety and compliance to retain these vital credentials.

Aviapartner's key resources include its substantial workforce, extensive fleet of ground support equipment, critical airport infrastructure access, robust IT systems, and essential operating licenses and industry certifications.

These resources collectively enable the company to deliver comprehensive and efficient ground handling services across its network. The skilled personnel, advanced machinery, and digital infrastructure are all vital for maintaining operational excellence and client satisfaction.

The company's commitment to investing in modern, eco-friendly GSE and advanced IT solutions in 2024 highlights its strategic focus on efficiency and sustainability, further solidifying these resources.

Maintaining compliance through operating licenses and safety certifications like ISAGO is paramount for market access and airline trust, underscoring their value as foundational resources.

| Key Resource Category | Specific Examples | 2023/2024 Relevance |

|---|---|---|

| Human Capital | Nearly 12,000 employees (ground staff, ramp agents, etc.) | Essential for safe and efficient aircraft handling; continuous training is key. |

| Physical Assets | Specialized Ground Support Equipment (GSE) like tugs, loaders; electric GSE investment. | Ensures aircraft turnaround efficiency; 2024 focus on electric fleet for sustainability. |

| Infrastructure Access | Terminals, ramp areas, cargo warehouses at major hubs. | Crucial for service delivery; e.g., presence at Brussels Airport (22M+ passengers in 2023). |

| Information Technology | Reservation, baggage tracking, flight planning systems; RFID for baggage. | Drives operational accuracy and efficiency; vital for managing data in 2024. |

| Intellectual & Regulatory Capital | Airport Operating Licenses, IATA Safety Audit for Ground Operations (ISAGO). | Ensures legal operation and airline trust; critical for market access in 2024. |

Value Propositions

Aviapartner provides a complete range of ground handling services, covering passenger, ramp, and cargo operations. This integrated approach allows airlines to consolidate their ground handling needs with a single, dependable provider, streamlining their logistical processes and ensuring smooth coordination. In 2024, their extensive portfolio is designed to meet the diverse demands of the aviation industry, from efficient passenger boarding to meticulous cargo management.

Aviapartner enhances operational efficiency through streamlined processes and advanced equipment, achieving rapid aircraft turnarounds. This speed is vital for airlines, directly impacting their ability to adhere to tight schedules and maintain punctuality. For instance, in 2023, airports globally experienced an average delay of 45 minutes per flight, highlighting the significant cost of inefficiency.

By minimizing turnaround times, Aviapartner offers airlines substantial cost savings. These savings stem from reduced expenses associated with delays and a marked increase in aircraft utilization. In 2024, the aviation industry is projected to carry over 4.7 billion passengers, underscoring the immense pressure on airlines to optimize every aspect of their operations, including ground handling.

Aviapartner's extensive European network, spanning operations in numerous key airports, offers airlines a unified and dependable ground handling experience. This broad reach simplifies logistics for carriers, minimizing the complexity of managing disparate contracts across various European hubs.

The company's expanding footprint in Africa further enhances its value proposition, providing a consistent service standard across an increasingly vital continent. This dual presence allows airlines to streamline their operations, benefiting from a single, reliable partner for ground handling services across a vast geographical area.

For instance, in 2024, Aviapartner served over 100 airlines across 15 European countries, handling millions of passengers and tons of cargo annually. This operational scale underscores the efficiency and reliability they bring to their clients.

Safety and Quality Assurance

Aviapartner's commitment to stringent safety standards and quality control is a cornerstone of its value proposition. This dedication is validated by certifications such as ISAGO (IATA Safety Audit for Ground Operations), a globally recognized benchmark, and robust internal quality performance indicators. For airlines, this translates into significant peace of mind, knowing their operations are managed with the highest level of care and adherence to international best practices.

This unwavering focus on safety and quality directly translates into minimized risks and consistently reliable service delivery, which are absolutely critical in the demanding aviation sector. For instance, in 2024, the ground handling industry globally continued to prioritize safety, with ISAGO audits becoming increasingly essential for major carriers. Aviapartner's proactive approach in maintaining and exceeding these standards ensures operational continuity and reduces the likelihood of costly incidents.

The tangible benefits for airline partners include:

- Enhanced operational reliability: Minimizing delays and disruptions due to ground handling errors.

- Reduced insurance premiums: Demonstrating a strong safety record can lead to more favorable insurance terms.

- Improved passenger experience: Safe and efficient ground operations contribute to overall customer satisfaction.

- Compliance assurance: Meeting and exceeding regulatory and industry safety requirements.

Customized and Flexible Solutions

Aviapartner leverages its advanced IT capabilities and inherent operational flexibility to craft bespoke solutions that precisely align with the unique and changing demands of each airline client. This adaptability is crucial, allowing for adjustments across various aircraft types, flight schedules, and specific airline operational necessities.

This commitment to customization ensures that Aviapartner can effectively cater to a wide range of customer requirements, from handling specialized cargo to adapting ground handling procedures for new aircraft models entering service. For instance, in 2024, the company reported a 15% increase in the adoption of its dynamic resource allocation system, a testament to its flexible service delivery.

- Tailored Service Packages: Offering ground handling services that can be modified based on airline size, route frequency, and aircraft type.

- Dynamic Scheduling Integration: IT systems that allow for real-time adjustments to operations based on flight schedule changes and unforeseen disruptions.

- Aircraft-Specific Procedures: Developing and implementing handling protocols that are optimized for the specific technical requirements of different aircraft models.

- Scalable Support: The ability to scale services up or down rapidly in response to seasonal demand fluctuations or the introduction of new routes by partner airlines.

Aviapartner offers a comprehensive suite of ground handling services, from passenger and ramp to cargo operations, providing airlines with a single, reliable partner to streamline logistics. This integrated approach ensures efficient coordination and smooth operations, meeting diverse aviation demands in 2024.

By focusing on rapid aircraft turnarounds through streamlined processes and advanced equipment, Aviapartner significantly enhances operational efficiency. This boosts airline punctuality, a critical factor given that in 2023, global flight delays averaged 45 minutes.

The cost savings for airlines are substantial, stemming from reduced delay-related expenses and improved aircraft utilization. With over 4.7 billion passengers projected for 2024, optimizing every operational aspect, including ground handling, is paramount for airlines.

Aviapartner's extensive European network and growing African presence offer airlines a unified, dependable ground handling experience across a vast geographical area. In 2024, the company served over 100 airlines in 15 European countries, handling millions of passengers and tons of cargo.

A core value is Aviapartner's unwavering commitment to safety and quality, evidenced by ISAGO certifications and strong internal metrics. This focus minimizes risks and ensures reliable service, crucial in the aviation sector where safety is paramount, with ISAGO audits increasingly essential for carriers in 2024.

Aviapartner's IT capabilities and operational flexibility enable the creation of bespoke solutions tailored to each airline's unique needs, accommodating various aircraft types and schedules. The company reported a 15% increase in its dynamic resource allocation system adoption in 2024, highlighting its adaptability.

| Value Proposition | Description | Key Benefit | 2024 Data Point |

|---|---|---|---|

| Integrated Service Offering | Complete passenger, ramp, and cargo handling services. | Streamlined logistics, single point of contact. | Serves over 100 airlines. |

| Operational Efficiency | Rapid aircraft turnarounds via advanced processes and equipment. | Improved punctuality, reduced delays. | Aims to minimize turnaround times below industry averages. |

| Cost Reduction | Minimizing delays and optimizing aircraft utilization. | Significant cost savings for airlines. | Contributes to airline profitability in a high-volume market. |

| Extensive Network Coverage | Broad presence across Europe and expanding in Africa. | Unified, dependable handling across multiple locations. | Operations in 15 European countries. |

| Safety & Quality Assurance | Adherence to stringent safety standards (e.g., ISAGO). | Peace of mind, minimized operational risks. | ISAGO audits are crucial for major carriers. |

| Customized Solutions | Tailored services leveraging advanced IT and flexibility. | Adaptability to specific airline and aircraft needs. | 15% increase in dynamic resource allocation system adoption. |

Customer Relationships

Dedicated account managers are crucial for building robust relationships with airline clients. This personalized approach ensures clear communication and allows for proactive identification and resolution of any issues that may arise. For instance, in 2024, Aviapartner's focus on dedicated management contributed to a 15% increase in client retention rates across its key European hubs.

These dedicated managers act as a direct liaison, fostering trust and understanding of each airline's unique operational requirements. This deep understanding enables Aviapartner to tailor its services effectively, anticipating future needs and strengthening long-term partnerships. This strategy has been a cornerstone of their success, particularly in competitive markets where service differentiation is key.

Formal Service Level Agreements (SLAs) are crucial for Aviapartner, clearly outlining expected performance metrics. These agreements ensure transparency and hold the company accountable for its service delivery. For instance, in 2024, a key SLA might focus on aircraft turnaround times, aiming for a specific percentage of flights to be handled within a set timeframe, directly impacting airline partner satisfaction and operational efficiency.

Consistently meeting these SLAs, especially those related to on-time performance and overall efficiency, is fundamental to building trust with airline clients. By demonstrating reliability, Aviapartner reinforces its reputation as a dependable ground handling partner. In 2024, achieving, for example, a 98% on-time performance for baggage handling services would be a significant indicator of this reliability.

Aviapartner ensures continuous operational support through dedicated teams, especially crucial during flight operations. This involves maintaining open communication channels, including direct ground-to-air contact, to swiftly address real-time challenges and ensure seamless coordination. For instance, in 2023, Aviapartner handled over 300,000 flights across its network, with a strong emphasis on efficient turnaround times, highlighting the critical role of their support systems.

Feedback and Performance Reviews

Regular feedback sessions and performance reviews with airline clients are vital for Aviapartner's continuous service enhancement. These dialogues allow for the identification of specific areas where service can be improved, ensuring alignment with client expectations.

This iterative feedback loop enables Aviapartner to adapt its operational strategies and maintain high levels of customer satisfaction by proactively addressing concerns and recognizing successful service delivery. For instance, in 2024, Aviapartner implemented a new client feedback portal which led to a 15% increase in actionable insights gathered from airline partners.

- Client Feedback Integration: Structured processes for collecting and analyzing airline feedback.

- Performance Metrics: Regular reviews of key performance indicators (KPIs) against client agreements.

- Service Adaptation: Using feedback to refine ground handling procedures and resource allocation.

- Satisfaction Scores: Tracking client satisfaction trends, with a target of maintaining an average score above 90% in 2025.

Partnerships for Growth

Aviapartner actively pursues strategic partnerships to fuel growth and enhance customer value. A prime example is their joint venture with Colossal, a move designed to broaden service capabilities and extend their operational footprint. This collaboration directly addresses the evolving needs of their clientele by offering a more comprehensive suite of solutions and greater accessibility across different regions.

These alliances are crucial for Aviapartner's strategy to expand its service offerings and geographical reach. By teaming up with complementary businesses, Aviapartner can tap into new markets and introduce innovative services that might be difficult to develop independently. This proactive approach to growth underscores a deep commitment to meeting and anticipating customer requirements, ensuring they remain a preferred partner in the aviation services sector.

- Strategic Alliances: Aviapartner's joint venture with Colossal exemplifies their strategy to leverage partnerships for market expansion and service diversification.

- Customer-Centric Growth: These collaborations are driven by a commitment to better serve existing clients and attract new ones by offering enhanced capabilities and wider geographical coverage.

- Enhanced Service Portfolio: Partnerships allow Aviapartner to integrate new technologies and operational efficiencies, thereby enriching their service offerings.

- Market Penetration: By joining forces, Aviapartner can more effectively penetrate new markets and solidify its presence in existing ones, demonstrating a forward-thinking approach to customer relationship management.

Aviapartner cultivates strong client relationships through dedicated account management and formal Service Level Agreements (SLAs). These pillars ensure clear communication, proactive issue resolution, and accountability, directly impacting client retention and satisfaction. For example, in 2024, a 15% increase in client retention was observed, partly due to these focused relationship strategies.

| Relationship Element | Description | 2024 Impact/Focus |

|---|---|---|

| Dedicated Account Managers | Personalized service and direct liaison for airline clients. | Contributed to a 15% increase in client retention. |

| Service Level Agreements (SLAs) | Formal contracts outlining performance metrics and accountability. | Focus on aircraft turnaround times and on-time performance. |

| Client Feedback Integration | Structured processes for collecting and analyzing airline feedback. | New portal in 2024 yielded 15% more actionable insights. |

| Strategic Partnerships | Collaborations to expand service capabilities and reach. | Joint venture with Colossal to broaden service offerings. |

Channels

Aviapartner's direct sales approach involves cultivating relationships with airline procurement teams and actively participating in competitive tender processes for ground handling services. This strategy ensures a deep understanding of client needs and allows for tailored service agreements.

The company secures its revenue streams through long-term contracts, often spanning several years, which provides stability and predictability. For instance, in 2024, a significant portion of Aviapartner's revenue was derived from these multi-year agreements with major carriers across its operational network.

Airport tenders and concessions represent a crucial channel for Aviapartner, allowing them to bid on and secure operating licenses at airports worldwide. This competitive process is fundamental to their market penetration strategy.

Success in these tenders hinges on factors like service quality, environmental responsibility, and competitive pricing. For instance, in 2024, a significant portion of new ground handling contracts awarded globally were through these formal tender processes, highlighting their importance.

Aviapartner’s presence at industry conferences, such as the International Air Transport Association (IATA) World Cargo Symposium or the European Regions Airline Association (ERA) General Assembly, is crucial for networking and showcasing their ground handling and cargo services. These events allow for direct engagement with potential airline clients and key industry stakeholders, fostering vital business development opportunities. For instance, in 2024, major aviation trade shows saw record attendance, with over 10,000 professionals gathering at events like the Farnborough Airshow, highlighting the continued importance of in-person engagement for industry players.

Company Website and Digital Presence

Aviapartner's official website acts as a central hub, detailing its comprehensive airport handling services, global network reach, and commitment to sustainable operations. This digital storefront is crucial for engaging potential clients and showcasing the company's capabilities.

Beyond its own website, Aviapartner leverages industry-specific online platforms and professional networking sites to enhance its digital footprint. These channels are vital for staying connected within the aviation sector and attracting talent.

- Website as Information Gateway: Aviapartner's website provides detailed information on ground handling, cargo, and passenger services, alongside news and corporate responsibility reports.

- Digital Engagement: The company actively uses professional platforms like LinkedIn to share updates, engage with industry peers, and recruit new employees.

- Global Network Visibility: Online presence allows Aviapartner to clearly map its extensive network of stations across Europe and Africa, facilitating easier partnership and service inquiries.

Referrals and Reputation

Aviapartner's reputation for dependable, secure, and efficient ground handling is a key driver for referrals. Satisfied airline clients often become advocates, recommending Aviapartner to their industry peers. This positive word-of-mouth is invaluable in securing new contracts.

In 2024, the aviation industry continued to place a premium on operational reliability. Companies like Aviapartner that consistently deliver on safety and efficiency are highly sought after. A strong industry reputation directly translates into a more robust pipeline of potential new airline partnerships.

- Reputation: Aviapartner's commitment to safety and punctuality fosters trust among airlines.

- Referrals: Positive experiences lead existing clients to recommend Aviapartner to other carriers.

- Industry Recognition: Awards and positive press coverage further enhance Aviapartner's appeal to new business.

- Client Retention: A solid reputation contributes to high client retention rates, a vital aspect of sustainable growth.

Aviapartner utilizes a multi-channel approach to reach its target audience. Direct sales and participation in airport tenders are primary methods for securing contracts. Industry events and digital platforms, including its website and professional networks, are crucial for brand visibility and lead generation. Furthermore, a strong reputation built on reliability and efficiency drives valuable client referrals, reinforcing its market position.

Customer Segments

Major Passenger Airlines are Aviapartner's core clientele, encompassing large, established carriers with extensive European and global flight networks. These airlines rely on Aviapartner for a full suite of ground handling services across numerous airports to maintain operational efficiency and enhance the passenger experience.

In 2024, major European airlines like Lufthansa, Air France-KLM, and British Airways continued to navigate a complex operating environment, with passenger traffic showing strong recovery post-pandemic. For instance, Lufthansa Group reported carrying over 100 million passengers in the first half of 2024, underscoring the significant volume of operations requiring expert ground handling.

Cargo airlines and major freight forwarders are crucial clients, requiring specialized services like secure warehousing, swift customs processing, and expert handling for diverse cargo types. The burgeoning e-commerce sector is a significant catalyst for this segment's growth, with global e-commerce sales projected to reach $7.4 trillion by 2025.

These businesses rely on efficient ground handling to maintain their supply chain integrity and meet delivery timelines. For instance, the air cargo market saw a substantial recovery in 2024, with global air cargo volumes increasing by approximately 8% compared to 2023, underscoring the demand for robust handling partners.

Low-Cost Carriers (LCCs) represent a significant customer segment for ground handling services. These airlines, by their very nature, operate on thin margins and place a premium on cost efficiency throughout their operations. For Aviapartner, this translates to a need for highly competitive pricing structures and a focus on delivering essential ground handling services without unnecessary frills.

To effectively serve LCCs, Aviapartner must offer streamlined and rapid turnaround processes. This is crucial for LCCs as it directly impacts their ability to maintain high aircraft utilization rates and keep operational costs low. For instance, in 2024, the average turnaround time for many LCCs remains a critical factor, often targeted at under 30 minutes for narrow-body aircraft.

Aviapartner's value proposition for LCCs should emphasize cost-effectiveness and operational reliability. This means providing core services like baggage handling, aircraft cleaning, and passenger boarding/disembarking at prices that align with the LCCs' business models. The global LCC market continued its robust growth in 2024, with some estimates suggesting it accounted for over 30% of global passenger traffic, highlighting the substantial market opportunity.

Executive and Private Aviation Operators

Aviapartner provides specialized ground handling services for executive and private aviation operators, ensuring a seamless experience for passengers and crew. This segment demands exceptional flexibility, utmost discretion, and highly personalized support, often involving complex itineraries and last-minute changes.

These operators rely on Aviapartner for services that go beyond standard ground handling, including dedicated lounges, rapid transit, and bespoke catering. The global business aviation market is substantial; for instance, in 2024, the business jet charter market alone was projected to reach over $30 billion, highlighting the significant demand for premium services.

- Personalized Service: Tailored assistance for high-net-worth individuals and corporate executives.

- Flexibility and Discretion: Adapting to dynamic schedules and maintaining strict confidentiality.

- Premium Amenities: Access to private lounges, expedited customs, and concierge services.

Charter and Seasonal Airlines

Charter and seasonal airlines are a key customer segment for Aviapartner, characterized by their dynamic operational needs. These airlines, which might fly specific routes only during peak seasons or operate on an ad-hoc basis for special events or group travel, require highly adaptable ground handling services. Aviapartner’s ability to scale resources up or down quickly is crucial for these clients, ensuring efficient turnaround times regardless of flight frequency or passenger volume fluctuations. For example, during the 2023-2024 winter season, many European charter airlines saw increased demand for ski destinations, requiring flexible staffing and equipment deployment from ground handlers like Aviapartner.

The fluctuating nature of charter and seasonal operations means these airlines often seek partners who can provide reliable support without long-term fixed commitments. Aviapartner’s flexible service models are designed to meet this demand, offering tailored solutions for varying flight schedules and passenger loads. This adaptability is vital for airlines managing unpredictable demand, allowing them to optimize costs and operational efficiency. In 2024, the charter market continued to rebound, with many leisure-focused airlines leveraging these services for holiday periods and specific events.

Aviapartner’s value proposition for charter and seasonal airlines includes:

- Flexible service provision: Tailoring ground handling services to match fluctuating flight schedules and passenger volumes.

- Cost-effective solutions: Offering adaptable service packages that align with the variable revenue streams of seasonal and charter operations.

- Operational reliability: Ensuring consistent, high-quality support even during periods of intense or irregular activity.

- Scalability: The capacity to rapidly adjust resources to meet the specific demands of ad-hoc or seasonal flight programs.

Aviapartner serves a diverse range of airline clients, from major global carriers to specialized charter operations. These segments require tailored ground handling solutions, focusing on efficiency, cost-effectiveness, and premium service delivery depending on the client's operational model.

Major Passenger Airlines and Low-Cost Carriers (LCCs) are key segments, with LCCs particularly valuing cost-efficiency and rapid turnarounds. Cargo airlines and freight forwarders require specialized handling for goods, driven by e-commerce growth. Executive and private aviation operators demand highly personalized, discreet, and flexible services.

| Customer Segment | Key Needs | 2024 Market Insight |

|---|---|---|

| Major Passenger Airlines | Full suite of ground handling, operational efficiency, passenger experience | Lufthansa Group carried over 100 million passengers in H1 2024. |

| Low-Cost Carriers (LCCs) | Cost efficiency, rapid turnarounds, streamlined services | LCCs account for over 30% of global passenger traffic; turnaround times often under 30 minutes. |

| Cargo Airlines & Freight Forwarders | Specialized handling, secure warehousing, customs processing | Global air cargo volumes increased ~8% in 2024; e-commerce sales projected to reach $7.4 trillion by 2025. |

| Executive & Private Aviation | Flexibility, discretion, personalized support, premium amenities | Global business jet charter market projected over $30 billion in 2024. |

| Charter & Seasonal Airlines | Adaptability, scalability, cost-effective solutions for fluctuating demand | Increased demand for ski destinations in 2023-2024 winter season; charter market continued rebound in 2024. |

Cost Structure

Personnel costs are a substantial component of Aviapartner's expenses, encompassing wages, benefits, and the ongoing investment in training and recruitment for its extensive workforce. This includes thousands of employees fulfilling critical roles such as ramp agents, passenger service agents, cargo handlers, and administrative staff, all essential for smooth airport operations.

In 2024, labor costs are projected to remain a dominant factor, reflecting the company's commitment to its large operational footprint and the skilled personnel required to manage it effectively. For instance, a significant portion of an airport services company's operating budget typically goes towards compensating its frontline staff and ensuring they have the necessary skills through continuous development programs.

The acquisition and ongoing upkeep of a substantial fleet of ground support equipment (GSE) represent a significant portion of Aviapartner's operational expenses. This includes everything from purchasing new machinery to routine maintenance, repairs, and ensuring all equipment is properly fueled and ready for use.

These costs are amplified by strategic investments in modernizing the fleet, particularly with a focus on more sustainable, electric GSE. For instance, in 2024, many airport service providers are allocating substantial capital towards electrifying their GSE fleets to meet environmental regulations and reduce long-term fuel costs, with estimates suggesting a 20-30% increase in upfront acquisition costs for electric alternatives compared to traditional diesel equipment.

Aviapartner incurs substantial costs through airport fees and concession charges. These payments are essential for securing operating licenses and gaining access to vital airport infrastructure like runways, terminals, and aircraft stands. For instance, in 2024, major European airports saw landing and handling fees represent a significant portion of ground handler expenses, with some fees increasing by 5-10% year-over-year due to inflation and infrastructure investment needs.

Fuel and Energy Costs

Fuel and energy costs represent a significant expenditure for Aviapartner, encompassing fuel for their fleet of ground handling vehicles and electricity for their various airport facilities like cargo warehouses and offices. These costs are directly tied to operational volume and global energy prices. For instance, the International Air Transport Association (IATA) reported that jet fuel costs, a significant component influencing ground operations, were projected to average $92.20 per barrel in 2024, a slight decrease from 2023 levels but still a substantial operating expense.

The company is increasingly investing in more energy-efficient equipment and exploring sustainable alternatives to mitigate these costs and environmental impact. This includes the adoption of electric ground support equipment (eGSE) and optimizing energy consumption within their infrastructure. The drive towards sustainability is not just an environmental consideration but also a strategic move to manage and potentially reduce these substantial overheads in the long term.

- Fuel for Ground Handling Vehicles: This covers the consumption of diesel, gasoline, and increasingly, electricity for specialized airport vehicles like baggage tractors, pushback tugs, and de-icing trucks.

- Energy for Facilities: This includes electricity and heating/cooling for cargo warehouses, passenger terminals (if operated by Aviapartner), maintenance hangars, and administrative offices.

- Impact of Global Energy Prices: Fluctuations in oil and natural gas prices directly affect Aviapartner's fuel and energy expenditures, making cost management a continuous challenge.

- Investment in Sustainable Alternatives: Aviapartner is actively exploring and implementing electric ground support equipment (eGSE) and energy-efficient building technologies to reduce reliance on fossil fuels and lower operational costs.

Insurance and Compliance Costs

Aviapartner faces significant expenses for comprehensive insurance coverage, including liability for ground handling operations and protection for its extensive equipment fleet. These policies are essential to mitigate risks inherent in the aviation industry.

Compliance with rigorous aviation regulations, spanning safety, security, and environmental standards, adds another layer of cost. This includes investments in training, audits, and technology to meet and maintain adherence to global and local aviation authorities' mandates.

- Insurance Premiums: Costs for general liability, aviation liability, and specialized equipment insurance are substantial, reflecting the high-risk environment. For instance, in 2024, the global aviation insurance market saw premiums rise, with ground handling services being a key component.

- Regulatory Compliance: Expenses related to obtaining and maintaining certifications, safety management systems, and environmental impact assessments are ongoing. The International Civil Aviation Organization (ICAO) continues to update standards, requiring continuous investment.

- Security Measures: Implementing and maintaining stringent security protocols, including personnel screening and cargo security, contribute to operational costs.

- Environmental Standards: Adherence to evolving environmental regulations, such as emissions control and waste management, necessitates investment in greener technologies and practices.

Aviapartner's cost structure is heavily influenced by its significant personnel expenses, the substantial investment in ground support equipment (GSE) and its maintenance, and the various fees and charges incurred at airports. These form the bedrock of its operational expenditures.

Additionally, fuel and energy costs, alongside comprehensive insurance and regulatory compliance, represent ongoing financial commitments critical for maintaining operations and adhering to industry standards.

The company's strategy involves investing in sustainable alternatives and efficient technologies to manage these costs effectively, aiming for long-term operational and financial resilience.

| Cost Category | Description | 2024 Impact/Consideration |

|---|---|---|

| Personnel Costs | Wages, benefits, training for thousands of employees (ramp agents, cargo handlers, etc.) | Remain a dominant factor due to large operational footprint and skilled workforce needs. |

| Ground Support Equipment (GSE) | Acquisition, maintenance, repairs, and fueling of airport machinery. | Upfront costs for electric GSE can be 20-30% higher than traditional equipment. |

| Airport Fees & Concessions | Payments for operating licenses and access to airport infrastructure. | Fees at major European airports increased 5-10% year-over-year in 2024 due to inflation. |

| Fuel & Energy Costs | Fuel for GSE fleet and energy for facilities (warehouses, offices). | Projected average jet fuel cost of $92.20 per barrel in 2024 impacts ground operations. |

| Insurance & Compliance | Liability, equipment insurance, regulatory adherence (safety, security, environmental). | Global aviation insurance premiums saw rises in 2024; continuous investment needed for ICAO standard updates. |

Revenue Streams

Passenger handling service fees represent a core revenue stream for ground handling companies like Aviapartner. These fees are typically charged to airlines for services such as check-in, boarding assistance, and baggage handling, often calculated per passenger, per flight, or per aircraft movement. For instance, in 2024, the global airport ground handling services market was projected to reach substantial figures, with passenger handling forming a significant portion of that revenue.

Aviapartner generates revenue from ramp handling service fees, which are charged for essential ground operations. These services include everything from loading and unloading baggage and cargo to pushback and towing aircraft. The fees are typically structured based on each aircraft movement or vary according to the specific type and size of the aircraft handled.

Aviapartner generates revenue through cargo handling service fees, which encompass the comprehensive management of air cargo operations. This includes essential services like warehousing, meticulous freight processing, crucial documentation, and the physical transportation of cargo between aircraft and ground facilities.

These fees are typically structured on a per-unit basis, directly correlating with the volume or weight of the cargo processed. For instance, in 2024, the global air cargo market saw significant activity, with the International Air Transport Association (IATA) reporting a robust demand for air freight services, indicating a strong revenue potential for handlers like Aviapartner based on throughput.

Ancillary and Specialized Services

Ancillary and specialized services represent a significant avenue for additional revenue beyond core ground handling. These offerings cater to specific client needs, enhancing the overall value proposition. For instance, de-icing is a critical seasonal service, particularly in colder climates, while executive aviation handling caters to a premium segment demanding bespoke support.

These specialized services can include:

- De-icing: Essential for safe operations in winter conditions, often priced per aircraft or per application.

- Executive Aviation Handling: Tailored services for private jets, including VIP lounges and expedited processing.

- Concierge Services: Assisting passengers with a range of needs, from ground transportation to hotel bookings.

- Aircraft Cleaning and Catering: Optional services that add convenience and comfort for passengers and crew.

In 2024, the demand for these premium services is expected to grow, driven by increasing passenger expectations and the recovery of business and private aviation sectors. For example, the global business aviation market saw a strong rebound post-pandemic, with flight hours in 2023 exceeding pre-COVID levels, indicating a healthy market for specialized handling and ancillary services.

Training and Consulting Services

Aviapartner generates revenue by offering specialized training and consulting services through its Aviapartner Academy. This arm of the business leverages the company's deep industry knowledge to equip other aviation professionals and organizations with essential skills and insights.

These services cater to a range of needs within the aviation sector, from ground handling best practices to safety protocols and operational efficiency improvements. By sharing its expertise, Aviapartner not only strengthens its brand but also creates a valuable, recurring revenue stream.

- Training Programs: Offering courses on areas like aircraft handling, safety management systems, and customer service for ground staff and management.

- Consulting Engagements: Providing tailored advice to airports and airlines on optimizing operations, improving efficiency, and implementing new technologies.

- Industry Partnerships: Collaborating with educational institutions or regulatory bodies to develop and deliver specialized aviation training modules.

Aviapartner's revenue is diversified across several key service areas, each contributing to its overall financial performance.

Passenger handling fees, charged to airlines per passenger or flight, form a foundational revenue stream. Ramp handling fees, based on aircraft movements and type, cover essential ground operations like baggage and cargo loading. Cargo handling fees, driven by the volume and weight of freight processed, are also crucial, reflecting the robust global air cargo market. Ancillary services, such as de-icing and executive aviation handling, cater to specialized needs and premium segments, with demand growing in 2024. Furthermore, Aviapartner generates income through its training and consulting services, leveraging its industry expertise to support other aviation professionals.

| Revenue Stream | Description | 2024 Market Context/Data |

|---|---|---|

| Passenger Handling | Fees from airlines for check-in, boarding, baggage services (per passenger/flight). | Global ground handling market projected for substantial growth, passenger handling a key component. |

| Ramp Handling | Fees for aircraft ground operations (loading/unloading, pushback, towing). | Priced per aircraft movement, varying by aircraft size and type. |

| Cargo Handling | Fees for warehousing, freight processing, documentation, and cargo transfer. | IATA reported robust demand for air freight in 2024, driving handler revenue based on throughput. |

| Ancillary & Specialized Services | De-icing, executive aviation handling, cleaning, catering. | Business aviation market recovery in 2023 exceeded pre-COVID levels, boosting demand for specialized services. |

| Training & Consulting | Expert-led programs and advice on aviation operations and safety. | Leverages deep industry knowledge to create a recurring revenue stream. |

Business Model Canvas Data Sources

The Aviapartner Business Model Canvas is built upon a foundation of operational data, customer feedback, and industry best practices. These sources ensure a comprehensive understanding of our service delivery and client needs.