Ault Alliance PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ault Alliance Bundle

Uncover the critical external factors shaping Ault Alliance's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements, understand the forces that could impact your investments or business strategies. Download the full, expertly crafted analysis now to gain the strategic foresight you need.

Political factors

Ault Alliance, now operating as Hyperscale Data, Inc., faces significant political headwinds due to its involvement in data centers and Bitcoin mining. Government regulations, particularly concerning energy consumption and environmental impact, directly affect operational costs and the viability of these energy-intensive industries. For instance, the ongoing debate around the energy footprint of cryptocurrency mining continues to shape regulatory approaches worldwide.

The company's ambitious expansion of its Michigan data center from 30 MW to 300 MW is a clear example of how political factors dictate growth. Securing the necessary permits and approvals from local and state governments is paramount, and any delays or unfavorable policy changes could severely hamper this strategic initiative. This dependency underscores the critical role of a stable and predictable regulatory environment for Hyperscale Data's future.

Ault Alliance's global operations are significantly influenced by international trade policies, including tariffs and investment agreements. For instance, the U.S. and China's ongoing trade tensions, which saw tariffs on billions of dollars of goods in 2023 and 2024, could affect the cost of data center components or the market access for Ault Alliance's technology products.

Geopolitical shifts and trade disputes directly impact supply chains, a critical area for Ault Alliance's data center infrastructure business. Disruptions in the flow of specialized hardware, exacerbated by trade wars or sanctions, could lead to increased costs and project delays. The company's diversified investments mean it must navigate varying political risks across different regions, from European Union trade regulations to emerging market investment climates.

The political stability within Michigan and Montana, key operating regions for Ault Alliance's Hyperscale Data centers, directly impacts operational continuity. Political instability could manifest as unpredictable changes in energy policy, affecting power supply reliability, or sudden shifts in tax structures, potentially increasing operational costs. Given Ault Alliance's significant investment in expanding its data center footprint in these states, maintaining a stable political climate is paramount for mitigating risks and ensuring predictable business operations.

Government Support for AI and Digital Infrastructure

Government initiatives and funding for artificial intelligence (AI) and digital infrastructure development present a significant landscape for companies like Ault Alliance. Policies aimed at fostering technological innovation, offering tax incentives for data center construction, and providing grants for AI research can directly fuel the company's expansion. This aligns with projections, such as a Goldman Sachs report anticipating a 160% surge in data center power demand due to AI, highlighting a potential synergy with governmental priorities.

These government actions can translate into tangible benefits for Ault Alliance's Hyperscale Data division:

- Increased demand: Government investment in AI research and deployment will likely drive greater demand for robust data center infrastructure.

- Favorable regulatory environment: Policies supporting data center development, including potential tax breaks or streamlined permitting processes, can reduce operational costs and accelerate project timelines.

- Access to funding: Grants and subsidies for AI-related infrastructure projects could provide crucial capital for expansion and technological upgrades.

Cybersecurity Regulations and National Security Concerns

Heightened cybersecurity regulations and national security concerns are increasingly shaping the digital infrastructure landscape, directly impacting companies like Ault Alliance's Hyperscale Data operations. Governments worldwide are implementing stricter rules to protect critical data infrastructure, driven by the growing threat of cyberattacks and the strategic importance of data centers. For instance, the United States' National Cybersecurity Strategy, updated in 2023, emphasizes strengthening critical infrastructure defenses, which could translate into more rigorous compliance demands for data center providers.

These evolving regulations, including data localization mandates and increased government oversight, present a significant political factor for Hyperscale Data. Compliance can necessitate substantial investments in security technologies and operational adjustments, potentially increasing operating costs. The sensitive nature of the data housed within these facilities makes them a focal point for national security considerations, meaning Ault Alliance must remain agile in adapting to new political directives.

- Increased Regulatory Scrutiny: Expect more stringent compliance requirements for data centers handling sensitive data.

- Data Localization Laws: Governments may enforce rules requiring data to be stored within national borders, affecting global data center strategies.

- National Security Implications: Data centers are viewed as critical infrastructure, subject to government intervention and oversight to prevent national security breaches.

- Compliance Costs: Adapting to new cybersecurity standards and data protection laws will likely incur significant operational expenses.

Governmental policies on energy consumption and environmental impact directly influence Ault Alliance's Bitcoin mining and data center operations. For example, state-level initiatives in 2024 and 2025 are increasingly scrutinizing the power demands of these sectors, potentially leading to new regulations or taxes. The ongoing global push for renewable energy sources also creates both opportunities and challenges for securing stable, cost-effective power for its facilities.

The company's expansion plans, particularly in Michigan, are subject to state and local government approvals, highlighting the critical role of political stability and supportive regulatory frameworks. Changes in zoning laws or permitting processes, which can occur with shifts in local governance in 2024-2025, could impact project timelines and costs. Navigating these varied political landscapes across different jurisdictions is essential for Ault Alliance's growth strategy.

International trade policies and geopolitical tensions continue to affect global supply chains for hardware components, a key factor for Ault Alliance's data center build-outs. Tariffs imposed in 2023 and continuing into 2024-2025 on technology goods could increase capital expenditures. Furthermore, national security concerns are driving increased scrutiny of foreign-owned critical infrastructure, potentially impacting Ault Alliance's international operations.

Government incentives for AI development and digital infrastructure present a significant tailwind for Ault Alliance's Hyperscale Data division. Federal and state programs in 2024-2025 are actively promoting investment in data centers to support AI advancement, as evidenced by projected data center power demand growth driven by AI. These initiatives can provide crucial support through tax breaks or direct funding, aligning with the company's strategic focus.

What is included in the product

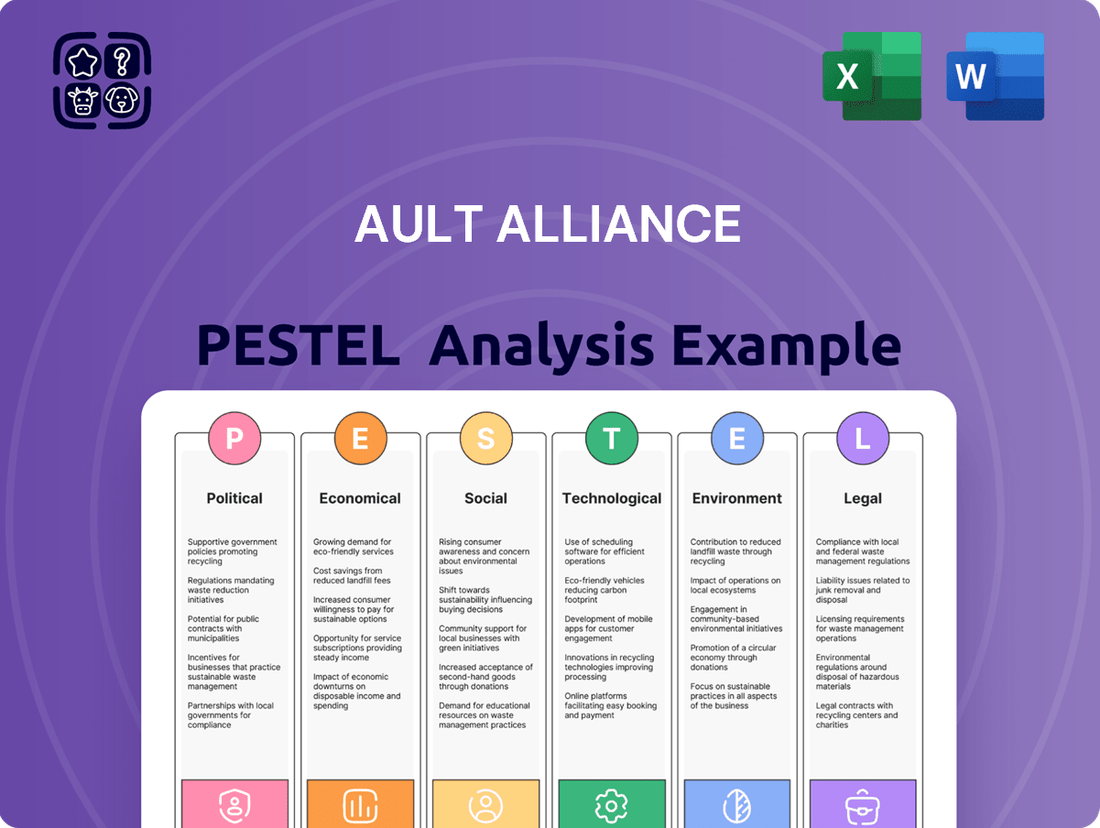

This PESTLE analysis examines the external macro-environmental factors impacting Ault Alliance, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides actionable insights for strategic decision-making by highlighting how these forces create both threats and opportunities for the company.

Provides a clear, actionable overview of external factors affecting Ault Alliance, enabling proactive strategy development and mitigating potential market disruptions.

Economic factors

Ault Alliance's Bitcoin mining segment is inherently tied to the price swings of Bitcoin. For instance, while they mined 552 Bitcoin in 2024, the actual revenue generated is directly influenced by Bitcoin's market value on any given day. This volatility means that even with consistent mining output, profitability can fluctuate dramatically.

The company itself acknowledges this exposure, noting that their projections are subject to the unpredictable nature of the Bitcoin market. This means that any financial forecast for their digital asset mining operations must account for the potential for significant ups and downs in Bitcoin's price.

Ault Alliance's ambitious expansion of its data center capacity from 30 MW to 300 MW, specifically targeting AI hyperscale development, hinges significantly on its ability to secure substantial capital. This strategic move necessitates access to robust financing, potentially through avenues like non-convertible debt issuance.

The economic landscape directly impacts this financing. For instance, the Federal Reserve's monetary policy, including interest rate decisions throughout 2024 and into 2025, will dictate the cost of borrowing. Higher interest rates, as seen in some periods of 2023-2024, increase the expense of debt financing, potentially making expansion projects less attractive or requiring higher returns to justify the investment.

Investor confidence also plays a crucial role. A positive economic outlook and strong market sentiment generally lead to greater availability of capital and more favorable lending terms. Conversely, economic uncertainty or a downturn can tighten credit markets, making it harder and more expensive for companies like Ault Alliance to raise the funds needed for significant infrastructure investments.

Ault Alliance's core operations, particularly its data centers and Bitcoin mining, are heavily reliant on energy. Fluctuations in energy costs and the reliability of supply directly impact the company's bottom line. For instance, the average industrial electricity price in Michigan, a key operational area for Ault Alliance, was approximately $0.085 per kilowatt-hour in early 2024, a critical figure for their cost calculations.

The company's strategic positioning in Michigan, close to power generation facilities, underscores the importance of this economic factor. Furthermore, Ault Alliance's proactive exploration of additional power sources in Montana demonstrates a commitment to securing stable and cost-effective energy, essential for maintaining competitive operational expenses and profitability in the energy-intensive digital asset mining sector.

Demand for AI and Data Center Services

The economic landscape is being reshaped by a powerful surge in demand for AI and data center services. This presents a substantial growth avenue for companies like Hyperscale Data, which are positioned to benefit from this trend. The increasing reliance on artificial intelligence is directly translating into a greater need for the robust infrastructure that data centers provide.

This burgeoning demand is not just theoretical; it's backed by significant financial projections. For instance, Goldman Sachs anticipates a remarkable 160% jump in data center power consumption driven by AI advancements. This highlights the sheer scale of the opportunity and the critical role data centers will play in supporting future technological innovation.

Recognizing this economic imperative, Hyperscale Data has strategically pivoted its focus towards AI hyperscale development. This strategic alignment allows the company to directly target and capture value from this rapidly expanding market segment.

- AI-driven infrastructure demand is a key economic driver.

- Goldman Sachs projects a 160% increase in data center power demand due to AI.

- Hyperscale Data's strategy targets this high-growth AI hyperscale market.

Overall Economic Growth and Investment Climate

The overall economic growth trajectory and the prevailing investment climate are critical determinants for Ault Alliance's strategic expansion and capital allocation. A robust economic environment, characterized by increasing consumer spending and business investment, directly fuels demand for the technology and infrastructure solutions Ault Alliance provides through its data center and other tech-focused subsidiaries. For instance, the projected global GDP growth of 2.7% for 2024, according to the IMF, suggests a generally supportive backdrop for such investments.

Conversely, periods of economic contraction or uncertainty can significantly dampen Ault Alliance's opportunities. During downturns, businesses tend to curtail capital expenditures, leading to reduced demand for data center services and technology upgrades. Furthermore, tighter credit markets, often a feature of recessions, can make it more challenging and expensive for Ault Alliance to secure the financing needed for acquisitions and new ventures.

- Global GDP Growth: The International Monetary Fund (IMF) projected global GDP growth of 2.7% for 2024, indicating a moderately positive environment for business investment.

- Inflationary Pressures: Persistent inflation in 2024, though potentially moderating from 2023 highs, can impact operational costs and consumer purchasing power, affecting demand for Ault Alliance's services.

- Interest Rate Environment: Central bank policies on interest rates in 2024-2025 will directly influence the cost of capital for Ault Alliance's acquisition strategies and operational financing.

Economic factors significantly shape Ault Alliance's operational landscape, particularly concerning its Bitcoin mining and data center ventures. The volatile nature of Bitcoin prices directly impacts revenue, as seen with their 552 Bitcoin mined in 2024, where market value dictates profitability.

The company's expansion plans, like increasing data center capacity to 300 MW for AI hyperscale development, are heavily dependent on access to capital. This access is influenced by interest rates, with Federal Reserve policies in 2024-2025 dictating borrowing costs, and overall investor confidence tied to economic outlooks.

Energy costs are a critical economic consideration for Ault Alliance's energy-intensive operations. The average industrial electricity price in Michigan, around $0.085 per kWh in early 2024, is a key input cost, driving their search for stable and cost-effective power sources.

The burgeoning demand for AI and data center services presents a significant economic opportunity, with Goldman Sachs projecting a 160% surge in data center power consumption due to AI by 2030. This trend underpins Hyperscale Data's strategic focus on AI hyperscale development.

| Economic Factor | Impact on Ault Alliance | Relevant Data (2024-2025) |

|---|---|---|

| Bitcoin Price Volatility | Directly affects revenue from mining operations. | 552 Bitcoin mined in 2024; market price fluctuations are a constant risk. |

| Interest Rates & Capital Access | Influences cost of debt for expansion and acquisitions. | Federal Reserve policy in 2024-2025 dictates borrowing costs; investor confidence impacts capital availability. |

| Energy Costs | Key operational expense for data centers and Bitcoin mining. | Michigan industrial electricity ~ $0.085/kWh (early 2024); securing stable, cost-effective power is crucial. |

| AI-Driven Data Center Demand | Creates significant growth opportunities for hyperscale development. | Goldman Sachs: 160% increase in data center power demand from AI by 2030. |

| Global Economic Growth | Impacts overall demand for services and investment climate. | IMF projected 2.7% global GDP growth for 2024; economic downturns can reduce demand and tighten credit. |

Same Document Delivered

Ault Alliance PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Ault Alliance delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. You'll gain immediate access to this detailed PESTLE analysis of Ault Alliance upon completing your purchase.

Sociological factors

The tech sector's insatiable demand for specialized skills, particularly in burgeoning fields like AI and data centers, presents a critical sociological challenge for companies like Ault Alliance. The rapid expansion of these industries means a scarcity of qualified engineers, data scientists, and IT professionals, intensifying competition for talent.

To counter this, Ault Alliance must prioritize robust talent acquisition and retention strategies. This involves not only offering highly competitive salaries and benefits, which in 2024 saw average tech salaries in specialized roles like AI engineering exceed $150,000 annually, but also cultivating a work environment that fosters innovation, professional development, and a strong sense of purpose.

Public perception of cryptocurrency and AI significantly shapes their integration into society and business. Growing societal acceptance of digital assets, as evidenced by a 2024 survey indicating a 35% increase in global crypto ownership compared to 2023, can foster a more favorable regulatory climate and boost investment in companies like Ault Alliance that leverage these technologies. Conversely, public apprehension regarding the environmental impact of cryptocurrency mining, with Bitcoin's energy consumption drawing scrutiny, or ethical concerns surrounding AI's potential for job displacement, could create headwinds for market adoption and brand reputation.

Global digital literacy is on the rise, with estimates suggesting that by the end of 2024, over 5.4 billion people will be active internet users, representing approximately 67% of the world's population. This surge directly fuels the demand for data centers and cloud services, a core market for Ault Alliance. As more individuals and businesses integrate digital tools and artificial intelligence into their daily operations, the need for reliable and scalable data infrastructure intensifies.

Workforce Diversity and Inclusion

Societal expectations for workforce diversity and inclusion are a significant driver for companies like Ault Alliance. As a diversified holding company, Ault Alliance must actively cultivate inclusive hiring practices and a supportive corporate culture to attract a wider range of talent. This commitment not only enhances its public image but also strengthens investor relations and the potential for strategic partnerships.

The push for diversity is not merely a social imperative but a tangible business advantage. Companies with diverse workforces often report higher innovation and better financial performance. For instance, McKinsey's 2023 report, Diversity Wins, found that companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability than companies in the fourth quartile. Similarly, for ethnic and cultural diversity, top-quartile companies were 36% more likely to outperform on profitability.

- Talent Attraction: Embracing diversity broadens the talent pool, allowing Ault Alliance to access a wider range of skills and perspectives.

- Innovation and Performance: Diverse teams are linked to increased innovation and improved financial outcomes, as evidenced by industry studies.

- Reputation and Stakeholder Relations: A strong diversity and inclusion record positively impacts public perception, investor confidence, and partnership opportunities.

- Regulatory and Social Pressure: Growing societal and potential regulatory emphasis on DEI requires proactive management by all corporations.

Data Privacy Concerns and User Trust

Societal concerns about data privacy are significantly influencing data center operations. As hyperscale data centers, like those Ault Alliance might leverage, handle vast amounts of sensitive client information, building and maintaining user trust is paramount. This means robust data protection measures and a high degree of transparency are no longer optional but essential for business continuity and growth.

The increasing demand for privacy directly shapes technological advancements and operational protocols within the data center industry. For instance, in 2024, cybersecurity spending by businesses globally was projected to reach over $230 billion, with a significant portion allocated to protecting data infrastructure. This trend underscores the industry's response to societal expectations.

- Data Protection Mandates: Regulations like GDPR and CCPA, continually evolving, impose strict requirements on how user data is collected, stored, and processed, directly impacting data center compliance.

- Consumer Awareness: Surveys in late 2024 indicated that over 70% of consumers are more concerned about their online privacy than they were a year prior, pushing companies to be more accountable.

- Trust as a Differentiator: Data centers that can demonstrably prove strong data security and privacy practices gain a competitive advantage, attracting clients who prioritize these aspects.

- Impact on Innovation: The need for privacy-preserving technologies is driving innovation in areas like homomorphic encryption and differential privacy, which data centers may increasingly integrate into their services.

Societal expectations for ethical AI deployment and data privacy are increasingly influencing technology companies like Ault Alliance. Public scrutiny over AI's impact on employment and potential biases, coupled with heightened awareness of data breaches, necessitates transparent practices and robust security measures. By late 2024, over 70% of consumers expressed greater concern about online privacy compared to the previous year, underscoring the demand for trustworthy data handling.

The growing demand for digital services, fueled by increasing global internet penetration which reached approximately 67% of the world's population by the end of 2024, directly benefits Ault Alliance's data center operations. This expansion in internet users creates a greater need for the infrastructure that supports online activities and AI-driven services.

Furthermore, the emphasis on diversity and inclusion within the workforce is a critical sociological factor. Companies demonstrating strong DEI initiatives, like Ault Alliance, often see improved innovation and financial performance, with top-quartile companies in gender diversity being 25% more likely to be more profitable according to a 2023 McKinsey report.

| Sociological Factor | Description | Impact on Ault Alliance | Supporting Data (2024/2025) |

|---|---|---|---|

| Talent Demand | High demand for specialized tech skills (AI, data science). | Intensifies competition for talent; necessitates strong retention strategies. | Average AI engineer salaries exceeded $150,000 annually. |

| Public Perception of Tech | Societal acceptance of crypto and AI. | Influences regulatory climate and investment; apprehension can create headwinds. | Global crypto ownership increased by 35% compared to 2023. |

| Digital Literacy | Increasing global internet user base. | Drives demand for data centers and cloud services. | Over 5.4 billion active internet users by end of 2024 (~67% of global population). |

| Diversity & Inclusion | Societal expectations for equitable workplaces. | Enhances talent pool, innovation, and public image; strengthens investor relations. | Companies with top-quartile gender diversity on exec teams 25% more likely to be more profitable (McKinsey, 2023). |

| Data Privacy Concerns | Growing consumer awareness and demand for data protection. | Requires robust data security and transparency; builds customer trust. | Over 70% of consumers more concerned about online privacy in late 2024 vs. prior year. |

Technological factors

The rapid advancements in artificial intelligence and machine learning are a significant technological force shaping Ault Alliance's strategic direction. This technological wave is directly fueling the company's pivot towards Hyperscale Data, Inc.

Ault Alliance is actively transforming its Michigan facility into an AI hyperscale data center. This move is designed to leverage the substantial growth anticipated in this sector, with projections indicating a 160% surge in data center power demand specifically driven by AI applications.

The relentless advancement in data center technology, from sophisticated cooling solutions to highly efficient servers and advanced network designs, directly influences Hyperscale Data's operational effectiveness and market standing. For instance, innovations in liquid cooling are enabling higher power densities, a critical factor as the company aims to expand its Michigan facility from 30 MW to 300 MW.

This infrastructure upgrade is essential to support the increasing demands of high-density computing, with hyperscale data centers globally investing billions in modernization. In 2024, the global data center market was valued at approximately $240 billion, with a significant portion allocated to infrastructure upgrades and new builds to accommodate AI workloads and advanced computing.

Advancements in Bitcoin mining hardware, known as ASICs, and software algorithms directly impact the profitability of Ault Alliance's mining ventures. More efficient mining rigs consume less energy per Bitcoin mined, a critical factor considering the fluctuating nature of Bitcoin prices and electricity expenses. For instance, by late 2024, the most efficient ASICs were achieving hash rates exceeding 200 TH/s with power efficiencies below 20 J/TH.

Ault Alliance's subsidiary, Sentinum, has actively engaged in Bitcoin mining, having mined approximately 1,100 Bitcoins as of early 2024. This demonstrates their direct involvement and reliance on the evolving mining technology landscape. The company's ability to leverage these technological improvements will be key to maintaining competitive operational costs and maximizing returns in the dynamic cryptocurrency market.

Cybersecurity Technologies and Threats

The escalating complexity of cyber threats demands ongoing investment in cutting-edge cybersecurity solutions for Ault Alliance's infrastructure. Protecting sensitive client information and ensuring uninterrupted operations are critical. For instance, the global average cost of a data breach reached $4.45 million in 2024, a figure that underscores the financial risks involved.

Ault Alliance must prioritize robust security protocols to safeguard its data centers and client data. Failure to implement and maintain strong defenses can result in severe financial penalties and irreparable damage to its reputation.

- Increased Sophistication: Cyber attackers are continuously developing more advanced methods, requiring Ault Alliance to stay ahead with evolving security technologies.

- Data Breach Costs: The average cost of a data breach in 2024 was $4.45 million, highlighting the significant financial implications of security failures.

- Reputational Risk: A security incident can erode customer trust and severely damage Ault Alliance's brand image.

- Regulatory Compliance: Adhering to data protection regulations, such as GDPR or CCPA, necessitates strong cybersecurity measures.

Development of Renewable Energy Technologies

The ongoing advancements in renewable energy technologies are significantly impacting industries reliant on substantial power consumption, such as data centers and Bitcoin mining. These innovations are making clean energy sources increasingly viable and cost-competitive. For instance, by the end of 2023, global renewable energy capacity additions were projected to reach 510 gigawatts (GW), a 7% increase from 2022, according to the International Energy Agency (IEA). This trend highlights a growing momentum towards cleaner power solutions.

Ault Alliance's strategic positioning, particularly its focus on employing eco-friendly power for its Michigan data center, directly benefits from these technological leaps. The company's initiative aligns with the broader market shift towards sustainability, leveraging more efficient and affordable renewable energy options to meet operational demands. This proactive approach can lead to reduced operating costs and a stronger environmental, social, and governance (ESG) profile.

- Solar Power Efficiency Gains: Continued research and development are driving up the efficiency of solar photovoltaic (PV) panels, with commercial modules now frequently exceeding 22% efficiency.

- Wind Turbine Advancements: Larger and more sophisticated wind turbines are being deployed, increasing energy capture and reducing the levelized cost of energy (LCOE) for wind power.

- Energy Storage Solutions: Innovations in battery technology, such as improved energy density and reduced manufacturing costs, are making energy storage more practical for intermittent renewable sources.

- Grid Modernization: Investments in smart grid technologies are enhancing the integration of renewable energy into existing power infrastructure, improving reliability and management.

Technological advancements are central to Ault Alliance's strategy, particularly in AI and data centers. The company is transforming its Michigan facility into an AI hyperscale data center, anticipating a significant surge in data center power demand driven by AI. Innovations in cooling and server efficiency are critical for this expansion, with global data center infrastructure investments in 2024 reaching substantial figures to accommodate AI workloads.

Efficient Bitcoin mining hardware, like ASICs, directly impacts Ault Alliance's mining profitability, with leading models in late 2024 exceeding 200 TH/s at under 20 J/TH. Cybersecurity is also paramount, given the escalating complexity of threats and the average 2024 data breach cost of $4.45 million, necessitating robust protection for operations and client data.

Furthermore, advancements in renewable energy technologies, such as solar and wind power efficiency and improved energy storage, are making clean energy more viable. Ault Alliance's focus on eco-friendly power for its data center aligns with this trend, leveraging more efficient and affordable renewable options to reduce operating costs and enhance its ESG profile.

| Technology Area | Key Advancement/Impact | Ault Alliance Relevance | 2024/2025 Data Point |

|---|---|---|---|

| AI & Data Centers | Hyperscale data center growth, AI-driven power demand | Transformation of Michigan facility into AI hyperscale data center | AI applications projected to drive 160% surge in data center power demand |

| Data Center Infrastructure | Liquid cooling, efficient servers, network design | Expansion of Michigan facility (30 MW to 300 MW) | Global data center market valued at ~$240 billion in 2024 |

| Bitcoin Mining Hardware | ASIC efficiency (hash rate, power consumption) | Sentinum's Bitcoin mining operations | Most efficient ASICs by late 2024: >200 TH/s, <20 J/TH |

| Cybersecurity | Sophistication of cyber threats, data breach costs | Protection of data centers and client information | Global average cost of a data breach in 2024: $4.45 million |

| Renewable Energy | Solar efficiency, wind turbine advancements, energy storage | Use of eco-friendly power for data center | Global renewable energy capacity additions projected to reach 510 GW in 2023 (IEA) |

Legal factors

Ault Alliance's data center operations are significantly influenced by data privacy and security legislation like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These laws impose stringent requirements on how personal data is handled, affecting Ault Alliance's data collection, storage, and processing practices.

Compliance with GDPR, which came into full effect in 2018, and CCPA, effective from 2020, necessitates robust data protection measures. For instance, GDPR mandates clear consent for data processing and grants individuals rights over their data, while CCPA provides California consumers with rights to know, delete, and opt-out of the sale of their personal information. Failure to adhere can result in substantial fines, with GDPR penalties reaching up to 4% of global annual revenue or €20 million, whichever is higher.

The evolving legal landscape for cryptocurrencies presents a significant factor for Ault Alliance. Jurisdictional differences in how digital assets like Bitcoin are classified and regulated directly affect the company's Bitcoin mining operations and its strategy for holding these assets. For instance, as of mid-2024, the U.S. Securities and Exchange Commission (SEC) continues to scrutinize crypto-related entities, with ongoing discussions around whether certain digital assets constitute securities.

Furthermore, Ault Alliance's broader financial operations, including its preferred stock offerings, are firmly within the purview of established securities laws. This necessitates strict adherence to SEC filing requirements and ongoing compliance with regulations designed to protect investors and ensure market integrity. The company's ability to raise capital and manage its balance sheet is intrinsically linked to its navigation of these legal frameworks.

The growth of data centers, including Ault Alliance's planned expansion in Michigan, faces scrutiny under environmental regulations. These rules govern energy usage, greenhouse gas emissions, and land development, requiring careful navigation for permits. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize energy efficiency standards for industrial facilities, which indirectly impacts data center operations and their permitting.

Corporate Governance and Shareholder Rights

Ault Alliance, as a publicly traded entity, operates under rigorous corporate governance mandates. These legal frameworks dictate essential practices such as the cadence and conduct of shareholder meetings, the transparency of financial reporting, and the structure of executive remuneration. Adherence to these regulations is paramount for maintaining investor confidence and regulatory compliance.

The company's recent shareholder activities highlight the practical application of these legal requirements. For instance, the successful approval of director elections and the ratification of financial instruments demonstrate the active engagement of shareholders within the established legal parameters. These events underscore the critical role of corporate governance in shaping company direction and accountability.

- Shareholder Approval: In recent proxy statements, Ault Alliance has reported shareholder approval for key governance matters, including the election of its board of directors.

- Financial Reporting Compliance: The company is obligated to file regular financial reports with regulatory bodies, ensuring transparency for investors.

- Executive Compensation Scrutiny: Legal frameworks govern executive compensation, requiring shareholder oversight and disclosure.

Intellectual Property Laws related to Technology

Intellectual property laws are crucial for Ault Alliance, especially given its diverse technology investments in areas like AI and power solutions. Protecting its own patented technologies and ensuring it doesn't infringe on existing patents held by competitors is paramount for maintaining a competitive edge and avoiding costly legal battles.

The company must navigate a complex web of patent, copyright, and trade secret laws to safeguard its innovations. For instance, in 2023, the U.S. Patent and Trademark Office issued over 300,000 utility patents, highlighting the dense IP landscape Ault Alliance operates within.

Key legal considerations for Ault Alliance include:

- Patent Protection: Securing patents for novel AI algorithms and power management systems developed by the company.

- Freedom to Operate: Conducting thorough patent searches to ensure its products and processes do not infringe on existing third-party patents.

- Copyright Enforcement: Protecting its proprietary software code and technical documentation from unauthorized use.

- Trade Secret Management: Implementing robust internal controls to safeguard confidential business information and technological know-how.

Ault Alliance's operations are significantly shaped by evolving data privacy regulations like GDPR and CCPA, impacting how it handles customer information. The company must also navigate the complex and varied legal frameworks surrounding cryptocurrency, which directly influence its Bitcoin mining and asset holding strategies. Furthermore, adherence to securities laws is critical for its financial activities, including preferred stock offerings and capital raising, ensuring investor protection and market integrity.

Environmental factors

Data centers, including those used for Bitcoin mining, are massive energy consumers, leading to a substantial carbon footprint. For instance, global data center energy consumption was estimated to be around 1% of total electricity demand in 2023, a figure projected to rise. This significant energy use directly translates into environmental concerns regarding greenhouse gas emissions.

Ault Alliance, rebranded as Hyperscale Data, Inc., is under growing pressure to mitigate its environmental impact. As regulatory bodies and investors increasingly focus on Environmental, Social, and Governance (ESG) factors, companies like Hyperscale Data must demonstrate a commitment to sustainability. This includes addressing the carbon intensity of their operations.

The company's initiative to power its Michigan data center with eco-friendly sources, such as renewable energy, shows a proactive approach to this environmental challenge. This strategy not only aims to reduce their carbon footprint but also aligns with market expectations for responsible corporate behavior in the digital infrastructure sector.

The increasing availability and decreasing cost of renewable energy sources are significant environmental factors for Ault Alliance's data center operations. In 2024, the global renewable energy market is projected to reach over $1.5 trillion, driven by advancements in solar and wind technologies, making cleaner power more accessible and cost-effective for large-scale consumers like data centers.

Ault Alliance's strategic positioning near power sources and their exploration of additional power in Montana directly impacts their ability to leverage these cleaner energy options. For instance, Montana's abundant wind resources offer a substantial opportunity for Ault Alliance to secure power purchase agreements for renewable energy, potentially reducing operational costs and their carbon footprint.

Data centers are thirsty operations, often relying heavily on water for cooling. For instance, a 100 MW data center could potentially use millions of gallons of water daily, depending on the cooling technology employed. As concerns about water scarcity intensify globally, companies like Ault Alliance must navigate potential environmental regulations and public scrutiny regarding their water footprint, especially with ambitious projects like their 300 MW Michigan facility.

E-waste Management from Technological Assets

The disposal and recycling of electronic waste, particularly from aging servers and specialized mining equipment, pose a significant environmental challenge for companies like Ault Alliance. As technology rapidly evolves, managing these obsolete assets responsibly is crucial.

Ault Alliance must implement robust e-waste management strategies to ensure compliance with an increasingly stringent regulatory landscape and to uphold its commitment to environmental stewardship. This includes adhering to directives like the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive, which sets targets for collection and recycling rates.

The growing volume of e-waste is a global concern. In 2022, the world generated an estimated 62 million tonnes of e-waste, a figure projected to reach 82 million tonnes by 2030.

- Regulatory Compliance: Adhering to global and local e-waste regulations is paramount to avoid penalties and maintain operational legitimacy.

- Environmental Responsibility: Implementing effective recycling programs demonstrates a commitment to sustainability, enhancing brand reputation.

- Resource Recovery: Proper e-waste management allows for the recovery of valuable materials like gold, silver, and copper, potentially offsetting disposal costs.

- Supply Chain Impact: Ensuring ethical and environmentally sound disposal practices throughout the technology lifecycle is vital for a responsible supply chain.

Climate Change and Extreme Weather Events

Climate change poses a significant environmental challenge, increasing the likelihood and severity of extreme weather events like heatwaves and intense storms. These events directly threaten Ault Alliance's data center operations, potentially causing disruptions through power outages or damage to critical infrastructure. For instance, the U.S. experienced an average of 22.2 billion-dollar weather and climate disasters per year between 2020 and 2023, a substantial increase from previous decades.

Ault Alliance must proactively address climate resilience by carefully considering the location and design of its facilities. This includes evaluating areas prone to flooding, wildfires, or extreme temperatures. The company's investment in robust cooling systems and backup power sources becomes even more crucial in anticipating and mitigating the impacts of these escalating environmental risks.

- Increased frequency of extreme weather events impacting infrastructure.

- Potential for data center operational disruptions due to power outages and damage.

- Necessity for climate-resilient siting and facility design strategies.

- Growing importance of robust cooling and backup power solutions.

Ault Alliance, now Hyperscale Data, Inc., faces significant environmental pressures related to energy consumption and carbon footprint. The company's data centers, including those for Bitcoin mining, consume vast amounts of electricity, estimated to be around 1% of global demand in 2023, a figure expected to grow. This reliance on energy directly contributes to greenhouse gas emissions, necessitating a focus on sustainability and responsible corporate behavior.

The increasing availability and affordability of renewable energy sources, such as wind and solar, present a key environmental opportunity. By 2024, the global renewable energy market is projected to exceed $1.5 trillion, making cleaner power more accessible for large consumers like data centers. Ault Alliance's strategic focus on locations with abundant renewable resources, like Montana's wind power, positions them to leverage these cost-effective and environmentally friendly options.

Water usage for cooling data centers is another critical environmental factor, with a 100 MW facility potentially consuming millions of gallons daily. As water scarcity concerns mount globally, Ault Alliance must manage its water footprint responsibly, especially for its 300 MW Michigan facility, to comply with regulations and public expectations.

The management of electronic waste (e-waste) is also a growing environmental challenge. Global e-waste generation reached an estimated 62 million tonnes in 2022, projected to hit 82 million tonnes by 2030. Ault Alliance must implement robust recycling strategies to meet regulatory requirements and recover valuable materials.

| Environmental Factor | Impact on Ault Alliance | Mitigation Strategy/Opportunity |

|---|---|---|

| Energy Consumption & Carbon Footprint | High electricity demand for data centers | Utilize renewable energy sources; improve energy efficiency |

| Renewable Energy Availability | Decreasing costs and increasing accessibility | Secure Power Purchase Agreements (PPAs) for wind and solar |

| Water Usage | Significant water needs for cooling | Implement water-efficient cooling technologies; explore recycled water options |

| Electronic Waste (E-waste) | Disposal of aging servers and mining equipment | Develop robust e-waste recycling and refurbishment programs |

| Climate Change & Extreme Weather | Risk of operational disruptions from power outages or damage | Climate-resilient facility design; robust backup power solutions |

PESTLE Analysis Data Sources

Our PESTLE analysis for Ault Alliance is built upon a comprehensive review of data from reputable financial news outlets, government regulatory bodies, and industry-specific market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.