Aviapartner Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aviapartner Bundle

Aviapartner operates within a dynamic aviation services landscape, facing significant pressures from powerful buyers and intense rivalry among existing players. Understanding the threat of substitutes and the bargaining power of suppliers is crucial for navigating this competitive arena.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Aviapartner’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of specialized ground support equipment (GSE) such as aircraft tugs and cargo loaders wield considerable bargaining power. The global GSE market is projected to reach approximately $10.5 billion by 2027, indicating robust demand and supplier influence.

The increasing demand for advanced, efficient, and environmentally friendly GSE, including electric and hybrid models, further strengthens the position of key manufacturers. This focus on innovation means ground handling companies like Aviapartner may face pricing adjustments and potential supply constraints based on these technological advancements.

Fuel and energy providers hold significant bargaining power over Aviapartner, particularly concerning traditional fuel sources for ground support equipment (GSE). The cost of jet fuel, a major expense, directly influences Aviapartner's profitability, especially as many operational assets still rely on fossil fuels. For instance, in 2023, global jet fuel prices averaged around $2.20 per gallon, a figure that can fluctuate considerably, impacting operational budgets.

This reliance on fluctuating fuel prices means that any increase in energy costs can directly squeeze Aviapartner's margins if these costs cannot be passed on to customers. The shift towards electric and hybrid GSE, however, is beginning to alter this dynamic. As Aviapartner invests in newer, greener technologies, the bargaining power may shift towards electricity suppliers and providers of charging infrastructure, introducing a new set of energy-related cost considerations.

The workforce, encompassing skilled personnel for passenger, ramp, and cargo handling, represents a critical supplier for ground handling services. The industry grapples with difficulties in attracting and keeping qualified employees, which can result in personnel deficits and upward pressure on wages. This dynamic amplifies the negotiating leverage of workers, necessitating investments in training and retention initiatives by companies like Aviapartner.

Technology and Software Vendors

Technology and software vendors, offering critical ground handling management systems, automation, and cybersecurity, are increasingly influential. As the aviation industry pushes for digital transformation, leveraging AI, data analytics, and real-time tracking, reliance on these specialized providers grows. This dependence grants them significant leverage.

The increasing demand for sophisticated operational software means that vendors providing these solutions can command higher prices. For instance, the global market for airport IT solutions was projected to reach over $6 billion in 2024, indicating substantial spending and reliance on these tech suppliers.

- Digital Transformation Drive: The aviation sector's commitment to digital transformation, including automation and AI, amplifies the importance of technology suppliers.

- Vendor Dependence: Companies like Aviapartner rely on these vendors for essential functions, from operational efficiency to data security, creating a power imbalance.

- Market Growth: The expanding market for airport IT solutions, estimated to exceed $6 billion in 2024, underscores the increasing financial clout of these technology providers.

Airport Infrastructure and Utilities

Airport authorities and utility providers hold significant bargaining power as they control essential infrastructure and services. For instance, airport landing fees and gate usage charges, which are set by authorities, directly influence Aviapartner's operating expenses. In 2024, average airport charges globally continued to reflect the ongoing recovery in air travel, with some airports increasing fees to recoup pandemic-related losses.

Their ability to dictate terms regarding infrastructure access and utility pricing, such as electricity and water, can substantially impact Aviapartner's cost structure and service delivery efficiency. For example, a 2024 report indicated that energy costs for airport ground handling services saw an average increase of 7% year-over-year across major European hubs, directly attributable to utility provider pricing.

- Airport authorities control critical resources like gate access and runway usage.

- Utility providers set pricing for essential services such as electricity and water.

- These entities can influence Aviapartner's operational costs and service efficiency through their pricing and regulatory decisions.

- In 2024, rising energy costs impacted ground handling operations, highlighting the influence of utility providers.

Suppliers of specialized ground support equipment (GSE) and technology vendors exhibit strong bargaining power due to industry reliance on advanced, innovative solutions. The global GSE market's projected growth to $10.5 billion by 2027 and the airport IT solutions market exceeding $6 billion in 2024 highlight their significant influence and pricing leverage.

Fuel providers also hold considerable sway, with jet fuel prices, averaging around $2.20 per gallon in 2023, directly impacting operational costs. While the shift to electric GSE may alter this dynamic, current dependence on fossil fuels empowers energy suppliers.

The workforce, particularly skilled ground handling personnel, represents another key supplier group. Labor shortages and the need for specialized skills grant employees increased bargaining power, leading to wage pressures and demands for better training and retention initiatives.

| Supplier Type | Key Products/Services | Bargaining Power Factors | Market Data (2024/2027) |

|---|---|---|---|

| GSE Manufacturers | Aircraft tugs, cargo loaders, specialized equipment | Demand for advanced/eco-friendly models, innovation | GSE Market: ~$10.5B by 2027 |

| Fuel & Energy Providers | Jet fuel, electricity, charging infrastructure | Reliance on fossil fuels, fluctuating energy prices | Jet Fuel Avg. Price (2023): ~$2.20/gallon |

| Technology Vendors | Airport IT solutions, operational software, AI, data analytics | Digital transformation drive, vendor dependence | Airport IT Market: >$6B in 2024 |

| Skilled Workforce | Ground handling personnel (ramp, cargo, passenger) | Labor shortages, demand for specialized skills | N/A (Qualitative factor) |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Aviapartner's airport ground handling services.

Instantly visualize competitive pressures with a dynamic spider chart, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Major airlines wield considerable bargaining power over ground handling services, primarily due to the sheer volume of business they represent. For instance, in 2024, a single major carrier might contract for thousands of flight turnarounds annually, making their business highly desirable for providers like Aviapartner. This volume allows them to negotiate aggressively on pricing and service level agreements, securing more favorable terms than smaller, less frequent customers.

The competitive landscape of the ground handling market further amplifies this power. With multiple providers vying for airline contracts, airlines can easily switch or threaten to switch if their demands aren't met. This leverage enables them to dictate terms, pushing down costs for ground handling operations and ensuring they receive premium service, as evidenced by the intense bidding wars seen for major route contracts throughout 2024.

Low-cost carriers (LCCs) exert significant bargaining power over ground handling services like those offered by Aviapartner. Their relentless focus on cost efficiency means they actively seek the most competitive pricing, often driving down the rates for essential services. For instance, in 2024, several LCCs were observed negotiating for reduced turnaround times and bundled service packages to lower their operational expenses.

This bargaining power is amplified by the LCCs' operational flexibility. They can readily switch between airports and ground handling providers if they find better terms, forcing companies like Aviapartner to remain highly competitive. Reports from early 2024 indicated that some LCCs were leveraging this by consolidating their ground handling needs with providers offering more favorable contract structures, putting pressure on established players.

Consequently, Aviapartner faces the challenge of balancing its need to maintain profitability with the demand for cost-effective ground handling from LCCs. The ability to offer competitive pricing without compromising on the quality and safety of its services is crucial for securing and retaining these important customers in the dynamic aviation market of 2024.

Consolidated airline alliances significantly amplify customer bargaining power in the ground handling sector. By pooling demand across numerous routes and airports, these alliances can negotiate more favorable terms, often securing lower prices and more tailored service agreements from ground handling providers like Aviapartner. For instance, the Star Alliance, a major global network, represents a substantial portion of global air traffic, giving its members considerable leverage.

Demand for Specific Service Quality

Airlines, as key customers for ground handling services, exert significant bargaining power due to their demand for high service quality, punctuality, and stringent safety standards. These requirements are critical for efficient aircraft turnaround and overall passenger satisfaction.

Failure to meet these exacting performance criteria can result in financial penalties or even the termination of contracts, empowering airlines to dictate strict operational benchmarks for service providers like Aviapartner.

- High Service Expectations: Airlines require flawless execution of ground handling tasks to maintain their operational schedules and brand reputation.

- Contractual Leverage: Performance clauses and penalty structures within contracts give airlines considerable power to enforce quality and punctuality.

- Regulatory Influence: Upcoming EU regulations, anticipated in late 2024 or early 2025, are set to further standardize ground handling safety and quality, likely elevating customer expectations and reinforcing airline bargaining power.

Potential for Self-Handling by Airlines

The potential for airlines to perform ground handling services themselves, known as self-handling, significantly impacts the bargaining power of customers. This capability acts as a credible threat to third-party providers like Aviapartner. For instance, a major carrier might invest in its own equipment and personnel if the cost of outsourcing these services exceeds a certain threshold.

This internal option directly limits the pricing power of ground handling companies. If Aviapartner's fees rise too high, airlines can choose to bring these operations in-house, thereby controlling costs and service quality. This is particularly relevant for larger airlines with substantial operations, as the economies of scale can make self-handling more feasible.

- Self-handling capability: Larger airlines can develop their own ground handling operations.

- Cost control: Airlines can switch to self-handling if third-party prices become uneconomical.

- Reduced pricing power: Ground handling providers face pressure to keep prices competitive due to this threat.

- Strategic option: Self-handling represents a strategic alternative for airlines seeking greater control over their operations.

The bargaining power of customers, primarily airlines, is a significant force impacting ground handling service providers like Aviapartner. This power stems from the substantial volume of business airlines represent, their ability to switch providers, and the potential for self-handling.

In 2024, major airlines continued to leverage their scale, often contracting for thousands of flight turnarounds annually, which naturally gives them considerable negotiation leverage on pricing and service terms. The competitive ground handling market further empowers airlines, as they can readily shift to alternative providers if dissatisfied, a dynamic observed in numerous contract negotiations throughout the year.

Low-cost carriers (LCCs) are particularly adept at driving down costs, actively seeking the most competitive rates for essential services. For instance, in early 2024, LCCs were noted for consolidating their ground handling needs with providers offering more favorable contract structures, thereby pressuring established players like Aviapartner to remain highly competitive.

The threat of self-handling, where airlines manage ground operations internally, also limits the pricing power of third-party providers. This option becomes more feasible for larger carriers, acting as a direct constraint on outsourcing costs and service quality expectations.

| Customer Type | Bargaining Power Factor | Impact on Ground Handling Providers (e.g., Aviapartner) | 2024 Observation |

|---|---|---|---|

| Major Airlines | High Volume of Business | Negotiate lower prices, favorable service level agreements. | Contracts for thousands of turnarounds annually, securing preferred terms. |

| Airlines (General) | Switching Costs / Provider Competition | Ability to switch providers if demands are not met, pushing down costs. | Intense bidding wars for major route contracts. |

| Low-Cost Carriers (LCCs) | Focus on Cost Efficiency | Drive down rates for essential services, seek bundled packages. | Consolidating needs with providers offering better contract structures. |

| Airlines (General) | Self-Handling Capability | Credible threat to outsource, limits pricing power of third parties. | Larger carriers consider internal operations if outsourcing costs rise. |

What You See Is What You Get

Aviapartner Porter's Five Forces Analysis

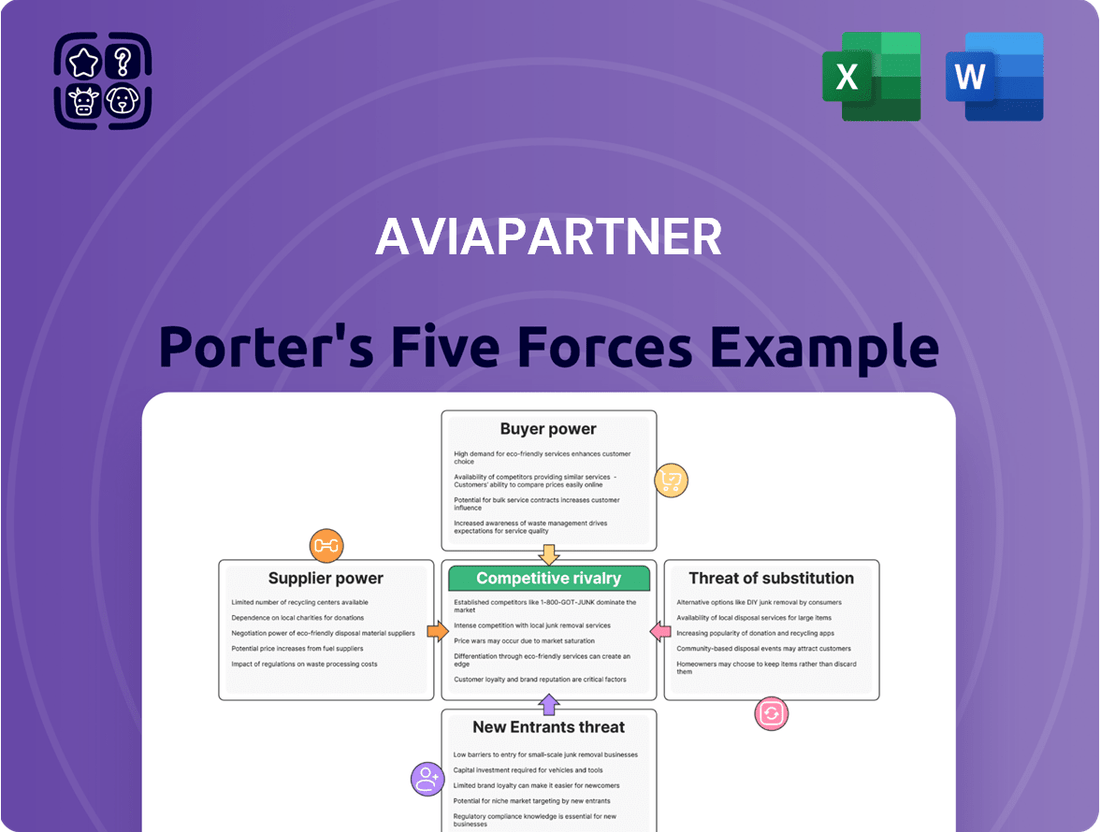

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the strategic landscape of Aviapartner through a robust Porter's Five Forces analysis, examining competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products or services. This comprehensive breakdown provides actionable insights into the industry's attractiveness and Aviapartner's competitive positioning.

Rivalry Among Competitors

The European airport ground handling sector is a crowded space, with major international players like Swissport, Dnata, Menzies Aviation, and Worldwide Flight Services actively competing. Aviapartner operates within this dynamic, facing numerous established and regional competitors, all vying for airline contracts and service dominance.

The ground handling services market is seeing robust expansion, particularly in Europe, which is a key and rapidly growing region. This upward trend in industry growth, fueled by rising air passenger and cargo volumes, naturally heightens competitive rivalry as firms vie for dominance in an increasingly lucrative market.

Competitive rivalry in the ground handling sector is intense, as services are largely commoditized, making it difficult to stand out purely on service quality. Companies like Aviapartner often compete on factors such as operational efficiency, punctuality, and the adoption of new technologies like automated baggage handling systems. For instance, in 2024, many ground handlers are investing in digital platforms to streamline operations and improve communication with airlines, aiming to gain a competitive edge through superior reliability and cost management.

Switching Costs for Customers

Switching costs for airlines from ground handling providers like Aviapartner are generally considered moderate. While there are operational adjustments and potential initial disruptions when changing providers, the competitive landscape and increasing regulatory standardization, particularly within the EU, tend to mitigate these costs. For instance, new EU regulations in 2024 are pushing for more standardized operational procedures across ground handlers, which should make it easier for airlines to transition between services.

The availability of multiple ground handling providers in many key airports directly influences these switching costs. Airlines can leverage this competition to negotiate better terms and reduce the perceived risk associated with a change. This market dynamic means that the investment required to switch is often outweighed by the potential benefits of a more cost-effective or service-improved provider.

- Moderate Switching Costs: Airlines face operational hurdles but these are offset by market competition.

- EU Regulatory Impact: New EU regulations in 2024 are standardizing operations, potentially lowering switching barriers.

- Competitive Market: The presence of numerous ground handling providers allows airlines to switch more readily.

Regulatory Environment

The regulatory environment significantly shapes competitive rivalry in the ground handling sector. New EU regulations for ground handling, anticipated for late 2024 or early 2025, are designed to harmonize safety and operational standards across European airports. This standardization, while promoting a more equitable competitive landscape, necessitates substantial compliance investments from all players.

These upcoming regulations could disproportionately affect smaller ground handling companies, potentially leading to consolidation as they struggle with the financial burden of adapting to new requirements. For instance, investments in updated equipment or enhanced training programs to meet standardized safety protocols could represent a significant capital outlay for smaller entities compared to larger, more established competitors.

- New EU Ground Handling Regulations: Expected late 2024/early 2025, aiming for standardized safety and operational requirements.

- Compliance Investment: Companies must invest to meet new standards, impacting profitability.

- Impact on Smaller Players: Smaller ground handling firms may face greater financial strain due to compliance costs.

Competitive rivalry within the ground handling sector is fierce, driven by a fragmented market and the commoditized nature of services. Aviapartner faces numerous competitors like Swissport and Dnata, all vying for airline contracts through price and operational efficiency. The drive for technological adoption, such as automated systems seen in 2024, further intensifies this competition as firms seek an edge.

The upcoming EU ground handling regulations, expected in late 2024 or early 2025, aim to standardize safety and operations. While this promotes a level playing field, it demands significant compliance investments, potentially straining smaller players and encouraging market consolidation. This regulatory shift underscores the dynamic and challenging competitive environment Aviapartner navigates.

| Competitor | Market Share (Europe, est. 2024) | Key Service Offerings |

|---|---|---|

| Swissport | ~20-25% | Ramp handling, baggage, passenger services, cargo |

| Dnata | ~10-15% | Full ground handling, cargo, catering |

| Menzies Aviation | ~8-12% | Ramp, passenger, cargo services |

| Worldwide Flight Services (WFS) | ~7-10% | Cargo handling, ramp services |

SSubstitutes Threaten

Airlines have the option to manage their own ground handling services, particularly at their primary airports or for specialized operations. This direct alternative bypasses third-party providers, significantly impacting the pricing flexibility and market penetration of companies like Aviapartner.

For instance, in 2024, several major carriers continued to invest in their in-house ground handling capabilities, especially for premium services or during peak seasons, to maintain control over service quality and costs. This trend suggests a persistent threat where airlines can choose to internalize operations, thereby reducing their reliance on external handlers.

Technological advancements in aircraft design present a potential long-term substitute threat to ground handling services. As aircraft become more sophisticated, with integrated systems designed to automate or simplify ground operations, the demand for traditional ground handling services could diminish. For instance, future aircraft might incorporate self-maneuvering capabilities or simplified loading systems, reducing the need for extensive ground crew and specialized equipment.

The increasing sophistication of airport-wide digital platforms and the advent of autonomous ground support equipment present a significant threat of substitutes for traditional ground handling services. As airports invest in these technologies, they may gain the capability to manage certain ground operations internally, bypassing the need for external providers like Aviapartner. This trend is amplified by the growing efficiency and cost-effectiveness of automated solutions, potentially reducing the perceived value of conventional ground handling models.

Intermodal Transport Alternatives

The threat of substitutes for air cargo handling services, particularly from intermodal transport, is a significant consideration. For certain types of goods and shorter transit times, advancements in other freight modes can offer competitive alternatives.

High-speed rail networks are expanding, offering faster transit than traditional rail and potentially competing with air cargo for time-sensitive shipments over medium distances. In 2023, global rail freight volume saw a steady increase, indicating growing capacity and efficiency in this sector.

Furthermore, sophisticated trucking logistics, including dedicated freight corridors and optimized fleet management, are enhancing the speed and reliability of road transport. This makes trucking a more viable substitute for air cargo on many routes, especially when factoring in the total door-to-door transit time and cost.

- Rail Freight Growth: Several countries reported significant year-over-year growth in rail freight volumes in 2023, demonstrating increased investment and operational efficiency.

- Trucking Efficiency Gains: Technological advancements in fleet management and route optimization have reportedly reduced average delivery times for trucking by up to 10% on key routes in 2024.

- Cost Competitiveness: For non-time-critical shipments, the lower per-unit cost of rail and road freight compared to air cargo remains a persistent substitute factor.

Shift to Decentralized Ground Operations

The emergence of decentralized ground operations presents a significant threat of substitutes for traditional, integrated service providers like Aviapartner. A future model could see non-traditional entities or on-demand platforms handling specific ground services, fragmenting the current comprehensive offering. This shift necessitates adaptation to a more flexible, potentially less integrated service environment.

This evolving landscape could see specialized third-party providers offering niche services, such as advanced baggage handling technology or specialized aircraft cleaning, directly to airlines. For instance, the growth of drone technology for inspections or automated ground support equipment could bypass traditional service contracts. In 2024, the global market for airport ground handling services was valued at approximately $70 billion, with a projected compound annual growth rate (CAGR) of around 4.5% through 2030, indicating a substantial market ripe for disruption.

- Decentralized Service Providers: Emergence of specialized companies offering single, highly efficient ground services (e.g., ramp handling, passenger boarding).

- On-Demand Platforms: Digital marketplaces connecting airlines with independent ground service providers, bypassing established intermediaries.

- Technological Substitutes: Automation and AI-driven solutions reducing reliance on human-intensive ground operations for certain tasks.

- Airline In-housing: Airlines potentially bringing specific, core ground operations back in-house to gain greater control and cost efficiencies.

Airlines can choose to perform their own ground handling, particularly at their main airports or for specialized tasks. This bypasses third-party providers, directly impacting the pricing power and market reach of companies like Aviapartner. In 2024, several major airlines continued to enhance their in-house ground handling capabilities, especially for premium services, to better control quality and costs.

Technological advancements also pose a threat. As aircraft become more sophisticated with systems designed to simplify ground operations, the need for traditional ground handling services could decrease. For example, future aircraft might feature self-maneuvering or simplified loading systems, reducing reliance on extensive ground crews and specialized equipment.

The growing sophistication of airport-wide digital platforms and the rise of autonomous ground support equipment present a significant substitute threat. Airports investing in these technologies may manage certain ground operations internally, bypassing external providers. This trend is bolstered by the increasing efficiency and cost-effectiveness of automated solutions, potentially diminishing the perceived value of conventional ground handling models.

Entrants Threaten

The ground handling sector demands substantial upfront capital for essential equipment like aircraft tugs, baggage loaders, and de-icing trucks. For instance, a single modern, electric aircraft tug can cost upwards of $250,000, and a fleet of specialized vehicles for a medium-sized airport can easily run into millions of dollars.

Beyond initial acquisition, ongoing maintenance, adherence to evolving safety regulations, and the necessary investment in advanced IT systems for operational efficiency create a continuous financial burden. This high level of expenditure acts as a significant deterrent for potential new entrants seeking to compete with established players like Aviapartner.

The aviation sector faces significant barriers to entry due to rigorous regulatory and safety compliance. New companies must invest substantially in meeting stringent international and national standards, including complex licensing procedures and robust safety management systems. For instance, the European Union's ongoing efforts to further standardize these requirements mean that any new entrant must be prepared for substantial upfront capital expenditure and ongoing compliance costs.

Established ground handling providers like Aviapartner benefit from deep-rooted relationships with airlines and airports, often cemented by multi-year agreements. New competitors must overcome the hurdle of penetrating these existing networks and vying for profitable contracts, a significant barrier to entry.

Operational Complexity and Expertise

The ground handling sector, where Aviapartner operates, is characterized by significant operational complexity. New entrants face the daunting task of acquiring specialized expertise across a wide range of services, from meticulous ramp handling and efficient passenger services to intricate cargo logistics. This isn't a simple matter of setting up shop; it requires building a deep reservoir of operational know-how and cultivating a skilled workforce. For instance, the International Air Transport Association (IATA) emphasizes rigorous training and certification for ground handling personnel, highlighting the specialized knowledge needed for safety and efficiency.

Building this expertise from the ground up represents a substantial barrier. New companies must invest heavily in training programs, safety protocols, and the development of experienced management teams. Consider the capital expenditure and time commitment required to train a single ramp agent to meet international aviation standards. This steep learning curve, coupled with the need for established relationships with airlines and airports, makes it challenging for newcomers to compete effectively with established players like Aviapartner, who have honed these skills over years of operation.

Key aspects of this complexity include:

- Specialized Skill Sets: Ground handling demands expertise in areas like aircraft marshalling, baggage loading, fueling, and de-icing, each requiring specific training and certifications.

- Regulatory Compliance: Adherence to stringent aviation safety regulations, such as those set by EASA or the FAA, adds layers of complexity and requires ongoing investment in compliance.

- Infrastructure Requirements: Access to and management of specialized ground support equipment (GSE) and suitable airport infrastructure are crucial, often requiring significant capital outlay.

Limited Airport Capacity and Slot Availability

The physical limitations of airports, such as a scarcity of gate availability and operational slots, present a significant barrier to new entrants in the ground handling services sector. Even with substantial capital and technical know-how, securing the necessary operational space at congested airports can be a formidable hurdle.

For instance, in 2024, major hubs like London Heathrow (LHR) and Amsterdam Schiphol (AMS) continued to grapple with capacity constraints, often leading to lengthy waiting times for aircraft and limited flexibility for ground handlers. This scarcity directly impacts the ability of new companies to establish a meaningful presence and compete effectively.

- Limited Gate Availability: Airports often have a fixed number of gates, and these are typically allocated to incumbent airlines and their chosen ground handlers, leaving little room for new players.

- Slot Restrictions: The number of take-off and landing slots at busy airports is strictly regulated. New entrants may find it difficult to secure sufficient slots to operate a viable business.

- Operational Congestion: Even if a new entrant secures a gate, the overall congestion at an airport can impede their ability to perform ground handling services efficiently, impacting turnaround times and customer satisfaction.

- Infrastructure Investment: Building new airport infrastructure or expanding existing facilities is a capital-intensive and time-consuming process, further limiting the potential for new market entrants to overcome capacity issues.

The threat of new entrants for Aviapartner is moderate, primarily due to the substantial capital investment required for specialized ground support equipment and the complex operational expertise needed. For example, a new ground handling company might need to invest tens of millions of dollars to acquire a sufficient fleet of modern, compliant vehicles and machinery for a single major airport. Furthermore, securing necessary airport infrastructure, like gate access and operational space, is a significant hurdle, especially at capacity-constrained hubs. In 2024, airports like Frankfurt (FRA) continued to manage limited apron space, making it challenging for new players to gain a foothold.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High cost of specialized GSE (e.g., aircraft tugs, loaders) and IT systems. | Significant deterrent, requiring millions in initial investment. |

| Operational Complexity & Expertise | Need for specialized skills in ramp handling, safety, and logistics. | Requires substantial investment in training and experienced personnel. |

| Regulatory & Safety Compliance | Adherence to stringent aviation standards and licensing. | Demands significant upfront capital and ongoing compliance costs. |

| Airport Infrastructure Access | Scarcity of gate availability and operational slots at busy airports. | Makes it difficult to secure the necessary space and operational flexibility. |

| Established Relationships | Existing long-term contracts between airlines and incumbent handlers. | New entrants must displace established players to secure contracts. |

Porter's Five Forces Analysis Data Sources

Our Aviapartner Porter's Five Forces analysis is built upon a robust foundation of data, including financial reports from industry players, aviation industry publications, and government aviation authority filings. This ensures a comprehensive understanding of the competitive landscape.