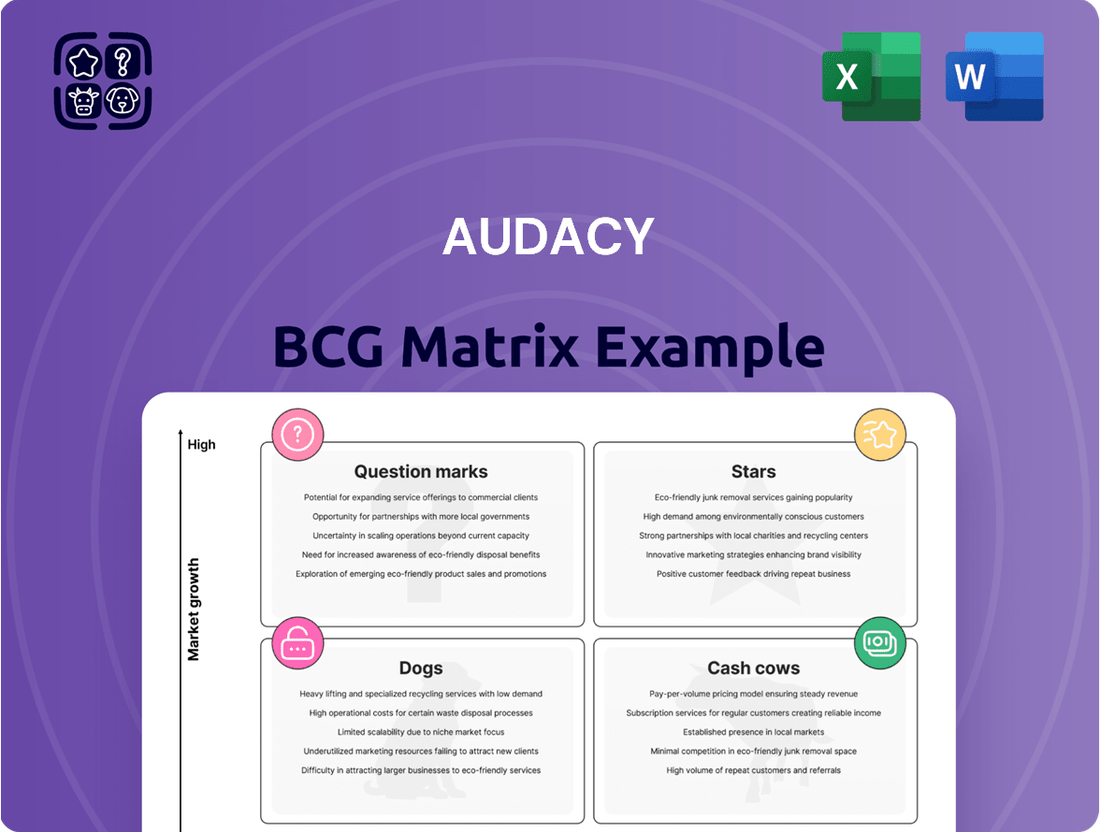

Audacy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Audacy Bundle

Curious about Audacy's product portfolio health? This glimpse into their BCG Matrix reveals the potential for growth and the need for strategic attention. Understand which of their offerings might be market leaders and which could be underperforming.

Want to go beyond the surface and truly grasp Audacy's competitive landscape? The full BCG Matrix report provides a definitive breakdown of their Stars, Cash Cows, Dogs, and Question Marks. Equip yourself with the insights needed to make informed decisions about resource allocation and future investments.

Don't miss out on the strategic advantage this comprehensive analysis offers. Purchase the complete Audacy BCG Matrix today and unlock a clear roadmap for optimizing their product mix and driving sustainable success.

Stars

Audacy's premium podcast network, encompassing brands like Pineapple Street Studios and collaborations with The Moth and PAVE Studios, is a prime example of a high-growth potential business. This segment is tapping into the booming digital audio market, a sector experiencing significant expansion.

The company's strategic investments in content and partnerships are designed to fully leverage this growth. Evidence of this success is seen in Audacy Podcasts climbing to the #8 position in Q3 2024 for weekly reach among U.S. podcast networks. This upward trajectory highlights their increasing penetration and appeal in a competitive landscape.

Digital Advertising Solutions represent Audacy's Stars in the BCG Matrix. The company has seen impressive digital revenue growth, with a 23% jump in Q1 2024 and 12% in Q2 2024, demonstrating a robust performance in the booming digital ad space.

Audacy is investing heavily in its Ad Tech Platform, aiming for modernization. Partnerships with companies like Experian are crucial for improving how they target specific audiences and personalize ad content.

These efforts are designed to make their sales processes more effective and provide advertisers with highly accurate targeting capabilities. This focus on precision is attracting a growing number of advertisers to Audacy's digital offerings, solidifying its Star status.

Audacy holds a commanding position in the sports audio market, a sector showing consistent growth. This leadership is bolstered by a 8.33% increase in sports programming revenue during the second quarter of 2024, underscoring its significant market share. The integration of broadcast, digital, and podcast sports content under the Audacy Sports banner further solidifies its dominance and appeal to a dedicated listener base.

Audacy App Streaming Platform

The Audacy app, a significant player in the digital audio streaming landscape, has demonstrated robust growth. In 2024, the platform continued to see strong increases in streaming audiences and app installs, reflecting its expanding user base and engagement. This upward trend is a key indicator of its market penetration and future potential.

Strategic collaborations have amplified the Audacy app's reach. A notable partnership with iHeartRadio, aimed at broadening content distribution, brought Audacy's offerings to over 500 new platforms and a vast array of 2,000 devices. This expansion is crucial for capturing a wider audience and solidifying its position.

- Growing Audience: Audacy's streaming audiences and app installs showed consistent year-over-year increases through 2024.

- Expanded Reach: The iHeartRadio partnership alone extended Audacy's content availability to over 500 additional platforms.

- Device Accessibility: The platform is now accessible on approximately 2,000 different devices, enhancing user convenience.

- Key Growth Driver: The app's broad accessibility and expanding user base position it as a primary contributor to Audacy's overall growth strategy.

AI-Powered Radio Operations and Ad Tech Innovation

Audacy's commitment to AI in radio operations positions it as a potential star in the BCG matrix. The company's February 2025 launch of Denver's first AI-scheduled and automated FM station, in collaboration with Super Hi-Fi, is a significant step. This move is projected to substantially lower operational expenses and boost efficiency within its broadcasting infrastructure.

- AI Automation: Audacy is leveraging AI to automate radio station scheduling and operations, aiming for significant cost reductions.

- Super Hi-Fi Partnership: The collaboration with Super Hi-Fi is key to implementing advanced AI-driven programming.

- AI Voiceovers: Audacy is experimenting with AI-generated voiceovers, which could further streamline production and reduce talent costs.

- Dynamic Ad Tech: Innovations in dynamic AI-contextual ads are designed to enhance ad targeting and effectiveness, a high-growth sector in audio.

Audacy's Digital Advertising Solutions are clearly positioned as Stars. The company reported a 23% digital revenue increase in Q1 2024 and a 12% rise in Q2 2024, showcasing strong performance in a high-growth market. Investments in their Ad Tech Platform, including partnerships with Experian for enhanced audience targeting, are driving effectiveness and attracting advertisers, reinforcing their Star status.

| Segment | BCG Category | Key Performance Indicators |

| Digital Advertising Solutions | Stars | 23% digital revenue growth (Q1 2024), 12% digital revenue growth (Q2 2024). Enhanced audience targeting via Ad Tech Platform and Experian partnership. |

| Audacy Podcasts | Stars | Ranked #8 in Q3 2024 for weekly reach among U.S. podcast networks. Tapping into a booming digital audio market. |

| Audacy Sports | Stars | 8.33% increase in sports programming revenue (Q2 2024). Dominant position in the growing sports audio market. |

| Audacy App | Stars | Consistent year-over-year increases in streaming audiences and app installs throughout 2024. Expanded content reach to over 500 new platforms via iHeartRadio partnership. |

What is included in the product

The Audacy BCG Matrix offers a strategic overview of Audacy's portfolio, categorizing its assets into Stars, Cash Cows, Question Marks, and Dogs.

It guides investment decisions by highlighting which business units to grow, maintain, or divest.

Audacy BCG Matrix offers a clear, visual snapshot of business unit performance, alleviating the pain of complex data analysis.

Cash Cows

Audacy's established major market radio stations are its undisputed cash cows. These stations, often leading in their respective metropolitan areas, consistently deliver strong advertising revenue, even amidst a shifting media landscape. For example, in 2023, Audacy's top 10 markets, which include major cities like New York and Los Angeles, accounted for a significant portion of the company's overall revenue, demonstrating the enduring power of these established outlets.

The loyal listenership and deep community roots of these flagship stations translate into predictable and substantial cash flow. This consistent revenue stream is vital for Audacy, providing the financial stability needed to invest in new ventures and navigate market fluctuations. Their long-standing brand recognition ensures a reliable platform for advertisers seeking to reach specific, engaged local audiences.

Core broadcast advertising revenue, primarily from traditional radio spot advertising, remains a significant and stable income source for Audacy. Despite evolving advertising landscapes, this segment leverages Audacy's broad network reach, generating consistent cash flow with minimal need for new investment in its established infrastructure. In 2024, Audacy's radio segment continued to be a primary revenue driver, contributing to the company's overall financial stability.

Audacy's portfolio features enduring syndicated radio programs, consistently drawing substantial audiences across numerous affiliate stations. These established programs, requiring limited new content investment, serve as reliable generators of advertising revenue.

The upcoming launch of Infinity Networks in February 2025 is strategically designed to amplify the reach of these high-value syndicated content, thereby solidifying their role as significant cash generators for Audacy.

Mature News/Talk Radio Brands

Mature news/talk radio brands within Audacy, such as KRLD in Dallas or KNX in Los Angeles, are classic cash cows. These stations boast established identities and robust local listener bases, contributing to their consistent performance.

Despite a slight revenue dip in the news/talk segment during Q2 2024, these brands typically command significant market share within their niche. This dominance translates into reliable and predictable advertising revenue, solidifying their role as dependable cash generators for Audacy.

- Resilient Listenership: Brands like KRLD and KNX maintain strong, loyal audiences.

- Stable Revenue Streams: High market share in their format ensures consistent advertising income.

- Q2 2024 Performance: The news/talk segment saw a minor revenue decrease, but cash cow brands mitigate this impact.

- Predictable Cash Flow: These mature brands are the bedrock of Audacy's financial stability.

Music Radio Segments with Consistent Listenership

Certain music radio formats within Audacy's portfolio, particularly those with strong local identities and a dedicated following, are performing as reliable cash cows. These segments consistently draw listeners, translating into stable revenue streams for the company.

The enduring appeal of these established formats is underscored by music radio revenue seeing a modest 1% growth in the second quarter of 2024. This indicates continued advertiser confidence and listener engagement.

- Brand Loyalty: Stations with deep local roots foster strong brand loyalty, ensuring a predictable audience base.

- Consistent Advertising: This loyalty attracts advertisers looking for reliable reach within specific demographics.

- Revenue Stability: The combination of consistent listenership and advertiser support makes these segments a dependable source of cash flow.

Audacy's established major market radio stations, particularly those with strong local identities and loyal followings, function as its primary cash cows. These stations consistently generate significant advertising revenue due to their broad reach and engaged listener bases. For instance, in the first half of 2024, Audacy's top 10 markets continued to be the company's revenue backbone.

The predictable and substantial cash flow from these mature brands is crucial for Audacy's financial health, enabling investment in growth areas and providing stability. Their established brand recognition ensures a reliable platform for advertisers seeking consistent audience engagement.

Core broadcast advertising revenue from these flagship stations, requiring minimal new investment, remains a stable income source. In 2024, the radio segment, driven by these cash cows, continued to be the primary revenue driver, underpinning the company's financial stability.

| Audacy Cash Cow Segments | Key Characteristics | 2024 Performance Indicators | Revenue Contribution |

| Major Market Radio Stations (e.g., NY, LA) | Leading market share, loyal listenership, deep community roots | Consistent strong advertising revenue, minimal new investment needed | Significant portion of overall revenue |

| Syndicated Radio Programs | High audience draw across affiliates, limited new content investment | Reliable advertising revenue generation | Stable income stream |

| Mature News/Talk Brands (e.g., KRLD, KNX) | Established identities, robust local listener bases, niche market dominance | Predictable advertising revenue, despite minor Q2 2024 dips | Bedrock of financial stability |

| Certain Music Radio Formats | Strong local identities, dedicated followings, consistent listenership | Modest revenue growth (e.g., 1% in Q2 2024), advertiser confidence | Dependable source of cash flow |

Preview = Final Product

Audacy BCG Matrix

The Audacy BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means no altered content or watermarks; you'll get the complete, professionally formatted strategic analysis ready for immediate application in your business planning.

Dogs

Audacy's underperforming local radio stations, particularly those in saturated or declining markets, represent significant challenges within its portfolio. These stations often struggle to attract substantial listener bases and, consequently, advertising revenue, making them prime candidates for strategic review. For example, Audacy announced significant cost-cutting measures, including layoffs in March 2025, signaling a focus on optimizing its asset base.

Stations that are cash traps, consuming resources without generating commensurate returns, are particularly vulnerable. In 2024, the broader radio advertising market continued to face headwinds, with digital advertising capturing a larger share of marketing spend. This trend exacerbates the difficulties faced by smaller, local stations that lack the scale or unique programming to compete effectively against national digital platforms and larger media groups.

Maintaining outdated analog broadcast infrastructure presents substantial ongoing expenses for Audacy, especially as the audio industry rapidly shifts towards digital. These legacy systems often yield decreasing returns, making their continued operation less efficient.

Audacy's strategic pivot to cloud-first technologies and AI-powered operations, exemplified by their Denver initiatives, directly addresses the need to shrink their physical equipment footprint and lower associated costs. This modernization effort highlights the underperformance of non-modernized analog assets.

Consequently, these aging analog assets are prime candidates for Audacy to phase out, optimizing resource allocation and embracing more cost-effective, future-ready broadcast solutions. This aligns with industry trends where digital dominance is paramount.

Audacy's Q2 2024 results revealed a concerning trend: while the company gained radio revenue share, both local and national spot advertising saw declines. This points to a persistent struggle within traditional ad sales, a segment that often relies on models lacking the sophistication of digital alternatives.

Sales teams still tied to these less targeted, traditional ad sales models are likely underperforming. Their inability to seamlessly integrate with robust digital advertising solutions means they are missing out on more efficient and potentially profitable avenues for revenue generation.

These legacy approaches are simply outmatched by the agility and precision of digital platforms. This makes traditional ad sales a less efficient and, consequently, a potentially unprofitable segment for companies like Audacy, despite efforts to gain overall radio revenue share.

Niche, Low-Listenership Podcast Content

Within Audacy's expanding podcast network, certain niche content or less popular series may struggle to gain traction. These offerings, even within a growing market, can exhibit low market share and fail to generate significant revenue, potentially becoming a resource drain.

The strategic consolidation of podcast brands under the Audacy Podcasts umbrella aims to concentrate resources on more successful and revenue-generating ventures. This approach acknowledges that not all content will achieve widespread listener engagement or advertiser appeal.

- Low Listener Engagement: Niche podcasts often appeal to a smaller, dedicated audience, limiting overall download numbers.

- Limited Advertiser Appeal: Advertisers typically seek broader reach, making it challenging for low-listenership podcasts to secure sponsorships.

- Resource Allocation: Maintaining and promoting content with minimal audience can divert valuable resources from more promising initiatives.

- Strategic Focus: Audacy's consolidation strategy prioritizes optimizing investment in podcasts with proven or high-potential audience engagement and monetization.

Divested or Non-Strategic Assets Post-Bankruptcy

Following its Chapter 11 bankruptcy and successful restructuring in September 2024, Audacy divested certain assets, such as an FM station in Forest City, N.C. This strategic move aligns with its leaner, more focused post-restructuring approach.

These divestitures typically target non-strategic or underperforming assets that no longer fit the company's core business objectives. Such assets, often characterized by low market share and limited growth potential, are prime candidates for removal to streamline operations.

Audacy's divestment of the Forest City, N.C. FM station exemplifies this strategy, freeing up resources and management attention for more promising ventures within its reorganized structure.

- Divestiture Rationale: Non-strategic or underperforming assets are divested to align with a leaner, post-restructuring business strategy.

- Asset Characteristics: These divested assets typically exhibit low market share and limited growth prospects.

- Example: Audacy divested an FM station in Forest City, N.C., following its Chapter 11 bankruptcy and restructuring in September 2024.

- Strategic Impact: Divestitures allow companies to focus resources on core, higher-potential business areas.

Audacy's "Dogs" in the BCG matrix are primarily its legacy terrestrial radio stations, especially those in less dynamic markets, which struggle with declining listenership and advertising revenue. These assets often require significant investment in infrastructure and marketing without yielding proportional returns, making them cash drains. The company's restructuring in 2024, including asset divestitures like the Forest City, N.C. FM station, highlights a strategic move away from such underperforming units to streamline operations and focus on more promising areas.

Furthermore, certain segments within Audacy's podcast network that exhibit low listener engagement and limited advertiser appeal also fall into this category. These niche podcasts, despite operating in a growing market, can consume resources without generating substantial revenue, mirroring the challenges faced by underperforming radio stations.

The company's Q2 2024 results showed declines in both local and national spot advertising, underscoring the difficulties in monetizing traditional radio formats, which often represent the "Dog" assets. This situation is compounded by ongoing operational costs associated with maintaining older, analog broadcast infrastructure, further burdening these underperforming segments.

Audacy's strategic pivot towards cloud-first technologies and AI-driven operations is a direct response to the need to reduce costs associated with these legacy assets and to invest in areas with higher growth potential.

Question Marks

Audacy's exploration into AI-driven content creation, including its collaboration with ElevenLabs for enhanced production, positions these ventures as question marks on the BCG matrix. These initiatives, while demonstrating high growth potential through increased efficiency and personalization, are in their nascent stages.

The market share for these AI-assisted content endeavors is currently minimal. Significant investment is still required to refine the technology, demonstrate scalable commercial viability, and gain broader market acceptance.

Audacy's strategic push into new geographic digital markets aligns with its digital transformation goals, positioning these ventures as potential Stars in the BCG matrix. These nascent markets offer high-growth potential, but also carry significant risk due to unproven consumer adoption and limited brand recognition. For instance, entering a new digital audio market in Southeast Asia in 2024 might require an initial investment of $10-20 million for content localization and marketing campaigns to build a user base from scratch.

The success of these expansions hinges on Audacy's ability to effectively penetrate these markets, which often demand substantial upfront investment to establish a foothold. Building brand awareness and acquiring users in these regions could cost upwards of $5 million in the first year, with revenue generation taking an estimated two to three years to materialize. This makes them capital-intensive endeavors, characteristic of Stars that need ongoing support to achieve market dominance.

Audacy's strategic podcast partnerships, like those with PAVE Studios and 'The RE-CAP Show,' are being cultivated as potential Stars in its BCG matrix. These collaborations tap into high-growth content genres, aiming to capture significant audience share. For instance, in 2023, the podcast advertising market was valued at approximately $2.1 billion in the US, a figure expected to grow substantially, providing a fertile ground for these emerging partnerships.

While these ventures introduce novel and potentially viral content, their market share within Audacy's broader portfolio is still in its nascent stages. They represent investments in areas with high future potential but uncertain immediate returns. Continued investment in promotion and seamless integration is crucial for these partnerships to expand their listener base and revenue streams, transitioning them from Question Marks to Stars.

Advanced Data Analytics for Audience Targeting

Audacy's strategic partnership with Experian in 2024 aims to revolutionize audience targeting through advanced digital identity graphs. This collaboration is designed to create highly precise and personalized advertising solutions, a critical component in the rapidly evolving ad tech sector.

While this initiative represents a significant investment in Audacy's future advertising capabilities, its current market share in this competitive space is still developing. The effectiveness and return on investment will heavily depend on continued technological advancement and widespread adoption by advertisers.

- Digital Identity Graph Integration: Audacy is integrating Experian's digital identity graphs to build a more comprehensive understanding of consumer behavior.

- Personalized Advertising Solutions: This enables the delivery of highly targeted and personalized ad experiences, aiming to increase engagement and conversion rates.

- Nascent Market Share: Despite the potential, Audacy's market share in this specialized digital targeting domain is currently small, requiring substantial growth to impact overall revenue significantly.

- Future Growth Potential: The success of this venture is a key driver for Audacy's growth in the high-potential ad tech market, contingent on successful execution and market acceptance.

Experimental Monetization Models and Niche Content Formats

Audacy might be experimenting with novel ways to make money, moving past just showing ads. Think about premium subscriptions for special content or trying out new interactive audio experiences. These are like the early birds of the audio world, showing promise for growth as the market changes.

However, these new ventures currently hold a small slice of the market. Their success hinges on significant customer buy-in and ongoing investment to truly take off. For instance, the podcast advertising market was projected to reach $2.7 billion in the US in 2024, highlighting the competitive landscape these new models must navigate.

- Premium Subscriptions: Offering ad-free listening or exclusive shows for a monthly fee.

- Interactive Audio: Developing formats that allow listener participation, potentially with new revenue streams.

- Niche Content: Focusing on underserved audio segments that may command higher subscription rates.

- Market Adoption: The key challenge is convincing a broad audience to embrace these new models, a hurdle many digital services face.

Audacy's ventures into AI-driven content creation and new digital markets represent potential growth areas, but their current market share is minimal. These initiatives, like AI-assisted production and expansion into new geographic digital audio markets, require substantial investment to refine technology, prove commercial viability, and gain broad acceptance. For instance, entering a new digital audio market in Southeast Asia in 2024 could involve an initial investment of $10-20 million for content localization and marketing to build a user base.

Similarly, strategic podcast partnerships and the integration of advanced audience targeting solutions with Experian, while promising, are in their early stages with limited current market penetration. These areas demand continued investment in promotion, integration, and technological advancement to transition from question marks to stars. The podcast advertising market alone was projected to reach $2.7 billion in the US in 2024, indicating the competitive landscape these nascent ventures must navigate to secure a significant market share.

Audacy's exploration of alternative revenue streams, such as premium subscriptions and interactive audio experiences, also falls into the question mark category. While these models offer future growth potential, their success is contingent on significant customer buy-in and ongoing investment to gain traction in a competitive digital market. The key challenge remains convincing a broad audience to embrace these new monetization strategies.

BCG Matrix Data Sources

Our Audacy BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.