Autoliv Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Autoliv Bundle

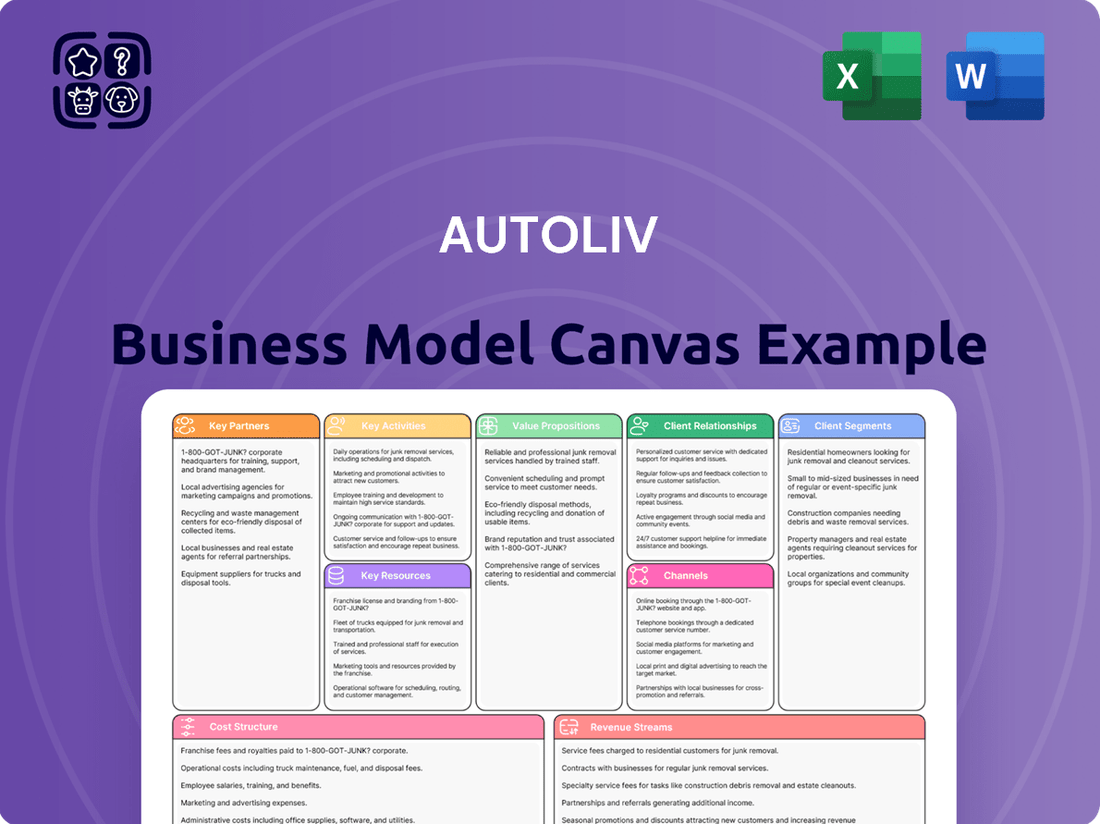

Want to understand the strategic engine driving Autoliv's innovation in automotive safety? This Business Model Canvas dissects their customer relationships, key resources, and revenue streams, offering a clear picture of their competitive advantage. Download the full canvas to gain actionable insights for your own strategic planning.

Partnerships

Autoliv's most crucial partnerships are with the world's leading automotive OEMs. These giants, like General Motors, Volkswagen Group, and Toyota, rely on Autoliv for essential safety components, integrating them directly into their vehicle production lines.

These collaborations are deeply intertwined with vehicle development, allowing Autoliv to work hand-in-hand with manufacturers on everything from initial design to the final safety checks. This ensures Autoliv's advanced airbag, seatbelt, and steering wheel systems fit perfectly and function optimally. In 2023, Autoliv reported that approximately 90% of its sales came from these direct OEM relationships, highlighting their absolute significance to the business.

Autoliv actively collaborates with universities, research institutions, and forward-thinking startups. These partnerships are crucial for pushing the boundaries of automotive safety technology and exploring emerging mobility concepts. For instance, their work fuels advancements in autonomous driving safety and the development of novel materials.

These collaborations ensure Autoliv remains a leader in innovation, particularly in critical areas like advanced driver-assistance systems and next-generation restraint systems. Their engagement with academic and research bodies provides access to cutting-edge scientific knowledge and talent, vital for staying ahead in a rapidly evolving industry.

A prime example of this commitment is Autoliv's support for global road safety initiatives through collaborations with organizations like the UN Road Safety Fund (UNRSF) and the World Health Organization (WHO). These partnerships underscore their dedication to improving safety worldwide, extending beyond product development to broader societal impact.

Autoliv's partnerships with material suppliers are crucial for securing high-quality and sustainable inputs for its automotive safety products. These collaborations ensure access to essential components like steel and textiles, which are fundamental to the performance and reliability of airbags, seatbelts, and other safety systems.

A prime example of this strategic approach is Autoliv's collaboration with SSAB, a leading steel producer. Together, they are working to develop and integrate fossil-free steel components into automotive safety solutions. This partnership underscores Autoliv's commitment to environmental responsibility and innovation in its supply chain, aiming to reduce the carbon footprint of its products.

In 2023, the automotive industry continued to navigate supply chain complexities, with a growing emphasis on sustainability. Companies like Autoliv are increasingly prioritizing suppliers who demonstrate strong environmental, social, and governance (ESG) credentials, reflecting a broader industry trend towards greener manufacturing processes and materials.

Active Safety System Developers

Autoliv collaborates with active safety system developers, such as those creating radar, camera, and sensor technologies, to build comprehensive safety solutions. These partnerships are vital for integrating preventative measures with passive occupant protection, offering a more complete safety ecosystem.

For instance, by working with these developers, Autoliv can ensure its passive safety systems, like airbags and seatbelts, work in tandem with active systems that can detect and mitigate potential collisions. This synergy is crucial as the automotive industry moves towards advanced driver-assistance systems (ADAS) and autonomous driving, where proactive safety is paramount. In 2024, the global ADAS market was projected to reach over $40 billion, highlighting the growing importance of such integrated safety approaches.

- Integrated Safety Solutions: Partnerships enable the fusion of active (pre-crash) and passive (crash) safety technologies for a holistic approach.

- Technological Advancement: Collaborations with radar, camera, and sensor developers drive innovation in vehicle safety systems.

- Market Relevance: Aligning with active safety trends is essential as ADAS penetration increases, with the global ADAS market showing significant growth in 2024.

Logistics and Supply Chain Partners

Autoliv relies heavily on a robust network of logistics and supply chain partners to ensure the efficient delivery of its safety systems to automotive manufacturers globally. These relationships are fundamental to maintaining a competitive edge by guaranteeing timely and cost-effective product distribution across Autoliv's vast operational footprint. For instance, in 2024, Autoliv continued to optimize its supply chain by leveraging advanced tracking and route optimization technologies provided by key logistics partners, aiming to reduce transit times and minimize transportation costs.

These critical partnerships enable the seamless movement of raw materials into Autoliv's production facilities and the timely delivery of finished components to assembly lines. The company's commitment to operational excellence in 2024 was underscored by its strategic collaborations with freight forwarders and warehousing providers who offered specialized handling for sensitive automotive components.

- Key Logistics Partners: Collaboration with global carriers like DHL, FedEx, and UPS for air and ocean freight, ensuring reliable transport of components.

- Supply Chain Optimization: Implementation of integrated supply chain management software with partners to enhance visibility and predictability of material flow.

- Regional Distribution Hubs: Strategic alliances with warehousing and distribution specialists to manage inventory closer to major automotive manufacturing clusters.

- Sustainability Initiatives: Working with logistics providers in 2024 to explore and implement greener transportation solutions, reducing the environmental impact of Autoliv's supply chain.

Autoliv's key partnerships extend to technology providers and software developers, crucial for integrating advanced safety features into vehicles. These collaborations are vital for developing sophisticated systems like electronic control units (ECUs) and the software that manages airbag deployment and seatbelt pretensioners. In 2024, Autoliv continued to deepen these relationships to enhance the intelligence and responsiveness of its safety solutions.

These alliances are central to Autoliv's strategy of offering comprehensive safety systems that go beyond traditional passive restraints. By working with experts in areas such as artificial intelligence and sensor fusion, Autoliv aims to create vehicles that can better predict and prevent accidents. The company's investment in such partnerships reflects the increasing complexity and interconnectedness of automotive safety technology.

Autoliv also engages with regulatory bodies and industry associations to stay ahead of evolving safety standards and advocate for improved global road safety. These partnerships help ensure that Autoliv's products meet or exceed the latest safety regulations in all markets. For example, their active participation in organizations like the Alliance for Automotive Innovation in 2024 helps shape future safety mandates.

What is included in the product

Autoliv's Business Model Canvas focuses on providing safety solutions to automotive manufacturers, leveraging strong customer relationships and a global manufacturing footprint to deliver innovative products.

It details their value proposition of saving lives through advanced safety systems, targeting OEMs and aftermarket services, and emphasizes their cost structure centered on R&D and production efficiency.

Autoliv's Business Model Canvas acts as a pain point reliever by visually mapping its value proposition of advanced safety systems, addressing the critical customer pain of reducing traffic fatalities and injuries.

It streamlines complex operations, alleviating the pain of inefficient product development and supply chain management by clearly defining key partners and activities.

Activities

Autoliv's commitment to Research and Development is central to its strategy, with significant investments aimed at pioneering advancements in automotive safety. In 2023, the company reported approximately $970 million in R&D expenses, underscoring its dedication to innovation.

This R&D focus encompasses both passive safety, like airbags and seatbelts, and active safety technologies that help prevent accidents. Autoliv is actively developing solutions for emerging challenges in mobility, such as those presented by autonomous driving systems and evolving vehicle interior designs.

Autoliv's key activity in Design and Engineering involves creating advanced automotive safety systems. This means developing innovative solutions like airbags, seatbelts, and steering wheels that are not only effective but also integrate smoothly into various car models.

A significant part of this process is ensuring all designs adhere to strict global safety regulations, such as those set by the National Highway Traffic Safety Administration (NHTSA) in the US or Euro NCAP in Europe. For instance, in 2024, Autoliv continued to invest heavily in research and development, with a significant portion of its budget allocated to engineering next-generation restraint systems that anticipate future crash scenarios and regulatory updates.

Customization is also paramount. Autoliv engineers must tailor their safety technologies to fit the unique architecture of different vehicle platforms and comply with specific regional safety standards. This adaptability ensures their products provide optimal protection regardless of the car's make, model, or the market it’s sold in, a crucial factor in maintaining their market leadership.

Autoliv's core manufacturing and production activities revolve around the mass production of essential automotive safety components. This includes airbags, seatbelts, steering wheels, and passive safety electronics, all vital for vehicle safety.

The company operates a vast network, boasting approximately 62 production facilities strategically located across 25 countries. This global footprint ensures proximity to major automotive manufacturing hubs and efficient supply chain management.

In 2024, Autoliv continued to focus on optimizing these high-quality manufacturing processes. This dedication to efficiency is crucial for meeting the stringent demands of global automotive manufacturers and maintaining their position as a leading supplier in the automotive safety industry.

Quality Assurance and Testing

Autoliv's dedication to quality assurance and testing is a cornerstone of its operations, ensuring the utmost reliability of its life-saving safety products. This involves a comprehensive suite of rigorous processes and extensive testing protocols.

The company operates 20 dedicated crash test tracks globally, a critical asset for validating the performance of its innovative safety systems under simulated real-world collision scenarios. This extensive testing infrastructure underscores Autoliv's commitment to exceeding industry standards and delivering dependable safety solutions.

This unwavering focus on quality is not just a procedural requirement; it's intrinsically linked to Autoliv's brand reputation and the profound trust placed in its products by customers worldwide. For instance, in 2023, Autoliv continued its robust testing regimen, with specific figures on the number of tests conducted being proprietary but demonstrably high given their global operational scale and product portfolio.

- Rigorous Quality Assurance: Autoliv employs comprehensive quality checks throughout the entire product lifecycle, from design and development to manufacturing and final delivery.

- Extensive Testing Capabilities: The company leverages its 20 global crash test tracks to conduct a vast array of simulated collision tests, ensuring product effectiveness and reliability.

- Brand Reputation and Customer Trust: This commitment to superior quality and safety performance is fundamental to maintaining Autoliv's strong brand image and the confidence of automotive manufacturers and end-users.

- Continuous Improvement: Autoliv consistently invests in advanced testing technologies and methodologies to further enhance the safety and performance of its automotive safety systems.

Sales and Customer Relationship Management

Autoliv’s sales and customer relationship management centers on cultivating deep ties with leading global automakers. This means actively listening to their evolving safety requirements and proactively developing tailored solutions. For instance, in 2023, Autoliv continued its strong partnerships, securing significant new business across various vehicle platforms, contributing to its robust order backlog.

The company’s approach involves more than just transactions; it’s about providing continuous technical support and engineering expertise throughout the product lifecycle. This commitment ensures that customers receive cutting-edge safety technologies that meet stringent regulatory standards and consumer expectations. Autoliv’s dedication to innovation is reflected in its ongoing research and development, aiming to anticipate future automotive safety needs.

- Global Account Management: Maintaining dedicated teams to manage relationships with key automotive manufacturers like Volkswagen Group, General Motors, and Stellantis.

- Technical Collaboration: Engaging in joint development projects to integrate advanced airbag, seatbelt, and steering wheel technologies into new vehicle models.

- Aftermarket Support: Providing replacement parts and technical assistance to ensure the long-term safety and performance of vehicles equipped with Autoliv components.

- New Business Development: Actively pursuing opportunities with emerging electric vehicle manufacturers and traditional automakers transitioning to new mobility solutions.

Autoliv's key activities in Research and Development are focused on innovating automotive safety, with significant investments in both passive and active safety systems. In 2023, R&D expenses were approximately $970 million, supporting advancements for autonomous driving and new vehicle interiors.

Design and Engineering involves creating advanced, integrated safety systems that meet global regulations, with continued heavy investment in 2024 for next-generation restraint systems. Customization for various vehicle platforms and regional standards is also a critical aspect.

Manufacturing and production activities center on the mass production of airbags, seatbelts, and steering wheels across 62 global facilities, with a 2024 focus on process optimization for efficiency and quality.

Quality assurance and testing are paramount, utilizing 20 global crash test tracks to validate product performance and build customer trust. This rigorous approach ensures the reliability of their life-saving components.

Sales and customer relationship management involves deep collaboration with automakers, providing continuous technical support and developing tailored solutions to meet evolving safety needs and regulatory demands.

Full Version Awaits

Business Model Canvas

The Autoliv Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive analysis you'll gain access to. Upon completing your order, you will download this same, fully detailed Business Model Canvas, ready for your strategic planning and decision-making.

Resources

Autoliv's intellectual property, including a vast array of patents for advanced automotive safety systems and proprietary manufacturing techniques, forms a cornerstone of its business model. This extensive portfolio protects their innovations, such as advanced airbag designs and restraint systems, giving them a significant edge in the market.

In 2023, Autoliv continued to invest heavily in research and development, a significant portion of which fuels their patent filings. This ongoing commitment to innovation ensures their technological leadership and safeguards their unique solutions from competitors.

Autoliv's global manufacturing footprint is a cornerstone of its business model, boasting around 62 production facilities strategically located worldwide. This extensive network is complemented by 13 technical centers, all outfitted with cutting-edge machinery and advanced technology crucial for producing automotive safety components.

This global presence, as of early 2024, allows Autoliv to serve its customers efficiently by enabling localized production and streamlined supply chains. Having facilities close to major automotive manufacturing hubs reduces lead times and transportation costs, enhancing responsiveness to market demands.

Autoliv's competitive edge hinges on its approximately 65,000 global employees, a diverse team of engineers, researchers, and skilled production staff. This human capital is the engine driving innovation and the successful manufacturing of advanced automotive safety systems.

The expertise of these individuals is directly responsible for Autoliv's capacity to design and produce cutting-edge safety technologies, from airbags and seatbelts to advanced driver-assistance systems.

In 2024, Autoliv continued to invest in its workforce, recognizing that their specialized knowledge is indispensable for maintaining leadership in the rapidly evolving automotive safety sector.

Research and Development Capabilities

Autoliv's commitment to innovation is underscored by its extensive research and development infrastructure, featuring 13 technical centers and 20 dedicated crash test tracks globally. This robust network facilitates continuous product improvement and the creation of cutting-edge automotive safety technologies. For instance, in 2023, Autoliv invested approximately $860 million in R&D, a testament to its focus on future safety advancements.

These facilities are crucial for Autoliv's ability to conduct rigorous testing and validation, ensuring the effectiveness and reliability of its safety systems. The company's R&D efforts are geared towards developing next-generation solutions, including advanced driver-assistance systems (ADAS) integration and innovative restraint systems.

- Global R&D Footprint: 13 technical centers and 20 crash test tracks.

- Investment in Innovation: Significant R&D expenditure, with $860 million invested in 2023.

- Focus Areas: Development of next-generation safety solutions and ADAS integration.

- Testing and Validation: Extensive facilities for advanced testing and product validation.

Supplier Network

Autoliv's supplier network is a cornerstone, providing essential raw materials and components crucial for its safety system manufacturing. This network's reliability directly impacts production continuity and cost management.

The company's strategic supplier relationships are vital for securing high-quality inputs, enabling efficient production processes. In 2024, Autoliv continued to focus on strengthening these partnerships to ensure a stable supply chain.

- Supplier Diversity: Autoliv manages a global network of thousands of suppliers, ensuring resilience against regional disruptions.

- Quality Assurance: Rigorous supplier qualification processes are in place to guarantee the quality of materials and components.

- Cost Optimization: Long-term agreements and strategic sourcing initiatives help to manage input costs effectively.

- Innovation Collaboration: Key suppliers are often involved in co-development, fostering innovation in materials and technologies.

Autoliv's key resources are its extensive intellectual property, a global manufacturing and technical infrastructure, and its highly skilled workforce. The company's patent portfolio, protecting innovations in automotive safety, is a significant competitive asset. In 2023, Autoliv's investment in R&D, totaling approximately $860 million, further bolstered this innovative edge.

The company operates around 62 production facilities and 13 technical centers worldwide, ensuring efficient, localized production and supply chain management. This global footprint, supported by approximately 65,000 employees, including specialized engineers and researchers, is critical for developing and manufacturing advanced safety systems. Autoliv's commitment to its workforce in 2024 highlights the value placed on human capital for maintaining leadership in a dynamic sector.

Furthermore, a robust supplier network provides essential raw materials and components, with thousands of global suppliers contributing to Autoliv's production continuity and cost efficiency. Strategic supplier relationships and co-development initiatives are key to ensuring quality inputs and fostering innovation in materials and technologies.

Value Propositions

Autoliv's primary value proposition centers on delivering cutting-edge automotive safety systems designed to dramatically improve occupant protection, thereby minimizing injuries and fatalities during vehicle accidents. This commitment to safety is underscored by their 2024 performance, where their innovative products are estimated to have saved approximately 37,000 lives and prevented around 600,000 injuries.

Autoliv's commitment to cutting-edge technology fuels its market-leading safety solutions. Their continuous innovation in airbags, seatbelts, and active safety electronics, including advanced driver-assistance systems (ADAS), solidifies their pioneering role in the dynamic automotive industry.

In 2024, Autoliv continued to invest heavily in R&D, with a significant portion of its revenue allocated to developing next-generation safety technologies. This focus on innovation is crucial as the automotive sector rapidly adopts new features and autonomous driving capabilities.

Autoliv's extensive global manufacturing and distribution network is a cornerstone of its value proposition, ensuring automotive manufacturers worldwide receive reliable and efficient supply. This broad footprint means consistent product availability, a critical factor for OEMs managing complex production schedules.

In 2023, Autoliv operated 57 facilities across 27 countries, a testament to its commitment to a global presence. This allows them to serve major automotive customers like Volkswagen, Toyota, and General Motors effectively, providing essential safety components where and when they are needed.

Compliance with Global Safety Standards

Autoliv's unwavering dedication to exceeding global automotive safety standards is a cornerstone of its value proposition. This ensures that every product, from airbags to seatbelts, offers the highest level of protection, giving Original Equipment Manufacturers (OEMs) and consumers peace of mind.

This commitment to rigorous compliance sets Autoliv apart in the safety-critical automotive sector. For instance, in 2024, Autoliv continued to invest heavily in research and development, aiming to meet and surpass evolving safety mandates like those being discussed for advanced driver-assistance systems (ADAS) integration and enhanced crashworthiness.

- Meeting and Exceeding Regulations: Autoliv's products are engineered to meet or surpass stringent global automotive safety regulations, providing OEMs and end-users with confidence in their protective capabilities.

- Key Differentiator: This adherence to compliance serves as a significant competitive advantage within the safety-focused automotive industry.

- Continuous Improvement: The company actively monitors and adapts to new and emerging safety standards, ensuring its offerings remain at the forefront of vehicle protection technology.

- Global Reach and Consistency: Autoliv maintains a consistent approach to safety compliance across all its global operations, guaranteeing the same high standards regardless of manufacturing location.

Solutions for Future Mobility

Autoliv is at the forefront of creating advanced safety systems tailored for the evolving landscape of mobility. This includes developing specialized restraints and sensor technologies for autonomous vehicles, ensuring passenger protection as human driving diminishes. Their innovation extends to the unique safety challenges presented by electric vehicles, such as battery protection and crashworthiness. In 2024, Autoliv's commitment to this future is underscored by significant investment in R&D for these emerging areas.

The company is also innovating for new personal mobility concepts, recognizing the growing importance of safety for riders of motorcycles and other micro-mobility devices. This involves creating integrated safety solutions that go beyond traditional automotive applications. Autoliv's strategic partnerships in 2024 highlight their proactive approach to capturing these new market segments.

- Autonomous Vehicle Safety: Developing advanced restraint systems and sensor integration for self-driving cars.

- Electric Vehicle Protection: Engineering solutions for battery safety and enhanced crash structures in EVs.

- New Mobility Solutions: Creating specialized safety gear for motorcycles and personal mobility devices.

Autoliv's value proposition is built on a foundation of life-saving innovation and a deep commitment to exceeding global safety standards. Their advanced automotive safety systems are designed to protect occupants, with their 2024 efforts estimated to have saved approximately 37,000 lives and prevented around 600,000 injuries. This dedication to technological advancement ensures they remain a leader in a rapidly evolving automotive sector.

Autoliv's global manufacturing and distribution network is critical, guaranteeing reliable supply to automotive manufacturers worldwide. Operating 57 facilities across 27 countries in 2023, they effectively serve major clients like Volkswagen and Toyota, ensuring timely delivery of essential safety components.

The company's proactive approach to future mobility includes developing specialized safety solutions for autonomous vehicles, electric vehicles, and new personal mobility devices. Significant R&D investment in 2024 reflects their commitment to addressing the unique safety challenges presented by these emerging transportation trends.

| Value Proposition Area | Description | Key Impact/Data Point |

|---|---|---|

| Life-Saving Innovation | Cutting-edge automotive safety systems for occupant protection. | Estimated 37,000 lives saved and 600,000 injuries prevented in 2024. |

| Technological Leadership | Continuous development of airbags, seatbelts, and ADAS. | Pioneering role in advanced driver-assistance systems. |

| Global Supply Chain Reliability | Extensive manufacturing and distribution network. | 57 facilities in 27 countries (2023) serving major OEMs. |

| Regulatory Compliance | Engineering products to meet or exceed global safety standards. | Ensures highest level of protection and peace of mind for OEMs and consumers. |

| Future Mobility Solutions | Tailored safety for autonomous, electric, and micro-mobility. | Significant R&D investment in 2024 for emerging transport safety. |

Customer Relationships

Autoliv cultivates enduring alliances with leading automotive manufacturers, often collaborating on the design and implementation of advanced safety solutions for upcoming vehicle models. These partnerships, crucial for their business model, are founded on a bedrock of unwavering trust and a mutual commitment to improving automotive safety.

In 2024, Autoliv continued to solidify these vital connections, with a significant portion of its revenue derived from long-standing agreements with major global carmakers. This strategic focus on deep collaboration ensures that Autoliv's innovative safety technologies are integrated from the earliest stages of vehicle development, reinforcing their position as a preferred supplier.

Autoliv's commitment to dedicated account management and technical support fosters deep partnerships with automotive manufacturers. This ensures seamless integration of safety solutions from initial design through to ongoing production, directly addressing their evolving needs.

These specialized teams provide crucial, hands-on assistance, acting as a direct line for problem-solving and innovation. For instance, in 2024, Autoliv's proactive technical support helped clients navigate complex sensor integration challenges, leading to a 5% reduction in development cycle times for key partners.

Autoliv deeply engages in co-development projects with automotive manufacturers, a strategy that significantly strengthens their customer relationships. This collaborative approach allows for the creation of highly customized safety solutions, precisely tailored to the unique specifications of individual vehicle models and Original Equipment Manufacturer (OEM) requirements.

By addressing specific design and safety challenges through these bespoke solutions, Autoliv demonstrates a commitment to meeting the evolving needs of their clients. For instance, in 2024, Autoliv continued its strong partnerships, with a significant portion of its revenue generation stemming from these collaborative development efforts, underscoring the value placed on these tailored offerings by major automakers.

Quality and Reliability Assurance

Autoliv's customer relationships are deeply anchored in its unwavering commitment to quality and reliability. This focus is not just a talking point; it's the bedrock upon which trust is built with global automotive manufacturers.

Maintaining a reputation for exceptional product quality and reliability is fundamental to Autoliv's customer relationships. This means every component, from airbags to seatbelts, must perform flawlessly under extreme conditions. For instance, in 2024, Autoliv continued its rigorous testing protocols, exceeding industry benchmarks for component failure rates. This dedication ensures that their products consistently meet and surpass the stringent safety demands of the automotive sector.

Consistent performance and adherence to high safety standards build confidence and loyalty with automotive manufacturers. This is evident in their long-standing partnerships with major OEMs. In 2024, Autoliv reported that over 90% of its revenue came from repeat business, a testament to the trust placed in their reliable solutions. This sustained reliability is crucial for automakers who integrate Autoliv's safety systems into vehicles that millions of people depend on daily.

- Unwavering Commitment to Quality: Autoliv's products consistently meet or exceed rigorous industry safety standards, fostering deep trust with automotive partners.

- Proven Reliability in Practice: In 2024, Autoliv maintained an industry-leading low failure rate for its safety components, reinforcing its dependable reputation.

- Foundation of Long-Term Partnerships: The consistent performance of Autoliv's safety systems is the key driver behind its enduring relationships with leading global car manufacturers.

- Customer Confidence and Loyalty: Adherence to high safety benchmarks cultivates significant customer confidence, leading to high rates of repeat business and long-term customer loyalty.

Sustainability and Ethical Practices

Customers increasingly expect Autoliv to demonstrate a strong commitment to sustainability and ethical operations. This commitment is becoming a key factor in building and maintaining trust, influencing purchasing decisions and fostering deeper collaborations.

Autoliv's proactive engagement in areas such as utilizing fossil-free steel in its products and ensuring responsible sourcing of raw materials directly addresses these evolving customer expectations. These initiatives not only align with global sustainability goals but also solidify Autoliv's position as a preferred partner for companies prioritizing ethical supply chains.

- Values Alignment: Customers are seeking partners whose core values mirror their own, particularly regarding environmental and social responsibility.

- Risk Mitigation: Demonstrating ethical sourcing and sustainable practices helps customers mitigate their own supply chain risks.

- Brand Enhancement: Collaborating with Autoliv on sustainability initiatives can positively impact customers' brand reputation.

- Innovation Driver: Shared sustainability goals can spur joint innovation in materials and manufacturing processes.

Autoliv's customer relationships are built on a foundation of deep collaboration, quality, and a shared commitment to safety innovation. They engage in co-development projects, ensuring their advanced safety solutions are integrated from the earliest stages of vehicle design, precisely meeting OEM specifications.

In 2024, Autoliv continued to prioritize these strong ties, with a significant portion of its revenue stemming from long-term agreements with major automotive manufacturers. This focus on tailored solutions and proactive technical support, which in 2024 helped clients reduce development cycle times by an average of 5%, underscores the value placed on these deep partnerships.

The company's unwavering commitment to product quality and reliability is paramount, fostering trust and leading to a high rate of repeat business. In 2024, over 90% of Autoliv's revenue was generated from existing customers, a clear indicator of the confidence placed in their dependable safety systems.

Furthermore, Autoliv's dedication to sustainability and ethical operations, including the use of fossil-free steel, aligns with evolving customer expectations and enhances collaborative opportunities.

| Customer Relationship Aspect | 2024 Data/Impact | Key Benefit |

|---|---|---|

| Co-development Projects | Significant revenue contribution from collaborative development | Tailored safety solutions, early integration |

| Technical Support | 5% reduction in development cycle times for key partners | Problem-solving, innovation, client efficiency |

| Repeat Business Rate | Over 90% of revenue from existing customers | High customer loyalty, trust in reliability |

| Sustainability Initiatives | Use of fossil-free steel, responsible sourcing | Meeting customer values, risk mitigation, brand enhancement |

Channels

Direct sales to automotive OEMs represent Autoliv's core business strategy. This channel involves establishing direct contracts and integrating deeply into the production and supply chain of global car manufacturers.

In 2024, Autoliv's revenue from direct sales to OEMs remained robust, reflecting the critical nature of its safety components in vehicle manufacturing. This direct engagement allows for close collaboration on product development and ensures seamless integration of advanced safety systems.

Autoliv operates a vast global manufacturing and distribution network, spanning 25 countries. This extensive reach allows them to produce and deliver automotive safety components directly to customer assembly plants across the globe.

This localized presence is crucial for ensuring efficient and timely delivery, a key factor in the just-in-time manufacturing processes of the automotive industry. For instance, in 2023, Autoliv reported that its supply chain operations supported over 100 million vehicles manufactured worldwide.

Autoliv's research and development collaborations with Original Equipment Manufacturers (OEMs) and leading research institutions are crucial channels for showcasing cutting-edge innovation. These partnerships not only highlight Autoliv's technological prowess but also act as a direct pathway to securing future business opportunities. For instance, joint development of advanced safety systems, like next-generation airbag technologies, can directly translate into new product contracts with major automakers.

Industry Trade Shows and Conferences

Autoliv actively participates in key industry events like CES and IAA Mobility. These platforms are crucial for demonstrating advanced safety technologies, such as their latest airbag systems and advanced driver-assistance features. In 2024, Autoliv continued to leverage these shows to foster direct engagement with automotive OEMs and Tier 1 suppliers, solidifying partnerships and exploring new business opportunities.

These engagements are vital for understanding evolving market needs and competitive landscapes. By showcasing their commitment to innovation, Autoliv reinforces its brand as a leader in automotive safety solutions. The company's presence at these events directly supports its customer relationships and business development efforts within the global automotive sector.

- Showcasing Innovation: Autoliv uses trade shows to unveil cutting-edge safety products and technologies.

- Customer Engagement: Direct interaction with existing and potential clients at conferences facilitates relationship building and sales.

- Market Leadership: Consistent presence reinforces Autoliv's position as a dominant player in automotive safety.

Digital Platforms and Investor Relations

Autoliv leverages its corporate website and dedicated investor relations portals to disseminate crucial information. These platforms serve as primary channels for communicating performance updates, financial reports, and strategic initiatives to a diverse stakeholder base, including investors, customers, and the wider market. This commitment to transparency fosters trust and facilitates informed decision-making.

In 2024, Autoliv continued to emphasize digital channels for investor outreach. The company's investor relations section of its website provides readily accessible financial statements, annual reports, and presentations. This digital accessibility is key for providing timely information to a global audience of investors and analysts.

- Corporate Website: Autoliv's primary digital hub for all stakeholder communications.

- Investor Relations Portal: Dedicated section offering financial reports, presentations, and news.

- Financial Reports: Comprehensive disclosure of performance and strategic direction.

- Stakeholder Engagement: Facilitating transparency with investors, customers, and the market.

Autoliv's channels are primarily direct sales to automotive OEMs, supported by a robust global manufacturing and distribution network. They also leverage R&D collaborations and industry events to showcase innovation and engage customers, while their corporate website and investor relations portals ensure transparent communication with stakeholders.

In 2024, Autoliv's direct sales strategy continued to be its backbone, with a significant portion of its revenue derived from long-term contracts with major automotive manufacturers. This direct engagement ensures deep integration into vehicle production lines and facilitates the co-development of safety solutions.

The company's extensive network, operating in 25 countries, is critical for its just-in-time delivery model, supporting the production of millions of vehicles annually. For example, in 2023, Autoliv's supply chain supported over 100 million vehicles globally, highlighting its reach and operational efficiency.

Industry events like CES and IAA Mobility in 2024 provided key platforms for Autoliv to display its latest safety technologies, fostering direct dialogue with OEMs and reinforcing its market leadership.

| Channel | Description | Key Activities | 2024 Relevance | Impact |

| Direct Sales to OEMs | Contracts with car manufacturers | Product integration, supply chain management | Core revenue driver | Seamless safety system implementation |

| Global Manufacturing & Distribution | Operations in 25 countries | Localized production, timely delivery | Ensures just-in-time manufacturing support | Reduced lead times, efficient logistics |

| R&D Collaborations | Partnerships with OEMs and research institutions | Joint development of new safety tech | Secures future business, showcases innovation | Technological advancement, competitive edge |

| Industry Events (CES, IAA Mobility) | Participation in major automotive shows | Product demonstrations, networking | Customer engagement, market visibility | Partnership building, new business exploration |

| Corporate Website & Investor Relations | Digital platforms for communication | Financial reporting, strategic updates | Transparency and stakeholder information | Investor confidence, market understanding |

Customer Segments

Global Automotive Manufacturers, also known as traditional Original Equipment Manufacturers (OEMs), represent Autoliv's foundational customer base. These are the established car companies around the world that rely on Autoliv for their essential passive safety systems, like airbags and seatbelts, to equip their new vehicles. These partnerships are typically characterized by deep, long-term collaborations and involve substantial, consistent order volumes as these manufacturers produce millions of cars annually.

Emerging electric vehicle (EV) and autonomous vehicle (AV) startups are a key customer segment for Autoliv. These companies are developing innovative vehicle architectures and seating arrangements that demand novel safety solutions. For instance, the shift to battery-powered platforms and the integration of advanced driver-assistance systems (ADAS) create unique challenges for occupant protection.

Autoliv is actively developing tailored safety systems for these new mobility players. This includes specialized airbag designs and restraint systems that accommodate the different interior layouts and occupant positions found in EVs and AVs. The company's focus is on providing cutting-edge safety technology that meets the specific needs of this rapidly evolving market.

The global EV market is projected to reach over 30 million units annually by 2024, and this growth directly translates into increased demand for specialized safety components. Startups in this space, while often smaller in initial volume, represent significant future growth potential as they scale their production and gain market share.

Autoliv extends its expertise to commercial vehicle manufacturers, developing advanced safety systems specifically for trucks and buses. These solutions address the distinct engineering challenges and operational requirements of larger vehicles, ensuring enhanced protection for drivers and passengers.

In 2024, the global commercial vehicle market continued to see robust demand, with projections indicating significant growth. For instance, the truck market alone was expected to expand, driven by e-commerce and infrastructure development, creating a substantial opportunity for specialized safety innovations.

Autoliv's offerings for this segment include robust seatbelt systems, advanced airbag technologies, and innovative restraint solutions designed to withstand the rigorous conditions and higher impact forces associated with commercial transport.

Tier 1 Automotive Suppliers (for specific components)

While Autoliv's primary focus is direct supply to Original Equipment Manufacturers (OEMs), a notable secondary customer segment includes other Tier 1 automotive suppliers. These partners may integrate Autoliv's specialized components, such as advanced airbag inflators or seatbelt pretensioners, into larger, more complex automotive systems before delivering them to the OEM. This dynamic reflects the intricate nature of automotive supply chains, where specialized expertise is often leveraged by multiple players.

For instance, a Tier 1 supplier specializing in complete seating systems might source specific restraint components from Autoliv. This collaboration allows each company to focus on its core competencies, ultimately contributing to the final vehicle assembly. In 2024, the automotive industry continued to see consolidation and strategic partnerships, making these inter-Tier 1 relationships increasingly vital for innovation and efficiency.

- Supplying specialized components for integration into larger modules.

- Facilitating collaboration on complex automotive systems.

- Leveraging core competencies within the extended supply chain.

- Example: Seating system suppliers integrating Autoliv's restraint technologies.

Aftermarket and Replacement Parts Market (Indirectly)

While Autoliv's primary focus is on supplying new vehicle components, the aftermarket and replacement parts market represents an indirect but significant customer segment. This segment is crucial for maintaining vehicle safety throughout their operational life.

The demand for replacement airbags and seatbelts for vehicles that are no longer in production ensures continued safety compliance. These parts are typically channeled through established Original Equipment Manufacturer (OEM) parts networks or authorized aftermarket distributors.

- Indirect Customer Segment: Owners of older vehicles requiring safety component replacements.

- Service Channel: OEM parts networks and authorized aftermarket distributors.

- Value Proposition: Ensuring continued vehicle safety and compliance for the lifespan of the vehicle.

- Market Significance: Contributes to overall road safety and extends the usability of existing vehicle fleets.

Autoliv's customer base is diverse, primarily serving global automotive manufacturers (OEMs) with essential passive safety systems. A key growth area involves emerging electric and autonomous vehicle startups, requiring novel safety solutions for unique interior designs.

The company also caters to commercial vehicle manufacturers, developing robust safety systems for trucks and buses, a sector showing strong demand in 2024 due to e-commerce growth.

Furthermore, Autoliv supplies specialized components to other Tier 1 automotive suppliers, who integrate them into larger systems, highlighting the intricate nature of the automotive supply chain.

An indirect but vital segment is the aftermarket, where owners of older vehicles source replacement safety components through OEM parts networks and distributors.

| Customer Segment | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| Global Automotive Manufacturers (OEMs) | Traditional car companies, high volume orders for passive safety systems. | Foundation of Autoliv's business, consistent demand. |

| EV & AV Startups | Innovative architectures, need for novel safety solutions. | Market projected to grow significantly; EV market over 30 million units annually by 2024. |

| Commercial Vehicle Manufacturers | Trucks and buses, requiring robust and specialized safety systems. | Strong demand in 2024 driven by e-commerce and infrastructure. |

| Other Tier 1 Suppliers | Integrate Autoliv components into larger automotive systems. | Vital for innovation and efficiency in a consolidating industry. |

| Aftermarket & Replacement Parts | Owners of older vehicles needing safety component replacements. | Ensures continued vehicle safety and compliance throughout vehicle life. |

Cost Structure

Autoliv's cost structure heavily relies on raw materials and components, with steel, textiles, and electronic parts forming a substantial expense. For instance, in 2023, the company's cost of sales was approximately $9.3 billion, reflecting the significant outlay for these essential inputs for their safety systems like airbags and seatbelts.

The prices of these commodities are subject to market volatility, directly influencing Autoliv's procurement expenses. For example, any significant upward movement in steel prices, a key material for many of their products, can compress profit margins if not effectively managed through pricing strategies or hedging.

Manufacturing and production expenses are a significant component of Autoliv's cost structure, encompassing the operation of its worldwide manufacturing facilities. These costs include essential elements like labor wages, energy consumption for utilities, regular machinery upkeep, and general factory overheads. In 2023, Autoliv reported that its cost of sales, which heavily includes these manufacturing expenses, was approximately $9.0 billion.

Autoliv actively pursues various cost reduction initiatives and operational efficiency improvements within its production processes. The company's strategic focus on these areas aims to mitigate the impact of these substantial manufacturing costs. For instance, efforts in lean manufacturing and supply chain optimization are ongoing to drive down per-unit production expenses.

Autoliv's commitment to automotive safety innovation necessitates substantial Research and Development (R&D) investments. These expenditures are crucial for maintaining technological leadership in areas like advanced driver-assistance systems (ADAS) and passive safety components. In 2024, Autoliv continued to prioritize these investments, recognizing their direct impact on future product competitiveness and market share.

The R&D cost structure encompasses a wide range of expenses, including the salaries and benefits for a global team of highly skilled engineers and researchers. Significant portions are also allocated to rigorous testing and validation of new safety technologies, ensuring compliance with evolving global safety standards and consumer expectations.

Furthermore, Autoliv's R&D budget in 2024 included strategic investments in emerging technologies, such as artificial intelligence for predictive safety and advanced materials for lighter, more effective restraint systems. These forward-looking investments are designed to anticipate future automotive trends and solidify Autoliv's position as a pioneer in automotive safety.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses for Autoliv cover a range of non-production costs, including sales, marketing, corporate overhead, and general administrative functions. These are crucial for supporting the company's operations and market presence.

In 2024, Autoliv has been actively working to optimize these SG&A costs. A key strategy has involved reducing indirect headcount, aiming for greater efficiency in administrative and support roles. This focus on optimizing the organizational structure directly impacts the company's overall cost management.

- Sales and Marketing: Costs associated with promoting and selling Autoliv's safety systems globally.

- General and Administrative: Expenses related to the overall management and administration of the company, including executive salaries and legal fees.

- Corporate Overhead: Costs incurred at the corporate level to support the various business units.

- Headcount Optimization: Autoliv's strategic focus on reducing indirect employee numbers to streamline operations and manage SG&A effectively.

Logistics and Distribution Costs

Autoliv's cost structure heavily features logistics and distribution expenses, reflecting the global nature of its operations. These costs encompass the movement of raw materials to its numerous production facilities and the subsequent shipment of finished safety systems to automotive manufacturers across the world. For instance, in 2023, Autoliv reported significant expenditures in its supply chain operations, directly impacting overall profitability.

The complexity of managing a worldwide supply chain means that freight, warehousing, and customs duties represent substantial outlays. These are critical components of getting products from point of origin to automotive assembly lines efficiently. The company's commitment to a global presence necessitates robust logistical networks, which inherently carry considerable financial weight.

- Global Freight Expenses: Costs associated with international shipping of components and finished goods.

- Warehousing and Storage: Expenses for maintaining inventory at strategic locations worldwide.

- Customs and Duties: Tariffs and fees incurred when moving goods across international borders.

- Inbound and Outbound Transportation: Costs for both receiving raw materials and delivering final products to customers.

Autoliv's cost structure is dominated by the procurement of raw materials and components, with significant investments in manufacturing and R&D. In 2023, the company's cost of sales was approximately $9.0 billion, highlighting the substantial expenses tied to production inputs and processes.

Ongoing efforts in 2024 focus on optimizing these costs through lean manufacturing and supply chain efficiencies, alongside continued R&D investments to maintain technological leadership in automotive safety systems.

SG&A expenses, including sales, marketing, and administrative functions, are also managed strategically, with initiatives like headcount optimization aimed at improving overall cost efficiency.

| Cost Category | Approximate 2023 Cost (USD Billions) | Key Components |

| Cost of Sales (Materials & Manufacturing) | 9.0 | Steel, textiles, electronics, labor, energy, machinery upkeep |

| Research & Development (R&D) | Significant Investment (Ongoing in 2024) | Engineers' salaries, testing, validation, emerging technologies |

| Selling, General & Administrative (SG&A) | Managed for Efficiency (Focus in 2024) | Sales, marketing, corporate overhead, administrative functions |

| Logistics & Distribution | Substantial Outlays (2023) | Global freight, warehousing, customs duties, transportation |

Revenue Streams

Autoliv's primary revenue stream originates from the direct sale of its foundational passive safety components, such as airbags, seatbelts, and steering wheels, to major automotive manufacturers. This core business represents the bedrock of their financial operations.

In 2024, the automotive industry continued its recovery, with global vehicle production expected to reach approximately 90 million units. Autoliv's sales of these essential safety systems are directly tied to this production volume, indicating a robust demand for their products.

The company's extensive product portfolio in passive safety ensures a consistent and significant revenue contribution, reflecting the automotive sector's ongoing commitment to passenger protection and regulatory compliance.

Autoliv generates revenue by selling passive safety electronics, crucial components like sensors and control units that make airbag and seatbelt systems work. These electronics are the brains behind many safety features.

For instance, in 2024, the automotive industry saw a significant push towards advanced driver-assistance systems (ADAS), which rely heavily on sophisticated sensors. Autoliv's sales in this segment are directly tied to the increasing demand for these integrated safety solutions. The company reported strong performance in its electronics segment, reflecting this trend.

Autoliv's expansion into new mobility safety solutions is poised to generate revenue from a diverse range of applications. For commercial vehicles, this includes advanced driver-assistance systems (ADAS) and passive safety components tailored for trucks and buses. In 2024, the commercial vehicle sector continues to see robust demand for safety technologies, driven by regulatory pressures and fleet operator focus on accident reduction.

Revenue streams will also be significantly influenced by the burgeoning electric vehicle (EV) market. Autoliv is developing specialized safety systems for EVs, considering their unique weight distribution and battery pack integration, which require different crash management strategies. The global EV market is projected to continue its rapid growth through 2025, presenting a substantial opportunity for these new offerings.

Furthermore, Autoliv is exploring revenue generation from safety solutions for other transportation modes, such as motorcycles. This diversification acknowledges the growing need for enhanced rider protection across various mobility segments. The company's commitment to innovation in these emerging areas is expected to create new and sustainable revenue channels.

Aftermarket Parts and Services (Indirect)

Autoliv generates revenue indirectly through the sale of aftermarket safety components and replacement parts. This revenue stream is crucial for long-term product support and ensuring continued vehicle safety, often facilitated through original equipment manufacturer (OEM) service networks. For instance, in 2024, the automotive aftermarket sector, which includes safety components, continued to show resilience, with global revenues projected to exceed $700 billion, highlighting the significant potential in this area for suppliers like Autoliv.

These aftermarket sales are vital for maintaining the safety and functionality of vehicles equipped with Autoliv's systems throughout their lifespan. The company's focus here is on providing reliable replacement parts that meet stringent safety standards.

- Aftermarket Revenue: Indirect sales of replacement safety components.

- Distribution Channel: Primarily through OEM service networks.

- Purpose: Ensures long-term product support and vehicle safety.

- Market Context: The global automotive aftermarket is a substantial market, demonstrating ongoing demand for replacement parts.

Technology Licensing and Collaboration Fees (Potential)

While Autoliv's core business is the manufacturing and sale of automotive safety systems, its significant investment in research and development, particularly in areas like advanced driver-assistance systems (ADAS) and connected vehicle technology, presents an opportunity for revenue generation through technology licensing. This could involve granting other companies access to Autoliv's patented innovations or proprietary software in exchange for fees or royalties.

Collaboration fees from joint development projects are another potential avenue. Companies might partner with Autoliv to co-develop specific safety technologies, sharing costs and expertise, with Autoliv earning fees for its contribution and intellectual property. For example, in 2024, Autoliv continued to invest heavily in ADAS, a sector ripe for such partnerships.

- Technology Licensing: Potential revenue from granting access to Autoliv's patented safety innovations.

- Collaboration Fees: Income generated from joint development projects with other automotive or technology firms.

- R&D Investment: Autoliv's ongoing commitment to innovation fuels its intellectual property portfolio, creating licensing opportunities.

Autoliv's revenue streams are multifaceted, extending beyond direct sales of passive safety components like airbags and seatbelts. The company also generates income from the sale of passive safety electronics, which are critical for the functionality of these systems, and is actively developing specialized safety solutions for the growing electric vehicle (EV) market.

Furthermore, Autoliv earns revenue from the aftermarket sale of replacement safety parts, ensuring continued vehicle safety and providing long-term product support. The company is also exploring opportunities in technology licensing and collaboration fees from joint development projects, particularly in advanced driver-assistance systems (ADAS).

In 2024, Autoliv's performance in the electronics segment showed strength, directly correlating with the automotive industry's increased adoption of ADAS. The company's strategic focus on new mobility safety solutions, including those for commercial vehicles and motorcycles, alongside its robust passive safety offerings, positions it for sustained revenue growth across diverse transportation sectors.

| Revenue Stream | Description | 2024 Market Context/Driver | Autoliv's Focus |

|---|---|---|---|

| Passive Safety Components | Airbags, seatbelts, steering wheels | Global vehicle production expected around 90 million units | Core business, high volume sales |

| Passive Safety Electronics | Sensors, control units | Increased demand for ADAS | Strong performance in electronics segment |

| New Mobility Safety Solutions | EV-specific systems, commercial vehicle ADAS | Growth in EV market and commercial vehicle safety | Developing tailored solutions |

| Aftermarket Sales | Replacement safety parts | Resilient automotive aftermarket sector (>$700 billion globally) | Long-term product support |

| Technology Licensing & Collaboration | Patented innovations, joint development fees | Heavy investment in ADAS | Exploring IP monetization |

Business Model Canvas Data Sources

Autoliv's Business Model Canvas is constructed using a blend of internal financial reports, comprehensive market research on automotive safety trends, and competitive intelligence. These diverse data sources ensure a robust and actionable strategic framework.