Autoliv Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Autoliv Bundle

Curious about Autoliv's strategic positioning? This glimpse into their BCG Matrix reveals how their products are categorized as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture; purchase the complete BCG Matrix for actionable insights and a clear path to optimizing your investment and product portfolio.

Stars

Autoliv is a leader in the global airbag market, and the demand for advanced systems like front-center and knee airbags is on the rise. These specialized airbags are becoming more common as safety rules get stricter and people care more about car safety.

These advanced airbags significantly improve occupant protection during different types of crashes. For instance, knee airbags help prevent lower limb injuries, while front-center airbags reduce the risk of occupants colliding with each other in side impacts. This trend is particularly strong in markets with higher average incomes, making it a key growth area for Autoliv.

In 2024, the automotive industry continued to prioritize advanced safety features. Reports indicate that the market for advanced driver-assistance systems (ADAS), which often includes advanced airbag technologies, is projected to grow substantially in the coming years, with some forecasts suggesting a compound annual growth rate (CAGR) exceeding 15% through 2030. This growth is driven by both regulatory mandates and consumer demand for safer vehicles.

Autoliv is a significant force in active seatbelt systems, capturing over 15% of the market in 2023. This segment is expected to expand robustly, with an estimated 8.5% CAGR from 2024 to 2032, underscoring its growth potential.

These advanced systems, featuring pretensioners and retractors, are vital for occupant safety during impacts. They work in tandem with other passive safety measures, solidifying Autoliv's standing in this dynamic and growing technological field.

High-value steering wheels with integrated features are a significant growth area for Autoliv, reflecting the automotive industry's shift towards more sophisticated vehicle interiors. These advanced steering wheels, often incorporating haptic feedback, heated grips, and integrated controls for driver-assistance systems, are increasingly sought after by consumers. Autoliv's strong market share, estimated at approximately 40% globally in this segment, underscores its leadership in this evolving market.

The demand for these feature-rich steering wheels is driven by the continuous integration of safety and convenience technologies directly into the driver's primary interface. This trend positions these products as stars within Autoliv's business portfolio, as they represent a high-growth, high-market-share category. For instance, the increasing adoption of Level 2 and Level 3 autonomous driving features necessitates more intuitive and responsive steering wheel controls, further boosting demand.

Passive Safety Systems in Emerging Markets

Autoliv is strategically focusing on emerging markets, particularly those with medium and low incomes, recognizing a significant growth opportunity. This expansion is fueled by the rising adoption of essential passive safety features like airbags and advanced seatbelts in these regions. For instance, Autoliv reported that sales in emerging markets grew by approximately 15% in 2023, outpacing developed markets.

The automotive industry's growth trajectory over the next three years is heavily weighted towards these emerging economies, with projections indicating that nearly all Light Vehicle Production (LVP) increases will originate from these areas. Autoliv is well-positioned to capitalize on this trend, leveraging its established global infrastructure to capture substantial market share as these automotive sectors mature.

- Growth Driver: Increasing installation rates of airbags and advanced seatbelts in medium- and low-income markets.

- Market Opportunity: Emerging markets are expected to account for nearly all LVP growth in the next three years.

- Autoliv's Advantage: Leveraging its global footprint to gain significant market share in these expanding automotive landscapes.

Integrated Passive and Active Safety Solutions for New Vehicle Architectures

Autoliv is at the forefront of integrating passive safety with active systems like ADAS for evolving vehicle architectures. This synergy is crucial as electrification and autonomy reshape the automotive landscape. The market for these combined safety solutions is experiencing significant growth, fueled by regulatory pressures and consumer expectations for enhanced protection. Autoliv's strategic focus positions it to capitalize on this trend by leveraging its established expertise.

The demand for advanced safety features is accelerating. For instance, in 2024, global automotive safety system market revenue was projected to reach approximately $70 billion, with ADAS and integrated passive safety components being key drivers. Autoliv's investment in these areas reflects a proactive approach to meeting future automotive safety needs.

- Market Growth: The global automotive safety systems market is projected for substantial growth, with ADAS integration being a primary catalyst.

- Regulatory Influence: Increasingly stringent government safety mandates worldwide are pushing manufacturers to adopt more sophisticated integrated safety solutions.

- Consumer Demand: Buyers are increasingly prioritizing vehicles with advanced safety technologies, driving demand for systems that combine passive and active protection.

- Autoliv's Strategy: Autoliv is strategically investing in R&D to ensure its passive safety products work seamlessly with emerging ADAS technologies, securing its position in this high-potential segment.

Autoliv's advanced airbag systems, such as front-center and knee airbags, represent a significant growth opportunity. These products are increasingly integrated into vehicles to meet stricter safety regulations and rising consumer demand for enhanced occupant protection. Their position as stars is solidified by their high growth potential and Autoliv's strong market presence.

High-value steering wheels with integrated safety and convenience features are also identified as stars. Autoliv's substantial global market share, around 40%, in this segment highlights its leadership. The increasing adoption of advanced driver-assistance systems (ADAS) further fuels demand for these sophisticated steering wheels.

The combination of passive safety systems with active features like ADAS is a key star segment for Autoliv. This synergy is driven by evolving vehicle architectures, electrification, and autonomy, with the global automotive safety system market projected to reach approximately $70 billion in 2024, with ADAS integration being a primary catalyst.

Emerging markets are a critical growth driver, with Autoliv's sales in these regions increasing by about 15% in 2023. These markets are expected to contribute nearly all global Light Vehicle Production growth in the coming years, positioning Autoliv's essential safety features as stars due to their expanding adoption.

| Product Segment | Market Position | Growth Outlook | Key Drivers |

|---|---|---|---|

| Advanced Airbags (Front-Center, Knee) | High Market Share | Strong Growth | Stricter Safety Regulations, Consumer Demand |

| High-Value Steering Wheels | Global Leader (~40% Share) | Robust Growth | ADAS Integration, In-car Technology Trends |

| Integrated Passive & Active Safety | Leading Integrator | Significant Growth | Electrification, Autonomous Driving, Regulatory Mandates |

| Emerging Market Penetration | Expanding Footprint | High Growth Potential | Increased Adoption of Safety Features, LVP Growth in Developing Economies |

What is included in the product

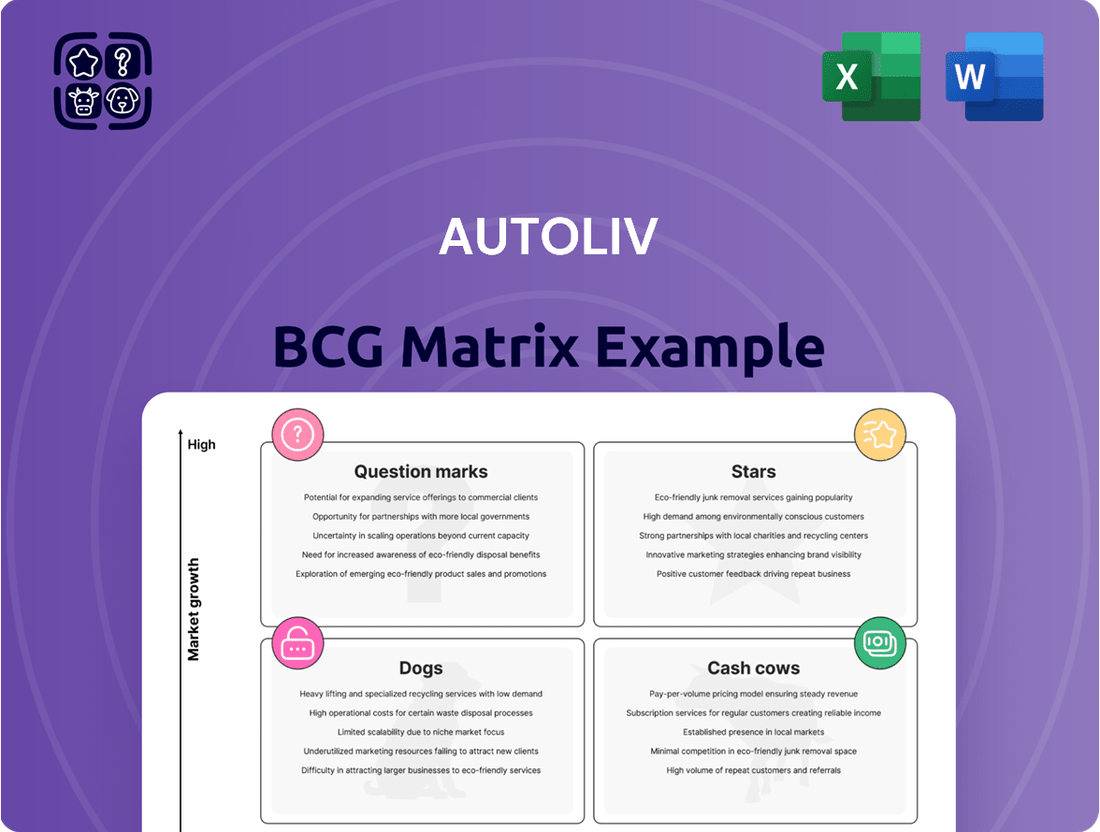

The Autoliv BCG Matrix analyzes its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

Autoliv BCG Matrix offers a clear visualization of business unit performance, alleviating the pain of strategic resource allocation uncertainty.

Cash Cows

Traditional airbag systems, encompassing driver and passenger airbags, represent a cornerstone of Autoliv's business, firmly positioned as a Cash Cow. As of December 2024, Autoliv commands an impressive 44-47% of the global market share for these essential safety components.

The widespread mandatory implementation of airbags across virtually all vehicle markets worldwide ensures a stable and predictable demand. This mature market, despite its lack of rapid growth, consistently generates significant revenue and robust positive cash flow for Autoliv, requiring minimal additional investment for promotion or market expansion.

Autoliv's standard seatbelt systems are a classic cash cow, holding a commanding global market share of approximately 45% as of December 2024. This mature market, while experiencing low growth, guarantees consistent demand for this essential life-saving technology.

The sheer ubiquity of seatbelts ensures Autoliv can reliably generate substantial profits from this segment. These earnings are crucial for funding the company's investments in newer, high-growth areas.

Autoliv's basic steering wheels are a classic cash cow within their product portfolio, holding a substantial share in the overall steering wheel market. This segment is characterized by its maturity and stability, meaning demand is consistent and predictable as they are a fundamental component in every vehicle. In 2023, the global automotive steering wheel market was valued at approximately $7.5 billion, with basic steering wheels forming a significant portion of this.

These products generate reliable, steady cash flow for Autoliv, requiring minimal new investment or aggressive marketing to maintain their position. Their essential nature ensures continued sales volume, contributing positively to the company's financial health without the need for rapid innovation or market expansion.

Core Passive Safety Electronics and Components (e.g., Inflators, Initiators)

Autoliv's core passive safety electronics, such as inflators and initiators, are firmly established as cash cows. As the dominant player in passive safety, these essential airbag components represent a mature market where Autoliv enjoys significant penetration. Their critical role in safety systems directly translates into consistent, strong profit generation and reliable cash flow for the company.

- Market Dominance: Autoliv is the leading global supplier of passive safety systems, ensuring high market share for its core electronic components.

- Mature Segment: Inflators and initiators are integral parts of established airbag technologies, indicating a stable and predictable demand.

- Profitability Driver: These components contribute significantly to Autoliv's robust profit margins due to their essential nature and the company's scale.

- Consistent Cash Flow: The mature market and strong profitability of these products make them a reliable source of consistent cash generation for Autoliv.

Established Global Manufacturing and Supply Chain Capabilities

Autoliv's robust global manufacturing and supply chain capabilities position it firmly within the Cash Cows quadrant of the BCG Matrix. Its extensive operational footprint, featuring 63 production facilities across 23 countries and 13 technical centers, underpins its ability to efficiently serve major automotive manufacturers worldwide.

This mature industry infrastructure is a significant cash-generating asset. The sheer scale of operations allows Autoliv to achieve economies of scale and maintain operational excellence, ensuring consistent production and a reliable supply chain that translates directly into strong, predictable cash flows.

- Global Reach: 63 production facilities in 23 countries.

- Technical Expertise: 13 dedicated technical centers.

- Market Strength: Serves major global automotive manufacturers.

- Efficiency Driver: Optimized infrastructure for economies of scale.

Autoliv's core passive safety electronics, such as inflators and initiators, are firmly established as cash cows. As the dominant player in passive safety, these essential airbag components represent a mature market where Autoliv enjoys significant penetration. Their critical role in safety systems directly translates into consistent, strong profit generation and reliable cash flow for the company.

The company's extensive manufacturing and supply chain infrastructure, with 63 production facilities across 23 countries and 13 technical centers, further solidifies its cash cow status. This global footprint enables economies of scale and operational efficiency, ensuring predictable and robust cash generation from its mature product lines.

These established product lines, like traditional airbags and seatbelts, benefit from widespread mandatory regulations, guaranteeing stable demand. This consistent revenue stream from mature markets is vital for funding Autoliv's investments in emerging technologies and high-growth areas.

| Product Segment | BCG Quadrant | Market Share (Global) | Growth Rate | Cash Flow Generation |

| Traditional Airbag Systems | Cash Cow | 44-47% | Low | High & Stable |

| Standard Seatbelt Systems | Cash Cow | ~45% | Low | High & Stable |

| Basic Steering Wheels | Cash Cow | Significant Portion of $7.5B Market (2023) | Low | High & Stable |

| Passive Safety Electronics (Inflators/Initiators) | Cash Cow | Dominant Player | Low | High & Stable |

What You’re Viewing Is Included

Autoliv BCG Matrix

The Autoliv BCG Matrix preview you are seeing is the identical, fully formatted document you will receive immediately after completing your purchase. This means you're getting a complete, professional analysis ready for strategic implementation without any watermarks or placeholder content. The report is meticulously designed to provide clear insights into Autoliv's product portfolio, enabling informed decision-making for your business strategy.

Dogs

Highly commoditized, undifferentiated basic components within Autoliv's passive safety portfolio, such as standard airbag inflators or basic seatbelt buckles, would likely fall into the 'dogs' category of the BCG matrix. These products face intense price competition, often leading to minimal profit margins. For instance, in 2024, the global market for automotive airbags was projected to reach over $30 billion, but a significant portion of this value is driven by advanced systems, leaving basic components with tighter margins.

Legacy products, such as older-generation airbag control units for discontinued vehicle models, often find themselves in niche markets with steadily declining demand. Autoliv’s focus on these items, which might represent a small fraction of their overall revenue, could strain resources better allocated to advanced driver-assistance systems (ADAS) or next-generation restraint technologies. For instance, while Autoliv reported strong growth in its ADAS segment in 2023, continued investment in supporting legacy components for a shrinking fleet of older vehicles presents a strategic challenge.

Autoliv's focus on efficiency means that manufacturing capacity for phased-out products, if not repurposed, can become a significant drag. These underutilized assets, perhaps tied to older airbag inflator technologies or specific older vehicle models, can continue to incur maintenance and operational expenses without contributing meaningfully to revenue. In 2024, companies across the automotive supply chain are actively divesting or repurposing such legacy assets to streamline operations and reinvest in growth areas like advanced driver-assistance systems (ADAS) components.

Non-Core, Historically Divested or De-emphasized Business Units

Autoliv's portfolio has historically included business units that, due to various factors, fit the 'dog' category within the BCG matrix. These were often smaller operations, acquired businesses that didn't integrate well, or product lines facing declining demand or intense competition.

For instance, in the past, Autoliv might have divested or significantly scaled back certain niche safety system components or regional manufacturing facilities that demonstrated low market share and minimal growth prospects. These units, while potentially contributing some revenue, were drains on resources and management attention, hindering the company's focus on its core, high-growth areas.

While specific financial data for historically divested units is not publicly detailed as ongoing 'dogs,' Autoliv's strategic divestitures in the past, such as the sale of its Electronics business in 2019, illustrate a pattern of shedding non-core assets. This move allowed Autoliv to concentrate on its primary segments like Airbags and Steering Wheels, which are critical to its current market leadership.

- Historical Divestitures: Autoliv's divestment of its Electronics business in 2019, which included ADAS (Advanced Driver-Assistance Systems) components, exemplifies shedding a unit that, while technologically relevant, may have been considered less core or facing significant competitive pressures at the time.

- Focus on Core Strengths: The decision to divest allowed Autoliv to sharpen its focus on its dominant product categories, such as steering wheels and airbag inflators, which represent the bulk of its revenue and market share.

- Resource Allocation: By divesting underperforming or non-strategic units, Autoliv frees up capital and management bandwidth to invest in areas with higher potential for growth and profitability, aligning with a strategy to optimize its business portfolio.

Product Lines Significantly Impacted by Unfavorable Regional Mix Shifts Without Recovery

Product lines heavily dependent on regions facing sustained downturns in vehicle production or unfavorable shifts in customer and geographic mix, without a foreseeable recovery, may fall into the 'dog' category. These segments consistently underperform and consume resources disproportionately. For instance, if a specific airbag system, primarily sold in a declining European market with intense price competition, shows no signs of market share improvement, it could be classified as a dog. This is particularly relevant given the general regional challenges and mix shifts noted in early 2025 earnings reports, impacting certain product lines more severely than others.

Consider the impact on product lines like advanced driver-assistance systems (ADAS) sensors if a major automotive customer in a struggling Asian market significantly reduces its orders for the foreseeable future. If Autoliv's market share in that specific segment and region remains stagnant or declines, and there are no alternative growth avenues identified, this product line could become a 'dog'. For example, a 10% year-over-year decline in light vehicle production in a key market, coupled with a loss of a significant customer contract for a specialized steering wheel component, would exemplify such a scenario.

- Product Lines Facing Prolonged Regional Decline: Segments tied to regions with persistent drops in vehicle output, such as certain European or South American markets experiencing economic headwinds, could be classified as dogs if recovery is not anticipated.

- Adverse Customer Mix Shifts: Product lines that are heavily reliant on a few large customers who are themselves struggling or shifting their sourcing strategies to lower-cost alternatives, without a corresponding increase in business from other customers, may become dogs.

- Lack of Market Share Growth: If specific product offerings, like certain types of seatbelt pretensioners, are not gaining traction or are losing ground to competitors in key markets, and there is no clear strategy for improvement, they risk becoming dogs.

- Resource Drain Without Returns: Product lines that require substantial investment in R&D or manufacturing but consistently fail to meet profitability targets due to market saturation or technological obsolescence, without a clear path to revitalization, are prime candidates for the dog category.

Dogs in Autoliv's portfolio represent products with low market share in low-growth markets, often characterized by intense price competition and minimal profitability. These might include highly commoditized, basic safety components or legacy products for older vehicle models. For instance, in 2024, while the overall automotive safety market is robust, basic components like standard seatbelt buckles face significant commoditization, impacting margins.

Such offerings can drain resources and management attention that could be better directed towards high-growth areas like advanced driver-assistance systems (ADAS). Autoliv's strategic divestitures, such as its Electronics business in 2019, highlight a proactive approach to shedding underperforming or non-core assets to focus on core strengths.

Product lines tied to declining regional markets or facing adverse customer mix shifts without a clear recovery path are also prime candidates for the dog category. For example, a product line heavily reliant on a struggling European market with declining vehicle production, like certain passive safety components, could become a dog if market share doesn't improve.

Companies often manage dogs by divesting them, phasing them out, or repurposing manufacturing capacity to more profitable ventures. This strategic pruning is crucial for optimizing resource allocation and maintaining a competitive edge in the rapidly evolving automotive safety landscape.

| Product Category Example | Market Growth | Market Share | Profitability | Strategic Consideration |

|---|---|---|---|---|

| Basic Seatbelt Buckles | Low | Low to Moderate | Low | Divest, Optimize, or Phase Out |

| Legacy Airbag Control Units (for discontinued models) | Declining | Niche | Very Low | Phase Out, Support with Minimal Resources |

| Specific Regional Passive Safety Components (in declining markets) | Low | Low | Low | Evaluate for Divestment or Repurposing |

Question Marks

Autoliv is poised to enter the powered two-wheeler safety market with its first motorcycle airbag, slated for a Q1 2025 launch. This move targets a high-growth segment where Autoliv currently holds minimal share but sees substantial future potential.

The global two-wheeler population is substantial, with estimates suggesting over 400 million motorcycles and scooters worldwide. This vast user base, coupled with a growing emphasis on rider safety, presents a significant opportunity for innovative solutions like Autoliv's airbag system.

While the initial market penetration will be low, the increasing regulatory push for enhanced safety features and consumer demand for protective gear are expected to drive rapid adoption. Autoliv's entry signifies a strategic diversification into a segment with strong upside potential, aligning with their broader mission of saving lives.

Autoliv is strategically targeting the commercial vehicle sector as part of its Mobility Safety Solutions (MSS) initiative. This move into an adjacent market is driven by its significant growth potential, aiming to diversify beyond its established strength in passenger car safety.

While Autoliv holds a leading position in passenger vehicle safety, its market share in commercial vehicles is expected to be less substantial initially. This presents an opportunity for focused investment and market penetration to secure a stronger foothold in this expanding segment.

The commercial vehicle market offers substantial growth prospects, and Autoliv's expansion into this area reflects a deliberate strategy to leverage its safety expertise across a broader automotive landscape. This diversification is key to its long-term growth trajectory.

Beyond its established pyro switches, Autoliv is targeting advanced electrical safety solutions for the booming EV market, a clear high-growth area. While pyro switches are a core offering, the company's position in these newer, specialized EV safety technologies is still developing.

Autoliv's strategic investments are focused on capturing market share in these evolving EV safety segments. The global EV market is projected to reach over 30 million units sold annually by 2024, highlighting the significant potential for advanced electrical safety innovations beyond traditional components.

Safety Solutions for Autonomous Driving and Future Mobility Concepts (e.g., Flying Cars)

Autoliv is investing heavily in safety for autonomous driving and future mobility, like flying cars. Their partnership with XPENG AEROHT highlights this commitment to these emerging, high-potential markets. While current market share in these areas is minimal due to their nascent stage, Autoliv is positioning itself for future growth through significant R&D.

- Autoliv's R&D Investment: Autoliv's commitment to future mobility safety is underscored by its ongoing significant investment in research and development, aiming to secure an early foothold in these rapidly evolving sectors.

- XPENG AEROHT Partnership: This collaboration signifies Autoliv's proactive approach to developing specialized safety systems tailored for advanced aerial mobility solutions.

- Nascent Market Presence: In 2024, Autoliv's market share in flying car safety solutions is virtually non-existent, reflecting the early developmental stage of this industry.

- High Growth Potential: Despite the low current market share, the autonomous driving and flying car sectors represent substantial long-term growth opportunities for Autoliv.

Deepening Partnerships with Chinese Domestic OEMs for Advanced Safety

Autoliv is aggressively pursuing deeper partnerships with Chinese domestic OEMs to bolster its position in the rapidly evolving automotive safety market. This strategy is particularly crucial given the significant growth in China's electric vehicle (EV) sector and ongoing urbanization trends, which are reshaping consumer demands and vehicle technologies.

The company recognizes the immense potential within China's domestic automotive landscape, despite past market complexities. By forging strategic alliances, such as its collaboration with Jiangling Motors Co. (JMC), Autoliv aims to leverage these partnerships to enhance its relative sales performance and gain substantial market share. For instance, in 2024, China's automotive production reached approximately 30 million units, with domestic brands showing robust growth, underscoring the strategic importance of this market for Autoliv.

- Market Share Growth: Autoliv's focus on Chinese domestic OEMs is a key driver for increasing its overall market share in the world's largest automotive market.

- Electrification and Urbanization Impact: These macro trends are creating new opportunities for advanced safety systems, a core competency for Autoliv.

- Strategic Alliances: Partnerships like the one with JMC are instrumental in navigating the Chinese market and achieving sales targets.

- Sales Performance Improvement: Autoliv is actively working to improve its relative sales performance against competitors within the Chinese domestic OEM segment.

Question Marks in Autoliv's portfolio represent emerging product categories or markets where the company has a nascent presence and faces significant uncertainty regarding future growth and market share. These are areas where Autoliv is investing in research and development, aiming to establish a competitive advantage.

The company is exploring new avenues such as powered two-wheeler safety and advanced electrical safety solutions for EVs, which are currently Question Marks due to their early stage of development and Autoliv's limited historical involvement.

These ventures, while carrying higher risk, also offer substantial potential for future growth and diversification, making them critical components of Autoliv's long-term strategy.

Autoliv's expansion into areas like flying car safety, with minimal current market share but significant R&D investment, perfectly encapsulates the characteristics of a Question Mark.

| Market Segment | Current Market Share (Approx.) | Growth Potential | Autoliv's Position | Strategic Focus |

|---|---|---|---|---|

| Powered Two-Wheeler Safety | Minimal | High | Nascent (Launching Q1 2025) | New market entry, diversification |

| Flying Car Safety | Virtually Non-existent (2024) | Very High | Early R&D, partnerships | Future mobility, innovation |

| Advanced EV Electrical Safety | Developing | High | Investing in new technologies | Capturing EV market share |

BCG Matrix Data Sources

Our Autoliv BCG Matrix leverages comprehensive data from Autoliv's annual reports, internal sales figures, and global automotive market research to accurately assess product portfolio performance.