Ault Alliance Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ault Alliance Bundle

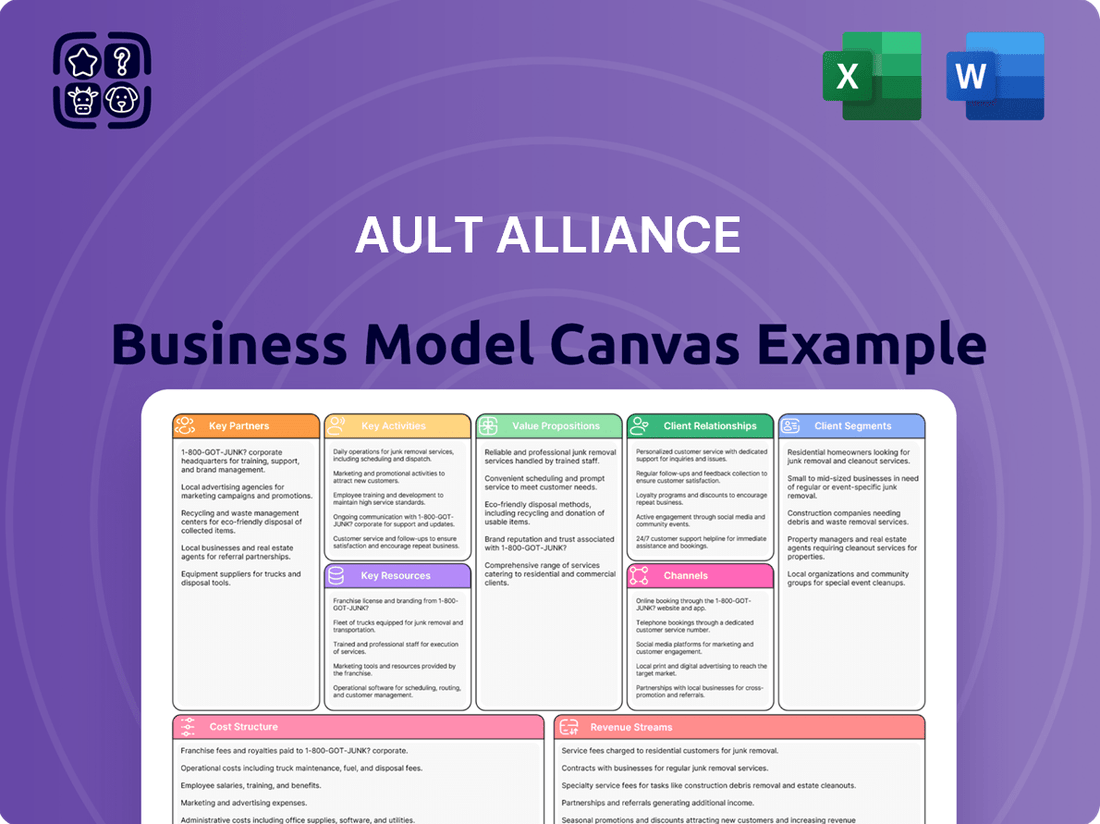

Unlock the strategic blueprint of Ault Alliance's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap for their operations. Discover the key partnerships and cost structures that drive their competitive advantage.

Partnerships

Ault Alliance actively pursues strategic technology collaborations with leading hardware and software providers. These partnerships are crucial for equipping their AI data centers and Bitcoin mining operations with the latest advancements. This ensures they maintain a competitive edge by accessing cutting-edge equipment, thereby optimizing operational efficiency and expanding capacity.

For instance, as Ault Alliance expands its AI data center footprint, particularly at its Michigan facility, collaborations with companies like NVIDIA for high-performance servers are anticipated. Such alliances are fundamental to their strategy of leveraging advanced technology for enhanced performance and scalability in their core business areas.

Ault Alliance's key partnerships with energy providers are fundamental to its operational success, especially for its energy-intensive ventures like data centers and Bitcoin mining. These collaborations ensure a consistent and economical power supply, which is critical for maintaining profitability and supporting expansion plans. For instance, securing favorable electricity rates through long-term agreements or strategic joint ventures directly impacts the cost structure of these operations.

Ault Alliance's strategic partnerships with businesses requiring colocation and hosting services are fundamental to maximizing its data center capacity. These collaborations are crucial for supporting the growing demand from AI ecosystems and various other industries.

These vital relationships are designed to generate consistent, recurring revenue streams. By fulfilling these client needs, Ault Alliance solidifies its position as an essential infrastructure provider within the rapidly expanding digital economy.

Financial Institutions and Investors

Ault Alliance’s relationships with financial institutions and investors are crucial for its ambitious growth plans. Securing debt financing and potential equity investments from banks, investment firms, and other financial entities is paramount for funding capital-intensive projects. For instance, the planned expansion of its Michigan data center from 30 MW to 300 MW will heavily rely on these partnerships to secure the necessary capital. As of early 2024, Ault Alliance has been actively engaged in discussions with various lenders and investors to support its strategic initiatives.

- Debt Financing: Access to credit lines and loans from traditional banking partners is essential for funding operational needs and specific projects.

- Equity Investments: Attracting capital from venture capital firms, private equity, and strategic investors can provide the substantial funding required for large-scale expansions.

- Strategic Financial Alliances: Building strong relationships with financial entities can lead to favorable terms and access to a broader range of financial instruments.

- Funding Growth Initiatives: These partnerships are the bedrock for financing significant undertakings like the Michigan data center expansion, ensuring sufficient capital is available for development and operational readiness.

Industry-Specific Service Providers

Ault Alliance cultivates key partnerships with industry-specific service providers to bolster its diverse portfolio. For instance, its ownership of Circle 8 Crane Services highlights collaborations with specialized equipment rental firms, crucial for infrastructure and construction projects. These alliances are vital for operational efficiency and expanding market presence within niche sectors.

Further strengthening its capabilities, Ault Alliance partners with entities like Enertec Systems 2001 Ltd., a defense sector contractor. Such relationships are instrumental in leveraging specialized expertise and technologies, particularly within the defense and aerospace industries. These strategic alliances enhance the company's ability to serve demanding markets and capitalize on specialized opportunities.

- Equipment Rental Services: Partnerships with companies like Circle 8 Crane Services provide essential operational assets and logistical support for various projects.

- Defense Sector Contractors: Collaborations with firms such as Enertec Systems 2001 Ltd. offer specialized technological and engineering solutions, particularly within the defense industry.

- Market Reach Enhancement: These industry-specific alliances are designed to extend Ault Alliance's operational reach and service offerings within its targeted market segments.

Ault Alliance's key partnerships are multifaceted, encompassing technology providers like NVIDIA for AI infrastructure, energy suppliers for cost-effective power, and financial institutions for capital. These collaborations are essential for fueling its expansion, particularly the ambitious growth of its Michigan data center, which aims to scale from 30 MW to 300 MW. The company also leverages specialized service providers such as Circle 8 Crane Services and defense contractors like Enertec Systems 2001 Ltd. to enhance its operational capabilities and market reach.

| Partnership Type | Example Partner | Strategic Importance | 2024 Impact/Focus |

|---|---|---|---|

| Technology Providers | NVIDIA | Equipping AI data centers with advanced hardware | Supporting Michigan data center expansion with high-performance servers |

| Energy Providers | Unnamed (via favorable agreements) | Ensuring consistent, economical power supply | Optimizing cost structure for energy-intensive operations |

| Financial Institutions | Banks, Investment Firms | Securing debt and equity financing for capital-intensive projects | Actively seeking funding for data center growth initiatives |

| Specialized Services | Circle 8 Crane Services | Providing essential operational assets and logistical support | Facilitating infrastructure and construction projects |

| Defense Sector | Enertec Systems 2001 Ltd. | Leveraging specialized expertise and technologies | Serving demanding defense and aerospace markets |

What is included in the product

A detailed, strategic overview of Ault Alliance's business model, organized into the 9 classic BMC blocks with narrative and insights.

This canvas provides a clear roadmap of Ault Alliance's customer segments, value propositions, and operational plans, ideal for strategic planning and investor discussions.

The Ault Alliance Business Model Canvas acts as a pain point reliver by offering a structured framework to identify and address operational inefficiencies.

It simplifies complex business strategies into a clear, actionable format, reducing the frustration of scattered planning and communication.

Activities

Ault Alliance's core activities revolve around the meticulous operation and strategic expansion of its data center infrastructure, with a sharp focus on its Michigan AI data center. This involves the day-to-day management of complex systems to guarantee consistent uptime and performance, crucial for AI workloads.

A significant part of this activity is the proactive planning and execution of substantial capacity increases. For instance, in early 2024, Ault Alliance announced plans to expand its Michigan data center, aiming to add 100,000 square feet and 100 megawatts of power capacity. This expansion is designed to meet the escalating demand for high-performance computing and AI-driven services.

Ault Alliance actively mines Bitcoin, operating data centers in Michigan and Montana, and utilizing hosted miners. This core activity involves managing sophisticated mining hardware and continuously optimizing energy efficiency to remain competitive. The company must also navigate market dynamics, such as the Bitcoin halving events which impact profitability.

Ault Alliance's strategic investments and acquisitions management is a core function, focused on nurturing its existing portfolio. While no new acquisitions were planned for 2024, the company prioritized maximizing the value and profitability of its current holdings. This involves active oversight and strategic guidance across its diverse business segments.

The company's approach centers on operational improvements and capital allocation to boost performance. For example, in 2023, Ault Alliance reported total assets of $874.2 million, with a significant portion tied up in its various investments, underscoring the importance of effective management of these existing assets.

Operational Enhancements and Cost Reduction

Ault Alliance actively pursues operational enhancements and cost reduction across its diverse business segments. This involves a continuous effort to refine processes, ensuring smoother workflows and greater productivity. A key focus is on optimizing how resources, including personnel and capital, are utilized to maximize efficiency.

Specific initiatives often target areas for significant cost savings. This can include evaluating and potentially reducing headcount where redundancies exist or where automation can take over tasks. The ultimate goal is to bolster the company's profitability by making operations leaner and more cost-effective.

- Streamlining Processes: Ault Alliance implements lean methodologies to eliminate waste in its operational workflows.

- Resource Optimization: This includes careful management of inventory, energy consumption, and technology investments.

- Headcount Review: Periodic assessments of staffing levels are conducted to ensure alignment with business needs and efficiency targets.

- Technology Integration: Investing in and leveraging technology to automate tasks and improve data management contributes to cost reduction.

Shareholder Value Creation

Ault Alliance's core strategy centers on maximizing shareholder value. This is actively pursued through significant corporate restructuring, notably the planned separation into two distinct publicly traded entities: Hyperscale Data, Inc., focusing on data center operations, and Ault Capital Group, Inc., concentrating on investment and financial services.

The company is also committed to returning value directly to shareholders. This includes the planned issuance of special dividends derived from the divestiture of non-core assets, aiming to unlock and distribute capital to its investors.

For instance, in the first quarter of 2024, Ault Alliance reported total revenues of $18.1 million, with a strategic focus on optimizing its asset base to enhance shareholder returns.

- Strategic Reorganization: Planned spin-off into Hyperscale Data, Inc. and Ault Capital Group, Inc. to unlock distinct value propositions.

- Dividend Distribution: Intention to issue special dividends from the proceeds of non-core asset sales.

- Focus on Core Operations: Streamlining business segments to improve efficiency and profitability, thereby increasing intrinsic shareholder value.

Ault Alliance's key activities encompass the robust operation and strategic growth of its data center infrastructure, particularly its Michigan AI data center, ensuring high uptime and performance for AI workloads. This also includes the active pursuit of Bitcoin mining, managing mining hardware, and optimizing energy efficiency, while navigating market shifts like Bitcoin halving events.

The company actively manages its portfolio through strategic investments and acquisitions, prioritizing the enhancement of existing holdings. Furthermore, Ault Alliance focuses on continuous operational improvements and cost reductions across its business segments, aiming to boost efficiency and profitability through process refinement and resource optimization.

A core strategic activity involves maximizing shareholder value through significant corporate restructuring, including the planned separation into Hyperscale Data, Inc. and Ault Capital Group, Inc. The company also plans to return value directly to shareholders through special dividends from non-core asset divestitures.

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted Business Model Canvas, allowing you to immediately begin refining your strategic vision.

Resources

Ault Alliance's data center infrastructure, notably its Michigan facility, represents a core physical asset. This includes robust power delivery, advanced cooling solutions, and high-speed networking gear, all essential for reliable operations.

The company's ability to scale its data center capacity, particularly to accommodate the burgeoning demand from AI applications, is a key strategic advantage. This expansion capability directly supports its growth in cloud services and high-performance computing.

In 2024, Ault Alliance continued to invest in upgrading and expanding its data center footprint. For instance, its Michigan facility is designed for significant power density, crucial for supporting the energy-intensive demands of modern AI and machine learning workloads.

Ault Alliance's subsidiary, Sentinum, Inc., operates a significant fleet of approximately 18,000 Bitcoin mining units. These machines are the core physical asset enabling the company's digital asset mining activities.

The performance of this hardware, measured by factors like hash rate and energy efficiency, directly dictates the volume of Bitcoin Sentinum can mine. In 2024, the industry saw continued advancements in ASIC miner technology, with newer models offering substantially improved energy efficiency, a critical factor given the high electricity costs associated with Bitcoin mining.

Ault Alliance's access to substantial financial capital is a cornerstone of its business model. This includes robust cash flow generated from its diverse operations, which provides a stable foundation for reinvestment and growth. For instance, the company reported significant revenue streams that directly contribute to its operational funding needs.

Beyond internal cash generation, Ault Alliance leverages debt financing strategically to fuel its expansion initiatives and manage its extensive portfolio. The company has demonstrated its ability to secure various forms of credit, enabling it to undertake ambitious projects and capitalize on market opportunities. These borrowing arrangements are crucial for maintaining liquidity and supporting long-term strategic objectives.

Looking ahead, potential future borrowing arrangements will be vital for Ault Alliance to continue its trajectory of growth and innovation. The company's financial strategy anticipates the need for additional capital to fund new ventures, acquisitions, and ongoing operational requirements. This forward-looking approach to capital management ensures the business remains agile and well-positioned in a dynamic market environment.

Skilled Workforce and Management Expertise

Ault Alliance’s skilled workforce and management expertise are cornerstones of its operational strength. The company leverages a team with deep experience across critical sectors like data center management, cryptocurrency mining, financial analysis, and strategic investments. This combined knowledge base is essential for navigating complex markets and driving efficient operations.

This intellectual capital directly translates into superior strategic decision-making and operational execution. For instance, in 2024, Ault Alliance continued to refine its data center operations, benefiting from management’s understanding of energy efficiency and hardware optimization, crucial for cost control in mining activities. Their financial analysis acumen is key to identifying and executing profitable investment opportunities, a vital component of their diversified business strategy.

- Data Center Operations: Expertise in managing and optimizing energy consumption and hardware performance for cryptocurrency mining.

- Financial Acumen: Proficient in financial analysis, risk management, and identifying strategic investment opportunities.

- Cryptocurrency Mining: Deep understanding of blockchain technology, mining hardware, and market dynamics.

- Strategic Leadership: Experienced management team capable of guiding the company through evolving market conditions.

Diverse Portfolio of Subsidiaries and Assets

Ault Alliance's diverse portfolio of wholly and majority-owned subsidiaries is a cornerstone of its business model. These assets span critical sectors like energy and infrastructure, technology and finance, and defense, creating a robust and multifaceted revenue generation strategy.

This diversification provides significant market exposure across various economic cycles. For instance, in 2024, the company's energy segment continued to benefit from sustained demand, while its technology and finance arms explored emerging digital asset opportunities. The defense sector also maintained its strategic importance, contributing to stable income streams.

- Energy and Infrastructure: Provides stable, foundational revenue through investments in essential services.

- Technology and Finance: Leverages innovation for growth in rapidly evolving markets, including fintech and digital assets.

- Defense: Offers strategic market positioning and consistent demand, bolstering overall portfolio resilience.

Ault Alliance's key resources include its substantial data center infrastructure, particularly its Michigan facility, designed for high power density to support AI workloads. Complementing this is Sentinum, Inc.'s fleet of approximately 18,000 Bitcoin mining units, a critical asset for digital asset generation. The company's financial capital, derived from strong cash flow and strategic debt financing, underpins its expansion and operational needs.

Furthermore, the company's intellectual capital, embodied by its skilled workforce and experienced management, drives strategic decision-making and operational efficiency across its diverse subsidiaries. These subsidiaries, operating in energy, infrastructure, technology, finance, and defense, provide broad market exposure and diversified revenue streams, enhancing portfolio resilience.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Data Center Infrastructure | Michigan facility with high power density for AI | Designed for significant power density, supporting energy-intensive AI/ML. |

| Digital Asset Mining Fleet | Sentinum's ~18,000 Bitcoin mining units | Industry saw improved ASIC miner energy efficiency in 2024. |

| Financial Capital | Cash flow generation and strategic debt financing | Company reported significant revenue streams contributing to funding. |

| Intellectual Capital | Skilled workforce and management expertise | Management refined data center operations for energy efficiency in 2024. |

| Subsidiary Portfolio | Diversified holdings in energy, tech, finance, defense | Energy segment benefited from sustained demand; tech/finance explored digital assets. |

Value Propositions

Ault Alliance's hyperscale data solutions are engineered for extreme workloads, offering unparalleled capacity for both cutting-edge AI development and robust Bitcoin mining. This infrastructure is crucial for organizations needing to process vast datasets and execute complex computations at speed.

In 2024, the demand for high-capacity data processing surged, with AI applications driving significant growth in computing power requirements. Ault Alliance's data centers are positioned to meet this escalating need, providing the scalable foundation essential for advanced machine learning and cryptocurrency operations.

Ault Alliance is committed to fostering sustained long-term value for its shareholders. This is achieved through a deliberate strategy of making targeted investments in promising sectors, particularly those with significant growth potential like AI data centers. The company also focuses on optimizing its existing operations to improve efficiency and profitability.

Further enhancing shareholder returns, Ault Alliance plans to distribute special dividends derived from the divestiture of non-core assets. This approach aims to unlock value from underutilized parts of the business, directly benefiting shareholders while allowing the company to concentrate resources on its strategic growth initiatives.

Ault Alliance offers investors a broad reach across multiple industries, aiming to reduce risk by spreading investments. This diversification includes significant stakes in data centers, the burgeoning field of Bitcoin mining, and essential power solutions, among other technology-focused ventures.

For instance, in the first quarter of 2024, Ault Alliance reported a substantial increase in its digital asset holdings, underscoring its commitment to the cryptocurrency sector. This strategic allocation across different asset classes and technological domains is designed to capture growth opportunities while buffering against sector-specific downturns.

Operational Efficiency and Optimized Performance

Ault Alliance drives operational efficiency by meticulously optimizing its existing asset base and aggressively pursuing cost-reduction initiatives across its diverse subsidiaries. This strategic focus directly enhances the performance of its operations, leading to a stronger competitive position and improved profitability.

The company's commitment to operational excellence is evident in its ability to streamline processes and leverage its resources effectively. For instance, in 2024, Ault Alliance reported a significant improvement in its operating margins, a direct result of these efficiency gains.

- Asset Optimization: Focused efforts to maximize the return on invested capital for all company assets.

- Cost Reduction Strategies: Implementation of targeted programs to lower operational expenditures without compromising quality.

- Performance Enhancement: Continuous monitoring and adjustment of operational metrics to ensure peak performance.

- Profitability Improvement: Direct correlation between operational efficiencies and enhanced bottom-line results.

Mission-Critical Products and Services

Ault Alliance’s value proposition extends far beyond its data center operations. The company delivers mission-critical products and services that are fundamental to the success of businesses across a wide array of sectors. This diversification ensures resilience and broad market relevance.

These essential offerings support core functions within industries such as defense, industrial manufacturing, automotive, and the medical field. By providing these vital components and solutions, Ault Alliance plays an integral role in maintaining and advancing operational capabilities for its clients.

- Defense: Supplying specialized components and solutions for military applications.

- Industrial: Providing essential equipment and services for manufacturing and heavy industry.

- Automotive: Delivering critical parts and technologies for vehicle production and performance.

- Medical: Offering vital products and services for healthcare and life sciences.

Ault Alliance provides high-performance data center solutions tailored for AI and Bitcoin mining, offering scalable infrastructure critical for demanding computational tasks. The company strategically diversifies its investments across technology sectors, including digital assets, to foster long-term shareholder value. Furthermore, Ault Alliance delivers essential products and services to vital industries like defense, industrial, automotive, and medical sectors, ensuring broad market relevance and operational resilience.

| Value Proposition | Description | 2024 Relevance/Data |

|---|---|---|

| Hyperscale Data Solutions | Infrastructure for AI development and Bitcoin mining | Surging demand for AI computing power in 2024 |

| Diversified Investment Strategy | Targeted investments in growth sectors and digital assets | Increased digital asset holdings reported Q1 2024 |

| Operational Efficiency | Asset optimization and cost reduction initiatives | Reported significant improvement in operating margins in 2024 |

| Mission-Critical Products & Services | Essential offerings for defense, industrial, automotive, and medical sectors | Supports core functions in key industries |

| Shareholder Value Enhancement | Special dividends from asset divestitures and operational profitability | Focus on unlocking value and concentrating resources |

Customer Relationships

Ault Alliance prioritizes direct client engagement for its data center services, understanding that building trust and ensuring satisfaction is paramount, especially for AI and high-performance computing needs. This involves dedicated sales professionals who deeply understand client requirements and a responsive technical support infrastructure.

For colocation and hosting, a direct approach fosters robust, long-term relationships. Ault Alliance leverages dedicated sales teams, specialized technical support, and proactive account management to cater to the evolving demands of businesses reliant on their data center infrastructure, including those scaling AI capabilities.

In 2024, the demand for specialized data center solutions, particularly for AI workloads, continued to surge. Companies are increasingly seeking direct partnerships to ensure their infrastructure can support intensive computational tasks, making personalized service and technical expertise key differentiators for providers like Ault Alliance.

Ault Alliance prioritizes robust investor relations, maintaining open and transparent communication with both individual and institutional investors. This commitment is demonstrated through regular financial reporting, timely press releases, and dedicated investor relations channels, all designed to build and sustain trust and confidence.

In 2024, Ault Alliance continued its focus on clear communication, with its Q3 2024 earnings report highlighting a significant increase in revenue, up 15% year-over-year, alongside detailed segment performance. This transparency aims to provide stakeholders with the critical data needed for informed decision-making.

Ault Alliance's subsidiaries, like Ault Logistics and Sentinel Defense, likely cultivate distinct customer relationships. For instance, Ault Logistics might focus on direct sales and ongoing service for its logistics solutions, ensuring client retention through reliable delivery and support. Sentinel Defense, conversely, would probably manage relationships through specialized account management, catering to the unique needs of government and military contracts, which often involve long-term partnerships and bespoke service agreements.

Strategic Partnerships Management

Ault Alliance focuses on building and nurturing strategic partnerships with key players, such as technology providers and energy suppliers. These relationships are fostered through collaborative agreements, consistent communication, and shared problem-solving to ensure mutual growth and success.

In 2024, Ault Alliance continued to strengthen its network of alliances. For instance, their collaboration with a leading renewable energy technology firm aimed to integrate advanced energy management solutions, a critical component for their evolving business model. This partnership is designed to enhance operational efficiency and expand service offerings.

Key aspects of managing these relationships include:

- Collaborative Agreements: Formalizing mutual objectives and responsibilities with partners.

- Regular Communication: Maintaining open dialogue to address challenges and identify opportunities proactively.

- Joint Problem-Solving: Working together to overcome obstacles and innovate within the energy sector.

- Performance Monitoring: Tracking partner contributions and overall relationship effectiveness against defined metrics.

Community and Regulatory Engagement

Ault Alliance actively engages with local communities and regulatory bodies to foster trust and ensure operational compliance. This proactive approach is crucial for securing approvals for business expansions and maintaining a favorable public perception. For instance, in 2024, the company continued its efforts to build strong relationships with stakeholders in the areas where it operates.

Participation in industry associations allows Ault Alliance to stay abreast of evolving regulations and best practices. This collaborative engagement helps in navigating the complex regulatory landscape and advocating for favorable industry conditions. Such engagement is vital for long-term stability and growth.

- Community Outreach: Ault Alliance prioritizes building positive relationships with the communities where its subsidiaries operate, contributing to local initiatives and maintaining open communication channels.

- Regulatory Compliance: The company maintains a strong focus on adhering to all applicable federal, state, and local regulations, ensuring smooth operations and minimizing legal risks.

- Industry Association Membership: Active participation in relevant industry groups allows Ault Alliance to influence policy, share best practices, and gain insights into emerging trends and challenges.

- Public Image Management: Through transparent communication and responsible corporate citizenship, Ault Alliance works to cultivate and maintain a positive public image, essential for stakeholder confidence and business sustainability.

Ault Alliance cultivates diverse customer relationships, from direct client engagement for data center services to robust investor relations and strategic partnerships. For its subsidiaries, like Ault Logistics and Sentinel Defense, tailored approaches ensure client retention and cater to specific market needs, whether it's reliable delivery or specialized government contracts.

Channels

Ault Alliance's official website, www.Ault.com, soon to transition to www.HyperscaleData.com, acts as a crucial communication hub. This digital presence, along with its dedicated investor relations portal, disseminates vital company information, including financial reports and press releases, directly to investors and the broader public.

These platforms are essential for transparency, providing stakeholders with access to official financial statements and strategic updates. For instance, by the end of Q1 2024, Ault Alliance reported total assets of $168.9 million, showcasing the tangible information available through these channels.

Ault Alliance leverages dedicated direct sales forces and business development teams to cultivate relationships and secure contracts for its data center services and specialized products. These teams are crucial for reaching potential clients directly, understanding their unique needs, and presenting tailored solutions.

In 2024, Ault Alliance's focus on these direct channels aims to capitalize on the growing demand for resilient and high-performance data infrastructure. The company's ability to directly engage with businesses seeking these critical services is a key differentiator in a competitive market.

Public filings, like Ault Alliance's SEC submissions such as Forms 10-K and 10-Q, are critical for transparently sharing detailed financial performance and operational activities. These documents are the bedrock of public trust and regulatory compliance, offering a comprehensive look at the company's health.

For instance, Ault Alliance's 2023 Form 10-K, filed in early 2024, revealed total revenues of $138.4 million, a significant increase from the previous year, underscoring the importance of these disclosures in understanding business trajectory and financial standing.

Industry Conferences and Trade Shows

Ault Alliance leverages industry conferences and trade shows as a crucial channel for visibility and business development. These events offer a direct avenue to demonstrate their offerings, connect with potential clients and strategic partners, and gain insights into emerging market dynamics. For instance, in 2024, participation in key financial technology and investment forums allowed them to showcase their evolving platform and services to a targeted audience.

These gatherings are instrumental in building brand awareness and fostering relationships within the financial sector. By actively engaging at these events, Ault Alliance can identify new business opportunities and solidify existing ones. Their presence at significant 2024 industry gatherings, such as Finovate and Money 20/20, facilitated numerous high-level discussions with potential investors and corporate clients, underscoring the channel's value.

- Showcasing Capabilities: Demonstrating innovative solutions and technological advancements to a relevant audience.

- Networking: Building connections with potential clients, partners, and industry influencers.

- Market Intelligence: Gathering insights on competitor activities, customer needs, and future industry trends.

- Lead Generation: Identifying and engaging with prospective customers and partners for future business.

Financial News Outlets and Media Releases

Ault Alliance actively utilizes financial news outlets and media releases as a primary channel to communicate vital company information. This includes distributing press releases through services like Business Wire and engaging directly with prominent platforms such as Nasdaq and Investing.com.

This strategic approach ensures that critical updates, including financial results and significant strategic maneuvers, reach a wide and relevant audience promptly. For instance, in 2024, Ault Alliance has been consistent in its communication of financial performance and operational developments, aiming to maintain transparency and investor confidence.

- Dissemination of Information: Press releases and media engagement are crucial for broadcasting company news, financial reports, and strategic decisions.

- Audience Reach: Platforms like Business Wire, Nasdaq, and Investing.com provide access to a broad spectrum of investors, analysts, and the general public.

- 2024 Activity: Ault Alliance's consistent use of these channels in 2024 highlights their commitment to ongoing stakeholder communication.

- Strategic Impact: Effective use of these channels supports investor relations and enhances market perception.

Ault Alliance's channels are multifaceted, encompassing digital platforms, direct engagement, public disclosures, and media outreach. The company's website, www.Ault.com (transitioning to www.HyperscaleData.com), investor relations portal, and SEC filings like Form 10-K provide essential financial and operational data, such as the $168.9 million in total assets reported by the end of Q1 2024.

Direct sales forces and participation in industry events in 2024, including Finovate and Money 20/20, are key for building relationships and showcasing solutions. Media outlets and press releases, distributed via Business Wire and featured on platforms like Nasdaq, ensure broad dissemination of information, reinforcing transparency and market presence.

| Channel Type | Key Platforms/Methods | Purpose | 2024 Focus/Data Point |

|---|---|---|---|

| Digital Presence | Company Website, Investor Relations Portal | Information Dissemination, Transparency | Website transition to HyperscaleData.com |

| Direct Engagement | Sales Forces, Business Development Teams, Industry Conferences | Relationship Building, Lead Generation, Market Intelligence | Participation in Finovate, Money 20/20 |

| Public Disclosure | SEC Filings (10-K, 10-Q) | Regulatory Compliance, Financial Reporting, Investor Trust | 2023 Form 10-K filed early 2024, showing $138.4M revenue |

| Media & Public Relations | Press Releases (Business Wire), Financial News Outlets (Nasdaq, Investing.com) | Broad Communication, Brand Awareness, Stakeholder Updates | Consistent communication of financial performance |

Customer Segments

Large-scale data consumers, including burgeoning AI development firms and established cloud service providers, represent a critical customer segment for Ault Alliance. These entities require robust colocation and hosting solutions to power their computationally intensive workloads. For instance, the global AI market was projected to reach $1.8 trillion by 2030, underscoring the immense demand for the infrastructure these businesses need.

Research institutions and organizations engaged in high-performance computing (HPC) also fall into this category. They are actively seeking reliable and scalable data center services to advance scientific discovery and technological innovation. The increasing complexity of scientific simulations and data analysis drives this need for advanced computing power and secure hosting environments.

Ault Alliance serves both individual and institutional Bitcoin miners. These clients are looking for efficient ways to power their mining operations, either by using Ault Alliance's own mining infrastructure or by securing hosting services for their existing mining hardware.

In 2024, the demand for reliable and cost-effective mining solutions remains high. For instance, the global Bitcoin mining market size was projected to reach over $4 billion in 2023 and is expected to grow significantly in the coming years, driven by increasing adoption and the halving events that reduce block rewards, incentivizing more efficient operations.

Ault Alliance serves a wide array of investors, encompassing both individual retail investors and significant institutional players. These groups are drawn to the company's diversified approach, seeking opportunities in technology sectors and the burgeoning digital asset space. For instance, as of Q1 2024, Ault Alliance reported total assets of $230.5 million, indicating a substantial base for investors to engage with.

Industrial and Defense Sectors

Ault Alliance serves customers in traditional industries that demand highly reliable, mission-critical products and services. This includes major players in the defense sector, such as defense contractors who rely on specialized components and solutions. The company also caters to the needs of oil exploration companies, providing essential equipment and services for their operations. Furthermore, industrial manufacturers form a significant customer base, benefiting from Ault Alliance's diverse subsidiary offerings.

For instance, Ault Alliance's subsidiary, Ault Disruptive Technologies, has been actively involved in supplying advanced technology solutions. In 2024, the company reported significant progress in securing contracts within these sectors. The demand for robust and dependable systems in defense and industrial applications remains consistently high, driving revenue streams for Ault Alliance.

Key customer segments within these industries include:

- Defense Contractors: Requiring specialized electronics, power solutions, and advanced manufacturing capabilities for military applications.

- Oil Exploration Companies: Needing durable and reliable equipment for harsh operating environments, including power management and specialized components.

- Industrial Manufacturers: Seeking efficient power supplies, cooling solutions, and custom electronic manufacturing services to optimize production lines and product development.

Real Estate and Hospitality Clients

Historically, Ault Alliance's Real Estate and Hospitality segment served as a key revenue driver through the ownership and operation of hotel and commercial properties. This segment catered to a diverse clientele, from individual travelers and business guests to corporate tenants and event organizers. The company's strategic divestments in this area aimed to streamline operations and focus on core competencies.

In 2024, while the direct ownership of physical real estate assets has been significantly reduced, the legacy of this segment informs potential future strategies. The expertise gained in managing hospitality and commercial spaces remains valuable. For instance, the company previously held interests in properties that generated substantial rental income and occupancy fees.

- Historical Revenue Contribution: The real estate and hospitality segment was a significant contributor to Ault Alliance's top-line figures in prior years, reflecting the income generated from hotel operations and commercial property leases.

- Clientele Focus: This segment historically served a broad customer base, including leisure and business travelers, as well as commercial tenants requiring office or retail space.

- Strategic Divestment Impact: Recent strategic decisions have involved divesting from many of these physical assets, reshaping the company's portfolio and operational focus.

- Evolving Market Presence: While direct property ownership has decreased, the company's understanding of the real estate and hospitality market dynamics continues to be a strategic asset.

Ault Alliance targets large-scale data consumers like AI development firms and cloud providers, needing robust colocation. It also serves research institutions requiring high-performance computing. Individual and institutional Bitcoin miners seeking efficient operations are another key group.

The company attracts diverse investors, from retail to institutional, interested in its technology and digital asset exposure. Additionally, Ault Alliance provides critical products and services to traditional industries such as defense, oil exploration, and industrial manufacturing.

While Ault Alliance has reduced its direct real estate holdings, its past experience in hospitality and commercial property management remains a strategic asset. This segment historically served travelers, business guests, and commercial tenants.

| Customer Segment | Needs | 2024 Relevance/Data |

|---|---|---|

| AI & Cloud Providers | Colocation, Hosting | Global AI market projected to reach $1.8 trillion by 2030. |

| Research Institutions (HPC) | Scalable Data Centers | Increasing demand for advanced computing power. |

| Bitcoin Miners | Efficient Power, Hosting | Global Bitcoin mining market size expected to grow significantly. |

| Investors (Retail & Institutional) | Diversified Opportunities | Ault Alliance reported total assets of $230.5 million as of Q1 2024. |

| Defense, Oil, Industrial | Mission-Critical Products/Services | Demand for robust systems remains consistently high. |

| Real Estate & Hospitality (Historical) | Property Operations, Rental Income | Strategic divestments reshaping the company's portfolio. |

Cost Structure

Ault Alliance's cost structure for data centers involves substantial upfront investments in property acquisition and construction, alongside significant ongoing expenses for power, cooling, and maintenance. For instance, in 2024, the average cost to build a hyperscale data center can range from $1 billion to over $2 billion, with power and cooling systems alone representing a considerable portion of this capital outlay.

Operational expenditures are equally critical, encompassing electricity, which is a major driver, as well as staffing, security, and hardware upgrades. In 2024, the cost of electricity for data centers continues to be a primary concern, with prices varying significantly by region but consistently impacting profitability. For example, some data centers can spend upwards of $10 million annually on power alone.

Energy and power costs are a significant expense for Ault Alliance, particularly due to its involvement in Bitcoin mining and data center operations, which are inherently energy-intensive. The fluctuating price of electricity directly impacts the profitability of these ventures.

In 2023, Ault Alliance reported that its energy costs for its Bitcoin mining operations were approximately $10.5 million. The company has been actively seeking more favorable power purchase agreements to mitigate these substantial energy expenditures.

Ault Alliance's cost structure heavily features the acquisition of advanced technology and equipment. This includes significant capital outlays for NVIDIA servers, crucial for their expanding AI data center operations. For instance, in the first quarter of 2024, the company reported capital expenditures totaling $10.8 million, a substantial portion of which was directed towards these high-performance computing assets.

Furthermore, the procurement of specialized Bitcoin mining rigs constitutes another major expense. These units are essential for their digital asset mining segment, directly impacting operational capacity and profitability. The ongoing need to upgrade and maintain this hardware means technology and equipment procurement remains a consistently high-cost area for Ault Alliance.

Personnel and Administrative Expenses

Personnel and administrative expenses are a significant component of Ault Alliance's cost structure, encompassing salaries, benefits, and various overheads necessary to manage its diverse portfolio of subsidiaries. These costs are inherent to operating a holding company with multiple business units, each requiring dedicated support functions.

As of the first quarter of 2024, Ault Alliance reported total operating expenses of $25.6 million. While specific figures for personnel and administrative costs are not broken out separately in all public filings, these categories represent a substantial portion of that total. The company has been actively pursuing strategies to streamline operations and improve efficiency.

In line with its strategic initiatives, Ault Alliance has been focused on reducing headcount and optimizing its administrative functions. These efforts aim to lower payroll expenses and associated costs, thereby improving the company's overall profitability and financial health. For instance, in 2023, the company completed several restructuring initiatives designed to consolidate operations and eliminate redundancies.

- Salaries and Wages: Direct compensation for employees across all subsidiaries and corporate functions.

- Employee Benefits: Costs associated with health insurance, retirement plans, and other employee welfare programs.

- Administrative Overhead: Includes rent, utilities, office supplies, legal fees, and other general operating expenses.

- Restructuring Costs: Expenses incurred during workforce reductions or operational consolidations to improve efficiency.

Financing and Debt Servicing Costs

Financing and debt servicing costs are a significant component of Ault Alliance's cost structure, particularly as the company pursues its expansion strategies. These costs directly reflect the interest paid on borrowed funds and any associated fees for managing debt.

For instance, in the first quarter of 2024, Ault Alliance reported interest expense of $4.3 million. This figure highlights the ongoing financial commitment required to service its debt obligations, which are crucial for funding its growth initiatives.

- Interest Expense: The primary cost related to debt is the interest paid on outstanding loans and credit facilities.

- Debt Management Fees: Additional costs can include fees for loan origination, commitment fees, or other administrative charges associated with borrowing.

- Impact on Profitability: Higher debt levels directly increase these financing costs, potentially impacting the company's net income and overall profitability.

Ault Alliance's cost structure is dominated by significant capital expenditures for data center infrastructure and Bitcoin mining equipment, alongside substantial operational costs for energy. In Q1 2024, the company's capital expenditures were $10.8 million, largely for AI data center assets. Energy costs, particularly for Bitcoin mining, are a major expense, with approximately $10.5 million incurred in 2023 for this segment.

Personnel and administrative expenses, including salaries and overhead, also form a considerable part of the cost base. In Q1 2024, total operating expenses reached $25.6 million, with these categories representing a significant portion. Financing costs are also notable, with $4.3 million in interest expense reported in Q1 2024, reflecting the company's debt servicing obligations for growth initiatives.

| Cost Category | Q1 2024 (Approximate) | 2023 (Approximate) | Key Drivers |

|---|---|---|---|

| Capital Expenditures (Data Centers/AI) | $10.8 million | N/A | Property, construction, hardware (e.g., NVIDIA servers) |

| Energy Costs (Bitcoin Mining) | N/A | $10.5 million | Electricity consumption for mining rigs |

| Total Operating Expenses | $25.6 million | N/A | Personnel, administration, utilities, maintenance |

| Interest Expense (Financing) | $4.3 million | N/A | Debt servicing on loans and credit facilities |

Revenue Streams

Ault Alliance generates revenue by offering colocation and hosting services in its data centers, a key area of growth for the company. These services are crucial for supporting AI ecosystems and various other industries requiring robust digital infrastructure. For instance, in 2024, the company has been actively expanding its data center footprint, recognizing the increasing demand from businesses needing reliable and secure environments for their computing needs.

Ault Alliance's Bitcoin mining operations generate revenue directly from successfully mining new Bitcoin. This income stream is inherently volatile, fluctuating with both the quantity of Bitcoin mined and its prevailing market price. For instance, in the first quarter of 2024, Ault Alliance reported that its Bitcoin mining segment contributed $1.3 million in revenue, showcasing the direct impact of mining success and market conditions on this crucial revenue stream.

Ault Alliance generates revenue from a diverse portfolio of subsidiary operations. These include businesses focused on power solutions, defense, and various technology sectors, alongside a significant crane rental operation. This multi-faceted approach diversifies income and mitigates risk across different economic environments.

For instance, in the first quarter of 2024, Ault Alliance reported total revenues of $13.1 million. A substantial portion of this revenue is driven by its energy-related segments, highlighting the importance of these operations to the company's overall financial performance.

Real Estate and Hospitality Income

Historically, Ault Alliance generated revenue from its hotel and commercial real estate holdings. This segment was a significant contributor to the company's income. For instance, in 2023, the company reported that its real estate segment contributed a portion of its overall revenue, though specific figures for this segment alone are often consolidated.

However, the company has been actively divesting these assets. This strategic shift means that future revenue streams from this sector are expected to diminish as the portfolio is reduced. The divestment strategy aims to streamline operations and focus on other core business areas.

- Historical Revenue Source: Income derived from owned hotels and commercial properties.

- Strategic Divestment: Ongoing sale of these real estate assets.

- Impact on Future Revenue: Expected decrease in income from this segment due to asset sales.

Private Credit and Structured Finance

Ault Alliance generates revenue from its licensed lending subsidiary by offering private credit and structured finance solutions. These services are tailored to meet the specific needs of entrepreneurial businesses seeking capital.

The company's focus on private credit allows it to provide flexible financing options outside of traditional banking channels. Structured finance involves packaging various financial assets into new securities, which can then be sold to investors. This dual approach diversifies revenue streams and caters to a broader client base.

- Private Credit: Direct lending to businesses, often for growth, acquisitions, or working capital.

- Structured Finance: Creating and distributing complex financial products based on underlying assets.

- Target Market: Primarily entrepreneurial businesses requiring bespoke financing solutions.

- Revenue Generation: Interest income, fees, and potential equity participation in financed deals.

Ault Alliance's revenue streams are diverse, encompassing data center colocation and hosting, Bitcoin mining, and income from a portfolio of subsidiaries in power solutions, defense, and technology. The company is also strategically divesting its hotel and commercial real estate holdings, which historically contributed to revenue but are expected to decrease as assets are sold. Additionally, a licensed lending subsidiary generates income through private credit and structured finance solutions for businesses.

| Revenue Stream | Description | 2024 Data/Notes |

|---|---|---|

| Data Center Services | Colocation and hosting for AI and digital infrastructure | Active expansion of data center footprint in 2024 to meet demand. |

| Bitcoin Mining | Revenue from mining new Bitcoin | Q1 2024 revenue of $1.3 million reported from this segment. |

| Subsidiary Operations | Diversified income from power, defense, technology, and crane rental businesses | Key contributor to overall revenue, with energy segments being significant. |

| Real Estate Holdings | Income from hotels and commercial properties | Strategic divestment ongoing; future revenue from this segment expected to decline. |

| Lending Subsidiary | Private credit and structured finance for businesses | Provides flexible financing solutions outside traditional banking. |

Business Model Canvas Data Sources

The Ault Alliance Business Model Canvas is built upon a foundation of robust financial statements, comprehensive market research reports, and internal strategic planning documents. These diverse data sources ensure each component of the canvas is informed by accurate, actionable intelligence.