Aviapartner Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aviapartner Bundle

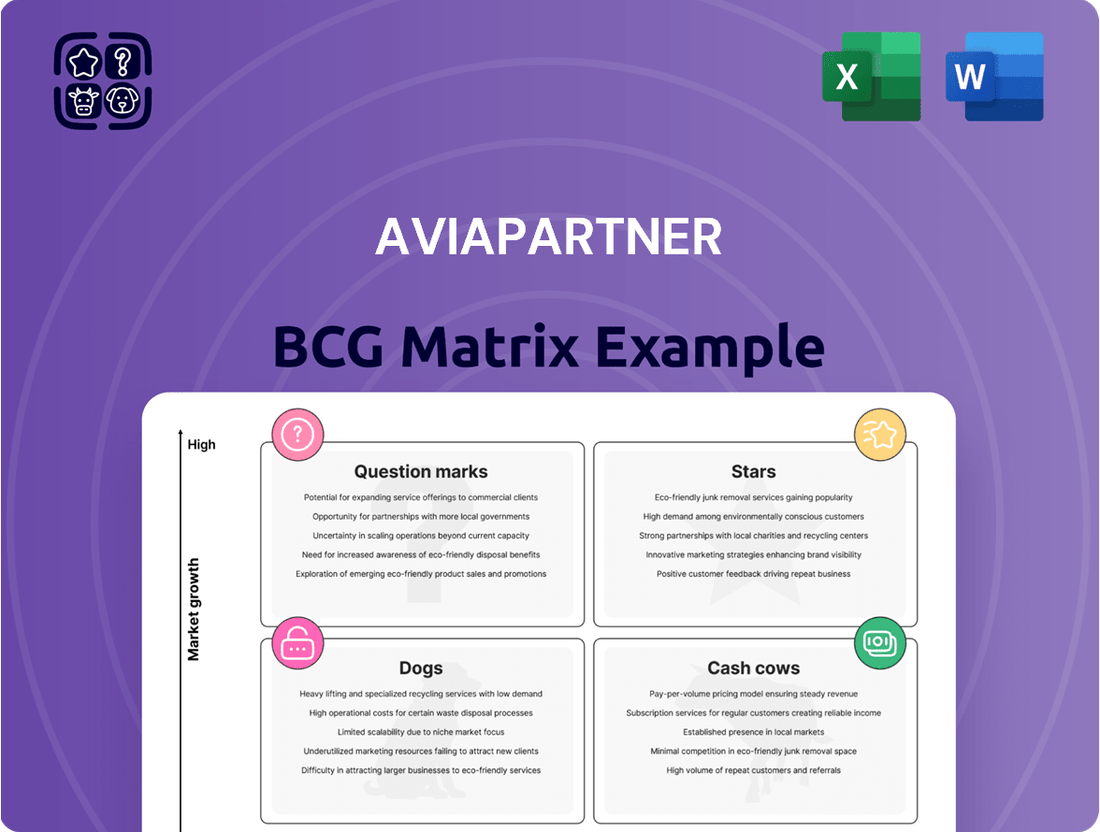

Curious about Aviapartner's strategic product portfolio? This snapshot highlights key areas, but the full BCG Matrix unlocks a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Purchase the full report for detailed quadrant placements and actionable insights to guide your investment decisions.

Stars

Aviapartner's recent success in securing ground service tenders at 12 of the 15 largest Spanish airports, including Madrid and Barcelona, highlights their strong position in a growing European aviation market. This expansion signifies a substantial increase in market share within a high-growth region.

Digital transformation and automation are pivotal for the ground handling sector's expansion, with companies like Aviapartner leveraging AI and real-time data to boost efficiency and safety. This focus on innovation positions these technological advancements as significant growth drivers within the industry.

In 2024, the global airport ground handling market was valued at approximately $75 billion and is projected to reach $110 billion by 2030, underscoring the substantial impact of digitalization. Aviapartner's investments in AI-powered predictive maintenance for ground support equipment, for instance, aim to reduce downtime by an estimated 15-20%, directly contributing to operational cost savings and improved service delivery.

Sustainable Ground Handling Solutions represent a burgeoning "Star" category within the aviation services landscape. The global market for electric ground support equipment (eGSE) is experiencing significant growth, with projections indicating a substantial increase in adoption driven by environmental regulations and operational efficiency gains. For instance, the eGSE market was valued at approximately USD 2.5 billion in 2023 and is expected to reach over USD 6 billion by 2030, showcasing a compound annual growth rate (CAGR) of around 13%.

Aviapartner’s strategic focus on electrified GSE and eco-sensitive fleets, especially in its expanding African operations, positions it to capitalize on this high-growth sector. This commitment aligns with the industry's broader push towards environmental responsibility, making sustainable solutions a key driver of future revenue and market share. By investing in these areas, Aviapartner aims to establish itself as a leader in eco-friendly ground handling.

Expansion into Premium Aviation Services

Aviapartner's AviaVIP brand, a result of strategic mergers, positions itself as a significant player in the premium aviation sector. This segment focuses on VIP, business, and private aviation, offering specialized services that cater to a discerning clientele. The company boasts the largest Fixed Base Operator (FBO) network across continental Europe, a testament to its established presence and operational capabilities in this high-margin niche.

This expansion into premium aviation services is a strategic move designed to capitalize on a growing segment of the market. By focusing on VIP, business, and private aviation, Aviapartner aims to attract high-spending customers and secure a strong competitive advantage. The company's extensive FBO network, spanning continental Europe, provides a crucial infrastructure advantage, enabling seamless and high-quality service delivery.

- Largest FBO Network: Aviapartner operates the most extensive Fixed Base Operator network in continental Europe.

- Premium Client Focus: The AviaVIP brand specifically targets VIP, business, and private aviation segments.

- High-Growth Niche: This segment represents a lucrative area within aviation, offering potential for premium pricing and strong margins.

- Strategic Advantage: The established network and brand positioning allow Aviapartner to capture a significant share of the premium aviation market.

Strategic Technology Partnerships

Strategic Technology Partnerships are crucial for Aviapartner's growth and efficiency within the BCG Matrix framework. By collaborating with innovative technology providers, Aviapartner can enhance its service offerings and operational capabilities.

These partnerships are designed to integrate cutting-edge solutions that address the evolving needs of the aviation industry. For instance, collaborations with companies like Iristick for augmented reality glasses and ADVEEZ for ground support equipment (GSE) fleet optimization showcase Aviapartner's commitment to technological advancement.

These alliances allow Aviapartner to deliver bundled services and achieve significant operational enhancements. In the rapidly expanding tech-driven market, such strategic alliances are key differentiators.

- Iristick Collaboration: Focuses on industrial augmented reality glasses to improve efficiency and safety in ground handling operations.

- ADVEEZ Partnership: Aims to optimize the ground support equipment fleet through advanced tracking and management solutions.

- Bundled Service Delivery: Integrates new technologies to offer enhanced, comprehensive services to clients.

- Operational Enhancements: Drives efficiency gains and cost reductions through the adoption of smart technologies in a competitive market.

Stars in Aviapartner's BCG Matrix represent high-growth, high-market-share segments. Sustainable Ground Handling Solutions, particularly the electric ground support equipment (eGSE) market, is a prime example. This sector is projected for substantial growth, with eGSE market value expected to climb from approximately USD 2.5 billion in 2023 to over USD 6 billion by 2030, indicating a strong CAGR of around 13%. Aviapartner's investment in electrified GSE and eco-sensitive fleets, especially in its expanding African operations, positions it to lead in this lucrative and environmentally conscious area.

What is included in the product

Strategic assessment of Aviapartner's portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear visual of Aviapartner's business units, identifying Stars, Cash Cows, Question Marks, and Dogs, alleviates the pain of strategic uncertainty.

Cash Cows

Aviapartner's established passenger handling services in Europe represent a classic Cash Cow. With a significant market share across many European airports, this segment benefits from stable demand and long-standing airline partnerships, serving over 400 carriers.

These mature operations consistently generate substantial cash flow. For instance, in 2024, the European airport services market was valued at approximately $30 billion, with passenger handling being a dominant segment, underscoring the stability and reliability of Aviapartner's revenue streams in this area.

Aviapartner's core ramp handling operations are a classic example of a Cash Cow within the BCG matrix. With a significant market share in its established European network, handling hundreds of thousands of aircraft movements annually, these services are fundamental to the aviation industry and generate consistent, reliable revenue for the company.

These operations are critical for Aviapartner, forming the backbone of its service offerings and contributing substantially to its financial stability. The sheer volume of aircraft handled underscores the maturity and strength of this business segment, which requires ongoing investment primarily for maintenance and efficiency upgrades rather than aggressive expansion.

Aviapartner's cargo handling services in key European markets like Belgium, the Netherlands, and Germany represent a solid cash cow. These operations are well-established in mature markets, consistently generating revenue and contributing to profitability.

In 2024, cargo volumes at major European hubs like Brussels Airport (BRU) and Amsterdam Airport Schiphol (AMS) remained robust. For instance, Brussels Airport reported handling over 760,000 tons of cargo in 2023, a testament to the sustained demand and Aviapartner's significant role in facilitating these operations.

General Aviation Services Portfolio

The general aviation services portfolio within Aviapartner's network is a prime example of a Cash Cow. This segment benefits from a stable, established client base, ensuring consistent revenue streams. While growth opportunities are modest, its high market share in mature service lines allows for predictable income generation.

In 2024, the general aviation sector continued to demonstrate resilience. For instance, the European Business Aviation Convention & Exhibition (EBACE) reported continued activity, with many FBOs (Fixed-Base Operators) maintaining strong operational performance. This stability is a hallmark of a Cash Cow, where consistent demand supports profitability.

- Stable Revenue: General aviation services consistently generate income due to recurring client needs.

- High Market Share: Aviapartner likely holds a dominant position in its serviced general aviation markets.

- Low Growth, High Profitability: Mature services offer steady profits with limited expansion potential.

- Cash Generation: This segment is a key contributor to Aviapartner's overall cash flow, funding other business units.

Proven Operational Excellence and Quality Systems

Aviapartner's dedication to operational excellence is a cornerstone of its success, particularly evident in its pursuit of a 99% on-time performance within a 15-minute window. This unwavering commitment to punctuality, coupled with its ISAGO (IATA Safety Audit for Ground Operations) certification across all its operations, highlights a deep-seated focus on quality and efficiency that resonates with its client base.

This proven track record of high-quality service delivery in established, mature markets allows Aviapartner to command and maintain strong profit margins. The operational efficiency achieved does not necessitate significant new capital expenditures, enabling the company to generate consistent returns and foster high customer loyalty without the need for aggressive expansion or innovation investment.

- On-Time Performance: Aiming for 99% within 15 minutes.

- Quality Assurance: ISAGO certified across all operations.

- Market Strength: Dominance in mature markets.

- Financial Benefit: High profit margins and customer retention due to operational excellence.

Aviapartner's established passenger and cargo handling services in mature European markets are its primary Cash Cows. These segments benefit from consistent demand and high market share, generating substantial and reliable cash flow for the company.

In 2024, the European airport services market, valued around $30 billion, saw passenger handling as a dominant force, supporting Aviapartner's stable revenue streams. Similarly, cargo volumes at hubs like Brussels Airport remained robust, with over 760,000 tons handled in 2023, highlighting the consistent demand Aviapartner caters to.

| Business Segment | BCG Category | Key Characteristics | 2024 Market Context |

| Passenger Handling (Europe) | Cash Cow | High market share, stable demand, long-term airline partnerships | Dominant segment in a $30B European airport services market |

| Cargo Handling (Key European Hubs) | Cash Cow | Well-established, consistent revenue, significant volumes | Robust cargo volumes at major hubs, e.g., BRU handling 760K+ tons in 2023 |

| General Aviation Services | Cash Cow | Stable client base, predictable income, modest growth | Resilient sector with strong operational performance at FBOs |

What You’re Viewing Is Included

Aviapartner BCG Matrix

The Aviapartner BCG Matrix preview you are viewing is the identical, fully-formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no surprises – just the complete, analysis-ready strategic tool. You can be confident that the detailed breakdown of Aviapartner's business units, categorized by market share and growth rate, is precisely what you'll be working with. This ensures you gain immediate strategic insights without any need for further editing or reformatting.

Dogs

Outdated manual processes in ground handling, such as paper-based flight manifests or manual baggage tagging, represent a significant 'dog' in the Aviapartner BCG Matrix. These methods are inherently slower and more error-prone than their digital counterparts, directly impacting efficiency and cost-effectiveness.

For instance, a study by SITA in 2023 revealed that manual data entry errors in logistics can lead to a 15-25% increase in operational costs. This translates to higher expenses for Aviapartner if these manual systems persist, hindering its ability to compete with more technologically advanced handlers.

Legacy Non-Electric Ground Support Equipment represents older, often diesel-powered machinery that hasn't been upgraded to newer electric or hybrid models. These assets typically face increasing operational costs due to higher fuel consumption and more frequent maintenance needs. For instance, in 2024, the global GSE market saw a continued push towards electrification, with many airports and ground handlers prioritizing emissions reduction, leaving older diesel units in a less competitive position.

This category generally falls into the 'Dog' quadrant of the BCG matrix. Such equipment yields low returns and operates in a market segment that is not experiencing significant growth, largely due to environmental regulations and the drive for operational efficiency. By 2025, the total cost of ownership for non-electric GSE is projected to be substantially higher than for their electric counterparts, impacting profitability.

Underperforming contracts in stagnant markets, often found at smaller, highly competitive airports, represent Aviapartner's 'dogs' in the BCG Matrix. These operations struggle with limited market share and profitability due to intense price pressure and minimal growth prospects. For instance, in 2024, smaller regional airports in Europe, where Aviapartner might have a presence, saw passenger traffic grow by a modest 2-3%, significantly lower than major hubs, making it difficult to achieve economies of scale and positive margins on ground handling services.

Operations Impacted by Persistent Labor Shortages

Persistent labor shortages significantly impact airport ground handling services, particularly in high-demand locations and specialized service lines. These challenges directly affect operational efficiency and cost structures.

Areas categorized as dogs within Aviapartner's operations are those experiencing severe staffing issues, leading to reduced service quality and increased operational expenses. For instance, in 2024, the aviation industry globally faced a shortage of approximately 2.3 million workers, with ground handling being a critical area affected.

- Ground Handling Services: Specific airport locations or service lines struggling with high staff turnover and difficulty in recruitment fall into this category.

- Operational Inefficiency: Labor shortages directly translate to slower turnaround times, delayed flights, and reduced capacity to handle passenger and cargo volumes.

- Increased Costs: Overtime pay, agency staffing, and recruitment expenses rise significantly as companies try to compensate for the lack of permanent staff.

- Service Quality Decline: Without adequate staffing, the ability to maintain high service standards for passengers and airlines diminishes, potentially leading to contract losses.

Services with Limited Automation Potential

Certain highly specialized or low-volume ground handling tasks at airports might fall into the 'dog' category of the Aviapartner BCG Matrix. These are services that are difficult to automate due to their unique nature or infrequent demand, requiring significant human labor. For instance, intricate aircraft de-icing procedures in specific weather conditions or the handling of exceptionally oversized cargo might fit this description.

The challenge for these services is their potential to become less profitable as the broader industry embraces automation. Without the ability to scale through technology or reduce labor costs, their margins could shrink. In 2023, the global airport ground handling services market was valued at approximately $65 billion, with labor costs representing a significant portion of operational expenses for many providers.

- Specialized Cargo Handling: Managing unique or hazardous materials that require bespoke handling protocols.

- Low-Volume Aircraft Type Support: Providing services for aircraft models with very limited operational presence.

- Complex Passenger Assistance: Catering to passengers with highly specific or uncommon needs that cannot be standardized.

- Niche Equipment Maintenance: Servicing specialized ground support equipment that is not widely used.

Outdated manual processes and legacy non-electric ground support equipment represent significant 'dogs' for Aviapartner. These areas are characterized by low returns and operate in markets facing increasing costs and regulatory pressure, hindering competitive advantage.

Underperforming contracts at smaller airports and persistent labor shortages further contribute to the 'dog' quadrant, directly impacting operational efficiency and profitability. For instance, global labor shortages in aviation affected approximately 2.3 million workers in 2024, with ground handling being a critical sector.

Specialized, low-volume ground handling tasks also fall into this category, facing challenges from automation trends and high labor costs. The global ground handling market, valued around $65 billion in 2023, highlights the significant operational expenses tied to labor.

| Category | Description | BCG Quadrant | Key Challenges | 2024/2025 Outlook |

| Manual Processes | Paper-based flight manifests, manual baggage tagging | Dog | Inefficiency, error-prone, higher operational costs | Increasing pressure for digitalization, potential cost increases |

| Legacy GSE | Older, diesel-powered ground support equipment | Dog | Higher fuel and maintenance costs, environmental regulations | Growing cost disadvantage compared to electric alternatives |

| Underperforming Contracts | Low-margin services at small, competitive airports | Dog | Limited growth, intense price pressure, lack of economies of scale | Stagnant market growth, difficulty in achieving profitability |

| Labor Shortages | Difficulty in recruiting and retaining ground handling staff | Dog | Reduced service quality, increased overtime and agency costs | Continued industry-wide staffing challenges impacting operations |

| Niche Services | Highly specialized or low-volume handling tasks | Dog | Difficult to automate, high labor dependency, shrinking margins | Potential for reduced profitability due to automation trends |

Question Marks

Aviapartner's joint venture, Colossal Aviapartner, in South Africa is strategically positioned to capitalize on Africa's burgeoning aviation sector. This move reflects a classic 'question mark' scenario within the BCG matrix, where high market growth potential is met with a low current market share.

The African aviation market is indeed experiencing significant expansion, with passenger traffic projected to grow substantially in the coming years. For instance, the International Air Transport Association (IATA) forecasted a strong recovery and continued growth trajectory for African airlines post-pandemic, with domestic traffic expected to surpass pre-COVID levels. This high growth environment makes it an attractive, albeit challenging, market for new entrants like Colossal Aviapartner.

However, Aviapartner's current footprint across the continent remains nascent. Establishing a significant presence will necessitate substantial capital investment in infrastructure, technology, and local partnerships. The success of Colossal Aviapartner will depend on its ability to navigate regulatory complexities, build brand recognition, and effectively compete against established players, all while managing the inherent risks associated with a developing market.

Full-scale AI and robotics deployment at Aviapartner represents a Stars category opportunity. This involves integrating advanced AI and robotic systems for tasks such as baggage handling, aircraft refueling, and catering across its operations. The global market for airport automation is projected to reach $2.5 billion by 2028, indicating substantial growth potential.

While this area offers high growth, it also demands significant upfront investment and the market penetration of these technologies is still in its nascent stages. For instance, the initial capital expenditure for a fully automated baggage handling system can range from $5 million to $20 million per airport, with uncertain immediate returns on investment.

The integration of IoT sensors and advanced data analytics for predictive maintenance of ground support equipment (GSE) represents a significant growth area, aiming to boost operational efficiency and slash expenses. This technology allows for anticipating equipment failures before they occur, minimizing downtime.

For Aviapartner, a full-scale implementation across its GSE fleet is probably in its early stages. Such a rollout demands considerable upfront capital expenditure. The expectation is that this investment will pave the way for future market share gains and improved profitability, though widespread impact is yet to be fully realized.

Exploration of New Geographic Regions

Expanding into new geographic regions, such as the Americas or Asia, would position Aviapartner as a 'Question Mark' in the BCG matrix. These markets offer significant growth potential, but Aviapartner's current market share there would likely be minimal, requiring substantial investment to establish a foothold.

Future strategic initiatives to enter entirely new continents would represent high growth prospects for Aviapartner. However, these ventures would commence with a very low market share, necessitating considerable upfront investment and dedicated market development efforts to gain traction.

- Market Potential: Asia's aviation market, for instance, is projected to see significant growth, with the International Air Transport Association (IATA) forecasting it to account for over half of the world's air traffic growth in the next two decades. This presents a substantial opportunity for expansion.

- Investment Needs: Entering a new continent like North America would require substantial capital for setting up new ground handling facilities, acquiring necessary certifications, and building relationships with airlines. For example, initial investments for new airport concessions can run into tens of millions of Euros.

- Risk Factor: The 'Question Mark' status highlights the inherent risk. Success is not guaranteed, and a failure to capture market share could lead to significant financial losses, impacting Aviapartner's overall profitability and resource allocation.

- Strategic Focus: Aviapartner would need to carefully select target regions, conduct thorough market analysis, and develop tailored entry strategies to mitigate risks and maximize the chances of converting these 'Question Marks' into 'Stars'.

Development of Niche Sustainable Technologies

Niche Sustainable Technologies, within the Aviapartner BCG Matrix, represent investments in specialized environmental solutions beyond common electric ground support equipment. This includes areas like sophisticated waste stream segregation and recycling or the development of novel, eco-friendlier de-icing fluids.

These ventures are characterized by their high future growth potential, yet currently hold a minimal market share in Aviapartner's overall operations. For instance, while electric GSE adoption is growing, advanced bio-degradable de-icing fluid research might still be in early-stage pilot programs, potentially representing less than 1% of total de-icing fluid usage in 2024.

The strategic implication is that these niche technologies require continued investment and nurturing to mature and capture larger market segments, much like a startup needing seed funding to scale.

- High Growth Potential: Focus on emerging sustainable solutions with significant future market expansion possibilities.

- Low Current Market Share: Acknowledge that these technologies are not yet widely adopted within the existing portfolio.

- Investment Focus: Prioritize R&D and pilot projects for specialized areas like advanced waste management and innovative de-icing agents.

- Strategic Importance: Position these as future drivers of competitive advantage and environmental leadership.

Question Marks in Aviapartner's BCG Matrix represent business areas with high market growth potential but low current market share. These are often new ventures or expansions into new territories that require significant investment to gain traction.

The success of these Question Marks hinges on Aviapartner's ability to effectively allocate resources, adapt to market dynamics, and execute strategic growth plans. Failure to do so could result in these ventures becoming Dogs or being divested.

For instance, Aviapartner's expansion into the South American market, with its projected 7.5% annual growth in air cargo traffic through 2027, presents a classic Question Mark scenario. While the market is expanding rapidly, Aviapartner's current share is minimal, necessitating substantial investment in infrastructure and local partnerships to compete effectively.

| Business Area | Market Growth | Market Share | BCG Category | Strategic Implication |

|---|---|---|---|---|

| South American Expansion | High (7.5% projected cargo growth) | Low | Question Mark | Requires significant investment for market penetration. |

| AI-driven Predictive Maintenance | High (growing adoption in aviation MRO) | Low (early stage implementation) | Question Mark | Potential for future cost savings and efficiency gains, needs continued R&D. |

| Entry into Southeast Asian Markets | Very High (projected 10%+ passenger growth) | Negligible | Question Mark | Substantial capital needed for infrastructure and regulatory compliance. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial performance, industry growth rates, and competitive landscape analysis, to accurately position Aviapartner's business units.