Ault Alliance Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ault Alliance Bundle

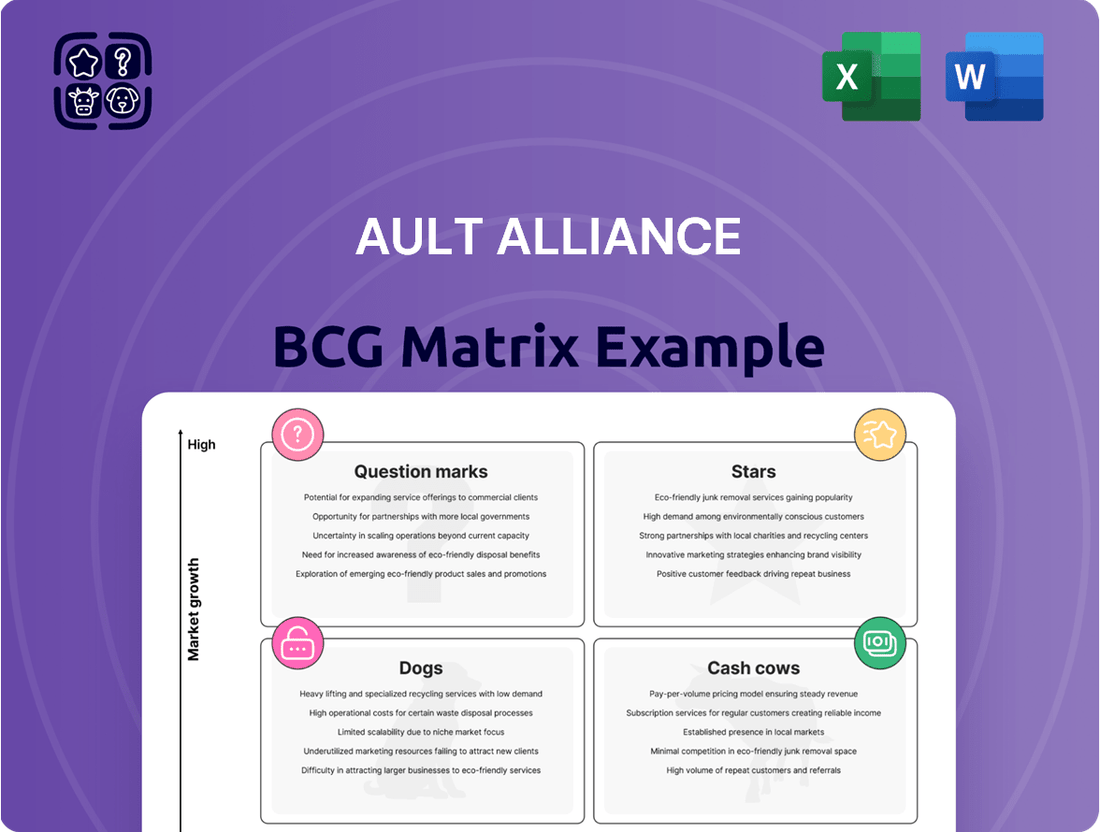

Curious about how Ault Alliance strategically positions its diverse portfolio? This glimpse into their BCG Matrix reveals the potential power of their Stars, the stability of their Cash Cows, and the challenges of their Dogs and Question Marks.

Unlock the full strategic potential by purchasing the complete Ault Alliance BCG Matrix. Gain a comprehensive understanding of each product's market share and growth rate, empowering you to make informed decisions about resource allocation and future investments.

Don't just guess where Ault Alliance is headed; know it. The full report provides actionable insights and a clear roadmap for optimizing their business strategy, ensuring you're always one step ahead.

Stars

Ault Alliance, poised to rebrand as Hyperscale Data, Inc., is strategically shifting its focus towards AI hyperscale data centers, with a significant expansion planned for its Michigan facility. This move is designed to capitalize on the surging demand for AI infrastructure.

The company intends to increase the Michigan data center's capacity by a factor of ten, escalating from its current 30 megawatts to a substantial 300 megawatts. This ambitious expansion aims to position Hyperscale Data, Inc. as a key player in the rapidly expanding AI data center market.

Sentinum, Ault Alliance's Bitcoin mining arm, is a strong performer in the Hyperscale Data segment. Revenue surged by 27% in the first half of 2024, with a preliminary 51% jump in Q1 2024, driven significantly by rising Bitcoin prices. By July 31, 2024, the company had mined 552 Bitcoin, and its strategic relocation to Montana for cheaper power is enhancing profitability.

Ault Alliance is positioning itself to offer more than just data center space; they are targeting specialized colocation and hosting services tailored for the burgeoning AI ecosystem. This strategic move aims to secure a substantial foothold in the critical support services that power advanced AI applications.

The demand for AI is a significant growth driver. Projections indicate that AI could fuel a 160% surge in data center power consumption, highlighting the immense market potential for Ault Alliance's specialized AI-focused services.

Strategic Focus on AI/Data Infrastructure

Ault Alliance's strategic pivot towards AI and data infrastructure is vividly demonstrated by its corporate name change to Hyperscale Data, Inc., effective September 10, 2024, and the adoption of the ticker symbol GPUS. This rebranding signals a definitive move to operate as a pure-play data center business, positioning itself to capitalize on the burgeoning demand for high-performance computing and data storage solutions. The company clearly identifies its future growth and market leadership potential within this specialized sector, aiming to unlock significant shareholder value through focused execution.

This strategic realignment is more than just a name change; it reflects a deep commitment to an industry poised for substantial expansion. The global data center market, particularly those supporting AI workloads, is experiencing unprecedented growth. For instance, the AI data center market alone was valued at approximately $30 billion in 2023 and is projected to reach over $100 billion by 2028, growing at a compound annual growth rate (CAGR) of over 25%. Hyperscale Data, Inc. is strategically positioning itself to capture a significant share of this expanding market.

- Pure-Play Data Center Focus: The rebranding to Hyperscale Data, Inc. and ticker GPUS on September 10, 2024, solidifies the company's identity as a dedicated data center operator.

- AI/Data Infrastructure Growth Driver: This strategic shift targets the high-growth AI and data infrastructure market, anticipating substantial demand for data center services.

- Market Opportunity: The global data center market, especially for AI, is expanding rapidly, presenting a significant opportunity for companies like Hyperscale Data, Inc. to establish market share.

- Shareholder Value Maximization: By concentrating resources and expertise on this high-potential sector, the company aims to enhance shareholder returns through focused growth initiatives.

Leveraging Key Data Center Facilities

Ault Alliance is strategically focusing its data center investments and development on key facilities in Michigan and Montana. This concentrated effort is designed to position the company as a significant provider in the high-density computing and AI hyperscale sectors.

By optimizing these specific assets, Ault Alliance aims to secure a leading market position. The company is actively seeking to lease substantial capacity from these locations, underscoring their importance in its growth strategy.

- Michigan Facility Focus: Ault Alliance is investing heavily in its Michigan data center, targeting high-density computing and AI workloads.

- Montana Expansion: Development in Montana is also a priority, aiming to capture a significant share of the hyperscale AI market.

- Leasing Strategy: The company plans to lease a substantial portion of the capacity from these optimized facilities to drive revenue and market penetration.

- Market Leadership Ambition: These expansion plans reflect Ault Alliance's confidence in achieving a leading position within the competitive data center market.

Stars in the Ault Alliance (now Hyperscale Data, Inc.) BCG Matrix represent high-growth, high-market-share ventures. Sentinum, the Bitcoin mining operation, currently fits this description due to its significant revenue growth and profitability enhancements. The company's strategic expansion into AI hyperscale data centers also positions it to become a Star, given the massive projected growth in AI-driven data center demand.

| Segment | Market Growth | Market Share | BCG Category |

| Sentinum (Bitcoin Mining) | High (driven by Bitcoin price volatility) | High (relative to its niche) | Star |

| AI Hyperscale Data Centers | Very High (projected 25%+ CAGR) | Low (currently building capacity) | Question Mark (potential Star) |

What is included in the product

The Ault Alliance BCG Matrix offers a strategic overview of its portfolio, categorizing business units into Stars, Cash Cows, Question Marks, and Dogs.

Ault Alliance BCG Matrix offers a clear, one-page overview to identify and address underperforming business units, relieving the pain of strategic indecision.

Cash Cows

Circle 8 Crane Services, LLC, a subsidiary focused on manned and operated heavy equipment rentals, stands as a prime example of a Cash Cow within Ault Alliance's portfolio. For the first quarter of 2024, this business generated approximately $13 million in revenue, showcasing its consistent performance.

With an expected revenue exceeding $50 million for 2023 and strong EBITDA, Circle 8 Crane Services demonstrates its position as a mature business with a substantial market share. This robust financial profile allows it to generate significant and reliable cash flow, a hallmark of a Cash Cow.

The planned spin-off of Circle 8 Crane Services into Ault Capital Group further underscores its importance as a stable income generator. Its consistent revenue streams and profitability make it a vital asset for the company's overall financial health.

Ault Global Real Estate Equities, Inc. (AGREE), the company's hotel and commercial real estate holdings, demonstrated robust performance in the first half of 2024, achieving a 23% revenue increase to $8.1 million.

These assets, previously considered for divestment, are now designated for distribution to stockholders as non-core assets, signaling their stable, income-generating nature and consistent cash flow contribution.

Ault Lending, LLC, functions as a licensed lending subsidiary focusing on private credit and structured finance. This area of the business is characterized by its consistent generation of interest income and fees, offering a stable cash flow for Ault Alliance.

While not experiencing the rapid growth of newer ventures, this segment is a dependable performer. In 2024, Ault Alliance reported that its lending segment, which includes Ault Lending, LLC, contributed significantly to its overall financial stability, demonstrating its role as a key cash flow generator.

Established Industrial Solutions

Ault Alliance's established industrial solutions, spanning automotive and medical/biopharma sectors, represent key cash cows. These segments are characterized by their mission-critical product offerings and strong market positions.

These mature businesses benefit from established customer relationships and consistent demand, generating stable revenue streams. Their profitability is often robust, requiring minimal capital expenditure for expansion, thus freeing up cash for other strategic initiatives.

- Automotive Sector: Provides essential components, contributing to consistent revenue.

- Medical/Biopharma Sector: Supplies critical products, ensuring stable demand and profit margins.

- Cash Generation: These segments act as reliable sources of cash due to their mature nature and low reinvestment needs.

Certain Defense/Aerospace Sector Holdings

Ault Alliance's investments in the defense and aerospace sectors, notably through Gresham Worldwide, Inc., represent its Cash Cows. These segments are characterized by long-term contracts and stable relationships with governmental and industrial clients, ensuring reliable and predictable revenue generation.

While these holdings may not exhibit rapid growth, their consistent cash flow is crucial for funding other strategic initiatives within the company's portfolio. For instance, Gresham Worldwide's participation in defense supply chains often involves multi-year agreements, providing a solid foundation for earnings.

- Defense/Aerospace Holdings: Represent stable, mature businesses within Ault Alliance's portfolio.

- Predictable Revenue: Benefitting from long-term contracts and established client bases.

- Cash Generation: Providing consistent cash flow to support other business units.

- Strategic Importance: Acting as a stable financial anchor for the company's diversified strategy.

Cash Cows within Ault Alliance's portfolio are mature businesses with significant market share, generating consistent and reliable cash flow. These segments typically require minimal capital for expansion, allowing them to fund other strategic initiatives.

Circle 8 Crane Services exemplifies this, generating approximately $13 million in revenue in Q1 2024 and expecting over $50 million for 2023. Similarly, Ault Global Real Estate Equities (AGREE) saw a 23% revenue increase to $8.1 million in H1 2024, demonstrating stable income generation.

Ault Lending, LLC, contributes significantly through consistent interest income and fees, reinforcing the company's financial stability. Established industrial solutions, particularly in automotive and medical/biopharma, also act as dependable cash generators due to consistent demand and strong customer relationships.

Investments in defense and aerospace, like Gresham Worldwide, Inc., are also considered Cash Cows, benefiting from long-term contracts and predictable revenue streams.

| Business Segment | Approx. Q1 2024 Revenue | 2023 Estimated Revenue | Key Characteristic |

|---|---|---|---|

| Circle 8 Crane Services | $13 million | >$50 million | Heavy equipment rentals, stable cash flow |

| Ault Global Real Estate Equities (AGREE) | $8.1 million (H1 2024) | N/A | Hotel & commercial real estate, income generation |

| Ault Lending, LLC | N/A | N/A | Private credit, consistent interest income |

| Industrial Solutions (Automotive, Medical/Biopharma) | N/A | N/A | Mission-critical products, stable demand |

| Defense/Aerospace (Gresham Worldwide) | N/A | N/A | Long-term contracts, predictable revenue |

Full Transparency, Always

Ault Alliance BCG Matrix

The Ault Alliance BCG Matrix preview you are examining is the identical, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present; you'll get the complete strategic tool ready for immediate application in your business planning. The insights and structure you see are precisely what will be delivered, ensuring you have an analysis-ready file for informed decision-making. This comprehensive report is designed for professional use, offering clear visualizations and actionable data to guide your portfolio strategy. You can confidently purchase knowing the preview accurately represents the high-quality, complete BCG Matrix you will download.

Dogs

Underperforming Legacy Acquisitions, within Ault Alliance's portfolio, represent businesses that haven't achieved substantial market presence or operate in shrinking sectors, and are not aligned with the company's AI data center strategy. These units can drain capital and resources without yielding adequate returns, making them potential candidates for divestment. For example, if a legacy manufacturing unit acquired in 2020 is showing declining revenues, with its market share dropping from 5% to 3% by Q1 2024, it would fit this category.

Ault Alliance is strategically divesting non-core assets, including subsidiaries not directly related to its AI focus. This move is part of a broader reorganization, with these businesses being spun off into Ault Capital Group, Inc.

These divested segments, while possessing some inherent value, are being shed due to a lack of alignment with Ault Alliance's forward-looking core strategy. Management views them as representing segments with limited growth potential or a small market share, prompting an exit from these operations.

Inefficient operational segments, often termed cash traps, are those business units within Ault Alliance that consume significant capital and resources but fail to generate adequate returns or demonstrate promising future growth. These segments can hinder overall company performance by diverting funds from more productive areas.

For instance, if a particular division consistently requires substantial investment for maintenance or operational costs but yields low profits, it would be classified here. Ault Alliance's reported efforts in 2024 to reduce its workforce by approximately 15% and streamline various operational processes signal a strategic move to address and divest from such underperforming or inefficient segments.

Highly Competitive Niche Markets

Ault Alliance's portfolio may include businesses operating within highly competitive niche markets. These segments are often characterized by numerous players, making it difficult for any single entity to secure a dominant market position. Without a distinct competitive edge or robust growth potential, these operations might face challenges in profitability.

For instance, a small tech component supplier in a crowded market, even with decent revenue, might have thin margins due to intense price competition. If such a business within Ault Alliance's diversified holdings lacks a clear path to increased market share or profitability, management might consider reducing its footprint or divesting the asset to reallocate resources more effectively.

- Market Saturation: Many niche markets are highly fragmented, leading to intense competition and limited pricing power for participants.

- Lack of Differentiation: Without unique products or services, businesses in these niches may struggle to stand out and attract customers.

- Profitability Challenges: High operating costs and competitive pressures can squeeze profit margins, making these units less attractive.

- Strategic Review: Companies like Ault Alliance often evaluate such holdings for potential divestiture or restructuring if they do not align with overall strategic growth objectives.

Assets with Limited Strategic Synergy

Assets with limited strategic synergy represent holdings that do not align with Ault Alliance's core AI data center business. These are typically divested to sharpen the company's focus and allocate resources more effectively toward its primary growth areas. For instance, if Ault Alliance were to divest a legacy manufacturing unit, it would fall into this category if it offered no technological overlap or market expansion opportunities with its AI data center ambitions.

The rationale behind separating these assets, even if they are profitable, is to streamline operations and enhance overall strategic clarity. This move signals that their contribution to the company's future trajectory is considered minimal. By shedding these non-core assets, Ault Alliance can concentrate its capital and management attention on ventures that directly support its AI data center expansion, potentially improving capital efficiency and shareholder value.

- Divestment Rationale: Separation of holdings lacking synergy with the core AI data center business.

- Focus Enhancement: Streamlining operations to concentrate resources on key growth areas.

- Non-Essential Status: Assets deemed to have limited contribution to future strategic vision.

- Resource Allocation: Redirecting capital and management attention to core AI data center initiatives.

Businesses categorized as Dogs within Ault Alliance's portfolio are those with low market share in slow-growing or declining industries. These segments often require significant investment to maintain but generate minimal returns, making them prime candidates for divestment or restructuring. For example, a legacy software division acquired years ago, now facing obsolescence and declining customer adoption, would fit this description. In 2024, Ault Alliance's strategic review identified and began divesting such non-core assets to sharpen its focus on AI data centers.

These underperforming units, often referred to as cash traps, consume valuable resources without contributing meaningfully to Ault Alliance's growth objectives. Their presence can dilute overall profitability and hinder the company's ability to invest in more promising ventures. By shedding these Dog-like assets, Ault Alliance aims to improve capital efficiency and accelerate its strategic pivot.

The divestment of these segments, even if they have some revenue, is driven by a lack of competitive advantage and limited future growth prospects. Ault Alliance's commitment to streamlining its operations, as evidenced by its 2024 restructuring efforts, underscores its strategy to exit businesses that do not align with its core AI data center focus.

Ault Alliance's approach to managing its portfolio, particularly in identifying and addressing "Dog" segments, is crucial for optimizing resource allocation and driving shareholder value. By divesting these low-performing assets, the company can redirect capital towards its high-growth AI initiatives, ensuring a more focused and efficient operational structure moving forward.

Question Marks

Ault Alliance's strategic emphasis on "disruptive technologies" places these ventures squarely in the Question Marks category of the BCG Matrix. These are companies with the potential for significant growth but currently possess a small market share, often due to their early-stage development or the novelty of their offerings.

For instance, a company in the burgeoning AI-powered cybersecurity space, like a startup Ault Alliance might invest in, could represent a Question Mark. While the cybersecurity market is projected to reach $300 billion by 2027, such a startup might only hold a fraction of a percent of that market initially, requiring substantial funding to innovate and capture market share.

The key challenge for these Question Mark investments is their uncertain future. Ault Alliance must carefully assess whether these disruptive technologies can scale effectively, transitioning into Stars with high growth and high market share, or if they will falter, becoming Dogs with low growth and low market share. This requires rigorous due diligence and a clear strategy for capital allocation and operational support.

Emerging AI ecosystem ventures for Ault Alliance, outside of its established Michigan data center, would likely be categorized as Question Marks in the BCG Matrix. These represent high-growth potential opportunities but with Ault Alliance currently holding a low market share, indicating significant risk and investment required to gain traction.

For instance, exploring ventures in specialized AI software development or niche AI application partnerships would fit this description. These areas are experiencing rapid expansion, but Ault Alliance would be entering as a relatively new player, necessitating substantial investment to compete effectively and build market share.

Consider the broader AI market growth projections; Grand View Research anticipated the global AI market to reach $136.77 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 37.3% from 2023 to 2030. Ault Alliance's entry into these nascent segments means they are targeting a rapidly expanding pie, but their initial slice will be small, demanding strategic focus and capital allocation.

BitNile.com's metaverse platform, slated for consolidation into Ault Alliance's 2023 financial results and intended for spin-off into Ault Capital Group, currently fits the profile of a Question Mark within the BCG Matrix. The metaverse sector is experiencing robust growth, with projections indicating a market size of $500 billion by 2024, according to some industry analyses.

However, if BitNile.com's platform has not yet secured substantial user engagement or generated significant revenue, it would signify a low market share within this burgeoning industry. This position necessitates considerable investment to increase its market share and potentially transition into a Star or Cash Cow.

Undeveloped Montana Data Center Potential

The Montana data center, set to launch in March 2024 with an initial 10MW capacity, signifies a nascent but promising venture for Ault Alliance. While ongoing studies explore significant expansion possibilities, its current market share and revenue generation within the competitive AI and Bitcoin mining sectors remain largely undeveloped. This positions it as a high-potential, low-market-share asset within the BCG framework.

- Montana Facility Launch: Operational by March 2024, initial 10MW capacity.

- Expansion Potential: Ongoing studies indicate significant future growth opportunities.

- Market Position: Currently a low market share, high-growth potential in AI/Bitcoin mining.

- Strategic Context: Represents an emerging asset compared to more established operations.

Unscaled Power Solutions Development

Ault Alliance's involvement in power solutions, particularly in areas not yet scaled for mass market adoption, would likely place them in the Question Marks category of the BCG Matrix. This signifies ventures with high growth potential but currently low market share, requiring significant investment to capture market position.

These nascent power technologies could be in cutting-edge renewable energy sources or advanced energy efficiency solutions. While these sectors exhibit strong growth trajectories, Ault Alliance's specific unscaled offerings are in their early stages, limiting their current market penetration.

For instance, if Ault Alliance is developing novel battery storage technologies or advanced grid management software that are not yet widely adopted, these would fit this classification. Such ventures demand substantial capital for research, development, and market entry, aligning with the characteristics of a Question Mark.

- High Growth Potential: Ault Alliance's unscaled power solutions are positioned in rapidly expanding markets like renewable energy and energy efficiency.

- Low Market Share: These technologies are in their infancy, meaning they have not yet achieved significant market penetration or widespread customer adoption.

- Investment Required: To transition these solutions from development to market leadership, substantial financial resources are necessary for R&D, scaling production, and marketing efforts.

- Strategic Focus: The company must carefully evaluate which of these unscaled solutions have the best chance of becoming future market leaders to justify continued investment.

Ault Alliance's ventures into emerging AI applications and specialized software development represent classic Question Marks. These are high-growth areas, with the global AI market expected to surge, but Ault Alliance, as a new entrant, holds a minimal market share, necessitating significant investment to compete.

Consider the projected growth; the AI market was valued at $136.77 billion in 2022 and is anticipated to grow at a CAGR of 37.3% through 2030. Ault Alliance's strategy here is to invest heavily to capture a piece of this expanding market, aiming to transform these initial small shares into dominant positions.

The success of these Question Marks hinges on Ault Alliance's ability to scale effectively and differentiate its offerings. The company must strategically allocate capital and provide operational support to nurture these nascent businesses, guiding them towards becoming market leaders or identifying those that should be divested.

| Venture Area | BCG Category | Market Growth | Ault Alliance Market Share | Strategic Imperative |

|---|---|---|---|---|

| AI-Powered Cybersecurity | Question Mark | High (Market projected $300B by 2027) | Low (Startup phase) | Significant investment for R&D and market penetration |

| Specialized AI Software | Question Mark | Very High (AI market CAGR 37.3% 2023-2030) | Low (New entrant) | Capital allocation for development and competitive positioning |

| Metaverse Platform (BitNile.com) | Question Mark | High (Market projected $500B by 2024) | Low (Uncertain user engagement/revenue) | Investment to increase market share and achieve Star/Cash Cow status |

BCG Matrix Data Sources

Our Ault Alliance BCG Matrix leverages comprehensive market data, including financial reports, industry growth rates, and competitive landscape analysis, to accurately position each business unit.