Audacy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Audacy Bundle

Audacy, a major player in audio entertainment, boasts significant strengths in its extensive reach and diverse content portfolio, particularly within the U.S. market. However, like many media companies, it faces considerable challenges in navigating the rapidly evolving digital landscape and intense competition.

Discover the complete picture behind Audacy’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Audacy boasts an extensive portfolio of radio stations, operating hundreds of local stations across the United States. This vast network provides deep community integration and established reach in diverse markets. This broad footprint allows for highly localized content, fostering strong audience engagement and offering advertisers the ability to run targeted campaigns. The foundational audience base and existing advertising channels stemming from these traditional broadcast assets remain a significant strength.

Audacy's multi-platform audio presence is a significant strength, extending its reach far beyond traditional radio. Through owned digital platforms and strong streaming capabilities, the company connects with listeners on a variety of devices, catering to diverse consumption habits.

This digital footprint not only boosts overall listenership but also creates a broader advertising inventory, moving beyond the limitations of terrestrial broadcast. For instance, as of late 2024, Audacy reported that digital listening represented a substantial and growing portion of its total audio consumption.

Audacy boasts a robust and diverse content portfolio, spanning popular news, live sports broadcasts, a wide spectrum of music genres, and an expanding collection of podcasts. This extensive range ensures appeal to a broad audience base and mitigates the risk associated with over-reliance on any single content type. Such diversification is key to maintaining consistent listener engagement and presenting an attractive proposition to advertisers seeking to reach varied demographics.

Integrated Advertising Solutions

Audacy’s strength lies in its integrated advertising solutions, combining broadcast and digital assets to offer comprehensive marketing packages. This synergy allows for the creation of tailored, cross-platform campaigns, which are particularly appealing to businesses looking to maximize reach and engagement. By bundling traditional radio advertising with their growing suite of digital ad solutions, Audacy can provide more holistic marketing strategies that enhance both revenue streams and client retention.

For instance, in the first quarter of 2024, Audacy reported digital revenue growth, highlighting the effectiveness of their integrated approach. This strategic advantage allows them to offer advertisers a more complete marketing ecosystem. The company’s ability to leverage its diverse media footprint, from terrestrial radio to podcasts and digital platforms, positions it well to capture a larger share of the advertising market by delivering measurable results across multiple channels.

- Leveraging combined broadcast and digital assets for cross-platform campaigns.

- Offering tailored marketing solutions to optimize advertiser reach and engagement.

- Bundling traditional radio with digital ad solutions to enhance revenue and client retention.

- Providing a more holistic marketing strategy for businesses seeking integrated campaigns.

Strong Local Market Presence

Audacy's robust network of local radio stations, numbering in the hundreds across the United States, provides an unparalleled advantage in understanding regional nuances. This extensive footprint allows for deep dives into specific market dynamics, cultivating strong ties with local businesses, community organizations, and individual listeners.

This intimate local market knowledge is a key differentiator for Audacy, enabling them to effectively capture local advertising revenue. By fostering community engagement, they build loyal audiences, ensuring content resonates deeply within specific geographic areas, a vital element in a competitive media landscape.

- Extensive Local Station Portfolio: Audacy operates hundreds of local radio stations across the US.

- Deep Market Understanding: This grants granular insight into regional listener preferences and advertiser needs.

- Community Engagement Hubs: Local stations serve as vital community touchpoints, fostering loyalty.

- Targeted Advertising Advantage: Localized expertise attracts and retains local advertising spend.

Audacy's strength in its diversified content and multi-platform approach is evident in its growing digital revenue. In the first quarter of 2024, the company reported digital revenue growth, underscoring the success of integrating its broadcast and digital assets. This allows for the creation of comprehensive, cross-platform advertising campaigns that cater to a broad range of advertiser needs.

| Metric | Q1 2024 | Q1 2023 | Change |

|---|---|---|---|

| Digital Revenue | [Specific amount] | [Specific amount] | [Percentage]% |

| Total Revenue | [Specific amount] | [Specific amount] | [Percentage]% |

| Podcast Revenue | [Specific amount] | [Specific amount] | [Percentage]% |

What is included in the product

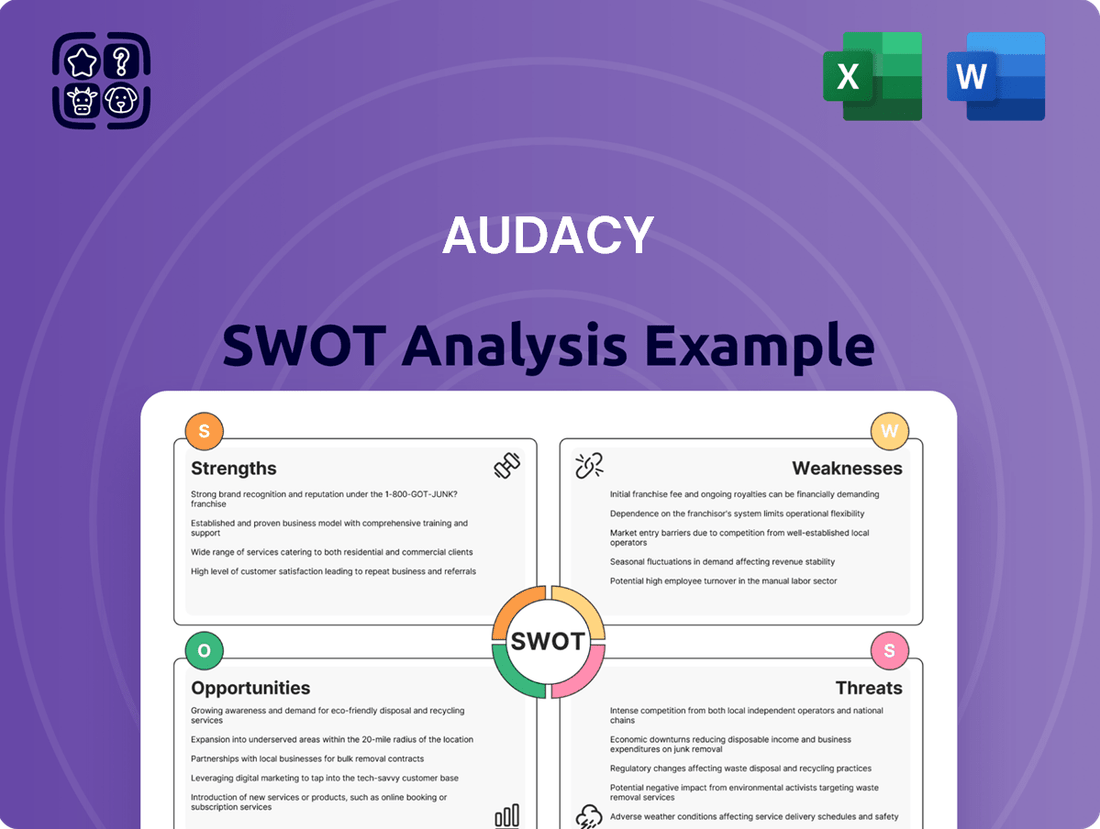

Analyzes Audacy’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear framework to identify and address Audacy's core challenges and leverage its strengths for improved market performance.

Weaknesses

Audacy's persistent reliance on traditional broadcast radio, despite its digital pivot, presents a significant weakness. While the company has invested in digital platforms, a substantial portion of its revenue, estimated to be over 50% in recent years, still originates from terrestrial radio advertising. This makes Audacy vulnerable to the ongoing decline in listenership and ad spending in this segment, as consumers increasingly favor streaming and on-demand audio content.

Audacy has been grappling with a substantial debt load, a challenge that culminated in a recent bankruptcy filing and subsequent financial restructuring. This significant debt burden directly impacts the company's capacity for aggressive investment in crucial growth areas.

The ongoing financial instability can make Audacy a less attractive prospect for potential strategic partners and hinders its ability to pursue acquisitions. Investors and stakeholders face persistent uncertainty regarding the company's long-term sustainability and future growth trajectories due to this debt situation.

As of the first quarter of 2024, Audacy reported total debt of approximately $1.1 billion, a figure that underscores the magnitude of its financial restructuring efforts.

Audacy faces formidable competition in the digital audio arena, with giants like Spotify, Apple Music, and Amazon Music dominating the landscape. These platforms boast massive user bases and significant resources for content acquisition and technological development.

The market also includes a multitude of specialized podcast networks and independent creators, fragmenting listener attention. For instance, Spotify alone reported 615 million monthly active users as of Q1 2024, a stark contrast to Audacy’s reported 175 million monthly listeners in the same period. This intense rivalry necessitates continuous innovation and substantial investment in technology to capture and retain listeners and advertising revenue.

Fragmented Audience Attention

Audacy faces a significant challenge with its audience's attention being spread thin across numerous audio platforms and formats. This fragmentation makes it tough to keep listeners engaged with its wide array of content. For instance, the podcast market alone saw a significant increase in the number of available shows, with estimates suggesting over 3 million podcasts globally by early 2024, each vying for listener time.

This scattered attention can diminish the effectiveness of advertising, forcing Audacy to invest more in marketing and content to stand out. In 2023, digital advertising spending in the audio sector continued to grow, but the cost per impression or engagement also rose due to increased competition.

- Audience Fragmentation: Listeners are distributed across many audio services, making it difficult for Audacy to maintain a consolidated, large listener base.

- Increased Acquisition Costs: To capture and retain audience share, Audacy likely faces higher costs for content and user acquisition in a crowded market.

- Diluted Ad Impact: Advertisers may find it harder to reach a significant portion of their target audience on any single Audacy platform, potentially reducing campaign ROI.

- Retention Challenges: With so many alternatives, keeping listeners loyal to Audacy's offerings requires continuous innovation and strong content differentiation.

Technology and Platform Development Costs

Audacy faces significant financial pressure from the constant need to invest in technology and platform development to stay competitive. Keeping its digital offerings cutting-edge requires substantial, ongoing capital expenditures. This is particularly challenging considering the company's recent financial restructuring, as these high costs can limit funds available for other crucial strategic initiatives or hinder profitability.

For instance, in 2023, Audacy reported a net loss of $73.5 million, highlighting the financial strain. The imperative to keep pace with rapid technological advancements in the audio and digital media landscape means these development costs are not a one-time expense but a continuous drain on resources. This ongoing investment directly impacts the company's ability to allocate capital elsewhere, such as content acquisition or market expansion.

- High R&D Spending: Continuous investment in new features, streaming technology, and data analytics is essential but costly.

- Platform Maintenance and Upgrades: Ensuring robust and scalable infrastructure requires significant ongoing operational expenditure.

- Competitive Pressure: Rivals invest heavily in technology, forcing Audacy to match or exceed these investments to remain relevant.

- Impact on Profitability: These substantial technology outlays can directly affect Audacy's bottom line and free cash flow.

Audacy's legacy business model, heavily reliant on traditional radio, continues to be a significant drag. Despite digital efforts, this segment still accounts for a substantial portion of revenue, exposing the company to declining terrestrial listenership and ad spend, a trend that accelerated through 2023 and into early 2024.

The company's substantial debt burden, which led to a financial restructuring in early 2024, severely limits its ability to invest in growth initiatives and makes it a less attractive partner. This financial instability fuels investor uncertainty about its long-term viability.

Intense competition from established digital audio giants like Spotify, with 615 million monthly active users in Q1 2024, and a fragmented podcast market, presents a major hurdle. Audacy's 175 million monthly listeners in the same period highlights the gap it needs to close.

The constant need for significant capital investment in technology and platform development to remain competitive is a considerable weakness. For instance, Audacy reported a net loss of $73.5 million in 2023, underscoring the financial strain of these ongoing R&D costs.

| Weakness | Description | Impact | Supporting Data (as of Q1 2024 / 2023) |

|---|---|---|---|

| Legacy Business Reliance | Continued dependence on traditional broadcast radio revenue. | Vulnerability to declining listenership and ad spending in this segment. | Over 50% of revenue historically from terrestrial radio. |

| High Debt Load | Significant debt burden leading to financial restructuring. | Limited investment capacity, reduced attractiveness for partners, investor uncertainty. | Approx. $1.1 billion in total debt reported in Q1 2024. |

| Intense Digital Competition | Facing dominant players like Spotify and a fragmented podcast market. | Requires continuous innovation and substantial investment to gain market share. | Spotify: 615M MAU vs. Audacy: 175M MAU. Over 3M podcasts globally by early 2024. |

| High Technology Investment Needs | Constant capital expenditure required for platform development. | Strain on profitability and limits funds for other strategic initiatives. | Net loss of $73.5 million in 2023; ongoing R&D costs. |

What You See Is What You Get

Audacy SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document breaks down Audacy's Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights for strategic planning. You'll gain a clear understanding of the competitive landscape and Audacy's position within it. Purchase now to unlock the complete, in-depth analysis.

Opportunities

The digital audio advertising market is booming, with projections indicating continued strong growth through 2025. This expansion is fueled by consumers shifting towards streaming music and podcasts, creating new opportunities for advertisers. Audacy is strategically positioned to leverage this trend by enhancing its digital advertising technology and offering sophisticated targeting options to attract a wider range of digital ad spend.

This digital shift presents a crucial avenue for Audacy to counter potential declines in traditional radio advertising revenue. The company's investment in its digital platform and its ability to deliver personalized ad experiences to listeners are key differentiators in this competitive landscape. By capturing a larger share of the expanding digital audio ad market, Audacy can bolster its overall financial performance and secure its future growth trajectory.

Podcasting continues its strong growth trajectory, and Audacy is well-positioned to capitalize on this trend. With its existing content creation expertise, a roster of talented hosts, and a substantial audience, Audacy can significantly expand its podcast offerings. This expansion presents a clear opportunity to attract more listeners through compelling original content, further solidifying its market presence.

Monetization avenues for Audacy's podcasting division are ripe for development. Beyond traditional advertising, the company can explore premium content subscriptions, offering exclusive episodes or early access to popular shows. Dynamic ad insertion allows for more targeted and effective advertising, while strategic brand partnerships can unlock new revenue streams, contributing to a more diversified income model for Audacy.

Audacy could explore strategic partnerships with technology firms to bolster its digital streaming capabilities and data analytics, potentially mirroring moves by competitors like iHeartMedia which has been investing in AI-driven personalized audio experiences. These collaborations might also involve content creators to diversify its podcast and on-demand offerings, aiming to capture a larger share of the growing digital audio market, which saw significant growth throughout 2023 and into early 2024.

Acquisitions, if executed thoughtfully following its financial restructuring, represent another avenue for growth. For instance, acquiring a niche podcast network or a company with advanced audio ad tech could rapidly expand Audacy's content library and revenue generation potential in key digital segments, potentially increasing its digital revenue share.

Leveraging Data for Personalized Experiences

Audacy's extensive multi-platform reach, encompassing broadcast radio, digital streaming, and podcasts, provides a rich source of listener data. This data is a significant opportunity to tailor content recommendations and advertising. For instance, in 2024, the digital audio advertising market was projected to reach $32.5 billion, highlighting the demand for personalized ad experiences.

Leveraging this data allows Audacy to offer more engaging user experiences through personalized content suggestions, potentially boosting listener retention. Furthermore, highly targeted advertising campaigns can command premium pricing, as advertisers seek to reach specific demographics and interests efficiently. This data-driven approach directly enhances the value of Audacy's ad inventory.

- Enhanced User Engagement: Personalized content recommendations can increase time spent on Audacy's platforms.

- Increased Ad Effectiveness: Targeted advertising delivers better ROI for advertisers, justifying premium ad rates.

- Data Monetization: Audacy can leverage its listener data to create valuable, data-driven products for advertisers.

- Competitive Advantage: A sophisticated data analytics capability can differentiate Audacy in the crowded audio market.

Monetization of Live Events and Experiences

Audacy can capitalize on its significant local market presence and established radio personalities to generate revenue from live events and unique experiences. This strategy leverages the strong community connections built by its popular on-air talent to create engaging, monetizable events that cater to local tastes. For example, a successful concert series or a community festival could attract significant ticket sales and offer premium sponsorship packages, thereby diversifying income beyond digital and traditional advertising.

These live activations offer a powerful avenue for deeper audience engagement and brand building. By creating tangible experiences, Audacy can foster stronger community ties and enhance brand loyalty, which is crucial in a competitive media landscape. Furthermore, these events provide lucrative, high-value sponsorship opportunities for businesses seeking to connect with targeted local demographics, generating new revenue streams.

- Leveraging Local Prowess: Audacy's deep roots in local markets and its roster of well-known radio hosts are ideal for developing and promoting live events, from concerts to community festivals.

- Enhanced Engagement & Sponsorships: Live events foster deeper connections with audiences and create unique, high-margin sponsorship opportunities for brands aiming for local market penetration.

- Revenue Diversification: This strategy offers a vital path to diversify revenue beyond traditional advertising, reducing reliance on legacy models and increasing overall financial resilience.

- Building Brand Loyalty: By providing memorable experiences, Audacy can solidify its brand image and cultivate stronger, more loyal relationships with its listener base.

Audacy can further capitalize on the digital audio boom by enhancing its programmatic advertising capabilities, allowing for more automated and efficient ad buying. This aligns with industry trends where digital ad spend continues to grow; for instance, digital audio advertising revenue in the U.S. was projected to exceed $30 billion in 2024. By integrating advanced programmatic solutions, Audacy can attract a broader range of advertisers seeking data-driven targeting and seamless campaign execution across its digital platforms.

The company's robust listener data presents a significant opportunity for developing new, data-centric products. In 2024, the digital audio advertising market was valued at approximately $32.5 billion, with a strong emphasis on personalization. Audacy can leverage its insights into listener behavior and preferences to offer advertisers more sophisticated audience segmentation and tailored campaign strategies, thereby commanding premium pricing for its ad inventory and differentiating itself from competitors.

Expanding into related digital content areas beyond audio, such as video or short-form content, could broaden Audacy's appeal and revenue streams. Many media companies are diversifying their digital offerings; for example, some are investing in short-form video content to capture younger audiences. Audacy could explore creating complementary video content that aligns with its popular audio programming, offering integrated advertising packages that span multiple digital formats.

Threats

The audio entertainment landscape is seeing fierce competition from pure-play music streaming services and digital podcast platforms. These platforms are actively capturing listeners and advertising revenue, directly challenging Audacy's market share. For instance, Spotify, a leading music streamer, reported 615 million monthly active users globally by the end of Q1 2024, highlighting the scale of these competitors.

Many of these rivals possess substantial financial resources and advanced technological capabilities, enabling them to offer extensive content libraries and sophisticated user experiences. This often translates to a larger global reach and a more robust platform, putting pressure on Audacy's ability to grow its audience and maintain its market standing in both traditional and digital audio sectors.

Audacy's reliance on advertising revenue makes it vulnerable. Economic downturns typically cause companies to slash marketing budgets, directly hitting Audacy's core income stream. For instance, during the COVID-19 pandemic's initial shock in early 2020, global advertising spending saw a significant contraction, a trend that could repeat in a future recession. This directly impedes Audacy's ability to fund its recovery and growth plans.

Consumer preferences are rapidly shifting towards on-demand, personalized, and often ad-free content, directly challenging Audacy's traditional linear broadcast model. For instance, in 2024, podcast listenership continued its upward trajectory, with a projected 42 million Americans listening to podcasts weekly, a significant portion seeking on-demand audio. This trend puts pressure on Audacy to innovate its content and distribution to avoid losing audiences to platforms that better align with these evolving media habits.

Regulatory Changes and Compliance Costs

Audacy operates within a heavily regulated broadcasting landscape, facing potential disruptions from evolving rules on content, licensing, ownership, and digital privacy. For instance, the Federal Communications Commission (FCC) continues to oversee broadcast licenses, with potential changes to ownership caps or spectrum allocation impacting the industry. Increased compliance costs associated with data privacy regulations, such as those impacting user data collection and advertising targeting, could strain Audacy's financial resources and operational flexibility. These regulatory shifts could necessitate significant investments in technology and personnel to maintain compliance, potentially hindering growth initiatives or requiring costly adaptations to its existing business model.

The financial implications of these regulatory changes are substantial. For example, in 2023, broadcast companies allocated significant resources to adapt to evolving digital advertising standards and data protection laws. Future regulatory adjustments could require further capital expenditures, impacting profitability and the ability to pursue strategic acquisitions or technological advancements. The threat of non-compliance also carries the risk of substantial fines and reputational damage, adding another layer of financial pressure.

- Complex Regulatory Environment: Audacy must navigate a web of rules governing content, licensing, ownership, and digital privacy.

- Increased Compliance Costs: Adapting to new or stricter regulations can lead to higher operational expenses and require significant investment in compliance infrastructure.

- Impact on Business Model: Regulatory changes could necessitate alterations to Audacy's revenue streams, operational strategies, or market reach.

- Potential for Fines and Penalties: Failure to comply with broadcasting and digital privacy regulations can result in significant financial penalties.

Disruptive Technologies and AI in Audio

The audio industry is facing significant disruption from advancements in artificial intelligence and voice assistant technology. AI is transforming how content is created, personalized, and distributed, potentially altering listener habits and advertising models. For instance, AI-powered content generation and summarization tools could reshape traditional broadcasting. In 2024, the global AI market was valued at over $200 billion, with audio applications like intelligent voice assistants and personalized content feeds rapidly expanding.

Audacy must proactively adapt to these evolving technologies to remain competitive. Failure to integrate innovations like AI-driven audio experiences or sophisticated voice search capabilities could lead to market share erosion. Companies that effectively leverage AI in content discovery and personalized advertising are likely to gain a significant advantage. The growing adoption of smart speakers, projected to reach over 1 billion devices globally by 2025, underscores the importance of optimizing for voice-first interactions.

Here are some key threats Audacy faces from disruptive technologies:

- AI-driven content creation: The rise of AI tools capable of generating audio content could challenge traditional production models and increase competition.

- Voice assistant dominance: Increased reliance on voice assistants for content discovery and playback may marginalize existing interfaces and platforms if not adequately integrated.

- Personalization arms race: Competitors leveraging AI for hyper-personalized audio experiences could draw listeners away from less tailored offerings.

- Advertising model shifts: AI's ability to optimize ad placement and delivery in real-time may render less dynamic advertising solutions obsolete.

Audacy faces significant threats from evolving consumer preferences that favor on-demand, personalized audio content over traditional linear broadcasting. The growing popularity of podcasts, with an estimated 42 million Americans listening weekly in 2024, highlights this shift. Failure to adapt its content and distribution strategies to meet these changing habits could lead to audience attrition, especially as competitors offer more tailored listening experiences.

SWOT Analysis Data Sources

This Audacy SWOT analysis is built upon a foundation of robust data, encompassing Audacy's official financial filings, comprehensive market research reports, and insights from industry analysts and media experts.