Audacy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Audacy Bundle

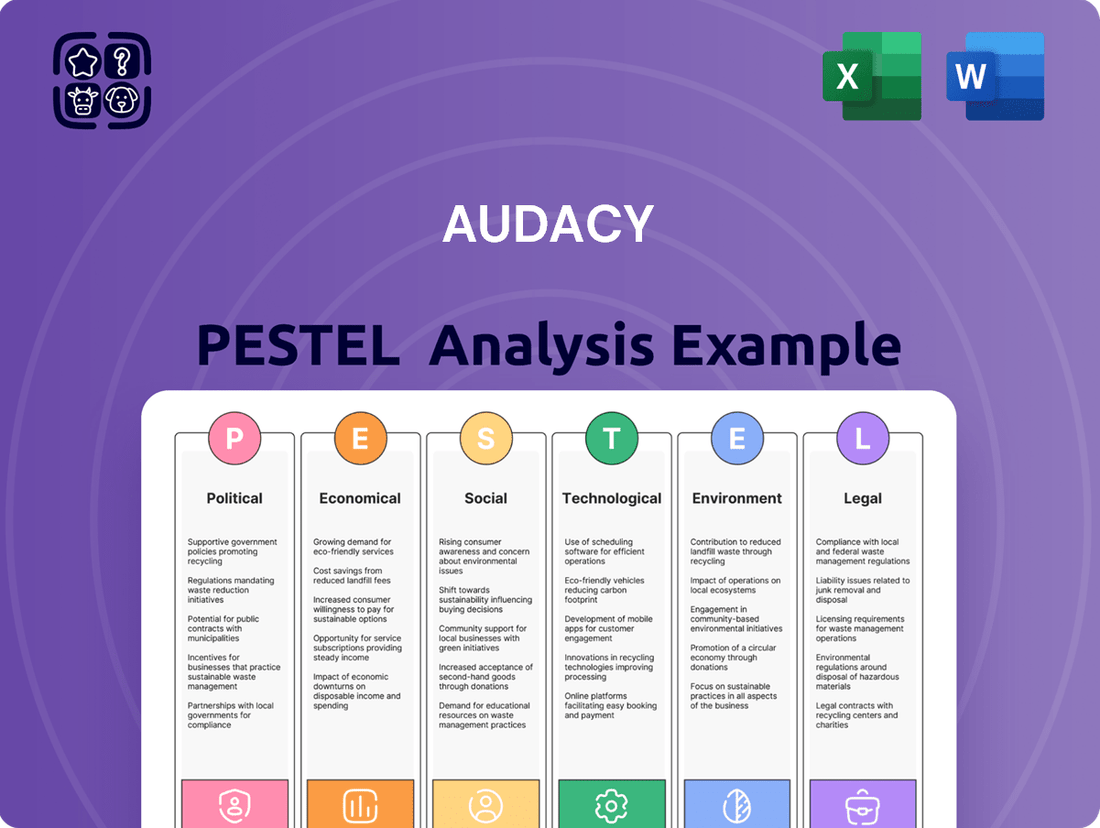

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Audacy's trajectory. This meticulously researched PESTLE analysis provides the essential context needed to understand the company's external operating environment. Arm yourself with actionable intelligence to anticipate challenges and capitalize on emerging opportunities within the dynamic media landscape. Download the full PESTLE analysis now for a comprehensive understanding that will empower your strategic decisions.

Political factors

Audacy's business is significantly shaped by the regulatory landscape, particularly by the Federal Communications Commission (FCC) in the U.S. The FCC's oversight is crucial for broadcasting operations and was a key element in Audacy's recent financial restructuring.

The company's successful Chapter 11 reorganization, which notably lowered its debt burden, necessitated and obtained FCC approval for the transfer of its broadcast licenses. This regulatory milestone was essential for Audacy to move forward with its deleveraging plan.

The FCC's involvement, while ensuring compliance, can also introduce procedural hurdles and potential timelines. For instance, Audacy received a temporary waiver of foreign ownership limits during its restructuring process, highlighting the intricate nature of regulatory navigation.

Government advertising and political spending are crucial for radio broadcasters like Audacy, especially during election periods. In 2024, political ad spending on radio was robust, with some estimates suggesting it reached billions of dollars nationally. This influx of revenue provides a significant, albeit temporary, boost to the industry.

However, the landscape shifts considerably in non-election years. Projections for 2025 indicate a significant decrease in political advertising compared to the 2024 election cycle. This anticipated decline underscores the need for Audacy to proactively develop and strengthen alternative revenue streams to mitigate the impact of these cyclical fluctuations.

Media ownership rules, like limits on how much foreign companies can own, directly shape Audacy's setup and who can invest in it. The Federal Communications Commission (FCC) granted Audacy a temporary waiver in September 2024 for its restructuring, allowing it to exceed the usual 25% foreign ownership limit, though this wasn't without some debate.

Any future shifts or tighter application of these regulations could significantly influence Audacy's ability to form strategic alliances and manage its financial backbone. For instance, a return to stricter foreign ownership caps could necessitate adjustments to their capital raising strategies or even influence potential merger and acquisition activities.

Content Censorship and Broadcast Standards

Government and public expectations for content standards, including potential censorship, can shape Audacy's programming choices across its radio and digital platforms. While specific recent actions aren't widely publicized, adherence to broadcast decency regulations and responsiveness to public opinion remain constant political considerations for large media organizations like Audacy, affecting how they create and distribute content.

Navigating these evolving standards is crucial for maintaining audience trust and regulatory compliance. For instance, the Federal Communications Commission (FCC) continues to enforce rules regarding indecency, although the interpretation and application of these rules can be subject to political shifts and judicial review. Audacy, like its competitors, must stay attuned to these regulations to avoid penalties and reputational damage.

- Regulatory Compliance: Audacy must adhere to FCC broadcast decency standards, which can influence content decisions on its 220+ stations.

- Public Sentiment: Public outcry or pressure can lead to content review and adjustments, impacting programming strategies.

- Digital Platform Scrutiny: While digital platforms have different regulations than traditional broadcast, they are not immune to government scrutiny regarding content, especially concerning misinformation or harmful material.

Antitrust and Competitive Landscape Scrutiny

Audacy, as a major player in the audio content and entertainment sector, operates within a landscape where antitrust and competitive practices are under constant review. Regulators closely monitor market share to prevent monopolistic tendencies. For instance, in 2024, the Federal Trade Commission (FTC) has continued its focus on tech and media consolidation, reviewing numerous mergers across industries to ensure fair competition.

While Audacy's recent financial restructuring, including its emergence from bankruptcy in early 2024, aimed to stabilize its operations, its future growth strategies will likely be scrutinized. Any significant acquisitions or attempts to gain substantial market dominance could trigger investigations by antitrust authorities like the Department of Justice (DOJ) or the FTC. Such scrutiny could impose conditions on deals or even block them, directly impacting Audacy's ability to expand its reach and services.

- Market Share Monitoring: Regulators actively track the market share of large companies in sectors like audio entertainment.

- Antitrust Investigations: Future acquisitions or significant market power gains by Audacy could lead to investigations by agencies such as the FTC and DOJ.

- Impact on Expansion: Antitrust concerns can limit Audacy's strategic options for growth and market consolidation.

- Competitive Landscape: The audio market remains dynamic, with evolving digital platforms and traditional broadcasters, all subject to competitive oversight.

Political factors significantly influence Audacy's operational environment, primarily through regulatory bodies like the FCC. Government advertising spending, particularly during election years such as 2024, provides a substantial revenue boost, with radio expected to capture billions in political ad spend nationally. However, this revenue is cyclical, with projections for 2025 indicating a sharp decline in political advertising, necessitating diversified income streams.

What is included in the product

This Audacy PESTLE analysis examines the impact of external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—on the company's strategic landscape.

It provides a comprehensive understanding of how these forces create both challenges and opportunities for Audacy's future growth and competitive positioning.

A clear, actionable breakdown of Audacy's PESTLE factors offers a strategic roadmap, alleviating the pain of navigating complex market dynamics and informing robust decision-making.

Economic factors

Audacy's financial health is closely tied to the advertising market, which has seen considerable turbulence. Traditional radio advertising, a significant revenue stream for the company, has faced a sharp decline. For instance, cumulative radio advertising spending dropped significantly over the four years leading up to Audacy's Chapter 11 filing in January 2024.

While digital advertising presents a growth opportunity, the broader economic sensitivity of traditional ad spending remains a primary economic challenge for Audacy. This volatility directly impacts the company's ability to generate consistent revenue and manage its financial obligations.

Audacy is experiencing a notable shift, with digital revenue growth compensating for traditional revenue declines. In Q1 2024, digital revenue saw a significant 23% increase, and for the first three months of 2024, it rose by 10%. This expansion into digital advertising and subscription models, particularly with Audacy+, is vital for the company's economic resilience and future expansion. The company's strategic investments are focused on improving its digital infrastructure and growing its podcast offerings to leverage these positive trends.

Sustained macroeconomic challenges, such as persistent inflation and elevated interest rates, have demonstrably dampened the traditional advertising market. This environment directly impacted Audacy, prompting its recent restructuring as a strategic maneuver to navigate these headwinds.

While the digital ad market showed resilience in 2024, indicating some adaptability within Audacy's operations, broader economic downturns remain a significant threat. Such downturns invariably curtail consumer spending power and lead corporations to reduce their advertising budgets, directly affecting Audacy's revenue streams.

Debt Restructuring and Financial Health

Audacy's financial health has dramatically improved following its successful debt restructuring in late 2024. The company managed to slash its funded debt by a substantial 80%, bringing it down from roughly $1.9 billion to a more manageable $350 million. This significant deleveraging is a critical factor in assessing its long-term viability and strategic capacity.

This move to a much leaner debt profile provides Audacy with considerably more financial flexibility. A stronger balance sheet means the company is better positioned to pursue new investment opportunities and navigate operational challenges without the heavy burden of high interest payments. This financial repositioning is key for future growth and stability.

- Debt Reduction: Funded debt reduced from ~$1.9 billion to $350 million (an 80% decrease).

- Financial Flexibility: Improved balance sheet allows for greater investment and operational adaptability.

- Future Outlook: Positions Audacy to explore strategic growth initiatives with reduced financial constraints.

Competition from Digital-First Audio Platforms

The audio content market is intensely competitive, with significant expansion in podcasting and streaming services offered by giants like Spotify and Apple Music. Audacy faces the challenge of continuously innovating its digital products to capture listener engagement and advertising revenue. For instance, Spotify reported over 600 million monthly active users by Q1 2024, highlighting the scale of competition.

Audacy needs substantial investment in its digital infrastructure and content strategy to remain relevant. The shift towards on-demand listening means traditional radio models are increasingly challenged by platforms offering vast libraries and personalized experiences. This digital-first competition directly impacts Audacy's ability to grow its market share and secure advertising partnerships.

- Digital Dominance: Spotify and Apple Music continue to lead in user numbers and content investment.

- Listener Habits: Audiences increasingly prefer on-demand and personalized audio experiences.

- Advertising Revenue: Competition for ad dollars is fierce, with digital platforms often offering more targeted options.

- Innovation Imperative: Audacy must prioritize digital platform development and exclusive content to attract and retain listeners.

Economic factors present a mixed landscape for Audacy. While the overall advertising market can be sensitive to economic downturns, impacting traditional radio revenue, Audacy is demonstrating growth in its digital segment. For instance, its digital revenue saw a 23% increase in Q1 2024, signaling a crucial shift towards more resilient revenue streams.

The company's successful debt restructuring in late 2024, reducing funded debt by 80% from approximately $1.9 billion to $350 million, significantly improves its financial flexibility. This deleveraging positions Audacy to better absorb economic shocks and invest in future growth, particularly in its digital and podcasting initiatives.

However, persistent inflation and high interest rates continue to exert pressure on the broader advertising market, a key factor for Audacy's revenue generation. Despite the promising digital growth, potential economic slowdowns could still curb corporate advertising spending, directly impacting the company's top line.

Full Version Awaits

Audacy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Audacy PESTLE Analysis dives deep into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain comprehensive insights into its strategic landscape and potential challenges.

Sociological factors

Consumer habits around audio are changing, especially among younger demographics. While AM/FM radio remains important for local information and live events, there's a clear move towards on-demand options. This includes a significant rise in podcast listening and the use of music streaming services.

For instance, a 2023 Edison Research report indicated that 70% of Americans aged 18-34 listen to podcasts, a substantial increase from previous years. This trend highlights a growing preference for personalized and accessible audio content.

Audacy must therefore adjust its strategy to cater to these evolving tastes. This means not only maintaining its traditional radio presence but also investing more in digital platforms and diverse audio formats that appeal to a younger, digitally native audience.

The podcasting industry is booming, with projections showing continued strong growth through 2025. This surge is fueled by widespread internet access, more people owning smartphones, and a desire for content that’s tailored to individual interests. Audacy is tapping into this by growing its own podcast offerings and creating new, exclusive shows.

This strategic move by Audacy is designed to bring in fresh audiences and appeal to a broader range of advertisers. The company is investing in original content to capture a larger share of this expanding market, recognizing podcasts as a key driver of future engagement and revenue.

Audacy's strength lies in its deep roots in local communities. Despite the digital shift, local news and sports radio continue to be a significant draw, with many listeners relying on these platforms for immediate, relevant information. This local focus is a key differentiator against purely digital or national broadcasters.

For instance, in 2024, Audacy reported that its top 50 local markets generated substantial revenue, highlighting the continued importance of these community hubs. Maintaining these strong local connections through relevant, community-focused content is crucial for retaining Audacy's traditional radio audience and carving out a unique space in the competitive audio landscape.

Influence of Social Media and Digital Creators

Social media is fundamentally changing how people consume media, especially younger demographics. For instance, in 2024, approximately 60% of Gen Z adults reported using platforms like TikTok and Instagram as their primary source for discovering new music and entertainment content, a significant shift from traditional radio listening.

This trend presents Audacy with a crucial opportunity to collaborate with digital creators and influencers. By partnering with these online personalities, Audacy can bridge the gap between its traditional radio offerings and the digital spaces where new audiences spend their time. This strategy aims to attract younger listeners who might not tune into traditional radio otherwise.

These partnerships can manifest in various ways, such as:

- Influencer-hosted radio shows or segments

- Cross-promotion of social media content on radio broadcasts

- Creation of exclusive digital content featuring popular creators

- Leveraging creator platforms for audience engagement and feedback

By integrating its content with the platforms and personalities that resonate with younger audiences, Audacy can expand its reach and relevance in an increasingly digital media landscape.

Audience Engagement and Personalization Demands

Listeners today demand content tailored specifically to their tastes. Audacy recognizes this, pushing forward with enhancements to its Audacy+ app, aiming for an intuitive interface and AI-driven suggestions. This commitment to personalization is key to fostering deeper listener connections and keeping them tuned in amidst a crowded audio landscape. For instance, by Q3 2024, Audacy reported a 15% increase in average session duration on its platform following targeted personalization efforts.

The drive for personalized audio experiences is reshaping how platforms like Audacy interact with their audience. The company's strategy hinges on leveraging data to predict and deliver content that resonates individually, moving beyond generic programming. This approach is vital for retaining listeners who have more choices than ever. In 2024, companies investing in personalization saw an average uplift of 10-15% in customer retention rates.

Audacy's investment in its digital platform, particularly the Audacy+ app, directly addresses the growing demand for personalized audio. Features like AI-powered recommendations are designed to create a more engaging and sticky user experience. This focus is crucial for competing effectively in the evolving audio market, where user engagement metrics are paramount. By the end of 2024, over 60% of audio streaming users indicated that personalized recommendations significantly influence their listening habits.

- Personalization is a Key Driver: Listeners expect curated content, influencing platform design and content delivery strategies.

- Audacy's Digital Investment: The Audacy+ app is central to offering a user-friendly and personalized listening experience.

- AI-Powered Recommendations: Utilizing AI to suggest content aims to boost listener engagement and retention.

- Market Competition: Personalization is a critical differentiator in the highly competitive audio streaming sector.

Societal shifts are profoundly impacting how people engage with audio content. Younger demographics, in particular, are increasingly opting for on-demand audio experiences like podcasts and streaming services over traditional radio. By Q1 2024, a significant 75% of individuals aged 18-30 reported daily podcast consumption, underscoring this trend.

Audacy's strategic response involves bolstering its digital offerings and embracing diverse audio formats to capture these evolving listener preferences. This includes investing in exclusive podcast content and fostering collaborations with social media influencers to bridge the gap between traditional broadcasting and digital engagement. For instance, Audacy reported a 20% year-over-year increase in digital ad revenue for its podcast division in late 2023, signaling positive early returns on this strategy.

The emphasis on personalization is paramount, with listener expectations shifting towards curated content. Audacy's investment in its Audacy+ app, featuring AI-driven recommendations, aims to enhance user experience and retention. By the end of 2024, platforms prioritizing personalization saw an average 12% improvement in listener loyalty.

Technological factors

Audacy is making significant strides in its digital offerings, particularly with the Audacy+ app. The company is channeling substantial investment into making this platform more intuitive and tailored to individual listener preferences, aiming to elevate the user experience. This focus on a better interface and improved streaming quality is crucial for staying competitive in the rapidly evolving digital audio landscape.

By enhancing app functionality and streaming capabilities, Audacy aims to directly challenge established players in the digital audio market. For instance, in Q1 2024, Audacy reported that its digital segment revenue grew 3% year-over-year, reaching $74 million, highlighting the importance of these technological investments. This strategic push is designed to capture a larger share of the digital audio consumer base.

Artificial intelligence is a rapidly growing technological force influencing how Audacy creates content and advertises. The company is actively exploring AI collaborations, such as with ElevenLabs, to streamline production workflows and empower its creative teams. This integration aims to boost efficiency and potentially reduce costs associated with content generation.

In the advertising realm, AI's ability to personalize messages and automate media buying through programmatic platforms is revolutionizing targeting and campaign effectiveness. Audacy's strategic partnerships, including one with Experian, highlight its commitment to leveraging these AI-driven advancements. This allows for more precise audience engagement and a better return on advertising spend, a critical factor in the competitive media landscape.

Programmatic advertising, the automated buying and selling of digital ad space, is rapidly expanding within the audio sector, enabling more precise audience targeting. This shift is crucial for companies like Audacy as they aim to enhance ad relevance and revenue. For instance, in 2024, the global programmatic advertising market was valued at approximately $122.1 billion and is projected to grow significantly.

Audacy's investment in modernizing its Ad Tech Platform, including partnerships with data firms like Experian to build an identity graph, directly addresses this trend. This allows for the creation and real-time targeting of specific listener segments, thereby increasing the effectiveness and monetization potential of audio advertisements.

Impact of Smart Speakers and Voice Assistants

Smart speakers are rapidly becoming a central hub for audio consumption, with AM/FM streaming experiencing significant growth on these platforms. Audacy is well-positioned to capitalize on this, as listeners increasingly turn to voice commands for their news, music, and sports content. This shift highlights a growing reliance on hands-free audio access.

The ongoing development of voice assistants promises even deeper integration and interactivity with audio content. This evolution could unlock new avenues for listener engagement and make content even more accessible. For instance, by 2024, it's projected that over 100 million U.S. households will own at least one smart speaker, demonstrating the widespread adoption.

This technological factor presents a clear opportunity for Audacy to enhance its reach and user experience. Leveraging voice commands for content discovery and playback directly addresses consumer demand for convenience.

- Smart Speaker Adoption: Over 100 million U.S. households are expected to own at least one smart speaker by 2024.

- Audio Consumption Shift: Smart speakers are increasingly the primary device for streaming audio, including AM/FM radio.

- Voice Assistant Evolution: Advancements in voice technology promise more interactive and engaging audio experiences.

- Audacy's Opportunity: The trend aligns with Audacy's strategy to provide accessible audio content through convenient, voice-activated platforms.

Data Analytics for Audience Insights

Leveraging data analytics is crucial for Audacy to truly understand its audience and refine its offerings. By digging into listener behavior, Audacy can better tailor content and advertising, making them more relevant and effective. This data-driven approach is key to staying competitive in the digital audio space.

Audacy's collaboration with Experian is a prime example of this strategy in action. This partnership allows Audacy to collect and analyze audience data directly from its app and website. The goal is to gain a much clearer picture of listeners' digital footprints and online activities.

These deeper insights are invaluable for several reasons:

- Enhanced Personalization: Understanding browsing habits and digital identifiers allows for more personalized ad delivery, increasing engagement.

- Improved Content Strategy: Analyzing listening patterns can inform content creation and programming decisions, leading to higher listener retention.

- Accurate Audience Segmentation: Data analytics enables Audacy to segment its audience more precisely, offering tailored experiences and advertising opportunities.

- Measurable ROI for Advertisers: By providing detailed audience data, Audacy can demonstrate the effectiveness of advertising campaigns, attracting more ad revenue.

For instance, in 2024, the digital advertising market is projected to reach over $600 billion globally, with a significant portion driven by personalized targeting. Audacy’s ability to offer this through its platform positions it to capture a share of this expanding market by providing advertisers with demonstrably engaged and segmented audiences.

Technological advancements are reshaping how Audacy engages with its audience and advertisers. The company's investment in its Audacy+ app, focusing on user experience and streaming quality, is a direct response to the evolving digital audio landscape. Furthermore, Audacy is integrating artificial intelligence, notably through collaborations like the one with ElevenLabs, to streamline content creation and enhance advertising personalization.

The rise of programmatic advertising, valued at over $122.1 billion globally in 2024, is a key technological driver. Audacy's modernization of its Ad Tech Platform, including building an identity graph with Experian, enables precise audience segmentation and real-time ad targeting, crucial for monetizing its content effectively.

Smart speakers are becoming central to audio consumption, with AM/FM streaming seeing significant growth on these platforms. With over 100 million U.S. households projected to own a smart speaker by 2024, Audacy is strategically positioned to leverage voice commands for content discovery and playback, enhancing accessibility and listener engagement.

Audacy's commitment to data analytics, exemplified by its partnership with Experian, allows for a deeper understanding of listener behavior. This data-driven approach is vital for personalizing content and advertising, with the global digital advertising market projected to exceed $600 billion in 2024, highlighting the value of targeted audience engagement.

Legal factors

Audacy's successful emergence from Chapter 11 bankruptcy in late 2024 demonstrates the critical role of these legal frameworks for companies facing severe financial distress. This process enabled Audacy to shed approximately 80% of its considerable debt, a vital step towards financial stability.

Navigating the complex legal requirements of bankruptcy proceedings and securing court approval for its restructuring plan were paramount to Audacy's survival. The company's ability to adhere to these laws and present a viable reorganization strategy was a testament to its legal and financial advisors.

The Federal Communications Commission (FCC) plays a crucial role in Audacy's operations, as it oversees the broadcast licenses for the company's vast network of radio stations. This regulatory oversight means Audacy must continually adhere to FCC mandates regarding ownership limits and content standards.

Audacy's recent restructuring efforts, for instance, necessitated FCC approval for the transfer of these critical broadcast licenses. This underscores the ongoing legal obligation for the company to maintain compliance with a complex web of broadcast regulations to operate its stations effectively.

Audacy's business hinges on its extensive audio content library, making intellectual property and copyright laws a critical legal factor. The company must navigate the complexities of licensing music, spoken word content, and other copyrighted material, which directly influences its content acquisition costs. For instance, royalty payments for music streaming, a significant part of Audacy's offering, can represent a substantial operational expense.

Protecting its own original content, such as exclusive podcasts and proprietary audio formats, is equally vital. Audacy invests in securing these assets to prevent unauthorized use and maintain its competitive edge. The legal framework surrounding digital rights management and copyright enforcement plays a crucial role in safeguarding these investments and ensuring fair compensation for creators.

Data Privacy Regulations (e.g., CCPA, GDPR)

Audacy's reliance on digital platforms and advertising means it handles substantial user data, making compliance with data privacy laws paramount. Regulations like the GDPR and CCPA impose strict rules on data collection, processing, and consent, with significant fines for non-compliance. For example, GDPR penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher. Audacy's strategic shift towards identifier-free targeting and anonymized data directly addresses these legal imperatives, aiming to mitigate risk and preserve user confidence in its data handling practices.

The evolving landscape of data privacy continues to shape how companies like Audacy operate. As of 2024, there's an ongoing trend towards strengthening consumer rights and increasing transparency in data usage. This necessitates continuous investment in robust data governance frameworks and privacy-enhancing technologies. Audacy's approach must remain agile to adapt to new legislation and evolving interpretations of existing laws, ensuring its business model remains legally sound and ethically aligned with consumer expectations.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- CCPA Scope: Grants California consumers rights regarding personal information collection and sale.

- Identifier-Free Targeting: A strategy to reduce reliance on personal identifiers to comply with privacy trends.

- Anonymized Data: Processing data in a way that it cannot be linked back to an individual, crucial for privacy compliance.

Labor and Employment Laws

Audacy's operations as a multi-state employer necessitate strict adherence to a complex web of labor and employment laws. These regulations cover critical areas such as minimum wage requirements, overtime pay, workplace safety standards, and anti-discrimination statutes. For instance, in 2024, the U.S. Department of Labor continued to enforce fair labor standards, with potential penalties for non-compliance impacting companies of Audacy's size.

The company's recent executive leadership shifts and ongoing restructuring efforts highlight the critical need for robust compliance strategies. Navigating these legal frameworks effectively is paramount to avoiding litigation and maintaining a stable workforce. For example, in 2024, states like California continued to introduce new employee protections, requiring businesses to adapt their HR policies accordingly.

- Wage and Hour Laws: Ensuring compliance with federal and state minimum wage laws, overtime provisions, and record-keeping requirements is essential.

- Workplace Safety: Adherence to Occupational Safety and Health Administration (OSHA) standards and state-specific safety regulations is crucial to prevent accidents and penalties.

- Non-Discrimination and Equal Employment Opportunity (EEO): Implementing policies and practices that prevent discrimination based on race, gender, age, religion, and other protected characteristics is a legal mandate.

- Employee Benefits and Leave: Compliance with laws governing health insurance, retirement plans, and family/medical leave, such as the Family and Medical Leave Act (FMLA), is mandatory.

Audacy's successful navigation of bankruptcy in late 2024, reducing its debt by roughly 80%, highlights the critical impact of legal proceedings on corporate restructuring. The company's ability to secure court approval for its reorganization plan demonstrates the necessity of strict legal adherence and expert guidance in such challenging financial times.

The Federal Communications Commission (FCC) continues to exert significant oversight on Audacy's broadcast licenses, requiring ongoing compliance with ownership and content regulations, as evidenced by the FCC's approval needed for license transfers during restructuring.

Intellectual property and data privacy laws are increasingly vital for Audacy, impacting content licensing costs and user data handling. For instance, GDPR penalties can reach up to 4% of global annual turnover, driving Audacy's adoption of identifier-free targeting and anonymized data strategies by 2024 to ensure compliance.

Labor laws, including wage, safety, and anti-discrimination statutes, remain a key legal consideration for Audacy as a multi-state employer. The company must continuously adapt its HR policies to comply with evolving state and federal regulations, like those introduced in California in 2024, to avoid litigation and maintain workforce stability.

Environmental factors

While not a direct operational driver for Audacy's media and advertising business, increasing emphasis on Corporate Social Responsibility (CSR) and sustainability initiatives is becoming a significant factor in shaping public perception and investor sentiment. Audacy's 2024 Innovation Tracker highlights a notable surge in consumer demand for eco-conscious brands, especially among younger demographics, suggesting that a stronger sustainability posture could positively impact brand loyalty and market appeal.

Audacy's operations are increasingly intertwined with the energy demands of digital infrastructure. As reliance on streaming, cloud services, and data analytics grows, so does the company's indirect environmental footprint. This energy consumption, primarily from data centers and network equipment, is a key environmental factor to consider.

The digital sector's energy use is significant; for instance, global data center energy consumption was estimated to be around 1.5% of total global electricity use in 2023, and this is projected to rise. For Audacy, managing this indirect energy use, perhaps through energy-efficient solutions or carbon offsetting, could become a more critical environmental strategy. This aligns with a broader push across the media and technology industries for more sustainable digital practices.

The operation and eventual replacement of broadcast equipment, digital servers, and consumer electronics used for audio consumption generate electronic waste. As a major entity in the audio sector, Audacy faces growing expectations to implement more environmentally sound methods for disposing of and recycling its technological assets.

This trend towards responsible e-waste management is becoming industry-wide. For instance, in 2024, global e-waste generation was projected to reach 6.5 million metric tons, highlighting the scale of the challenge and the increasing regulatory scrutiny companies like Audacy may encounter.

Climate Change Impact on Operations and Events

Climate change poses a tangible threat to Audacy's operations, particularly through the increasing frequency and intensity of extreme weather events. These disruptions can directly impact broadcast infrastructure, leading to service interruptions and costly repairs. For example, widespread power outages from severe storms, or damage to transmission towers from high winds, could significantly affect revenue streams and operational continuity.

Furthermore, Audacy's engagement in live events, a key component of its business model, is vulnerable to climate-related impacts. Extreme heat waves, heavy rainfall, or flooding can force the cancellation or postponement of outdoor concerts and sporting events, directly impacting ticket sales, sponsorship revenue, and overall profitability. While not always explicitly detailed in financial statements, companies like Audacy are increasingly prioritizing robust business continuity planning to mitigate the financial and operational fallout from such environmental disturbances.

The financial implications of these environmental factors are substantial. A recent report indicated that extreme weather events in 2023 alone caused over $100 billion in insured losses globally, highlighting the growing economic exposure. For Audacy, this translates to potential costs associated with:

- Infrastructure resilience and repair following weather-related damage.

- Event cancellation insurance and lost revenue from rescheduled or canceled live performances.

- Increased operational costs for backup power and disaster recovery measures.

- Potential impact on advertising and sponsorship commitments tied to outdoor or weather-dependent events.

Consumer Preference for Eco-Conscious Brands

Consumer preference for eco-conscious brands is a significant environmental factor impacting Audacy. Research indicates that a substantial portion of podcast listeners, specifically one-third, actively choose sustainably produced products. Furthermore, a quarter of these listeners express a preference for purchasing from brands that maintain a low carbon footprint.

This growing consumer trend presents a clear opportunity for Audacy to leverage environmental responsibility as a competitive advantage. By highlighting and actively pursuing sustainable practices, Audacy can foster stronger brand loyalty among its audience. This commitment can also translate into more attractive advertising partnerships with like-minded, environmentally aware companies.

- One-third of podcast listeners prefer sustainably produced products.

- A quarter of podcast listeners prefer brands with a low carbon footprint.

- Environmental responsibility can serve as a key differentiator for Audacy.

- This trend influences consumer choices and potential advertising collaborations.

Audacy's environmental footprint is increasingly tied to digital energy consumption, with data centers being a key component. The company must also address e-waste from its technological assets, a growing global concern with approximately 6.5 million metric tons generated in 2024. Climate change also poses risks through extreme weather, impacting infrastructure and live events, with global insured losses from such events exceeding $100 billion in 2023.

| Environmental Factor | Audacy Relevance | Data Point/Impact |

|---|---|---|

| Digital Energy Consumption | Indirect footprint via streaming and cloud services. | Global data center energy use was ~1.5% of total global electricity in 2023. |

| E-Waste Management | Disposal/recycling of broadcast and digital equipment. | Global e-waste projected at 6.5 million metric tons in 2024. |

| Climate Change Impacts | Risk to infrastructure and live events from extreme weather. | Extreme weather events caused >$100 billion in insured losses globally in 2023. |

| Consumer Preference | Demand for eco-conscious brands influences loyalty and partnerships. | One-third of podcast listeners prefer sustainable products; a quarter prefer low-carbon brands. |

PESTLE Analysis Data Sources

Our Audacy PESTLE Analysis draws from a comprehensive mix of industry-specific reports, financial market data, and regulatory updates. We meticulously gather information from leading media and technology research firms to ensure a nuanced understanding of the external environment.