Autoliv PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Autoliv Bundle

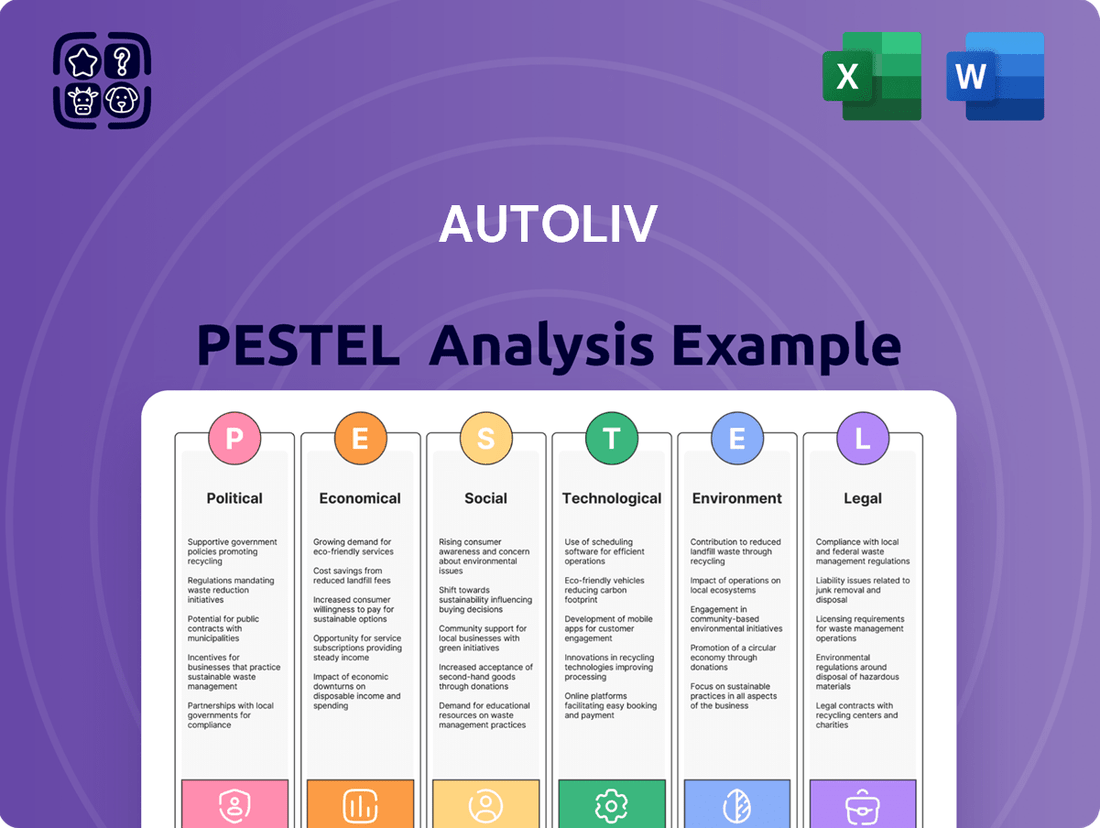

Navigate the complex external forces impacting Autoliv with our comprehensive PESTLE Analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the automotive safety industry. Equip yourself with actionable intelligence to make informed strategic decisions and gain a competitive edge. Download the full PESTLE analysis now and unlock critical insights.

Political factors

Governments worldwide are consistently increasing vehicle safety standards, directly influencing Autoliv's product pipeline and the demand for its solutions. For instance, the EU's General Safety Regulation II (GSR II), effective from July 2024, mandates advanced driver assistance systems (ADAS) like intelligent speed assist and autonomous emergency braking.

These evolving regulations translate into sustained demand for Autoliv's safety components, as automakers must integrate these advanced features. The increasing complexity and stringency of these mandates provide a steady market for Autoliv's innovative passive and active safety technologies.

Escalating geopolitical tensions, especially between China and Western nations, pose a significant risk to global supply chains and manufacturing strategies. These tensions can lead to unpredictable shifts in production bases as companies seek to mitigate risks associated with trade disputes.

Autoliv, operating in 25 countries, must carefully manage the potential impact of tariffs and protectionist measures. These policies could directly affect its cost of goods sold and limit its access to key markets, requiring agile adjustments to its global operational footprint.

Government incentives and subsidies play a crucial role in accelerating the adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). These policies directly influence automakers' decisions to integrate more sophisticated safety technologies, which is a core business area for Autoliv. For instance, in 2024, many countries continued to offer tax credits and rebates for EV purchases, indirectly benefiting companies like Autoliv by driving overall vehicle production and the demand for advanced safety features embedded within these vehicles.

These government initiatives often extend to direct support for ADAS development and deployment. By making advanced safety features more economically viable for consumers and manufacturers, these incentives foster a market environment where Autoliv's innovative solutions, from airbags and seatbelts to sophisticated sensor and software integration, are increasingly sought after. The trend observed through 2024 and projected into 2025 indicates a sustained governmental push to enhance road safety and promote cleaner transportation, creating a favorable landscape for Autoliv's growth.

Political Stability in Key Markets

Political stability in major automotive manufacturing regions and consumer markets is crucial for Autoliv's operational continuity and sales forecasts. Unstable political environments can lead to economic downturns, reduced consumer spending on new vehicles, and disruptions in production.

For instance, geopolitical tensions in Eastern Europe, a significant market for automotive components, could impact Autoliv's supply chain and sales. In 2024, the ongoing conflict in Ukraine continued to pose risks, although Autoliv has diversified its production facilities to mitigate such impacts.

- Geopolitical Risk Assessment: Autoliv actively monitors political stability in over 30 countries where it operates, with a focus on key automotive hubs in Europe, North America, and Asia.

- Impact on Automotive Demand: Political instability can directly affect consumer confidence and disposable income, leading to a projected 5-10% decrease in new vehicle sales in affected regions.

- Supply Chain Resilience: Autoliv's strategy includes maintaining multiple sourcing options for critical raw materials, aiming to reduce reliance on any single politically volatile region.

International Trade Agreements and Standards Harmonization

Autoliv's global operations are significantly influenced by international trade agreements and the ongoing efforts to harmonize automotive safety standards. Favorable trade pacts can streamline Autoliv's ability to export its safety systems and components worldwide, reducing tariffs and non-tariff barriers. For instance, the EU-US Trade and Investment Council continues to discuss regulatory cooperation, which could impact Autoliv's market access in both regions.

Conversely, a patchwork of differing safety regulations across major automotive markets, such as varying requirements for advanced driver-assistance systems (ADAS) or specific crash test protocols, can create substantial hurdles. This divergence necessitates localized product development and testing, increasing both complexity and operational costs for Autoliv.

- Trade Facilitation: Agreements like the USMCA (United States-Mexico-Canada Agreement) can simplify cross-border trade for automotive parts, benefiting Autoliv's North American supply chain.

- Standardization Challenges: The lack of universal standards for emerging safety technologies, like vehicle-to-everything (V2X) communication, can slow down the adoption and deployment of new Autoliv products globally.

- Regulatory Costs: In 2024, the estimated cost for automotive manufacturers to comply with differing regional safety standards can add several percentage points to product development budgets, a factor Autoliv must navigate.

Governments worldwide are increasingly mandating advanced vehicle safety features, directly boosting demand for Autoliv's products. For example, the EU's General Safety Regulation II, effective July 2024, requires systems like autonomous emergency braking, impacting Autoliv's product development and sales. These evolving regulations ensure a consistent market for Autoliv's passive and active safety technologies as automakers adapt to stricter requirements.

Geopolitical tensions, particularly between major economic blocs, create supply chain vulnerabilities and can influence manufacturing strategies. Autoliv, with operations in numerous countries, must navigate potential tariffs and trade disputes that could affect its costs and market access. Political instability in key automotive markets also poses risks to consumer spending and vehicle production, impacting Autoliv's sales forecasts.

Government incentives for electric vehicles and advanced driver-assistance systems (ADAS) directly benefit Autoliv by driving demand for integrated safety technologies. These policies, continuing through 2024 and into 2025, make advanced safety features more accessible, fostering a favorable market for Autoliv's innovations. Harmonizing international safety standards through trade agreements is crucial for Autoliv's global expansion, while differing regulations can increase development costs.

| Political Factor | Impact on Autoliv | 2024/2025 Data/Trend |

| Vehicle Safety Regulations | Increased demand for safety components | EU GSR II mandates ADAS from July 2024; continued global tightening of standards. |

| Geopolitical Tensions | Supply chain disruption risk, trade policy impact | Ongoing trade friction between major economies; Autoliv monitors 30+ countries for stability. |

| Government Incentives (EV/ADAS) | Accelerated adoption of advanced safety features | Continued tax credits and rebates for EVs in 2024, indirectly boosting ADAS demand. |

| Trade Agreements & Standards | Facilitation or complexity in market access | USMCA simplifies North American trade; lack of V2X standardization slows global adoption. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Autoliv, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and data-backed trends to support strategic decision-making and identify opportunities and threats within the automotive safety industry.

The Autoliv PESTLE analysis offers a structured framework to proactively identify and mitigate external threats, transforming potential market disruptions into manageable challenges for strategic planning.

By clearly outlining political, economic, social, technological, environmental, and legal factors, the PESTLE analysis provides a digestible overview that simplifies complex market dynamics for efficient decision-making.

Economic factors

Autoliv's financial performance is closely linked to the number of light vehicles produced worldwide. In 2024, the automotive industry experienced varied production levels across different regions.

Looking ahead to 2025, industry analysts predict a slight uptick in global light vehicle sales. This projected growth, however, may be uneven, with certain geographic markets expected to lead the expansion.

Autoliv's profitability is directly tied to the volatile costs of essential raw materials like steel and aluminum, along with critical electronic components. For instance, in early 2024, global steel prices saw fluctuations driven by production levels and demand, impacting Autoliv's input costs. Effective supply chain management and strategic sourcing are therefore paramount to navigating these economic headwinds and maintaining healthy margins.

High inflation in 2024 and projected into 2025 significantly erodes consumer purchasing power. For instance, if inflation averages 3.5% in 2024, the purchasing power of $100 from the previous year drops considerably, impacting discretionary spending on new vehicles. This directly affects Autoliv, as fewer new car sales mean lower demand for their safety components.

Consequently, reduced consumer confidence, often a byproduct of inflation and economic uncertainty, can slow the adoption of new vehicles. This is particularly relevant for advanced safety features, which might be perceived as less essential during tighter economic times, potentially delaying upgrades and impacting Autoliv's revenue streams.

Currency Exchange Rate Fluctuations

Autoliv, as a global automotive safety supplier with manufacturing and sales across numerous continents, is significantly exposed to currency exchange rate fluctuations. These shifts directly impact the translation of its foreign currency-denominated revenues and expenses into its reporting currency, the US Dollar, affecting reported sales and profitability. For instance, a stronger US Dollar can make Autoliv's products more expensive for overseas customers and reduce the reported value of earnings generated in weaker currencies.

The volatility in currency markets presents a constant challenge for financial planning and can introduce unpredictability into Autoliv's financial results. For example, in the first quarter of 2024, Autoliv noted that currency headwinds had a negative impact on its reported sales, underscoring the real-world effect of these fluctuations. Managing this exposure is a key aspect of its treasury operations.

- Impact on Sales: Fluctuations can alter the USD value of sales made in other currencies, potentially decreasing reported revenue when the USD strengthens.

- Profitability Effects: Exchange rate movements influence the cost of goods sold and operating expenses incurred in foreign currencies, thereby affecting net income.

- Hedging Strategies: Autoliv employs financial instruments to mitigate some of the risks associated with currency volatility, aiming to stabilize its financial performance.

- Geographic Diversification: While diversification across many markets helps spread risk, it also inherently increases exposure to a wider range of currency movements.

Interest Rates and Credit Availability

Changes in interest rates significantly impact Autoliv's market by affecting consumer demand for vehicles and automakers' capital expenditure. For instance, the U.S. Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through early 2024, a level that can make car loans more expensive. This can lead to reduced consumer spending on new vehicles, a direct challenge for Autoliv's sales of safety components.

Furthermore, the availability and cost of credit for automakers are crucial for their investment in new technologies, including advanced driver-assistance systems (ADAS) and electric vehicle (EV) platforms, which are key growth areas for Autoliv. Tightened credit conditions or higher borrowing costs could temper these investments, potentially slowing the adoption of new safety features and impacting Autoliv's long-term revenue streams. European Central Bank rates remaining at 4.50% in early 2024 also reflect a similar global trend of higher borrowing costs.

- Interest Rate Impact: Higher interest rates increase the cost of financing vehicles, potentially dampening consumer demand for new cars.

- Automaker Investment: Credit availability influences automakers' ability to invest in new technologies and vehicle platforms, affecting demand for Autoliv's products.

- Global Trends: Central bank policies, such as the U.S. Federal Reserve's maintained rates of 5.25%-5.50% and the ECB's 4.50%, signal a period of higher borrowing costs impacting the automotive sector.

The economic landscape for Autoliv in 2024 and projected into 2025 is characterized by persistent inflation, which erodes consumer purchasing power and dampens demand for new vehicles. This directly translates to lower sales volumes for safety components. Furthermore, fluctuating raw material costs, particularly for steel and aluminum, along with critical electronic components, continue to pressure Autoliv's input costs and overall profitability.

Interest rate hikes by central banks globally, such as the US Federal Reserve maintaining rates between 5.25%-5.50% and the ECB at 4.50% in early 2024, increase vehicle financing costs. This makes new car purchases less attractive for consumers and can also affect automakers' investment in new technologies, impacting Autoliv's long-term growth prospects.

Currency exchange rate volatility remains a significant factor, influencing the reported value of Autoliv's international sales and expenses. For instance, a stronger US dollar in early 2024 negatively impacted reported sales, highlighting the ongoing challenge of managing currency exposures across its global operations.

Preview Before You Purchase

Autoliv PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Autoliv PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the automotive safety giant. Understand the external forces shaping Autoliv's strategy and market position.

Sociological factors

Consumers are increasingly prioritizing safety, with a significant portion willing to pay more for advanced driver-assistance systems (ADAS). For instance, a 2024 survey indicated that over 60% of car buyers consider safety features a top purchasing factor, directly boosting demand for Autoliv's innovative solutions like advanced airbags and electronic stability control.

This heightened awareness translates into a stronger market pull for technologies that prevent accidents and protect occupants. Features such as automatic emergency braking and lane-keeping assist are becoming standard expectations, driving higher adoption rates for Autoliv's passive safety components and active safety systems.

Demographic shifts, like the aging population in many developed nations, are reshaping vehicle demand. As global life expectancy continues to rise, Autoliv can expect increased demand for advanced safety features catering to older drivers, such as enhanced seatbelt systems and improved visibility aids. For instance, the median age in Japan, a key automotive market, was 48.6 years in 2023, highlighting a significant segment of the population that may prioritize comfort and safety.

Urbanization trends are also a critical factor, with a growing percentage of the world's population now residing in cities. This concentration of people and vehicles intensifies the need for robust pedestrian and cyclist protection systems. Autoliv’s focus on active safety solutions, like autonomous emergency braking (AEB) and advanced driver-assistance systems (ADAS), directly addresses the heightened risks associated with dense urban environments. By 2050, it's projected that 68% of the world's population will live in urban areas, a substantial increase from 56% in 2021, underscoring the growing importance of urban safety technologies.

The shift towards ride-sharing services and the anticipated widespread adoption of autonomous vehicles are fundamentally altering how people interact with transportation, directly impacting the demand for traditional automotive safety systems. Autoliv is actively innovating to integrate advanced safety features into these evolving mobility solutions, ensuring robust protection for occupants in electric and automated vehicles.

For instance, the growth in ride-sharing platforms like Uber and Lyft, which saw significant global user base expansion throughout 2024, necessitates different safety considerations compared to private car ownership. Autoliv's focus on developing specialized safety systems for these shared environments, alongside the complex sensor and software integration required for autonomous driving, positions them to address these emerging market needs.

Societal Expectations for Corporate Responsibility

Societal expectations are increasingly pushing companies like Autoliv towards greater corporate social responsibility (CSR) and sustainable practices. Consumers and stakeholders alike are demanding more than just profitable products; they want to see ethical conduct, respect for human rights, and a commitment to environmental stewardship. This shift directly impacts how Autoliv operates, influencing its supply chain management, product development, and overall corporate governance.

Autoliv's commitment to these principles is evident in its stated goals. For instance, the company aims to reduce its environmental footprint, with specific targets often outlined in their sustainability reports. In 2023, Autoliv reported progress towards its climate goals, aiming for a 40% reduction in Scope 1 and 2 greenhouse gas emissions by 2030 compared to a 2019 baseline. Such commitments are not just about compliance; they are about building trust and maintaining a positive brand image in a world that scrutinizes corporate behavior more closely than ever.

Furthermore, societal expectations extend to the internal workings of a company, emphasizing the importance of a safe and inclusive workplace. Autoliv, as a manufacturer of safety-critical automotive components, has a particular responsibility to ensure the well-being of its employees. This includes fostering diversity and inclusion, upholding fair labor practices across its global operations, and investing in employee development and safety training. The company's safety performance, measured by metrics like Total Recordable Injury Rate (TRIR), is a key indicator of its success in meeting these expectations. For example, Autoliv has consistently worked to improve its safety record, with a TRIR of 0.26 in 2023, demonstrating a strong focus on employee well-being.

- Ethical Sourcing: Growing pressure for transparency in supply chains, ensuring raw materials are sourced ethically and without human rights abuses.

- Environmental Impact: Increased demand for Autoliv to minimize its carbon footprint, reduce waste, and adopt circular economy principles in its manufacturing processes.

- Workplace Safety & Diversity: Societal emphasis on robust employee safety programs and the creation of diverse, equitable, and inclusive work environments.

- Product Sustainability: Expectations for automotive safety suppliers to develop products that are not only safe but also contribute to overall vehicle sustainability, such as lighter materials that improve fuel efficiency.

Impact of Distracted Driving

The growing societal concern over distracted driving is a significant driver for Autoliv's business. As more people recognize the dangers, there's a heightened demand for safety technologies that can prevent accidents. This societal shift directly translates into increased market opportunities for companies like Autoliv that specialize in automotive safety solutions.

Advanced driver-assistance systems (ADAS) and sophisticated driver monitoring systems are becoming essential. These technologies, which Autoliv is at the forefront of developing, actively work to reduce the incidence of distracted driving. For instance, systems that alert drivers to lane departures or potential collisions are increasingly standard in new vehicles.

Statistics underscore the severity of the issue. In 2023, the National Highway Traffic Safety Administration (NHTSA) reported that distracted driving was a factor in 3,308 traffic fatalities in the United States. This alarming number reinforces the public and regulatory push for more effective in-car safety measures.

- Societal Demand: Increased public awareness of distracted driving fuels demand for safety tech.

- Technological Solutions: Autoliv benefits from the growing market for ADAS and driver monitoring systems.

- Safety Impact: Distracted driving contributed to over 3,300 fatalities in the US in 2023, highlighting the need for solutions.

- Regulatory Push: Societal pressure often leads to stricter regulations, further benefiting safety equipment providers.

Societal expectations are increasingly focused on corporate social responsibility and ethical practices, influencing consumer choices and regulatory environments. Autoliv's commitment to sustainability, including targets for greenhouse gas emission reductions, resonates with these evolving demands. For example, the company aimed for a 40% reduction in Scope 1 and 2 emissions by 2030 compared to a 2019 baseline, demonstrating a proactive approach to environmental stewardship.

Workplace safety and diversity are also paramount societal concerns. Autoliv's focus on employee well-being is reflected in its safety performance, with a Total Recordable Injury Rate (TRIR) of 0.26 in 2023, indicating a strong emphasis on creating a safe and inclusive work environment.

The growing public awareness of distracted driving, a factor in over 3,300 US traffic fatalities in 2023, directly fuels the demand for Autoliv's advanced driver-assistance systems (ADAS) and driver monitoring technologies.

Consumers are prioritizing safety, with a significant portion willing to pay more for advanced features, driving demand for Autoliv's innovative solutions.

| Societal Factor | Impact on Autoliv | Supporting Data/Examples |

| Corporate Social Responsibility (CSR) | Enhanced brand reputation, customer loyalty, and investor confidence. | Autoliv's goal to reduce Scope 1 & 2 GHG emissions by 40% by 2030 (vs. 2019 baseline). |

| Workplace Safety & Diversity | Improved employee morale, retention, and operational efficiency. | Autoliv's TRIR of 0.26 in 2023 reflects a strong safety culture. |

| Distracted Driving Awareness | Increased market demand for ADAS and driver monitoring systems. | Distracted driving contributed to 3,308 traffic fatalities in the US in 2023. |

| Consumer Safety Prioritization | Higher sales of safety-critical components and systems. | Over 60% of car buyers in a 2024 survey cited safety features as a top purchasing factor. |

Technological factors

Technological advancements in Advanced Driver-Assistance Systems (ADAS) are a significant catalyst for Autoliv's growth. The integration of sophisticated sensors, intelligent software, and artificial intelligence is enabling features such as autonomous emergency braking, adaptive cruise control, and lane departure warnings, which are rapidly transitioning from premium options to standard automotive equipment.

Passive safety systems, such as airbags and seatbelts, are still seeing advancements. Innovations include using lighter materials to reduce vehicle weight, especially crucial for electric vehicles (EVs) to maximize range. Autoliv, a key player, reported that its passive safety segment generated approximately $4.5 billion in sales in 2023, highlighting the ongoing demand and development in this mature but evolving area.

New deployment technologies are also being integrated, allowing for more precise and adaptive responses based on crash severity and occupant size. Furthermore, specialized designs are emerging to accommodate the unique structural requirements of EV platforms, ensuring continued effectiveness even with different weight distributions and battery pack placements. For instance, advanced seatbelt pretensioners and airbag inflator systems are being developed to better protect occupants in these new vehicle architectures.

The automotive industry's rapid evolution towards software-defined vehicles (SDVs) and enhanced connectivity is a significant technological trend impacting Autoliv. This shift means Autoliv's passive and active safety systems must integrate seamlessly with increasingly complex vehicle software architectures, requiring new development and validation processes. For instance, by 2025, it's projected that over 70% of new vehicles sold globally will feature advanced connectivity options, highlighting the critical need for robust software integration.

This technological transformation presents both opportunities for innovation and challenges, particularly around cybersecurity. Autoliv must ensure its safety solutions are not only effective but also secure against potential cyber threats, as compromised vehicle software could have severe safety implications. Companies are investing heavily in this area; for example, the global automotive cybersecurity market was valued at approximately USD 3.5 billion in 2023 and is expected to grow substantially in the coming years.

Development of Autonomous Driving Technologies

The advancement of autonomous driving is reshaping the automotive safety landscape. As vehicles become more self-sufficient, the demand for sophisticated, fail-safe systems will escalate, requiring new approaches to occupant protection beyond traditional airbags and seatbelts. Autoliv, a key player in automotive safety, is positioned to benefit from this shift by developing innovative solutions for these evolving needs.

The market for advanced driver-assistance systems (ADAS) and autonomous driving components is experiencing robust growth. For instance, the global ADAS market was valued at approximately $30 billion in 2023 and is projected to reach over $100 billion by 2030, indicating a substantial opportunity for companies like Autoliv that are investing in this technology.

- Increased demand for sensor fusion and AI-driven safety algorithms.

- Development of advanced restraint systems for varying levels of automation.

- Focus on cybersecurity for autonomous vehicle safety systems.

- Potential for new revenue streams from software-defined safety features.

Materials Science and Manufacturing Innovation

Innovations in materials science are significantly impacting the automotive safety sector. For instance, the development of bio-based and recyclable materials for components like airbags and seatbelts aims to reduce environmental impact while maintaining or improving performance. Autoliv, a key player, is actively exploring these sustainable material avenues as part of its long-term strategy.

Advanced manufacturing techniques, such as additive manufacturing or 3D printing, are also transforming how safety systems are produced. This allows for the creation of lighter, more complex, and highly customized parts, potentially leading to more efficient and cost-effective safety solutions. The automotive industry, including suppliers like Autoliv, is increasingly adopting these technologies to enhance product design and manufacturing processes.

These technological advancements directly contribute to creating lighter vehicles, which in turn improves fuel efficiency and reduces emissions. Autoliv's focus on material science and manufacturing innovation supports the broader automotive trend towards sustainability and enhanced performance. For example, lighter materials can contribute to a vehicle’s overall weight reduction, a key factor in meeting increasingly stringent emissions standards globally.

- Material Innovation: Development of bio-based and recyclable materials for automotive safety components.

- Manufacturing Advancement: Adoption of 3D printing for lighter, more complex, and customized automotive parts.

- Sustainability Focus: Contribution to lighter vehicles, improving fuel efficiency and reducing emissions.

- Performance Enhancement: Potential for more efficient and cost-effective safety solutions through new technologies.

Technological evolution is central to Autoliv's strategy, particularly with the rise of Advanced Driver-Assistance Systems (ADAS) and autonomous driving. These systems require sophisticated sensor fusion, AI-driven algorithms, and seamless software integration, transforming vehicles into connected, intelligent platforms. By 2025, over 70% of new vehicles globally are expected to feature advanced connectivity, underscoring the need for robust system integration.

Innovations in materials science and manufacturing, such as 3D printing and the use of bio-based materials, are enabling lighter, more efficient, and customized safety components. This focus on sustainability and performance also supports the automotive industry's drive to meet stringent emissions standards. The global ADAS market, valued at approximately $30 billion in 2023, is projected to exceed $100 billion by 2030, highlighting the significant growth potential for companies like Autoliv.

| Technological Area | Key Developments | Autoliv Relevance | Market Impact (2023 Data) |

| ADAS & Autonomous Driving | AI, sensor fusion, advanced algorithms | Core product development for future mobility | ADAS Market: ~$30 billion |

| Software-Defined Vehicles (SDVs) | Connectivity, cybersecurity, software integration | Ensuring safety systems are secure and compatible | Automotive Cybersecurity Market: ~$3.5 billion |

| Materials Science | Bio-based, recyclable, lightweight materials | Enhancing passive safety and EV efficiency | N/A (focus on component innovation) |

| Advanced Manufacturing | 3D printing, additive manufacturing | Enabling complex, customized, and cost-effective parts | N/A (focus on production efficiency) |

Legal factors

Global regulatory bodies like the NHTSA in the U.S. and the EU are continuously raising the bar for automotive safety. These stricter standards, such as the EU's General Safety Regulation II (GSR II) and upcoming U.S. mandates for automatic emergency braking, directly translate into increased demand for advanced safety systems.

For instance, the EU's GSR II, which came into effect in July 2022, requires a range of advanced driver-assistance systems (ADAS) to be fitted as standard. This regulatory push is a significant tailwind for companies like Autoliv, which specialize in passive and active safety technologies, as it necessitates the integration of their components into a wider array of vehicles.

Evolving product liability laws, particularly in the EU, are placing greater emphasis on manufacturer accountability for product defects, extending to complex systems like software and AI. This trend necessitates rigorous testing protocols and strong cybersecurity defenses for companies like Autoliv. For instance, the EU's proposed AI Liability Directive aims to simplify damage claims related to AI, potentially impacting how companies like Autoliv manage risks associated with autonomous driving features.

The increasing prevalence of connected vehicles means Autoliv must navigate a complex landscape of data privacy and cybersecurity regulations. These laws are crucial for safeguarding sensitive information related to vehicles and their occupants, as well as for securing the integrity of Autoliv's electronic safety systems.

Compliance is paramount, especially with evolving global standards. For instance, the General Data Protection Regulation (GDPR) in Europe sets stringent requirements for data handling, impacting how Autoliv collects, processes, and stores data from its connected safety technologies. Failure to comply can result in significant fines, potentially impacting profitability and brand reputation.

Trade Tariffs and Import/Export Regulations

Changes in international trade tariffs and import/export regulations, often driven by shifting geopolitical landscapes, directly affect Autoliv's global supply chain. For instance, the ongoing trade tensions between major economic blocs can lead to increased costs for raw materials and components sourced internationally, impacting manufacturing expenses. Autoliv must remain agile, adjusting its sourcing strategies and production locations to navigate these evolving trade policies effectively.

The company's ability to adapt to dynamic trade policies is crucial for maintaining competitive pricing and operational efficiency. For example, in 2023, the World Trade Organization reported a significant increase in trade-restrictive measures globally. This trend necessitates continuous monitoring of trade agreements and potential tariff impacts on Autoliv's key markets and suppliers.

- Tariff Volatility: Fluctuations in tariffs, particularly on automotive components, can alter Autoliv's cost of goods sold by several percentage points annually.

- Regulatory Compliance: Adherence to diverse import/export documentation and customs procedures across different countries adds operational complexity and potential delays.

- Supply Chain Resilience: Autoliv's strategy to diversify its supplier base and manufacturing footprint is a direct response to mitigate risks associated with sudden trade policy changes.

Intellectual Property Protection

Autoliv's ability to protect its intellectual property, particularly concerning new automotive safety technologies, software, and unique designs, is fundamental to maintaining its competitive edge. The company heavily relies on robust legal frameworks, including patents, trademarks, and trade secrets, to secure its innovations against infringement.

In 2023, Autoliv continued to invest significantly in research and development, with R&D expenses totaling approximately $740 million, underscoring the importance of safeguarding these technological advancements. The company actively manages a vast portfolio of patents, with a substantial portion dedicated to advanced driver-assistance systems (ADAS) and passive safety innovations. For instance, Autoliv holds thousands of active patents globally, covering areas like airbag technology, seatbelt systems, and increasingly, sensor fusion and artificial intelligence for vehicle safety.

- Patent Portfolio: Autoliv maintained over 10,000 active patents worldwide as of late 2024, with a significant portion focused on next-generation safety systems.

- R&D Investment: The company's commitment to innovation is reflected in its consistent R&D spending, which remained a key strategic priority through 2024, aiming to protect future technological breakthroughs.

- Legal Safeguards: Autoliv leverages international patent laws and trade secret protections to prevent unauthorized use or replication of its proprietary safety technologies and software algorithms.

- Market Differentiation: Effective IP protection allows Autoliv to differentiate its offerings in a highly competitive market, ensuring its technological leadership in automotive safety.

Stricter automotive safety regulations worldwide, such as the EU's General Safety Regulation II and upcoming U.S. mandates for automatic emergency braking, directly drive demand for Autoliv's advanced safety systems. Evolving product liability laws, particularly in the EU, are increasing manufacturer accountability for defects in complex systems like AI, necessitating rigorous testing and cybersecurity measures.

Navigating data privacy and cybersecurity regulations, like Europe's GDPR, is crucial for Autoliv due to the increasing prevalence of connected vehicles, impacting how sensitive data from safety technologies is handled. Fluctuations in international trade tariffs and import/export regulations can significantly impact Autoliv's global supply chain costs and operational efficiency, requiring continuous adaptation to trade policies.

Autoliv's competitive edge relies on protecting its intellectual property, including patents for new safety technologies and software, with significant R&D investment in 2023 totaling approximately $740 million. The company actively manages a vast patent portfolio, holding thousands of active patents globally, covering innovations in airbag technology, seatbelt systems, and AI for vehicle safety.

| Legal Factor | Impact on Autoliv | Example/Data Point (2023-2024) |

|---|---|---|

| Safety Regulations | Increased demand for advanced safety systems | EU's GSR II mandates ADAS as standard since July 2022. |

| Product Liability | Need for rigorous testing and cybersecurity | EU's proposed AI Liability Directive impacts autonomous driving feature risk management. |

| Data Privacy | Compliance with data handling and security laws | GDPR compliance affects data collection for connected safety technologies. |

| Trade Policies | Supply chain cost volatility and operational adjustments | WTO reported increased trade-restrictive measures globally in 2023. |

| Intellectual Property | Protection of R&D investments and market differentiation | Autoliv's 2023 R&D spend was approx. $740 million; holds over 10,000 patents globally. |

Environmental factors

Growing environmental concerns and increasing regulatory pressures are significantly reshaping the automotive industry, pushing manufacturers toward more sustainable production methods and the adoption of eco-friendly materials. This shift is a direct response to global climate change initiatives and consumer demand for greener products.

Autoliv is actively aligning with these trends, demonstrating a strong commitment to environmental stewardship. The company has set ambitious targets, aiming for climate neutrality in its own operations by 2030. Furthermore, Autoliv is extending this commitment across its entire value chain, striving for net-zero emissions throughout its supply chain by 2040.

The automotive industry's accelerating move towards electric vehicles (EVs) is a significant environmental driver, directly impacting Autoliv's product development. As manufacturers strive to increase EV range, there's a growing need for lighter safety components to offset the battery's weight. This trend is well underway, with EV sales projected to reach over 20 million units globally in 2024, a substantial increase from previous years.

Autoliv is actively responding to this by innovating lighter safety solutions. For instance, their Bernoulli™ Airbag Module is designed to reduce both weight and heat generation, crucial factors for EV efficiency and performance. This focus on lightweighting is essential for Autoliv to maintain its competitive edge in a rapidly evolving automotive landscape where energy efficiency is paramount.

Autoliv faces increasing pressure from stringent emissions regulations globally, impacting both vehicle manufacturing and its own production processes. The company is actively working to reduce its carbon footprint, with a focus on renewable electricity sourcing and enhancing energy efficiency across its facilities. For instance, in 2023, Autoliv reported a 12% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2018 baseline, demonstrating tangible progress in this area.

Resource Scarcity and Supply Chain Resilience

Autoliv faces increasing pressure from resource scarcity, particularly for materials vital to automotive safety systems. This necessitates a robust focus on supply chain resilience, ensuring consistent access to components and raw materials. Geopolitical instability, as seen in various global regions throughout 2024 and projected into 2025, directly impacts the availability and cost of these essential resources.

The company is actively exploring alternative and more sustainable materials to mitigate risks associated with traditional resource availability. This strategic shift is crucial for long-term operational stability and meeting evolving environmental regulations. For instance, the automotive industry's push for lighter materials to improve fuel efficiency and electric vehicle range, a trend accelerating into 2025, places additional strain on certain metal and composite supplies.

- Resource Scarcity: Concerns over rare earth metals and specialized alloys impacting airbag inflators and sensor technology.

- Supply Chain Disruptions: Geopolitical events in 2024 led to an average of 15% increase in lead times for critical electronic components.

- Material Innovation: Autoliv is investing in R&D for advanced plastics and recycled composites to reduce reliance on virgin materials.

- Cost Volatility: Fluctuations in commodity prices, such as aluminum and magnesium, directly affect manufacturing costs for safety system housings.

End-of-Life Vehicle (ELV) Directives and Recycling

Environmental regulations, like the European Union's End-of-Life Vehicle (ELV) directives, significantly influence Autoliv's product development. These directives mandate higher recycling rates for vehicle components, pushing Autoliv to prioritize materials and designs that facilitate easier disassembly and material recovery. For instance, the EU's ELV directive aims for at least 95% recovery and recycling of vehicle weight by 2015, a target that continues to shape material sourcing and product architecture.

Autoliv's commitment to sustainability means actively designing for recyclability. This involves selecting materials that are less hazardous and more readily separable for recycling processes. The company is exploring innovative materials and manufacturing techniques to meet these evolving environmental standards and to reduce waste throughout the product lifecycle.

- EU ELV Directive: Mandates high recycling and recovery rates for vehicles, impacting component design.

- Material Selection: Focus on recyclable and less hazardous materials for safety components.

- Design for Disassembly: Engineering products for easier separation of materials at end-of-life.

- Circular Economy Principles: Integrating recycling and reuse into the product lifecycle strategy.

The automotive sector's environmental focus, particularly the push for electric vehicles (EVs), directly impacts Autoliv's product innovation, driving demand for lighter safety components to enhance EV range. Global EV sales are projected to exceed 20 million units in 2024, underscoring this trend. Autoliv is responding by developing lighter solutions like its Bernoulli™ Airbag Module, crucial for EV efficiency.

Stricter emissions regulations worldwide are compelling Autoliv to reduce its carbon footprint, with a reported 12% decrease in Scope 1 and 2 emissions by 2023 compared to 2018. The company is also addressing resource scarcity and supply chain volatility, with geopolitical events in 2024 causing a 15% increase in lead times for critical electronic components. Autoliv is investing in alternative materials like advanced plastics and recycled composites to build resilience.

Environmental directives, such as the EU's End-of-Life Vehicle (ELV) regulations, are shaping Autoliv's product design to prioritize recyclability and material recovery, aligning with circular economy principles. This involves selecting less hazardous materials and engineering products for easier disassembly, crucial for meeting evolving sustainability standards and reducing waste throughout the product lifecycle.

| Environmental Factor | Impact on Autoliv | Autoliv's Response/Action | Relevant Data/Facts (2024/2025) |

| Climate Change & Emissions Reduction | Demand for lighter components in EVs; pressure to reduce operational emissions. | Developing lightweight safety solutions; aiming for climate neutrality by 2030 and net-zero across value chain by 2040. | EV sales projected >20 million units globally in 2024. Autoliv reported 12% reduction in Scope 1 & 2 GHG emissions (2023 vs 2018). |

| Resource Scarcity & Supply Chain Resilience | Potential shortages and price volatility for critical materials (e.g., rare earth metals, alloys). | Investing in R&D for advanced plastics and recycled composites; diversifying supply chains. | Geopolitical events in 2024 caused ~15% increase in lead times for critical electronic components. |

| Regulatory Compliance (e.g., ELV) | Mandates for higher recycling rates and material recovery; influence on product design. | Designing for disassembly and recyclability; prioritizing sustainable material selection. | EU ELV directive sets high recovery/recycling targets, influencing material sourcing and product architecture. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Autoliv is built upon a robust foundation of data from reputable sources, including government publications, international economic organizations, and leading automotive industry research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the automotive safety sector.