Ault Alliance Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ault Alliance Bundle

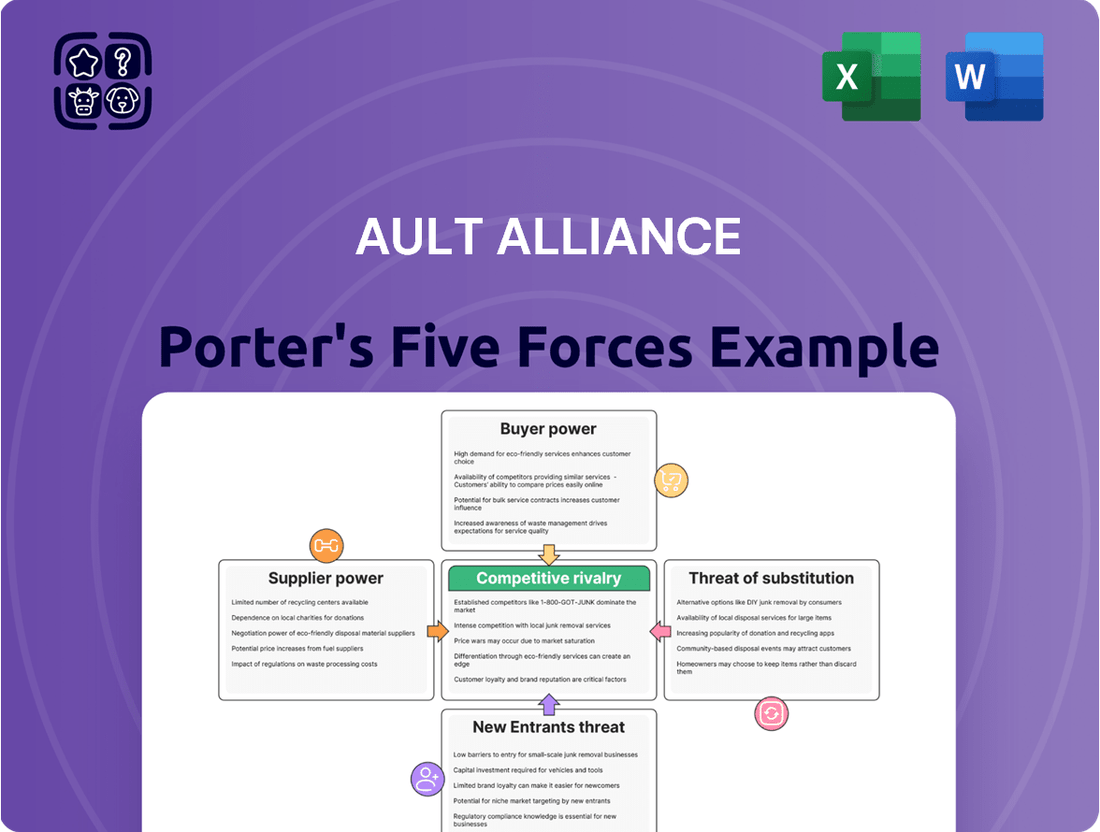

Our Porter's Five Forces analysis for Ault Alliance reveals the intricate web of competitive forces shaping its market landscape. Understand the power dynamics with suppliers and buyers, the threat of new entrants, and the pressure from substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ault Alliance’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Ault Alliance, now operating as Hyperscale Data, faces a potential challenge with the concentration of key suppliers for its specialized data center needs. The market for high-performance components like advanced GPUs essential for AI workloads and robust mining rigs is often dominated by a few manufacturers. For instance, in 2024, NVIDIA continued its strong market position in high-end GPUs, with reports indicating they held over 80% of the discrete GPU market share, a figure that remained consistent into early 2025. This limited supplier base means these companies can wield considerable influence over pricing and supply terms.

When few alternatives exist for critical equipment, Ault Alliance could find itself in a position where it must accept higher costs or less advantageous contractual conditions from these dominant suppliers. This dependency directly impacts the company's operational expenses and its ability to negotiate favorable terms, potentially squeezing profit margins if supply chain disruptions or price increases occur without readily available substitutes.

Suppliers offering unique inputs, particularly in specialized technology sectors, hold significant bargaining power. For Ault Alliance, this is evident in its reliance on advanced AI chips and efficient power solutions for its data center operations and other technology-driven businesses. For example, in 2023, the global market for AI chips was estimated to be worth over $40 billion, with a few key manufacturers dominating the supply of cutting-edge processors.

When suppliers provide components that are proprietary or difficult to replicate, their leverage increases substantially. Ault Alliance's need for these specialized, high-value inputs means these suppliers can often dictate terms and pricing. This uniqueness translates into higher costs for Ault Alliance, as the specialized nature of the technology offers a distinct competitive advantage that is not easily substituted.

Ault Alliance faces significant switching costs when dealing with suppliers of critical infrastructure, such as data center components or power solutions. These costs can include substantial expenses for retooling manufacturing processes, retraining personnel on new systems, and overcoming complex integration challenges with existing technology. For instance, if a supplier of specialized cooling systems for their data centers were to change, Ault Alliance might incur millions in new equipment purchases and installation, alongside weeks of operational downtime and extensive staff training, making a switch economically unviable.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant challenge to Ault Alliance's bargaining power. If key suppliers, particularly those in the data center hosting or Bitcoin mining sectors, possess the capability and motivation to enter Ault Alliance's operational domains, their leverage naturally escalates. This potential shift could compel Ault Alliance to negotiate less favorable terms to safeguard its essential supply chains.

For instance, imagine a primary provider of specialized mining hardware deciding to offer direct cloud-based mining services. This move would directly compete with Ault Alliance's existing business model, potentially fragmenting its customer base and diminishing its market share. Such a scenario underscores the importance of Ault Alliance maintaining strong, mutually beneficial relationships with its current suppliers to mitigate this risk.

- Supplier Capability: Assess if suppliers have the financial and technical resources to operate Ault Alliance's business segments.

- Supplier Incentive: Evaluate if suppliers see greater profit potential in directly serving Ault Alliance's customers.

- Market Dynamics: Analyze if the market conditions favor supplier entry into Ault Alliance's core operations.

- Competitive Landscape: Understand how many suppliers could realistically integrate forward and the impact on Ault Alliance's competitive position.

Importance of Ault Alliance to Suppliers

The bargaining power of suppliers to Ault Alliance is significantly influenced by how crucial Ault Alliance is to the supplier's overall business. If Ault Alliance constitutes a substantial portion of a supplier's revenue, the supplier is likely more amenable to offering competitive pricing and favorable terms to retain this key client. For instance, if a critical component supplier for Ault Alliance's data center operations reported that Ault Alliance accounted for 15% of their total sales in 2024, their willingness to negotiate would be higher.

Conversely, if Ault Alliance represents only a minor fraction of a supplier's customer base, the supplier holds considerably more leverage. In such scenarios, suppliers are less incentivized to bend on pricing or terms, as the loss of Ault Alliance as a customer would have a negligible impact on their financial performance. This dynamic can lead to less favorable contract negotiations for Ault Alliance.

- Supplier Dependence: The degree to which a supplier relies on Ault Alliance for revenue directly impacts their bargaining power.

- Revenue Contribution: If Ault Alliance is a major customer, suppliers are more likely to offer concessions.

- Market Share: For suppliers where Ault Alliance is a small client, their leverage is amplified.

- Negotiating Leverage: Ault Alliance's purchasing volume and its importance to a supplier's sales are key factors in negotiation outcomes.

The bargaining power of suppliers for Ault Alliance is substantial, especially for specialized components like advanced GPUs and AI chips, where a few manufacturers dominate the market. For example, NVIDIA's strong hold on the discrete GPU market, exceeding 80% share in 2024, exemplifies this concentration. This limited supplier base allows them to dictate pricing and terms, potentially impacting Ault Alliance's operational costs and profit margins due to high switching costs and the unique nature of the technology supplied.

Suppliers of critical infrastructure for Ault Alliance's data centers and power solutions can exert significant influence due to high switching costs, which involve substantial expenses for retooling, retraining, and integration. Furthermore, the threat of forward integration by suppliers, such as specialized hardware providers offering direct cloud services, directly challenges Ault Alliance's business model and market position.

The degree to which Ault Alliance contributes to a supplier's revenue is a key determinant of supplier bargaining power. If Ault Alliance represents a significant portion of a supplier's sales, the supplier is more inclined to offer favorable terms. Conversely, if Ault Alliance is a minor client, the supplier's leverage increases, leading to less advantageous negotiations for the company.

| Factor | Description | Impact on Ault Alliance | 2024 Data/Example | Implication |

|---|---|---|---|---|

| Supplier Concentration | Few suppliers dominate the market for critical components. | Limited choice, higher prices, less favorable terms. | NVIDIA's >80% discrete GPU market share. | Increased dependency on key providers. |

| Switching Costs | High expenses to change suppliers for specialized equipment. | Discourages supplier changes, locks in current terms. | Millions in retooling, downtime, training for data center cooling systems. | Reduced flexibility in supplier relationships. |

| Uniqueness of Input | Suppliers offer proprietary or difficult-to-replicate technology. | Suppliers can dictate terms and pricing. | Dominance in AI chip market by a few key manufacturers. | Higher costs for essential technology. |

| Supplier Dependence on Ault Alliance | Ault Alliance's revenue contribution to the supplier. | Low contribution empowers suppliers; high contribution reduces their power. | Ault Alliance accounting for 15% of a component supplier's sales. | Negotiating leverage varies significantly by supplier. |

What is included in the product

Tailored exclusively for Ault Alliance, this analysis dissects the competitive forces shaping its industry, including the threat of new entrants, buyer and supplier power, the threat of substitutes, and the intensity of rivalry.

Instantly identify and address competitive threats with a dynamic, visual representation of all five forces.

Customers Bargaining Power

Ault Alliance's customer concentration, especially within its data center and colocation segments, directly influences customer bargaining power. A significant reliance on a few major clients could empower these customers to negotiate more favorable terms, potentially impacting Ault Alliance's pricing and service offerings.

Customers of Ault Alliance, particularly in its data center, Bitcoin mining, and power solutions segments, benefit from a range of alternative providers. This availability of substitutes significantly amplifies their bargaining power. For instance, the cryptocurrency mining landscape in 2024 is characterized by numerous hosting providers, each offering varying levels of efficiency and pricing.

The ease with which these customers can shift their operations to competing entities that offer comparable hosting, mining, or energy solutions directly impacts Ault Alliance. This competitive dynamic inherently exerts downward pressure on the company's pricing strategies and the terms of its service agreements, as customers can readily seek more favorable arrangements elsewhere.

Customers in sectors like data centers and Bitcoin mining, particularly large-scale operators, exhibit significant price sensitivity. This is directly tied to their substantial operational expenditures, making cost-effectiveness a paramount concern. For instance, during 2024, the fluctuating energy prices directly impacted the operational costs for these businesses, intensifying their search for competitive power solutions.

This heightened price sensitivity translates into increased bargaining power for customers. They are compelled to explore and secure the most economical options available, which can exert downward pressure on Ault Alliance's pricing and, consequently, its profit margins. Ault Alliance's ability to offer competitive pricing in 2024 was a key factor in retaining these large clients.

Threat of Backward Integration by Customers

The threat of backward integration by Ault Alliance's customers, especially large enterprises or significant crypto miners, directly impacts their bargaining power. If these customers possess the financial resources and technical expertise to establish their own data centers or power generation facilities, they gain leverage. This capability allows them to credibly threaten to bring operations in-house, putting pressure on Ault Alliance to offer more favorable pricing or service terms to retain their business.

This potential for self-sufficiency means customers can more easily walk away if Ault Alliance's offerings become too expensive or do not meet their evolving needs. For instance, a large cryptocurrency mining operation might assess the capital expenditure required for its own power infrastructure against the ongoing operational costs with Ault Alliance. In 2024, the volatility in energy markets and the increasing demand for efficient, cost-effective power solutions for large-scale computing operations highlight this dynamic.

- Customer Leverage: Customers capable of backward integration can negotiate better terms from Ault Alliance.

- Cost Avoidance: The threat of self-provisioning incentivizes Ault Alliance to remain competitive on price and service.

- Market Dynamics: Increased energy costs and demand for specialized power solutions in 2024 amplify this threat.

- Strategic Consideration: Ault Alliance must continuously innovate and optimize its offerings to counter customer integration efforts.

Customer Information and Transparency

The increasing availability of information regarding pricing, service levels, and features across various data center and technology providers significantly empowers customers. This transparency makes it simpler for clients to conduct thorough comparisons and engage in more effective negotiations, thereby diminishing Ault Alliance's leverage in pricing decisions.

For instance, in 2024, the global cloud computing market, a key area for data center services, was valued at approximately $600 billion, with substantial year-over-year growth. This competitive landscape means customers have numerous alternatives, from hyperscalers like Amazon Web Services and Microsoft Azure to specialized colocation providers.

- Informed Decision-Making: Customers can access detailed reviews, benchmark reports, and pricing sheets from multiple vendors, allowing for objective assessments of value.

- Negotiating Leverage: Armed with comparative data, customers can push for better terms, discounts, and service level agreements (SLAs).

- Reduced Switching Costs (Perceived): While actual switching can be complex, the ease of information gathering lowers the perceived barrier to exploring alternatives.

- Market Pressure on Pricing: The readily available data creates downward pressure on prices as providers strive to remain competitive.

Ault Alliance faces considerable customer bargaining power due to the availability of numerous alternatives in its core markets, such as data centers and Bitcoin mining. Customers, especially large-scale operators, are highly price-sensitive, directly impacting Ault Alliance's pricing strategies and profit margins. The potential for customers to integrate operations backward further strengthens their negotiating position.

The 2024 market for data center services and cryptocurrency mining hosting is highly competitive, with many providers offering comparable solutions. This abundance of choice, coupled with increasing price transparency, allows customers to readily compare offerings and demand more favorable terms from Ault Alliance to retain their business.

| Factor | Impact on Ault Alliance | 2024 Market Context |

|---|---|---|

| Customer Concentration | High reliance on few clients increases their leverage. | Specific client concentration data for Ault Alliance is proprietary, but industry trends show large enterprises dominate data center usage. |

| Availability of Substitutes | Numerous alternative providers empower customers. | The Bitcoin mining hosting market in 2024 features dozens of global providers, with energy efficiency and pricing being key differentiators. |

| Price Sensitivity | Customers seek cost-effective solutions due to high operational expenditures. | In 2024, fluctuating energy prices directly impacted mining profitability, intensifying the search for competitive power solutions. |

| Threat of Backward Integration | Customers may bring operations in-house if terms are unfavorable. | Large crypto miners assess the ROI of self-owned power generation versus colocation services, a decision heavily influenced by energy market stability. |

| Information Transparency | Easier customer comparison leads to increased negotiating power. | The global cloud computing market, valued around $600 billion in 2024, offers extensive benchmarking and pricing data, facilitating customer comparisons. |

What You See Is What You Get

Ault Alliance Porter's Five Forces Analysis

This preview showcases the complete Ault Alliance Porter's Five Forces Analysis you will receive immediately after purchase. You are looking at the actual, professionally formatted document, ensuring no surprises or placeholders. Once you complete your purchase, you’ll gain instant access to this exact, ready-to-use file.

Rivalry Among Competitors

Ault Alliance operates in a highly competitive arena, facing a broad spectrum of rivals across data centers, Bitcoin mining, and various technology niches. This diverse competitive set includes established giants with significant resources and agile startups eager to disrupt the market.

The sheer number and varied nature of these competitors mean Ault Alliance must constantly innovate and adapt to maintain its edge. For instance, in the data center sector, major players like Equinix and Digital Realty command substantial market share, while the Bitcoin mining landscape is characterized by companies such as Marathon Digital Holdings and Riot Platforms, each with their own operational efficiencies and strategies.

This intense rivalry fuels a race for market share and capital. In 2024, the demand for data center capacity continued to surge, driven by AI and cloud computing growth, creating both opportunities and heightened competition for providers like Ault Alliance. Similarly, the volatile yet potentially lucrative Bitcoin mining sector sees new entrants and existing players constantly adjusting their strategies to optimize energy consumption and hash rates.

The burgeoning demand for AI-driven data centers and associated infrastructure, exemplified by Ault Alliance's expansion plans for its Michigan facility, presents a dual impact on competitive rivalry. This robust growth attracts new entrants eager to capitalize on the expanding market, potentially intensifying competition.

However, the rapid expansion also offers established players like Ault Alliance the chance to grow their capacity and market presence organically, potentially reducing the direct need to poach market share from rivals. For instance, Ault Alliance's focus on expanding its data center operations in 2024 aligns with the broader industry trend of increased investment in high-performance computing infrastructure.

Ault Alliance's ability to differentiate its data center services, Bitcoin mining operations, and power solutions is a key factor in managing competitive rivalry. If these offerings become too similar to competitors, the market often devolves into price wars, squeezing profit margins for everyone involved.

For instance, in the Bitcoin mining sector, unique technological advancements or more efficient energy sourcing can provide a significant edge. Ault Alliance's focus on integrated power solutions, like its recent expansion into distributed energy resources, aims to create a distinct value proposition that moves beyond just the hash rate. This differentiation helps them avoid being solely judged on price compared to other mining operations.

Exit Barriers

Ault Alliance faces intensified competitive rivalry due to high exit barriers in its core data center and Bitcoin mining operations. These sectors demand substantial upfront capital for infrastructure and specialized hardware, making it difficult and costly for companies to leave the market.

This situation can force even unprofitable firms to continue operations to recoup some of their investment, leading to aggressive pricing strategies and a general increase in competitive intensity. For instance, the sheer scale of investment required for a modern data center, often running into tens or hundreds of millions of dollars, creates a significant lock-in effect.

This dynamic is particularly relevant in the Bitcoin mining sector, where specialized ASIC hardware depreciates rapidly and energy costs are a major fixed expense. Companies with high exit barriers are compelled to compete fiercely to cover these ongoing costs, potentially squeezing profit margins for all players.

- High Capital Investment: Data center and Bitcoin mining infrastructure require significant capital, creating substantial exit barriers.

- Specialized Equipment: The need for specialized, often rapidly depreciating, hardware locks companies into operations.

- Fixed Cost Pressure: High fixed costs compel companies to operate even at low profitability, intensifying rivalry.

Strategic Stakes

Ault Alliance's strategic pivot towards data centers and AI, underscored by its rebranding to Hyperscale Data and the sale of non-core businesses, signals a significant increase in its competitive rivalry. This focus means the company is deeply invested in these high-growth sectors, making aggressive competition a certainty as it strives to solidify its market standing and pursue ambitious expansion plans.

Companies with substantial strategic stakes, like Ault Alliance in the data center and AI arenas, tend to engage in more intense competition. They are driven to protect their investments and capture market share, often leading to price wars, accelerated innovation, and strategic partnerships to gain an edge.

- Strategic Focus: Ault Alliance's rebranding to Hyperscale Data highlights its commitment to the data center and AI industries, areas with immense growth potential.

- Divestitures: The divestiture of non-core assets demonstrates a clear strategy to concentrate resources on its primary, high-stakes sectors.

- Increased Rivalry: This strategic concentration naturally intensifies competition as Ault Alliance vies for dominance against established and emerging players in the data center and AI markets.

The competitive rivalry within Ault Alliance's operational sectors, particularly data centers and Bitcoin mining, is exceptionally high. This intensity stems from substantial capital investments required, specialized equipment needs, and significant fixed costs, which create high exit barriers. Consequently, companies are compelled to compete aggressively to cover their expenses, often leading to price pressures and a constant drive for operational efficiency.

In 2024, the demand for AI-driven data centers fueled expansion for companies like Ault Alliance, but this growth also attracted new competitors. The Bitcoin mining landscape, meanwhile, continued its volatile trajectory, with existing players and new entrants vying for market share through optimized energy usage and hash rates. Ault Alliance's strategic focus on these areas, evidenced by its rebranding to Hyperscale Data, underscores its commitment to navigating this fierce competitive environment.

| Sector | Key Competitors (Examples) | 2024 Market Dynamics |

|---|---|---|

| Data Centers | Equinix, Digital Realty, CyrusOne | Surging demand from AI and cloud computing; intensified competition for capacity. |

| Bitcoin Mining | Marathon Digital Holdings, Riot Platforms, CleanSpark | High energy costs, hardware innovation, and fluctuating Bitcoin prices drive rivalry. |

| Ault Alliance (Hyperscale Data) | N/A (Focus on differentiation) | Expansion in Michigan facility; emphasis on integrated power solutions to stand out. |

SSubstitutes Threaten

The threat of substitutes for Ault Alliance's data center services is significant, primarily stemming from the rise of alternative computing paradigms. Technologies such as edge computing, which processes data closer to its source, and serverless computing, which abstracts away server management, can reduce the reliance on traditional colocation and hyperscale data centers. For instance, the global edge computing market was projected to reach over $200 billion by 2024, indicating a growing preference for decentralized processing.

The threat of substitutes for Bitcoin mining is evolving, primarily through alternative consensus mechanisms. For instance, Ethereum's successful transition to Proof-of-Stake in September 2022 significantly reduced its energy consumption, presenting a model that could influence other cryptocurrencies and potentially lessen the demand for energy-intensive Proof-of-Work mining, which Bitcoin currently utilizes.

Advancements in hardware efficiency also pose a threat. While Bitcoin mining hardware has become more powerful, the ongoing development of more energy-efficient Application-Specific Integrated Circuits (ASICs) could lower the barrier to entry and increase competition, potentially impacting the profitability of existing large-scale operations. Furthermore, the emergence of new digital asset generation methods not reliant on traditional mining could divert investor and developer interest away from Bitcoin.

The cost-effectiveness of substitute solutions is a critical factor in assessing their threat to Ault Alliance. If alternative data processing methods or crypto-asset generation techniques offer a substantially lower price point or improved efficiency, customers will naturally gravitate towards these cheaper options. This shift can directly impact Ault Alliance's pricing power and market share.

For instance, if the cost of cloud-based data analytics solutions, a potential substitute for some of Ault Alliance's services, drops by 15% due to advancements in infrastructure, it could present a significant challenge. Similarly, if new, more energy-efficient methods for crypto-asset mining emerge, reducing operational costs for competitors, Ault Alliance's current crypto-asset generation strategies might become less competitive, potentially impacting its revenue streams from that segment.

Performance and Quality of Substitutes

The performance and quality of potential substitutes are a major concern for Ault Alliance. If emerging technologies can offer faster processing, better security, greater scalability, or more environmentally friendly operations than Ault Alliance's current data center and mining services, they represent a significant threat. For instance, advancements in artificial intelligence that require less intensive computing power, thereby reducing reliance on massive data centers, could diminish demand for Ault Alliance's core infrastructure offerings.

Consider the ongoing evolution in cloud computing and specialized hardware. For example, by early 2024, advancements in AI chip design have led to significant performance gains, potentially reducing the need for traditional large-scale data center footprints for certain AI workloads. This shift could directly impact the demand for Ault Alliance's data center services if alternative, more efficient solutions become widely adopted.

- Technological Advancements: New technologies offering superior speed, security, or scalability pose a direct threat to Ault Alliance's data center and mining operations.

- AI Efficiency: More efficient AI processing methods that are less reliant on extensive data center infrastructure could reduce demand for Ault Alliance's services.

- Environmental Sustainability: Substitute solutions with a better environmental footprint may attract customers seeking greener alternatives.

- Cost-Effectiveness: If substitutes offer comparable or better performance at a lower cost, they become a more attractive option for businesses.

Customer Propensity to Substitute

Customer willingness to adopt new technologies or switch providers significantly shapes the threat of substitutes for Ault Alliance. Factors like the ease of moving to a new service, the perceived risk involved, and the perceived benefits of any new offering all play a crucial role in how likely customers are to consider alternatives.

In the financial services sector, customer inertia can be a powerful force. For instance, in 2024, while digital banking adoption continued to rise, many consumers still preferred established brick-and-mortar institutions for certain transactions due to trust and familiarity. This suggests that for Ault Alliance, a seamless transition process and clear communication of value propositions are key to mitigating the threat from substitutes.

- Ease of Transition: High switching costs or complex onboarding processes for alternative financial solutions can deter customers.

- Perceived Risk: Concerns about the security, reliability, or regulatory compliance of new providers can make customers hesitant to switch.

- Perceived Value of Innovation: Substitutes offering demonstrably superior features, lower costs, or greater convenience are more likely to attract customers.

The threat of substitutes for Ault Alliance's offerings is substantial, driven by evolving technologies and changing market demands. For its data center services, alternatives like cloud computing and edge computing are gaining traction. In 2024, the global edge computing market continued its rapid expansion, with projections indicating significant growth as businesses seek decentralized processing capabilities. This shift can reduce the need for traditional, centralized data center infrastructure that Ault Alliance provides.

Regarding its Bitcoin mining operations, the threat comes from alternative digital asset generation methods and shifts in consensus mechanisms. For example, the increasing efficiency of Proof-of-Stake systems, as demonstrated by Ethereum's successful transition, offers a less energy-intensive alternative to Bitcoin's Proof-of-Work. Furthermore, advancements in ASIC hardware efficiency, while benefiting mining overall, can also lower the barrier to entry for smaller competitors, intensifying market competition and potentially impacting the profitability of large-scale operations like Ault Alliance's.

| Substitute Area | Key Substitute Technologies/Methods | Impact on Ault Alliance | 2024 Market Data/Trends |

|---|---|---|---|

| Data Centers | Cloud Computing, Edge Computing | Reduced demand for traditional colocation; potential shift in infrastructure needs. | Global edge computing market projected to exceed $200 billion by 2024. |

| Bitcoin Mining | Proof-of-Stake (PoS) consensus, more energy-efficient ASICs, alternative digital assets | Potential decrease in demand for energy-intensive PoW mining; increased competition from efficient operations. | Ethereum's successful PoS transition in 2022 highlighted an alternative model. |

Entrants Threaten

The data center and Bitcoin mining sectors, key areas for Ault Alliance's Hyperscale Data, demand immense upfront capital. For instance, establishing a hyperscale data center can easily cost hundreds of millions to billions of dollars, covering land acquisition, construction, cooling systems, and robust power infrastructure. Similarly, Bitcoin mining operations require significant investment in specialized ASIC hardware, secure facilities, and reliable, high-capacity energy sources, with large-scale operations often involving tens of millions in initial outlay.

This substantial financial barrier significantly deters potential new competitors. New entrants must secure considerable funding to even begin operations, making it difficult to challenge established players like Ault Alliance who have already made these significant investments. In 2024, the ongoing demand for advanced data processing and the cyclical nature of cryptocurrency markets means that the capital required for competitive entry remains exceptionally high, effectively limiting the threat of new entrants.

Ault Alliance, through its significant investments in data center operations and Bitcoin mining, leverages substantial economies of scale. This scale allows the company to negotiate more favorable pricing for electricity, a critical cost in mining, and secure bulk discounts on essential hardware. For instance, in 2024, major Bitcoin mining operations often achieve power costs below $0.05 per kilowatt-hour due to their scale, a rate difficult for new, smaller entrants to match.

These cost advantages create a formidable barrier to entry. New companies entering the Bitcoin mining space would face higher per-unit operational expenses, from energy to equipment procurement. This makes it exceedingly challenging for them to compete on price with established, large-scale players like Ault Alliance, effectively deterring potential new competitors.

For Ault Alliance's data center and colocation services, securing access to established distribution channels, which often means building strong relationships with major clients and ensuring prime locations with consistent power, presents a significant hurdle for potential new entrants. These established connections and infrastructure are not easily replicated.

Newcomers often find it challenging to penetrate these existing networks and build the necessary trust and credibility in a competitive market. For instance, in the data center industry, securing long-term contracts with large enterprises is a crucial distribution channel, and these are typically held by incumbent players.

Proprietary Technology and Expertise

New entrants face a significant hurdle due to Ault Alliance's proprietary technology and specialized expertise in data center and Bitcoin mining operations. While the core technology is accessible, Ault Alliance's unique optimizations for AI workloads and advanced power solutions, potentially including proprietary cooling systems, are not easily replicated. This niche knowledge and operational experience act as a substantial barrier.

This specialized expertise translates into tangible advantages. For instance, in 2024, companies with highly efficient cooling solutions could see operational cost reductions of up to 15% compared to standard systems, directly impacting profitability and making it harder for less optimized new entrants to compete on price.

- Proprietary Optimization: Ault Alliance's tailored approach to data center and Bitcoin mining operations enhances efficiency and reduces costs.

- Niche Expertise: Specialized knowledge in AI power solutions and cooling technologies is difficult for newcomers to acquire quickly.

- Competitive Cost Advantage: Optimized operations can lead to lower energy consumption and operational expenses, creating a pricing advantage.

Government Policy and Regulations

Government policy and evolving regulations present a substantial threat to new entrants in sectors like data centers and cryptocurrency mining, which are key to Ault Alliance's operations. These policies often dictate data handling, energy consumption limits, and environmental impact standards. For instance, in 2024, many regions are strengthening regulations around data center energy efficiency and carbon emissions, requiring significant upfront investment in compliance for any new player.

Navigating complex permitting processes, environmental impact assessments, and stringent energy grid connection requirements can be both time-consuming and prohibitively expensive for newcomers. These regulatory hurdles can delay or even halt new operations, effectively limiting the number of potential competitors. The cost of compliance alone can be a major barrier, especially when factoring in the need for specialized infrastructure to meet these demands.

- Regulatory Hurdles: New entrants face significant challenges in obtaining necessary permits and approvals for data center and cryptocurrency mining operations, particularly concerning energy usage and environmental standards.

- Evolving Policies: The dynamic nature of government regulations, such as stricter energy efficiency mandates and carbon footprint reporting, requires continuous adaptation and investment from potential new competitors.

- Cost of Compliance: The financial burden associated with meeting complex permitting, environmental, and energy grid requirements acts as a substantial barrier to entry for smaller or less capitalized firms.

The threat of new entrants for Ault Alliance is relatively low due to the substantial capital requirements for its data center and Bitcoin mining operations. Establishing these facilities demands hundreds of millions to billions of dollars, creating a significant financial barrier that deters most potential competitors. In 2024, the ongoing need for advanced infrastructure and the high cost of specialized hardware like ASIC miners mean that new entrants must secure considerable funding to even begin operations, making it difficult to challenge established players.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ault Alliance is built upon a foundation of diverse and credible data sources. This includes Ault Alliance's own SEC filings and investor relations materials, alongside industry-specific reports from market research firms and financial data providers.